Market Overview

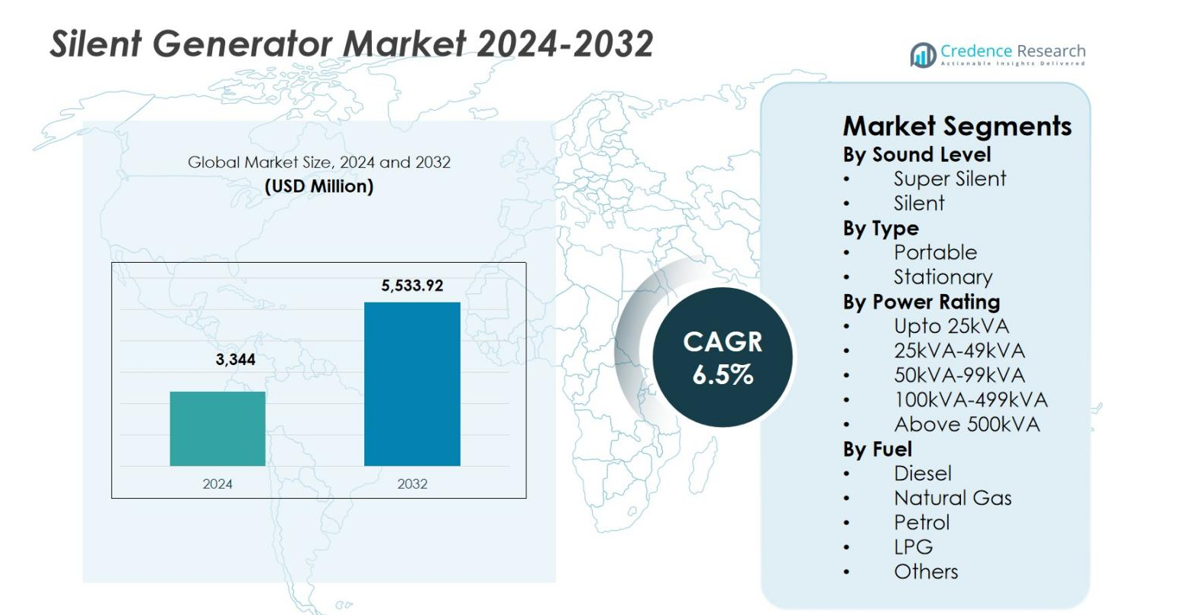

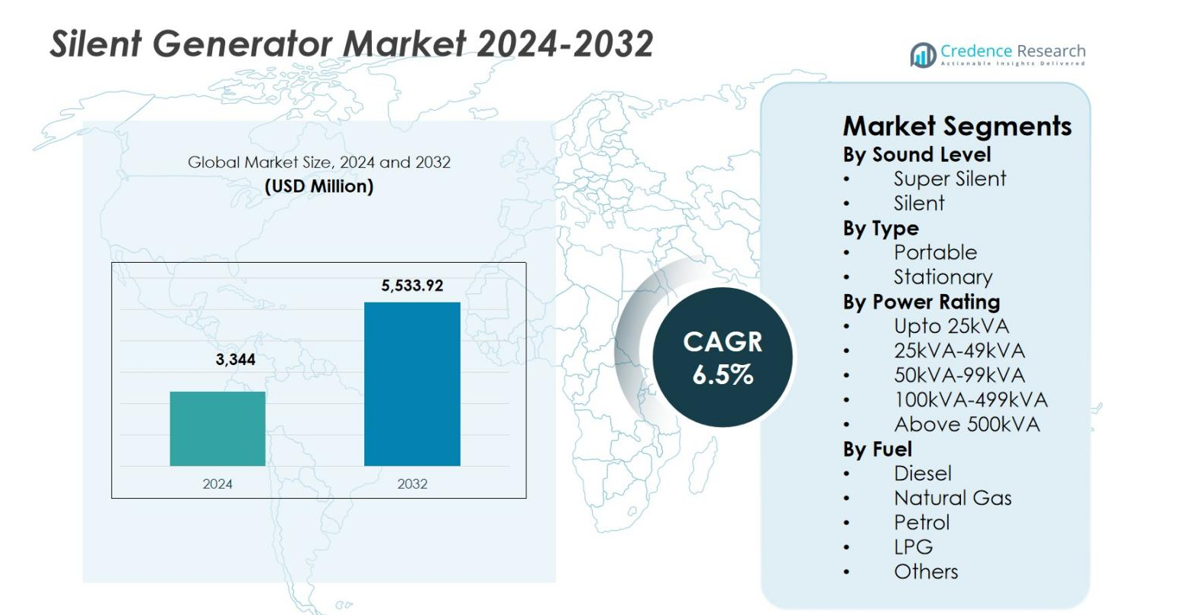

Silent Generator Market size was valued at USD 3,344 million in 2024 and is anticipated to reach USD 5,533.92 million by 2032, growing at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silent Generator Market Size 2024 |

USD 3,344 million |

| Silent Generator Market, CAGR |

6.5% |

| Silent Generator Market Size 2032 |

USD 5,533.92 million |

Silent Generator Market is driven by the strong presence of established manufacturers such as Cummins Inc., Rolls-Royce plc, Atlas Copco, Generac Power Systems, Honda India, Mahindra Powerol, Yanmar Holdings, Greaves Cotton, Multiquip, and Huu Toan, which focus on low-noise performance, fuel efficiency, and regulatory compliance across diverse applications. These companies emphasize product innovation, wide power-rating portfolios, and robust service networks to address commercial, industrial, and residential backup power needs. Regionally, Asia-Pacific leads the Silent Generator Market with a 34.1% share, supported by rapid urbanization, infrastructure expansion, manufacturing growth, and frequent power reliability challenges. North America and Europe follow, driven by strict noise regulations, data center expansion, and strong adoption in healthcare and commercial facilities.

Market Insights

- The Silent Generator Market was valued at USD 3,344 million in 2024 and is projected to reach USD 5,533.92 million by 2032, growing at a CAGR of 6.5% during the forecast period.

- Rising demand for reliable backup power and low-noise solutions across residential, commercial, and industrial sectors is driving growth, supported by urbanization, data centers, hospitals, and construction projects.

- Key trends include adoption of advanced acoustic enclosures, vibration-dampening technologies, digital monitoring systems, and hybrid generator configurations to improve efficiency and compliance with noise and emission regulations.

- Leading players such as Cummins Inc., Rolls-Royce plc, Atlas Copco, Generac Power Systems, Honda India, Mahindra Powerol, and Yanmar Holdings focus on product innovation, service network expansion, and lifecycle solutions to strengthen market presence.

- Regionally, Asia-Pacific leads with 34.1% share in 2024, followed by North America 32.6% and Europe 28.4%, with the Super Silent segment holding 8% share and Stationary type capturing 67.4% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Sound Level:

By sound level, the Super Silent segment dominates the Silent Generator Market, accounting for 61.8% market share in 2024. This leadership is driven by stringent noise pollution regulations across urban, residential, healthcare, and commercial environments, where low decibel operation is mandatory. Super silent generators are widely adopted in hospitals, data centers, hotels, and residential complexes due to advanced acoustic enclosures, vibration isolation systems, and optimized exhaust designs. Rising urbanization, infrastructure density, and increasing use of backup power in noise-sensitive locations continue to reinforce demand, positioning super silent generators as the preferred choice over standard silent variants.

- For instance, Ascot International supplies a 1250kVA ultra silent generator tailored for data centers, delivering 65dBA noise emission at 1 meter to enable installation near server rooms without operational disruptions.

By Type:

By type, Stationary silent generators held the dominant share of 67.4% in 2024, supported by their extensive deployment in industrial facilities, commercial buildings, infrastructure projects, and institutional settings. Stationary units offer higher power stability, continuous-duty capability, and integration with fixed electrical systems, making them ideal for prime and standby power applications. Growth is driven by expanding manufacturing capacity, data centers, healthcare infrastructure, and large commercial complexes requiring uninterrupted power supply. Additionally, increasing investments in smart buildings and industrial automation further strengthen demand for stationary silent generators over portable alternatives.

- For instance, Generac equipped healthcare facilities like hospitals with Modular Power Systems for paralleled operation, ensuring redundancy so one generator backs up critical loads within 10 seconds per NEC 700 and NFPA 110 standards if another fails.

By Power Rating:

By power rating, the 100kVA–499kVA segment led the Silent Generator Market with a 34.6% share in 2024. This segment benefits from its versatility across commercial complexes, hospitals, mid-sized industrial plants, telecom infrastructure, and construction sites. Generators in this range balance high power output with fuel efficiency, manageable footprint, and compliance with emission and noise standards. Growing investments in commercial real estate, healthcare facilities, and infrastructure development drive sustained demand. The segment’s ability to support both standby and continuous power needs makes it the most commercially attractive power category.

Key Growth Drivers

Rising Demand for Reliable Backup Power

The Silent Generator Market benefits significantly from growing dependence on uninterrupted power supply across residential, commercial, and industrial sectors. Rapid urbanization, expansion of data centers, healthcare facilities, and commercial complexes increase the need for dependable backup systems. Silent generators are preferred due to their low noise emissions, making them suitable for densely populated and noise-sensitive environments. Frequent grid instability, weather-related outages, and rising electricity demand in emerging economies further accelerate adoption. As power reliability becomes critical for operational continuity, silent generators increasingly serve as essential infrastructure assets.

- For instance, Cummins QuietConnect Series generators deliver backup power for homes with sound levels at 65 dB(A) measured at 23 feet under normal load, using a 999cc air-cooled V-Twin engine that supports natural gas or LP fuel.

Stringent Noise Pollution Regulations

Strict enforcement of noise control regulations strongly drives the Silent Generator Market. Governments and municipal authorities across urban regions impose defined decibel limits for equipment operating in residential, commercial, and institutional areas. Silent generators, equipped with advanced acoustic enclosures and vibration control technologies, ensure regulatory compliance without compromising performance. This regulatory environment pushes end users to replace conventional generators with quieter alternatives. Compliance requirements in hospitals, hotels, educational institutions, and construction sites continue to expand the installed base of silent generators worldwide.

- For instance, DECIBEL soundproofed diesel generators at a Marriott hotel using metal double-sided perforated silencers and soundproof doors, reducing noise below 60 dB to meet client standards and ensure guest comfort.

Expanding Infrastructure and Construction Activities

Large-scale infrastructure development and construction activities directly support growth in the Silent Generator Market. Ongoing investments in transportation networks, real estate projects, manufacturing facilities, and public infrastructure require reliable temporary and standby power solutions. Silent generators are widely used on construction sites due to their ability to operate continuously with minimal noise disruption. Growth in smart cities, industrial corridors, and urban redevelopment projects further strengthens demand, as developers prioritize compliance with environmental standards and community noise expectations.

Key Trends & Opportunities

Integration of Advanced Noise Reduction and Control Technologies

Technological advancements represent a key trend shaping the Silent Generator Market. Manufacturers increasingly integrate multi-layer acoustic insulation, optimized airflow systems, and vibration-dampening mounts to achieve superior noise attenuation. Digital monitoring systems and smart controllers improve performance efficiency and maintenance planning. These innovations enhance operational reliability while meeting strict noise and emission standards. Continuous product upgrades create opportunities for premium offerings, enabling manufacturers to differentiate their portfolios and target high-value applications in healthcare, data centers, and commercial infrastructure.

- For instance, Cummins incorporates multi-layer panels in its acoustic enclosures, consisting of steel outer layers with insulation and perforated internal liners, achieving 20–35 dB noise reduction in outdoor applications.

Growing Adoption in Urban and Residential Applications

Urban expansion creates strong opportunities for silent generators in residential and mixed-use developments. Rising adoption of home backup power systems, gated communities, and high-rise buildings drives demand for compact, low-noise generators. Silent generators support uninterrupted power without disturbing occupants or surrounding neighborhoods. Increasing awareness of comfort, safety, and regulatory compliance further supports residential adoption. This trend opens new opportunities for manufacturers to develop smaller, fuel-efficient, and aesthetically integrated silent generator solutions.

- For instance, Sudhir Power provides home backup diesel generators ranging from 7.5 kVA to 82.5 kVA, designed for residential electrical panels in urban settings. These CPCB IV compliant units ensure high-quality power delivery without harming electronics in homes or offices.

Key Challenges

High Initial Cost and Maintenance Requirements

High upfront investment presents a key challenge in the Silent Generator Market. Advanced soundproofing materials, specialized enclosures, and compliance-driven engineering increase manufacturing costs. These factors result in higher purchase prices compared to conventional generators, limiting adoption among cost-sensitive users. Maintenance of acoustic components and specialized parts further adds to operational expenses. Price sensitivity in developing regions can restrict market penetration, particularly in small enterprises and residential segments with limited budgets.

Increasing Competition from Alternative Power Solutions

Rising competition from alternative power technologies challenges growth in the Silent Generator Market. Renewable energy systems, battery storage solutions, and hybrid power configurations increasingly serve as substitutes for conventional generators. These alternatives offer lower operating noise, reduced emissions, and long-term cost benefits. Government incentives promoting clean energy adoption further intensify competitive pressure. As end users seek sustainable and quieter power solutions, silent generator manufacturers must innovate and position their products strategically to maintain market relevance.

Regional Analysis

North America

North America accounted for 32.6% of the Silent Generator Market share in 2024, driven by strong demand across commercial buildings, healthcare facilities, data centers, and residential backup power applications. The region benefits from well-established infrastructure, high power reliability requirements, and strict enforcement of noise and emission regulations. Silent generators are widely deployed in urban areas to ensure compliance with municipal noise limits. Frequent weather-related power outages, including hurricanes and winter storms, further support adoption. Technological advancements and replacement of aging generator fleets also contribute to sustained market growth across the United States and Canada.

Europe

Europe held 28.4% market share in 2024, supported by stringent environmental and noise pollution regulations across residential, commercial, and industrial sectors. Countries such as Germany, the UK, France, and Italy demonstrate high adoption due to strict urban noise norms and sustainability-focused infrastructure development. Silent generators are extensively used in hospitals, hotels, public institutions, and construction sites to ensure regulatory compliance. Growth is further supported by modernization of power backup systems, expansion of smart cities, and increasing investments in renewable-integrated hybrid generator solutions across Western and Northern Europe.

Asia-Pacific

Asia-Pacific dominated the Silent Generator Market with a 34.1% share in 2024, driven by rapid urbanization, infrastructure expansion, and rising electricity demand. Strong growth in construction activities, manufacturing facilities, telecom infrastructure, and commercial real estate fuels widespread adoption. Countries including China, India, Japan, and Southeast Asian nations rely heavily on silent generators due to grid instability and frequent power interruptions. Increasing enforcement of urban noise regulations and expanding residential backup power usage further strengthen demand. Cost-effective manufacturing and rising industrialization position Asia-Pacific as the leading growth engine globally.

Latin America

Latin America captured 3.1% of the Silent Generator Market share in 2024, supported by growing investments in infrastructure, healthcare, and commercial construction. Countries such as Brazil, Mexico, and Chile drive regional demand due to increasing power reliability concerns and urban development. Silent generators are increasingly adopted in hospitals, hotels, and retail complexes to minimize noise disturbance in dense urban environments. Grid fluctuations and rising electricity demand further support market expansion. However, budget constraints and slower regulatory enforcement limit adoption compared to more developed regions.

Middle East & Africa

The Middle East & Africa accounted for 1.8% market share in 2024, driven by infrastructure development, construction projects, and growing demand for reliable backup power. Silent generators are widely used in commercial buildings, oil & gas facilities, healthcare centers, and hospitality projects, particularly in the Gulf Cooperation Council countries. Extreme climatic conditions and grid reliability challenges increase reliance on backup power solutions. Urban expansion and large-scale construction activities support demand, although high upfront costs and uneven regulatory frameworks restrain faster market penetration across parts of Africa.

Market Segmentations:

By Sound Level

By Type

By Power Rating

- Upto 25kVA

- 25kVA-49kVA

- 50kVA-99kVA

- 100kVA-499kVA

- Above 500kVA

By Fuel

- Diesel

- Natural Gas

- Petrol

- LPG

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Silent Generator Market is shaped by the presence of key players such as Cummins Inc., Rolls-Royce plc, Atlas Copco, Generac Power Systems, Honda India, Mahindra Powerol, Yanmar Holdings, Greaves Cotton, Multiquip, and Huu Toan. Market participants focus on expanding product portfolios with advanced acoustic enclosures, fuel-efficient engines, and emission-compliant designs to meet evolving regulatory requirements. Companies emphasize reliability, durability, and low noise performance to strengthen positioning across commercial, industrial, and residential applications. Strategic initiatives include capacity expansion, localization of manufacturing, and strengthening dealer and service networks to improve regional reach. Players also invest in digital monitoring, hybrid generator solutions, and aftersales services to enhance lifecycle value. Competitive intensity remains high as manufacturers balance cost optimization with technological innovation to address diverse power ratings and application-specific requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Cummins launched a 17-liter engine platform generator set producing up to 1 MW of power, expanding its Centum Series for compact, high-output needs in urban environments.

- In May 2025, Rehlko (formerly Kohler Energy) expanded its strategic partnership with Liebherr to advance the next‑generation KD Series of large industrial generators.

- In October 2024, HIMOINSA, part of the Yanmar Group, launched the Yanmar-powered HGY Series generators designed for critical power supply, featuring advanced engine technology from 1250kVA to 3500kVA with super-silent capabilities supporting alternative fuels like HVO and hydrogen.

Report Coverage

The research report offers an in-depth analysis based on Sound Level, Type, Power Rating, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Silent Generator Market demand will rise steadily due to increasing dependence on uninterrupted power supply across commercial and industrial sectors.

- Urban expansion and higher population density will strengthen adoption of low-noise power solutions in residential and mixed-use developments.

- Stricter noise and emission regulations will continue to drive replacement of conventional generators with silent models.

- Infrastructure development and large-scale construction projects will sustain demand for stationary silent generators.

- Healthcare facilities and data centers will remain key end users due to critical power reliability requirements.

- Technological advancements in acoustic insulation and vibration control will improve performance and user acceptance.

- Integration of digital monitoring and remote management will enhance operational efficiency and maintenance planning.

- Growth in emerging economies will accelerate market expansion due to grid instability and rising electricity demand.

- Manufacturers will focus on fuel efficiency and hybrid configurations to align with sustainability objectives.

- Competitive strategies will increasingly emphasize localized manufacturing and expanded service networks.