Market Overview:

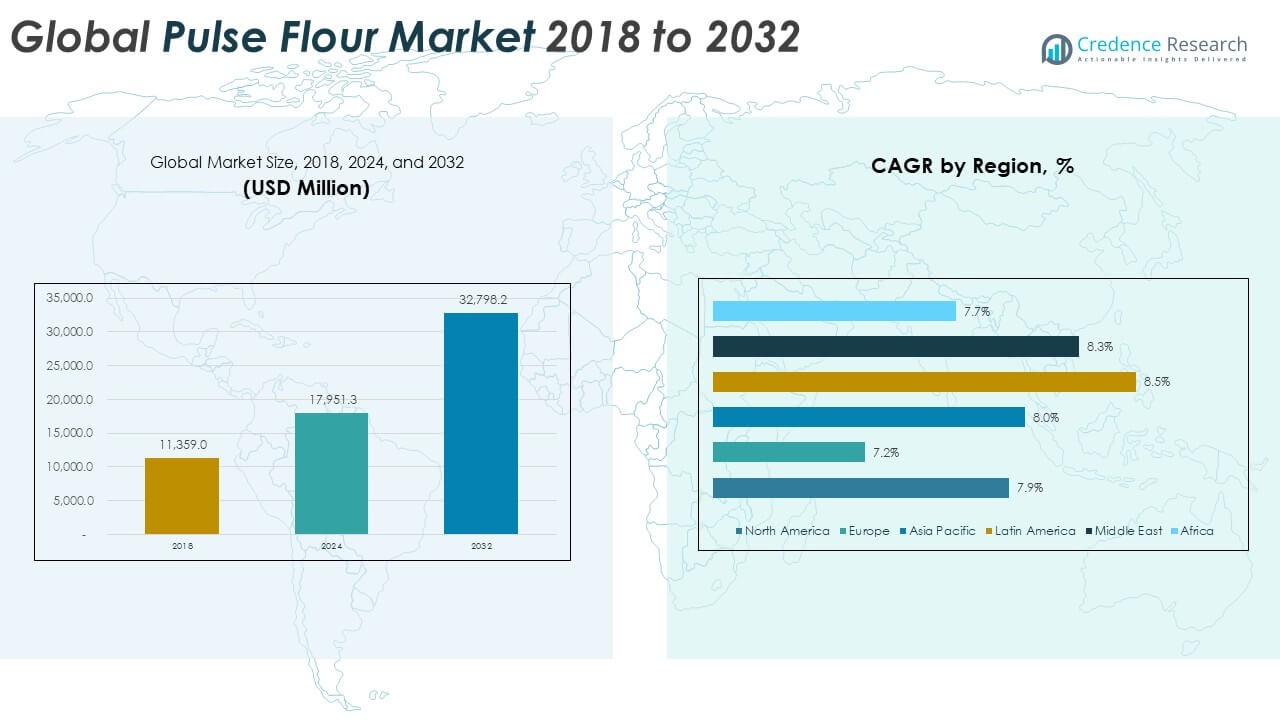

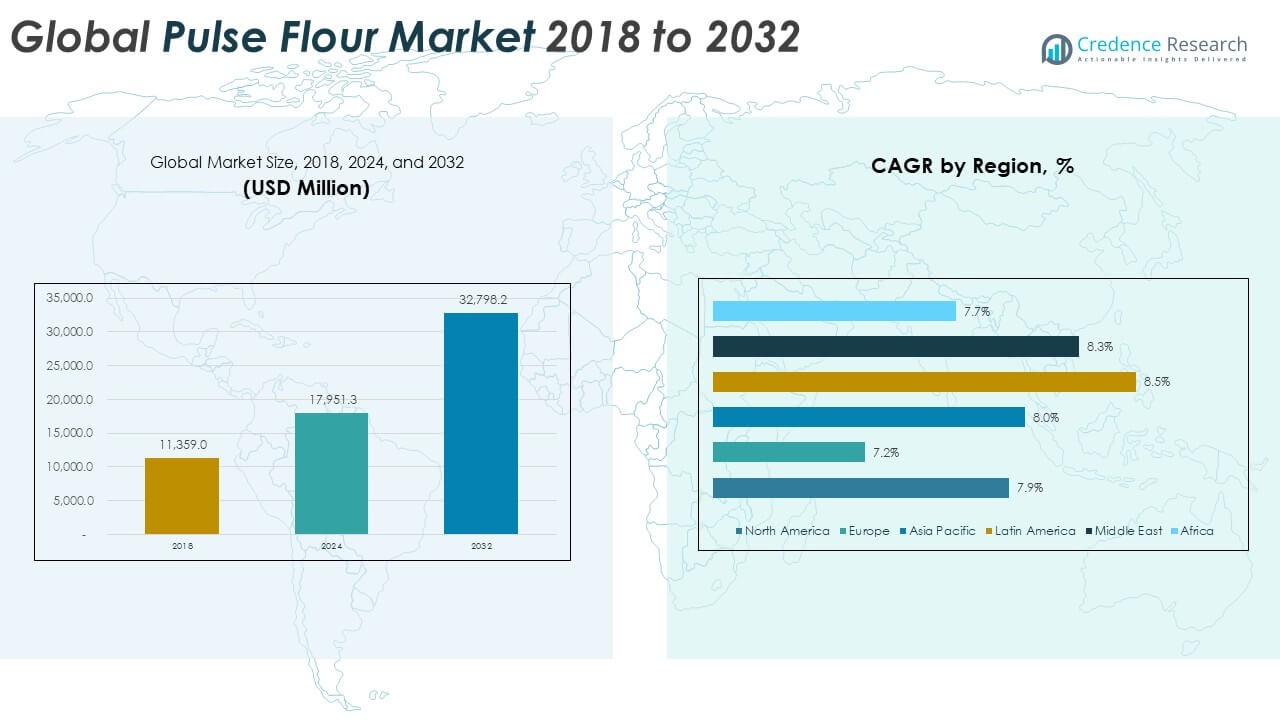

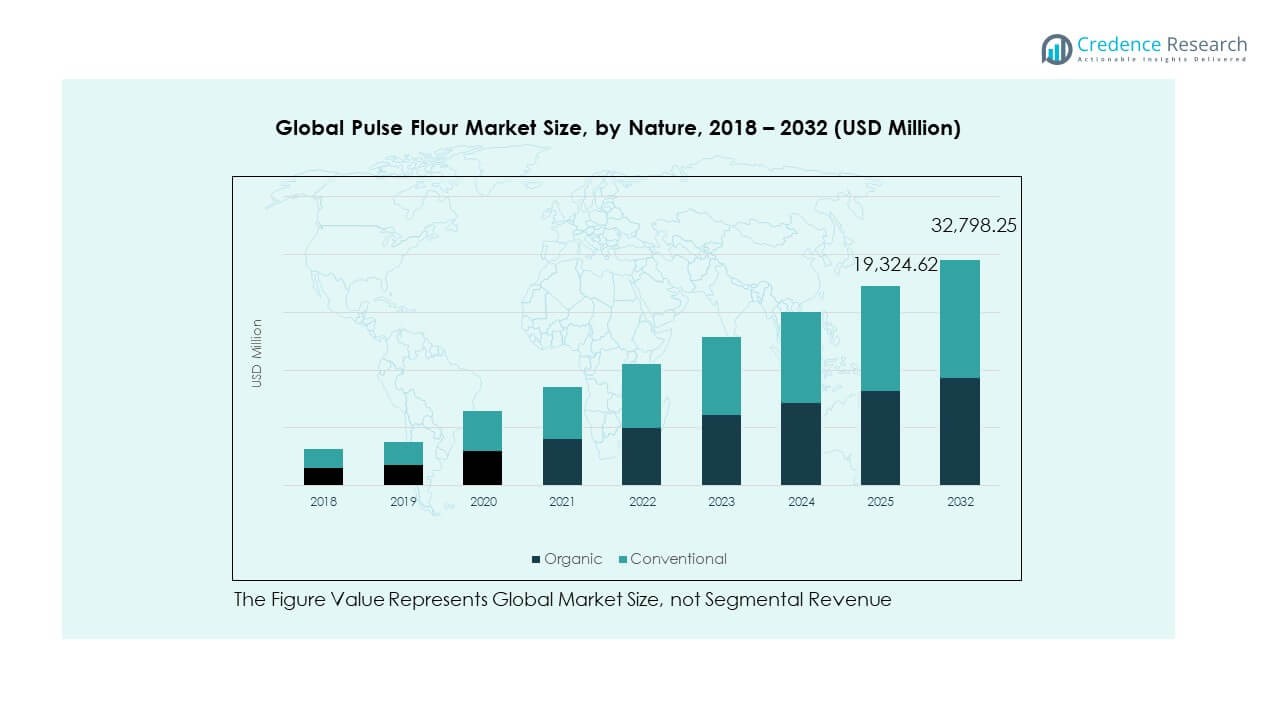

The Global Pulse Flour Market size was valued at USD 11,359.0 million in 2018 to USD 17,951.3 million in 2024 and is anticipated to reach USD 32,798.2 million by 2032, at a CAGR of 7.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pulse Flour Market Size 2024 |

USD 17,951.3 Million |

| Pulse Flour Market, CAGR |

7.85% |

| Pulse Flour Market Size 2032 |

USD 32,798.2 Million |

Rising health awareness and shifting dietary preferences toward plant-based protein are driving the market. Consumers are increasingly adopting pulse flour for its gluten-free, high-fiber, and nutrient-dense properties. Expanding applications in bakery, snacks, pasta, and meat alternatives further strengthen demand. Food manufacturers are investing in product innovation to enhance texture, taste, and nutritional profiles. Government initiatives supporting sustainable crop cultivation also promote pulse flour production worldwide.

North America and Europe lead the Global Pulse Flour Market due to high consumption of plant-based food products and advanced food processing industries. Asia Pacific is emerging as a high-growth region, supported by large-scale pulse production and rising demand for affordable protein sources. Countries like India and China contribute significantly due to their strong agricultural base and growing health-conscious populations. Latin America and the Middle East show increasing potential with expanding food manufacturing capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Pulse Flour Market was valued at USD 11,359.0 million in 2018, reached USD 17,951.3 million in 2024, and is projected to attain USD 32,798.2 million by 2032, expanding at a CAGR of 7.85% during the forecast period.

- Asia Pacific (38%), Europe (23%), and North America (23%) dominate the market, driven by advanced food industries, strong agricultural output, and growing consumer preference for plant-based and gluten-free products.

- Latin America represents the fastest-growing region with an 8% share, fueled by rising awareness of sustainable diets, affordable raw material availability, and increasing adoption of pulse-based foods across bakery and snack segments.

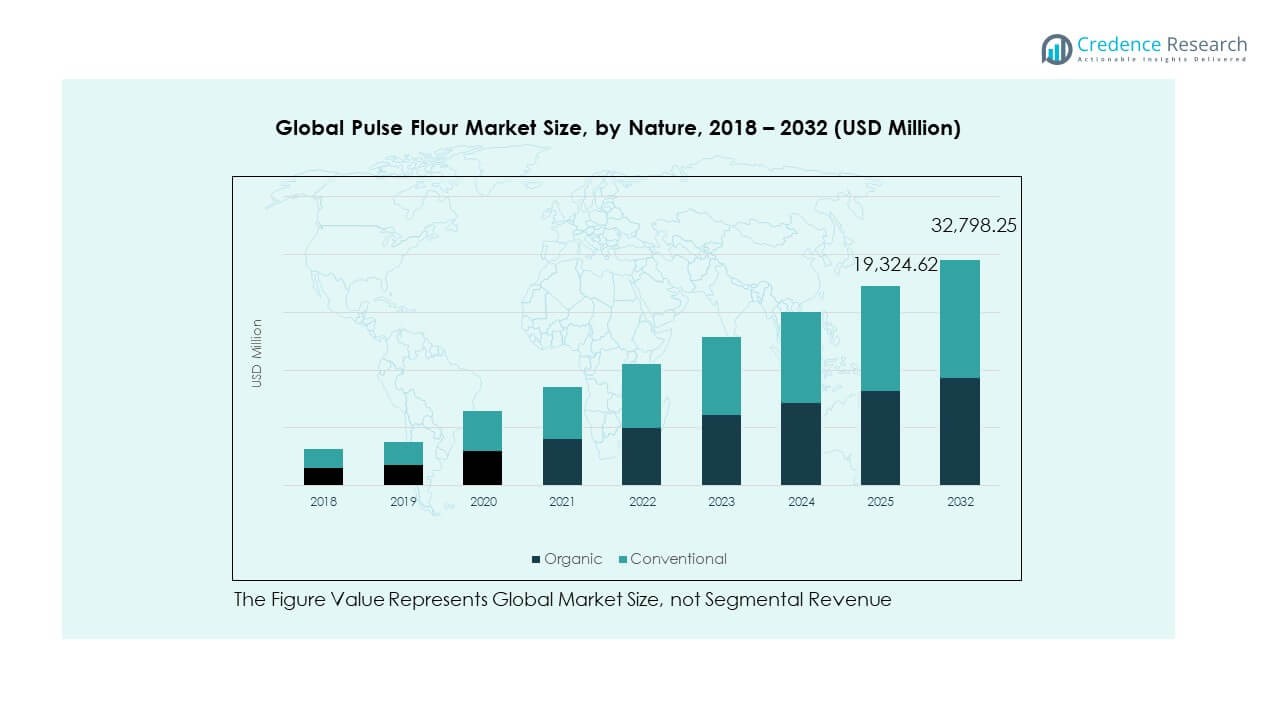

- The conventional pulse flour segment accounted for roughly 60% of the total market in 2024 due to large-scale farming, cost efficiency, and high consumer accessibility.

- The organic pulse flour segment captured around 40% share, supported by rising demand for clean-label, non-GMO, and eco-friendly food ingredients across developed and emerging markets.

Market Drivers:

Rising Shift Toward Plant-Based and Gluten-Free Diets

The Global Pulse Flour Market is driven by increasing consumer demand for plant-based protein alternatives. Growing awareness of the health benefits of pulses, such as chickpeas, lentils, and peas, promotes wider adoption in bakery and snack products. Pulse flour offers gluten-free and allergen-free advantages, supporting inclusion in diverse diets. It appeals to consumers seeking high-protein and low-glycemic food options. Manufacturers are reformulating traditional recipes to replace refined flour with nutrient-rich pulse ingredients. Rising veganism and flexitarian lifestyles also contribute to market expansion. Health-conscious consumers view pulse flour as a sustainable and ethical choice for everyday meals.

- For instance, AGT Food and Ingredients produces pea protein isolates with verified protein concentrations between 55% and 82%, enabled by proprietary technology to deliver high-protein, allergen-free pulse-based ingredients for bakery and snack manufacturers. AGT Foods’ protein ingredients have been shown in scientific studies to maintain nutritional integrity while enabling cleaner labeling and higher protein fortification in new gluten-free recipes.

Expanding Use Across Processed and Convenience Foods

Demand is increasing from the processed food industry due to the growing appeal of high-protein and fiber-enriched products. Pulse flour serves as a natural thickener, binder, and texturizer in snacks, soups, and sauces. The product’s ability to improve moisture retention and shelf life supports its integration into ready-to-eat meals. Food manufacturers are developing clean-label and protein-rich convenience foods to align with consumer trends. Pulse-based pasta, noodles, and baked items are gaining market visibility. It provides superior nutritional content compared to conventional flour. The rise of urban lifestyles and quick meal options continues to stimulate product demand.

- For instance, Ingredion’s HOMECRAFT® pulse-based flours, including pea, lentil, faba bean, and chickpea, provide twice as much protein as traditional cereal grains, with verified gluten-free properties and application in snacks, noodles, and ready-to-eat meals, demonstrating advances in protein enrichment and clean-label functional properties.

Sustainability and Agricultural Advantages of Pulses

Pulses require less water and fertilizer, making them ideal for sustainable agriculture practices. Farmers are encouraged to cultivate pulses for soil enrichment through nitrogen fixation. Governments and organizations promote pulse farming to reduce environmental footprints and ensure food security. The Global Pulse Flour Market benefits from sustainability-driven consumer choices. Its eco-friendly appeal attracts brands prioritizing green manufacturing. Supply chain resilience and climate adaptability strengthen its agricultural importance. Increasing global production supports cost efficiency and broader market availability. Sustainable sourcing has become a core strategy for manufacturers.

Technological Advancements in Flour Processing and Product Development

Innovation in flour milling and fractionation technologies enhances pulse flour quality and consistency. Advanced processing techniques help retain essential amino acids, fibers, and micronutrients. Manufacturers invest in modern equipment to achieve smoother textures and better functionality for different food formats. It supports the creation of specialized flours tailored to bakery, beverage, and snack applications. Improved dehulling and drying systems reduce off-flavors, enhancing consumer acceptance. The growing research focus on protein extraction and blending technologies enables versatile uses. Rising R&D spending ensures product innovation meets evolving consumer demands.

Market Trends:

Rising Demand for Clean-Label and Functional Food Products

Clean-label trends are shaping purchasing behavior among health-conscious consumers. The Global Pulse Flour Market is witnessing strong demand for products with natural, simple ingredient lists. Pulse flour fits these expectations by being chemical-free, minimally processed, and nutrient-dense. Its high protein, iron, and fiber content aligns with functional food innovation. Brands highlight its role in digestive health, energy balance, and muscle maintenance. Consumer preference for transparency drives labeling focused on source origin and sustainability. The market’s growth aligns with the global movement toward healthy and natural eating patterns.

Growth in Pulse-Based Bakery and Snack Applications

The bakery and snack sectors are increasingly adopting pulse flour to improve nutritional profiles. Manufacturers are blending it with wheat or rice flour to enhance protein and fiber content. It contributes to better texture, moisture balance, and flavor stability in baked products. The Global Pulse Flour Market gains momentum from new product launches in energy bars, cookies, and crackers. Demand for high-protein snacks among athletes and health-conscious consumers is rising. Pulse flour also reduces dependence on traditional grains, supporting product differentiation. Brands use this ingredient to meet clean-label and protein-focused trends.

- For instance, Bunge introduced lentil functional flour that allows baked goods and snacks to make protein claims, meeting “good source” or “excellent source” in various applications, while only using non-GMO lentils, water, and heat—enabling clean label and protein-enhanced formulations.

Expansion in Alternative Protein and Meat Substitute Segments

The rapid rise of the plant-based protein industry supports pulse flour integration into meat substitutes. It provides desirable binding and emulsification properties in burgers, sausages, and nuggets. The Global Pulse Flour Market benefits from increasing investments by food tech companies. Its versatility allows replacement of soy or wheat-based proteins without compromising texture or taste. Growing consumer skepticism toward synthetic additives fuels adoption of pulse-based options. Pulse ingredients enable sustainable protein production, aligning with climate-conscious consumers. Demand for ethical and nutritious food continues to expand across regions.

Regional Product Innovation and Localization Strategies

Manufacturers are adapting pulse flour formulations to match local taste preferences and culinary traditions. In Western markets, chickpea and lentil flours dominate gluten-free baking. In Asia, pea and mung bean flours find application in noodles, batters, and snacks. The Global Pulse Flour Market benefits from this regional diversification. Localization allows brands to capture regional supply strengths and cultural appeal. Cross-border trade in pulse-based ingredients promotes product innovation and hybrid recipes. Companies are partnering with local farmers to ensure consistent quality. Regional R&D centers support flavor optimization and product performance.

Market Challenges Analysis:

Supply Chain Volatility and Quality Standardization Issues

The Global Pulse Flour Market faces challenges from inconsistent raw material supply due to weather and crop yield variations. Fluctuating global pulse prices affect production cost stability. Regional differences in pulse quality lead to formulation inconsistencies for manufacturers. Limited processing infrastructure in developing countries constrains large-scale production. Quality control and safety standards vary across suppliers, complicating global trade. It requires investment in modern processing and certification systems. Transportation costs and export regulations also influence pricing and supply reliability. Companies must enhance traceability to maintain consistent flour quality.

Consumer Acceptance and Product Formulation Barriers

Pulse flour’s distinct flavor and texture present challenges in traditional food formulations. Some consumers prefer the sensory attributes of wheat or refined flour. Food producers need advanced technology to balance taste, aroma, and color in pulse-based products. The Global Pulse Flour Market faces resistance from consumers unfamiliar with pulse-based recipes. Manufacturers invest in blending strategies and flavor-masking techniques to overcome these limitations. Scaling production while preserving nutritional quality remains complex. Limited awareness in certain regions slows market penetration. Continuous consumer education and recipe innovation are vital for long-term acceptance.

Market Opportunities:

Growing Application in Nutraceuticals and Functional Food Products

The growing consumer focus on preventive health creates strong opportunities for pulse flour in functional foods. Its rich protein and micronutrient profile suits sports nutrition and dietary supplements. The Global Pulse Flour Market benefits from expanding uses in fortified products targeting heart and digestive health. Food companies are developing new formulations that combine flavor with nutritional value. Pulse-based ingredients align with wellness-focused product innovation. The opportunity extends to developing high-protein drinks and breakfast products. Rising health consciousness ensures continued product diversification.

Expansion in Emerging Markets and Food Industry Investments

Emerging economies in Asia, Latin America, and Africa present vast growth potential due to expanding urban populations. Consumers in these regions seek affordable, nutritious food sources. The Global Pulse Flour Market benefits from government support for domestic pulse processing and trade. Local startups and multinational food brands are investing in new plants and supply chains. Regional collaborations help strengthen availability and reduce dependency on imports. Expanding retail infrastructure promotes access to pulse-based foods. The opportunity lies in capturing the growing middle-class demand for healthy, sustainable food alternatives.

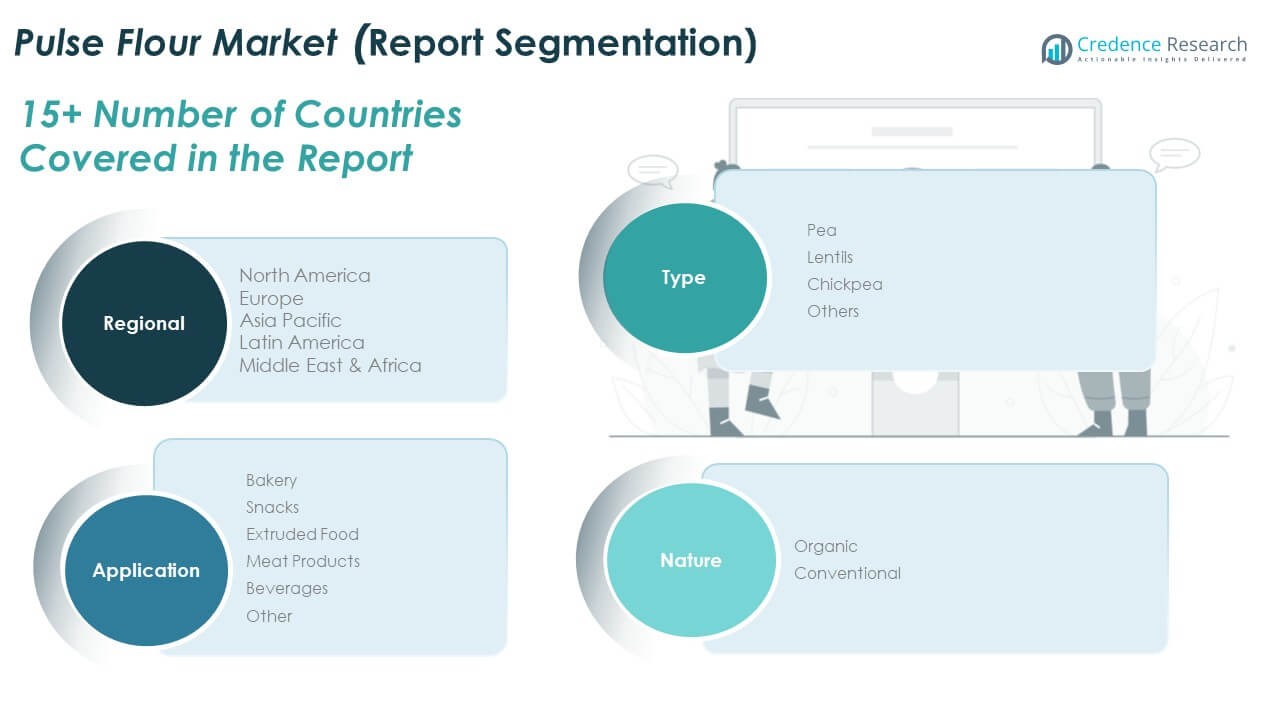

Market Segmentation Analysis:

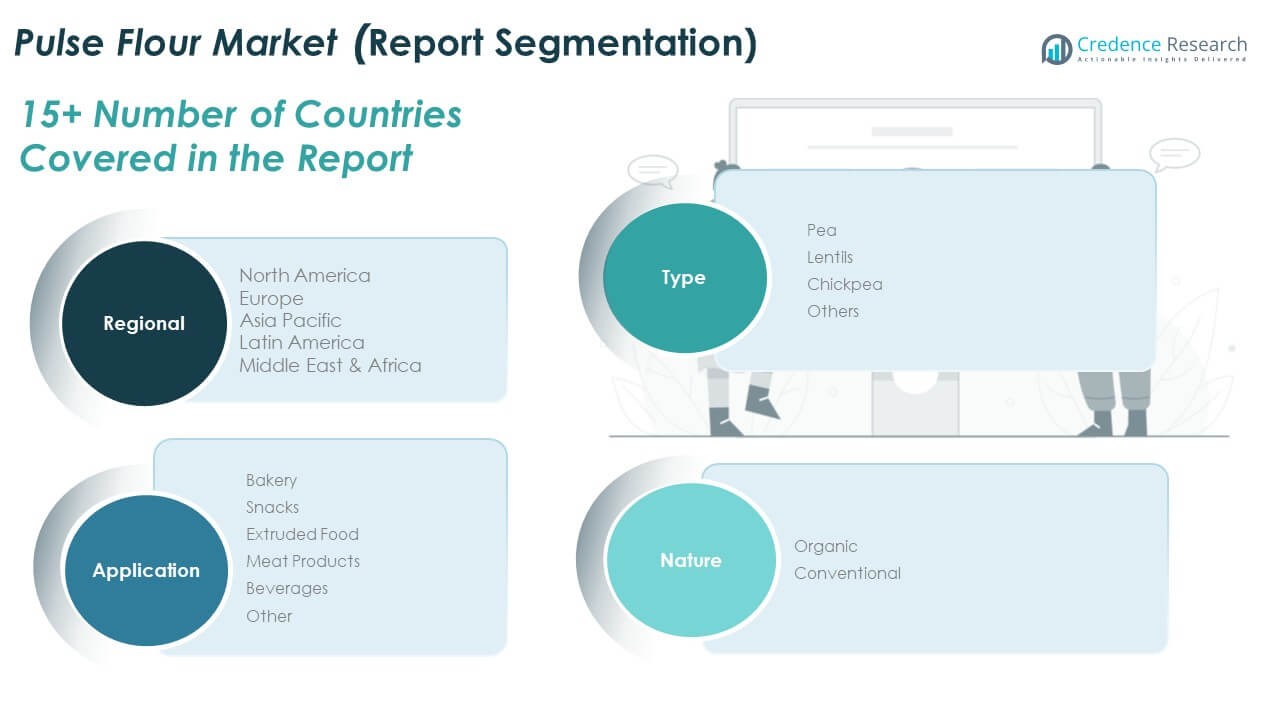

By Type

The Global Pulse Flour Market is segmented into pea, lentil, chickpea, and other pulse types. Pea flour holds a dominant share due to its mild flavor, high protein content, and wide use in bakery and snack formulations. Lentil flour is gaining traction for its iron and fiber benefits, appealing to health-conscious consumers. Chickpea flour continues to be popular in gluten-free and ethnic food applications. Other pulse flours, including mung bean and fava bean, contribute to niche applications in specialized diets and functional foods. Product innovation across these categories supports diversified use in the food industry.

- For instance, PURIS manufactures pea protein with a minimum of 80% protein content, verified through independent analysis, and used in gluten-free bakery, snack, and beverage applications to boost nutritional content without altering product taste or texture. Nutriati’s Artesa chickpea flour is verified to contain above 12% protein and is used in high-quality gluten-free pasta and bakery products with reliable texture and allergen-free certification.

By Application

The market is categorized into bakery, snacks, extruded food, meat products, beverages, and others. Bakery and snacks represent leading segments driven by rising demand for protein-rich and gluten-free alternatives. Extruded foods and meat products use pulse flour for texture enhancement and nutritional improvement. Beverages are emerging as a new application segment, integrating plant-based protein powders and meal replacements. Other uses include soups, sauces, and instant mixes. It continues to expand across processed and convenience food formats.

- For instance, Roquette’s pea protein isolate (S85Plus) delivers 80 grams of protein per 100 grams, enabling bakery products and extruded snacks to attain high-protein claims and improved dietary profiles according to official nutritional analysis and regulatory submissions. Ingredion’s VITESSENCE® Pulse 1803 organic pea protein isolate is USDA-certified organic, supports protein-rich applications in beverages, extruded snacks, and ready meals, and is recognized for enhanced solubility and clean-label properties.

By Nature

The market is divided into organic and conventional pulse flour. Conventional flour dominates due to large-scale production and cost efficiency. Organic pulse flour is expanding rapidly, supported by consumer preference for clean-label and sustainably produced food. Demand for chemical-free, non-GMO products reinforces growth in this segment. Food manufacturers are incorporating organic certification to align with health-focused branding. It reflects a global transition toward sustainable food choices.

Segmentation:

- By Type

- Pea

- Lentils

- Chickpea

- Others

- By Application

- Bakery

- Snacks

- Extruded Food

- Meat Products

- Beverages

- Others

- By Nature

- By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Pulse Flour Market size was valued at USD 2,587.57 million in 2018 to USD 4,106.24 million in 2024 and is anticipated to reach USD 7,543.60 million by 2032, at a CAGR of 7.9% during the forecast period. North America holds nearly 23% share of the global market. Strong consumer demand for gluten-free and protein-rich foods supports rapid growth in this region. The United States leads with advanced food processing infrastructure and innovation in plant-based products. Canada contributes through high pulse production and export capacity. It benefits from strong investments in R&D and product formulation using pea and lentil flours. Government programs encouraging sustainable agriculture reinforce industry growth. Rising veganism and health-conscious lifestyles are creating steady demand for pulse-based bakery and snack products.

Europe

The Europe Global Pulse Flour Market size was valued at USD 2,814.75 million in 2018 to USD 4,302.94 million in 2024 and is anticipated to reach USD 7,507.52 million by 2032, at a CAGR of 7.2% during the forecast period. Europe represents nearly 23% share of the global market. High awareness of plant-based nutrition and sustainable food systems drives market expansion. The region’s strong bakery and functional food industries adopt pulse flour for nutritional enhancement. Western European countries like Germany, the UK, and France lead consumption through advanced processing and health-oriented innovation. Eastern Europe shows steady growth supported by local pulse cultivation. It benefits from supportive policies promoting alternative protein sources and sustainable agriculture. Manufacturers continue to develop premium pulse-based products for clean-label consumers.

Asia Pacific

The Asia Pacific Global Pulse Flour Market size was valued at USD 4,177.83 million in 2018 to USD 6,657.89 million in 2024 and is anticipated to reach USD 12,299.34 million by 2032, at a CAGR of 8.0% during the forecast period. Asia Pacific dominates with nearly 38% share of the global market. Strong agricultural production and high pulse availability drive regional leadership. China and India are major contributors due to growing domestic demand and export activities. Japan and South Korea show rising adoption in processed and convenience foods. It benefits from industrial modernization and the adoption of sustainable food solutions. Rapid urbanization and dietary diversification stimulate new product development. Local manufacturers are integrating pulse flour into noodles, snacks, and beverages, supporting market dynamism.

Latin America

The Latin America Global Pulse Flour Market size was valued at USD 831.48 million in 2018 to USD 1,367.12 million in 2024 and is anticipated to reach USD 2,627.14 million by 2032, at a CAGR of 8.5% during the forecast period. Latin America holds around 8% share of the global market. Brazil and Argentina dominate regional consumption, supported by expanding food and beverage industries. Rising awareness of plant-based diets and protein enrichment is driving demand. It benefits from abundant pulse production and the availability of low-cost raw materials. The region is witnessing the entry of new local brands and collaborations with international players. Growth in health-oriented consumer segments promotes demand for pulse-based bakery and extruded foods. Trade policies improving export potential further enhance regional performance.

Middle East

The Middle East Global Pulse Flour Market size was valued at USD 656.55 million in 2018 to USD 1,062.21 million in 2024 and is anticipated to reach USD 2,000.69 million by 2032, at a CAGR of 8.3% during the forecast period. The Middle East accounts for nearly 5% share of the global market. Increasing focus on nutritional diversification and sustainable food production supports growth. GCC countries lead regional adoption through expanding food processing capacity. It benefits from rising import volumes and industrial investment in clean-label foods. The demand for fortified and high-protein flour in bakery and snack segments is strengthening. Regional partnerships with global ingredient suppliers enhance supply consistency. Government programs promoting food security and dietary diversification sustain long-term potential.

Africa

The Africa Global Pulse Flour Market size was valued at USD 290.79 million in 2018 to USD 454.94 million in 2024 and is anticipated to reach USD 819.96 million by 2032, at a CAGR of 7.7% during the forecast period. Africa contributes nearly 3% share of the global market. Rising pulse cultivation and growing urban populations drive the regional industry. South Africa leads with expanding food manufacturing sectors and modern retail networks. It benefits from improving agricultural practices and local processing facilities. Demand for affordable, protein-rich alternatives is increasing across developing economies. Countries like Egypt and Kenya are focusing on pulse-based foods to address nutritional gaps. Growing investment in food processing and trade integration supports steady market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Pulse Flour Market features a moderately fragmented competitive landscape with both global and regional participants. Key players focus on expanding production capacity, enhancing product purity, and developing specialized pulse flours tailored to bakery, snack, and beverage industries. It experiences steady consolidation through acquisitions and collaborations aimed at securing raw material sources and broadening geographic presence. Companies emphasize R&D to improve texture, flavor, and nutritional content. Strategic partnerships with food processors strengthen market reach. Leading firms include Ingredion Inc., Tate & Lyle PLC, Bühler Holding AG, Limagrain Ingredients, and Avena Foods Limited.

Recent Developments:

- In November 2024, Tate & Lyle PLC completed its acquisition of CP Kelco, a global supplier of pectin, specialty gums, and nature-based ingredients. Over the following months, the collaboration facilitated the development of specialized ingredient solutions, including improved stabilization for high-protein, pulse-based smoothies and dairy alternatives, with notable integration benefits highlighted in earnings calls as recently as May 2025. This acquisition positions Tate & Lyle for further innovations in pulse flour processing and specialty food applications, strengthening its portfolio and customer engagement in the sustainable food segment.

- Ingredion Inc. announced two key partnership updates in 2025. In March, Ingredion partnered with sweet protein start-up Oobli to bring new plant-based sweetener proteins to market, expanding the range of finished products and pulse-based alternatives globally.

- In January 2025, Bühler Holding AG acquired advanced puffing technology from CEREX, aimed at diversifying its offerings in food, petfood, and feed applications—including pulse flours for healthy snack and cereal products.

- On June 25, 2025, Limagrain Ingredients, through its parent entity Vilmorin & Cie, entered exclusive discussions for a strategic partnership with Abu Dhabi Developmental Holding Company (ADQ), set to consolidate Limagrain Vegetable Seeds and initiate joint R&D especially for desert-adapted genetics.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, and Nature segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of pulse flour in gluten-free and plant-based product lines.

- Increased demand for protein-rich bakery and snack innovations.

- Growing investment in advanced processing and milling technologies.

- Expansion of organic and clean-label pulse flour offerings.

- Strong growth potential in emerging economies driven by urbanization.

- Enhanced focus on sustainable sourcing and agricultural efficiency.

- Broader application in nutraceuticals, beverages, and functional foods.

- Rising collaborations among food producers and ingredient suppliers.

- Increased consumer preference for high-fiber and nutrient-dense alternatives.

- Continuous R&D driving improved taste, texture, and product diversity.