| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Russia Off The Road Tire Market Size 2023 |

USD 324.88 Million |

| Russia Off The Road Tire Market, CAGR |

1.95% |

| Russia Off The Road Tire Market Size 2032 |

USD 387.10 Million |

Market Overview:

Russia Off The Road Tire Market size was valued at USD 324.88 million in 2023 and is anticipated to reach USD 387.10 million by 2032, at a CAGR of 1.95% during the forecast period (2023-2032).

The Russia OTR tire market is driven by several key factors that are shaping its growth trajectory. The country’s ongoing infrastructure development, including large-scale construction projects such as highways, bridges, and airports, is a major driver, as these projects rely heavily on heavy machinery that requires durable OTR tires. Additionally, Russia’s abundant mineral resources have fueled the growth of the mining sector, further increasing the demand for specialized tires designed to withstand the harsh conditions of mining operations. Another significant driver is the increasing mechanization of agriculture, where modern farming equipment such as tractors and harvesters rely on high-performance OTR tires for better efficiency and productivity. Furthermore, technological advancements in tire design, including innovations like low-rolling-resistance tires and sensor integration for monitoring tire pressure and temperature, are enhancing the overall performance and safety of OTR tires, making them more appealing to end-users.

Regionally, the demand for OTR tires in Russia is concentrated in areas with high industrial activity. The Siberian region, known for its extensive mineral deposits, sees a substantial demand for OTR tires due to the growing mining operations in the area. Central Russia is experiencing significant infrastructure expansion, driving the need for OTR tires for construction and industrial vehicles. Similarly, the Ural Mountains, a key region rich in natural resources, remains a central hub for mining and industrial operations, further boosting the demand for OTR tires. These regions, along with their ongoing industrial and infrastructural developments, are crucial in supporting the growth of the OTR tire market in Russia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Russia Off the Road Tire market was valued at USD 324.88 million in 2023 and is projected to reach USD 387.10 million by 2032, with a CAGR of 1.95% from 2023 to 2032.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Ongoing infrastructure development, including highways, bridges, and airports, is driving demand for OTR tires used in heavy machinery for construction projects.

- Russia’s mining sector, particularly in Siberia and the Ural Mountains, is a key contributor to the growing demand for durable OTR tires suited for harsh, off-road conditions.

- Agricultural mechanization is increasing, with tractors, harvesters, and other machinery relying on high-performance OTR tires to improve efficiency and productivity.

- Technological advancements in tire design, such as low-rolling-resistance tires and tire pressure monitoring sensors, are enhancing tire performance, further stimulating demand.

- The Russia OTR tire market faces challenges related to high import dependence, with a significant portion of OTR tires still being imported, which affects pricing and supply chain stability.

- Economic instability, including fluctuations in oil prices, inflation, and sanctions, is posing challenges for the market by limiting investment in key sectors like mining and construction.

Market Drivers:

Infrastructure Development

One of the primary drivers for the growth of the Russia Off-the-Road (OTR) tire market is the ongoing expansion of infrastructure across the country. Russia has been making significant investments in improving its infrastructure, including the development of roads, bridges, airports, and railways. These projects require heavy machinery, such as excavators, bulldozers, and cranes, all of which rely on durable and high-performance OTR tires for optimal performance. The increasing scale and frequency of these construction projects are propelling the demand for tires capable of handling the harsh and often uneven terrains that machinery faces during operations. As Russia continues to focus on infrastructure improvement, the need for specialized tires will rise, ensuring a robust market for OTR tires.

Growth in the Mining Sector

Russia is home to vast mineral resources, making mining a crucial sector for its economy. For instance, Minetech Machinery LLC, the official distributor of DuraMax Tire in Russia, supplies OTR tires specifically engineered for mining vehicles operating in demanding environments such as Siberia and the Ural Mountains. This growth directly contributes to the increasing demand for OTR tires, as mining operations require heavy-duty vehicles to transport materials across rough, off-road terrain. Mining vehicles, including trucks, excavators, and loaders, rely heavily on OTR tires for their ability to provide durability and stability in extreme conditions. As Russia’s mining industry continues to expand and new mines are developed, the need for specialized OTR tires designed for these harsh conditions is set to increase.

Agricultural Mechanization

The shift toward modern agricultural practices in Russia is another significant driver of the OTR tire market. With a growing focus on enhancing productivity, Russian agriculture is increasingly relying on mechanized equipment, including tractors, harvesters, and other heavy machinery. These machines require high-quality OTR tires to ensure efficient and effective operations in the field. As the country pushes for greater agricultural output to meet domestic and international demand, the need for reliable and durable tires will continue to rise. Moreover, advancements in agricultural technology, such as precision farming and automated machinery, will further elevate the demand for OTR tires tailored to agricultural applications. This sector’s growing mechanization plays a critical role in driving market growth.

Technological Advancements in Tire Design

Another key factor contributing to the growth of the OTR tire market in Russia is the continuous innovation and technological advancements in tire design. For example, Magna offers a Tire Pressure Monitoring System (TPMS) that provides real-time monitoring of tire pressure and temperature, ensuring around-the-clock fleet efficiency and safety—even when vehicles are powered off or operating underground. Manufacturers are increasingly focusing on developing tires with enhanced performance characteristics, such as improved durability, load-bearing capacity, and resistance to wear and tear. Technological improvements, including the integration of sensors for monitoring tire pressure and temperature, are further boosting the appeal of OTR tires for end-users. These innovations not only enhance the safety and performance of vehicles but also extend tire life, offering cost-effective solutions to industries like construction, mining, and agriculture. As manufacturers continue to develop advanced OTR tire solutions, these technological improvements will play a pivotal role in meeting the growing demand for high-performance tires in Russia.

Market Trends:

Increased Demand for High-Performance Tires

A prominent trend in the Russia Off-the-Road (OTR) tire market is the increasing preference for high-performance tires that offer enhanced durability and operational efficiency. With industries such as mining, agriculture, and construction continuing to grow, there is a heightened demand for tires that can withstand the extreme conditions these sectors often face. In particular, tires with improved tread designs, reinforced sidewalls, and better load-carrying capacities are becoming increasingly sought after. These innovations help mitigate the risks of tire failure in harsh terrains, thus ensuring continuous operations and reducing downtime for heavy machinery. As Russia’s industrial base expands, the shift toward these high-performance OTR tires is expected to remain a significant trend in the market.

Focus on Sustainability and Eco-Friendly Tires

Sustainability is another major trend influencing the Russia OTR tire market. As industries become more focused on reducing their environmental footprint, there is growing demand for eco-friendly OTR tires made from renewable or recycled materials. Manufacturers are responding by developing tires that not only offer high performance but also have a lower environmental impact. Additionally, innovations in tire recycling processes, including the reuse of worn-out tires for the production of new ones, are gaining traction in Russia. For instance, Companies like EcoStar Factory have invested over 350 million rubles to open new recycling facilities in the Russian Far East, with an annual capacity to recycle 10,000 tonnes of tires into rubber crumb. This aligns with global efforts to promote sustainability in industrial operations, particularly in resource-intensive sectors like mining and agriculture. The rise in eco-conscious consumer preferences and government regulations around environmental sustainability is likely to continue shaping this market trend.

Smart Tire Technologies

The adoption of smart tire technologies is an emerging trend within the Russia OTR tire market. Sensors embedded in tires to monitor real-time data such as tire pressure, temperature, and wear levels are becoming increasingly prevalent across industries. These technologies allow for predictive maintenance, helping businesses to identify potential issues before they lead to tire failure or costly repairs. This shift toward smart tires offers significant advantages in terms of operational efficiency, safety, and cost savings. As the Russian market evolves, the integration of smart tire solutions in the OTR sector is likely to gain momentum, driven by the need for greater operational reliability in challenging working conditions.

Expansion of Local Manufacturing Capabilities

A growing trend in the Russia OTR tire market is the expansion of local tire manufacturing. Russia is investing in the development of domestic tire production facilities, aiming to reduce reliance on imported OTR tires. This trend is driven by the desire to support local industries, reduce logistics costs, and ensure a more stable supply chain for key sectors such as mining, agriculture, and construction. For example, Tatneft and Kazakhstan’s Allur Group, inaugurated a new tire production facility in Saran, Kazakhstan, in December 2022. In addition, local production allows for the customization of OTR tires to better suit the specific demands of the Russian market. As these manufacturing facilities continue to grow, Russia is likely to see an increase in the availability of cost-competitive and tailored OTR tire solutions, further stimulating market growth.

Market Challenges Analysis:

High Import Dependence

One of the primary challenges facing the Russia Off-the-Road (OTR) tire market is the high dependence on imported tires. For instance, Russia imports a significant portion of its OTR tires from countries such as China, South Korea, Japan, Belarus, and Turkey, with China being the largest supplier for passenger, truck, and industrial tires. While there has been growth in local manufacturing, a significant portion of OTR tires used in Russia is still imported, particularly from countries with established tire production capabilities. This reliance on imports makes the market vulnerable to external factors such as fluctuations in global supply chains, trade restrictions, and currency exchange rates. Import duties and logistical costs further inflate the price of OTR tires, making them less cost-effective for local industries. Although efforts to develop domestic production are ongoing, the current dependence on imports remains a key constraint for the market.

Fluctuations in Raw Material Prices

The fluctuating prices of raw materials used in tire manufacturing represent another significant challenge for the Russia OTR tire market. Rubber, steel, and chemical components are essential in the production of durable and high-performance OTR tires. However, the global nature of raw material supply chains means that prices can be volatile, particularly in response to economic factors, geopolitical tensions, or natural disasters. These fluctuations directly impact the cost of production for tire manufacturers, which may result in higher prices for end-users. In turn, this could affect the affordability and demand for OTR tires, especially among smaller enterprises with limited budgets.

Economic Instability

Economic instability in Russia poses a restraint to the growth of the OTR tire market. Factors such as fluctuating oil prices, inflation, and economic sanctions can reduce the financial capacity of industries reliant on heavy machinery, such as mining, agriculture, and construction. This economic uncertainty can lead to reduced investments in infrastructure and mining projects, slowing the demand for OTR tires. Moreover, financial constraints could lead to companies delaying the purchase of new machinery or opting for budget-friendly alternatives to high-quality OTR tires, limiting market growth.

Regulatory and Environmental Constraints

Increasingly stringent environmental regulations in Russia may also pose challenges to the OTR tire market. As industries face pressure to reduce their carbon footprint and environmental impact, compliance with regulations on tire disposal and emissions may increase operational costs. Tire manufacturers may need to invest in sustainable materials and production processes to meet these standards, potentially raising the price of OTR tires. Additionally, stricter regulations could limit the market for older, less efficient tire technologies, forcing manufacturers to innovate and upgrade their products to remain competitive.

Market Opportunities:

One of the key opportunities in the Russia Off-the-Road (OTR) tire market lies in the expansion of domestic manufacturing capabilities. With an increasing emphasis on local production, Russia has the potential to reduce its reliance on imported tires, thereby improving supply chain resilience and cost efficiency. By investing in modern manufacturing facilities and adopting advanced tire production technologies, Russian tire manufacturers can cater to the growing demand in sectors such as construction, mining, and agriculture. Local production also presents opportunities for customized tire solutions tailored to the specific needs of Russian industries, which could lead to improved market competitiveness and reduced dependence on global suppliers.

Another significant opportunity for the Russia OTR tire market is the growing adoption of smart tire technologies. As industries continue to focus on enhancing operational efficiency and safety, integrating smart sensors into OTR tires offers a promising avenue for growth. These technologies, which monitor tire performance in real-time, enable predictive maintenance, reduce downtime, and improve the overall longevity of tires. As Russian industries increasingly recognize the benefits of these innovations, there will be greater demand for smart OTR tires, creating opportunities for manufacturers to develop and offer advanced solutions. Moreover, the rise of digitalization in heavy industries positions the Russian OTR tire market to benefit from the broader trend toward technological advancements in equipment management.

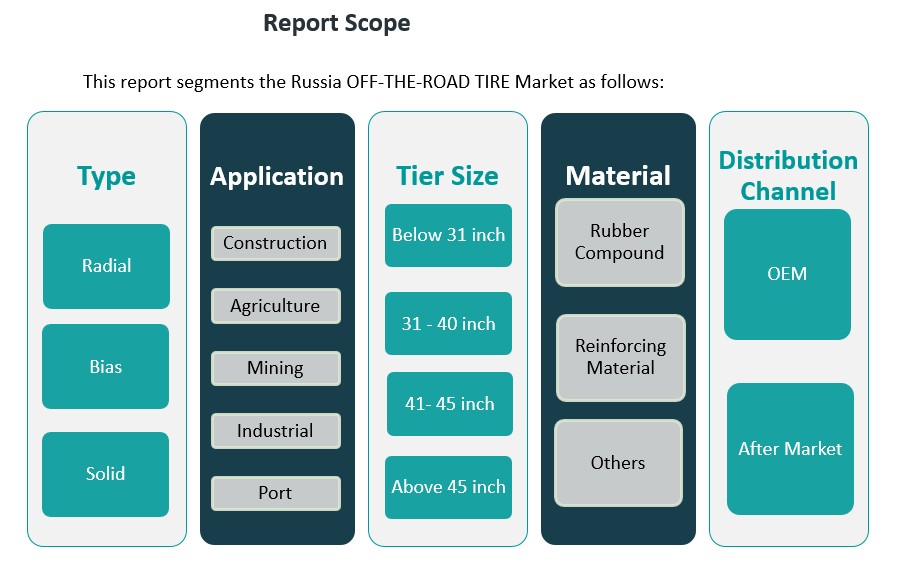

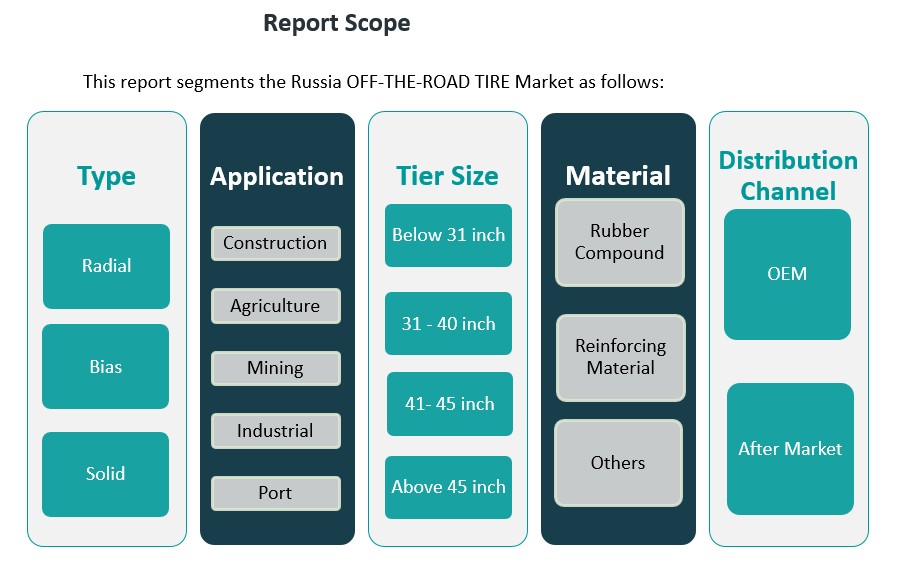

Market Segmentation Analysis:

The Russia Off-the-Road (OTR) tire market is segmented across various categories, each contributing to its growth and development.

By Type Segment

The OTR tire market is dominated by three key types: radial, bias, and solid tires. Radial tires hold the largest market share due to their superior performance, durability, and fuel efficiency, making them ideal for heavy machinery in construction and mining applications. Bias tires are typically used in applications where cost-effectiveness is a priority, offering adequate performance for certain agricultural and industrial machinery. Solid tires, known for their durability and ability to withstand harsh conditions, are gaining traction in port and industrial applications, where minimal downtime is essential.

By Application Segment

The OTR tire market is heavily influenced by its applications across construction, agriculture, mining, industrial, and port sectors. The construction industry leads the demand for OTR tires, driven by ongoing infrastructure projects requiring robust and reliable tires for heavy machinery. The mining sector also significantly contributes to market growth, as mining equipment demands high-performance tires to navigate rugged terrains. Agriculture continues to adopt mechanization, increasing the need for OTR tires in farming equipment. Meanwhile, the industrial and port sectors, particularly those relying on machinery for material handling and transport, also represent substantial opportunities for OTR tire manufacturers.

By Tire Size and Material Segments

Tires in the 31-40 inch and above 45-inch categories are increasingly popular due to their ability to support larger vehicles used in mining and construction. In terms of materials, rubber compounds dominate the market, with reinforcing materials like steel and fabric playing a key role in enhancing tire durability.

By Distribution Channel Segment

The market is split between OEM and aftermarket segments, with aftermarket sales experiencing steady growth due to the increasing need for tire replacements and maintenance.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The Russia Off-the-Road (OTR) tire market exhibits regional variations driven by factors such as industrial activities, natural resources, and infrastructure development. Key regions like Siberia, Central Russia, and the Ural Mountains contribute significantly to the overall demand for OTR tires due to the presence of large-scale industries, including mining, construction, and agriculture.

Siberia (Approximately 30% Market Share)

Siberia plays a pivotal role in the growth of the Russia OTR tire market, particularly due to its vast mineral deposits and expanding mining operations. The region is home to some of the country’s most prominent mining sites, including coal, gold, and diamond extraction industries, which require heavy-duty equipment like dump trucks, excavators, and loaders—all of which rely heavily on durable OTR tires. With mining operations continuing to scale up, Siberia accounts for nearly 30% of the market share in Russia, making it one of the largest regional contributors. The harsh climate and difficult terrains further drive the demand for high-performance OTR tires designed to withstand extreme conditions.

Central Russia (Approximately 40% Market Share)

Central Russia, including major industrial hubs such as Moscow and Nizhny Novgorod, accounts for the largest share of the OTR tire market, with an estimated 40%. The region is experiencing rapid infrastructure development, including road construction, urbanization, and public works projects, which require heavy machinery and equipment. These activities boost the demand for OTR tires in the construction sector, where reliable, high-performance tires are essential for various equipment types, including bulldozers, cranes, and excavators. Central Russia is also home to a significant portion of the country’s agricultural activities, further driving the need for OTR tires in farming equipment.

Ural Mountains (Approximately 15% Market Share)

The Ural Mountains, rich in natural resources, are another key region for the OTR tire market. Mining remains the dominant sector in this area, with demand for OTR tires driven by the need for durable tires capable of withstanding the region’s tough terrain. While the Ural Mountains hold around 15% of the market share, their importance cannot be overstated, as they represent a major hub for resource extraction, including the mining of minerals such as copper and iron. The OTR tires used in this region must be specially designed to handle the heavy-duty vehicles employed in mining operations.

Far East and Other Regions (Approximately 15% Market Share)

The Far East region of Russia, including territories such as Primorsky Krai, contributes to the remaining 15% of the OTR tire market share. This region is characterized by its mix of agricultural and industrial activities, with an emphasis on mining, forestry, and port operations. The demand for OTR tires in these industries is driven by the need for specialized tires for mining machinery and vehicles used in harsh, often remote environments. Despite being smaller in market share compared to Siberia and Central Russia, the Far East is growing in importance, with regional investments in infrastructure and industry boosting the demand for OTR tires.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Hankook Tire

Competitive Analysis:

The Russia Off-the-Road (OTR) tire market is highly competitive, with both domestic and international players vying for market share. Key global manufacturers, such as Michelin, Bridgestone, Goodyear, and Continental, dominate the market due to their established reputation, advanced technology, and robust distribution networks. These companies offer a wide range of OTR tires designed for various industries, including construction, mining, and agriculture. Additionally, domestic tire manufacturers like Sibur and Tatneft are gaining traction by focusing on cost-effective solutions tailored to local market needs. They are expanding production capacities and improving tire durability to meet the demands of Russia’s harsh climate and rugged terrains. Competitive strategies include technological innovations in tire design, the adoption of smart tire technologies, and localized manufacturing to reduce dependency on imports. As the market grows, manufacturers are focusing on enhancing tire performance, sustainability, and operational efficiency to maintain their competitive edge.

Recent Developments:

- In March 2024, Goodyear, a leading US-based tire manufacturer, launched the RL-5K OTR tire, specifically designed for heavy-duty loaders and wheel dozers. This new product features a three-star load capacity rating, enhancing durability and performance for demanding operations in the off-the-road tire segment. The RL-5K tire is part of Goodyear’s ongoing efforts to advance OTR tire technology, focusing on improved efficiency, durability, and operational performance for challenging environments.

- In March 2025, Bridgestone unveiled two new tires featuring its next-generation ENLITEN technology at the Technology & Maintenance Council (TMC) Annual Meeting. The new Bridgestone R273 Ecopia and Duravis M705 are designed for regional and mixed fleet use, focusing on enhanced performance and sustainability. ENLITEN technology improves tire wear and increases the use of renewable and recycled materials.

Market Concentration & Characteristics:

The Russia Off-the-Road (OTR) tire market is moderately concentrated, with a mix of global and domestic players competing for market share. International manufacturers such as Michelin, Bridgestone, Goodyear, and Continental dominate the high-performance tire segment, leveraging advanced technology and established brand recognition. Domestic companies like Belshina OAO and PJSC TATNEFT (Nizhnekamskshina) cater to cost-sensitive segments, offering competitive pricing and localized solutions. This dual structure fosters healthy competition, driving innovation and improving product offerings across various tire types and applications. The market is characterized by a diverse range of tire types, including radial, bias, and solid tires, each serving specific industry needs. Radial tires dominate due to their superior performance and durability, particularly in mining and construction applications. The aftermarket segment holds a significant share, driven by the need for frequent tire replacements in demanding operational conditions. Additionally, there is a growing trend toward the adoption of smart tire technologies, integrating sensors for real-time monitoring to enhance operational efficiency and safety. These characteristics indicate a dynamic market responsive to technological advancements and evolving industry demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Russia OTR tire market is expected to grow at a steady pace, driven by increased demand from infrastructure projects and industrial activities.

- Mining operations will remain a key driver, with the sector’s expansion pushing the need for more durable and high-performance tires.

- Agricultural mechanization in Russia will lead to higher demand for OTR tires designed for farming equipment.

- Technological advancements in tire design, such as enhanced durability and wear resistance, will continue to shape market growth.

- The growing adoption of smart tire technologies for real-time monitoring will drive innovation and improve operational efficiency.

- Domestic manufacturing of OTR tires is expected to expand, reducing reliance on imports and lowering production costs.

- Eco-friendly tire solutions, including recyclable materials and sustainable production practices, will gain prominence.

- Rising competition among international and domestic players will lead to more competitive pricing and better product offerings.

- Ongoing development in the Far East and Siberian regions will further boost the demand for OTR tires.

- Regulatory changes around environmental standards will encourage manufacturers to focus on producing more sustainable and efficient tire solutions.