| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Russia Water Pump Market Size 2023 |

USD 988.03 Million |

| Russia Water Pump Market, CAGR |

1.66% |

| Russia Water Pump Market Size 2032 |

USD 1,147.20 Million |

Market Overview:

Russia Water Pump Market size was valued at USD 988.03 million in 2023 and is anticipated to reach USD 1,147.20 million by 2032, at a CAGR of 1.66% during the forecast period (2023-2032).

A significant driver of the water pump market in Russia is the continuous growth of industrial activities, especially in sectors like oil and gas, chemicals, and mining, where water pumps play a crucial role in maintaining operational processes. These industries require highly reliable and durable pumps to handle the extreme conditions often encountered in their operations. Additionally, the increasing focus on environmental sustainability has driven the need for more energy-efficient and eco-friendly pumping solutions. As industries strive to reduce their carbon footprint, pumps with lower energy consumption and longer life cycles are becoming more desirable. The government’s investment in modernizing wastewater treatment plants, coupled with rising consumer demand for potable water, further supports market growth. Such initiatives ensure that water pumps meet high-performance standards in both urban and rural regions. The shift towards automation and smart technologies in water management systems, offering better control and performance, is another factor contributing to the market’s expansion. These advancements allow for real-time monitoring and maintenance, optimizing the efficiency of water pumps across various applications.

The demand for water pumps is highest in the Central and Northwestern regions of Russia, particularly in Moscow and St. Petersburg, where industrial activities and urban development are most concentrated. These areas benefit from strong infrastructure projects that require robust water management systems, from sewage treatment to flood control. In addition, the government’s investment in modernizing water infrastructure in both urban and rural areas is anticipated to create opportunities for market players. Other regions, such as Siberia and the Far East, are also seeing increased demand due to the ongoing development of local industries and the need to improve water supply systems for remote areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Russia Water Pump Market was valued at USD 988.03 million in 2023 and is projected to reach USD 1,147.20 million by 2032, growing at a CAGR of 1.66% from 2023 to 2032.

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Industrial growth, particularly in sectors like oil, gas, chemicals, and mining, is a key driver for the increased demand for durable and reliable water pumps in Russia.

- The expansion of urbanization, especially in cities like Moscow and St. Petersburg, is boosting the need for advanced water management systems in municipal infrastructure.

- Technological advancements, such as smart pumps integrated with IoT systems and real-time monitoring, are enhancing the efficiency and sustainability of water management solutions.

- The Russian government’s focus on modernizing water infrastructure and wastewater treatment facilities is creating significant opportunities for water pump manufacturers.

- Environmental sustainability and water conservation are increasingly driving the demand for energy-efficient, eco-friendly pumps across various sectors.

- Despite high growth potential, challenges such as high maintenance costs, regulatory hurdles, and infrastructure gaps in remote regions could impede market expansion.

Market Drivers:

Industrial Growth and Urbanization

The continuous growth of industrial sectors such as oil and gas, chemicals, mining, and manufacturing significantly drives the demand for water pumps in Russia. These industries rely heavily on water pumping systems to support their complex operational processes, including fluid handling, cooling, and wastewater treatment. As industrial activities expand across the country, the need for efficient and reliable water pumps becomes increasingly important. Furthermore, urbanization trends, particularly in major cities like Moscow and St. Petersburg, are contributing to the growing demand for water management systems. As more people migrate to urban areas, there is an increasing need for improved water supply and sewage infrastructure, further boosting market requirements for water pumps.

Technological Advancements in Water Management

Technological innovations are a major driver in the Russia water pump market. The industry is witnessing a shift toward more energy-efficient and smart water pumps, designed to meet the evolving needs of both industrial and residential sectors. Advances in pump technologies, such as automation, real-time monitoring, and integration with Internet of Things (IoT) systems, are enhancing the overall performance of water pumps. These innovations help to optimize water usage, reduce energy consumption, and ensure operational efficiency. As industries and municipalities focus on sustainability and cost-effectiveness, the demand for high-performance pumps with advanced control systems and intelligent features continues to grow.

Government Initiatives and Infrastructure Development

The Russian government has recognized the importance of modernizing its water infrastructure, and substantial investments are being directed toward the renovation of water treatment plants, pipelines, and sewage systems. For example, the New Development Bank (NDB) has allocated $320 million to modernize water supply and sanitation systems in five cities along the Volga River. Government initiatives to address water scarcity, improve water quality, and upgrade wastewater treatment facilities have created significant demand for advanced water pumps. These developments are part of broader efforts to ensure environmental sustainability and support the country’s water management goals. The modernization of infrastructure is not limited to urban areas but extends to rural regions, where the need for reliable water supply systems is also rising. Such investments are expected to drive long-term growth in the water pump market.

Environmental Sustainability and Water Conservation

With growing awareness of environmental issues, there is an increasing demand for eco-friendly water pumps that promote sustainability and water conservation. The need for water-efficient solutions is becoming more pronounced, especially as industries and municipalities strive to reduce water wastage and improve their environmental footprint. Pumps with lower energy consumption, higher efficiency, and longer lifecycles are being prioritized in both industrial and residential applications. For example, solar-powered water pumps are gaining traction as an environmentally friendly solution in agriculture, where they support irrigation systems without relying on fossil fuels. Additionally, regulations that require industries to meet specific environmental standards are driving the adoption of sustainable water management practices. The push toward energy-efficient, durable, and environmentally responsible pumps is expected to remain a key driver in the Russia water pump market in the foreseeable future.

Market Trends:

Shift Towards Smart Water Pumps

The Russia water pump market is increasingly witnessing a trend toward the adoption of smart water pumps. These pumps are equipped with advanced control systems that enable real-time monitoring, remote operation, and predictive maintenance. The growing adoption of Internet of Things (IoT) technology is facilitating the integration of pumps with automated water management systems, enhancing operational efficiency across various sectors. Industries and municipalities are increasingly investing in smart pumps to improve water usage efficiency, reduce downtime, and lower operational costs. For example, cities like Moscow have implemented IoT-enabled pumps that allow for real-time monitoring of water pressure and flow rates, ensuring optimal performance and reducing water wastage. This trend is driven by the demand for greater control over water distribution systems and a focus on optimizing resource utilization. As digital technologies continue to evolve, the role of smart water pumps in Russia’s water management landscape is expected to become more prominent.

Rising Demand for Energy-Efficient Solutions

Energy efficiency remains a critical trend in the Russian water pump market. With increasing energy costs and growing environmental awareness, both industrial and residential sectors are seeking water pumps that offer improved energy performance. Energy-efficient pumps help to minimize electricity consumption while delivering the same or even higher levels of performance, thus driving down operating costs for end-users. Additionally, energy-saving technologies such as variable speed drives and electronically commutated motors (ECMs) are being incorporated into new pump models. These innovations align with the broader global shift towards sustainable practices and are expected to continue influencing market dynamics as both regulatory frameworks and consumer preferences emphasize energy conservation.

Integration of Advanced Materials in Pump Design

Another key trend in the Russia water pump market is the use of advanced materials in pump manufacturing. Manufacturers are increasingly turning to durable and corrosion-resistant materials such as stainless steel, carbon composite, and advanced polymers to enhance the lifespan and performance of water pumps. These materials help to reduce maintenance requirements, improve reliability, and extend the operational life of pumps, especially in challenging industrial environments. For instance, corrosion-resistant stainless steel pumps are gaining traction due to their reliability and reduced maintenance needs in challenging industrial applications. The integration of advanced materials is particularly crucial in sectors like oil and gas, mining, and chemical processing, where pumps are exposed to harsh chemicals and high-pressure conditions. As the need for long-lasting, low-maintenance pumps grows, this trend is expected to gain further traction in the market.

Emphasis on Sustainable Water Management Practices

As global water scarcity issues intensify, there is a growing trend towards adopting sustainable water management practices in Russia. Both private and public sectors are increasingly focused on reducing water wastage and improving the efficiency of water distribution networks. The market is seeing a rise in demand for water pumps that are capable of handling diverse applications, from desalination and wastewater treatment to flood management and irrigation. These pumps are designed not only to optimize water usage but also to minimize environmental impact by reducing water and energy losses. The emphasis on sustainability is driving manufacturers to develop innovative pump solutions that contribute to water conservation, thus aligning with global environmental goals and regulatory requirements.

Market Challenges Analysis:

High Maintenance and Operational Costs

One of the key restraints in the Russia water pump market is the high maintenance and operational costs associated with certain pump systems. While advanced pumps offer superior performance, they often require regular maintenance, spare parts, and technical expertise, which can be costly for end-users, especially in remote or less-developed areas. The need for frequent repairs and replacements can increase the total cost of ownership, making it a significant challenge for industries and municipalities with limited budgets. Additionally, some pumps are energy-intensive, further contributing to operational expenses. The high upfront and ongoing costs associated with water pumps can limit their adoption in price-sensitive sectors.

Regulatory and Environmental Compliance

Regulatory challenges pose another restraint for the growth of the water pump market in Russia. Compliance with stringent environmental standards for wastewater treatment and water conservation can be difficult for many industries. As regulatory requirements become more stringent, companies must invest in advanced, eco-friendly technologies that may not always align with their budget constraints. Additionally, obtaining necessary permits for large-scale infrastructure projects involving water management can be a time-consuming and costly process. These regulatory hurdles create a barrier to rapid market expansion and the adoption of new technologies in certain regions.

Infrastructure Gaps and Regional Disparities

Regional disparities in infrastructure development also pose challenges for the water pump market. While urban centers like Moscow and St. Petersburg have well-developed infrastructure, many rural and remote areas in Russia still face inadequate water supply and sewage systems. These regions often lack the necessary resources for implementing and maintaining advanced water management technologies, limiting the overall market potential. Additionally, the harsh climate conditions in certain regions require specialized pump systems, further increasing costs and operational complexity. For example, specialized centrifugal pumps are required to withstand extreme conditions in regions like Siberia and the Far East. Overcoming these regional infrastructure gaps remains a significant challenge for market players seeking to expand across the entire country.

Market Opportunities:

The Russia water pump market presents significant opportunities driven by the increasing demand for sustainable water management solutions. As water scarcity becomes a growing concern, both industries and municipalities are focusing on reducing water wastage and improving water efficiency. The Russian government’s emphasis on modernizing water infrastructure and wastewater treatment facilities provides a favorable environment for water pump manufacturers. There is a clear opportunity for companies to introduce advanced pumps that enhance water conservation, energy efficiency, and operational performance. By offering eco-friendly, energy-efficient solutions, manufacturers can cater to the growing demand for sustainable water management technologies, positioning themselves as leaders in this evolving market.

There is also a substantial market opportunity in Russia’s underdeveloped and rural regions, where the demand for reliable water management systems is increasing. Despite the well-developed infrastructure in urban centers, many remote areas lack efficient water supply and wastewater treatment systems. As part of ongoing efforts to modernize and expand the country’s water infrastructure, these regions are ripe for investment in water pump solutions. Companies that can develop cost-effective, durable, and climate-resistant pumps tailored for harsh environments will find opportunities for growth in these underserved markets. The focus on infrastructure development, combined with the government’s push for regional modernization, opens new avenues for expansion and long-term market success.

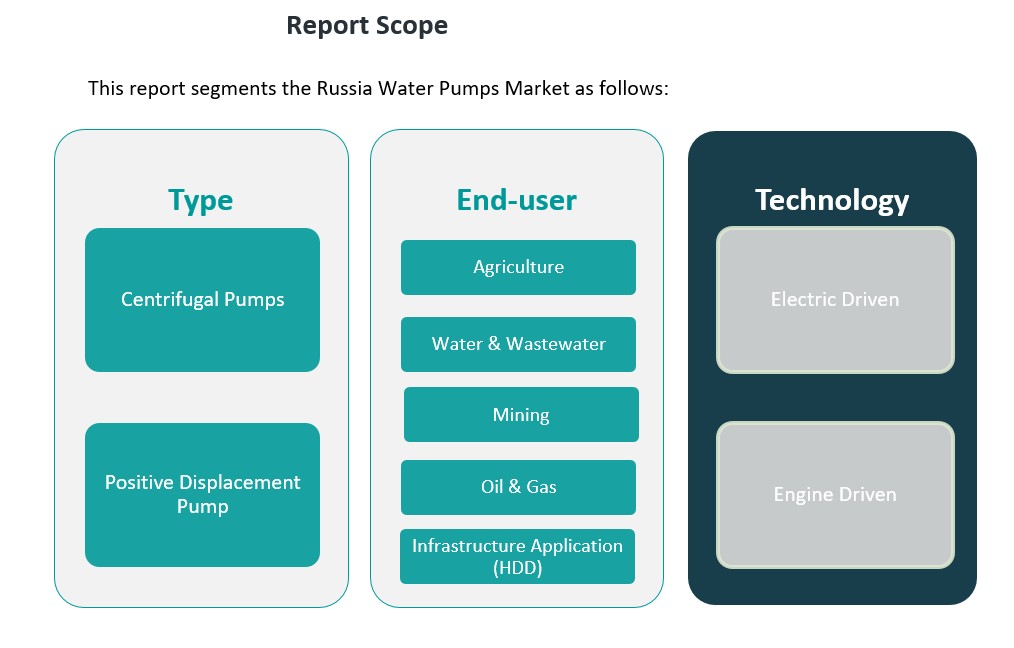

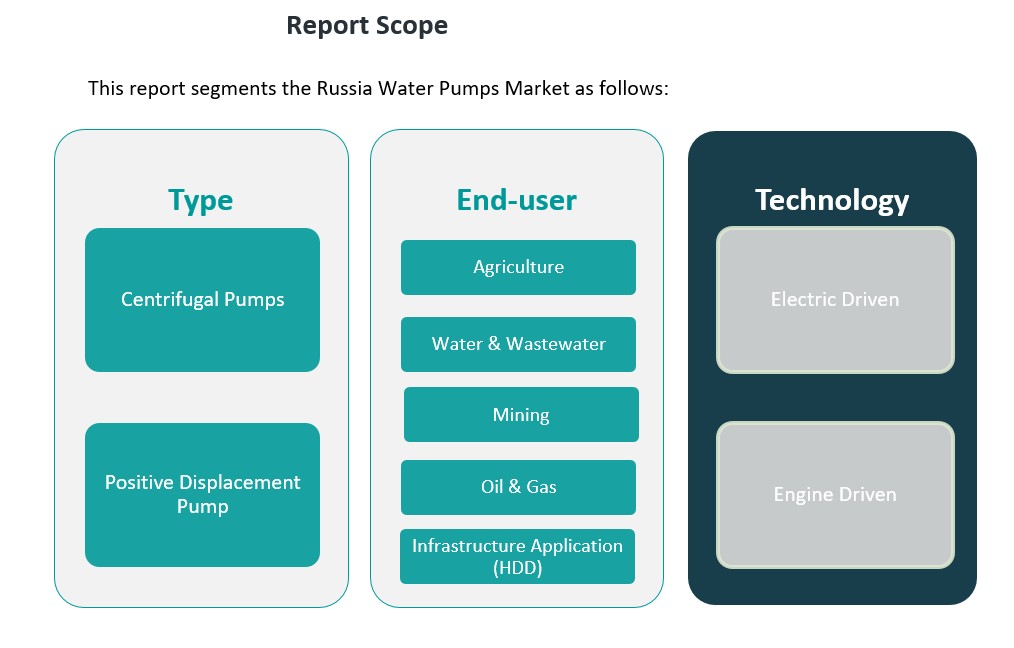

Market Segmentation Analysis:

The Russia water pump market is categorized based on type, end-user application, and technology, each contributing uniquely to the market’s growth and development.

By Type Segment

The market is primarily divided into two types of pumps: centrifugal pumps and positive displacement pumps. Centrifugal pumps dominate the market due to their high efficiency, reliability, and ability to handle large volumes of water, making them ideal for industrial, municipal, and agricultural applications. Positive displacement pumps, on the other hand, are preferred for applications requiring high pressure and the ability to pump viscous fluids. These pumps are commonly used in the oil and gas, mining, and chemical sectors where precise fluid handling is necessary.

By End-User Segment

The water pump market in Russia is driven by several key industries. The agriculture sector represents a significant portion of the market, where water pumps are critical for irrigation and livestock management. The water and wastewater segment is another major end-user, with pumps being essential for water treatment, distribution, and sewage management. Additionally, the mining and oil & gas industries heavily rely on specialized pumps for fluid handling and operational processes. The infrastructure sector, including Horizontal Directional Drilling (HDD), is also growing rapidly, driven by urban development and pipeline installation projects.

By Technology Segment

The technology segment is divided into electric-driven and engine-driven pumps. Electric-driven pumps are preferred for their energy efficiency and environmental benefits, especially in urban areas. Engine-driven pumps, while less efficient, are widely used in remote and off-grid areas where access to electricity is limited, and the demand for portability and durability is high. Both technologies are crucial in meeting the diverse needs of the Russian water pump market.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The Russia water pump market exhibits regional variation driven by industrial activity, infrastructure development, and water management needs. Key regions, such as Moscow, St. Petersburg, and Siberia, contribute significantly to market dynamics, while rural and remote areas show growth potential.

Central and Northwestern Russia (Moscow, St. Petersburg)

The Central and Northwestern regions of Russia, particularly Moscow and St. Petersburg, hold the largest share of the water pump market. Moscow, as the political and economic hub of Russia, is home to numerous industrial operations, large-scale construction projects, and urban development initiatives. These activities drive high demand for water pumps in municipal water supply, wastewater treatment, and flood control systems. St. Petersburg, another major urban center, also experiences substantial demand for water management solutions due to ongoing infrastructure development and industrial expansion. These two regions together account for approximately 35-40% of the total market share, driven by their economic significance and dense population, which fuels the need for efficient water management systems.

Siberia and the Far East

Siberia and the Far East, while not as industrially concentrated as the Central and Northwestern regions, represent important growth areas for the water pump market. These regions are rich in natural resources, such as oil, gas, and minerals, which require specialized pumping systems for extraction and processing. Additionally, the harsh climate conditions and challenging landscapes in these regions necessitate durable and reliable water pumps designed to withstand extreme temperatures and rugged terrains. Siberia and the Far East together make up around 20-25% of the market share, with increasing investment in infrastructure and resource extraction driving demand for water pumps in both industrial and municipal applications.

Southern Russia and the Volga Region

Southern Russia and the Volga region have seen moderate growth in water pump demand, primarily due to agriculture, irrigation, and water treatment needs. The Volga region, known for its large-scale agricultural activities, requires water pumps for irrigation, especially in the face of fluctuating water levels. This region holds around 15-18% of the total market share, with agriculture being the dominant driver. As agricultural efficiency improves, the demand for reliable irrigation systems, including water pumps, continues to rise.

Ural Region

The Ural region, an industrial hub with significant manufacturing and mining activities, also contributes to the overall market share of Russia’s water pump industry. The need for water pumps in the mining and chemical industries has led to steady growth in this region, accounting for approximately 10-12% of the market. The Ural region’s focus on heavy industries, including metals and minerals processing, further strengthens its position as a key player in the water pump market.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT INC.

- EBARA CORPORATION

- NK Kron

- Defu Machinery

Competitive Analysis:

The Russia water pump market is highly competitive, with both domestic and international players vying for market share. Leading manufacturers such as Grundfos, KSB, and ITT Corporation dominate the market due to their strong presence, advanced technology, and extensive product portfolios. These companies offer a wide range of centrifugal and positive displacement pumps, catering to industrial, agricultural, and municipal applications. Additionally, local players like JSC “Pump” and “Energocomplekt” leverage their regional knowledge and cost-effective solutions to capture a significant portion of the market, particularly in the energy and mining sectors. Competition in the market is driven by technological innovation, with a focus on energy-efficient, smart, and durable pumps. Companies are increasingly incorporating IoT integration, automation, and energy-saving features into their products to meet the growing demand for sustainable solutions. Strategic partnerships, mergers, and acquisitions are also common as companies look to expand their market reach and improve operational efficiency.

Recent Developments:

- Servotech Power Systems Ltd.launched solar pump controllers on October 28, 2024, designed for 2HP to 10HP water pumps. This aligns with initiatives like PM-KUSUM to promote sustainable farming practices through water-efficient solutions.

- Roto Pumps Ltd.announced the launch of its subsidiary, Roto Energy Systems Ltd., in Feb 2024. This new division focuses on solar-powered water pumping solutions, including submersible and surface pumps, catering to eco-friendly water management needs.

- Grundfos’ commitment to the Water Resilience Coalition in March 2025 aligns with the water pump market’s focus on sustainability and efficient water management. The coalition’s goals include measurable improvements in global water sustainability by 2030.

- On February 28, 2025, KSB launched the MultiTec Plus pump series, specifically optimized for drinking water transport. This product integrates energy-saving technologies and real-time monitoring capabilities, emphasizing advancements in smart and sustainable water pumping solutions.

Market Concentration & Characteristics:

The Russia water pump market is moderately concentrated, with a mix of international and regional players competing for market share. Global brands like Grundfos, KSB, and ITT Corporation hold a significant portion of the market, offering advanced technology and a wide product range. These international companies benefit from strong financial resources, extensive distribution networks, and a reputation for high-quality, reliable pumps. On the other hand, regional manufacturers such as JSC “Pump” and “Energocomplekt” cater to local needs by providing cost-effective solutions and leveraging their proximity to key markets. The market is characterized by a high level of competition, particularly in the industrial and municipal sectors. Companies are increasingly focusing on innovation, with an emphasis on energy-efficient, smart pumps, and sustainable water management solutions. The market also reflects regional disparities, with demand varying based on industrial activity, infrastructure development, and geographical challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Continued industrial growth will drive demand for reliable water pumps in sectors like oil, gas, and mining.

- The expansion of urban infrastructure projects will increase the need for efficient water management systems.

- Rising environmental concerns will accelerate the adoption of energy-efficient and eco-friendly pump solutions.

- Technological innovations, including smart and IoT-integrated pumps, will enhance performance and operational efficiency.

- Increased government investments in water and wastewater treatment plants will support long-term market growth.

- The growing focus on agriculture and irrigation in rural areas will spur demand for durable water pumps.

- Advancements in pump materials, such as corrosion-resistant and durable composites, will improve pump longevity.

- Regional infrastructure development in Siberia and the Far East will create new opportunities for water pump manufacturers.

- Adoption of automation and real-time monitoring technologies will transform water pump usage across industries.

- Mergers, acquisitions, and partnerships will intensify competition and expand market reach in emerging segments.