Market Overview

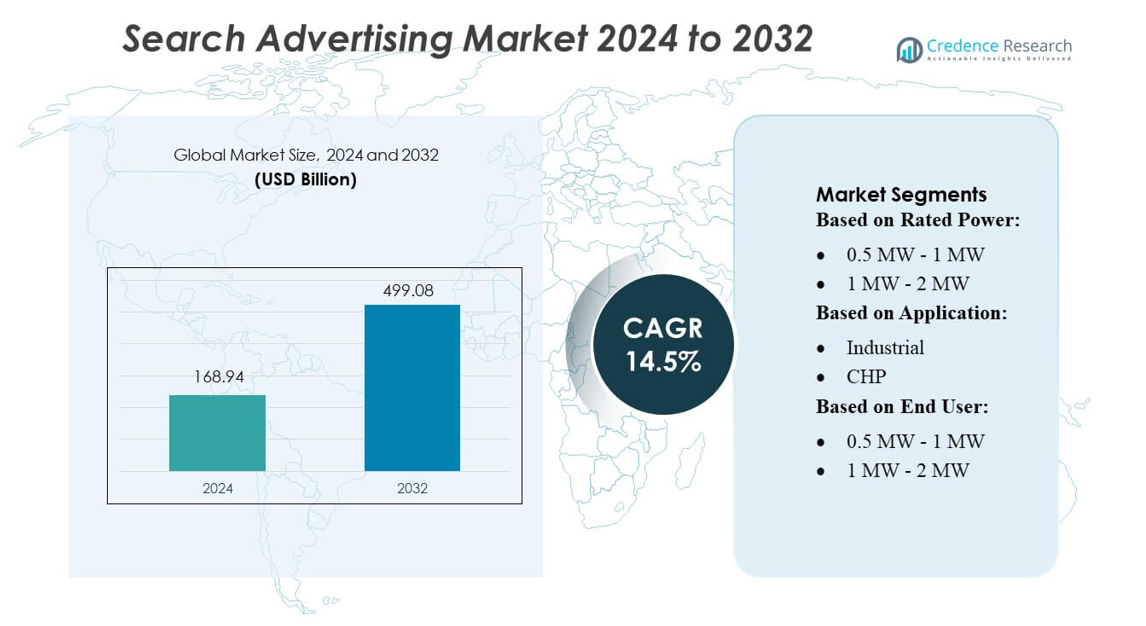

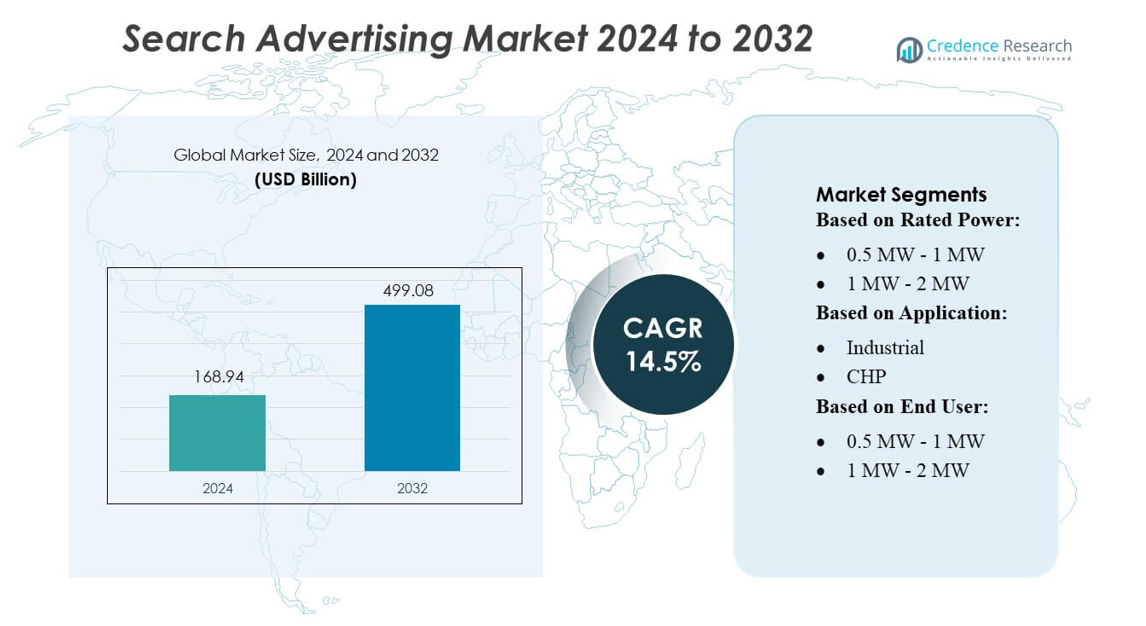

Search Advertising Market size was valued USD 168.94 billion in 2024 and is anticipated to reach USD 499.08 billion by 2032, at a CAGR of 14.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Search Advertising Market Size 2024 |

USD 168.94 billion |

| Search Advertising Market, CAGR |

14.5% |

| Search Advertising Market Size 2032 |

USD 499.08 billion |

The Search Advertising market is dominated by a few major players Google, Microsoft (Bing), Amazon, and Baidu which together shape the competitive landscape. Google leads the sector, leveraging its overwhelming search engine presence to drive ad revenues. Microsoft’s Bing remains second, offering a lower-cost but smaller-scale alternative. Amazon is rapidly scaling its search ad business via e-commerce intent data, while Baidu maintains strong influence in the Chinese market. Regionally, North America is the leading market for search advertising, accounting for approximately 38 % of the global spend.

Market Insights

- The Search Advertising Market reached USD 168.94 billion in 2024 and is projected to hit USD 499.08 billion by 2032, advancing at a 14.5% CAGR, driven by rising digital consumption and performance-based ad models.

- Growing adoption of AI-powered bidding, personalized targeting, and automated campaign management acts as a key market driver, enabling brands to optimize conversions and reduce customer acquisition costs.

- The market experiences strong trends such as voice-based search advertising, retail media expansion, and deeper integration of first-party data, supporting higher ad relevance and measurable ROI across platforms.

- Competitive dynamics remain intense, with Google dominating global share, followed by Microsoft (Bing), Amazon, and Baidu; search ads linked to e-commerce intent continue to gain segment share, particularly across product-focused queries.

- Regionally, North America leads with 38% market share, while Asia-Pacific shows the fastest expansion; retail, technology, and consumer services represent the largest spending segments across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Rated Power

The 2 MW–3.5 MW segment holds the dominant share in the market, accounting for over 32–35% due to its balanced output, high operational efficiency, and suitability for large-scale industrial and utility-grade deployments. Demand remains strong in facilities requiring reliable baseload and peak-shaving capabilities, particularly in regions facing grid instability. Growth is driven by increasing industrial automation, expanding manufacturing clusters, and the rising need for decentralized power systems that optimize load distribution while reducing operational costs. The segment also benefits from advancements in control systems and improved fuel flexibility.

- For instance, Fiat’s 1.0-liter FireFly engine (also known as the GSE or Global Small Engine family) is a lightweight, compact engine family that uses an advanced aluminum block design to improve efficiency and reduce weight.

By Application

The Industrial segment leads the market with an estimated 38–40% share, supported by rising energy loads across manufacturing, mining, chemicals, and heavy engineering sectors. Its dominance stems from continuous power requirements, stringent operational uptime standards, and growing adoption of cogeneration technologies that enhance energy efficiency. Industrial users increasingly adopt modular, fuel-flexible systems to reduce dependence on volatile grid supply and meet emission compliance thresholds. Demand is further strengthened by expanding industrial infrastructure in developing economies and the push for resilient on-site power solutions that ensure stable production cycles.

- For instance, Mercedes-Benz (via Daimler) has deployed its GenH2 hydrogen fuel-cell truck, which delivers a continuous 300 kW from the fuel cell coupled with a 70 kWh buffer battery, and during its trials covered more than 225,000 km, consuming between 5.6 and 8.0 kg of hydrogen per 100 km.

By End User

The Backup Power segment remains the largest, capturing over 40% of market share, driven by rising demand for uninterrupted operations across data centers, hospitals, commercial complexes, and industrial facilities. Increasing grid outages, higher digitalization, and business continuity requirements underpin this segment’s dominance. Backup solutions are preferred for their rapid start-up capability, operational reliability, and cost-effective deployment. Growth is reinforced by the expansion of critical infrastructure, including telecommunications and cloud services, as well as regulatory expectations for redundancy systems in high-risk operational environments.

Key Growth Drivers

Rising Digital Consumer Engagement

The rapid increase in online search behavior continues to drive the expansion of search advertising, as consumers rely heavily on search engines for product discovery, price comparison, and service evaluations. Advertisers increasingly shift budgets toward digital channels where intent-driven users convert at higher rates. Growth is supported by expanding internet penetration, mobile search adoption, and improved analytics that help brands optimize bidding strategies. Businesses recognize search advertising as a cost-efficient, performance-driven tool that delivers measurable ROI, further strengthening overall market growth.

- For instance, Honda recently revealed that its next-generation hybrid e:HEV models will be equipped with a high-precision system-on-chip capable of 2,000 TOPS (sparse) performance with 20 TOPS/W efficiency — a powerful AI unit that supports more responsive, connected-car features tied to digital channels.

Advancements in AI-Driven Targeting

AI-enabled algorithms significantly enhance the precision and efficiency of search advertising by improving keyword relevance, real-time bidding, and user intent prediction. Machine learning helps advertisers automate campaign optimization, reduce acquisition costs, and increase conversion rates. Predictive analytics identifies emerging consumer patterns, while automated ad creation tools streamline campaign workflows. These capabilities enable brands to scale personalized campaigns across large audiences, enhancing performance visibility. As platforms integrate deeper AI functionalities, advertisers gain more control over relevance scoring, quality metrics, and dynamic budget allocation.

- For instance, Volkswagen has extended its “Digital Production Platform” to 43 factories worldwide, using AI via AWS SageMaker for quality-inspection and energy-optimization tasks.

Growth of Mobile and Voice Search

Expanding mobile usage and increasing adoption of voice-enabled digital assistants strengthen search advertising demand by generating higher volumes of real-time, localized queries. Marketers benefit from location-based targeting, click-to-call features, and mobile-optimized ad formats that deliver stronger engagement. Voice search encourages more conversational, long-tail keywords, opening new opportunities for advertisers. The shift toward mobile-first browsing and faster connectivity improves user responsiveness and increases ad inventory. These trends collectively drive more impressions, better conversion potential, and greater investment in mobile-focused search campaigns.

Key Trends & Opportunities

Rise of Automation and Smart Bidding

Automation tools and smart bidding strategies are reshaping campaign management by allowing advertisers to optimize performance with minimal manual intervention. Platforms increasingly apply machine learning to predict conversion likelihood, adjust bids in real time, and improve keyword relevance. This trend benefits advertisers seeking efficiency at scale. Automation also supports dynamic search ads that match evolving user queries, creating broader reach. As marketing teams adopt intelligent tools for audience segmentation and budget distribution, the market sees significant opportunities for improved campaign agility and reduced operational workload.

- For instance, MHI is leveraging its ΣSynX® digital-innovation platform to automate complex operations: for instance, its TOMONI® solution monitors over 150 power-plant units globally, using AI-driven predictive models for optimization and maintenance.

Expansion of Retail Media and Commerce Search

Retail media networks are emerging as high-value search ecosystems, enabling brands to advertise directly within e-commerce platforms where purchase intent is strongest. Search-based placements on retail websites offer richer first-party data, transparency in performance measurement, and superior conversion attribution. This trend creates opportunities for advertisers to integrate commerce search with broader digital strategies. As retailers invest in sponsored product ads, keyword bidding, and AI-driven recommendation systems, brands gain new channels to influence shoppers’ decisions at critical points in the purchase journey.

- For instance, Cummins has made several notable technological strides: for instance, it launched a 6.7-litre hydrogen internal-combustion engine (H₂-ICE) in collaboration with a UK consortium, which reduces tailpipe carbon emissions by over 99 %.

Growing Emphasis on Privacy-Friendly Targeting

As data-privacy regulations strengthen globally, search advertising increasingly shifts toward privacy-compliant targeting methods based on contextual relevance and first-party data. Advertisers adapt by refining keyword strategies, leveraging consent-based data, and incorporating anonymized user signals. This shift encourages innovation in audience modeling and privacy-safe measurement tools. Opportunities arise for platforms offering transparent data governance and ethical ad frameworks. Businesses benefit from trusted user relationships, while regulatory-aligned advertising practices enhance long-term market stability and consumer confidence.

Key Challenges

Increasing Competition and Rising CPCs

The search advertising market faces escalating cost pressures as more brands compete for high-value keywords across key industries such as finance, retail, and technology. Rising cost-per-click (CPC) rates force advertisers to allocate larger budgets to maintain visibility, particularly within competitive verticals. Smaller businesses struggle to achieve cost-effective results, leading to reduced campaign reach. This challenge intensifies demand for optimized bidding strategies, deeper keyword segmentation, and stronger conversion tracking to prevent budget inefficiencies. Competition also pushes brands toward niche targeting to maintain performance.

Dependency on Platform Algorithms

Advertisers remain heavily dependent on search engine algorithms that dictate ad placement, quality scores, and pricing dynamics. Frequent platform updates can disrupt campaign performance, reduce keyword visibility, and alter bidding efficiency. Limited transparency in algorithmic decision-making creates uncertainty for marketers who rely on consistent performance metrics for planning. This dependency forces advertisers to continually adapt strategies, invest in analytics, and diversify spending across multiple search platforms. Failure to align campaigns with evolving algorithmic criteria can result in declining ROI and reduced competitiveness.

Regional Analysis

North America

North America holds the largest share of the global search advertising market at around 40%. The region benefits from strong digital adoption, high online spending, and advanced advertising technologies. Businesses invest heavily in search ads to capture consumer intent across e-commerce, retail, and service sectors. The U.S. leads the region due to mature marketing capabilities and strong use of AI and data analytics. High mobile and internet penetration further supports consistent growth, making North America the most influential region in shaping search advertising strategies.

Asia-Pacific

Asia-Pacific accounts for about 30% of the market and remains the fastest-growing region. The rise of mobile-first users, expanding internet access, and rapid e-commerce growth drive search ad spending. Countries like China, India, and Southeast Asian nations contribute significantly as businesses rely on search engines to reach large, digitally active populations. Advertisers benefit from high search volumes, strong smartphone usage, and increasing adoption of localized ad formats. The region’s young consumer base and growing digital economy ensure continued growth in search advertising.

Europe

Europe represents around 20% of the global search advertising market. Growth is supported by strong digital infrastructure, high online shopping activity, and increasing adoption of privacy-focused advertising models. Major markets such as the UK, Germany, and France drive demand as businesses use search ads for customer acquisition and brand visibility. European advertisers focus on targeted campaigns, multilingual search optimization, and compliance with strict data regulations. Steady digital transformation across industries continues to support the region’s market share.

Latin America

Latin America holds about 5% of the search advertising market. Growth is driven by rising internet access, increasing smartphone use, and expanding e-commerce activity. Brazil and Mexico lead regional spending as businesses shift from traditional media to digital platforms. Search advertising helps companies reach price-sensitive and mobile-focused consumers effectively. Although economic volatility can impact ad budgets, the region’s young population and expanding online shopping behavior support steady long-term growth.

Middle East & Africa

The Middle East & Africa region accounts for around 5% of global search advertising. Growth is supported by increasing digital adoption, improving internet infrastructure, and rising use of mobile devices. Gulf countries such as the UAE and Saudi Arabia lead spending due to strong investments in digital transformation. Businesses use search advertising to target consumers across retail, travel, and services. While overall adoption is still developing, increasing online activity and government digital initiatives are gradually expanding the region’s market share.

Market Segmentations:

By Rated Power:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Search Advertising Market features a diverse mix of participants, with key players such as Fiat Automobiles S.p.A, Mercedes-Benz, Honda Motor Co., Ltd., Volkswagen AG, Mitsubishi Heavy Industries, Ltd., General Motors, Cummins Inc., AB Volvo, Renault Group, and Ford Motor Company. The Search Advertising Market remains highly dynamic, shaped by continuous advancements in AI-driven targeting, automation, and cross-platform integration. Major technology companies and ad-tech providers compete by enhancing keyword relevance, improving bidding algorithms, and offering privacy-centric data solutions that ensure compliance while maintaining advertising efficiency. The market also experiences strong competition from emerging platforms introducing innovative campaign optimization tools, real-time analytics, and performance-based pricing models aimed at reducing customer acquisition costs. As advertisers shift toward omnichannel strategies, providers differentiate through scalable cloud-based infrastructures, advanced attribution modeling, and seamless integration with social, video, and retail media ecosystems. Overall, competitive intensity persists as companies prioritize measurable ROI, faster optimization cycles, and increased transparency across the advertising value chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fiat Automobiles S.p.A

- Mercedes-Benz

- Honda Motor Co., Ltd.

- Volkswagen AG

- Mitsubishi Heavy Industries, Ltd.

- General Motors

- Cummins Inc.

- AB Volvo

- Renault Group

- Ford Motor Company

Recent Developments

- In July 2025, Caterpillar’s Holly Gregory discusses how the engineering and construction giant is developing its power offerings. The plant leverages machine learning for better optimization of fuel dispatch between battery storage and gas engines (Cat CG260, 15 MW), leading to a 22% reduction in fuel consumption compared to systems with traditional control.

- In June 2025, Mitsubishi Heavy Industries group company, Mitsubishi Heavy Industries Engine & Turbocharger , has showcased a hydrogen-engine generator. This engine has 30% lower CO2 emissions compared to diesel gensets, and it has already been successfully tested at Thailand’s Map Ta Phut Industrial Port.

- In April 2024, Rolls-Royce signed a Memorandum of Understanding (MOU) with ASCO Carbon Dioxide Ltd (ASCO) and Landmark Power Holdings Limited (LMPH) to develop scalable solutions for clean power generation with carbon capture from its mtu gas reciprocating engines.

- In May 2023, Google, Inc. expanded its collaboration with SAP SE to introduce a comprehensive open data solution. This solution will enable customers to build a complete data cloud, integrating data from their enterprise systems via SAP Datasphere and Google’s data cloud

Report Coverage

The research report offers an in-depth analysis based on Rated Power, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will accelerate adoption of AI-driven bidding models to improve campaign efficiency and targeting accuracy.

- Search platforms will increasingly integrate generative AI to enhance ad creation and automate keyword strategies.

- Privacy-centric advertising frameworks will expand as platforms adapt to stricter data protection regulations.

- Voice and visual search will gain stronger traction, prompting advertisers to optimize campaigns for new query formats.

- Cross-channel integration will deepen as search ads align more closely with social, retail media, and video ecosystems.

- Cloud-based analytics will enhance real-time performance measurement and accelerate optimization cycles.

- First-party data strategies will become more critical as third-party tracking continues to decline.

- Automation tools will further reduce manual campaign management, increasing efficiency for advertisers of all sizes.

- Mobile-first search behavior will continue to dominate, pushing platforms to refine mobile ad formats and speed performance.

- Competition will intensify as emerging ad-tech players introduce differentiated pricing models and transparency-focused solutions.