Market Overview

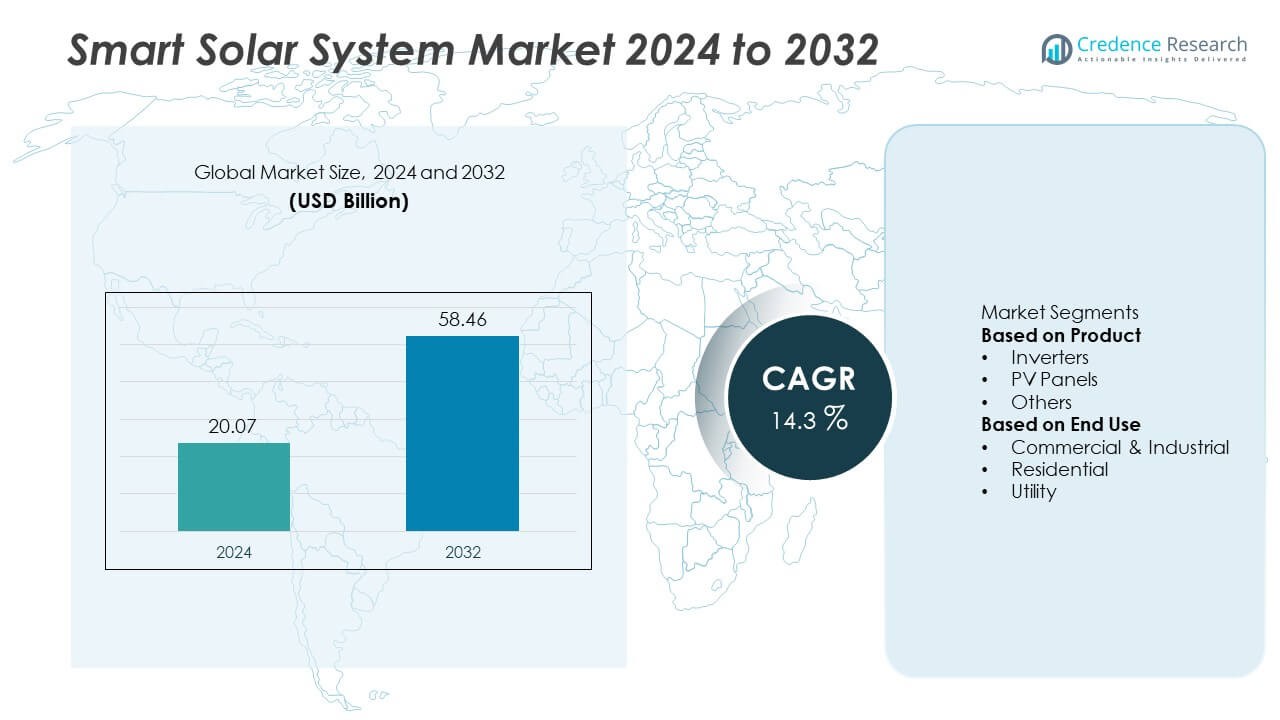

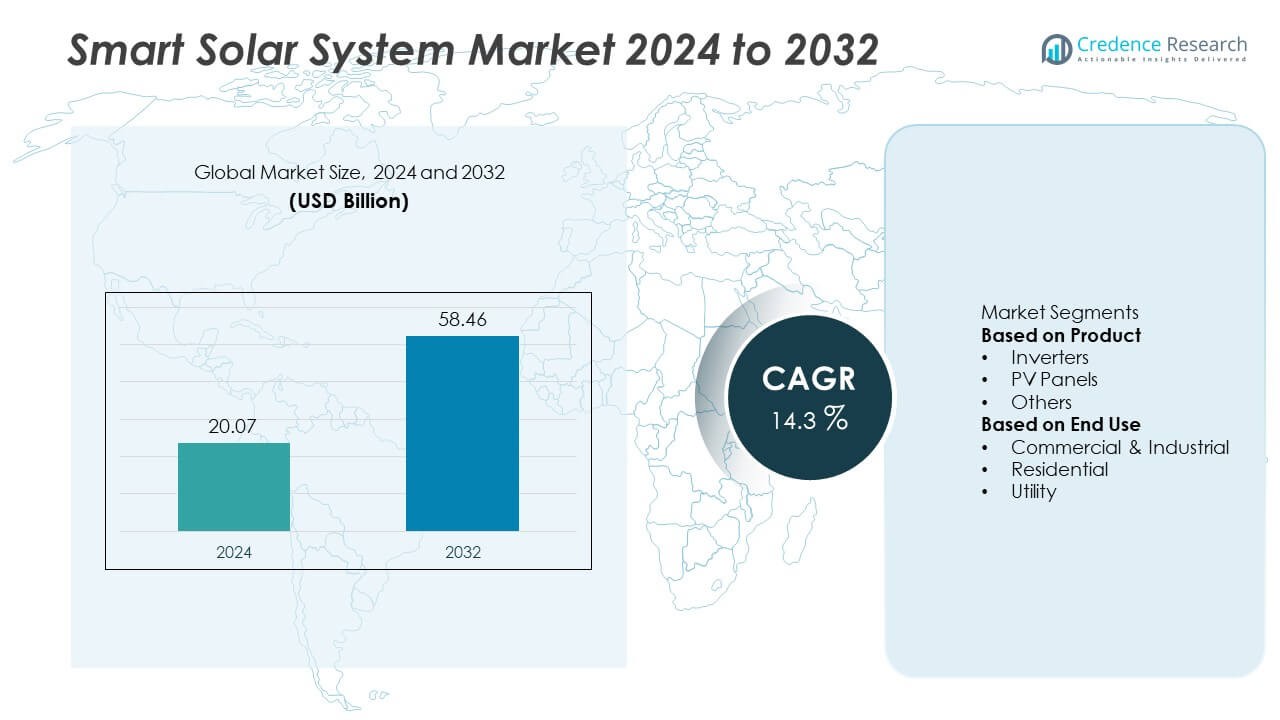

The Smart Solar System Market was valued at USD 20.07 billion in 2024 and is projected to reach USD 58.46 billion by 2032, expanding at a CAGR of 14.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Solar System Market Size 2024 |

USD 20.07 Billion |

| Smart Solar System Market, CAGR |

14.3% |

| Smart Solar System Market Size 2032 |

USD 58.46 Billion |

The smart solar system market is dominated by leading companies such as Huawei Technologies Co., Ltd, ABB, SMA Solar Technology AG, JinkoSolar Holding Co., Ltd, Enphase Energy, Smart Solar Corporation, Lumina Smart, Schneider Electric, Smart Solar Energy, and Smart Commercial Solar. These players excel through innovations in AI-based monitoring, smart inverters, and IoT-integrated photovoltaic systems. Asia-Pacific led the market in 2024 with a 35.2% share, driven by large-scale solar installations in China, India, and Japan. North America followed with a 31.6% share, supported by strong residential and commercial adoption, while Europe held a 26.8% share due to stringent renewable energy regulations and widespread integration of smart energy management systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The smart solar system market was valued at USD 20.07 billion in 2024 and is projected to reach USD 58.46 billion by 2032, growing at a CAGR of 14.3%.

- Rising demand for energy efficiency and smart grid integration drives market growth, with the PV panels segment holding a 47.9% share in 2024 due to increasing adoption in residential and commercial projects.

- Integration of IoT, AI, and cloud-based monitoring platforms is transforming solar energy management and improving predictive maintenance.

- Major players such as Huawei Technologies Co., Ltd, ABB, and Enphase Energy focus on advanced inverter technology, storage integration, and AI-based analytics to gain a competitive edge.

- Asia-Pacific led the market with a 35.2% share in 2024, followed by North America at 31.6% and Europe at 26.8%, driven by government incentives, renewable energy targets, and expanding solar infrastructure development.

Market Segmentation Analysis:

By Product

The PV panels segment dominated the smart solar system market in 2024, accounting for a 54.6% share. This leadership stems from the growing installation of high-efficiency photovoltaic modules across residential, commercial, and utility-scale projects. Continuous improvements in monocrystalline and bifacial panel technologies have enhanced energy conversion efficiency, reducing overall system costs. The adoption of AI-driven monitoring systems for performance optimization further supports segment expansion. Increasing demand for decentralized and rooftop solar systems, along with government subsidies for solar installations, continues to strengthen the dominance of PV panels globally.

- For instance, JinkoSolar’s Tiger Neo 3.0 series, built with next-generation TOPCon cell technology, produces up to 670 watts per module with a certified conversion efficiency of up to 24.8%.

By End Use

The utility segment held the largest 47.3% share of the smart solar system market in 2024. Large-scale solar farms equipped with intelligent inverters, grid-connected sensors, and predictive maintenance software drive this dominance. Utilities leverage smart solar networks to optimize energy generation, improve grid stability, and enable real-time performance tracking. The rising integration of battery storage and IoT-enabled monitoring platforms supports efficient power distribution. Growing investments in renewable infrastructure and national targets for clean energy generation further accelerate smart solar adoption across the utility sector worldwide.

- For instance, ABB provides a wide range of digital solutions for renewable energy. Its inverter systems and digital offerings, including the ABB Ability™ Energy Management suite, are used globally to manage grid interactions and optimize solar plant performance.

Key Growth Drivers

Rising Adoption of IoT and AI-Based Solar Management Systems

Integration of IoT and artificial intelligence in solar infrastructure enhances energy generation and operational efficiency. Smart sensors and AI-driven analytics enable real-time performance monitoring, predictive maintenance, and fault detection. These technologies help optimize power output and extend equipment lifespan, reducing downtime and operational costs. The growing focus on digital transformation in the energy sector and the adoption of cloud-based solar monitoring systems are accelerating the deployment of intelligent solar management solutions across residential, commercial, and utility-scale installations.

- For instance, Enphase Energy’s IQ Gateway platform connects over 4.5 million microinverters globally, collecting 8 billion data samples daily to enable real-time energy tracking and predictive diagnostics for both residential and utility solar networks.

Government Incentives and Renewable Energy Policies

Supportive government regulations, tax incentives, and feed-in tariffs are major growth catalysts for the smart solar system market. Many countries offer subsidies and net metering schemes to promote solar adoption and reduce dependency on fossil fuels. Investments in smart grids and clean energy programs further encourage large-scale solar integration. The combination of favorable policies and rising environmental awareness is driving both private and public sector investments, expanding the market’s footprint in developed and emerging economies alike.

- For instance, the U.S. Department of Energy awarded approximately $3.4 billion toward Smart Grid Investment Grants (SGIG) in 2009 for 99 projects across the country. These projects enabled the deployment of a range of smart grid technologies, which included systems for integrating renewable energy like solar power.

Declining Solar Technology Costs

Falling prices of photovoltaic panels, inverters, and energy storage systems have made smart solar solutions more accessible. Technological advancements in solar cell design and large-scale production efficiency have significantly reduced installation costs. This cost advantage enables broader adoption across residential and industrial sectors. The affordability of smart solar systems combined with their long-term energy savings continues to attract investors and end users, reinforcing the market’s upward trajectory in both developed and emerging regions.

Key Trends & Opportunities

Integration of Energy Storage Systems

The combination of smart solar systems with advanced energy storage solutions such as lithium-ion and solid-state batteries is emerging as a key opportunity. Energy storage enables stable power supply and grid independence, especially in regions with intermittent sunlight. Real-time monitoring and AI-based battery management systems optimize energy utilization. This integration supports the transition toward decentralized power generation, offering new growth avenues for manufacturers and service providers in the renewable energy ecosystem.

- For instance, Huawei’s Smart String Energy Storage System integrates pack-level management for each battery pack, uses AI-driven algorithms to enhance discharge efficiency and extend battery cycle life.

Expansion of Smart Grid Infrastructure

The development of smart grids enhances the integration and efficiency of solar power systems. Smart grids allow two-way energy flow, demand response, and automated control of electricity distribution. Governments and utilities are investing heavily in grid modernization to support renewable integration. The growing need for energy resilience and better load management drives the deployment of connected solar systems, presenting new opportunities for grid-interactive and AI-enabled solar technologies.

- For instance, Schneider Electric’s EcoStruxure™ platform connects over 1 billion devices and has been deployed at over 480,000 sites. The platform, which includes EcoStruxure™ Grid, integrates solar assets with grid automation systems to stabilize voltage fluctuations and enhance distributed energy performance across multiple regions.

Key Challenges

High Installation and Maintenance Costs

Despite declining solar component prices, the high initial setup cost for smart solar systems remains a major barrier. Integrating advanced monitoring devices, IoT platforms, and energy storage systems increases capital expenditure. Maintenance costs for data-driven systems, including software upgrades and connectivity management, further add to operational expenses. These financial challenges can limit adoption in small and medium-scale applications, especially in developing economies with limited access to financing.

Intermittent Energy Generation and Grid Integration Issues

Smart solar systems face challenges in maintaining consistent energy output due to weather variability and limited sunlight availability. Fluctuations in solar power generation can strain existing grid infrastructure. Effective energy management requires advanced storage and grid-balancing technologies, which are still evolving. The lack of standardized integration protocols across regions hampers large-scale deployment. Addressing these challenges is crucial to ensure reliability, scalability, and grid stability for widespread adoption of smart solar systems globally.

Regional Analysis

North America

North America held a 31.8% share of the smart solar system market in 2024, driven by increasing investments in renewable energy infrastructure and advanced grid modernization initiatives. The United States leads the region due to strong federal incentives, tax credits, and state-level clean energy mandates. High adoption of smart monitoring systems and integration of AI-based analytics enhance energy efficiency. Canada also contributes significantly through smart grid pilot projects and community solar programs. Growing consumer awareness of sustainable power solutions and the expansion of residential solar installations continue to support the region’s robust market growth.

Europe

Europe accounted for a 28.7% share of the smart solar system market in 2024, supported by strict carbon reduction targets and widespread adoption of smart energy management solutions. Germany, France, and the Netherlands lead with extensive implementation of smart solar grids and digital energy platforms. The European Union’s renewable directives and subsidies for solar-plus-storage systems strengthen adoption across both residential and commercial sectors. The rise of decentralized power generation and increasing investments in sustainable building technologies further boost demand, positioning Europe as a leader in smart solar innovation and efficiency-driven energy systems.

Asia-Pacific

Asia-Pacific dominated the smart solar system market with a 30.9% share in 2024, emerging as the fastest-growing regional market. China, India, and Japan are driving growth through large-scale solar projects, favorable government policies, and declining technology costs. Rapid urbanization and rising electricity demand encourage the integration of IoT-enabled solar panels and storage systems. National initiatives promoting smart cities and green energy adoption further strengthen regional leadership. Expanding manufacturing capacity for photovoltaic components and growing investment in AI-driven energy management platforms make Asia-Pacific a pivotal hub for smart solar advancements.

Latin America

Latin America captured a 5.1% share of the smart solar system market in 2024, with growth led by Brazil, Chile, and Mexico. Increasing solar energy capacity, combined with favorable renewable energy policies, supports regional expansion. Utility-scale solar farms and distributed solar systems are gaining traction, particularly in areas with strong solar irradiation. However, challenges such as limited digital infrastructure and financing constraints slow widespread adoption. Partnerships with international energy firms and growing investments in solar analytics platforms are expected to enhance operational efficiency and drive the region’s market momentum over the coming years.

Middle East & Africa

The Middle East & Africa region held a 3.5% share of the smart solar system market in 2024. Rapid development of smart city projects and diversification away from fossil fuels are key growth drivers. The UAE and Saudi Arabia lead through large-scale solar power installations integrated with digital monitoring systems. African nations, including South Africa and Kenya, are expanding solar microgrids to address rural electrification needs. Despite limited technical expertise and infrastructure challenges, rising energy demand and government-backed renewable initiatives continue to fuel regional adoption of intelligent solar systems.

Market Segmentations:

By Product

- Inverters

- PV Panels

- Others

By End Use

- Commercial & Industrial

- Residential

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The smart solar system market is highly competitive, featuring key players such as Smart Solar Corporation, Huawei Technologies Co., Ltd, SMA Solar Technology AG, Smart Commercial Solar, Enphase Energy, Lumina Smart, ABB, JinkoSolar Holding Co., Ltd, Schneider Electric, and Smart Solar Energy. These companies lead through continuous innovation in smart photovoltaic technologies, energy storage integration, and digital monitoring platforms. Major players are investing in AI-driven solar optimization, IoT-enabled performance analytics, and hybrid systems combining solar with battery storage. Strategic partnerships, mergers, and acquisitions are strengthening their global footprints, while sustainability-focused business models drive customer loyalty. Many manufacturers focus on enhancing grid connectivity, predictive maintenance, and system efficiency through advanced data analytics and remote diagnostics. Growing competition from regional suppliers offering cost-efficient smart modules is encouraging global brands to diversify portfolios, emphasizing localized solutions, smart grid compatibility, and value-added service offerings to sustain their leadership in the evolving solar energy ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Smart Solar Corporation

- Huawei Technologies Co., Ltd

- SMA Solar Technology AG

- Smart Commercial Solar

- Enphase Energy

- Lumina Smart

- ABB

- JinkoSolar Holding Co., Ltd

- Schneider Electric

- Smart Solar Energy

Recent Developments

- In October 2025, Enphase Energy, Inc. released a comprehensive off-grid solar and battery solution integrating its IQ8™ Series microinverters and IQ® Battery 5P, with over 100 fully off-grid sites already in operation.

- In September 2025, JinkoSolar reported shipment of 41.84 GW of solar modules in H1 2025, pushing its cumulative global deliveries past 350 GW and making its N-type Tiger Neo series the industry’s best-selling high-efficiency product family.

- In June 2025, SMA Solar Technology AG expanded its restructuring and transformation programme, initially launched in September 2024, to adapt its business to shifting market conditions and reduce its cost base.

- In May 2025, Huawei Technologies Co., Ltd. launched its next-generation All-Scenario Grid Forming ESS Platform named “Smart String Grid Forming ESS”, which supports pack-level optimisation with a minimum management unit of 104 cells in a typical 5 MWh system.

Report Coverage

The research report offers an in-depth analysis based on Product, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI and IoT-based solar monitoring systems will continue to rise globally.

- Integration of smart inverters and energy storage will enhance system efficiency and grid stability.

- Governments will strengthen policies and subsidies supporting solar digitalization and automation.

- Demand for hybrid smart solar systems combining PV and battery storage will increase rapidly.

- Commercial and industrial sectors will lead installations due to cost optimization benefits.

- Expansion of smart grids will boost adoption of connected and automated solar solutions.

- Technological advancements will reduce maintenance costs and improve real-time energy analytics.

- Partnerships between solar manufacturers and tech firms will accelerate innovation in energy management.

- Asia-Pacific will remain the fastest-growing market driven by renewable capacity expansion.

- Rising consumer preference for sustainable and self-sufficient energy systems will drive future growth.