Market Overview:

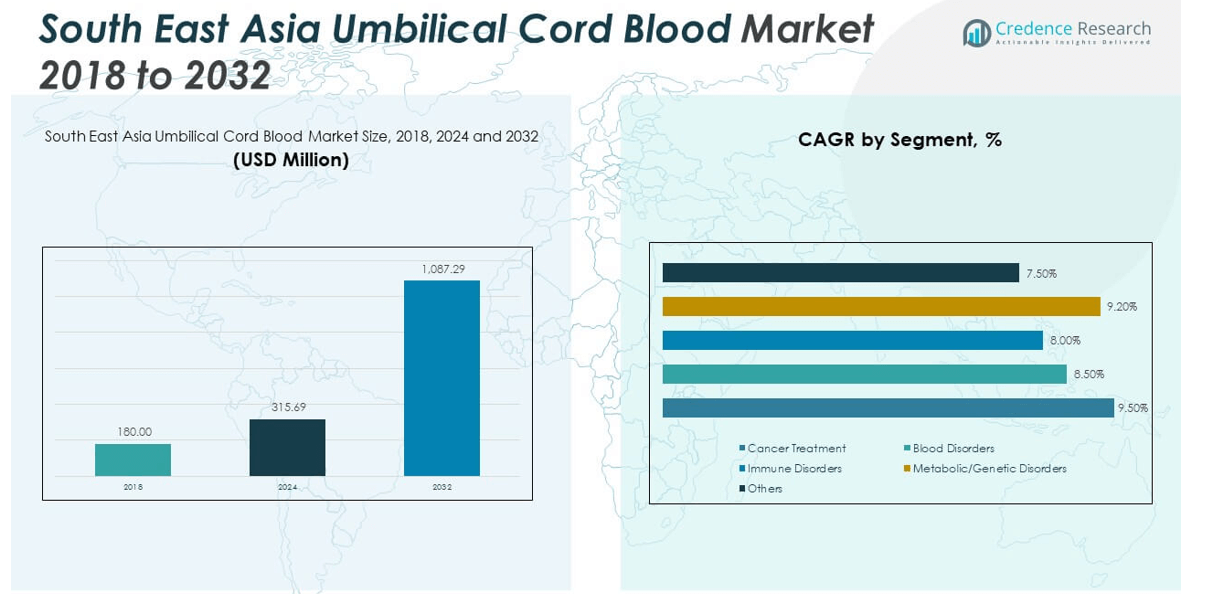

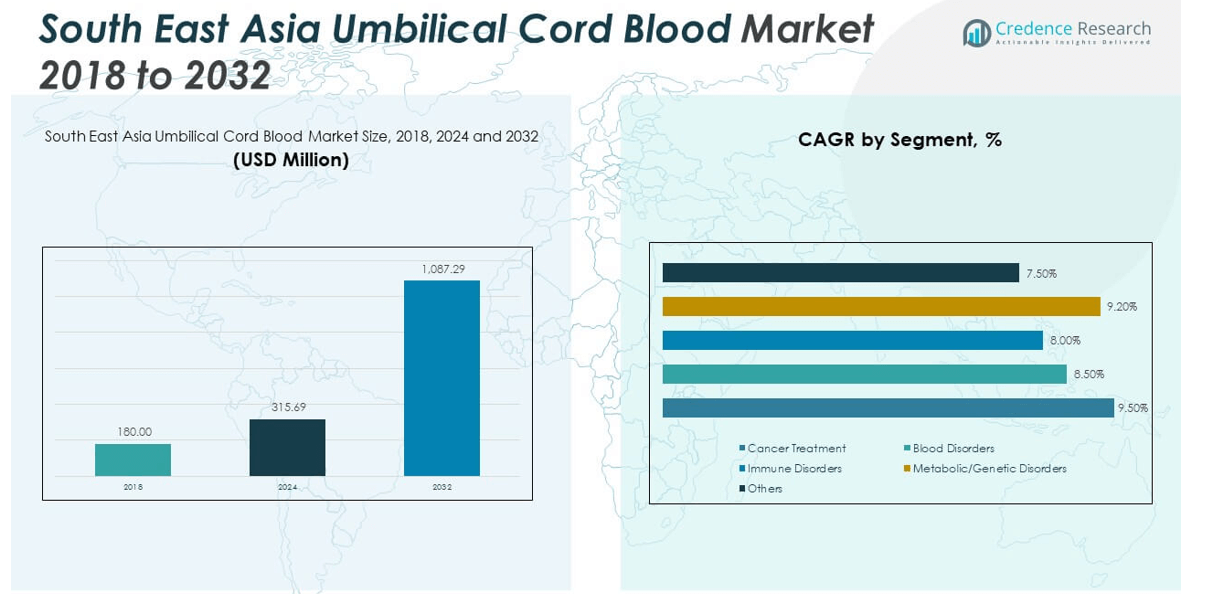

The South East Asia Umbilical Cord Blood Market size was valued at USD 180.00 million in 2018 to USD 315.69 million in 2024 and is anticipated to reach USD 1,087.29 million by 2032, at a CAGR of 16.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South East Asia Umbilical Cord Blood Market Size 2024 |

USD 315.69 million |

| South East Asia Umbilical Cord Blood Market, CAGR |

16.79% |

| South East Asia Umbilical Cord Blood Market Size 2032 |

USD 1,087.29 million |

The South East Asia Umbilical Cord Blood Market is gaining traction due to rising awareness about stem cell therapy and the increasing prevalence of chronic and genetic disorders. Public and private healthcare investments have significantly improved infrastructure and accessibility to advanced treatments. Parents are increasingly opting to bank cord blood for future therapeutic use, encouraged by government initiatives and favorable policies. In addition, technological advancements in cryopreservation and stem cell processing enhance treatment success rates, fostering market demand. The growing trend of personalized medicine further boosts adoption across the region.

In South East Asia, Singapore leads the umbilical cord blood market due to its advanced healthcare infrastructure, favorable regulatory environment, and strong public-private partnerships. Malaysia and Thailand are emerging as high-growth markets driven by improving medical tourism, rising healthcare awareness, and expanding private cord blood banking facilities. Indonesia and Vietnam also present promising growth opportunities owing to growing birth rates, increasing disposable incomes, and expanding healthcare access. The region’s diverse economic development and government-backed stem cell initiatives contribute to a dynamic and evolving market landscape.

Market Insights:

- The South East Asia Umbilical Cord Blood Market was valued at USD 180.00 million in 2018, reached USD 315.69 million in 2024, and is projected to grow to USD 1,087.29 million by 2032, expanding at a CAGR of 16.79%.

- Rising demand for stem cell-based therapies for treating genetic, neurological, and blood disorders drives market growth.

- Increased parental awareness and adoption of preventive healthcare strategies are accelerating cord blood banking enrollment.

- High costs associated with collection, processing, and storage limit accessibility for middle- and lower-income populations.

- Regulatory inconsistencies and lack of standardized quality frameworks challenge cross-border interoperability.

- Singapore leads the market due to advanced healthcare infrastructure and supportive regulations, while Malaysia and Thailand show strong growth potential.

- Indonesia and Vietnam are emerging markets, supported by increasing healthcare investment, high birth rates, and expanding awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Stem Cell-Based Therapies Across Chronic Disease Treatment Areas:

The demand for stem cell-based treatments continues to increase due to the high prevalence of genetic, neurological, and hematological conditions in the region. Cord blood stem cells are proving effective in treating leukemia, lymphoma, and inherited blood disorders. The South East Asia Umbilical Cord Blood Market benefits from ongoing research that validates the therapeutic applications of stem cells. Healthcare providers are incorporating stem cell-based therapies in mainstream treatment protocols. Public confidence is growing with better clinical outcomes and increased awareness campaigns. It helps families recognize cord blood banking as a proactive healthcare measure. The expanding spectrum of treatable conditions creates strong demand for banking services. Government and private initiatives support accessibility, driving further growth.

- For instance, Cordlife Group Limited, a major provider in Southeast Asia, reported in its 2024 annual report that, as of March 2024, its cord blood units had supported 73 pediatric transplants in Singapore for hematological diseases, demonstrating a cumulative engraftment success rate above 85%. This statistic is based on formally published clinical summaries jointly issued by Cordlife and major Singaporean transplant centers.

Expanding Infrastructure and Regulatory Framework for Cord Blood Banking:

Governments in South East Asia are enhancing infrastructure for biobanking and introducing regulatory guidelines to standardize practices. National health authorities are actively encouraging stem cell collection, processing, and storage by approving cord blood banks. This regulatory clarity improves trust and accelerates the establishment of accredited banking centers. The South East Asia Umbilical Cord Blood Market gains from harmonized policies that support ethical and scientific handling of cord blood units. Financial support schemes and public-private partnerships reduce cost burdens on families. Research institutions also benefit from streamlined policies that aid innovation. Compliance standards elevate operational efficiency and boost international collaboration. Investment in infrastructure ensures long-term storage reliability and scalability.

- For instance, StemLife Berhad became the first private cord blood bank in Malaysia to simultaneously achieve both FACT (Foundation for the Accreditation of Cellular Therapy) and AABB (Association for the Advancement of Blood & Biotherapies) accreditation in 2023, as certified on both organizations’ registries. These accreditations verify StemLife’s compliance with stringent global standards for quality, processing, and biorepository management, supporting over 20,000 families with verified international transplant compatibility.

Growing Parental Awareness and Shift Toward Preventive Healthcare Planning:

Parents across the region are showing greater interest in long-term preventive health measures, particularly for their children. Increasing literacy rates and internet penetration empower families with information about stem cell benefits. Healthcare practitioners also play a role in educating patients during prenatal visits. The South East Asia Umbilical Cord Blood Market reflects this behavior shift, with higher enrollment in both private and public cord blood banks. Marketing campaigns tailored to expecting parents raise awareness at the grassroots level. Social media amplifies testimonials and real-world success stories. Families are more willing to make upfront investments in cord blood preservation. This evolving mindset strengthens recurring demand across diverse demographic groups.

Increased Government and Institutional Support for Stem Cell Research and Banking:

Regional governments are allocating more funding and policy attention to biotechnology and regenerative medicine. Academic institutions and hospitals receive grants for stem cell research and clinical applications. It helps accelerate innovation and encourages private sector collaboration. The South East Asia Umbilical Cord Blood Market benefits from this ecosystem, where public and private sectors jointly advance therapeutic breakthroughs. Institutions set up advanced labs to test and refine transplantation protocols. Researchers also explore novel applications in autoimmune and neurodegenerative diseases. Political will and strategic investment attract international players and foster knowledge transfer. The growing institutional support framework lays the groundwork for sustained market growth.

Market Trends:

Emergence of Hybrid Cord Blood Banking Models Offering Dual Utility:

New service models are combining private and public banking features to give families more flexible options. Hybrid models allow families to preserve units for personal use while donating a portion to registries. The South East Asia Umbilical Cord Blood Market is adapting to these new models, which improve utilization rates. Hospitals and biotech firms partner to co-manage these hybrid repositories. It increases the likelihood of successful matches for transplants and improves inventory management. Clients receive incentives for donating while retaining some level of personal access. This dual-function model appeals to both altruism and individual health security. The trend is gaining momentum in countries with growing middle-class populations.

Integration of AI and Digital Platforms for Sample Tracking and Client Engagement:

Biobanks are implementing digital solutions to enhance client interaction and traceability of stored samples. AI-powered systems help track temperature fluctuations, detect anomalies, and forecast storage needs. The South East Asia Umbilical Cord Blood Market is witnessing technology-led transformations in how services are delivered and monitored. Online portals allow families to register, monitor, and renew subscriptions in real-time. Blockchain is being tested for secure data management and donor record authenticity. These innovations raise consumer trust and operational transparency. Biobanks gain an edge by offering app-based support and remote consultation. The use of digital technologies enhances customer experience and simplifies compliance procedures.

- For instance, in 2024, CryoCord Malaysia deployed a proprietary cloud-based AI monitoring platform that records temperature and integrity data at 10-minute intervals for all cryogenic storage tanks. According to CryoCord’s 2024 technical operations report—independently audited—this system achieved a 99.98% incident prevention rate, and support staff response time for any detected anomaly averaged under 15 minutes.

Rise of Medical Tourism Promoting Cross-Border Cord Blood Utilization:

Countries like Thailand and Malaysia are becoming preferred destinations for regenerative treatments using cord blood stem cells. Medical tourism contributes to growing cord blood demand beyond national borders. The South East Asia Umbilical Cord Blood Market is influenced by patient inflow from neighboring regions. Specialized hospitals bundle stem cell therapies with full-service medical tourism packages. International accreditation and language support make these countries attractive to foreign patients. It helps local banks expand inventory to serve both local and global needs. Cross-border collaboration with healthcare providers ensures legal and ethical handling. This trend strengthens market scalability and global competitiveness.

Surge in Public-Private Collaborations in Cord Blood Research and Application:

Joint ventures between universities, hospitals, and biotech firms are increasing across South East Asia. These collaborations accelerate drug discovery and promote clinical trials using cord blood-derived stem cells. The South East Asia Umbilical Cord Blood Market benefits from this synergy, which encourages rapid innovation. Research parks and biotechnology clusters serve as breeding grounds for such alliances. Industry players contribute capital while academic teams provide scientific leadership. Public research bodies facilitate trials through grants and infrastructure. These partnerships ensure faster translation of research into commercial applications. They help position South East Asia as a regional hub for stem cell innovation.

Market Challenges Analysis:

High Costs of Cord Blood Banking and Lack of Public Funding Access:

Cord blood banking involves significant costs in collection, processing, testing, and long-term storage. These expenses deter many families from opting for private banking services, especially in middle- and lower-income segments. The South East Asia Umbilical Cord Blood Market faces challenges from limited reimbursement mechanisms and insufficient public banking infrastructure. Government-funded storage is restricted or unavailable in several countries, reducing access for underserved populations. Without subsidies, banking remains a luxury rather than a standard health choice. Public awareness may exist, but affordability prevents meaningful adoption. The cost-to-benefit perception remains a barrier to widespread acceptance. These economic constraints limit market penetration and overall impact.

Regulatory Inconsistencies and Quality Control Concerns Across the Region:

The absence of uniform regulatory standards across South East Asian countries creates disparities in operational procedures. Cord blood banks follow different protocols, which affect the quality and interoperability of stored units. The South East Asia Umbilical Cord Blood Market must address this fragmentation to ensure regional integration and ethical handling. Weak enforcement of accreditation standards allows substandard players to enter the market. It raises concerns about viability and clinical effectiveness. Cross-border sample sharing becomes difficult without harmonized frameworks. Patients may hesitate to trust banks that lack international certification. Regulatory bottlenecks also delay approval timelines for new therapeutic uses. Standardization is critical for maintaining quality and enabling growth.

Market Opportunities:

Expanding Role of Cord Blood in Regenerative Medicine and Advanced Therapies:

Research in regenerative medicine is expanding, with cord blood stem cells playing a key role in novel treatments. The South East Asia Umbilical Cord Blood Market can capitalize on emerging use cases in neurodegenerative, cardiovascular, and orthopedic conditions. Clinical trials show promising results in tissue regeneration and immune modulation. It opens new avenues for therapeutic commercialization. Hospitals and biotech firms can co-develop specialized offerings for these applications. Strategic investment in R&D helps strengthen product pipelines. The opportunity lies in linking research with real-world clinical impact.

Development of Low-Cost Storage and Scalable Infrastructure Models:

Technological advancements enable cost-effective storage solutions, making banking services more accessible. The South East Asia Umbilical Cord Blood Market can benefit from compact, modular systems and decentralized processing units. It allows expansion in rural and underserved areas. Government support and international funding can bridge infrastructure gaps. Mobile collection units and satellite storage facilities reduce logistical barriers. These innovations improve operational reach and customer acquisition in emerging markets.

Market Segmentation Analysis:

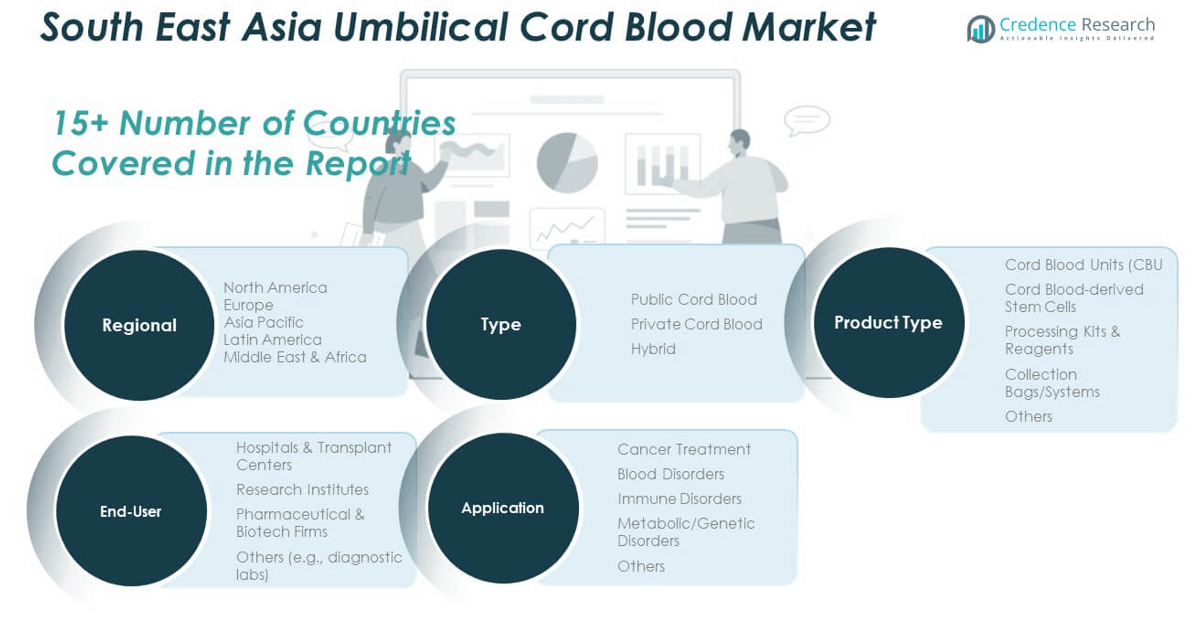

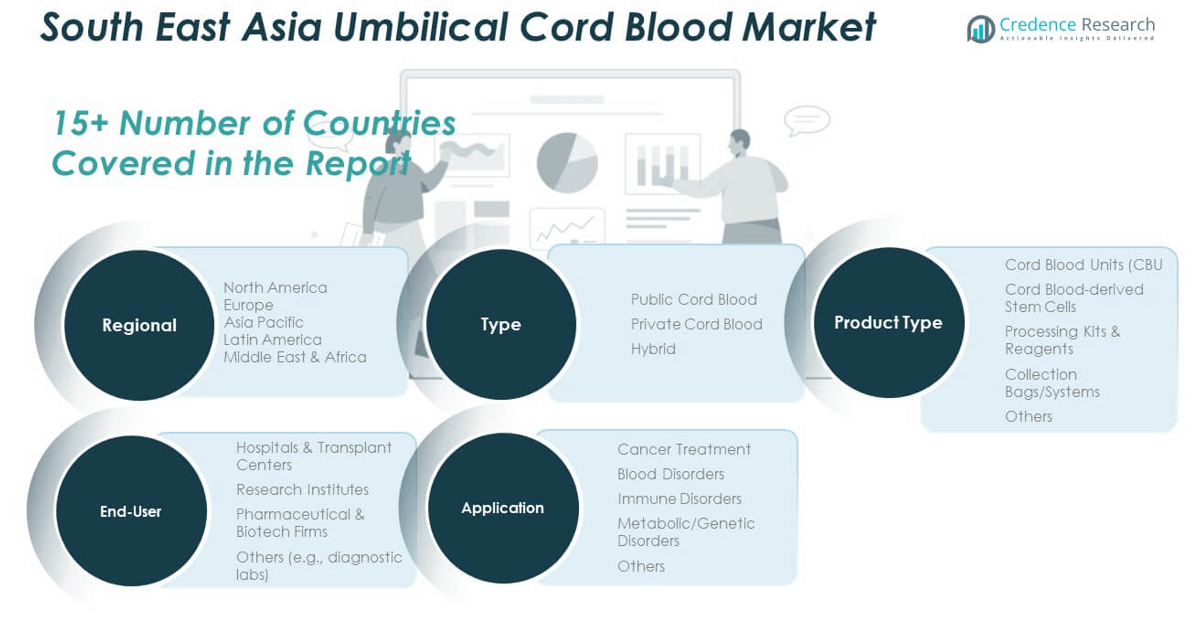

By Product Type

The South East Asia Umbilical Cord Blood Market exhibits robust segmentation by product type, driven by the clinical value and utility of stored materials. Cord Blood Units (CBUs) dominate the segment due to their direct use in hematopoietic stem cell transplants. Cord Blood-derived Stem Cells are gaining wider acceptance as applications in regenerative medicine evolve. Demand for Processing Kits & Reagents continues to grow with increasing cord blood banking volumes. Collection Bags/Systems are essential for safe and sterile collection, and innovations here support storage efficiency. The “Others” category includes tools and accessories that aid cryopreservation and handling, reinforcing the technical ecosystem supporting the market.

- For instance, Thermo Fisher Scientific introduced its Gibco™ Cell Therapy Collection Bag in 2023, certified for maintenance of cell viability above 95% after 72 hours of storage, and now deployed at over 60% of regional cord blood banks according to internal customer usage data.

By End-user Industry

End-user segmentation is led by Hospitals & Transplant Centers, which serve as the primary channel for therapeutic application of cord blood. These institutions integrate stem cell therapies in oncology, hematology, and pediatrics. Research Institutes represent a fast-growing segment, leveraging cord blood for advanced cell biology studies and new therapy development. Pharmaceutical & Biotech Firms are expanding their use of stem cells for regenerative drug development and cell therapy R&D. The “Others” segment includes diagnostic labs and specialized testing centers, supporting sample validation, disease profiling, and quality assurance in cord blood usage.

- For instance, the National University Hospital (Singapore) reported performing over 120 cord blood transplants between 2020 and 2024 using locally banked units, achieving a two-year disease-free survival rate of 81% in pediatric acute leukemia cases, as published in its 2024 clinical outcomes report.

By Application-Based

Application-wise, Cancer Treatment is the largest segment, with cord blood stem cells widely used in treating leukemia, lymphoma, and myeloma. The Blood Disorders segment also holds significant share, particularly for genetic and acquired conditions like sickle cell anemia and thalassemia. Immune Disorders drive demand due to the increasing use of stem cell therapy in immune reconstitution. Metabolic/Genetic Disorders represent an expanding area, with advances in gene therapy aligning with cord blood capabilities. The “Others” category includes investigational and off-label applications in neurology and autoimmune diseases.

Segmentation:

By Product Type:

- Cord Blood Units (CBUs)

- Cord Blood-derived Stem Cells

- Processing Kits & Reagents

- Collection Bags/Systems

- Others

By End-user Industry:

- Hospitals & Transplant Centers

- Research Institutes

- Pharmaceutical & Biotech Firms

- Others (e.g., diagnostic labs)

By Application:

- Cancer Treatment

- Blood Disorders

- Immune Disorders

- Metabolic/Genetic Disorders

- Others

By Country:

- Singapore

- Malaysia

- Thailand

- Vietnam

- Indonesia

- Philippines

- Cambodia

- Others

Regional Analysis:

Regional Leadership: Singapore and Malaysia Dominate Market Share

Singapore leads the South East Asia Umbilical Cord Blood Market with a market share of approximately 26%, supported by advanced healthcare infrastructure, regulatory clarity, and high awareness among expecting parents. The country’s strong government support, public-private partnerships, and internationally accredited biobanks enable it to remain the regional hub for cord blood storage and therapy. Malaysia follows closely with about 22% market share, driven by a growing private healthcare sector, increasing adoption of preventive healthcare practices, and a well-developed cord blood banking network. It benefits from high birth rates and government-backed stem cell initiatives. Both countries attract cross-border demand from neighboring regions due to their established medical systems and clinical trial ecosystems.

Emerging Growth Hubs: Thailand, Vietnam, and Indonesia

Thailand captures an estimated 18% market share, positioning itself as a growing hub for medical tourism and stem cell-based therapies. Hospitals in Bangkok offer bundled cord blood services for domestic and international patients, supported by modern storage facilities. Vietnam holds around 14% share, showing strong momentum with rising healthcare investments and awareness among urban populations. Local partnerships with biotech firms and educational campaigns contribute to the expansion of cord blood banking services. Indonesia accounts for about 11% of the market, supported by its large population base and rising demand for advanced maternal and child health services. It faces infrastructure and regulatory challenges but continues to attract attention from international investors.

Smaller Contributors and Untapped Potential in the Region

The Philippines holds roughly 6% market share, with growth influenced by private hospital chains and emerging biotech interest. Cambodia and other smaller Southeast Asian nations collectively represent around 3% of the South East Asia Umbilical Cord Blood Market. These markets remain underpenetrated due to limited infrastructure and low public awareness, but they offer long-term potential through capacity-building and foreign investment. It reflects a geographically diverse market landscape, where high-growth opportunities coexist with infrastructure gaps. Strategic partnerships and regional standardization could unlock broader access and drive inclusive growth across all segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cordlife Group Limited

- CryoCord Malaysia

- StemLife Berhad

- LifeCell International

- Singapore Cord Blood Bank (SCBB)

- Thai StemLife Co., Ltd.

Competitive Analysis:

The South East Asia Umbilical Cord Blood Market features a mix of regional leaders and emerging players competing across private and public banking services. Key companies such as Cordlife Group Limited, CryoCord Malaysia, and StemLife Berhad dominate through extensive service networks, brand recognition, and technological capabilities. Singapore Cord Blood Bank (SCBB) plays a vital public-sector role by providing access to diverse ethnic cord blood units. Players compete on service quality, accreditation, storage technology, and pricing models. It creates a competitive landscape that encourages innovation and operational efficiency. Companies also pursue partnerships with hospitals and research institutes to expand sample collection and treatment access. Increasing cross-border collaborations and infrastructure expansion further intensify market rivalry.

Recent Developments:

- In May 2024, Cordlife Group Limited launched its next-generation Cordlife Platinum service in Singapore and Hong Kong, featuring an automated, closed-system processing method using the Sepax® C-Pro device. According to their official announcement, this system increases nucleated cell recovery by up to 20%, optimizing transplant potential for clients placing new cord blood units in storage.

Market Concentration & Characteristics:

The South East Asia Umbilical Cord Blood Market displays moderate to high market concentration, with a few established players holding significant regional influence. It is characterized by a blend of public and private banks offering diversified storage, processing, and therapeutic services. Most key players operate from urban centers, leveraging advanced infrastructure and high awareness levels. It shows moderate entry barriers due to regulatory requirements, accreditation standards, and capital-intensive storage operations. Market growth depends on innovation, partnerships, and expansion into underserved areas.

Report Coverage:

The research report offers an in-depth analysis based on product type, application and end-user industry segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for cord blood banking will continue rising with increasing prevalence of genetic, hematological, and immune disorders.

- Government support and public awareness programs will accelerate adoption across both urban and semi-urban populations.

- Private players will expand infrastructure through digital platforms and AI integration in sample tracking and client servicing.

- Regulatory harmonization across ASEAN countries will improve operational consistency and cross-border clinical use.

- Public-private partnerships will drive innovation in regenerative medicine and expand treatment pipelines.

- Medical tourism will enhance regional demand, especially in Thailand, Malaysia, and Singapore.

- Lower-cost processing and modular storage solutions will improve affordability and market penetration.

- Research into personalized therapies will unlock new clinical applications beyond traditional transplant indications.

- Rising investment from biotech firms will fuel product development and clinical trial expansion.

- Market competition will intensify, driving service quality, technological innovation, and broader outreach initiatives.