Market Overview

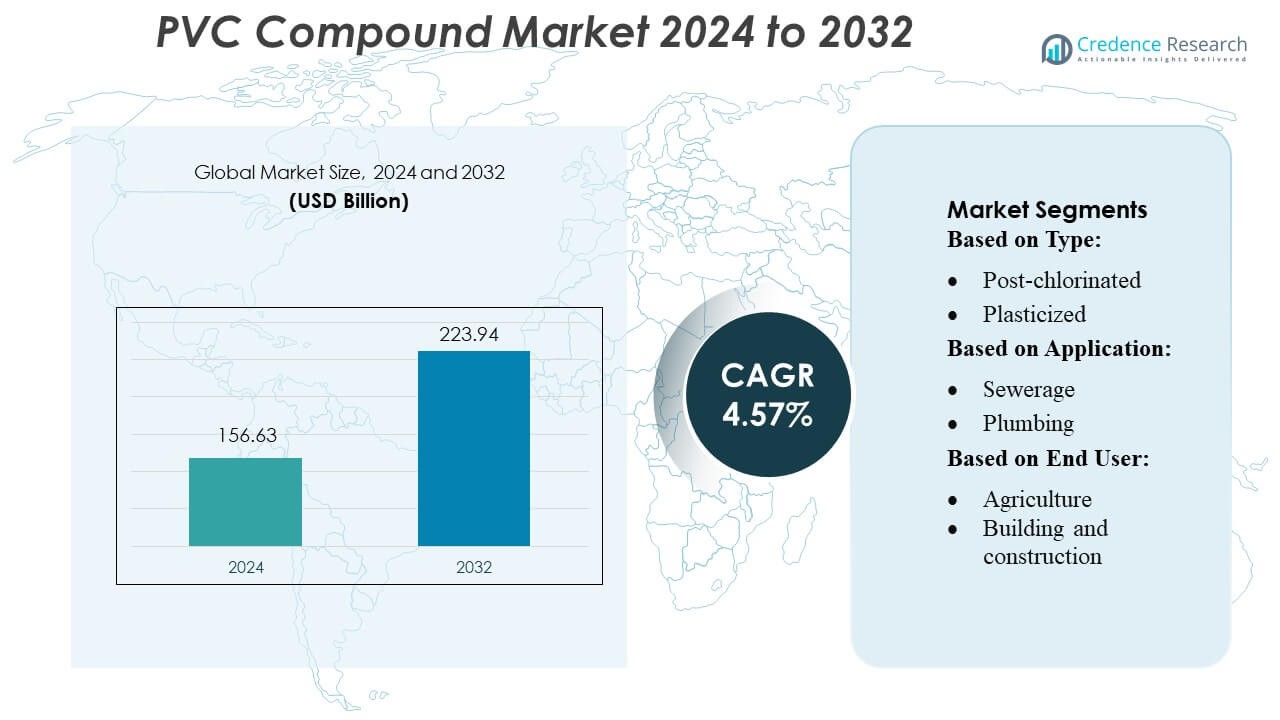

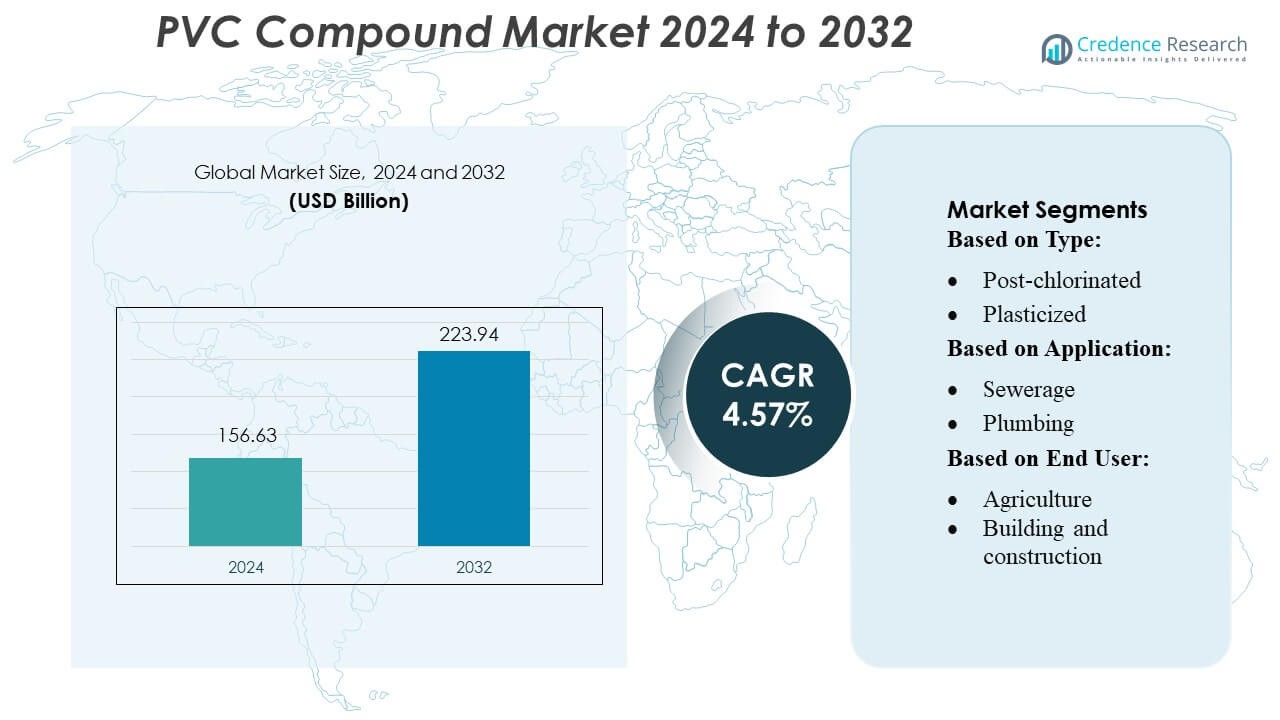

PVC Compound Market size was valued USD 156.63 billion in 2024 and is anticipated to reach USD 223.94 billion by 2032, at a CAGR of 4.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PVC Compound Market Size 2024 |

USD 156.63 Billion |

| PVC Compound Market, CAGR |

4.57% |

| PVC Compound Market Size 2032 |

USD 223.94 Billion |

The PVC Compound Market features a competitive mix of global producers that focus on high-performance formulations, sustainable stabilizer systems, and expanded regional manufacturing to strengthen their market positions. Companies continuously enhance product quality for construction, electrical, automotive, and industrial applications while investing in recyclable and low-VOC compound technologies to meet evolving regulatory standards. Asia-Pacific leads the global market with an exact market share of 47%, driven by large construction activity, strong manufacturing capacity, extensive cable-insulation demand, and rapid infrastructure development across China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The PVC Compound Market was valued at USD 156.63 billion in 2024 and is expected to reach USD 223.94 billion by 2032, registering a CAGR of 4.57%, supported by rising demand from construction, electrical, automotive, and industrial applications.

- Market growth is driven by increasing consumption of PVC pipes, profiles, and cable insulation, as well as expanding use of CPVC and high-performance compounds in hot-water, industrial, and high-pressure systems.

- Sustainable, lead-free, and low-VOC formulations represent key trends as producers invest in recyclable compounds and advanced stabilizer technologies to meet tightening environmental regulations.

- Competitive activity intensifies as global manufacturers expand regional production, strengthen OEM partnerships, and upgrade compounding capabilities; however, fluctuating raw-material prices and strict compliance requirements continue to restrain margins.

- Asia-Pacific leads with a 47% market share, while the building and construction segment remains the largest application area with over 50% share, supported by rapid infrastructure development and growing telecom cable installations.

Market Segmentation Analysis:

By Type

Post-chlorinated PVC (CPVC) dominates the type segment, accounting for an estimated 45–50% market share, driven by its superior thermal resistance, higher chlorine content, and suitability for hot-water and industrial piping systems. Plasticized PVC follows, supported by its flexibility and demand in wire insulation and consumer goods. Unplasticized PVC (uPVC) continues to gain traction in structural applications due to its rigidity and durability. Growth across all types is propelled by rising infrastructure investments, strict fire-safety standards, and expanding use of CPVC in high-temperature fluid-handling applications.

- For instance, Entec Polymers uses its broad compounding expertise to blend ABS, ASA, and EBA with CPVC, achieving consistent additive dispersion in its resins technical team has helped compounders reduce development time by up to 30 hours per formulation, thanks to enhanced processing support.

By Application

The plumbing segment leads the market with 35–40% share, supported by extensive adoption of uPVC and CPVC compounds for residential and commercial piping. Sewerage and water-supply applications follow, driven by the rising need for corrosion-resistant and cost-efficient pipeline materials. The oil and gas and irrigation segments continue expanding as PVC compounds offer improved chemical resistance, longer lifecycle, and lower installation cost. Overall demand is strengthened by urbanization, water-infrastructure modernization, and substitution of metal pipes with lightweight polymeric systems in municipal and private projects.

- For instance, Formosa Plastics Corporation, U.S.A. announced an expansion for its PVC plant in Baton Rouge, Louisiana, increasing capacity by approximately 136,000 metric tons (300 million pounds) annually.

By End User

The building and construction sector accounts for the dominant 50%+ market share, attributed to heavy consumption of PVC compounds in pipes, fittings, window profiles, conduits, and flooring materials. Agriculture represents the second-largest segment, driven by demand for PVC-based irrigation systems, drip lines, and water-management solutions. The telecommunications segment benefits from increased deployment of PVC-insulated cables for fiber-optic protection and electrical networks. Growth across end users is fueled by rapid construction activities, modernization of utility infrastructure, and expanding agricultural irrigation networks in emerging economies.

Key Growth Drivers

1. Expanding Demand in Building & Construction

The building and construction sector significantly drives PVC compound demand due to rising consumption in pipes, profiles, fittings, flooring, and insulation materials. Rapid urbanization, housing expansion, and modernization of water infrastructure increase the need for durable, corrosion-resistant materials. Government investments in sewerage upgrades, sanitation projects, and affordable housing further strengthen market growth. PVC compounds’ cost-effectiveness, easy processing, and long service life make them preferred materials over metals, accelerating large-scale adoption across residential, commercial, and municipal applications.

- For instance, Celanese Corporation has invested in a carbon-capture and utilization (CCU) project at its Clear Lake, Texas site that is designed to capture 180,000 metric tons of CO₂ annually and convert it into 130,000 metric tons of low-carbon methanol, which is then used as a feedstock in its engineered materials.

2. Rising Use in Electrical and Cable Insulation

Growing electricity distribution networks and increasing telecom infrastructure fuel demand for PVC compounds in wire and cable insulation applications. PVC’s excellent dielectric strength, flame resistance, and flexibility make it suitable for both low-voltage and communication cables. Expansion of fiber-optic networks, data centers, and 5G infrastructure accelerates the need for protective cable sheathing materials. Additionally, the shift toward renewable energy installations, smart grids, and power-distribution modernization supports sustained consumption of specialized PVC compounds designed for enhanced heat stability and improved weather resistance.

- For instance, Avient Corporation recently launched its ECCOH™ XL 8054 cross-linkable flame retardant solution that meets EN 50363-0 G17/G18 fire-safety standards while achieving high elongation at break and surviving a hot-set test at 250 °C.

3. Growth in Automotive and Consumer Goods Applications

The automotive and consumer goods sectors increasingly adopt PVC compounds due to their versatility, lightweight properties, and cost advantages. Automotive manufacturers use PVC in interior trims, underbody coatings, seals, and wire harnessing to reduce weight and enhance durability. Consumer product manufacturers rely on plasticized PVC for flexible packaging, footwear, and household goods. Rising disposable incomes, vehicle production recovery, and expanding manufacturing capacity in Asia-Pacific drive higher consumption. Improved formulations offering enhanced UV stability, chemical resistance, and recyclability further support adoption across diverse applications.

Key Trends & Opportunities

1. Advancements in Sustainable and Recyclable PVC Compounds

Sustainability trends shape the market as manufacturers develop low-VOC, lead-free, and recyclable PVC compounds to comply with global environmental regulations. Growing preference for bio-based plasticizers and reduced-toxicity stabilizers creates opportunities for innovative formulations. Circular economy initiatives encourage closed-loop recycling of PVC pipes, profiles, and cable sheathing. Companies adopting greener production technologies and energy-efficient compounding processes gain competitive advantages. This shift improves material performance while addressing environmental concerns, driving greater acceptance of eco-friendly PVC compounds across construction, automotive, and electrical applications.

- For instance, Shin-Etsu is targeting a 30% reduction in energy consumption at its Rotterdam PVC plant through process electrification, which would enable CO₂-neutral operations by reusing low-temperature heat.

2. Rising Adoption of High-Performance PVC Compounds

Demand for high-performance PVC compounds offering enhanced thermal stability, chemical resistance, and mechanical strength continues to rise. End users seek specialty PVC grades suitable for high-pressure piping, hot-water systems, medical devices, and industrial components. CPVC and engineered PVC compounds experience increasing adoption due to their suitability for challenging environments such as industrial water treatment and oil and gas piping. Manufacturers investing in advanced compounding technologies, nanofillers, and performance additives capitalize on growing demand for materials that meet stricter safety and efficiency standards.

- For instance, Westlake’s NAPCO division has developed molecular-oriented PVC (PVCO) pipe in sizes from 6 in to 12 in (150 mm to 300 mm), where the molecular stretching increases strength while cutting more than 40% of the pipe weight compared to conventional PVC.

3. Increasing Infrastructure Investments in Emerging Economies

Rapid infrastructure development across Asia-Pacific, the Middle East, and Africa presents strong growth opportunities. Government initiatives targeting water supply expansion, irrigation modernization, urban sanitation, and electricity distribution strengthen demand for PVC pipes, cables, and fittings. Rising construction of industrial parks, commercial complexes, and transportation networks generates substantial consumption of PVC-based materials. As cost-efficient solutions with long service life, PVC compounds benefit from large-scale public and private investments in essential infrastructure, creating steady market expansion opportunities in developing regions.

Key Challenges

1. Fluctuating Raw Material Prices

Volatility in the prices of key raw materials such as ethylene and chlorine significantly impacts production costs for PVC compounds. Supply chain disruptions, energy price fluctuations, and limited feedstock availability create instability in manufacturing margins. Dependence on petrochemical derivatives exposes producers to global market dynamics and geopolitical risks. These fluctuations affect pricing strategies and can reduce competitiveness in price-sensitive markets. Manufacturers face increasing pressure to optimize sourcing strategies, adopt cost-efficient production technologies, and strengthen inventory management practices to mitigate these challenges.

2. Environmental Regulations and Sustainability Pressures

Stringent regulations on plastic waste management, disposal practices, and use of hazardous additives challenge market participants. Restrictions on phthalate plasticizers, lead-based stabilizers, and chlorine-related environmental concerns push companies to redesign formulations. Compliance with REACH, RoHS, and extended producer responsibility frameworks increases operational complexity and costs. Growing awareness of plastic pollution encourages end users to consider alternative materials, placing additional pressure on PVC manufacturers. The need for sustainable practices and advanced recycling systems becomes critical to maintaining market acceptance and regulatory compliance.

Regional Analysis

North America

North America holds around 22–25% of the PVC compound market, supported by strong demand from the construction, automotive, and electrical industries. The region benefits from advanced compounding technologies, high consumption of CPVC in plumbing, and rising investments in water and wastewater rehabilitation projects. Growth is reinforced by increasing cable-insulation requirements driven by grid modernization and broadband expansion. The U.S. dominates regional consumption due to large-scale residential development and infrastructure upgrades, while regulatory shifts toward lead-free stabilizers continue accelerating adoption of high-performance and eco-friendly PVC compound formulations.

Europe

Europe accounts for approximately 18–20% of the global market, driven by stringent environmental standards and strong adoption of recyclable and low-VOC PVC compounds. Demand is supported by extensive use of PVC profiles, pipes, and insulation materials in renovation projects across Western Europe. Growth in telecom fiber deployment and electric-vehicle manufacturing further strengthens consumption of specialty cable-grade compounds. Germany, Italy, and France remain key markets, supported by advanced manufacturing infrastructure and strict quality standards. Sustainability directives and circular-economy policies continue shaping innovation, encouraging the transition to bio-based plasticizers and non-toxic stabilizer systems.

Asia-Pacific

Asia-Pacific leads the PVC compound market with a dominant 45–48% share, driven by large-scale construction, expanding industrial output, and rapid infrastructure development. China and India remain the primary growth engines due to high demand for PVC pipes, profiles, cable insulation, and consumer goods. Government investments in water supply networks, urban housing, irrigation systems, and renewable-energy grids significantly boost consumption. Expanding automotive production and increasing adoption of flexible PVC in consumer applications further accelerate growth. The region’s competitive manufacturing costs, rising polymer-processing capacity, and growing export orientation reinforce its global leadership

Latin America

Latin America represents about 7–8% of global demand, supported by stable growth in construction, agriculture, and utilities. Brazil, Mexico, and Argentina drive regional consumption due to rising use of PVC pipes in irrigation, urban water supply, and sewerage infrastructure. The expansion of electrical networks and growing cable-manufacturing activity further support demand for insulation-grade PVC compounds. Economic recovery initiatives and increased public spending on housing and sanitation projects stimulate market stability. However, market expansion is moderately constrained by price volatility, import dependency for additives, and currency fluctuations affecting material procurement.

Middle East & Africa

The Middle East & Africa region holds approximately 5–7% of the global market, driven by investments in water management, construction, and oil & gas infrastructure. GCC countries, particularly Saudi Arabia and the UAE, generate strong demand for PVC compounds used in pipes, cable sheathing, and industrial components. Growing urbanization, desalination projects, and expansion of utility networks support steady market growth. In Africa, rising agricultural irrigation needs and development of low-cost housing drive PVC pipe consumption. Limited domestic compounding capacity and dependency on imported raw materials remain key constraints but also open opportunities for local manufacturing expansion.

Market Segmentations:

By Type:

- Post-chlorinated

- Plasticized

By Application:

By End User:

- Agriculture

- Building and construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The PVC Compound Market remains highly competitive, with leading participants such as Entec Polymers, Covestro AG, Formosa Plastics Corporation U.S.A., Celanese Corporation, Avient Corporation, Shin-Etsu Chemical Co., Ltd., Westlake Corporation, Sterling Plastics, Inc., Dupont, and LG Chem. The PVC Compound Market demonstrates a competitive environment driven by continuous product innovation, capacity expansion, and a strong focus on regulatory compliance. Companies prioritize the development of high-performance formulations with enhanced thermal stability, improved chemical resistance, and greater processing efficiency to meet the needs of construction, electrical, automotive, and industrial sectors. Sustainability remains a major differentiator, as manufacturers invest in lead-free stabilizers, low-VOC additives, and recyclable compound technologies to align with global environmental standards. Market participants also emphasize regional footprint expansion, strategic collaborations with OEMs, and optimization of supply chains to ensure reliable delivery and cost efficiency.

Key Player Analysis

- Entec Polymers

- Covestro AG

- Formosa Plastics Corporation, U.S.A.

- Celanese Corporation

- Avient Corporation

- Shin-Etsu Chemical Co., Ltd.

- Westlake Corporation

- Sterling Plastics, Inc.

- Dupont

- LG Chem

Recent Developments

- In July 2024, Formosa Plastics Corporation, U.S.A. announced the company’s expansion of PVC facility in Baton Rouge, Louisiana. This will have a significant impact on increasing the capability of the facility, enabling more effectively respond to the increasing needs of the customers.

- In May 2024, Westlake Corporation announced its intention to construct a build PVCO pipe facility at its manufacturing location in Wichita Falls, Texas. The expansion of the facility represents a major step in Westlake’s dedication to expanding, innovating, and creating jobs in the area.

- In April 2024, Delrin announced a strategic distribution partnership with Channel Prime Alliance and Entec to supply all grades of its products to customers across North America (US, Canada, and Mexico). This collaboration aims to expand Delrin’s reach and help customers solve design challenges by making its premium homopolymer acetal materials more accessible through these Ravago companies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as construction, telecom, and utility sectors increase their use of PVC-based piping, profiles, and cable insulation.

- Demand for CPVC and high-performance PVC compounds will rise due to their suitability for high-temperature and industrial applications.

- Manufacturers will accelerate the adoption of lead-free stabilizers and sustainable plasticizers to meet tightening environmental regulations.

- Recycling technologies and circular-economy models will gain greater importance across PVC processing industries.

- Infrastructure modernization in emerging economies will drive large-scale consumption of PVC pipes and fittings.

- Growth in renewable energy and power-distribution projects will boost demand for cable-grade PVC compounds.

- Automotive lightweighting and interior applications will support increasing use of flexible and semi-rigid PVC materials.

- Digitalization and process automation in compounding plants will improve efficiency and product consistency.

- Companies will invest more in regional production facilities to reduce supply-chain dependency and enhance responsiveness.

- Innovation in specialty medical, industrial, and performance additives will expand application opportunities for PVC compounds.