Market Overview:

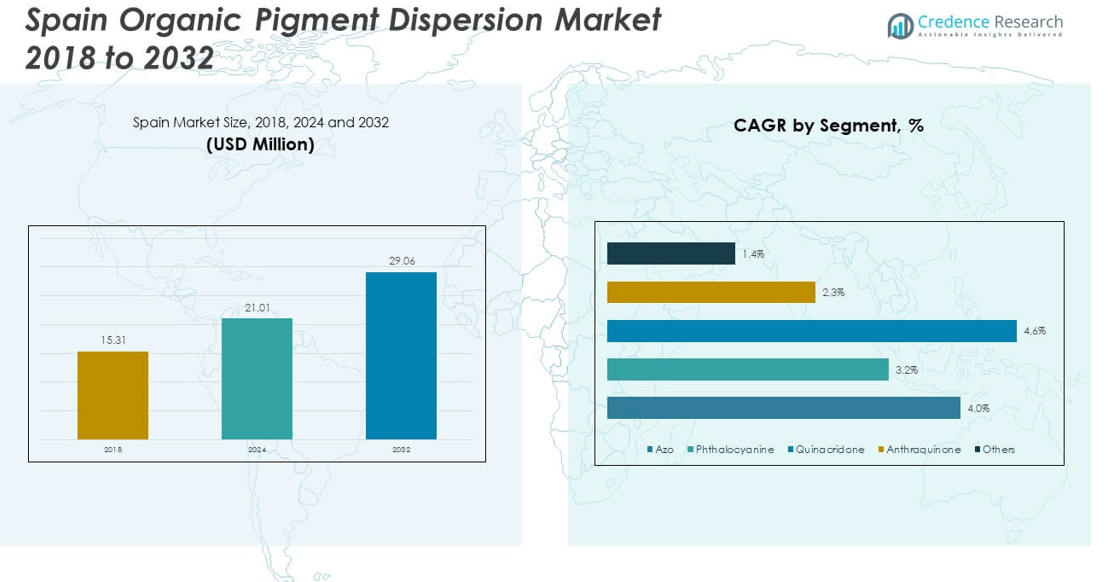

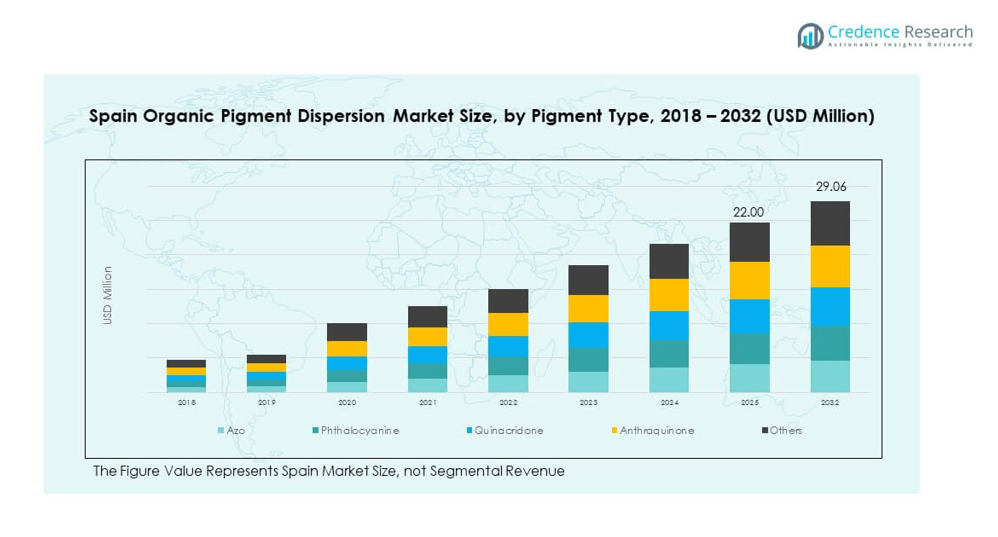

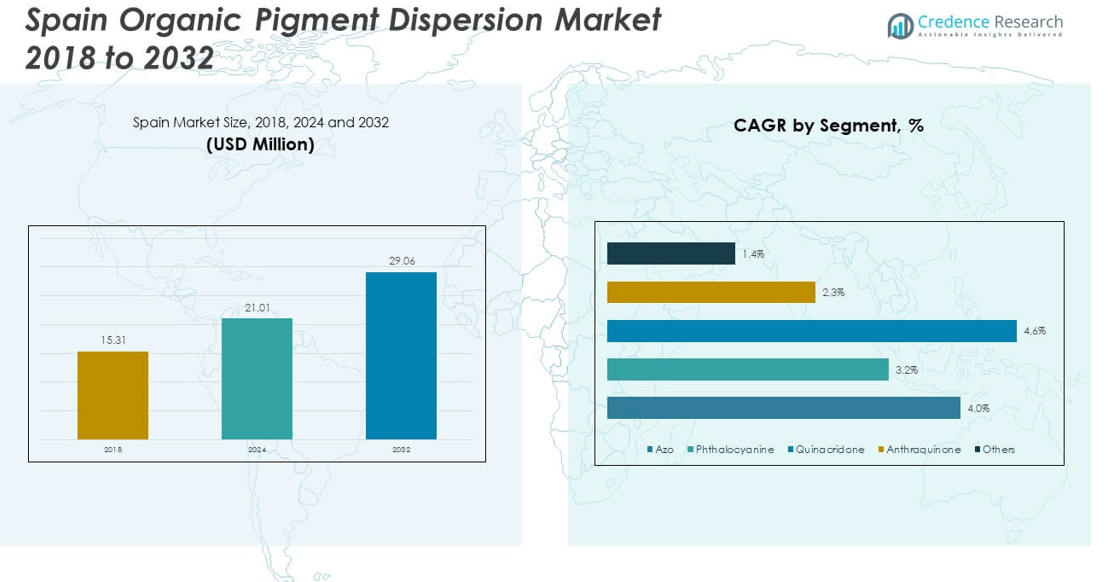

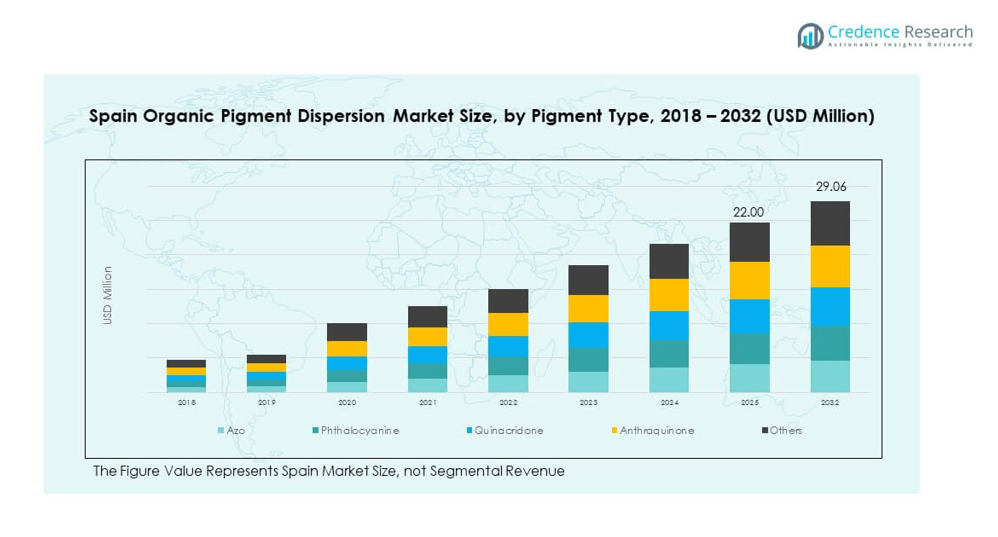

The Spain Organic Pigment Dispersion Market size was valued at USD 15.31 million in 2018 to USD 21.01 million in 2024 and is anticipated to reach USD 29.06 million by 2032, at a CAGR of 4.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Organic Pigment Dispersion Market Size 2024 |

USD 21.01 million |

| Spain Organic Pigment Dispersion Market, CAGR |

4.06% |

| Spain Organic Pigment Dispersion Market Size 2032 |

USD 29.06 million |

The market is driven by strict environmental regulations, increased consumer demand for sustainable materials, and the shift toward water-based dispersions. Manufacturers prioritize low-toxicity pigments to comply with EU norms while meeting industry needs for durability and vibrancy. The demand from automotive coatings, decorative paints, and packaging sectors strengthens overall adoption. It also benefits from expanding applications in textiles and cosmetics, where consumer preferences align with safer and more sustainable products. Technological advancements in dispersion quality and stability support broader industrial integration.

Regionally, Northern Spain leads the market due to its strong industrial clusters and demand from automotive and construction sectors. Central Spain shows steady growth fueled by printing and packaging activities, supported by innovation in sustainable materials. Southern Spain emerges as a promising region, with textiles, agriculture, and consumer goods industries driving wider pigment adoption. Across Europe, Germany, France, and Italy remain influential markets, while Eastern Europe shows faster adoption with industrial expansion and stricter regulatory alignment.

Market Insights

- The Spain Organic Pigment Dispersion Market was valued at USD 15.31 million in 2018, reached USD 21.01 million in 2024, and is projected to hit USD 29.06 million by 2032, growing at a CAGR of 4.06%.

- Northern Spain held the largest share at 35%, supported by strong automotive and construction industries, while Central Spain accounted for 30% due to packaging and printing demand.

- Southern Spain represented 20% of the market and is the fastest-growing region, driven by textiles, agriculture, and export-oriented industries.

- Azo pigments dominated the market with 38% share in 2024, widely used in plastics and packaging applications.

- Phthalocyanine pigments accounted for 32% share, supported by strong adoption in paints, coatings, and printing inks across Spain.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Eco-Friendly Pigment Solutions

The Spain Organic Pigment Dispersion Market expands as industries prioritize eco-friendly formulations. Regulatory bodies enforce restrictions on hazardous pigments, making organic dispersions a preferred choice. Companies in packaging, automotive, and textiles adopt them to align with sustainability goals. The appeal lies in their low toxicity, biodegradability, and compliance with EU environmental policies. End users value organic dispersions for delivering vibrant, long-lasting colors without compromising safety. It benefits from increased demand for water-based inks and coatings. Growing consumer awareness about green products strengthens adoption. Rising investments in R&D accelerate product development and market uptake.

- For example, Clariant launched its Licosperse™ eco-compatible pigment preparations in Europe, featuring heavy metal-free and resin-free formulations. Designed for sustainable wood coatings and oil- or wax-based products, these preparations use non-toxic raw materials and deliver improved durability and low-migration properties compared to traditional dyes.

Expanding Applications Across Industrial Sectors

The market experiences growth through adoption across diverse industrial sectors. Construction materials incorporate organic dispersions to achieve durable color effects in coatings. Packaging companies use them to meet branding and sustainability demands. Textile industries integrate them for better shade stability and eco-friendly dyeing. It benefits from their versatility in plastics and polymers. Rising use in electronic materials further highlights market potential. Automakers demand high-performance pigments for coatings that enhance appearance and durability. Increasing industrial applications build a strong foundation for long-term growth.

Support from European Regulatory and Policy Frameworks

The market gains momentum through supportive European Union regulations. Directives promote substitution of hazardous colorants with organic alternatives. Spain aligns with EU targets, encouraging adoption across industries. The focus on circular economy initiatives enhances relevance of eco-friendly pigment dispersions. It benefits from stricter compliance requirements in packaging and labeling standards. Regulatory support improves acceptance among manufacturers seeking to reduce environmental impact. Consumer preferences align with policy goals, fostering a favorable environment. Incentives for sustainable manufacturing practices further encourage adoption.

Advancements in Production and Formulation Technology

Technological progress fuels innovation within the Spain Organic Pigment Dispersion Market. Manufacturers invest in improving dispersion stability and enhancing application efficiency. Advanced milling and dispersion technologies ensure consistent pigment quality. Improved formulations provide better resistance to weathering, heat, and light. It benefits from innovations that expand color ranges and application versatility. Smart pigment technologies support customization and durability in high-performance uses. Enhanced compatibility with diverse substrates broadens industrial applications. Continuous technological improvements strengthen competitiveness and product performance.

- For example, Sun Chemical has showcased its latest water-based polyurethane dispersions (PUDs), including the HYDRAN® GP line, in European markets. These dispersions are amine-free, designed to provide high film hardness and flexibility, and support durable and sustainable solutions for packaging and industrial applications.

Market Trends

Rising Popularity of Water-Based and Solvent-Free Dispersions

The Spain Organic Pigment Dispersion Market reflects a clear trend toward water-based systems. End users prioritize solvent-free dispersions that align with emission reduction goals. This shift enhances safety for workers and reduces environmental impact. Water-based dispersions also deliver high-quality finishes without compromising performance. It benefits from industries like packaging and automotive adopting these safer alternatives. Consumer demand for sustainable and odor-free products accelerates this trend. Strict VOC regulations further support widespread adoption. The transition ensures long-term alignment with green standards.

Integration of Smart and Functional Pigments

Functional pigments gain traction across industries seeking added performance. Smart pigments in organic dispersions deliver thermal response, UV resistance, or anti-counterfeiting functions. It benefits from rising demand in security printing, electronics, and advanced coatings. Spanish manufacturers explore applications in smart packaging and branding. Functional attributes add value by enhancing durability and product differentiation. The trend positions organic dispersions beyond colorants into performance-enhancing solutions. Companies that innovate in this direction strengthen market competitiveness. This integration shapes future product development and demand.

- For example, NanoMatriX offers UV-fluorescent security pigments with particle sizes ranging from 500 nm to 15 μm. These pigments are integrated into inks and coatings for applications such as high-value documents and product authentication.

Increasing Adoption of Digital Printing Technologies

The growth of digital printing transforms pigment dispersion usage in Spain. Industries like textiles, packaging, and advertising require pigments compatible with digital systems. The Spain Organic Pigment Dispersion Market benefits from demand for stable, high-resolution inks. Advancements in inkjet technology push manufacturers to refine dispersions. These pigments provide consistency, fast drying, and enhanced print durability. Adoption supports customization and cost-effective small-batch production. It aligns with brand strategies that favor unique and eco-friendly prints. The digital trend broadens market penetration in creative sectors.

Focus on Regional and Localized Supply Chains

Localized supply chains gain importance in pigment dispersion manufacturing. Companies emphasize near-sourcing to reduce logistics costs and carbon emissions. Spain develops capabilities to serve regional industries with reliable pigment solutions. It benefits from reduced dependence on external suppliers. Local production improves responsiveness to customer demands and regulatory shifts. Stronger regional networks enhance stability against global disruptions. The trend also supports faster adoption of customized dispersions. Strengthening localized supply ensures resilience and long-term growth.

- For example, in May 2024, BASF announced a capacity expansion at its Tarragona, Spain facility, adding new manufacturing assets for Basoflux® aqueous-based dispersions and paraffin inhibitors. The company stated that this investment would strengthen supply reliability and improve responsiveness to customer demand in Europe.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Risks

The Spain Organic Pigment Dispersion Market faces volatility in raw material sourcing. Organic pigment precursors often depend on global supply chains. Price instability of natural and synthetic intermediates disrupts production planning. It challenges manufacturers by increasing operational costs. Supply risks heighten due to geopolitical factors and trade disruptions. Dependence on limited sources reduces flexibility and resilience. Companies struggle to balance quality, cost, and availability in procurement. This challenge pressures margins and long-term growth strategies.

Competition from Alternative Pigment Technologies

Alternative technologies create competitive challenges for organic dispersions. Inorganic pigments provide superior opacity and lower cost for some applications. Synthetic dyes compete in textiles and plastics by offering wider shade ranges. The Spain Organic Pigment Dispersion Market adapts to maintain differentiation. It faces pressure to enhance performance and justify premium pricing. Companies must innovate to remain relevant against these alternatives. Resistance to change among traditional users also slows transition. Competitive pressure drives continuous innovation and efficiency improvements.

Market Opportunities

Growing Potential in Emerging Industrial Applications

The Spain Organic Pigment Dispersion Market presents opportunities in emerging applications. Electronics adopt dispersions for functional coatings with enhanced conductivity. Smart packaging integrates pigments with security and branding features. Textile printing expands with eco-friendly dispersions replacing synthetic alternatives. It benefits from untapped opportunities in cosmetics, agriculture, and advanced polymers. Expansion into high-value industries increases long-term market potential. Local innovators capitalize on these opportunities by developing niche solutions. Emerging applications strengthen resilience and diversify revenue streams.

Expansion Through Global Collaborations and Innovation Networks

Collaborations create strong growth opportunities for Spanish pigment manufacturers. Partnerships with global chemical companies enable access to advanced technologies. Innovation networks support development of next-generation pigment formulations. The Spain Organic Pigment Dispersion Market gains strength from shared expertise and R&D investments. It benefits from collaborations with universities and research institutes. Global alliances also enhance market visibility and competitiveness. Opportunities expand by aligning with multinational sustainability goals. This collaborative approach secures growth across diverse industries.

Market Segmentation Analysis

By pigment type, the Spain Organic Pigment Dispersion Market is led by azo pigments, valued for their cost efficiency and wide color range across inks and plastics. Phthalocyanine pigments contribute strong demand due to their superior stability and suitability in coatings and packaging. Quinacridone and anthraquinone pigments hold smaller shares but are preferred for premium applications requiring high durability and weather resistance. It maintains diversity through the “others” category, which includes specialty pigments addressing niche performance needs in advanced materials.

- For example, Diacolorchem EU, S.A., based in Barcelona, manufactures and supplies organic pigments, offering a portfolio that includes azo compounds for applications in adhesives, coatings, and plastics.

By application, the Spain Organic Pigment Dispersion Market shows paints and coatings as the largest segment, driven by strong demand in automotive, construction, and decorative industries. Printing inks follow with steady growth supported by the expansion of packaging and publishing sectors. Plastics and polymers utilize dispersions to achieve durable color quality and sustainability alignment. It gains traction in textiles, where eco-friendly dyes support growth in apparel and home furnishing. Cosmetics represent a smaller but promising segment as consumer preference shifts toward safe, vibrant formulations. Other applications, including specialty uses in electronics and agriculture, highlight untapped opportunities and reinforce the broad adaptability of organic pigment dispersions.

- For example, BASF Curtex S.A., based in L’Hospitalet de Llobregat, Spain, manufactures pigment dispersions applied in plastics masterbatch and decorative paints for the local market.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regional Analysis

Northern Spain Market Share and Growth Factors

Northern Spain accounts for 35% of the Spain Organic Pigment Dispersion Market. The region benefits from strong industrial clusters in chemicals, coatings, and packaging. Local manufacturers in Basque Country and Catalonia integrate organic dispersions into paints and polymers. It thrives on established research hubs and proximity to European suppliers. Adoption in automotive coatings and construction materials remains high. Government-backed initiatives for sustainable production strengthen market presence. The industrial orientation of Northern Spain positions it as the leading subregion.

Central Spain Market Share and Industrial Applications

Central Spain represents 30% of the Spain Organic Pigment Dispersion Market. The region benefits from Madrid’s industrial and printing sectors, driving steady demand. Printing inks and packaging industries form the core application base. It gains momentum from the rise of sustainable packaging in FMCG and retail. Investments in eco-friendly materials support wider acceptance. Local demand for cosmetics and textiles further boosts usage. Central Spain shows resilience by diversifying applications across multiple industries.

Southern Spain Market Share and Emerging Opportunities

Southern Spain contributes 20% of the Spain Organic Pigment Dispersion Market. Growth is driven by rising demand from textiles, agriculture, and construction. Andalusia and Valencia show stronger adoption of pigments in plastics and coatings. It benefits from the export-oriented manufacturing base in these regions. Market penetration in paints and coatings expands due to infrastructure development. Emerging opportunities in packaging and consumer goods strengthen the subregion’s role. Southern Spain shows potential for faster growth in the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Heubach Group

Competitive Analysis

The Spain Organic Pigment Dispersion Market is characterized by the presence of global and regional leaders such as BASF SE, Clariant AG, Heubach GmbH, Lanxess AG, Venator Materials PLC, Cabot Corporation, Ferro Corporation, DIC Corporation, and Sudarshan Chemical Industries. These companies focus on expanding product portfolios and improving pigment performance to secure a competitive edge. It remains highly consolidated, with top players controlling a significant share of the market. Strategies include mergers, acquisitions, and partnerships to strengthen geographic reach. Companies also invest in advanced dispersion technologies that improve stability and application versatility. Local players emphasize niche offerings to cater to specific end-use industries. The competition continues to be shaped by sustainability standards, cost efficiency, and technological innovation, positioning leading players for long-term growth.

Recent Developments

- In June 2025, Clariant AG introduced HOSTAPHAT OPS 100, which is a dispersing agent specifically developed for metal-containing pigment applications, including those relevant to the organic pigment dispersion segment in Spain.

- In March 2025, Sudarshan Chemical Industries Limited completed the acquisition of Germany-based Heubach Group, combining both companies’ operations and expertise to create a global pigment leader with a strong presence in major markets including Spain and the broader European region. This acquisition provides Sudarshan Chemical access to Heubach’s extensive technological capabilities, resulting in an expanded asset footprint across 19 international sites and a broader pigment product portfolio.

- In November 2023, Heubach GmbH expanded its cooperation with TER Chemicals to include inorganic colored pigments, anti-corrosion pigments, and pigment preparations in Germany and Austria. This partnership aims to enhance product availability for coatings and related applications.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as industries adopt eco-friendly pigments for coatings, packaging, and textiles.

- Advancements in dispersion technologies will improve stability, color strength, and application versatility.

- Water-based and solvent-free systems will dominate, supported by EU environmental compliance.

- Functional and smart pigments will find broader use in security, electronics, and smart packaging.

- Digital printing will expand pigment adoption in textiles, advertising, and personalized packaging.

- Localized production and shorter supply chains will improve reliability and reduce dependence on imports.

- Partnerships between global suppliers and Spanish manufacturers will drive innovation and competitiveness.

- Regulatory frameworks will continue to encourage sustainable pigment development and adoption.

- Growth opportunities will emerge in cosmetics and specialty applications with eco-friendly preferences.

- Research collaborations with universities and institutes will strengthen Spain’s role in pigment innovation.