Market Overview

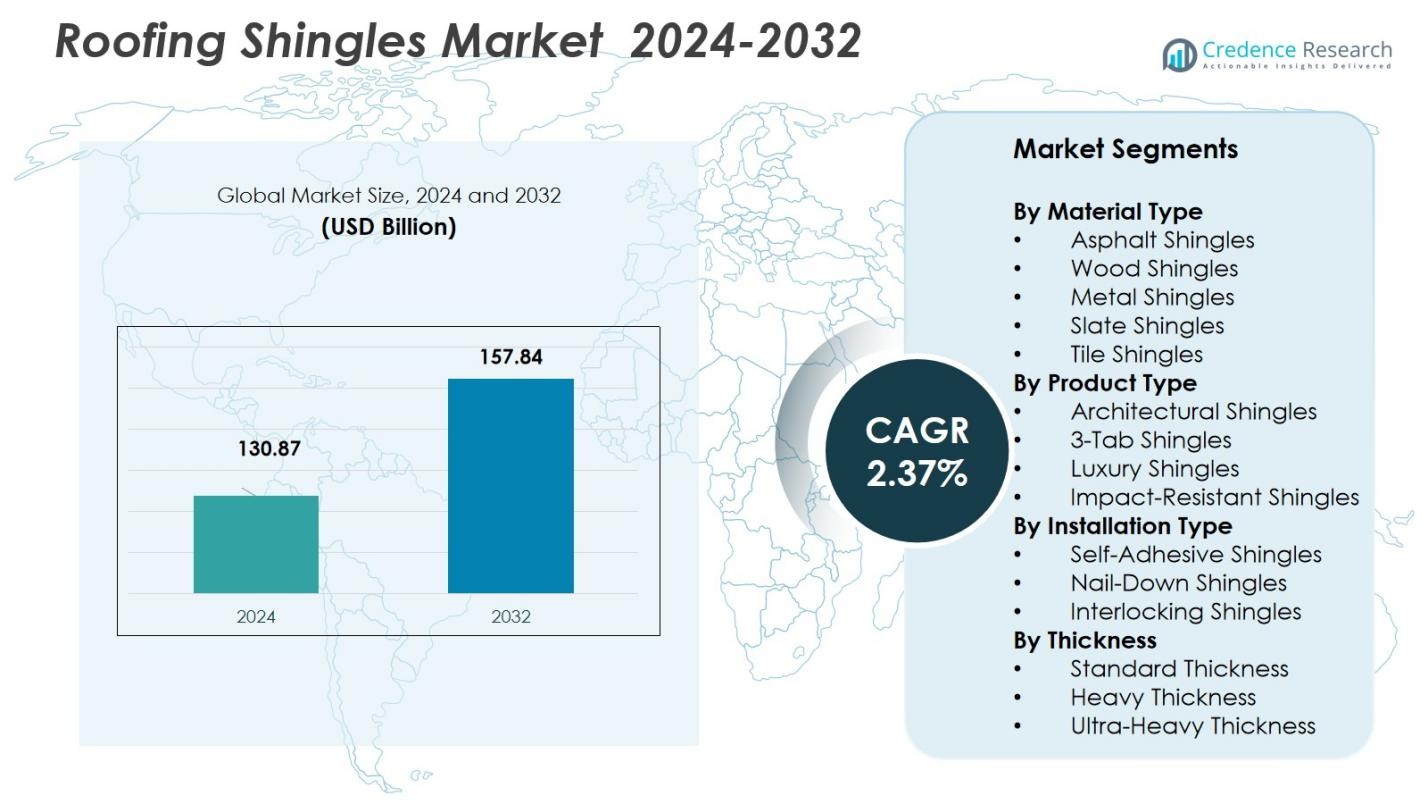

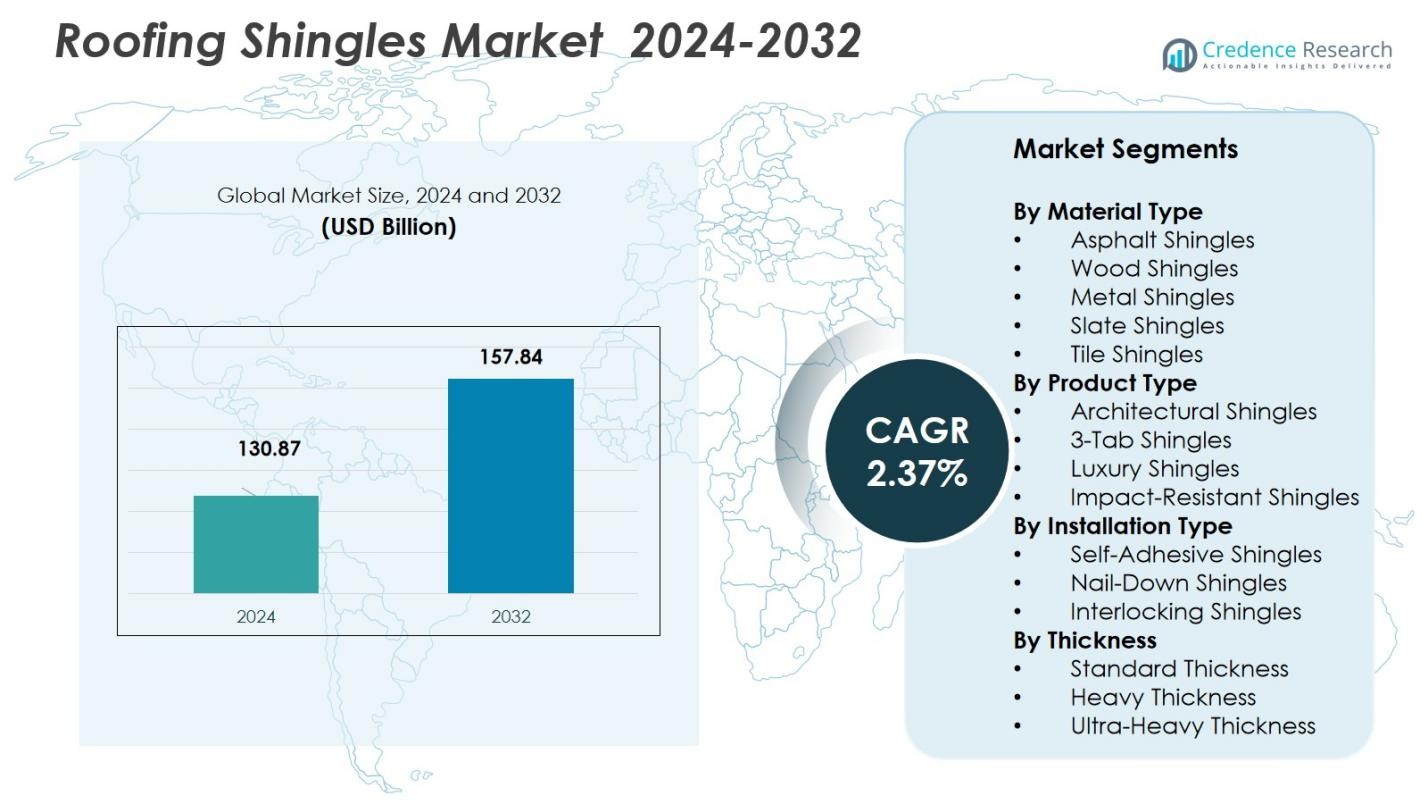

The Roofing Shingles Market size was valued at USD 130.87 Billion in 2024 and is anticipated to reach USD 157.84 Billion by 2032, at a CAGR of 2.37% during the forecast period. 2024

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Roofing Shingles Market Size 2024 |

USD 130.87 Billion |

| Roofing Shingles Market, CAGR |

2.37% |

| Roofing Shingles Market Size 2032 |

USD 157.84 Billion |

The Roofing Shingles Market is dominated by key players such as CertainTeed, GAF, Owens Corning, IKO Industries, and Atlas Roofing Corporation. These companies maintain significant market shares through extensive product portfolios and strong distribution networks. CertainTeed, a leading manufacturer, is known for its high-quality asphalt and architectural shingles, while GAF continues to lead in innovation with a range of impact-resistant and energy-efficient solutions. North America holds the largest share of the market, with over 40% of global revenue in 2024, driven by strong demand for re-roofing and new construction. Europe follows closely, contributing more than 30%, due to ongoing residential and commercial construction projects, particularly focused on energy-efficient roofing solutions. The Asia-Pacific region is seeing rapid growth, driven by increased urbanization and infrastructure development, capturing around 38.55% of the market share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Roofing Shingles Market was valued at USD 130.87 Billion in 2024 and is projected to grow at a CAGR of 2.37% through the forecast period to reach USD 157.84 Billion.

- Growing construction and renovation activity worldwide, especially in residential housing, drives demand for cost‑effective and durable roofing solutions — reinforcing the dominance of the Asphalt Shingles segment which held 70% share in 2024.

- Increasing awareness of energy efficiency and environmental sustainability encourages uptake of reflective and eco‑friendly shingles, prompting manufacturers to expand their sustainable product offerings.

- Rising consumer preference for aesthetic versatility and durability boosts demand for Architectural Shingles, shaping product‑type trends toward higher‑value shingle categories.

- North America leads the regional market with over 40% share in 2024, followed by Europe with more than 30%, while Asia-Pacific is experiencing rapid growth, capturing 38.55% of the market.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Material Type:

In the Roofing Shingles Market, the Asphalt Shingles segment holds the dominant share, accounting for 70% of the market in 2024. This dominance is driven by their cost-effectiveness, durability, and ease of installation, making them the preferred choice for residential and commercial applications. The widespread availability and variety of asphalt shingles, coupled with their long lifespan and resistance to weather conditions, further enhance their market appeal. Other material types, such as wood, metal, slate, and tile, contribute to the market but remain comparatively smaller in share due to their higher cost and installation complexity.

- For instance, IKO Industries Ltd. advances asphalt shingles via cool roof technology, reflecting sunlight to cut energy costs while maintaining the material’s core advantages in weather durability and simple installation.

By Product Type:

The Architectural Shingles segment leads the Roofing Shingles Market, commanding a 50% share in 2024. These shingles offer enhanced aesthetic appeal, durability, and resistance to harsh weather, making them highly preferred by homeowners and builders. Their multi-layer design provides better protection and a longer lifespan compared to traditional 3-tab shingles. Architectural shingles’ growing popularity can be attributed to their ability to mimic more expensive roofing materials while offering a cost-effective solution. Other product types, such as luxury and impact-resistant shingles, account for smaller market shares due to their higher price points.

- For instance, Owens Corning’s architectural shingles feature a multi-layer design that offers better protection and longevity compared to traditional 3-tab shingles.

By Installation Type:

In the Roofing Shingles Market, the Nail-Down Shingles segment holds the largest share at 60% in 2024. Nail-down shingles are widely adopted due to their traditional installation method, ease of use, and reliability. This segment benefits from their cost-effectiveness and long-standing reputation in the industry. Self-adhesive shingles are gaining traction due to their ease of installation and reduced labor costs, while interlocking shingles are preferred for their secure fit and enhanced wind resistance. Despite these growing alternatives, nail-down shingles remain the dominant choice for both residential and commercial projects.

Key Growth Drivers

Rising Demand for Durable Roofing Solutions

The increasing demand for durable, weather-resistant roofing solutions is one of the primary drivers of growth in the Roofing Shingles Market. With consumers seeking products that can withstand extreme weather conditions, especially in regions prone to heavy rainfall, snow, or high winds, durable roofing materials are essential. Asphalt and architectural shingles are particularly favored for their long lifespan and strong resistance to weathering, making them the preferred choice for both residential and commercial projects. This growing demand for reliability continues to boost market expansion.

- For instance, CertainTeed Landmark PRO shingles achieve UL 2218 Class 3 impact resistance for hail protection and UL Class A fire resistance, paired with a 30-year StreakFighter algae-resistance warranty.

Sustainability and Eco-Friendly Materials

The growing emphasis on sustainability and environmentally friendly building materials is significantly influencing the Roofing Shingles Market. As consumers and builders seek more eco-conscious solutions, there is an increasing preference for shingles made from recycled materials or sustainable resources, such as wood and metal. Additionally, the push for energy-efficient homes is driving demand for reflective roofing materials that reduce cooling costs. These sustainability trends are enhancing the appeal of certain roofing materials, contributing to the overall market growth.

- For instance, certain companies produce recycled shingles made from materials like old tires and plastic bottles, which help reduce landfill waste and promote a circular economy.

Advancements in Shingle Technology

Technological advancements in roofing shingles, particularly in the development of impact-resistant and energy-efficient products, are propelling market growth. Manufacturers are focusing on innovations that improve the durability, insulation properties, and overall performance of roofing materials. The integration of smart technologies in roofing systems, such as self-healing shingles and those equipped with solar capabilities, is attracting homeowners seeking modern, high-performance solutions. These technological enhancements are creating new opportunities for growth and differentiation within the Roofing Shingles Market.

Key Trends & Opportunities

Growing Popularity of Architectural Shingles

Architectural shingles are experiencing significant growth within the Roofing Shingles Market due to their aesthetic appeal and enhanced functionality. These shingles provide a multi-layered structure, offering better protection against weather elements and a longer lifespan compared to traditional 3-tab shingles. The increasing preference for architectural shingles, particularly in residential construction, presents a key opportunity for manufacturers to tap into the high-demand market. As homeowners increasingly prioritize aesthetics alongside durability, the adoption of architectural shingles is expected to continue its upward trajectory.

- For instance, GAF, North America’s largest roofing manufacturer, offers the Timberline architectural shingle line, known for its advanced weather resistance and impact protection features.

Integration of Smart Roofing Solutions

The integration of smart technologies in roofing systems is another growing trend within the Roofing Shingles Market. Homeowners are increasingly seeking roofing materials that not only offer protection but also incorporate features like solar panel integration and energy efficiency. Smart roofing solutions, which monitor and adjust for temperature regulation and energy consumption, are gaining traction, particularly in regions with extreme weather. This trend represents a significant opportunity for growth as manufacturers look to innovate and meet the demand for smart, sustainable solutions.

- For instance, companies like Waaree offer integrated solar roofing solutions where solar shingles serve as both protective roofing material and power generators, enhancing energy efficiency by directly converting sunlight into electricity while withstanding harsh weather conditions.

Key Challenges

High Installation and Maintenance Costs

One of the key challenges facing the Roofing Shingles Market is the high installation and maintenance costs associated with certain roofing materials, such as slate, tile, and metal shingles. While these materials offer durability and aesthetic appeal, their higher upfront costs, combined with more complex installation processes, make them less accessible to price-sensitive consumers. This cost barrier limits their adoption, particularly in residential projects where budget constraints are more prevalent. Overcoming this challenge requires manufacturers to develop cost-effective alternatives without compromising on quality.

Fluctuating Raw Material Prices

The Roofing Shingles Market faces challenges from fluctuating raw material prices, which can significantly impact production costs. Key materials such as asphalt, metal, and wood are subject to price volatility due to supply chain disruptions, changes in demand, and geopolitical factors. These fluctuations can result in higher costs for manufacturers, potentially affecting the final price of roofing shingles for consumers. Ensuring a stable supply of raw materials at consistent prices remains a critical challenge for the industry to maintain profitability and market stability.

Regional Analysis

North America

North America holds a substantial share of the global roofing shingles market, with more than 40% of global revenue stemming from the region in 2025. The dominance reflects strong demand for re-roofing and new residential construction, supported by regulatory emphasis on energy-efficient and impact-resistant shingles. Climate conditions-ranging from cold, snow-prone zones in Canada and northern U.S. to hurricane-prone coasts-drive preference for durable materials such as asphalt and impact-resistant shingles. The presence of established producers and high replacement cycles also sustain market momentum in this region.

Europe

Europe accounts for over 30% of global roofing revenue in 2025, indicating a robust regional market. The region’s demand is driven by extensive renovation of aging housing stock and retrofit projects aiming to improve energy efficiency. Diverse climate conditions across the region from Mediterranean to cold northern climates-favor a mix of shingles and alternative roofing materials, but shingles remain important due to ease of installation and cost-effectiveness. Stringent building codes and increasing adoption of energy-efficient roofing solutions further support sustained demand in the European market.

Asia‑Pacific (APAC)

Asia-Pacific commands a meaningful share of the roofing materials market, with 38.55% of global roofing materials revenue attributable to the region in 2024. Rapid urbanization, booming real estate and infrastructure development, and rising disposable incomes are driving demand for affordable, durable roofing such as shingles. Countries like China, India, and other emerging economies are witnessing a surge in residential and commercial construction, boosting overall uptake. Growth in APAC is further supported by increasing awareness of energy-efficient and weather-resistant roofing solutions, favoring shingles over traditional materials in many contexts.

Latin America (South America)

Latin America contributes slightly 5% of global roofing market revenue as of 2025. Growth in this region is supported by rising investment in housing and infrastructure projects, especially in urbanizing areas. However, limited penetration compared to North America or Europe reflects lower per-capita income and slower pace of large-scale renovation cycles. Demand here tends to favor cost-effective roofing solutions, which creates a modest but steady market for shingles-particularly in middle-income residential segments looking for affordable durability.

Middle East & Africa (MEA)

The Middle East region accounts for 2% of global roofing market revenue in 2025, while Africa contributes around 1%. Despite slower overall share, growth in MEA is supported by rising commercial and residential construction in urban centers and increasing interest in weather- and heat-resistant roofing solutions. In regions with harsh climates (high heat, sandstorms, occasional heavy rains), demand for robust, low-maintenance shingles and roofs is growing. Market expansion is constrained by lower adoption rates and competition from traditional and alternative roofing materials in many areas.

Market Segmentations:

By Material Type

- Asphalt Shingles

- Wood Shingles

- Metal Shingles

- Slate Shingles

- Tile Shingles

By Product Type

- Architectural Shingles

- 3-Tab Shingles

- Luxury Shingles

- Impact-Resistant Shingles

By Installation Type

- Self-Adhesive Shingles

- Nail-Down Shingles

- Interlocking Shingles

By Thickness

- Standard Thickness

- Heavy Thickness

- Ultra-Heavy Thickness

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Roofing Shingles Market is characterized by the presence of key players such as CertainTeed, Fisher Family Construction, Inger Group, GAF, and IKO Industries. These industry leaders have a significant share of the market, leveraging their strong brand recognition, wide distribution networks, and extensive product portfolios to maintain a competitive edge. They continue to innovate by offering a range of roofing materials, such as asphalt, architectural, and impact-resistant shingles, to meet diverse consumer needs. The market is also witnessing increased competition from regional players who offer cost-effective solutions to cater to growing demand in emerging markets. Additionally, manufacturers are focusing on sustainability, incorporating eco-friendly materials and energy-efficient solutions into their products, which helps them align with growing consumer preference for green building materials. Strategic partnerships, mergers, acquisitions, and collaborations are common tactics employed by key players to strengthen their market position and expand their geographic reach.

Key Player Analysis

- USA Roofing & Construction

- Risk Free Roofing Boston

- Contemporary Exteriors

- Fisher Family Construction

- PREFA

- CertainTeed

- Bluebird Roofing & Construction

- IKO Industries

- Inger Group

- Owens Corning

Recent Developments

- In February 2025, GAF unveiled a suite of new roofing offerings at the 2025 International Roofing Expo (IRE), including the solar‑enabled Timberline Solar® ES 2 and TimberSteel™ Premium Metal Roofing System.

- In May 2025, CertainTeed introduced a new FORTIFIED™‑certified roofing system, launching two components: CertaSeam™ Roof Tape and SwiftStart® SA Starter Shingle, to enhance weather‑resistance and installation efficiency.

- In 2025, TAMKO Building Products LLC launched StormFighter FLEX® High‑Performance Shingle, which was voted “Product of the Year USA” by consumers for its innovation, durability, and contractor‑friendly installation benefits.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product Type, Installation Type, Thickness and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Roofing Shingles Market is expected to see continued growth driven by increasing construction and renovation activities globally.

- Consumer demand for durable, energy-efficient, and weather-resistant roofing materials will fuel market expansion.

- Technological advancements, such as the development of smart shingles and integrated solar capabilities, will drive innovation in the market.

- There will be a growing shift toward eco-friendly and sustainable roofing materials as regulatory standards become stricter and consumer preferences evolve.

- The preference for architectural and impact-resistant shingles will continue to rise due to their aesthetic appeal and enhanced protection.

- The North American and European markets will remain dominant, while the Asia-Pacific region is expected to experience the highest growth due to rapid urbanization.

- Cost-effective roofing solutions will gain popularity in emerging markets, expanding opportunities for players targeting budget-conscious consumers.

- The adoption of self-adhesive and interlocking shingles will increase due to their ease of installation and low labor costs.

- Key players will focus on strategic partnerships and acquisitions to expand their product offerings and geographic presence.

- The increasing demand for retrofitting and energy-efficient building solutions will create sustained growth in the roofing shingles sector.

Market Segmentation Analysis:

Market Segmentation Analysis: