| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Industrial Catalyst Market Size 2024 |

USD 1343.93 Million |

| South Korea Industrial Catalyst Market, CAGR |

6.79% |

| South Korea Industrial Catalyst Market Size 2032 |

USD 2272.9 Million |

Market Overview:

The South Korea Industrial Catalyst Market is projected to grow from USD 1343.93 million in 2024 to an estimated USD 2272.9 million by 2032, with a compound annual growth rate (CAGR) of 6.79% from 2024 to 2032.

Several factors contribute to this upward trajectory. The increasing demand for efficient and sustainable production processes has heightened the reliance on industrial catalysts to accelerate chemical reactions and enhance process efficiency. Stricter environmental regulations have further propelled the adoption of advanced catalyst technologies aimed at reducing emissions and minimizing environmental impact. Additionally, the burgeoning petrochemical and refining industries in South Korea necessitate high-performance catalysts to optimize operations and maintain competitiveness in the global market. The government’s focus on green and sustainable growth, supported by policies that encourage cleaner manufacturing, has also stimulated catalyst innovation. Furthermore, increasing foreign investments in the chemical and energy sectors are expected to provide additional momentum to the industrial catalyst market.

Regionally, South Korea represents a significant portion of the Asia-Pacific industrial catalyst market. The country’s commitment to technological innovation and substantial investments in research and development have positioned it as a key player in the sector. Collaborations between government bodies and private enterprises have fostered an environment conducive to advancements in catalyst technologies. Furthermore, South Korea’s strategic initiatives to support national strategic industries, including the establishment of a $34 billion policy fund, underscore the nation’s dedication to bolstering sectors such as semiconductors, future mobility, and rechargeable batteries. The concentration of major industrial catalyst manufacturers and the presence of a well-developed infrastructure amplify the country’s production and distribution capabilities. In addition, strong export potential to neighboring countries such as China and Japan enhances South Korea’s regional influence in the catalyst market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The South Korea Industrial Catalyst Market is projected to grow from USD 1,343.93 million in 2024 to USD 2,272.9 million by 2032, registering a CAGR of 6.79%.

- The global industrial catalyst market is projected to grow from USD 31.56 billion in 2024 to USD 51.15 billion by 2032, with a CAGR of 6.22% from 2024 to 2032.

- Rising demand for energy-efficient and sustainable production methods is significantly increasing the adoption of advanced catalyst technologies.

- Government-imposed environmental regulations are accelerating the use of emission-reducing catalysts across chemical, refining, and manufacturing sectors.

- Expanding petrochemical and refining industries, particularly with digital and automation integration, are driving demand for high-performance, process-specific catalysts.

- Substantial R&D investments in catalyst innovation, including nanostructured and multifunctional catalysts, are reinforcing South Korea’s position as a regional innovation hub.

- Market growth is challenged by high production costs, reliance on precious metals, and the complex nature of catalyst manufacturing processes.

- The Seoul Capital Area and southeastern regions dominate the national market share, while strong export potential to China and Japan enhances regional influence.

Market Drivers:

Rising Demand for Sustainable and Efficient Production Processes

One of the key drivers of the South Korea industrial catalyst market is the increasing emphasis on sustainable and energy-efficient production methods. For instance, companies like Umicore Catalysis Korea are at the forefront of this trend, manufacturing catalysts that enhance chemical reaction efficiency while reducing energy consumption. Umicore’s facility in Ulsan specializes in automotive emission control and industrial catalysts, contributing to cleaner production processes. Catalysts enable lower energy consumption during production processes, making them an attractive solution for companies aiming to meet both economic and environmental goals. This growing focus on sustainable manufacturing is pushing demand for innovative catalyst technologies that offer improved selectivity and yield, thereby supporting long-term industrial growth.

Stringent Environmental Regulations and Emission Control Policies

Environmental sustainability has emerged as a central concern in South Korea’s industrial policy framework. The government’s commitment to lowering greenhouse gas emissions and reducing industrial pollutants has led to stricter regulations on emissions from manufacturing facilities and refineries. For instance, the government has mandated the use of advanced technologies like selective catalytic reduction (SCR) systems and flue gas desulfurization (FGD) in coal-fired power plants to reduce nitrogen oxide and sulfur dioxide emissions. This regulatory landscape has directly influenced the industrial catalyst market, as companies are compelled to incorporate advanced catalyst systems that minimize the release of harmful byproducts. Catalysts play a pivotal role in pollution abatement technologies such as catalytic converters and selective catalytic reduction systems, both of which are increasingly being integrated into industrial operations to comply with national and international environmental standards.

Expansion of Petrochemical and Refining Industries

South Korea’s petrochemical and refining sectors are undergoing consistent expansion, driven by domestic demand and strategic export initiatives. These industries are among the largest consumers of industrial catalysts, which are essential in processes such as hydrocracking, reforming, and fluid catalytic cracking. As companies invest in modernizing their refining infrastructure and enhancing process optimization, the demand for high-performance catalysts continues to rise. Furthermore, increasing integration of digital and automation technologies in refining operations has created opportunities for specialized catalysts that are tailored for precision and high throughput, thereby driving market development.

Investments in Research and Development and Technological Advancements

The South Korean government, along with private sector enterprises, has placed significant emphasis on research and development in chemical engineering and materials science. These investments have contributed to breakthroughs in catalyst design, including the development of nanostructured and multifunctional catalysts with enhanced durability and efficiency. Strategic collaborations between universities, research institutes, and industrial players have also accelerated the commercialization of next-generation catalyst solutions. As a result, South Korea has positioned itself as a regional hub for catalyst innovation, ensuring the market remains competitive and aligned with evolving industry requirements.

Market Trends:

Shift Toward Renewable Feedstocks and Green Chemistry

A prominent trend in the South Korea industrial catalyst market is the transition toward renewable feedstocks and green chemistry principles. As sustainability becomes central to industrial policy and corporate strategy, industries are moving away from conventional fossil-based raw materials and exploring biomass-derived alternatives. Catalysts designed for bio-based processes are gaining traction, particularly in sectors such as fine chemicals and biofuels. This shift is being supported by government-led initiatives promoting low-carbon technologies and eco-friendly production methods. As a result, demand for catalysts that enable efficient transformation of renewable feedstocks is growing, creating new opportunities for catalyst developers focused on environmental innovation.

Adoption of Zeolite and Nano-Catalysts in High-Precision Applications

Technological evolution within the catalyst space has accelerated the use of advanced materials such as zeolites and nano-catalysts. In South Korea, these innovations are increasingly being adopted in precision-driven industries including specialty chemicals, pharmaceuticals, and clean energy solutions. Zeolite-based catalysts are valued for their high thermal stability and molecular sieving properties, which are ideal for fine chemical synthesis and fuel processing. For instance, research at POSTECH has led to the development of thermally stable zeolites like PST-32 and PST-2, which exhibit higher catalytic activity for producing essential chemicals such as ethylene and propylene. Meanwhile, nano-catalysts offer superior surface area and catalytic efficiency, enhancing reaction rates even under milder operating conditions. The rising utilization of these advanced materials reflects South Korea’s commitment to leveraging cutting-edge technologies to maintain a competitive edge in high-performance applications.

Localization of Catalyst Manufacturing and Supply Chain Resilience

Amid ongoing global supply chain disruptions and geopolitical uncertainties, South Korea is actively working to localize critical components of its industrial ecosystem, including catalyst production. For instance, companies like Heesung Catalysts have established comprehensive catalyst technology campuses to integrate development, production, and evaluation processes within the country. The trend toward domestic manufacturing is driven by the need to ensure a stable supply of essential materials and reduce reliance on imports, particularly from China and other regional suppliers. Several South Korean companies are investing in local catalyst manufacturing facilities to meet the growing domestic demand and support export ambitions. This localization trend not only strengthens supply chain resilience but also fosters innovation through closer integration of R&D, production, and end-user industries.

Integration of AI and Data-Driven Catalyst Design

An emerging trend in the South Korea industrial catalyst market is the integration of artificial intelligence (AI) and data analytics into catalyst research and design. Advanced computational models and machine learning algorithms are now being used to simulate catalytic reactions and predict catalyst behavior under various conditions. This approach significantly shortens development cycles and improves the precision of catalyst formulations. South Korean research institutions and tech-forward enterprises are increasingly collaborating to build AI-driven platforms for catalyst innovation, aiming to accelerate commercialization while reducing experimentation costs. This fusion of digital tools with chemical engineering is redefining the future of catalyst development in the country.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

One of the primary restraints in the South Korea industrial catalyst market is the high cost associated with catalyst production. Manufacturing industrial catalysts involves intricate chemical processes, advanced equipment, and precise material handling, all of which contribute to elevated production expenses. Furthermore, catalysts often require rare or precious metals such as platinum, palladium, and rhodium, the prices of which are subject to global market volatility. For instance, platinum-based catalysts used in hydrogenation processes are expensive due to the high cost of raw materials like platinum and the complex manufacturing processes involved These high costs limit the accessibility of advanced catalysts for small- and medium-sized enterprises, which may lack the capital to adopt or scale such solutions, thereby hindering broader market penetration.

Stringent Regulatory Compliance and Environmental Safety Concerns

While environmental regulations have driven demand for catalysts that reduce emissions, they also pose a challenge for manufacturers. Catalyst production and application must adhere to strict regulatory frameworks concerning chemical safety, waste management, and emissions control. Navigating these regulations requires ongoing compliance investments, which can strain operational budgets, particularly for emerging players. Additionally, the disposal or recycling of spent catalysts, especially those containing hazardous or toxic substances, presents environmental and logistical difficulties, further complicating sustainability goals.

Raw Material Supply Chain Volatility

The availability and pricing of key raw materials used in catalyst production represent a persistent challenge. South Korea relies on imports for several essential raw materials, making the industry susceptible to supply chain disruptions, trade restrictions, and geopolitical tensions. Sudden fluctuations in material costs can impact profitability and delay production schedules. To mitigate this risk, companies must invest in supply chain diversification and strategic sourcing, which can be resource-intensive and complex to implement.

Market Opportunities:

The South Korea industrial catalyst market presents significant growth potential, particularly in the context of the country’s strategic push toward clean energy and carbon neutrality. As South Korea advances its Green New Deal and 2050 carbon neutrality objectives, there is a rising need for catalysts that support low-emission and energy-efficient industrial processes. This includes opportunities in areas such as hydrogen production, carbon capture and storage (CCS), and fuel cell technologies—each of which relies heavily on advanced catalyst systems. The government’s ongoing investments in renewable energy infrastructure and clean technology research further enhance the demand for high-performance catalysts, creating a favorable environment for both local and international catalyst manufacturers.

In addition to clean energy, there is considerable opportunity in the growing specialty chemicals and pharmaceutical sectors, which require highly selective and tailored catalysts for complex synthesis processes. The emergence of smart manufacturing and digital chemical engineering in South Korea also opens doors for customized catalyst solutions enabled by AI and machine learning. Moreover, the government’s support for reshoring manufacturing capabilities and reducing dependency on imported catalyst components offers incentives for domestic production expansion. As industries modernize and shift toward value-added and precision-based outputs, the demand for innovative, application-specific catalysts is expected to rise. This creates an attractive landscape for companies that can deliver advanced, cost-effective, and environmentally compliant catalyst solutions tailored to South Korea’s evolving industrial framework.

Market Segmentation Analysis:

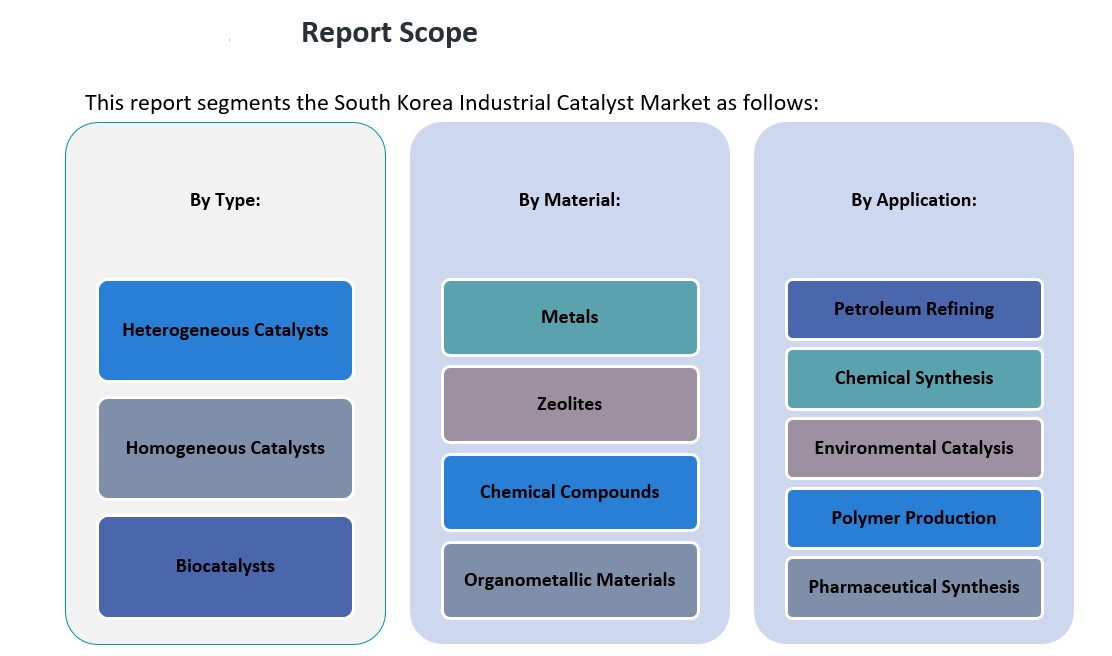

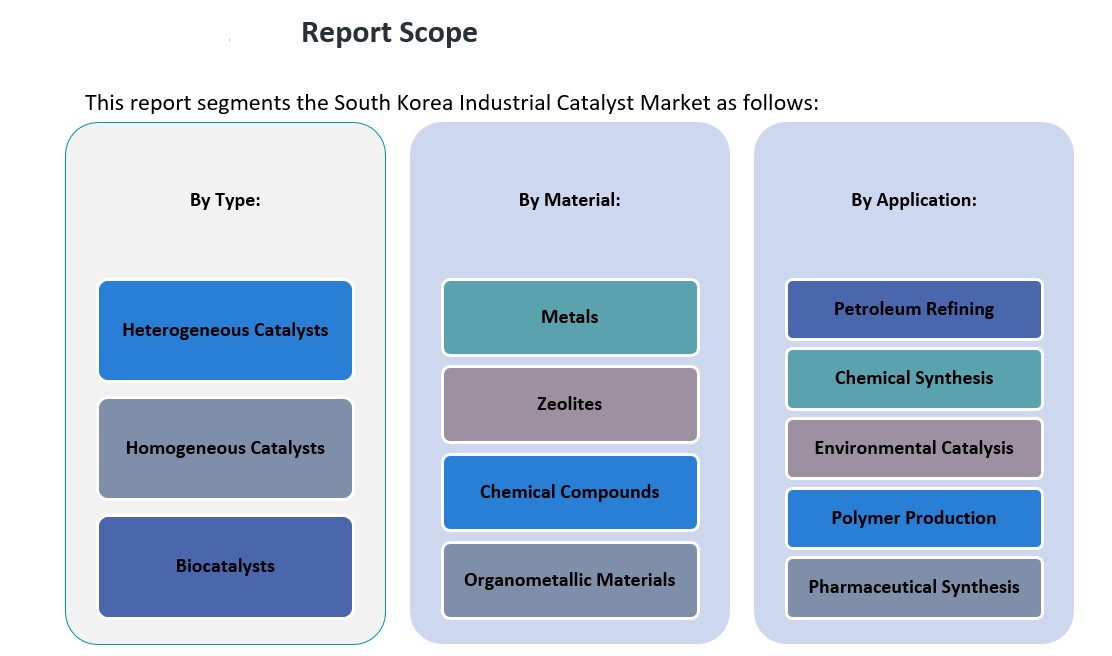

The South Korea industrial catalyst market is segmented by type, application, and material, each playing a distinct role in shaping the market dynamics.

By type, heterogeneous catalysts dominate the market due to their extensive use in large-scale industrial processes such as petroleum refining and chemical synthesis. Their advantages in terms of recovery, stability, and cost-efficiency make them the preferred choice for most manufacturers. Homogeneous catalysts, while offering high selectivity, are more prevalent in specialized applications due to challenges in separation and reuse. Biocatalysts, though still emerging, are witnessing increasing adoption in the pharmaceutical and food processing sectors due to their environmental compatibility and operational efficiency under mild conditions.

By application, petroleum refining remains the largest segment, driven by the country’s strong refining infrastructure and continued demand for clean fuels. Chemical synthesis follows closely, supported by South Korea’s advanced chemical manufacturing capabilities. Environmental catalysis is gaining momentum amid growing regulatory pressure to reduce industrial emissions. Additionally, polymer production and pharmaceutical synthesis segments are expanding steadily, fueled by demand for high-performance materials and precision drug manufacturing technologies.

By material, metal-based catalysts lead the market, particularly those utilizing platinum group metals, which are critical in both refining and automotive applications. Zeolites are also widely used due to their high surface area and thermal stability, especially in hydrocracking and fluid catalytic cracking. Chemical compounds and organometallic materials serve more niche, high-value applications, especially in specialty chemical and pharmaceutical synthesis, where precision and activity are crucial.

Segmentation:

By Type Segment

-

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

By Application Segment

-

- Petroleum Refining

- Chemical Synthesis

- Environmental Catalysis

- Polymer Production

- Pharmaceutical Synthesis

By Material Segment

-

- Metals

- Zeolites

- Chemical Compounds

- Organometallic Materials

Regional Analysis:

South Korea’s industrial catalyst market is primarily concentrated in key industrial regions, notably the Seoul Capital Area, which includes Seoul, Incheon, and Gyeonggi Province. This region serves as the nation’s industrial and economic hub, housing a significant portion of the country’s chemical manufacturing and petroleum refining facilities. The Seoul Capital Area contributes approximately 55% to the national industrial catalyst market, underscoring its dominance in industrial activities.

The southeastern region, encompassing cities such as Ulsan, Busan, and Pohang, accounts for around 30% of the market share. Ulsan, in particular, is renowned for its extensive petrochemical complexes and large-scale refineries, making it a critical area for catalyst consumption. The presence of major industrial players in this region further amplifies its significance in the market landscape.

The southwestern region, including Gwangju and Jeolla provinces, holds a smaller market share of approximately 10%. This area is gradually expanding its industrial base, focusing on specialized chemical production and emerging industries, which is expected to contribute to increased catalyst demand in the future.

Other regions collectively contribute about 5% to the market, encompassing smaller industrial zones and specialized manufacturing facilities scattered across the country. While their individual contributions are modest, they play a role in the overall diversification and resilience of South Korea’s industrial catalyst market.

Key Player Analysis:

- Mitsubishi Chemical Corporation

- LG Chem

- R. Grace (Asia-Pacific operations)

- BASF SE (Regional)

- Reliance Industries Limited

- Sinopec Catalyst Co., Ltd.

- Johnson Matthey (Asia-Pacific operations)

- South KoreaNational Petroleum Corporation (CNPC)

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

Competitive Analysis:

The South Korea industrial catalyst market is characterized by the presence of both domestic and international players competing across various industrial segments. Leading multinational corporations such as BASF SE, Johnson Matthey, and Clariant maintain a strong foothold through advanced product portfolios, continuous innovation, and strategic partnerships with South Korean manufacturers. At the same time, domestic companies like LG Chem and Hanwha Corporation contribute significantly by offering localized solutions and leveraging their understanding of regulatory and market dynamics. The competitive landscape is further shaped by ongoing investments in R&D and sustainable catalyst technologies. Companies are increasingly focused on developing catalysts that support clean energy and emission control initiatives, aligning with national goals for environmental sustainability. The market remains moderately consolidated, with players differentiating themselves through technological advancement, cost competitiveness, and industry-specific expertise, particularly in refining, chemical processing, and environmental catalysis sectors. Strategic collaborations and long-term supply agreements also serve as key competitive strategies.

Recent Developments:

- In December 2023, Mitsubishi Corporation partnered with Amogy and SK Innovation to advance ammonia-to-power and ammonia cracking technologies for hydrogen applications in East Asia, particularly Japan and South Korea. This collaboration aims to support clean energy solutions and reduce emissions, aligning with South Korea’s plan to meet 7.1% of its power demand through hydrogen and ammonia by 2036.

- In January 2024, LG Chem and Enilive signed a joint venture agreement to establish a biorefinery in South Korea. The facility, expected to be operational by 2026, will process approximately 400,000 tons of renewable bio-feedstocks annually, producing sustainable aviation fuel (SAF), hydrotreated vegetable oil (HVO), and bio-naphtha using Eni’s Ecofining technology.

- In March 2025, LG Chem introduced its precursor-free LPF cathode material at Interbattery 2025 in Seoul. This innovative material reduces development time, wastewater output, and carbon emissions. LG Chem plans to commence production within the first half of 2025, emphasizing performance and environmental sustainability.

Market Concentration & Characteristics:

The South Korean industrial catalyst market is characterized by a competitive landscape featuring both domestic and international players. Major multinational corporations such as BASF SE, Johnson Matthey, and Clariant AG have established a significant presence, leveraging their extensive product portfolios and advanced technological capabilities. Concurrently, prominent local companies like LG Chem and Hanwha Corporation contribute robustly, utilizing their deep understanding of regional market dynamics and regulatory frameworks. The market exhibits a moderate to high level of concentration, with leading firms focusing on strategic initiatives such as mergers and acquisitions, research and development investments, and the development of sustainable catalyst technologies. This strategic emphasis aligns with South Korea’s national objectives for environmental sustainability and industrial innovation. Additionally, the market is experiencing a shift towards eco-friendly and energy-efficient catalysts, driven by stringent environmental regulations and the country’s commitment to reducing carbon emissions. This trend is fostering innovation and encouraging companies to develop advanced catalyst solutions that meet both industrial performance requirements and environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, Application Segment and Material Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to maintain steady growth through 2030, supported by increasing demand across refining and chemical manufacturing industries.

- Investments in green technologies will drive innovation in sustainable and low-emission catalyst formulations.

- Growing interest in hydrogen production and carbon capture solutions will expand the need for specialized catalysts.

- Advances in nanotechnology and AI-driven catalyst design will enhance efficiency and shorten development cycles.

- South Korea’s push for energy transition and carbon neutrality will influence catalyst demand in clean energy applications.

- Local manufacturing capabilities are likely to expand, reducing dependency on imported raw materials and enhancing supply chain resilience.

- Regulatory pressure for environmental compliance will create opportunities for emission control catalysts.

- The pharmaceutical and fine chemical sectors will demand highly selective, high-performance catalysts for precision synthesis.

- Strategic partnerships between academia, industry, and government will accelerate R&D and commercialization efforts.

- Increasing competition and consolidation are expected as global and regional players vie for market share with differentiated offerings.