Market Overview

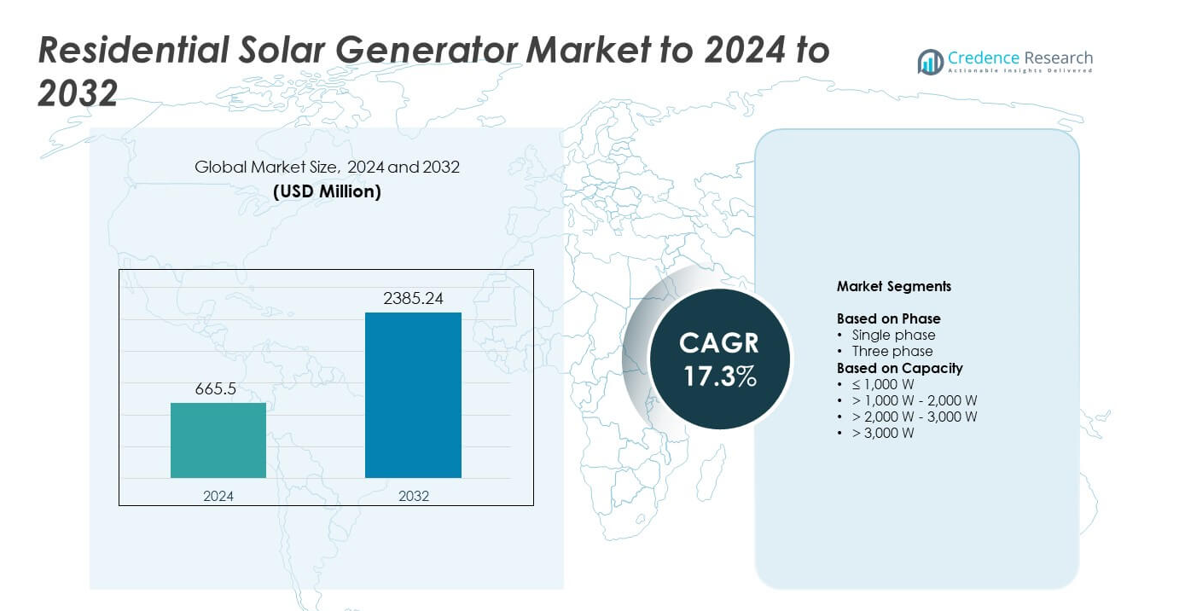

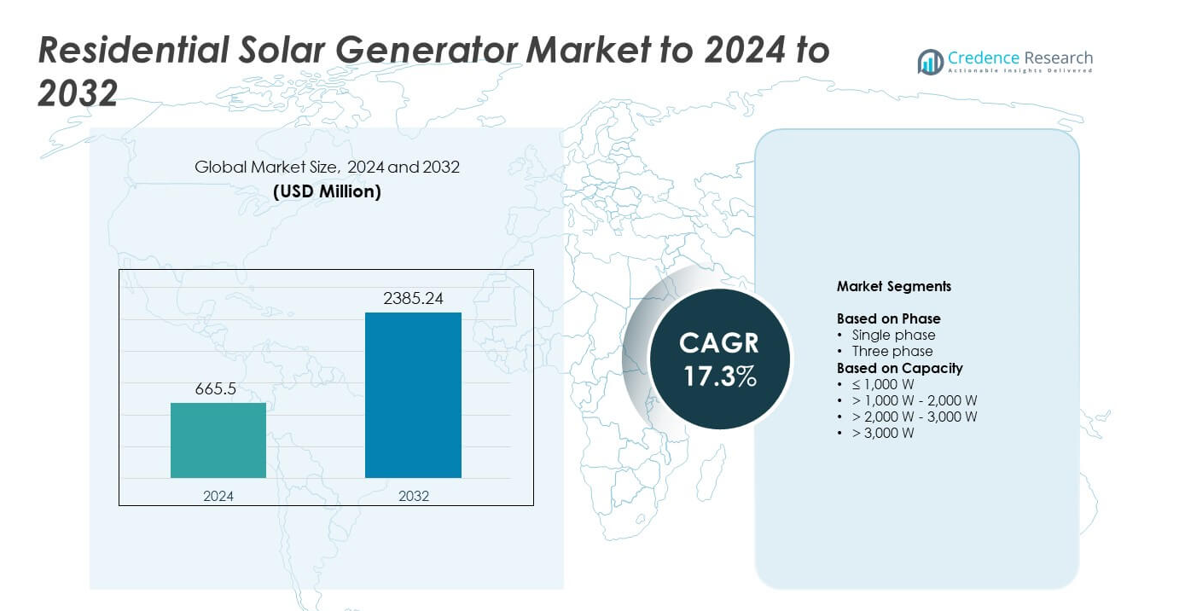

Residential Solar Generator market size was valued at USD 665.5 million in 2024 and is anticipated to reach USD 2,385.24 million by 2032, at a CAGR of 17.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Solar Generator Market Size 2024 |

USD 665.5 million |

| Residential Solar Generator Market, CAGR |

17.3% |

| Residential Solar Generator Market Size 2032 |

USD 2,385.24 million |

The Residential Solar Generator market is dominated by key players such as EcoFlow, GROWATT, Anker, Jackery, and BLUETTI, who are driving innovation through high-capacity lithium-ion and LiFePO₄ batteries, modular designs, and smart energy management systems. These companies focus on enhancing portability, charging efficiency, hybrid compatibility, and IoT-enabled monitoring to meet growing consumer demand for reliable and eco-friendly backup power. Regionally, North America leads the market with a 34% share, driven by frequent power outages, supportive government incentives, and strong adoption of smart home technologies. Asia-Pacific follows closely with a 30% share, fueled by rapid urbanization, rising residential power needs, and government initiatives promoting solar adoption. Europe holds around 27% of the market, benefiting from renewable energy mandates, net-zero targets, and technological innovations in storage efficiency and hybrid systems. Together, these regions account for the majority of global residential solar generator demand.

Market Insights

- The Residential Solar Generator market was valued at USD 665.5 million in 2024 and is projected to reach USD 2,385.24 million by 2032, growing at a CAGR of 17.3% during the forecast period.

- Rising consumer demand for reliable backup power, increasing frequency of outages, and government incentives for clean energy are driving market growth globally.

- Key trends include integration with smart home energy management systems, modular and scalable designs, IoT-enabled monitoring, and the rising adoption of hybrid and portable solar solutions.

- The competitive landscape features leading players such as EcoFlow, GROWATT, Anker, Jackery, and BLUETTI, focusing on battery innovations, AI-driven energy management, and hybrid compatibility to strengthen market presence.

- Regionally, North America led with a 34% share, followed by Asia-Pacific at 30% and Europe at 27%; the single-phase segment accounted for 68% share, while the >1,000 W–2,000 W capacity segment dominated with 42% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Phase:

The single-phase segment dominated the residential solar generator market in 2024, accounting for approximately 68% of the total share. Its dominance is attributed to widespread use in small- to medium-sized homes that primarily rely on low-voltage electrical systems. Single-phase generators are easier to install, cost-efficient, and compatible with common household appliances, driving their extensive adoption. Additionally, advancements in inverter technology and compact battery storage solutions have enhanced performance efficiency. The growing preference for energy independence and off-grid backup among homeowners continues to strengthen demand for single-phase solar generators.

- For instance, SMA’s single-phase Sunny Boy 3.0–6.0 inverters provide 3–6 kW AC for homes.

By Capacity:

The >1,000 W–2,000 W capacity segment held the largest share of around 42% in 2024, owing to its suitability for powering multiple household appliances, including refrigerators, lighting systems, and communication devices during outages. This range balances portability and sufficient power output, appealing to urban and suburban homeowners. Increasing availability of lithium-ion battery-based models and plug-and-play systems has further boosted adoption. Continuous innovations in power conversion efficiency and modular battery expansion options are encouraging consumers to invest in this segment for reliable and sustainable home energy solutions.

- For instance, Anker’s 555 PowerHouse delivers 1,024 Wh capacity and 1,000 W AC output.

Key Growth Drivers

Rising Demand for Reliable Backup Power Solutions

The increasing frequency of power outages and grid instability has accelerated the adoption of residential solar generators. Homeowners are increasingly turning to solar-powered systems as sustainable backup solutions that ensure uninterrupted power during emergencies. Solar generators eliminate dependence on fossil fuels, reduce operational noise, and require minimal maintenance compared to traditional portable generators. Furthermore, the growing awareness of energy resilience and the need for emergency preparedness in disaster-prone regions have strengthened market growth. The development of high-capacity lithium-ion batteries and smart inverter technologies enhances reliability and performance, enabling users to power essential home appliances efficiently. This surge in consumer awareness, combined with falling solar component costs, continues to drive robust adoption across urban and rural households worldwide.

- For instance, Enphase Energy shipped 195 MWh of IQ Batteries (Q3 2025), showing the surge in home energy storage.

Government Incentives and Clean Energy Policies

Supportive government policies promoting renewable energy adoption have become a major catalyst for residential solar generator demand. Incentives such as tax credits, rebates, and net metering programs significantly reduce upfront installation costs, making solar systems more affordable to homeowners. For instance, several countries have implemented long-term renewable energy targets and subsidy frameworks to encourage distributed solar generation at the household level. In addition, international commitments to reduce carbon emissions under agreements like the Paris Accord are fostering large-scale investments in solar infrastructure. These policy measures not only improve affordability but also enhance consumer confidence in solar technologies. As more governments tighten regulations on diesel and gasoline generators, the shift toward clean, emission-free solar generators is gaining momentum, especially in developed economies with strong decarbonization agendas.

- For instance, BYD’s Battery-Box Premium HVM modules scale from 8.3 kWh to 66.2 kWh, aligning with distributed energy programs supported by renewable incentives.

Advancements in Battery Storage and Inverter Technologies

Technological innovations in energy storage and inverter systems are playing a pivotal role in driving the residential solar generator market. Modern lithium-ion and lithium iron phosphate (LiFePO₄) batteries offer higher energy density, longer life cycles, and improved thermal stability compared to conventional lead-acid batteries. These advancements enable longer runtime and more efficient power utilization for household applications. Moreover, smart inverters equipped with Internet of Things (IoT) capabilities allow users to monitor energy generation and consumption in real time, optimizing system performance. The integration of modular battery systems also supports scalability, allowing consumers to expand capacity as their energy needs grow. Continuous R&D investments by manufacturers are enhancing energy conversion efficiency, durability, and portability, thereby broadening adoption among residential users seeking both convenience and sustainability.

Key Trends & Opportunities

Integration of Smart Home Energy Management Systems

The integration of solar generators with smart home energy management systems (HEMS) is emerging as a transformative trend in the residential segment. Consumers increasingly demand real-time visibility and control over their energy usage through connected devices and mobile applications. Solar generators equipped with IoT-enabled controls and AI-based analytics allow seamless load optimization and remote operation. This integration enhances overall system efficiency and extends battery lifespan by intelligently managing power distribution. As smart homes become mainstream, the compatibility of solar generators with devices like smart thermostats, EV chargers, and home batteries presents a major opportunity for manufacturers. Companies investing in interoperability and user-friendly digital interfaces are well-positioned to capture this growing demand for intelligent, autonomous energy ecosystems.

- For instance, SPAN offers a range of smart panels, including a 48-circuit option, that manage circuits and provide real-time, software-driven energy routing and load control for homes with renewable energy and storage.

Expansion of Off-Grid and Rural Electrification Projects

The growing emphasis on rural electrification and off-grid energy access is opening new opportunities in the residential solar generator market. Many remote areas still lack reliable grid infrastructure, making portable and solar-based solutions an attractive alternative. Governments and non-profit organizations are increasingly funding solar electrification projects to promote clean energy accessibility. Residential solar generators serve as scalable solutions that can be easily deployed and maintained in these regions. Furthermore, falling prices of solar modules and storage batteries are making off-grid systems economically viable for low-income households. Manufacturers targeting emerging markets in Asia, Africa, and Latin America are likely to benefit significantly from these developments as they align with global efforts to achieve universal electricity access and sustainable rural development.

- For instance, M-KOPA serves over 3 million active customers with a range of products, including distributed solar systems, across several African markets.

Growing Popularity of Hybrid and Portable Solar Solutions

The demand for hybrid solar generators that combine photovoltaic (PV) and battery technologies with auxiliary power sources such as wind or fuel-based systems is on the rise. These hybrid systems provide enhanced energy reliability, particularly in regions with intermittent sunlight. The trend toward portable solar generators is also gaining momentum among homeowners seeking mobility for outdoor or emergency use. Compact, lightweight designs equipped with high-efficiency panels and fast-charging capabilities appeal to consumers who prioritize convenience and flexibility. Manufacturers focusing on multifunctional systems with USB, AC, and DC outputs are expanding their customer base. The convergence of portability, hybrid operation, and advanced battery storage positions this segment as a key growth opportunity in the evolving solar energy landscape.

Key Challenges

High Initial Costs and Limited Consumer Awareness

Despite declining prices of solar components, the upfront cost of purchasing and installing residential solar generators remains a major challenge. Many households hesitate to invest due to the significant expense associated with high-capacity battery systems and advanced inverter technologies. Additionally, limited consumer awareness about long-term savings, performance benefits, and financing options restricts wider adoption. In developing economies, the lack of structured subsidy programs and easy financing further discourages potential users. Manufacturers and policymakers need to strengthen awareness campaigns, introduce flexible payment schemes, and highlight return-on-investment benefits to overcome cost-related barriers. Bridging the knowledge gap will be essential to accelerating market penetration and ensuring equitable adoption across income segments.

Storage Limitations and Energy Efficiency Constraints

Energy storage remains a technical challenge for the residential solar generator market. While lithium-ion and LiFePO₄ technologies have improved, limitations in charge capacity and energy conversion efficiency restrict extended power availability during prolonged outages. Moreover, efficiency losses occur during energy transfer between solar panels, batteries, and inverters, impacting overall system performance. Harsh weather conditions and temperature fluctuations can also degrade battery lifespan, increasing maintenance requirements. Addressing these challenges requires ongoing innovation in high-density batteries, thermal management, and power optimization algorithms. Manufacturers investing in advanced storage materials and smart control systems will be better positioned to enhance reliability and efficiency, ensuring consistent performance for residential users.

Regional Analysis

North America:

North America held the largest share of approximately 34% in the residential solar generator market in 2024, driven by increasing adoption of renewable energy and frequent power outages caused by extreme weather events. The United States leads regional growth, supported by federal tax credits, state-level incentives, and growing consumer preference for sustainable backup power. Advancements in lithium-ion battery systems and integration with smart home technologies further enhance adoption. Canada also shows rising demand for off-grid and rural electrification solutions, with supportive clean energy policies encouraging residential users to shift toward solar-based backup power systems.

Europe:

Europe accounted for around 27% of the residential solar generator market share in 2024, fueled by strong renewable energy mandates and net-zero emission targets. Countries such as Germany, the Netherlands, and the United Kingdom are leading in adoption, supported by government subsidies, feed-in tariffs, and consumer incentives. The region’s focus on energy self-sufficiency and decarbonization is driving demand for residential solar backup systems. Technological innovation in storage efficiency and integration of hybrid systems further support growth. The increasing installation of rooftop solar panels in urban homes also enhances the region’s transition toward decentralized energy generation.

Asia-Pacific:

Asia-Pacific captured nearly 30% of the market share in 2024 and is projected to witness significant expansion due to rapid urbanization, population growth, and rising residential power needs. China, Japan, and India are at the forefront, driven by government initiatives promoting solar adoption and domestic manufacturing of photovoltaic systems. Declining solar equipment costs and growing awareness of renewable alternatives are supporting mass adoption. Rural electrification projects and off-grid energy programs in Southeast Asia further strengthen regional demand. Technological innovations by local manufacturers and favorable financing mechanisms continue to make residential solar generators more accessible and efficient.

Latin America:

Latin America represented about 6% of the global residential solar generator market in 2024, supported by expanding renewable energy infrastructure and favorable sunlight availability. Brazil, Mexico, and Chile are key contributors, driven by government-backed solar initiatives and increasing household adoption of sustainable energy solutions. Rural and semi-urban areas are particularly embracing portable and hybrid solar generators due to unreliable grid connections. Continuous cost reductions in solar panels and storage systems are improving affordability across middle-income households. Additionally, partnerships between local distributors and global solar technology providers are accelerating the region’s residential clean energy transition.

Middle East & Africa:

The Middle East & Africa (MEA) region accounted for around 3% of the residential solar generator market in 2024, with growing adoption in areas facing unreliable grid infrastructure and high solar irradiance. Countries like South Africa, the UAE, and Saudi Arabia are increasingly investing in small-scale solar power systems to enhance energy independence. Rising demand for off-grid and portable generators in remote areas further drives growth. Government initiatives promoting renewable energy diversification and falling solar module prices are encouraging residential uptake. Continuous investment in storage technology and regional manufacturing is expected to strengthen MEA’s market presence.Top of Form

Market Segmentations:

By Phase

By Capacity

- ≤ 1,000 W

- > 1,000 W – 2,000 W

- > 2,000 W – 3,000 W

- > 3,000 W

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The residential solar generator market features strong competition among leading players such as Powerenz, Nature’s Generator, EcoFlow, GROWATT, Bluetti, Jackery, PowerOak, Lion Energy, HomeGrid, ACOPOWER, OUPES, Anker, Generac Power Systems, Humless, Renogy, Anern, Milesolar, Goal Zero, FibroGen, and Aton Solar. The competitive environment is defined by continuous innovation in battery efficiency, inverter technology, and compact power storage systems. Companies focus on expanding product portfolios that integrate advanced lithium-ion and LiFePO4 batteries, enabling faster charging and longer cycle life. Emphasis on hybrid solutions combining solar input with grid and vehicle charging is rising, enhancing flexibility for residential users. Strategic partnerships with component suppliers and retailers strengthen brand presence across key markets. Firms increasingly invest in modular generator systems and mobile applications for energy monitoring, improving user convenience and grid independence. Overall, sustained R&D efforts and global distribution expansion continue to shape market rivalry and technology leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Powerenz

- Nature’s Generator

- EcoFlow

- GROWATT

- Bluetti

- Jackery

- PowerOak

- Lion Energy

- HomeGrid

- ACOPOWER

- OUPES

- Anker

- Generac Power Systems

- Humless

- Renogy

- Anern

- Milesolar

- Goal Zero

- FibroGen

- Aton Solar

Recent Developments

- In 2024, EcoFlow launched its DELTA Pro Ultra modular home battery system, offering a 6 kWh base capacity expandable up to 90 kWh, with integrated solar MPPT charging and smart home automation. The system enables whole-home backup, seamless grid integration, and mobile app-based energy management.

- In 2024, Generac introduced its updated PWRcell 2 solar and energy storage system, which features an AC-coupled architecture, a key shift from the previous DC-coupled model.

- In 2022, Bluetti Power introduced its AC500 modular power station delivering 5,000 W pure sine wave output, compatible with up to six B300S battery modules for a total of 18,432 Wh capacity. The system supports multiple charging methods including solar, AC, car, and generator inputs, with advanced BMS protection

Report Coverage

The research report offers an in-depth analysis based on Phase, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Residential solar generators will increasingly integrate with smart home systems for real-time energy management.

- Modular and scalable battery solutions will drive adoption among households seeking flexible energy storage.

- Hybrid systems combining solar, battery storage, and grid connectivity will become more common.

- Manufacturers will focus on enhancing efficiency through advanced MPPT solar charging and energy optimization algorithms.

- Portable solar generators will gain traction for emergency backup and off-grid applications.

- IoT-enabled monitoring and predictive maintenance will improve system reliability and user convenience.

- Collaborative solutions between solar panel and storage providers will create unified residential energy ecosystems.

- Technological innovations will reduce system footprint and installation complexity for urban homes.

- Integration with electric vehicles will emerge as a key trend for household energy management.

- Rising consumer awareness and sustainability initiatives will drive long-term market growth globally.