| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silver Paste Market Size 2024 |

USD 1,540.4 million |

| Silver Paste Market, CAGR |

6.17% |

| Silver Paste Market Size 2032 |

USD 2,491.3 million |

Market Overview

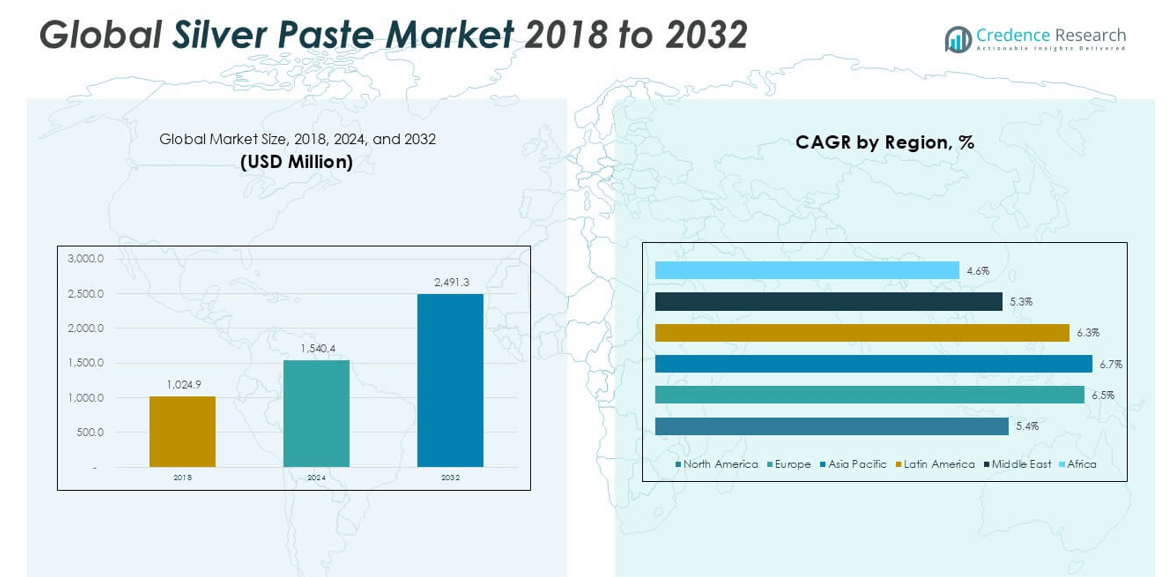

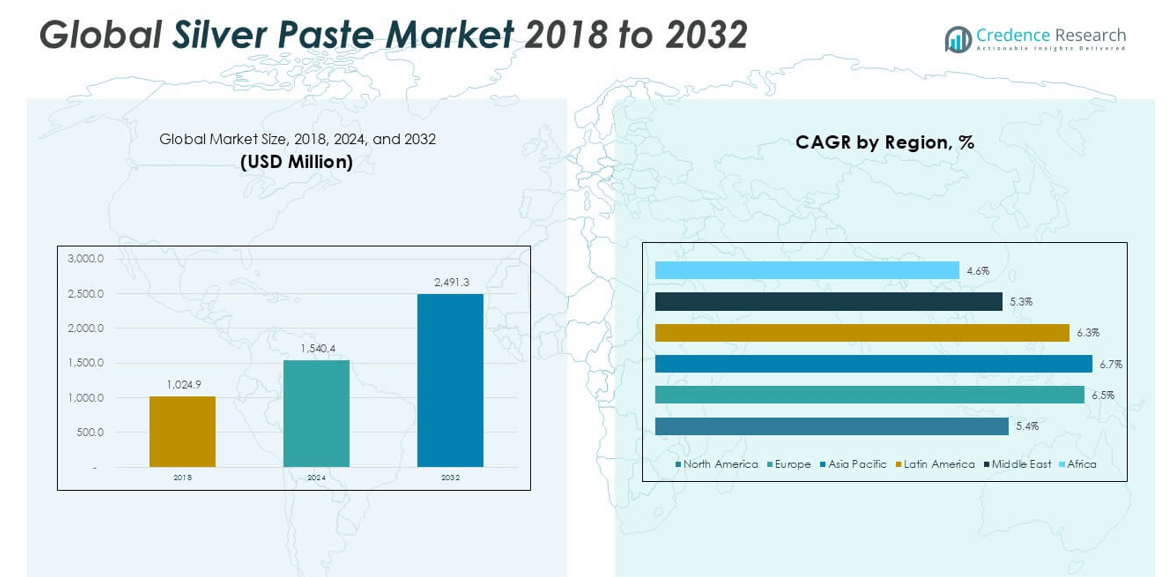

The Global Silver Paste Market is projected to grow from USD 1,540.4 million in 2024 to an estimated USD 2,491.3 million by 2032, with a compound annual growth rate (CAGR) of 6.17% from 2025 to 2032.

The market is witnessing strong momentum due to the growing preference for renewable energy, especially solar power, which uses silver paste in photovoltaic cells. In addition, the expanding electronics industry—particularly in emerging economies—is fueling demand for thick film pastes and conductive adhesives. A notable trend is the rising use of silver nanoparticle-based pastes for advanced applications, driven by their superior conductivity and compatibility with emerging technologies. Environmental regulations and efforts toward sustainable manufacturing are also influencing formulation innovations.

Geographically, Asia Pacific dominates the global silver paste market due to its robust electronics and solar manufacturing sectors, particularly in China, Japan, and South Korea. North America and Europe follow, supported by technological advancements and growing investments in renewable energy infrastructure. Key players in the global market include DuPont, Heraeus Holding GmbH, Henkel AG & Co. KGaA, Murata Manufacturing Co., Ltd., and KYOCERA Corporation, all of which are actively investing in R&D and product innovation to maintain their competitive edge.

Market Insights

- The Global Silver Paste Market is valued at USD 1,540.4 million in 2024 and is projected to reach USD 2,491.3 million by 2032, growing at a CAGR of 6.17%.

- Increasing demand from electronics and photovoltaic sectors is fueling market growth due to silver paste’s superior conductivity and thermal stability.

- Rising adoption of electric vehicles and automotive electronics is boosting the use of silver paste in sensors, control units, and battery systems.

- Growth in flexible and printed electronics is encouraging development of low-temperature and stretchable silver paste formulations.

- Volatility in silver prices and raw material availability poses cost challenges for manufacturers across key application sectors.

- Strict environmental regulations are pushing companies to reformulate products, increasing production complexity and R\&D costs.

- Asia Pacific holds the largest market share at 34.7% in 2024, driven by strong solar and electronics manufacturing in China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from the Electronics and Semiconductor Industry

The Global Silver Paste Market is benefiting from the rapid expansion of the electronics and semiconductor industry. Silver paste is widely used in printed circuit boards (PCBs), semiconductor packaging, and electronic components due to its excellent electrical conductivity and thermal stability. Growing consumer preference for compact, high-performance electronic devices continues to push demand. The increased use of advanced driver-assistance systems (ADAS), IoT devices, and 5G technology further supports the need for reliable conductive materials. Manufacturers are focusing on enhancing performance and miniaturization, which requires materials with superior electrical properties. This shift is positioning silver paste as a critical component in next-generation electronics.

- For instance, global semiconductor industry employed over 345,000 people in the United States

Expanding Adoption in Photovoltaic Applications

The Global Silver Paste Market is experiencing strong growth due to its vital role in photovoltaic (PV) solar cells. Silver paste is a primary material used to form conductive contacts on solar panels, which are essential for energy conversion. Governments worldwide are prioritizing solar energy projects to meet sustainability goals and reduce carbon emissions. Demand for silver paste is directly linked to rising solar module production, especially in Asia Pacific. Solar cell manufacturers seek high-efficiency materials, and silver paste delivers the required electrical performance. The market is responding with improved formulations tailored for high-efficiency PV cells.

- For instance, the global solar photovoltaic (PV) market accounted for 1,386.09 terawatt-hours of electricity in 2024 and employed more than 230,000 people in the United States alone

Innovation in Automotive Electrification and Sensors

Automotive electrification is creating new opportunities for the Global Silver Paste Market. It supports the development of electronic control units, sensors, and battery systems in electric vehicles (EVs). The push for vehicle safety and connectivity features such as LiDAR, radar, and camera modules is accelerating the need for reliable conductive materials. Silver paste ensures efficient electrical transmission in compact automotive electronic systems. EV manufacturers are adopting advanced materials to meet performance and safety standards. This trend continues to strengthen the position of silver paste in automotive electronics manufacturing.

Technological Advancements and Material Optimization

Ongoing innovation in materials science is reshaping the Global Silver Paste Market. Companies are investing in research to develop low-temperature curing, lead-free, and cost-effective silver paste formulations. These advancements aim to meet the evolving requirements of various industries, including flexible electronics and wearable devices. It is also supporting environmental compliance and sustainability targets. The development of nano-silver pastes and hybrid formulations is expanding application possibilities. These innovations enhance durability, conductivity, and compatibility with modern substrates, reinforcing the market’s growth trajectory.

Market Trends

Integration of Silver Paste in Next-Generation Photovoltaic Technologies

The Global Silver Paste Market is witnessing a shift toward advanced photovoltaic technologies, including Passivated Emitter and Rear Cell (PERC) and Heterojunction (HJT) cells. These technologies require high-purity silver pastes to enhance energy conversion efficiency. The market is aligning with the increasing demand for clean energy and the global transition to solar power. Manufacturers are focusing on optimizing silver paste for reduced usage without compromising electrical performance. It is enabling thinner grid lines on solar cells, which improves light absorption and overall efficiency. The trend is pushing silver paste suppliers to invest in formulation improvements tailored for new-generation solar technologies.

- For instance, First Solar, a leading U.S. solar panel manufacturer, expanded its American manufacturing capacity to more than 10 gigawatts (GW) by 2025, with recent facilities in Alabama and Louisiana each adding 3.5 GW of nameplate production capacity. This single company alone produced 12.1 GW of solar modules in 2023, underlining the scale of material demand driving the silver paste market.

Growing Focus on Flexible and Printed Electronics

Flexible and printed electronics are gaining traction across consumer electronics, healthcare, and wearable device sectors, fueling growth in the Global Silver Paste Market. These applications demand materials that are both conductive and compatible with flexible substrates. Silver paste, especially in nanoparticle and flake form, meets the electrical and mechanical requirements for flexible circuits and sensors. It is playing a key role in enabling new product designs that are lightweight and compact. The rising adoption of foldable smartphones and bendable displays is further amplifying this trend. Companies are developing specialized silver pastes that maintain conductivity under mechanical stress and bending.

- For instance, over 61 million flexible display units were shipped globally in 2022, serving as a key application area for conductive silver pastes used in foldable phones and tablets. Additionally, First Solar reported a backlog exceeding 78 gigawatts for its photovoltaic modules—showing how the electronics sector’s demand for flexible, conductive materials continues to grow in scale.

Shift Toward Cost Optimization and Silver Content Reduction

Rising silver prices are driving manufacturers to reduce silver content in paste formulations, without compromising performance. The Global Silver Paste Market is responding by developing hybrid pastes using alternative metals and advanced dispersion technologies. These solutions aim to maintain conductivity while lowering material costs. It is helping producers balance performance with affordability, especially in cost-sensitive applications like consumer electronics and automotive components. The trend is encouraging greater research collaboration between material scientists and manufacturers. Silver paste suppliers are innovating with fine-tuned particle size distributions and carrier systems to optimize usage.

Increased R\&D for Low-Temperature and Lead-Free Formulations

Environmental regulations and sustainability goals are prompting the Global Silver Paste Market to adopt low-temperature curing and lead-free formulations. These new-generation pastes are designed to meet regulatory compliance in electronics manufacturing, especially in Europe and North America. It is supporting the shift toward environmentally friendly production processes. Low-temperature silver pastes are critical for substrates like plastics and flexible films, which are sensitive to heat. Manufacturers are increasing R\&D efforts to enhance the mechanical stability and reliability of these products. The trend aligns with global efforts to minimize environmental impact while meeting technical performance standards.

Market Challenges

Volatility in Silver Prices and Raw Material Supply Constraints

The Global Silver Paste Market faces significant challenges due to the volatility in silver prices and limited availability of raw materials. Price fluctuations increase production costs, making it difficult for manufacturers to maintain stable pricing structures. It creates uncertainty in long-term contracts and planning, especially for cost-sensitive sectors such as consumer electronics and solar manufacturing. Disruptions in the silver supply chain, driven by geopolitical factors and mining limitations, further impact market stability. Companies are under pressure to secure alternative sourcing strategies or adopt silver-reduction technologies. These challenges directly affect profit margins and operational efficiency across the supply chain.

- For instance, during July 2025, silver prices reached 38.96 US dollars per ounce—marking the highest level since 2011.

Stringent Environmental Regulations and Technical Limitations

Environmental regulations governing electronic waste disposal and hazardous materials are tightening across major markets. The Global Silver Paste Market must comply with RoHS and REACH directives, which limit the use of lead and other harmful substances. It compels manufacturers to invest in reformulating products, which can increase development time and costs. Technical limitations also persist in optimizing performance while reducing silver content, particularly in high-efficiency applications. The balance between conductivity, adhesion, and environmental compliance remains complex. These constraints slow down product innovation and create barriers for new entrants aiming to scale production efficiently.

Market Opportunities

Expansion of Renewable Energy Projects and Solar Installations

The Global Silver Paste Market holds strong growth potential due to the global expansion of solar energy initiatives. Governments are scaling up investments in photovoltaic infrastructure to meet renewable energy targets and reduce carbon emissions. Silver paste remains essential in solar cell manufacturing for its superior conductivity and reliability. It plays a critical role in emerging technologies such as bifacial and tandem solar cells. The market can capitalize on increasing solar panel installations in Asia Pacific, North America, and Europe. This trend opens opportunities for silver paste manufacturers to expand production capacity and tailor products for high-efficiency solar modules.

Emerging Applications in Flexible and Wearable Electronics

Flexible and wearable electronics present significant untapped opportunities for the Global Silver Paste Market. These applications require conductive materials that perform well on bendable and stretchable substrates. Silver paste meets these needs with specialized formulations suitable for healthcare devices, smart textiles, and foldable displays. It supports innovation in next-generation consumer and medical electronics by enabling compact, lightweight designs. Rising consumer demand for smart wearables and remote health monitoring devices will drive product development. Manufacturers can leverage this shift by investing in R\&D focused on stretchable and low-temperature silver paste solutions.

Market Segmentation Analysis

By Substrate

The Global Silver Paste Market is segmented by substrate into ceramics, glass, polymers, metals, and others. Ceramics hold a substantial share due to their widespread use in electronic components such as capacitors and thick-film circuits, where silver paste ensures strong conductivity and thermal stability. Glass substrates are increasingly used in solar panels and display technologies, benefiting from silver paste’s compatibility with transparent conductive layers. Polymers offer flexibility and lightweight advantages, making them suitable for printed electronics and wearable devices that require stretchable silver paste formulations. Metals are used in applications where strong adhesion and electrical continuity are essential, particularly in automotive and power systems. The “others” category includes emerging substrates in flexible electronics and next-generation sensors, which present future growth opportunities.

- For instance, surveys from the electronics industry indicate that the ceramics segment accounted for the consumption of around 1,800 metric tons of silver paste globally in 2023.

By End Use

The Global Silver Paste Market is categorized by end use into electronics and microelectronics, solar energy, automotive, medical devices, and others. Electronics and microelectronics account for the largest share, driven by demand for high-performance conductive materials in semiconductors, PCBs, and display panels. Solar energy is a rapidly growing segment, where silver paste plays a vital role in enhancing photovoltaic cell efficiency. The automotive sector increasingly relies on silver paste for sensors, control units, and electric vehicle components. Medical devices use silver paste in wearable health monitors and diagnostic tools due to its biocompatibility and conductivity. The “others” segment includes sectors like aerospace and industrial automation, contributing to broader application diversity.

- For instance, over 5,000 metric tons of silver paste were used by the electronics and microelectronics segment worldwide in 2023.

Segments

Based on Substrate

- Ceramics

- Glass

- Polymers

- Metals

- Others

Based on End Use

- Electronics and Microelectronics

- Solar Energy

- Automotive

- Medical Devices

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Silver Paste Market

The North America Silver Paste Market is projected to grow from USD 293.90 million in 2024 to USD 448.44 million by 2032, reflecting a CAGR of 5.4%. It accounts for approximately 19.1% of the global market share in 2024. Strong demand from the electronics and automotive sectors, particularly in the United States and Canada, supports this regional growth. Silver paste plays a critical role in semiconductor packaging and EV powertrain components. The region benefits from advanced R\&D infrastructure and early adoption of new technologies. Expanding solar installations in the U.S. also support the increasing demand for conductive pastes in photovoltaic cells.

Europe Silver Paste Market

Europe’s Silver Paste Market is expected to grow from USD 352.70 million in 2024 to USD 586.96 million by 2032, with a CAGR of 6.5%. It holds around 22.9% of the global market share in 2024, driven by technological innovation and regulatory support for green energy. Germany, France, and the Netherlands are leading markets due to their strong automotive and renewable energy industries. The region focuses on sustainable manufacturing practices, accelerating the use of lead-free and low-temperature silver pastes. It also benefits from a growing demand for medical devices and flexible electronics. European companies are actively investing in R\&D to enhance product performance and reduce silver consumption.

Asia Pacific Silver Paste Market

The Asia Pacific Silver Paste Market dominates globally, rising from USD 534.48 million in 2024 to USD 897.63 million in 2032 at a CAGR of 6.7%. It contributes the largest regional market share at 34.7% in 2024. China, Japan, South Korea, and Taiwan are central to this growth due to their leadership in electronics manufacturing and solar panel production. The region is home to major semiconductor foundries and PV module suppliers. Rapid industrialization and growing electric vehicle adoption further accelerate market expansion. Silver paste usage in printed electronics and consumer devices continues to grow, supported by favorable government policies and cost-effective production.

Latin America Silver Paste Market

The Latin America Silver Paste Market is forecasted to increase from USD 163.50 million in 2024 to USD 267.57 million by 2032, growing at a CAGR of 6.3%. It represents 10.6% of the global market share in 2024. Brazil and Mexico lead regional demand, primarily in the automotive and renewable energy sectors. Emerging industrial hubs and supportive energy policies are creating new growth avenues for silver paste applications. It supports the manufacturing of low-cost solar modules and electronics tailored for local consumption. Infrastructure development and foreign investments in manufacturing are expected to drive steady demand. The region’s expanding middle class also fuels consumption of electronic devices, boosting silver paste usage.

Middle East Silver Paste Market

The Middle East Silver Paste Market is projected to grow from USD 115.04 million in 2024 to USD 174.39 million by 2032 at a CAGR of 5.3%. It accounts for around 7.5% of the global market share in 2024. Countries like the UAE and Saudi Arabia are focusing on energy diversification, increasing investment in solar energy projects. Silver paste supports the development of efficient photovoltaic modules suited for high-temperature environments. Demand for electronics and medical devices is also growing with rising healthcare infrastructure. It is gradually adopting advanced materials to meet evolving technical standards. The region remains dependent on imports, although local production is expected to rise with government support.

Africa Silver Paste Market

The Africa Silver Paste Market will grow from USD 80.74 million in 2024 to USD 116.35 million by 2032, registering a CAGR of 4.6%. It holds the smallest share, contributing around 5.2% to the global market in 2024. South Africa and Egypt are key contributors due to their growing electronics and solar industries. Off-grid solar installations are creating steady demand for silver paste in PV modules. It remains a developing market with significant potential for foreign investment and technological partnerships. Challenges include limited industrial capacity and a fragmented supply chain. However, improving infrastructure and energy access goals offer long-term opportunities for silver paste suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- 3M

- AG Pro Technology Corp.

- Cermet Materials Inc.

- KYOCERA Corporation

- Ferro Corporation

- Samsung SDI Co., Ltd.

- Henkel AG & Company KGaA

- Johnson Matthey

- Targray Technology International Inc.

Competitive Analysis

The Global Silver Paste Market features a competitive landscape marked by innovation, strategic alliances, and regional expansions. Leading players such as 3M, Henkel AG & Company KGaA, and KYOCERA Corporation invest in product development to meet evolving technical requirements across electronics and solar industries. It is characterized by the presence of multinational corporations and specialized regional manufacturers. Companies focus on enhancing conductivity, reducing silver content, and developing eco-friendly formulations. The market sees frequent partnerships with solar panel producers and electronics OEMs to strengthen supply chain integration. Competition remains intense, with players leveraging technology, pricing, and sustainability to gain market share.

Recent Developments

- In January 2025, 3M introduced new thermal management and battery adhesive solutions specifically designed for the automotive industry, with a focus on electric vehicle (EV) battery packs and heat management. These innovations aim to improve battery performance, extend lifespan, and enhance overall vehicle efficiency by optimizing temperature control.

Market Concentration and Characteristics

The Global Silver Paste Market shows moderate to high market concentration, with a few key players holding a significant share of the total revenue. It is defined by technological expertise, strong R&D capabilities, and long-term partnerships with end-use industries such as electronics, solar energy, and automotive. Companies focus on developing customized formulations that meet precise conductivity, adhesion, and environmental standards. Barriers to entry remain high due to the capital-intensive nature of production and strict quality requirements. The market demonstrates stable demand patterns, driven by innovation cycles in electronics and renewable energy. It favors firms with global distribution networks and the ability to scale manufacturing efficiently.

Report Coverage

The research report offers an in-depth analysis based on Substrate, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Governments will continue expanding solar energy infrastructure, driving sustained demand for silver paste in high-efficiency PV cells.

- Miniaturization and performance requirements in smartphones, IoT devices, and wearables will boost the need for high-conductivity silver paste.

- Electric vehicles and autonomous driving systems will expand silver paste applications in sensors, control units, and battery components.

- Manufacturers will develop cost-effective silver-reduction solutions to address raw material price volatility without sacrificing performance.

- Flexible substrates and printed circuit technologies in medical and consumer electronics will drive demand for stretchable and low-temperature silver pastes.

- Environmental regulations will push companies to create lead-free, eco-friendly formulations aligned with global sustainability goals.

- Companies will invest in nanotechnology and hybrid material research to expand silver paste applications and improve functional performance.

- Latin America, the Middle East, and Africa will witness gradual growth as electronics and solar adoption increases in these regions.

- Key players may pursue backward integration and secure silver sourcing to reduce supply disruptions and improve cost control.

- Collaborations between silver paste producers and end-use manufacturers will intensify, enhancing innovation, customization, and global market reach.