Market Overview:

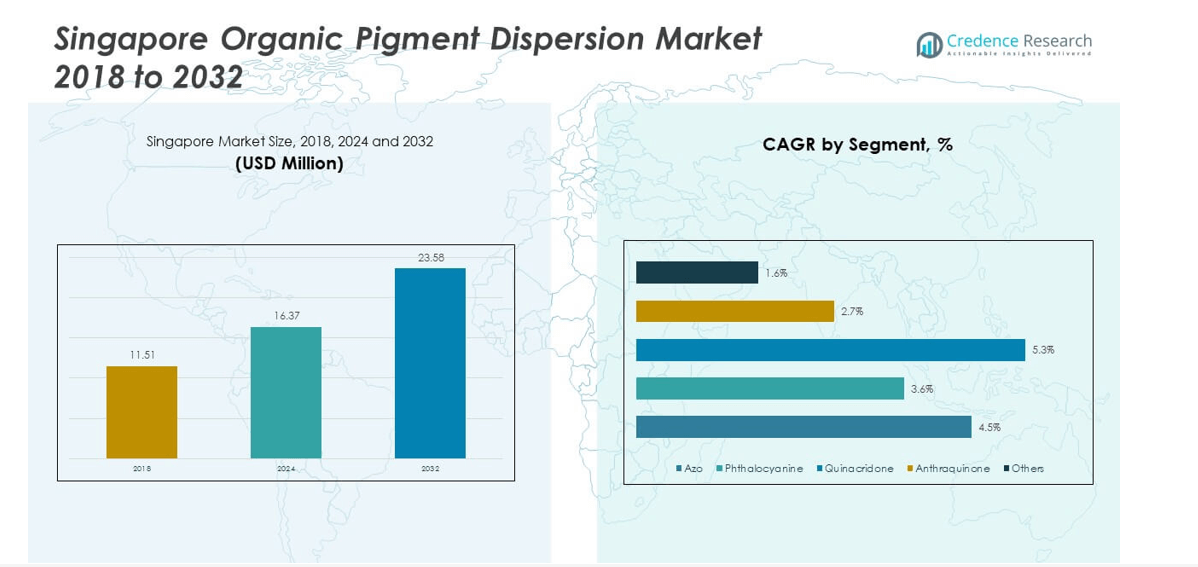

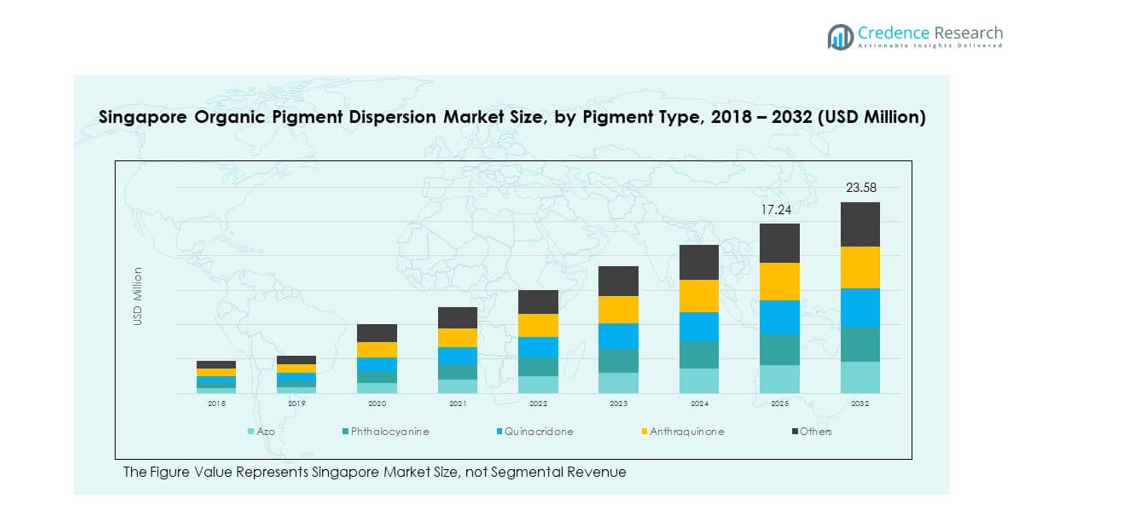

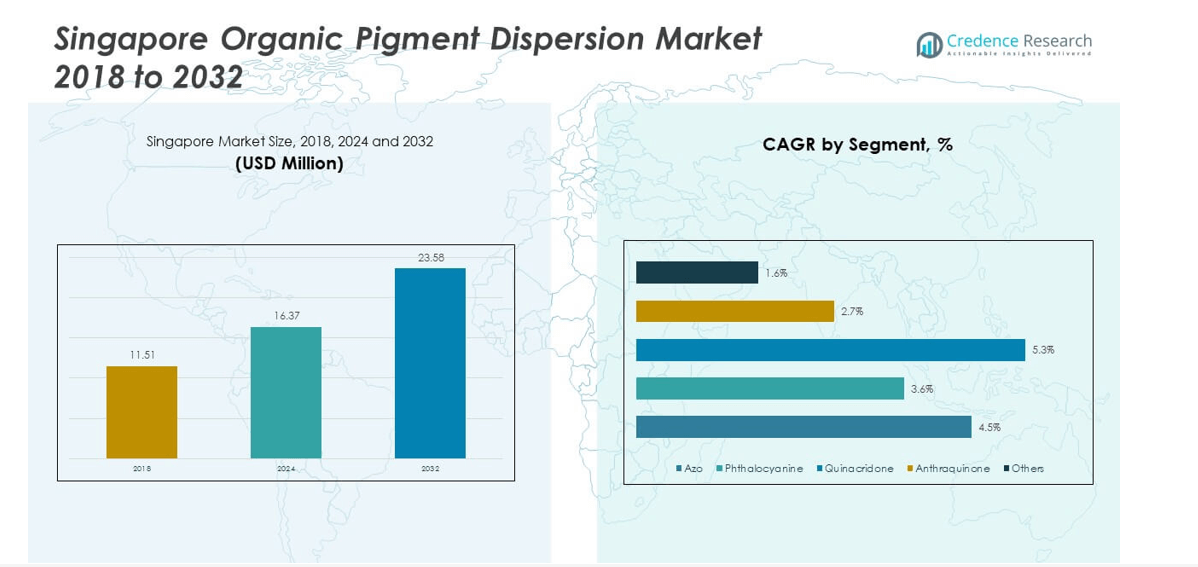

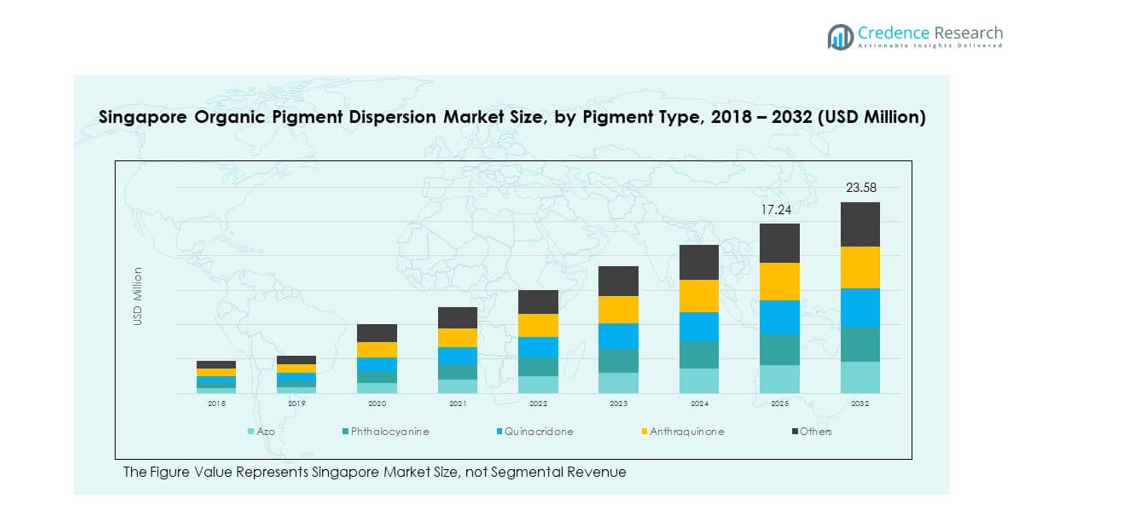

The Singapore Organic Pigment Dispersion Market size was valued at USD 11.51 million in 2018 to USD 16.37 million in 2024 and is anticipated to reach USD 23.58 million by 2032, at a CAGR of 4.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Singapore Organic Pigment Dispersion Market Size 2024 |

USD 16.37 million |

| Singapore Organic Pigment Dispersion Market, CAGR |

4.58% |

| Singapore Organic Pigment Dispersion Market Size 2032 |

USD 23.58 million |

Market drivers include the rising need for eco-friendly and high-performance pigments in printing, coatings, plastics, and textiles. Growing emphasis on sustainability encourages the adoption of dispersions that meet environmental standards and consumer expectations. Technological advancements in pigment formulations improve stability, durability, and color quality, making them suitable for high-end applications. Expanding demand from the packaging and automotive industries further strengthens the market outlook. Regulatory policies in Singapore also support safer and greener chemical use, which encourages investment in innovative dispersion technologies.

Geographically, Central Singapore remains the leading subregion due to its concentration of industrial, commercial, and trade activities. East and West Singapore follow with their strong industrial clusters in Jurong and Changi, driving logistics and production efficiency. North and North-East Singapore show rising importance as the government promotes decentralization of industrial development. These subregions benefit from growing textile, plastics, and specialty applications. Together, the geographic diversity creates a balanced and resilient market structure that strengthens Singapore’s role as a regional supply hub.

Market Insights

- The Singapore Organic Pigment Dispersion Market was valued at USD 11.51 million in 2018, reached USD 16.37 million in 2024, and is projected to attain USD 23.58 million by 2032, growing at a CAGR of 4.58%.

- Central Singapore accounted for 40% share in 2024, driven by its strong industrial base, advanced infrastructure, and concentration of commercial hubs, followed by East and West Singapore with 37% and North/North-East with 23%.

- North and North-East Singapore, with a 23% share, represent the fastest-growing region, supported by government-backed industrial decentralization and expansion in textiles and plastics.

- By pigment type, Azo pigments represented the largest share of over 35% in 2024, supported by their versatility and broad application in printing inks and coatings.

- Phthalocyanine pigments held close to 28% share, reflecting strong demand in paints, plastics, and packaging, while other pigment categories contributed smaller but steady shares across niche applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Eco-Friendly Pigments in Multiple Applications

The Singapore Organic Pigment Dispersion Market benefits from increasing demand for sustainable and non-toxic colorants across industries. Manufacturers in coatings, plastics, and inks are adopting eco-friendly pigment dispersions to align with environmental standards. Growing awareness among consumers about the harmful impact of synthetic pigments strengthens this adoption. It supports industries aiming to reduce volatile organic compound emissions in formulations. Water-based applications see strong growth as companies prefer safer and cleaner alternatives. This trend creates opportunities for product developers focused on green chemistry. Strict regional environmental regulations also accelerate market adoption. Rising investments in sustainable solutions strengthen long-term growth.

- For example, in June 2022, Clariant launched Dispersogen® Flex 100, a universal dispersing agent for organic and inorganic pigment preparations. It is low-VOC, label-free, and carries Clariant’s EcoTain® label, supporting sustainable water-based coatings and meeting global regulatory requirements.

Expansion of Advanced Coating and Packaging Applications

Growth in advanced coatings and packaging sectors fuels pigment dispersion adoption in Singapore. Packaging producers demand superior color strength, durability, and stability for diverse substrates. Organic pigment dispersions offer compatibility with water-based and solvent-based systems, making them versatile. The Singapore Organic Pigment Dispersion Market grows further with demand for high-quality printing inks used in premium packaging. It also gains momentum from the automotive industry, which requires durable pigments for coatings. Rising e-commerce activity drives packaging innovations and enhances pigment usage. The growing need for high-performance labeling solutions adds momentum. Market participants are investing in tailored products for these industries.

- For example, in October 2024, Heubach introduced Ultrazur® HGIN62-R and Ultrazur® HPRB01 pigment solutions at SEPAWA 2024. These products were presented as sustainable options for packaging and coatings, emphasizing high-quality color performance for industrial applications.

Technological Innovations Driving Product Performance and Efficiency

Research and development activities play a central role in shaping the pigment dispersion industry. Companies invest in advanced processing techniques that improve color uniformity and dispersion stability. Nanotechnology integration enhances pigment properties and broadens end-use applications. It enables higher efficiency and durability, especially in demanding industries such as automotive and electronics. The Singapore Organic Pigment Dispersion Market benefits from local innovation hubs fostering material science advancements. Collaboration between manufacturers and research institutes accelerates commercialization of new products. Custom formulations designed for specific industrial requirements enhance competitiveness. These innovations improve adoption rates and customer satisfaction.

Regulatory Support and Strategic Industrial Policies

The regulatory environment in Singapore favors adoption of environmentally safe pigment dispersions. Government policies encourage sustainable production and responsible chemical management. It creates a supportive landscape for manufacturers committed to compliance. Strong trade connections allow efficient import and export of pigment solutions to regional markets. The Singapore Organic Pigment Dispersion Market strengthens with government-backed sustainability initiatives in packaging and construction. Industrial policies promote innovation, green chemistry, and advanced materials. Local companies benefit from incentives encouraging clean technology integration. These factors make the market more resilient and growth-oriented.

Market Trends

Growing Adoption of Digital Printing and Customized Applications

Digital printing expansion supports organic pigment dispersion usage in specialized applications. Rising demand for personalized packaging and promotional materials enhances growth. It boosts adoption in textile printing, commercial signage, and labels. The Singapore Organic Pigment Dispersion Market aligns with this trend by supplying high-performance inks. Digital printing requires pigments with excellent dispersion stability and vibrant shades. Companies develop formulations to meet high-speed printing needs. This transformation encourages long-term industry engagement. Expanding consumer preference for customization amplifies demand.

Increasing Integration of Smart Manufacturing Practices

Smart manufacturing practices change pigment dispersion production efficiency. Automation and digital monitoring improve process consistency, reducing defects. It enhances supply chain efficiency by ensuring reliable product delivery. The Singapore Organic Pigment Dispersion Market incorporates these practices to optimize resource use. Predictive analytics help producers maintain consistent quality and lower waste. Companies employ real-time monitoring to manage complex formulations. Improved production systems support competitive pricing. This integration positions Singapore as a technologically advanced hub.

- For example, Chevron Oronite installed nearly 1,000 wireless IIoT sensors and devices at its Singapore lubricant additives plant. The system enables remote equipment data extraction, reduces manual fieldwork, improves asset efficiency, and saves significant man-hours annually.

Rising Popularity of Sustainable Textile and Fashion Applications

The textile sector witnesses rising adoption of organic pigment dispersions for eco-friendly fabrics. Fashion brands demand sustainable dyes that maintain durability and color vibrancy. The Singapore Organic Pigment Dispersion Market supports this shift through high-quality solutions. It provides dispersions compatible with water-based textile printing. The global fashion industry’s focus on sustainability drives higher adoption. Innovative pigments offer resistance to fading and enhanced softness. Collaborations with textile manufacturers create tailored solutions. Consumer preference for ethical fashion strengthens this trend further.

- For example, Lubrizol stated that its advanced high-stability dispersions are designed to improve printhead life and overall throughput in direct-to-film (DTF) printing, while supporting industry goals for more sustainable printing solutions.

Development of Specialty Pigments for Niche Applications

Manufacturers introduce specialty pigment dispersions for electronics, construction, and automotive applications. These pigments provide enhanced properties such as heat resistance and UV stability. It broadens the end-use scope beyond traditional industries. The Singapore Organic Pigment Dispersion Market benefits from rising niche demand. Specialty applications require high-performance dispersions tailored to specific technical needs. Producers develop advanced pigments for printed electronics and smart packaging. This trend highlights the versatility of organic pigment dispersions. Expansion into niche markets ensures long-term competitiveness.

Market Challenges Analysis

High Production Costs and Intense Global Competition

The Singapore Organic Pigment Dispersion Market faces rising production costs due to raw material fluctuations. Manufacturers invest heavily in R&D, which increases operational expenses. It challenges smaller players with limited resources to compete effectively. Intense global competition from low-cost producers in Asia creates pricing pressures. Singaporean manufacturers focus on quality and compliance, but high costs affect margins. Demand for low-priced alternatives puts strain on premium pigment suppliers. Companies must balance quality with affordability. Strategic alliances become essential to maintain market position.

Regulatory Compliance and Limited Local Manufacturing Scale

Strict environmental regulations demand continuous adaptation and compliance. The Singapore Organic Pigment Dispersion Market aligns with these rules, but the process adds costs. It requires specialized infrastructure, certifications, and audits to remain competitive. Limited scale of local manufacturing reduces economies of scale compared to larger markets. It creates dependency on imports, which exposes companies to trade fluctuations. Manufacturers face difficulties in scaling up production to meet growing demand. High compliance requirements also restrict new entrants. It limits innovation speed and increases industry consolidation.

Market Opportunities

Expanding Regional Trade and Export Potential Across Asia-Pacific

The Singapore Organic Pigment Dispersion Market holds strong potential for regional trade growth. It benefits from Singapore’s position as a strategic logistics hub. Strong connectivity with Asia-Pacific markets allows access to diverse industries. Demand for organic pigments in textiles, coatings, and packaging across the region supports export expansion. It also creates opportunities for Singaporean firms to develop regional partnerships. Trade agreements further facilitate cross-border market penetration. Rising demand from emerging economies boosts growth prospects. This dynamic enhances Singapore’s role as a supply leader.

Innovation in Sustainable Solutions and Customized Formulations

Ongoing demand for eco-friendly pigment solutions provides innovation opportunities. The Singapore Organic Pigment Dispersion Market benefits from R&D focused on green chemistry. It encourages companies to design dispersions tailored for specific applications. Sustainable formulations for textiles, packaging, and printing drive customer preference. Innovation in water-based dispersions meets regulatory and consumer requirements. Local firms invest in differentiated products to strengthen competitive edge. These advancements expand application scope across industries. Innovation becomes a central opportunity for sustained market growth.

Market Segmentation Analysis

By pigment type, the Singapore Organic Pigment Dispersion Market is led by azo pigments due to their versatility, strong tinting strength, and cost-effectiveness. Phthalocyanine pigments hold a significant share for their stability, brightness, and use in coatings and printing applications. Quinacridone pigments support high-end uses in automotive and packaging where durability and color quality are critical. Anthraquinone pigments provide niche opportunities with their deep shades, while other pigment types serve specialty and emerging applications. It demonstrates balanced adoption across both mass-market and premium product categories.

- For example, DIC Corporation’s Sunbrite® Yellow 74 (Pigment Yellow 74) is a widely used azo pigment recommended for coatings and packaging inks. It offers high opacity along with strong acid and weather resistance and is supplied to the coatings industry in Asia, including Singapore.

By application, the Singapore Organic Pigment Dispersion Market shows printing inks as the leading segment, driven by growth in packaging, labeling, and digital printing. Paints and coatings follow closely with strong demand from construction and automotive industries. Plastics and polymers account for a growing share due to their use in consumer goods, packaging materials, and industrial components. Textiles represent an emerging opportunity as sustainable dyes gain acceptance in fashion and apparel. Cosmetics contribute steadily, supported by demand for safe and vibrant color formulations. Other applications include niche industries requiring specialized pigment dispersions. This application diversity strengthens the market’s overall growth potential.

- For example, Clariant’s Hostaperm® Red E5B is recognized for its high weatherfastness and strong color durability in automotive and industrial coatings.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regional Analysis

Central Singapore holds 40% share of the Singapore Organic Pigment Dispersion Market. This subregion is home to the largest concentration of manufacturing and commercial activities. It benefits from strong infrastructure, access to research hubs, and proximity to port facilities. It also serves as the base for many multinational headquarters driving trade of pigment dispersions. The cluster of advanced printing, packaging, and coatings companies ensures strong demand. Strategic connectivity strengthens export-oriented production. Central Singapore remains the leading hub for innovation and trade.

East and West Singapore together account for 37% of the market share. Industrial estates in Jurong and Changi play a key role in production and logistics. The Singapore Organic Pigment Dispersion Market benefits from their integration with petrochemical, plastics, and specialty chemical clusters. It supports pigment dispersion supply for coatings, automotive, and construction applications. Efficient transport links in these regions ensure timely distribution across domestic and regional markets. Industrial diversity in these subregions creates consistent demand. Local partnerships enhance value-added opportunities.

North and North-East Singapore represent 23% of the market. These subregions are expanding through small-to-medium scale manufacturers and growing research collaborations. It reflects the government’s push to decentralize industries and support innovation beyond the central hub. The Singapore Organic Pigment Dispersion Market in this area gains momentum from emerging textile and plastics applications. Residential and industrial balance fosters sustainable development. Strong logistics infrastructure supports distribution from this base to other subregions. Growing industrial parks continue to attract investment into pigment-related industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Sudarshan Chemical

- DIC Corporation

- Cabot Corporation

- Heubach GmbH

- Penn Colors

- Pidilite Industries

- Lanxess

Competitive Analysis

The Singapore Organic Pigment Dispersion Market demonstrates a competitive landscape driven by global and regional companies. Key players include BASF SE, Sudarshan Chemical, DIC Corporation, Cabot Corporation, Heubach GmbH, Penn Colors, Pidilite Industries, and Lanxess. These firms focus on sustainability, innovation, and tailored product portfolios to meet diverse industrial needs. It benefits from strategic collaborations, regional expansions, and technology-driven advancements in pigment formulation. Multinationals strengthen their presence in Singapore by leveraging trade networks and local partnerships. Regional players compete by offering cost-effective solutions while ensuring regulatory compliance. Product differentiation, quality standards, and supply chain efficiency remain critical factors shaping competition. The market maintains a balance between global leaders and local innovators, fostering steady growth across industries.

Recent Developments

- In May 2025, BASF South East Asia Pte Ltd signed a Power Purchase Agreement with SP Group in Singapore for the installation of solar rooftop panels at its Jurong Island Performance Chemicals site and the Chemetall site, aligning with BASF’s green transformation strategy and aiming for the panels to be operational by the end of 2025, with Chemetall’s site expected to meet 100% of its electricity demand through this renewable energy initiative.

- In March 2025, Sudarshan Chemical Industries Limited completed the acquisition of Germany-based Heubach Group, creating a global pigment entity with a diversified asset footprint across 19 sites globally and combining Sudarshan’s operations with Heubach’s technological expertise, with the combined company led by Sudarshan’s Managing Director Rajesh Rathi.

- In March 2025, Sun Chemical, a subsidiary of DIC Corporation, announced the launch of new metallic effect pigments for cosmetics, including Chione Electric Scarlet SR90D and Chione Electric Sienna SC90D, showcasing these innovations at in-cosmetics Global 2025, and emphasizing expanded offerings in vegan and multifunctional pigment solutions.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly pigment dispersions will expand due to sustainability regulations across industries.

- Growth in packaging and printing applications will drive higher adoption of advanced pigment formulations.

- Digital printing expansion will create opportunities for specialized dispersions tailored for high-speed applications.

- Textile and fashion industries will increasingly adopt organic pigment dispersions for sustainable production.

- Technological advancements in dispersion stability and nanotechnology will enhance product performance.

- Singapore’s role as a regional trade hub will strengthen export opportunities across Asia-Pacific and Oceania.

- Rising industrialization in Southeast Asia will increase reliance on Singapore for pigment supply.

- Local innovation and R&D collaborations will support the development of customized pigment solutions.

- Strategic partnerships between global players and local distributors will improve market penetration.

- Focus on premium, durable pigments for automotive and construction industries will sustain long-term growth.