Market Overview:

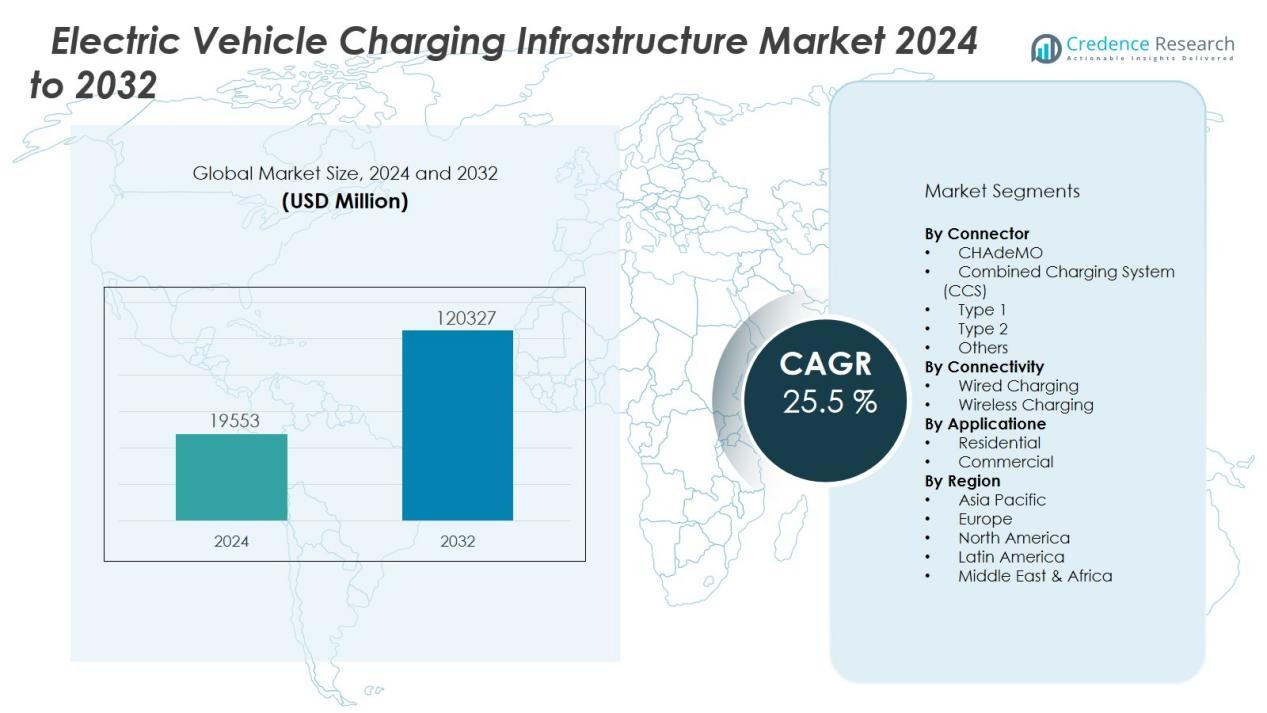

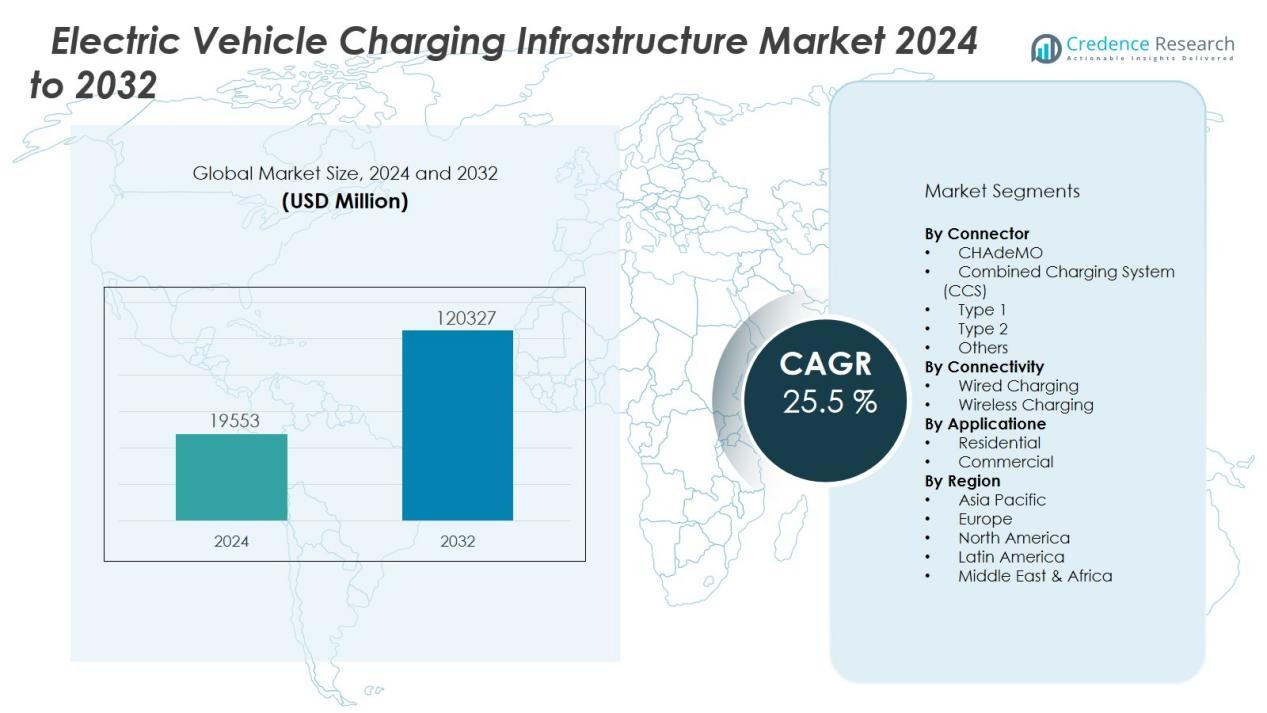

The electric vehicle charging infrastructure market size was valued at USD 19553 million in 2024 and is anticipated to reach USD 120327 million by 2032, at a CAGR of 25.5 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Charging Infrastructure Market Size 2024 |

USD 19553 Million |

| Electric Vehicle Charging Infrastructure Market, CAGR |

25.5 % |

| Electric Vehicle Charging Infrastructure Market Size 2032 |

USD 120327 Million |

Key market drivers include stringent emission regulations, subsidies for EV adoption, and the rising demand for sustainable mobility solutions. Technological advancements, such as ultra-fast DC charging, wireless charging systems, and vehicle-to-grid (V2G) integration, are enhancing user convenience and operational efficiency. Automakers are increasingly collaborating with energy providers and charging infrastructure companies to develop seamless charging ecosystems, while fleet electrification in logistics and public transport is creating significant new opportunities.

Regionally, Asia-Pacific dominates the EV charging infrastructure market, supported by large-scale EV adoption in China, India, and Japan, alongside strong government incentives and infrastructure investments. Europe follows closely, driven by stringent climate policies and the rapid deployment of fast-charging networks across urban and highway corridors. North America is witnessing steady growth, with the United States leading initiatives under federal funding programs to expand nationwide charging networks. Emerging markets in Latin America and the Middle East are gradually developing infrastructure to support growing EV penetration, though adoption remains at an early stage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The electric vehicle charging infrastructure market was valued at USD 19,553 million in 2024 and is projected to reach USD 120,327 million by 2032, growing at a CAGR of 25.5% during 2024–2032.

- Stringent emission regulations, government subsidies, and rising demand for sustainable mobility are the primary forces driving adoption across global markets.

- Advancements such as ultra-fast DC charging, wireless charging, and vehicle-to-grid (V2G) integration are improving convenience and operational efficiency.

- Automakers, utilities, and infrastructure companies are investing heavily in collaborative projects to expand seamless charging ecosystems.

- High installation costs, uneven infrastructure distribution, and grid capacity challenges remain key barriers to scaling charging networks.

- Asia-Pacific leads with 45% market share, driven by China, India, and Japan, followed by Europe at 30% and North America at 20%.

- Fleet electrification in logistics, ride-hailing, and public transport presents long-term growth opportunities for infrastructure providers worldwide.

Market Drivers:

Government Policies and Incentives Encouraging Adoption:

The electric vehicle charging infrastructure market benefits strongly from supportive government regulations and incentive programs. Nations are implementing subsidies, tax benefits, and grants to accelerate EV adoption and ensure the development of reliable charging networks. Regulatory mandates on emissions and sustainability goals push automakers and energy providers to invest in infrastructure. Public-private partnerships further strengthen funding opportunities and expand charging accessibility across both urban and rural areas.

- For instance, In the UK, the government dedicated GBP1.6billion, with the goal that firms such as bp pulse will help install 300,000 public chargers by 2030. In the Netherlands, the government and Fastned partnered to install over 200 fast-charging stations along highways, substantially increasing accessibility for EV drivers.

Rising EV Sales Driving Infrastructure Expansion:

Global EV sales continue to surge, creating direct demand for robust charging facilities. The electric vehicle charging infrastructure market grows in parallel with consumer preference for sustainable mobility and the rising availability of affordable EV models. It requires scaling charging capacity to meet the needs of both individual users and commercial fleets. Urbanization trends and the need for efficient transport solutions further boost the requirement for widespread charging stations.

- For instance, the City of Milwaukee secured nearly $15million to install chargers at 53 sites citywide in 2024, expanding public access and supporting climate goals.

Technological Advancements Enhancing Efficiency:

Rapid innovation in charging technologies drives efficiency and convenience for users. The electric vehicle charging infrastructure market is advancing through ultra-fast DC charging, smart grid integration, and wireless solutions. It supports reduced charging times, higher energy transfer, and seamless connectivity with digital platforms. Vehicle-to-grid (V2G) capabilities also create new revenue streams by enabling energy feedback into the grid, strengthening adoption across regions.

Growing Investment from Automakers and Energy Providers:

Large-scale investments from automotive manufacturers, utilities, and private companies accelerate infrastructure deployment. The electric vehicle charging infrastructure market gains momentum as industry stakeholders collaborate to create integrated charging ecosystems. It includes strategic alliances for cross-border networks and bundled services that enhance user convenience. The focus on fleet electrification in logistics, public transport, and ride-hailing further stimulates infrastructure development worldwide.

Market Trends:

Integration of Smart Technologies and Energy Management:

The electric vehicle charging infrastructure market is witnessing strong integration of smart technologies that enhance efficiency and user experience. Smart charging systems allow dynamic load management, optimize energy distribution, and reduce strain on power grids. It leverages data analytics and IoT platforms to provide real-time monitoring, predictive maintenance, and seamless payment solutions. Vehicle-to-grid (V2G) technology is emerging as a transformative trend, enabling EVs to function as distributed energy storage units. This not only supports grid stability but also creates revenue opportunities for EV owners. The convergence of renewable energy sources such as solar and wind with charging networks further strengthens sustainability and promotes low-carbon mobility.

- For instance, Virta’s Charge Point Management System supports 450 charger models and manages real-time data from over 100,000 charging stations, processing 40GB of data every hour to optimize network operations and user experience.

Expansion of Ultra-Fast and Public Charging Networks:

The electric vehicle charging infrastructure market is evolving with rapid deployment of ultra-fast and high-capacity charging solutions. Demand for DC fast chargers is increasing as consumers seek shorter charging times to match the convenience of refueling traditional vehicles. It is driving investments in highway corridors, urban hubs, and commercial fleet depots to enable long-distance travel and high-frequency use cases. Public charging networks are also expanding through collaborations between automakers, utilities, and private operators. Subscription-based models, roaming agreements, and interoperability standards are gaining traction, ensuring consistent access across different platforms. This shift towards accessible and efficient charging ecosystems strengthens user confidence and accelerates EV adoption worldwide.

- For instance, EVgo, one of the largest DC fast-charging networks in the US, reports strong growth during Q2 2025, delivering 88 GWh of energy to over 1.5M customer accounts.

Market Challenges Analysis:

High Costs and Infrastructure Deployment Barriers:

The electric vehicle charging infrastructure market faces significant challenges due to high installation and operational costs. Building fast-charging networks requires heavy investments in land, equipment, and advanced power systems, which limit scalability in price-sensitive regions. It struggles with uneven distribution, as rural and semi-urban areas often lack adequate infrastructure compared to metropolitan cities. Grid capacity constraints and the need for substantial upgrades to handle peak loads further delay expansion. Uncertainty around return on investment also discourages private players from making long-term commitments. These factors collectively slow down the pace of widespread infrastructure deployment.

Interoperability and Standardization Issues:

The electric vehicle charging infrastructure market also encounters barriers due to lack of universal charging standards and interoperability challenges. Different regions and manufacturers adopt varying connector types, voltage requirements, and payment systems, which create inconvenience for users. It weakens consumer confidence when charging compatibility across networks remains uncertain. Software integration and roaming agreements between providers are still limited, restricting seamless usage. Cybersecurity risks linked to connected charging platforms raise further concerns for operators and customers. Addressing these issues is critical to build trust and accelerate adoption of EV charging solutions on a global scale.

Market Opportunities:

Rising Demand for Fast and Smart Charging Solutions:

The electric vehicle charging infrastructure market holds significant opportunities in the expansion of fast and smart charging solutions. Consumer preference for reduced charging times is creating strong demand for ultra-fast DC chargers across highways, commercial hubs, and urban centers. It benefits from growing integration with smart grids, IoT-enabled platforms, and digital payment systems that enhance convenience and efficiency. The adoption of vehicle-to-grid (V2G) technology also presents new revenue streams by enabling EVs to feed energy back into the grid. Renewable energy integration with charging stations further positions infrastructure providers as enablers of sustainable mobility. These advancements create lucrative opportunities for both established players and new entrants.

Growth Potential in Emerging Markets and Fleet Electrification:

The electric vehicle charging infrastructure market also sees opportunity in expanding across emerging economies and large-scale fleet operations. Rapid urbanization, government incentives, and rising EV adoption in Asia-Pacific, Latin America, and the Middle East create untapped growth potential. It gains momentum through collaborations with governments, utilities, and private investors to build large-scale charging corridors. Electrification of logistics, public transportation, and ride-hailing fleets demands reliable and high-capacity charging solutions. Subscription-based services and interoperable charging networks present scalable business models for operators. These developments open long-term opportunities for infrastructure expansion and market consolidation on a global level.

Market Segmentation Analysis:

By Connector

The electric vehicle charging infrastructure market is segmented by connector type into CHAdeMO, Combined Charging System (CCS), Type 1, Type 2, and others. CCS holds a dominant position due to its compatibility with both AC and DC charging, along with strong adoption in Europe and North America. Type 2 connectors are widely deployed in residential and public setups across Europe, supported by regulatory mandates. CHAdeMO maintains relevance in Japan and select Asian markets but faces declining global adoption as CCS gains traction. It reflects a growing preference for universal standards that enhance interoperability and convenience for consumers.

- For instance, the Netherlands alone hosts over 1,000 publicly accessible Type 2 charging points per million inhabitants, making it the country with the highest density of such chargers in Europe.

By Connectivity

The market is classified by connectivity into wired and wireless charging systems. Wired charging remains the primary segment due to established infrastructure, lower costs, and broad consumer familiarity. Wireless charging is emerging with promising growth, driven by advancements in inductive technology and demand for user-friendly solutions. It offers hands-free convenience and integration with smart mobility solutions but faces challenges of high cost and limited commercialization. Increasing R&D investments are expected to accelerate wireless adoption in premium EV models and fleet applications.

- For instance, Tesla reported over 50,000 Superchargers installed globally by mid-2023, reinforcing the dominance of wired charging infrastructure in EV adoption.

By Application

The electric vehicle charging infrastructure market is divided into residential and commercial applications. Residential charging dominates due to strong demand for home-based overnight charging solutions. Commercial charging, including public stations, fleet hubs, and highway corridors, is expanding rapidly with government funding and private investments. It supports large-scale EV adoption by ensuring convenient access to high-capacity and ultra-fast chargers. Growth in commercial networks is expected to outpace residential in the long term as EV penetration rises globally.

Segmentations:

By Connector:

- CHAdeMO

- Combined Charging System (CCS)

- Type 1

- Type 2

- Others

By Connectivity:

- Wired Charging

- Wireless Charging

By Application:

By Region:

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East & Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific accounts for 45% market share in the electric vehicle charging infrastructure market, making it the largest regional contributor. China leads with massive government investments, strict emission targets, and a well-established EV ecosystem supported by domestic manufacturers. It benefits from extensive deployment of public charging stations across highways and cities, ensuring accessibility for both passenger and commercial EVs. Japan and South Korea are expanding their networks with advanced fast-charging technologies and renewable energy integration. India is accelerating infrastructure development with state-led incentives and private sector collaborations, though challenges in grid stability remain. Rapid urbanization and growing EV sales continue to drive regional dominance.

Europe:

Europe holds 30% market share in the electric vehicle charging infrastructure market, supported by stringent emission regulations and strong sustainability initiatives. Countries such as Germany, France, and the Netherlands lead in developing dense public charging networks to meet climate neutrality targets. It benefits from large-scale adoption of fast-charging corridors across highways that enable seamless cross-border EV travel. The European Union promotes interoperability and standardized charging protocols, which increase user confidence and convenience. Investments in renewable energy integration further support the transition to low-carbon transportation. Partnerships between automakers and energy providers continue to expand the availability of charging services.

North America :

North America commands 20% market share in the electric vehicle charging infrastructure market, driven by federal funding programs and ambitious electrification goals. The United States dominates the region with nationwide initiatives to build fast-charging corridors and urban charging hubs. It is witnessing increasing collaboration between automakers, charging network operators, and utilities to expand infrastructure at scale. Canada supports growth with clean energy policies and government-backed EV adoption incentives. The focus on interoperability and user-friendly charging solutions is improving consumer trust. Rising EV penetration across both passenger and commercial fleets ensures continued growth momentum in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB Ltd.

- Leviton Manufacturing Co., Inc.

- ChargePoint, Inc.

- Blink Charging Co.

- Webasto Group

- Tesla Inc.

- bp pulse (Bp p.l.c.)

- Schneider Electric

- Siemens

- Eaton Corporation plc

- Delta Electronics, Inc.

- Broadband TelCom Power, Inc.

- Tritium DCFC Limited

Competitive Analysis:

The electric vehicle charging infrastructure market is highly competitive, with global leaders and regional players focusing on technology, scale, and strategic partnerships. Key participants include ABB Ltd., Leviton Manufacturing Co., Inc., ChargePoint, Inc., Blink Charging Co., Webasto Group, Tesla Inc., bp pulse (Bp p.l.c.), Schneider Electric, and Siemens. It is characterized by continuous innovation in ultra-fast charging, smart grid integration, and digital payment platforms. Leading companies emphasize expanding charging networks across highways, urban centers, and fleet hubs to strengthen market presence. Strategic alliances with automakers and utilities are common, enabling interoperability and improving user convenience. Players also focus on mergers, acquisitions, and government-backed projects to enhance global reach and secure long-term growth opportunities. The competitive landscape is defined by aggressive investments in research, large-scale deployments, and a shift toward sustainable, renewable-powered charging ecosystems.

Recent Developments:

- In August 2025, ABB Ltd. entered into a long-term agreement with Noveon Magnetics for the supply of US-made EcoFlux™ NdFeB rare earth magnets, with monthly deliveries beginning immediately to support ABB’s North American motor production facility.

- In May 2025, ChargePoint, Inc. formed an industry-first partnership with Eaton to launch bidirectional EV charging and turnkey infrastructure solutions in North America and Europe, advancing transportation electrification across multiple segments.

- In January 2024, Leviton Manufacturing Co., Inc. acquired PRISM Data Centre Solutions Limited, a UK-based manufacturer of network enclosures and data cabinets, to expand its offerings for enterprise and data centre customers in the EMEA region.

Market Concentration & Characteristics:

The electric vehicle charging infrastructure market demonstrates moderate concentration, with a mix of global leaders, regional players, and emerging startups competing for market presence. It is characterized by high capital intensity, strong reliance on government policies, and rapid technological innovation. Leading companies focus on expanding fast-charging networks, integrating renewable energy, and offering subscription-based services to strengthen customer loyalty. Regional players cater to localized needs, often collaborating with utilities and municipalities to enhance accessibility. The market is highly dynamic, with partnerships, mergers, and acquisitions playing a key role in shaping competitive positioning. Continuous advancements in smart charging, interoperability, and vehicle-to-grid integration define its evolving characteristics and create opportunities for both established and new entrants.

Report Coverage:

The research report offers an in-depth analysis based on Connector, Connectivity, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The electric vehicle charging infrastructure market will expand with stronger government mandates on clean mobility and stricter emission norms.

- Public and private investments will accelerate deployment of fast-charging stations across highways, urban centers, and fleet hubs.

- Smart charging technologies will play a central role in optimizing energy distribution and reducing pressure on existing power grids.

- Integration of renewable energy sources such as solar and wind into charging networks will enhance sustainability.

- Vehicle-to-grid (V2G) capabilities will create new revenue streams and strengthen grid stability by allowing bidirectional energy flow.

- Automakers will increasingly collaborate with utilities and technology providers to build seamless charging ecosystems.

- Emerging economies will witness rapid infrastructure growth, supported by urbanization and rising EV adoption in large cities.

- Interoperability standards and roaming agreements will improve cross-network accessibility and enhance consumer trust.

- Fleet electrification in logistics, ride-hailing, and public transport will drive large-scale demand for high-capacity charging solutions.

- Continuous innovation in ultra-fast DC charging and wireless technologies will redefine convenience and accelerate global adoption of EVs.