Market Overview

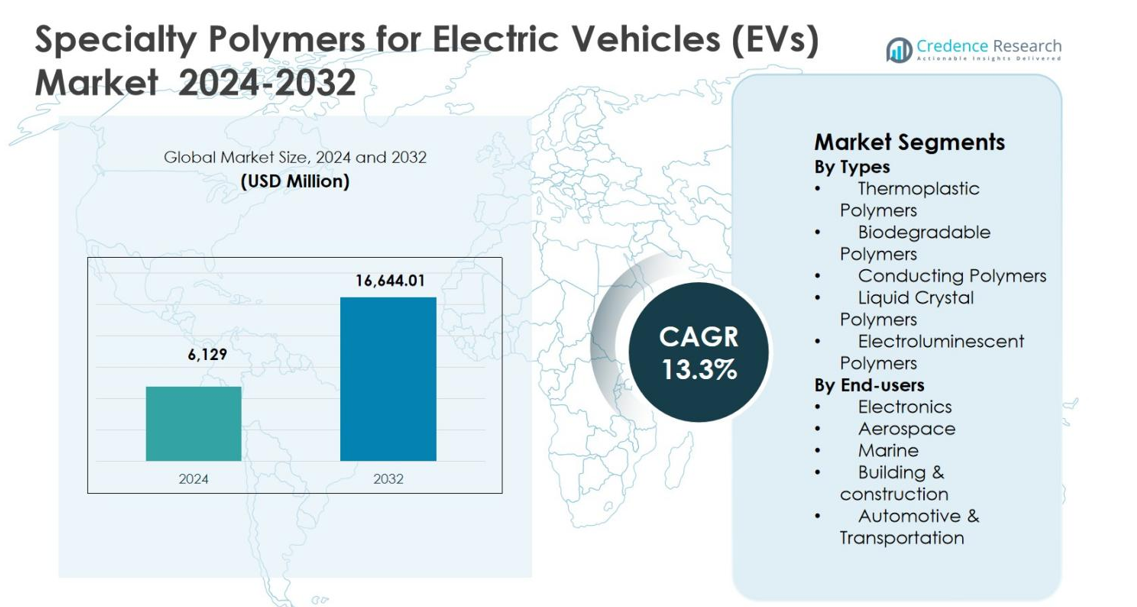

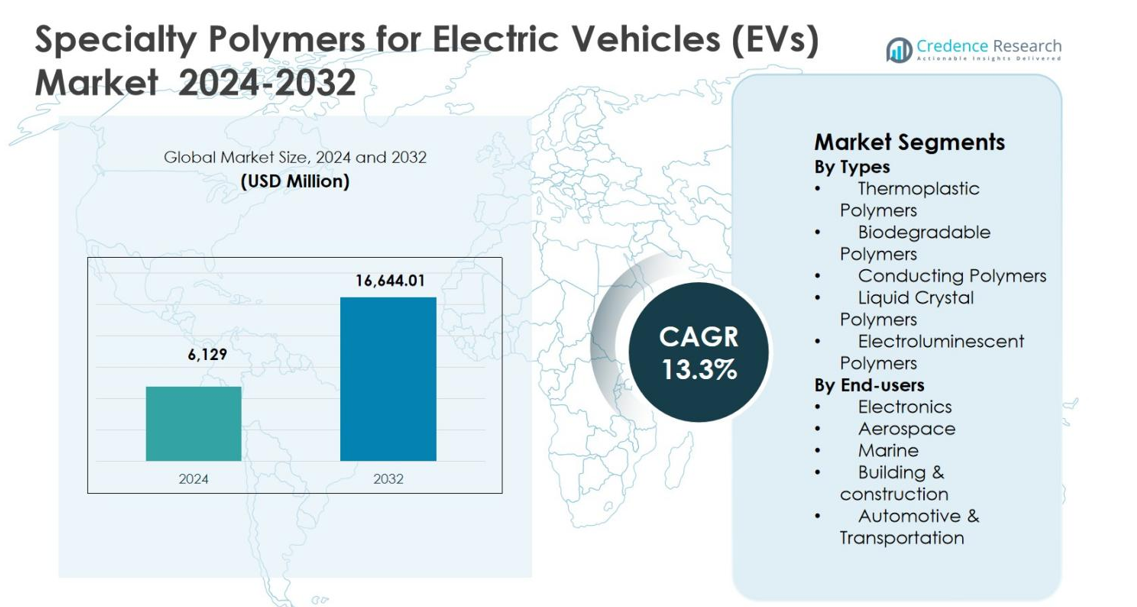

Specialty Polymers for Electric Vehicles (EVs) Market size was valued at USD 6,129 million in 2024 and is anticipated to reach USD 16,644.01 million by 2032, expanding at a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Polymers for Electric Vehicles (EVs) Market Size 2024 |

USD 6,129 million |

| Specialty Polymers for Electric Vehicles (EVs) Market, CAGR |

13.3% |

| Specialty Polymers for Electric Vehicles (EVs) Market Size 2032 |

USD 16,644.01 million |

Specialty Polymers for Electric Vehicles (EVs) Market is shaped by the strong presence of global chemical and material leaders such as BASF SE, Solvay Group, Arkema Group, The Dow Chemical Company, LyondellBasell Industries N.V., Clariant, 3M, and Celanese Corporation, which focus on advanced polymer solutions for batteries, power electronics, and lightweight vehicle components. These companies emphasize material innovation, thermal stability, electrical insulation, and sustainability to meet evolving EV requirements. Asia Pacific led the market with a 34.8% share in 2024, supported by large-scale EV production and battery manufacturing in China, Japan, and South Korea. Europe followed with a 31.4% share, driven by stringent emission regulations and strong automotive R&D, while North America accounted for 28.6%, supported by advanced EV adoption and material innovation.

Market Insights

- Specialty Polymers for Electric Vehicles (EVs) Market was valued at USD 6,129 million in 2024 and is projected to reach USD 16,644.01 million by 2032, growing at a CAGR of 13.3% during the forecast period.

- Market growth is driven by rapid EV production expansion, rising demand for lightweight and high-performance materials, and increasing adoption of specialty polymers in batteries, power electronics, and thermal management systems.

- Thermoplastic polymers dominated the market with a 6% segment share in 2024, supported by their recyclability, mechanical strength, and suitability for EV structural and electrical components, followed by conducting and liquid crystal polymers.

- Leading companies such as BASF SE, Solvay Group, Arkema Group, Dow Chemical Company, and LyondellBasell focus on innovation, sustainability, and partnerships with EV manufacturers to strengthen market positioning.

- Asia Pacific led with a 8% regional share in 2024, followed by Europe at 31.4% and North America at 28.6%, while Latin America and Middle East & Africa together accounted for the remaining share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Types:

The Specialty Polymers for Electric Vehicles (EVs) Market, by types, is led by Thermoplastic Polymers, which accounted for 42.6% market share in 2024, driven by their lightweight properties, high mechanical strength, recyclability, and excellent thermal resistance for battery housings, connectors, and interior components. Strong demand for polyamide, PEEK, and polypropylene in EV powertrain and structural applications reinforces this dominance. Conducting polymers and liquid crystal polymers follow, supported by rising use in electronic components and thermal management systems, while biodegradable and electroluminescent polymers gain traction in sustainable materials and advanced display technologies.

- For instance, Lanxess’s Durethan BKV30FN04, a glass-fiber-reinforced polyamide 6, equips battery module housings from INFAC with halogen-free flame retardancy and high-voltage insulation up to 800 V, enabling complex function integration and lighter weight.

By End-users:

By end-users, Automotive & Transportation dominated the Specialty Polymers for Electric Vehicles (EVs) Market with a 51.8% share in 2024, supported by accelerating EV production, stringent emission regulations, and the need for lightweight and high-performance materials. Specialty polymers are widely used in battery modules, cable insulation, power electronics, and thermal management systems. Electronics held the second-largest share due to growing demand for polymer-based connectors and insulation materials, while aerospace, marine, and building & construction segments contributed steadily through adoption of high-strength and corrosion-resistant polymer solutions.

- For instance, SABIC’s NORYL NHP8000VT3 resin, a polyphenylene ether-based material, enables ultra-thin-wall insulation films for high-voltage (600-800 V) EV battery modules, achieving the highest CTI PLC0 rating and UL94 V0 at 0.25 mm thickness for enhanced safety and space savings.

Key Growth Drivers

Rapid Expansion of Electric Vehicle Production

The accelerating global production of electric vehicles is a primary growth driver for the Specialty Polymers for Electric Vehicles (EVs) Market. Automakers increasingly rely on advanced polymers to reduce vehicle weight, improve energy efficiency, and extend driving range. Specialty polymers replace traditional metals in battery enclosures, power electronics, connectors, and interior components due to their superior strength-to-weight ratio and design flexibility. Government incentives, emission regulations, and expanding charging infrastructure further stimulate EV manufacturing, directly increasing demand for high-performance thermoplastic, conducting, and liquid crystal polymers.

- For instance, Covestro supplies Makrolon® polycarbonate and Bayblend® PC/ABS resins for EV battery enclosures, enabling injection-molded, flame-retardant designs with tight tolerances for mass production.

Rising Demand for Lightweight and High-Performance Materials

Light weighting remains a critical focus in EV design, strongly driving the Specialty Polymers for Electric Vehicles (EVs) Market. Specialty polymers enable significant weight reduction while maintaining thermal stability, flame retardancy, and mechanical durability required for high-voltage EV systems. Their use enhances battery efficiency, vehicle safety, and overall performance. Automakers and component manufacturers increasingly adopt polymer composites and advanced thermoplastics to meet efficiency targets, comply with safety standards, and support modular vehicle architectures, reinforcing sustained demand across global EV platforms.

- For instance, SABIC employs NORYL GTX™ resins in hybrid plastic/metal designs for lightweight honeycomb crash protection structures in EV battery systems. These modified PPE resins with polyamide provide low density, dimensional stability, and E-coat capability up to 220°C for 30 minutes, replacing heavier metals while ensuring impact protection.

Advancements in Battery and Power Electronics Technologies

Continuous advancements in battery chemistry and power electronics significantly propel the Specialty Polymers for Electric Vehicles (EVs) Market. Next-generation lithium-ion and solid-state batteries require polymers with superior thermal management, electrical insulation, and chemical resistance. Specialty polymers support improved heat dissipation, reduced risk of thermal runaway, and enhanced durability of battery packs. Growing investments in fast-charging technologies and high-voltage systems further boost the need for conducting and high-temperature polymers, strengthening their role in advanced EV architectures.

Key Trends & Opportunities

Growing Adoption of Sustainable and Recyclable Polymers

Sustainability has emerged as a key trend shaping the Specialty Polymers for Electric Vehicles (EVs) Market. Automakers increasingly prioritize recyclable and bio-based polymers to reduce vehicle lifecycle emissions and comply with environmental regulations. Biodegradable and recyclable thermoplastics present significant opportunities for material innovation in EV interiors and non-structural components. Manufacturers investing in circular polymer solutions and low-carbon production processes can gain competitive advantages while addressing sustainability goals across the EV value chain.

- For instance, Avient developed reSound™ REC thermoplastic elastomers (TPEs) incorporating recycled polyvinyl butyral (PVB) from broken vehicle glass, closing the loop for automotive applications.

Increasing Integration of Smart and Functional Polymers

The integration of smart and functional polymers presents a strong growth opportunity in the Specialty Polymers for Electric Vehicles (EVs) Market. Conducting and electroluminescent polymers enable advanced sensing, lighting, and energy-monitoring applications within EVs. These materials support intelligent battery management systems, enhanced human–machine interfaces, and lightweight display technologies. As EVs evolve toward connected and autonomous platforms, demand for multifunctional polymer materials is expected to increase, opening new avenues for product differentiation and innovation.

- For instance, BASF’s OPPANOL® high-molecular-weight polyisobutylene serves as a cathode binder in EV batteries. It exhibits superior elasticity and elongation to accommodate mechanical expansion during battery operation, reducing physical damage risk.

Key Challenges

High Material Costs and Price Volatility

High costs associated with specialty polymers pose a significant challenge for the Specialty Polymers for Electric Vehicles (EVs) Market. Advanced polymers require complex manufacturing processes and specialized raw materials, leading to higher prices compared to conventional plastics and metals. Fluctuations in petrochemical feedstock prices further impact cost structures. These factors can limit adoption, particularly among cost-sensitive EV manufacturers, and create pricing pressure across the supply chain.

Performance Validation and Regulatory Compliance

Ensuring consistent performance and meeting stringent regulatory standards remains a challenge in the Specialty Polymers for Electric Vehicles (EVs) Market. EV applications demand polymers that withstand extreme temperatures, high voltages, and long-term mechanical stress. Extensive testing, certification requirements, and evolving safety regulations increase development timelines and costs. Manufacturers must continuously invest in material validation and compliance processes, which can slow commercialization and restrict rapid adoption of new polymer technologies.

Regional Analysis

North America

North America held 28.6% market share in 2024 in the Specialty Polymers for Electric Vehicles (EVs) Market, supported by strong EV adoption, advanced automotive manufacturing, and sustained investments in battery technology. The United States leads regional demand due to the presence of major EV manufacturers and polymer suppliers, alongside federal incentives promoting electric mobility. Specialty polymers are widely used in battery enclosures, thermal management systems, and power electronics. Growing focus on lightweight materials, recycling initiatives, and high-performance polymers for fast-charging applications continues to strengthen regional market growth.

Europe

Europe accounted for 31.4% market share in 2024 in the Specialty Polymers for Electric Vehicles (EVs) Market, driven by strict emission regulations and aggressive electrification targets. Countries including Germany, France, and the United Kingdom are major contributors, supported by strong automotive OEM presence and advanced polymer R&D capabilities. The region emphasizes sustainable and recyclable polymer materials to meet environmental compliance standards. Rising investments in EV battery gigafactories and lightweight vehicle design further boost demand for thermoplastic and conducting polymers across automotive and transportation applications.

Asia Pacific

Asia Pacific dominated the Specialty Polymers for Electric Vehicles (EVs) Market with a 34.8% market share in 2024, led by rapid EV production growth in China, Japan, and South Korea. Strong government incentives, expanding charging infrastructure, and large-scale battery manufacturing drive high consumption of specialty polymers. The region benefits from cost-effective manufacturing, robust supply chains, and growing domestic demand for electric passenger and commercial vehicles. Increasing adoption of advanced polymers in battery packs, connectors, and electronic components continues to reinforce Asia Pacific’s leadership.

Latin America

Latin America captured 3.1% market share in 2024 in the Specialty Polymers for Electric Vehicles (EVs) Market, supported by gradual EV adoption and emerging automotive manufacturing hubs in Brazil and Mexico. Government initiatives promoting clean transportation and rising investments in electric public transport systems are driving polymer demand. Specialty polymers are increasingly used in lightweight automotive components and electrical insulation materials. Although the market remains in a developing stage, improving regulatory frameworks and growing regional partnerships present steady growth opportunities.

Middle East & Africa

The Middle East & Africa region accounted for 2.1% market share in 2024 in the Specialty Polymers for Electric Vehicles (EVs) Market, driven by early-stage EV adoption and infrastructure development. Countries such as the United Arab Emirates and South Africa are investing in electric mobility and sustainable transportation solutions. Demand for specialty polymers is rising in EV components requiring thermal resistance and durability under harsh climatic conditions. Increasing government focus on diversification and clean energy initiatives supports long-term market expansion across the region.

Market Segmentations:

By Types

- Thermoplastic Polymers

- Biodegradable Polymers

- Conducting Polymers

- Liquid Crystal Polymers

- Electroluminescent Polymers

By End-users

- Electronics

- Aerospace

- Marine

- Building & construction

- Automotive & Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Specialty Polymers for Electric Vehicles (EVs) Market includes BASF SE, Solvay Group, Arkema Group, The Dow Chemical Company, LyondellBasell Industries N.V., Clariant, 3M, Celanese Corporation, Specialty Polymers, Inc., and AmeriLux International, LLC. The market features a mix of global chemical leaders and specialized material manufacturers focused on high-performance polymer solutions for EV applications. Companies compete through continuous material innovation, emphasizing lightweighting, thermal stability, electrical insulation, and flame-retardant properties tailored for batteries, power electronics, and charging systems. Strategic investments in polymer R&D, capacity expansion, and advanced compounding technologies strengthen product differentiation. Collaborations with automotive OEMs and battery manufacturers support early material integration and long-term supply agreements. Sustainability initiatives, including recyclable and low-carbon polymers, further shape competition, while regional manufacturing footprints and technical service capabilities influence customer preference and market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, BASF SE launched Glysantin Electrified low electrical conductivity coolants for electric vehicles, designed to improve battery safety and comply with the new GB 29743.2-2025 standard in China.

- In August 2025, SABIC introduced LNP™ THERMOCOMP™ non-brominated/non-chlorinated flame-retardant PBT compounds for critical EV components, enhancing safety and performance in high-demand electrical applications.

- In July 2025, Covestro launched Baysafe BEF, an advanced flame-retardant polyurethane encapsulation foam for EV batteries. The material limits thermal propagation between cells, aligning with China’s new battery safety regulations to enhance overall vehicle safety.

Report Coverage

The research report offers an in-depth analysis based on Type, End Users and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Specialty Polymers for Electric Vehicles (EVs) Market will experience sustained demand growth driven by increasing global EV production and model diversification.

- Automakers will continue replacing traditional materials with specialty polymers to achieve weight reduction and improved energy efficiency.

- Advancements in battery technology will accelerate the adoption of high-temperature and electrically insulating polymer materials.

- Demand for conducting and functional polymers will increase with the expansion of smart power electronics and battery management systems.

- Sustainability requirements will push manufacturers toward recyclable, bio-based, and low-carbon polymer solutions.

- Continuous innovation in thermal management polymers will support safer and faster-charging EV architectures.

- Strategic partnerships between polymer producers and automotive OEMs will strengthen long-term supply relationships.

- Expansion of EV manufacturing capacity in Asia Pacific will influence global polymer supply chains.

- Regulatory standards for fire safety and electrical performance will drive material certification and innovation.

- Customization of polymer formulations for specific EV platforms will become a key competitive differentiator.