Market Overview

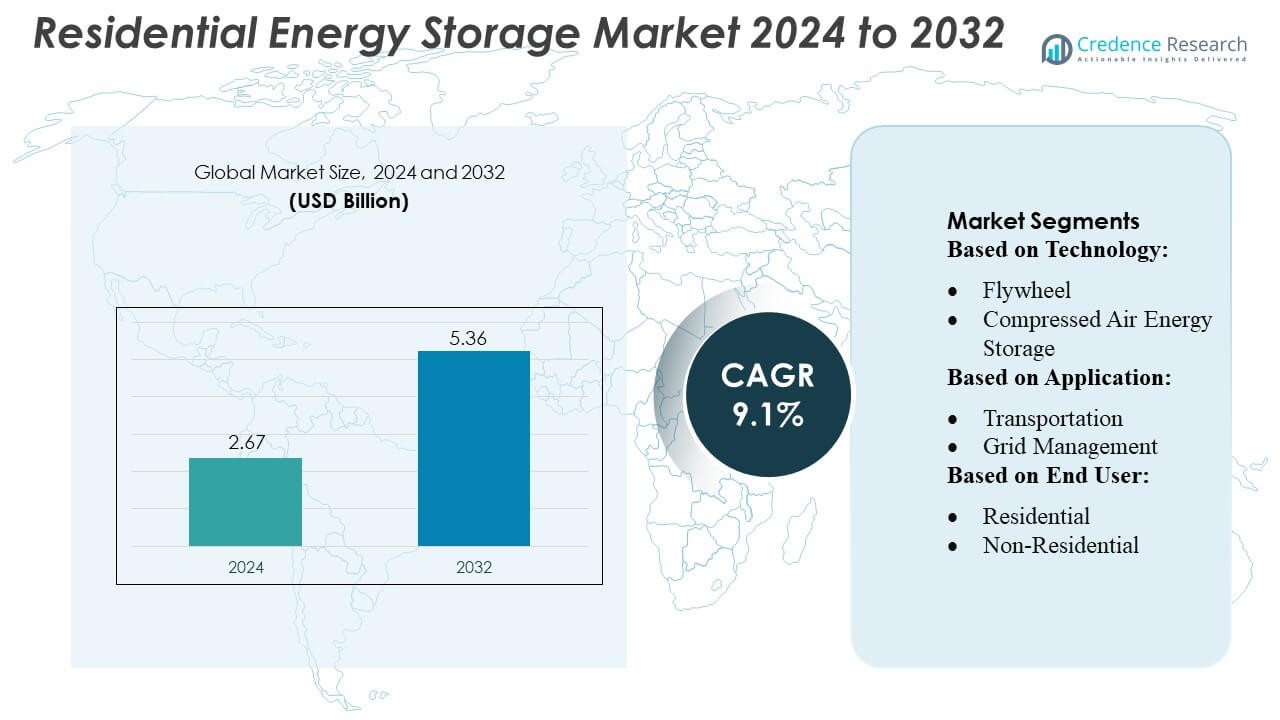

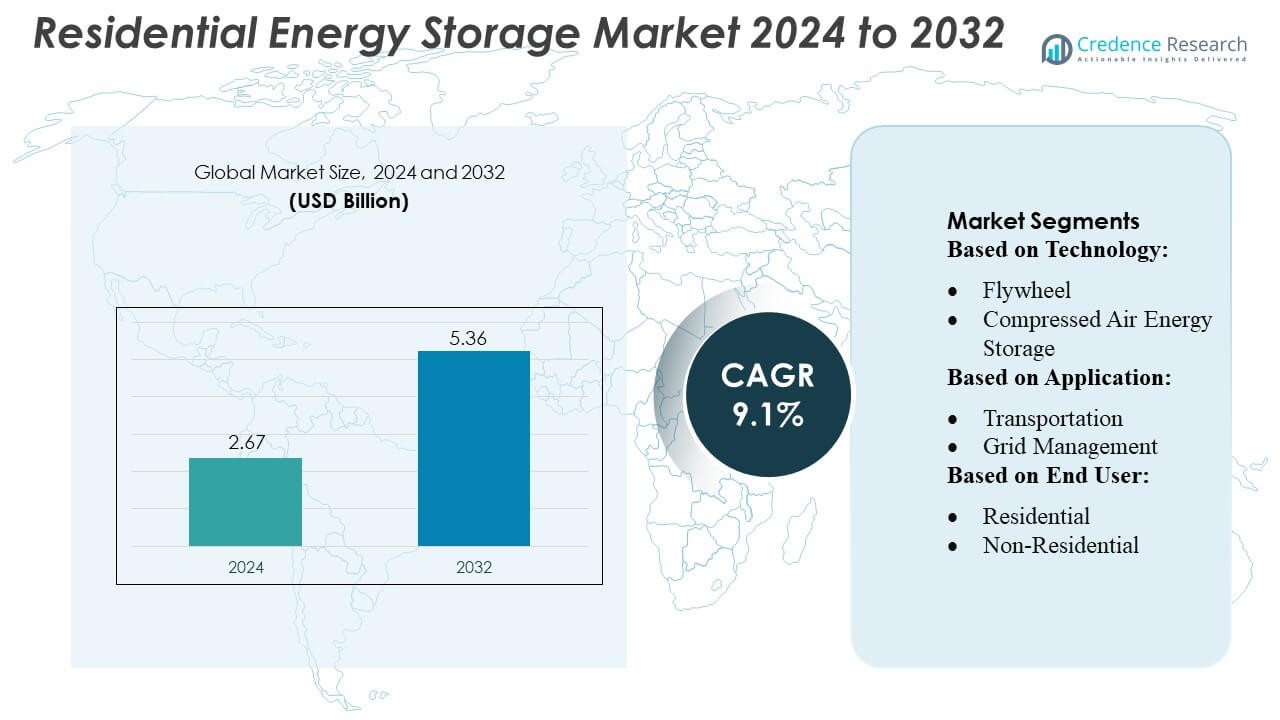

Residential Energy Storage Market size was valued USD 2.67 billion in 2024 and is anticipated to reach USD 5.36 billion by 2032, at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Energy Storage Market Size 2024 |

USD 2.67 Billion |

| Residential Energy Storage Market, CAGR |

9.1% |

| Residential Energy Storage Market Size 2032 |

USD 5.36 Billion |

The Residential Energy Storage Market is highly competitive, with key players including Showa Denko Materials Co., Ltd., Maxwell Technologies, Inc., The Furukawa Battery Co., Ltd., LG Chem, Langley Holdings plc, Electrovaya, GENERAL ELECTRIC, Ecoult, Saft, and Altairnano driving innovation and market growth. These companies focus on enhancing battery efficiency, lifecycle, and integration with solar PV and smart home systems, while expanding their regional presence through strategic partnerships and product diversification. North America leads the market, holding approximately 35% of the global share, driven by high solar PV adoption, supportive government incentives, and rising demand for energy resilience and backup power. Technological advancements, declining costs, and growing consumer awareness continue to strengthen North America’s leadership, while competitive strategies among global manufacturers shape the evolving landscape and accelerate adoption across Europe, Asia-Pacific, and other emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Residential Energy Storage Market was valued at USD 2.67 billion in 2024 and is projected to reach USD 5.36 billion by 2032, growing at a CAGR of 9.1% during the forecast period.

- North America leads the market with approximately 35% share, supported by high solar PV adoption, government incentives, and growing demand for energy resilience and backup power. Europe and Asia-Pacific follow, with rising renewable energy integration and urbanization driving growth.

- Lithium-ion batteries dominate the technology segment, accounting for the largest share due to high efficiency, long lifecycle, and compatibility with residential solar systems. Electro-chemical and electro-mechanical technologies are gradually expanding in niche applications.

- Market growth is driven by declining battery costs, increasing residential solar installations, smart home integration, and incentives for peak shaving and energy cost optimization.

- High initial investment costs, safety concerns, and regulatory variations remain key restraints, while competitive strategies and innovation among leading players accelerate adoption across regions.

Market Segmentation Analysis:

By Technology

The Electro-Chemical segment, particularly Lithium-Ion batteries, dominates the residential energy storage market, capturing over 60% of the technology share. Lithium-ion’s high energy density, long lifecycle, and declining costs drive widespread adoption in residential setups. Other technologies like Lead Acid and Flow Batteries serve niche applications due to lower efficiency or higher maintenance needs. Emerging technologies such as Molten Salt and Phase Change Materials are gaining attention for long-duration storage, but the market preference remains with Lithium-Ion due to proven reliability, scalability, and compatibility with solar PV systems.

- For instance, The Furukawa Battery Co., Ltd. Under recommended conditions (25 °C, Depth-of-Discharge 70 %), the UB‑1000 model is rated for approximately 4,500 cycles, and the UB‑50‑12 model about 4,000 cycles.

By Application

Grid Management leads the application segment, accounting for approximately 55% of market share, as residential energy storage increasingly supports peak shaving, load balancing, and demand response programs. While Transportation applications, such as electric vehicle integration, are expanding, their penetration in residential systems remains limited. The growing adoption of smart grids and distributed energy resources further strengthens grid management’s prominence. Consumers are investing in storage solutions to enhance energy security, optimize electricity costs, and participate in utility-driven incentive programs, reinforcing grid management as the primary residential application.

- For instance, LG ESS Home 5 system (another variant) shows a nominal battery capacity of 15.8 kWh, with a usable capacity of 14.4 kWh under standard conditions.

By End User

The Residential end-user segment holds a dominant position, representing nearly 70% of the market. Increasing electricity costs, rising solar PV adoption, and government incentives for home energy storage drive residential deployment. Non-residential segments, including commercial and industrial users, are growing but still lag due to higher system complexity and cost. Utilities also deploy residential storage for distributed grid support, yet residential customers remain the core growth driver, leveraging energy autonomy, backup power, and cost savings. Technological advancements in compact, modular storage solutions further accelerate market penetration among homeowners.

Key Growth Drivers

Rising Adoption of Solar PV Systems

The rapid increase in residential solar photovoltaic (PV) installations is a major driver for energy storage adoption. Homeowners are increasingly investing in storage solutions to store excess solar energy, reduce reliance on the grid, and optimize electricity costs. Technological advancements in lithium-ion and other battery systems, coupled with government incentives and rebates, make storage systems more accessible. Integration with smart home energy management systems further enhances usability, driving market growth across both developed and emerging regions.

- For instance, GKN Hydrogen’s storage system has reportedly demonstrated over 7,000 charge/discharge cycles with 99% efficiency, and can preserve hydrogen stored in metal hydride “without degradation for up to 30 years.

Energy Cost Savings and Peak Shaving

Residential energy storage enables homeowners to reduce electricity bills through peak shaving and load shifting. Consumers can store energy during off-peak hours when electricity rates are lower and utilize it during peak periods, optimizing energy costs. Rising electricity tariffs and time-of-use pricing policies encourage adoption. Energy storage also allows homeowners to participate in demand response programs, creating additional economic benefits. These financial incentives and cost-optimization opportunities continue to accelerate the deployment of residential storage systems globally.

- For instance, Electrovaya achieved UL2580 certification for 448 distinct battery‑system models, covering 24 V, 36 V, and 48 V lithium‑ion systems.

Grid Resiliency and Backup Power

Increasing frequency of power outages and grid instability has heightened demand for residential energy storage as a reliable backup solution. Homeowners prioritize uninterrupted power supply during emergencies, natural disasters, or blackouts. Advanced storage systems provide stable electricity for critical household appliances while supporting grid resiliency. This driver is reinforced by growing awareness of climate change impacts and energy security concerns. Utilities are also promoting residential storage to enhance distributed grid reliability, further fueling market expansion.

Key Trends & Opportunities

Integration with Smart Home and IoT Systems

Residential energy storage is increasingly integrated with smart home and Internet of Things (IoT) technologies, enabling real-time energy monitoring and management. Homeowners can optimize consumption, remotely control battery usage, and automate storage operations. This trend enhances system efficiency and user convenience, creating new market opportunities. Partnerships between battery manufacturers, solar providers, and smart home technology companies are expected to expand, driving innovation and adoption.

- For instance, GE’s continuing investment in power conversion and storage integration. The 2025 data sheet shows that the FLEXINVERTER BESS solution supports up to 1,500 Vdc input, with DC‑input current capacity up to 4200 A (at 25 °C) and can output up to 4.4 MVA AC power in a standard 20‑ft ISO‑container format.

Declining Battery Costs and Technological Advancements

Continuous improvements in battery technology, particularly lithium-ion systems, and reductions in production costs are creating opportunities for widespread residential adoption. Enhanced energy density, longer lifecycle, and faster charging capabilities make systems more attractive to homeowners. Emerging technologies such as solid-state batteries and flow batteries are expected to further improve performance. Cost-effective solutions paired with government subsidies and financing options enable more households to adopt residential energy storage, expanding market potential.

- For instance, Ecoult UltraBattery-based systems have operated for over 20,000 cycles without significant loss of capacity under conditions involving frequent charging/discharging.

Emergence of Virtual Power Plants (VPPs)

Residential energy storage systems are increasingly leveraged in virtual power plant networks, aggregating distributed storage to support grid management. This presents opportunities for homeowners to monetize stored energy while contributing to grid stability. Utilities and energy service providers are promoting VPP participation through incentives and dynamic pricing schemes. The development of VPPs enhances the business case for residential storage, encouraging adoption and creating a scalable market ecosystem for both technology providers and consumers.

Key Challenges

High Initial Investment Costs

Despite declining battery prices, residential energy storage systems still require significant upfront investment, limiting adoption in price-sensitive markets. Costs for installation, maintenance, and integration with existing solar or grid infrastructure can be prohibitive for many households. Lack of awareness about financing schemes or incentives further constrains market penetration. Manufacturers and policymakers need to address affordability through cost reduction, leasing options, and targeted subsidies to expand adoption and overcome this barrier.

Technological and Safety Concerns

Battery safety, efficiency, and degradation remain critical challenges for residential energy storage systems. Issues such as thermal runaway, limited lifecycle, and energy losses can affect performance and user confidence. Additionally, integration with grid infrastructure and varying local regulations create technical complexities. Ongoing research, stringent safety standards, and reliable system monitoring are essential to address these concerns, ensuring consumer trust and fostering sustainable market growth.

Regional Analysis

North America

North America holds a dominant position in the residential energy storage market, capturing approximately 35% of global market share in 2024. Growth is fueled by widespread adoption of residential solar PV systems, supportive government incentives, and time-of-use electricity pricing. Homeowners increasingly deploy lithium-ion storage systems for peak shaving, backup power, and integration with smart home technologies. Frequent power outages and the need for energy resilience further boost demand. The U.S. leads the region, followed by Canada, with utilities and private consumers driving large-scale adoption. Technological advancements and declining battery costs continue to strengthen North America’s market leadership.

Europe

Europe accounts for roughly 28% of the global residential energy storage market, driven by renewable energy policies, financial incentives, and high electricity tariffs. Germany, the U.K., France, and the Netherlands lead adoption with extensive solar PV penetration and feed-in tariff programs. Lithium-ion batteries dominate due to energy efficiency and long lifecycle, while emerging technologies like flow and thermal batteries gain niche traction. Residential storage supports grid stability, peak shaving, and energy autonomy. Virtual power plant initiatives and smart energy management systems create additional growth opportunities, positioning Europe as a key regional market with strong regulatory support and technology adoption.

Asia-Pacific

Asia-Pacific represents about 25% of the global residential energy storage market, showing the fastest growth rate globally. Strong adoption in China, Japan, South Korea, and Australia is driven by urbanization, rising electricity demand, and supportive government policies promoting solar-plus-storage systems. Lithium-ion batteries dominate due to cost efficiency, reliability, and integration capabilities with residential solar PV. Storage solutions are increasingly used for energy independence, electric vehicle charging, and grid support. Declining battery costs, technological advancements, and favorable financing schemes further accelerate adoption, making Asia-Pacific a rapidly expanding market with significant long-term growth potential.

Latin America

Latin America contributes approximately 6% of the global residential energy storage market, with Brazil, Mexico, and Chile as key adopters. Market growth is propelled by rising electricity costs, unreliable grid infrastructure in remote areas, and renewable energy incentives. Residential storage systems are primarily used for backup power, load shifting, and energy cost optimization. Lithium-ion batteries are the preferred technology, while thermal and lead-acid solutions serve specific regional needs. Increasing awareness of energy efficiency and expanding solar PV penetration present significant growth opportunities, though adoption remains constrained by affordability and limited financing options in several countries.

Middle East & Africa

The Middle East & Africa region holds nearly 6% of global market share, with adoption concentrated in the UAE, Saudi Arabia, South Africa, and Egypt. Residential energy storage is driven by rising energy costs, intermittent grid supply, and government initiatives promoting renewable energy integration. Lithium-ion systems dominate, providing reliable backup power and supporting solar PV installations. Energy independence, demand for uninterrupted power, and favorable subsidies accelerate adoption. Despite infrastructural and cost challenges, residential storage deployment is expected to grow steadily, fueled by policy support, private investments, and increasing awareness of energy resilience and sustainability in both urban and off-grid areas.

Market Segmentations:

By Technology:

- Flywheel

- Compressed Air Energy Storage

By Application:

- Transportation

- Grid Management

By End User:

- Residential

- Non-Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The residential energy storage market players such as Showa Denko Materials Co., Ltd., Maxwell Technologies, Inc., The Furukawa Battery Co., Ltd., LG Chem, Langley Holdings plc, Electrovaya, GENERAL ELECTRIC, Ecoult, Saft, and Altairnano. The residential energy storage market is highly competitive, characterized by rapid technological innovation, declining battery costs, and growing integration with residential solar PV systems. Companies compete on system efficiency, energy density, lifecycle performance, and compatibility with smart home and grid management solutions. Strategic initiatives such as partnerships, mergers, and product diversification are common to strengthen market presence and regional reach. Innovation in compact, modular, and scalable storage solutions is driving differentiation. Additionally, supportive government policies, subsidies, and energy incentive programs further intensify competition, compelling manufacturers to continuously improve performance, safety, and reliability to capture a larger share of the expanding residential energy storage market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Showa Denko Materials Co., Ltd.

- Maxwell Technologies, Inc.

- The Furukawa Battery Co., Ltd.

- LG Chem

- Langley Holdings plc

- Electrovaya

- GENERAL ELECTRIC

- Ecoult

- Saft

- Altairnano

Recent Developments

- In May 2025, NTPC Green Energy (NGEL) launched an engineering, procurement, and construction (EPC) tender for a 250 MW/1,000 MWh battery energy storage system (BESS) at its Kayamkulam thermal plant in Kerala. The project aims to enhance grid stability by integrating a large-scale battery storage system, crucial for balancing intermittent renewable energy sources.

- In May 2025, CATL announced the TENER Stack, a 9MWh energy storage system designed to be more efficient, safer, and easier to transport than previous technologies. Key features include a 45% increase in volume utilization and a 50% boost in energy density compared to traditional systems, along with enhanced safety measures.

- In September 2024, Eaton and Tesla announced a collaboration to improve home energy systems by integrating Tesla’s Powerwall with Eaton’s AbleEdge™ smart breakers. This partnership aims to make it easier for homeowners and installers to implement intelligent load management, which optimizes energy use and extends backup power during grid outages.

- In June 2024, ABB has introduced the ReliaHome Smart Panel will empower homeowners to take control of their energy use by providing insights needed to save energy and costs. Developed in collaboration with software partner Lumin, this innovative solution streamlines the coordination of home energy assets, offering enhanced energy optimization, circuit scheduling, and real-time control capabilities.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of residential energy storage systems will continue to rise with growing solar PV installations.

- Advanced lithium-ion batteries and emerging technologies will drive efficiency and reliability improvements.

- Integration with smart home and IoT systems will enhance energy management and user convenience.

- Energy cost optimization and peak shaving will remain a major incentive for homeowners.

- Virtual power plants and grid-support programs will expand opportunities for residential storage.

- Declining battery costs will make storage systems more accessible to a wider range of consumers.

- Backup power and energy resilience will increasingly influence purchase decisions.

- Government incentives and renewable energy policies will continue to support market growth.

- Modular and scalable storage solutions will gain preference in diverse household setups.

- Regional adoption in Asia-Pacific, Latin America, and the Middle East will grow rapidly alongside North America and Europe.