Market Overview

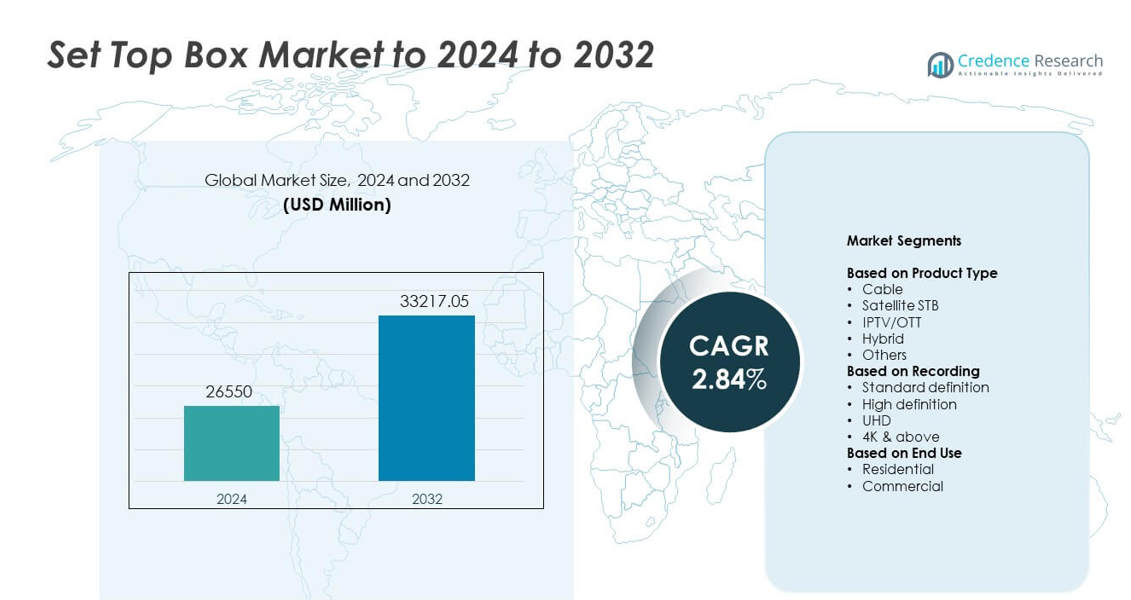

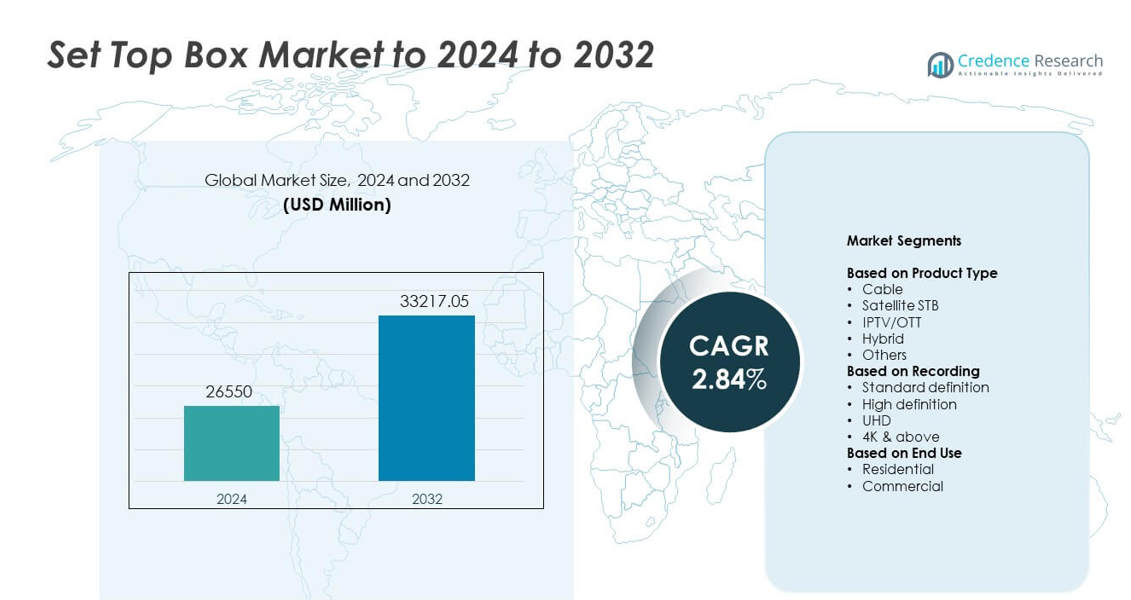

Set Top Box Market size was valued at USD 26,550 million in 2024 and is anticipated to reach USD 33,217.05 million by 2032, at a CAGR of 2.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Set Top Box Market Size 2024 |

USD 26,550 million |

| Set Top Box Market, CAGR |

2.84% |

| Set Top Box Market Size 2032 |

USD 33,217.05 million |

The Set Top Box Market is shaped by major players such as Huawei, Kaon Media, ARRIS, Humax, Dish Network, Apple, CommScope, Intek Digital, and EchoStar, each driving innovation through hybrid, IPTV, and OTT-enabled devices. These companies compete by enhancing processing speed, picture quality, and integrated streaming capabilities. Asia Pacific leads the market with about 34% share, supported by large subscriber bases and rapid digital adoption. North America follows with nearly 32% share due to strong pay-TV penetration and advanced broadband networks, while Europe holds around 27% share driven by mature digital broadcasting standards.

Market Insights

- The Set Top Box Market reached USD 26,550 million in 2024 and will rise to USD 33,217.05 million by 2032 at a CAGR of 2.84%.

- Growth is driven by rising adoption of hybrid, IPTV, and OTT-enabled devices, supported by upgrades to HD, UHD, and 4K viewing formats.

- Key trends include cloud-based DVR expansion, voice-enabled interfaces, and integration of smart features that enhance user control and viewing flexibility.

- Competition intensifies as manufacturers advance processing speed, interface quality, and streaming integration, while facing pressure from smart TVs that reduce standalone STB demand.

- Asia Pacific leads the market with about 34% share, followed by North America at nearly 32% and Europe at around 27%, while cable units hold the highest segment share at about 39%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Cable set top boxes led the Set Top Box Market in 2024 with about 39% share. Strong demand came from established pay-TV networks that continue to serve large subscriber bases in emerging and developed markets. Cable units offer stable signal quality and support bundled broadband plans, which keeps adoption steady. Satellite STBs held notable use in rural areas with limited cable reach, while IPTV or OTT devices grew due to rising internet adoption. Hybrid models gained pace as operators promoted unified content access through integrated broadcast and streaming delivery.

- For instance, Sky reported Sky Q in 3.6 million homes in 2018, showing strong hybrid set-top box uptake.

By Recording

High definition units dominated this segment in 2024 with nearly 46% share. Broad adoption came from mainstream households that prefer clear picture quality at accessible prices. HD devices benefit from strong channel support, mature broadcasting standards, and lower upgrade costs. Standard definition systems declined as consumers shifted to higher-resolution screens, while UHD and 4K options rose in premium segments. Growth in smart TVs and improved broadband networks continued to push viewers toward better visual clarity and more advanced recording formats.

- For instance, Dish Network’s Hopper 3 DVR can record up to 16 programs at once and store about 500 hours of HD video.

By End Use

Residential users held the dominant position in 2024 with about 78% share. Households drove demand due to rising adoption of digital TV services, bundled operator plans, and platform upgrades from HD to UHD. The segment also expanded as families relied on hybrid and OTT-enabled boxes for mixed viewing needs. Commercial users, including hotels and corporate spaces, maintained stable demand, supported by structured entertainment systems and multi-room broadcast setups. Residential growth remained stronger due to wider device replacement cycles and expanding broadband penetration.

Key Growth Drivers

Rising Shift Toward Digital and Hybrid TV Platforms

Growing migration from analog to digital broadcasting continues to boost set top box demand. Hybrid models gain strong traction as viewers seek unified access to linear TV and streaming platforms. Operators promote upgrades through bundled broadband plans, which strengthens device replacement cycles. Expanding digital infrastructure in emerging regions also supports higher adoption. This broad transition remains a major growth driver across global markets.

- For instance, Comcast reported that it finished the year 2024 with approximately 12.5 million domestic video customersFor instance, Comcast reported that it finished the year 2024 with approximately 12.5 million domestic video customers

Expansion of High-Definition and Ultra-HD Content

The rapid increase in HD, UHD, and 4K content encourages households to replace older boxes with advanced units. Broadcasters invest in enhanced picture formats to improve viewer experience, pushing demand for compatible devices. Affordable HD and UHD TV sets also accelerate upgrades. Higher video quality expectations keep consumers shifting toward smarter, faster, and higher-resolution STBs, making this a key growth driver.

- For instance, Netflix offers thousands of titles in Australia, with its Premium plan enabling 4K Ultra HD streaming with HDR and Spatial Audio on up to four devices at once.

Growth in Broadband Penetration and IPTV or OTT Adoption

Improved broadband speeds and cheaper data plans support wider IPTV and OTT usage. Telecom operators integrate STBs with streaming services to offer flexible content choices. The shift toward connected viewing habits strengthens demand for internet-enabled boxes. Rising smart home adoption further supports device integration. This expansion in digital connectivity stands as another key growth driver for the market.

Key Trends & Opportunities

Integration of Voice Control and Smart Features

Manufacturers adopt voice assistants, AI-driven recommendations, and faster processors to enhance user experience. Smart features create opportunities for operators to deliver personalized content and interactive services. This shift aligns STBs with broader smart home ecosystems, expanding value beyond basic broadcasting. The trend allows companies to capture users seeking modern, intuitive, and connected entertainment devices.

- For instance, Amazon’s current 3rd Generation Fire TV Cube (released in 2022) uses an octa-core processor (with 4x 2.2 GHz and 4x 2.0 GHz cores) and includes eight far-field microphones for hands-free Alexa control.

Rising Demand for Cloud-Based DVR and Multi-Screen Viewing

Cloud DVR adoption reduces reliance on physical storage and offers flexible viewing options across devices. Operators leverage cloud infrastructure to provide remote access, extended recording hours, and seamless cross-platform playback. Multi-screen consumption creates new opportunities for integrated STB solutions that support mobile and tablet streaming. This trend enhances customer retention through convenience-driven service upgrades.

- For instance, Sling TV offered 50 hours of free cloud DVR storage and, in January 2025, introduced an optional paid add-on for an unlimited cloud DVR option for subscribers.

Key Challenges

Growing Competition from Smart TVs with Built-In Streaming

Smart TVs integrate OTT apps and advanced processing, reducing the need for separate set top boxes. Users prefer simplified setups with fewer devices, which pressures traditional STB shipments. Manufacturers must innovate through hybrid features, advanced interfaces, or value-added services to remain relevant. This shift in consumer preference stands as a major challenge for market expansion.

Rising Regulatory Pressure and Content Distribution Costs

Compliance with evolving broadcasting rules increases operational complexity for providers. Content licensing fees and spectrum management costs also impact pricing flexibility. Operators face pressure to balance affordability with upgraded technology, slowing rapid device replacement in some regions. This regulatory and cost burden forms a key challenge for sustained growth in the market.

Regional Analysis

North America

North America held about 32% share in 2024, supported by strong pay-TV penetration and widespread use of advanced HD and UHD set top boxes. Demand stayed steady as operators promoted hybrid and IPTV-based devices to retain subscribers in a competitive streaming landscape. Frequent upgrades to higher-resolution TVs also encouraged replacement of older STBs. Growth in OTT integration helped cable and satellite providers maintain relevance. The region benefited from robust broadband coverage, which strengthened adoption of connected and cloud-enabled recording features across households.

Europe

Europe accounted for nearly 27% share in 2024, driven by mature digital TV adoption and strong regulatory support for standardized broadcast technologies. Widespread preference for HD and UHD content encouraged migration to next-generation set top boxes. Hybrid models gained traction due to rising OTT usage across major markets. Operators invested in integrated viewing platforms to reduce churn and enhance user experience. Stable broadband networks across Western Europe supported IPTV growth, while Eastern Europe showed steady demand for cable and satellite units as households continued upgrading older devices.

Asia Pacific

Asia Pacific dominated the global market with about 34% share in 2024, backed by large subscriber bases and expanding digital infrastructure. Countries such as China and India saw rapid adoption of affordable cable and DTH services. Strong growth in broadband penetration supported rising IPTV and OTT-linked set top boxes. Urban households upgraded quickly to HD and UHD units, while rural regions continued to adopt basic digital boxes. Government-led digitization programs further accelerated market expansion. Increasing smart TV presence influenced hybrid device demand as consumers sought flexible and cost-effective viewing options.

Latin America

Latin America held around 4% share in 2024, shaped by steady demand for cable and satellite services across urban and semi-urban regions. Economic constraints slowed widespread upgrades, but digital migration kept base-level adoption stable. Operators introduced cost-efficient HD models to attract subscribers, while IPTV gained momentum in markets with improving broadband networks. The region relied heavily on bundled pay-TV packages, supporting continued use of traditional STBs. Gradual adoption of hybrid units emerged as streaming platforms expanded their presence and households sought mixed content access.

Middle East & Africa

Middle East & Africa captured nearly 3% share in 2024, driven by rising penetration of satellite TV services in areas with limited cable infrastructure. Demand increased for HD and UHD boxes as households adopted modern TV displays. Broadband expansion in Gulf countries enabled growing use of IPTV and hybrid units. Affordability remained a key factor in device selection across Africa, favoring basic digital set top boxes. Ongoing government-led digital switchovers supported gradual market growth, while expanding OTT availability encouraged operators to integrate streaming access into newer devices.

Market Segmentations:

By Product Type

- Cable

- Satellite STB

- IPTV/OTT

- Hybrid

- Others

By Recording

- Standard definition

- High definition

- UHD

- 4K & above

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Set Top Box Market features leading participants such as Huawei, Kaon Media, ARRIS, Humax, Dish Network, Apple, CommScope, Intek Digital, and EchoStar. The competitive landscape is shaped by rapid innovation in hybrid platforms, IPTV integration, and cloud-based recording features. Companies focus on developing advanced interfaces, faster processors, and energy-efficient designs to enhance user experience and meet evolving viewing habits. Many brands emphasize partnerships with telecom operators to secure long-term service contracts and strengthen market reach. Growth in UHD and 4K broadcasting also drives upgrades, pushing manufacturers to offer devices with higher processing power. Expanding OTT adoption encourages firms to integrate streaming ecosystems and support multi-screen viewing. Intense price competition remains a factor in emerging regions, where affordability influences purchasing decisions. Across global markets, differentiation increasingly relies on software updates, seamless connectivity, and added-value digital services that improve platform engagement and extend device lifecycles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huawei

- Kaon Media

- ARRIS

- Humax

- Dish Network

- Apple

- CommScope

- Intek Digital

- EchoStar

Recent Developments

- In 2024, Apple released tvOS 18 for Apple TV 4K. The update added InSight, smarter subtitles, and new screen savers for viewers.

- In 2024, CommScope and du launched the VIP7802 4K Android TV set-top box. The device includes voice control and major streaming apps for du’s converged platform.

- In 2022, Dish Network introduced the Hopper Plus Android TV streaming add-on box. Hopper Plus turns existing Hopper DVRs into full streaming set-top hubs.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Recording, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady demand as hybrid viewing becomes more common.

- IPTV and OTT-linked set top boxes will grow with rising broadband penetration.

- Cloud-based DVR functions will gain wider use due to ease of access.

- Higher adoption of UHD and 4K displays will push demand for advanced STBs.

- Smart features such as voice control and AI-based content suggestions will expand.

- Operators will integrate more streaming services to retain customer engagement.

- Emerging markets will drive shipment growth through ongoing digital migration.

- Competition from smart TVs will push manufacturers to offer value-added features.

- Energy-efficient and compact designs will gain preference among households.

- Software-driven upgrades will play a larger role in extending device life cycles.