| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Russia Feminine Hygiene Products Market Size 2023 |

USD 418.52 Million |

| Russia Feminine Hygiene Products Market, CAGR |

4.58% |

| Russia Feminine Hygiene Products Market Size 2032 |

USD 627.38 Million |

Market Overview:

Russia Feminine Hygiene Products Market size was valued at USD 418.52 million in 2023 and is anticipated to reach USD 627.38 million by 2032, at a CAGR of 4.58% during the forecast period (2023-2032).

Several key factors are propelling the growth of the feminine hygiene market in Russia. Rising consumer awareness about menstrual health and hygiene is leading to a preference for high-quality products. Additionally, the growing demand for premium and eco-friendly products, such as organic cotton pads and biodegradable materials, is influencing purchasing decisions. The expansion of e-commerce platforms has also played a significant role, providing consumers with convenient access to a wide range of products, including international brands. Furthermore, the increasing focus on women’s health and wellness, coupled with improvements in education and awareness campaigns, has contributed to a more open attitude towards menstrual health, further boosting product adoption. With a growing emphasis on hygiene and sustainability, consumers are gradually shifting away from traditional products towards innovative, healthier, and more environmentally friendly alternatives.

Russia stands as the largest market for feminine hygiene products in Europe, commanding approximately 13% of the regional market share. The market is characterized by strong domestic production capabilities and a growing focus on product innovation and distribution networks, particularly in urban areas. Consumer preferences are evolving, with increasing demand for premium products and a growing acceptance of alternative menstrual products, supported by increasing awareness about sustainable menstrual products. In addition, the rising influence of social media and online influencers has played a pivotal role in shaping consumer perceptions, leading to a greater interest in health-conscious and eco-friendly options. Regional differences also influence the market, as urban areas exhibit a more significant demand for advanced and premium products compared to rural areas where traditional products still hold sway. With ongoing infrastructure developments and improvements in distribution channels, the market is expected to continue its expansion in the coming years.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Russian feminine hygiene products market is projected to grow from USD 418.52 million in 2023 to USD 627.38 million by 2032, with a CAGR of 4.58% during the forecast period.

- The global feminine hygiene products market, valued at USD 23,490.00 million in 2023, is projected to reach USD 43,917.35 million by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

- Increasing consumer awareness of menstrual health is driving the demand for high-quality, dermatologically tested products across various age groups.

- The growing preference for eco-friendly and organic products, such as biodegradable pads and menstrual cups, is significantly influencing consumer purchasing decisions.

- E-commerce platforms are playing a crucial role in expanding the market, providing consumers with easy access to a wide range of products, including international brands.

- Rising disposable income in urban areas is encouraging Russian consumers to opt for premium products with advanced features, like odor control and enhanced absorbency.

- Price sensitivity and economic instability in rural regions may limit the adoption of higher-priced, eco-friendly alternatives, posing a challenge for market expansion.

- Regional disparities in product availability, especially in rural areas, continue to limit access to a wide range of feminine hygiene products, despite the growth of e-commerce.

Market Drivers:

Increasing Awareness of Menstrual Health

One of the primary drivers of the Russian feminine hygiene products market is the rising awareness regarding menstrual health. Over the past few years, there has been a significant shift in how Russian consumers perceive menstrual hygiene, with more emphasis placed on understanding the health implications of using high-quality feminine hygiene products. For instance, in December 2023, Ontex, a major player in the Russian market, launched SatinSense tampons with a silky coating for enhanced comfort and Confidaily daily liners, which have become a preferred choice for protection and quality after extensive testing. This heightened awareness is a result of both public health initiatives and social media, which have helped de-stigmatize menstruation and promote better hygiene practices. Women are increasingly seeking products that support their health and well-being, prompting a surge in demand for hygienic, dermatologically tested, and safe products. This trend is particularly evident among younger generations, who are more inclined to prioritize health-conscious choices.

Demand for Eco-Friendly and Organic Products

Another significant factor influencing the growth of the feminine hygiene market in Russia is the rising demand for eco-friendly and organic products. As global sustainability concerns gain traction, Russian consumers are becoming more environmentally conscious, seeking menstrual products that are biodegradable or made from organic materials, such as cotton. This shift towards sustainable products is driven by both health considerations and environmental factors, as more women are looking for options that are gentle on both their bodies and the planet. For instance, brands like Isdin have introduced intimate washes, wipes, and pH-balanced products, further expanding the range of eco-friendly offerings available to Russian women. The growing popularity of menstrual cups, organic cotton pads, and tampons with fewer chemicals highlights this transition. Moreover, an increasing number of brands are responding to this demand by introducing eco-friendly alternatives to traditional products, thereby expanding the variety of options available to consumers.

E-Commerce and Convenience

The rapid growth of e-commerce in Russia has also played a crucial role in driving the feminine hygiene products market. The convenience of purchasing products online, combined with the availability of a wide range of brands and product types, has made it easier for consumers to access feminine hygiene products. E-commerce platforms allow women to explore diverse product options, compare prices, and make informed decisions about the best products for their needs. Additionally, the privacy and discretion offered by online shopping further appeal to Russian consumers, many of whom prefer the convenience of home delivery for personal care items. The expansion of online retailers, along with dedicated subscription services for feminine hygiene products, has significantly contributed to the market’s growth, as more women opt for the ease of digital shopping.

Rising Disposable Income and Changing Lifestyles

The growth of disposable income among Russian consumers, especially in urban areas, is another important driver for the feminine hygiene products market. As the economic situation improves, many women are willing to invest more in personal care and hygiene products that offer greater comfort and performance. The shift toward premium products, including those with advanced features like odor control, extra absorbency, and organic materials, is evident as disposable income rises. Changing lifestyles, particularly among working women and young professionals, have also increased the demand for more convenient and efficient menstrual hygiene products. Women are seeking products that align with their busy lives, thus driving the market for advanced, high-performance, and sustainable products that cater to modern needs.

Market Trends:

Shift Towards Premium and Specialized Products

The Russian feminine hygiene products market is experiencing a notable trend toward premium and specialized product. As consumer awareness grows and disposable income increases, women are becoming more selective about the products they use. There is a rising preference for high-quality products that offer enhanced comfort, absorbency, and added features such as odor control and dermatologically tested materials. For instance, according to Essity’s annual report, their premium product lines, including Libresse, have seen double-digit growth in Russia, driven by consumer interest in added comfort and specialized features such as odor control and skin-friendly materials. Specialized products, such as pantyliners for sensitive skin, organic cotton pads, and tampons with advanced absorbency technology, are gaining traction. Consumers are also increasingly looking for products tailored to specific needs, including those designed for active lifestyles or different menstrual flow levels. This trend towards premiumization indicates a shift from traditional, mass-market products to more personalized, higher-quality offerings.

Expansion of Organic and Natural Options

A significant trend in the Russian feminine hygiene products market is the growing preference for organic and natural options. As global awareness of environmental sustainability increases, Russian consumers are placing more importance on the ingredients used in their feminine hygiene products. Organic cotton pads, tampons free from synthetic chemicals, and reusable menstrual cups are becoming more sought after, driven by a desire for products that are both gentle on the body and environmentally friendly. The appeal of these products lies in their promise of reduced exposure to chemicals and synthetic materials, which many consumers perceive as a healthier alternative. This trend aligns with broader global shifts toward organic and natural beauty and hygiene products, with local brands and international manufacturers responding by increasing their range of eco-friendly options.

Growth of Subscription Services and E-commerce Platforms

The rise of e-commerce continues to shape the feminine hygiene products market in Russia, with more consumers turning to online platforms for their purchases. This trend is driven by the convenience, privacy, and product variety that e-commerce offers. Subscription services for feminine hygiene products are also gaining popularity, allowing consumers to receive regular deliveries of their preferred products without the need for frequent purchases. These services cater to the growing demand for convenience and are particularly appealing to busy, health-conscious women who prefer having products delivered directly to their doorstep. The growth of digital platforms has also made it easier for women to access a broader range of international and niche brands, enhancing their shopping experience and allowing for better-informed purchasing decisions.

Increasing Popularity of Sustainable Packaging

Sustainability is a significant trend affecting the feminine hygiene products market in Russia, particularly regarding packaging. With the increasing demand for eco-friendly products, there is a growing emphasis on reducing waste through sustainable packaging solutions. Brands are shifting towards recyclable, biodegradable, and plastic-free packaging to meet the expectations of environmentally conscious consumers. For example, KNH has launched eco-friendly menstrual pads and panty liners using biodegradable materials and recyclable packaging, aiming to minimize carbon footprints. This trend is part of a broader movement toward sustainable consumer goods, as Russian consumers become more aware of the environmental impact of their purchasing choices. Manufacturers are responding by introducing products with minimalistic and eco-friendly packaging, further driving the demand for sustainable feminine hygiene products. This growing focus on packaging sustainability is likely to play a key role in shaping the future of the market in Russia.

Market Challenges Analysis:

Price Sensitivity and Economic Instability

One of the key market restraints in the Russian feminine hygiene products market is price sensitivity, particularly in light of economic instability. Despite the growing disposable income in certain urban areas, a significant portion of the population remains cost-conscious, particularly in rural regions where average incomes are lower. Economic fluctuations and inflationary pressures can further limit consumer spending power, particularly for premium products. As a result, price-sensitive consumers may opt for lower-cost, traditional products over more innovative or eco-friendly alternatives. This can hinder the widespread adoption of higher-end, sustainable, and organic products that are often priced at a premium.

Cultural Barriers and Limited Awareness

Another challenge facing the feminine hygiene products market in Russia is the persistence of cultural barriers and limited awareness, especially in more rural areas. For instance, Kotex found that menstruation remains a taboo subject in Russia, especially outside major urban centers, resulting in limited and generic communication from brands. Although menstrual health awareness is increasing, it remains a sensitive subject in some segments of society. In certain regions, the stigma surrounding menstruation can discourage women from openly discussing or seeking out modern hygiene products. This cultural hesitancy can slow the penetration of new, innovative products, particularly those that address environmental concerns or offer specialized features. Overcoming these barriers requires targeted education campaigns and initiatives to increase awareness and normalize the conversation around menstrual health.

Limited Product Availability in Rural Areas

In many remote or rural parts of Russia, access to a wide variety of feminine hygiene products remains limited. Despite the growth of e-commerce, distribution channels outside of major urban centers are still underdeveloped, leading to product shortages or limited choices for consumers in these areas. While online shopping is growing, logistical challenges such as delivery times, costs, and lack of local infrastructure can deter rural consumers from purchasing products that are not readily available in physical stores. Expanding distribution networks and ensuring product availability in underserved regions remains a significant challenge for the industry.

Market Opportunities:

One of the most significant market opportunities in the Russian feminine hygiene products sector lies in the increasing demand for eco-friendly and sustainable options. As global environmental concerns continue to shape consumer behavior, Russian consumers are becoming more inclined to choose products that align with their sustainability values. This trend is particularly evident among younger generations, who are actively seeking organic cotton pads, biodegradable tampons, and reusable menstrual products. The demand for such products presents a considerable growth opportunity for both local and international brands to expand their product lines and capture the attention of environmentally conscious consumers. With the Russian government’s increasing focus on sustainability, companies that adopt eco-friendly practices and sustainable packaging can differentiate themselves in a competitive market.

Another promising opportunity for the Russian feminine hygiene products market lies in the continued expansion of distribution channels, particularly through e-commerce platforms. The growing shift towards online shopping, combined with the increasing use of digital platforms, offers significant growth potential. E-commerce not only provides convenience but also allows consumers in remote and rural areas access to a wider range of feminine hygiene products that may not be available locally. By enhancing their online presence and establishing subscription-based services, brands can tap into an emerging consumer segment looking for convenience and product variety. Furthermore, partnering with e-commerce giants and improving logistics infrastructure can help address distribution challenges, ultimately driving sales growth and market penetration.

Market Segmentation Analysis:

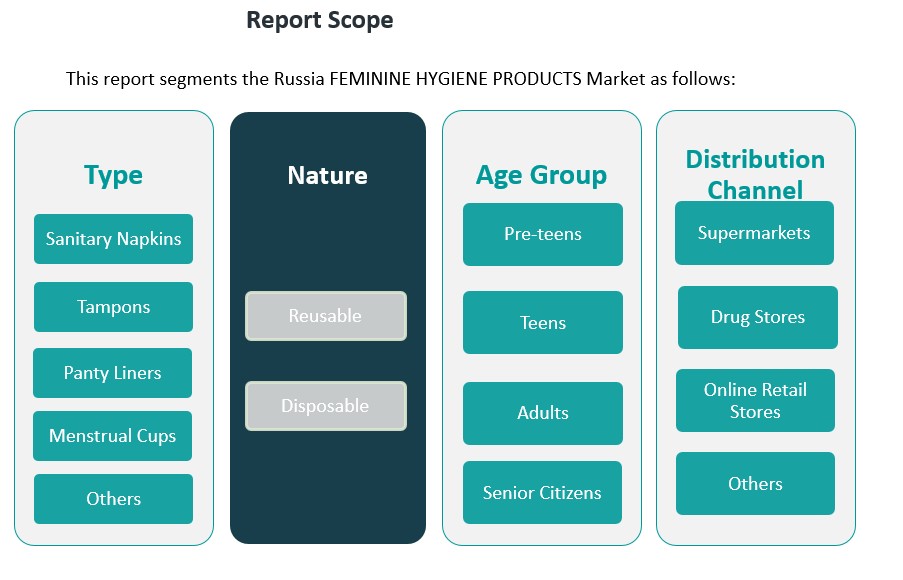

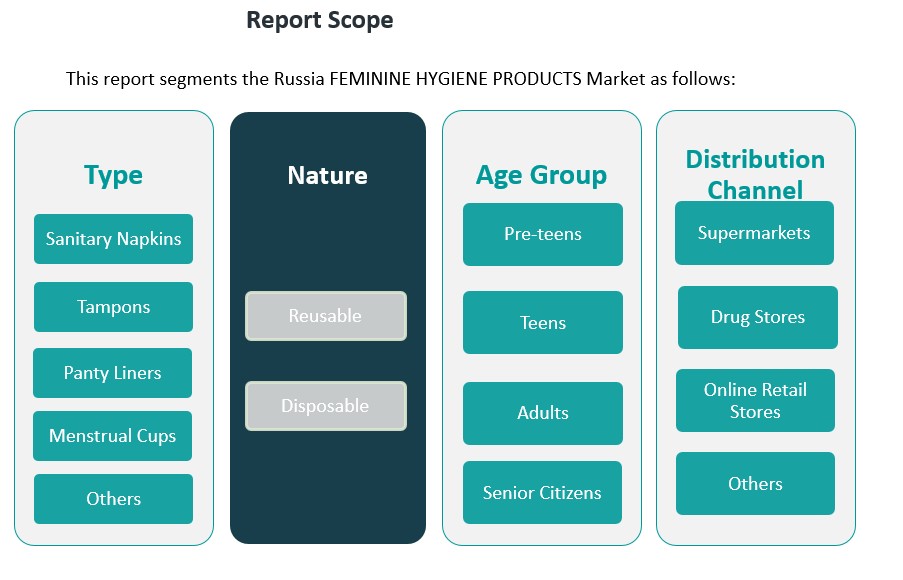

The Russian feminine hygiene products market is diverse, with significant segmentation across product types, nature, age groups, and distribution channels.

By Type

The market is primarily driven by sanitary napkins, which dominate the segment due to their widespread use and convenience. Tampons also hold a considerable market share, especially among women seeking comfort and protection during physical activities. Panty liners and menstrual cups are gaining traction due to their eco-friendly appeal and increasing consumer awareness around sustainability. The “Others” segment includes a range of specialized products such as intimate washes and organic alternatives, which cater to niche demands.

By Nature

Disposable products continue to lead the market, offering convenience and ease of use. However, there is a growing shift towards reusable products, particularly menstrual cups and cloth pads, as consumers become more environmentally conscious and seek longer-lasting, sustainable options.

By Age-Group

The market is segmented by age, with the largest consumer base being adults. Pre-teens and teens are becoming more conscious of menstrual health, influencing a rise in product innovation aimed at younger users. Senior citizens represent a smaller but significant segment, with products designed for comfort and ease of use during menopause and beyond.

By Distribution Channel

Supermarkets and drug stores remain the dominant distribution channels for feminine hygiene products in Russia, offering accessibility and convenience. However, e-commerce is rapidly growing, driven by the increasing adoption of online shopping, especially for premium and eco-friendly products. Other distribution channels include specialized retail stores and subscription services, providing alternatives to traditional shopping methods.

Segmentation:

By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

By Nature

By Age-Group

- Pre-teens

- Teens

- Adults

- Senior Citizens

By Distribution Channel

- Supermarkets

- Drug Stores

- Online Retail Stores

- Others

Regional Analysis:

Russia stands as the largest market for feminine hygiene products in Europe, commanding approximately 13% of the regional market share. The market is characterized by strong domestic production capabilities and a growing focus on product innovation and distribution networks, particularly in urban areas. Consumer preferences are evolving, with increasing demand for premium products and a growing acceptance of alternative menstrual products, supported by increasing awareness about sustainable menstrual products.

In addition, the rising influence of social media and online influencers has played a pivotal role in shaping consumer perceptions, leading to a greater interest in health-conscious and eco-friendly options. Regional differences also influence the market, as urban areas exhibit a more significant demand for advanced and premium products compared to rural areas where traditional products still hold sway. With ongoing infrastructure developments and improvements in distribution channels, the market is expected to continue its expansion in the coming years.

Key Player Analysis:

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- Ontex

Competitive Analysis:

The Russia feminine hygiene products market is competitive, with several key players dominating both local and international segments. Leading global brands such as Procter & Gamble (Tampax, Always), Kimberly-Clark (Kotex), and Johnson & Johnson (Carefree) maintain strong market positions due to their extensive product offerings and brand recognition. These companies continue to innovate, introducing new product lines that cater to evolving consumer preferences, including organic and eco-friendly options. Local players, including companies like SCA Hygiene Products (Libresse), are also expanding their presence by adapting to regional preferences, focusing on sustainability and affordability. The market is witnessing an increasing number of niche players offering specialized products such as menstrual cups and organic cotton alternatives, aiming to capture the growing demand for sustainable and health-conscious options. As competition intensifies, companies must focus on product differentiation, sustainability, and efficient distribution networks to secure market share.

Recent Developments:

- In January 2025, Unicharm Corporation, in partnership with Toyota Tsusho, began local production of Sofy Long Lasting sanitary napkins in Kenya. Although this initiative targets the African market rather than Russia, it underscores Unicharm’s global expansion efforts and commitment to making sanitary products more accessible worldwide.

- In March 2025, Procter & Gamble launched Always Pocket Flexfoam, a new addition to its feminine care line, designed for portability and on-the-go protection. The launch was celebrated with a high-profile partnership at Coachella 2025, where Always and Tampax became the festival’s first-ever period care partners, providing products and on-site activations for attendees. This campaign highlights P&G’s commitment to both product innovation and experiential marketing in the feminine hygiene space.

- In July 2023, Unicharm’s subsidiary in Indonesia launched Charm Daun Sirih + Herbal Bio sanitary napkins, featuring eco-friendly materials. The company continues to innovate with products using bio-materials and is expanding its range of disposable period underwear to meet growing demand, particularly among younger consumers.

Market Concentration & Characteristics:

The Russian feminine hygiene products market exhibits a moderately concentrated structure, indicating a competitive landscape with a balanced presence of both multinational corporations and domestic brands. Key international players such as Procter & Gamble, Kimberly-Clark, and Essity maintain significant market shares, leveraging their established brand recognition and extensive distribution networks. Simultaneously, local manufacturers are gaining traction by offering products tailored to regional preferences and price sensitivities. The market is characterized by a diverse product portfolio, including sanitary napkins, tampons, panty liners, menstrual cups, and intimate cleansers. Sanitary napkins dominate the market, while tampons and menstrual cups are experiencing growing demand, particularly among urban consumers seeking convenience and sustainability. The rise of eco-consciousness has spurred interest in organic and reusable products, prompting brands to innovate and diversify their offerings. Distribution channels are expanding beyond traditional supermarkets and pharmacies to include online platforms, catering to the increasing preference for digital shopping experiences. This evolution reflects broader global trends towards convenience, sustainability, and personalized consumer choices in the feminine hygiene sector

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Age-Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Russian feminine hygiene products market is expected to continue growing, driven by increasing awareness of menstrual health.

- Demand for eco-friendly and organic products will rise as consumers prioritize sustainability.

- Premium products, offering enhanced comfort and absorbency, will see increased adoption across urban areas.

- E-commerce will play a pivotal role in expanding market reach, offering convenience and privacy.

- The shift towards reusable products like menstrual cups will grow as environmental concerns increase.

- Local brands will gain market share by offering tailored solutions for Russian consumers.

- Innovative product launches focused on hygiene and sustainability will shape competitive dynamics.

- Increased disposable income will support the demand for higher-quality, specialized feminine hygiene items.

- Social media and influencers will continue to drive awareness and change consumer preferences.

- Government initiatives promoting menstrual health education and product accessibility will further expand the market.