Market Overview

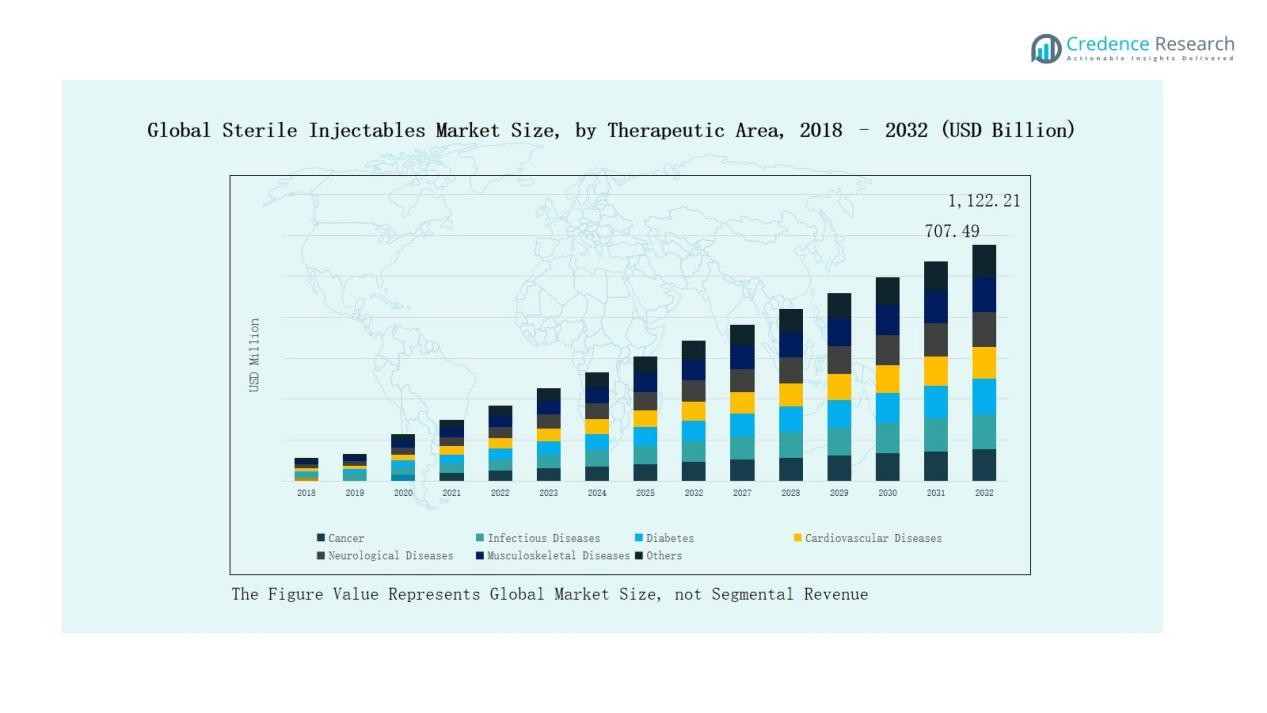

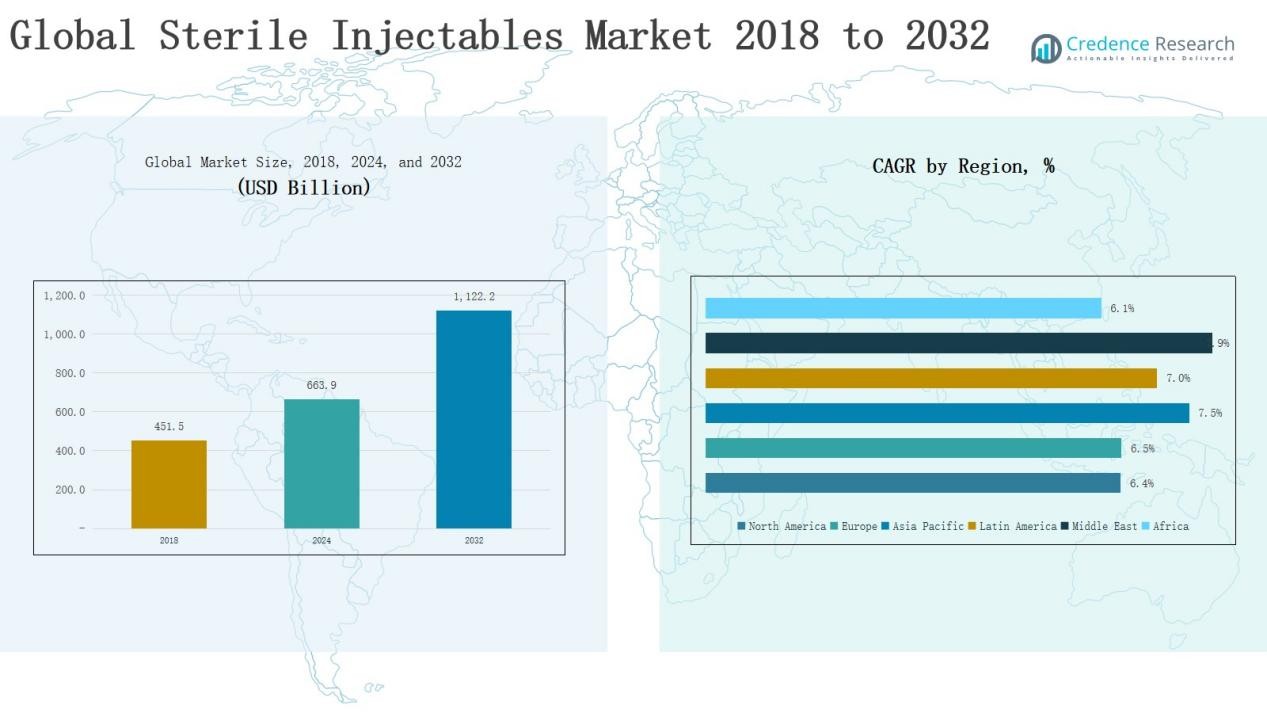

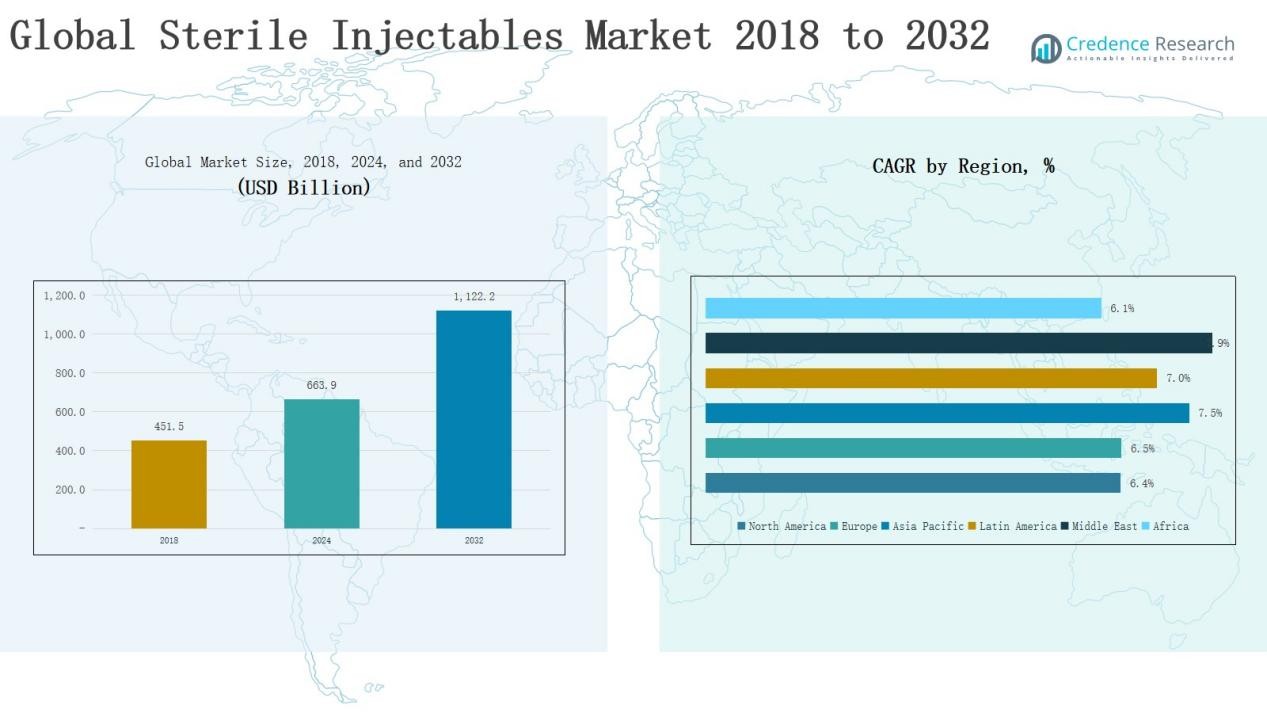

Global Sterile Injectables Market size was valued at USD 451.5 Billion in 2018 to USD 663.9 Billion in 2024 and is anticipated to reach USD 1,122.2 Billion by 2032, at a CAGR of 6.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sterile Injectables Market Size 2024 |

USD 663.9 Billion |

| Sterile Injectables Market, CAGR |

6.81% |

| Sterile Injectables Market Size 2032 |

USD 1,122.2 Billion |

What is the current market size for Global Sterile Injectables Market, and what is its projected size in 2032?

The Global Sterile Injectables Market is shaped by the strong presence of leading players such as Pfizer, Amgen, Sanofi, Johnson & Johnson, AstraZeneca, Eli Lilly, Merck, Baxter, and Mylan, each leveraging extensive biologics pipelines, oncology portfolios, and global distribution networks to strengthen competitiveness. These companies actively invest in R&D, biosimilar development, and strategic partnerships to expand market reach and improve affordability. Among regions, North America led the market in 2024 with a 33% share, supported by advanced healthcare infrastructure, favorable reimbursement systems, and rapid adoption of biologics and biosimilars. This dominance reflects the region’s strong clinical demand and innovation leadership.

Market Insights

Market Insights

- The Global Sterile Injectables Market grew from USD 451.5 Billion in 2018 to USD 663.9 Billion in 2024, projected to reach USD 1,122.2 Billion by 2032.

- Monoclonal antibodies led with 36% share in 2024, supported by oncology and autoimmune therapies, while vaccines (14%) and cytokines (12%) followed as strong growth drivers.

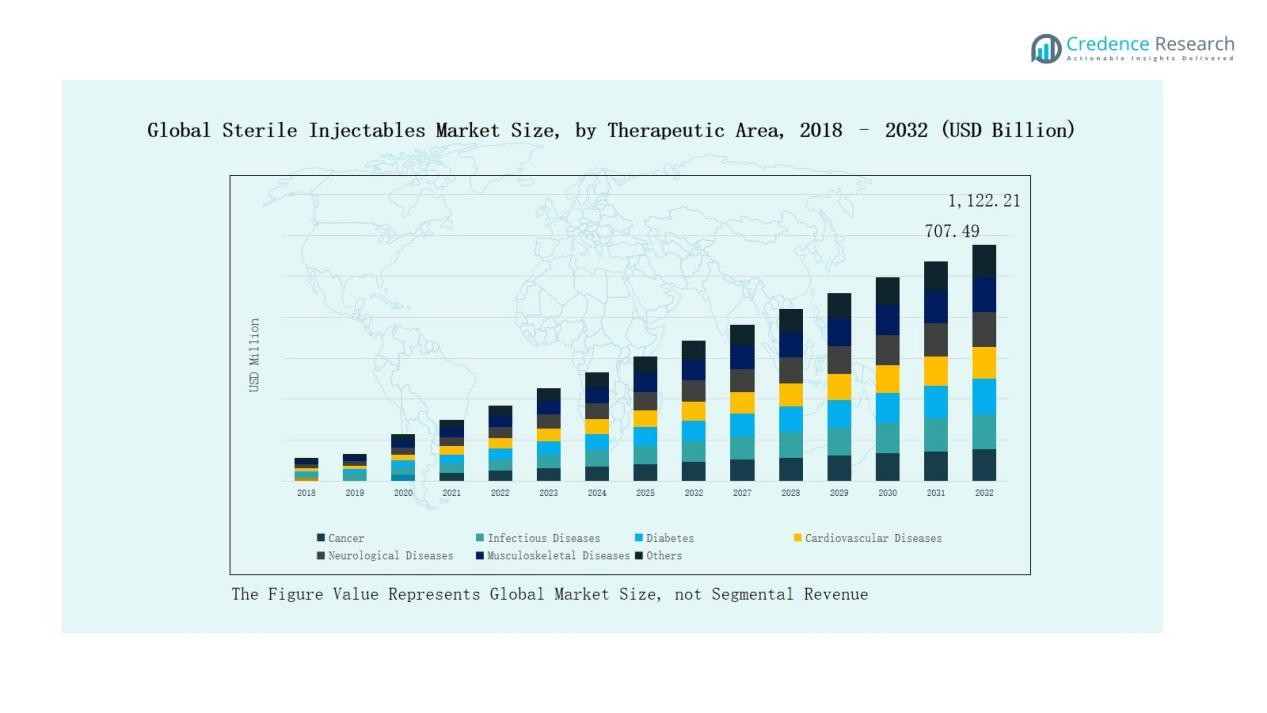

- By therapeutic area, cancer dominated with 38% share, followed by infectious diseases (21%) and diabetes (12%), highlighting the critical role of biologics and biosimilars.

- North America held 33% share in 2024, followed by Europe (28%) and Asia Pacific (23%), reflecting strong healthcare infrastructure and rising biologics adoption across regions.

- Leading companies including Pfizer, Amgen, Sanofi, Johnson & Johnson, AstraZeneca, Eli Lilly, Merck, Baxter, and Mylan continue to drive innovation, biosimilar development, and competitive expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Drug Type

In the Global Sterile Injectables Market, monoclonal antibodies lead with 36% share in 2024, driven by oncology and autoimmune treatments alongside strong biologics pipelines. Vaccines hold 14% share, supported by global immunization efforts and mRNA advancements. Cytokines represent 12%, while insulin accounts for 10% due to the diabetes burden. Immunoglobulin secures 9% share with demand in immunodeficiency therapies. Peptide hormones and peptide antibiotics capture 6% and 5% respectively, addressing endocrine and antimicrobial needs. Blood factors account for 4%, sustained by hemophilia treatments, while other injectables contribute 4% from anesthesia and diagnostic use.

For instance, Pfizer and BioNTech’s Comirnaty, the first mRNA COVID-19 vaccine to gain full FDA approval in 2021, had billions of doses administered globally, underscoring the vital role of sterile injectable vaccines in public health.

By Therapeutic Area

Cancer dominates with 38% share in 2024, fueled by high biologics adoption and targeted oncology therapies. Infectious diseases follow with 21%, benefiting from vaccine uptake and pandemic preparedness. Diabetes holds 12%, driven by insulin and GLP-1 analogs, while cardiovascular diseases capture 10% through anticoagulation and biologics. Neurological diseases account for 7%, musculoskeletal disorders 6%, and other conditions 6%, covering ophthalmology, dermatology, and gastrointestinal applications. Strong prevalence of chronic illnesses and rising biologics approvals reinforce growth across all therapeutic segments.

For instance, Merck’s immunotherapy drug Keytruda generated over $25 billion in revenue in 2023, making it one of the world’s top-selling oncology biologics.

Key Growth Drivers

Rising Prevalence of Chronic Diseases

The growing incidence of chronic conditions such as cancer, diabetes, and cardiovascular disorders fuels strong demand for sterile injectables. These therapies deliver rapid and targeted treatment, making them essential in critical care. Oncology dominates demand, supported by biologics like monoclonal antibodies. Increasing lifestyle-related diseases globally and a rising aging population further boost the need for injectable biologics and biosimilars. This trend positions sterile injectables as a vital treatment option across multiple therapeutic areas, ensuring sustained long-term market expansion.

For instance, Amgen’s Repatha® (evolocumab), an injectable biologic for lowering LDL cholesterol in cardiovascular patients, has been widely adopted, with over 1 Billion patients treated worldwide by 2021, reflecting the rising importance of sterile injectables in cardiovascular care.

Expanding Biologics and Biosimilars Pipeline

The global pipeline of biologics and biosimilars continues to expand, driving adoption of sterile injectables. Biopharmaceutical companies increasingly prioritize injectable formats for new drug launches, particularly in oncology, immunology, and infectious diseases. Patent expirations of blockbuster biologics create opportunities for biosimilars, making therapies more affordable and accessible. Regulatory approvals worldwide encourage rapid commercialization. As research shifts toward personalized medicine, injectable biologics remain the preferred choice for targeted therapies. This expanding portfolio strengthens sterile injectables’ market position across advanced and emerging economies.

For instance, in June 2025, Sandoz launched Wyost® and Jubbonti®, the first interchangeable biosimilars for Amgen’s Xgeva® and Prolia® (denosumab) in the U.S., enhancing access to lower-cost osteoporosis and oncology therapies.

Government and Institutional Support

Government healthcare initiatives and institutional support programs play a critical role in the adoption of sterile injectables. National immunization drives, pandemic preparedness policies, and funding for biologics infrastructure accelerate demand. Public-private collaborations foster innovation and expand access to injectable therapies in low- and middle-income countries. Favorable reimbursement frameworks in developed markets further enhance adoption. Increased investment in cold-chain infrastructure and hospital supply networks also ensures reliable distribution. This strong policy backing reinforces sterile injectables’ position as a frontline treatment modality.

Key Trends & Opportunities

Shift Toward Targeted and Personalized Therapies

Personalized medicine is reshaping the sterile injectables market, with biologics and biosimilars tailored to individual patient needs. Growth in precision oncology, immunotherapies, and advanced neurological treatments underscores this trend. Pharmaceutical companies are focusing on developing injectable therapies with higher efficacy and fewer side effects. The rising use of biomarkers and genetic profiling supports adoption. This shift creates opportunities for drug developers to expand their product portfolios while offering patients improved outcomes, making personalized sterile injectables a major opportunity segment.

For instance, Bristol Myers Squibb’s Opdivo (nivolumab), a sterile injectable immunotherapy, is prescribed based on PD-L1 biomarker testing to treat cancers such as non-small cell lung cancer, enabling greater treatment precision.

Growth of Contract Manufacturing and Outsourcing

Contract manufacturing organizations (CMOs) and outsourcing partnerships are gaining traction as companies seek cost-efficient sterile injectable production. Rising complexity of biologics manufacturing encourages outsourcing to specialized providers with advanced capabilities. CMOs support scalability, compliance, and global distribution, which are critical for meeting surging demand. Emerging markets, especially in Asia-Pacific, present opportunities for low-cost manufacturing hubs. Strategic collaborations also help biopharma firms reduce capital expenditure and speed up product launches. This trend positions outsourcing as a long-term growth enabler for the market.

For instance, Lonza Group, a Swiss-based CMO, has expanded its capabilities in cell and gene therapy production to support biopharma firms in scaling advanced therapies efficiently.

Key Challenges

High Production and Development Costs

Sterile injectable manufacturing requires sophisticated infrastructure, strict compliance, and advanced aseptic processes, leading to high production costs. Biopharmaceutical firms face significant upfront investments in facilities, quality systems, and skilled labor. Developing biologics and biosimilars adds additional R&D expenses. These costs increase financial risk, especially for smaller players, and limit affordability in low-income markets. The challenge of balancing safety, efficacy, and cost-efficiency remains critical. Manufacturers must adopt process innovations and partnerships to mitigate expenses while maintaining high quality standards.

Supply Chain and Cold-Chain Constraints

Sterile injectables require stringent handling, with cold-chain infrastructure vital for biologics and vaccines. Disruptions in global supply chains, as seen during the COVID-19 pandemic, exposed vulnerabilities in distribution networks. Many regions still lack adequate storage and logistics capabilities, limiting access to essential injectables. Maintaining temperature integrity during transport is a major challenge, especially in emerging markets. Infrastructure gaps and high logistical costs restrict equitable access. Strengthening global supply networks and investing in advanced cold-chain solutions remain essential to address these hurdles.

Regulatory and Safety Compliance Barriers

The sterile injectables market faces complex and evolving regulatory requirements that demand strict compliance. Manufacturers must adhere to Good Manufacturing Practices (GMP), sterility assurance protocols, and continuous quality monitoring. Meeting these requirements increases operational complexity and costs. Regulatory delays in approvals often slow time-to-market for new drugs. Additionally, product recalls or contamination issues can damage brand reputation and patient safety. Navigating diverse international standards poses further challenges for global players. Ensuring consistent compliance while accelerating innovation remains a pressing concern.

Regional Analysis

North America

North America leads the global sterile injectables market, accounting for 33% share in 2024 with revenues of USD 218.37 billion, rising from USD 135.92 billion in 2018. Strong healthcare infrastructure, high biologics adoption, and advanced research pipelines sustain regional dominance. The U.S. drives most demand, supported by favorable reimbursement systems and rapid uptake of biosimilars. A robust presence of key pharmaceutical companies further strengthens growth. With a 6.4% CAGR, the market is projected to reach USD 359.11 billion by 2032, highlighting North America’s continued leadership in oncology, immunology, and chronic disease treatments.

Europe

Europe captures 28% share in 2024, valued at USD 182.58 billion, up from USD 112.65 billion in 2018. Rising demand for biologics, vaccines, and insulin injectables drives regional growth. Germany, France, and the UK serve as key contributors, supported by strong government healthcare initiatives and widespread adoption of biosimilars. Strategic collaborations with research institutions enhance innovation in sterile injectables. With a projected 6.5% CAGR, the market is set to reach USD 300.53 billion by 2032, positioning Europe as a consistent growth hub with balanced demand across oncology, diabetes, and cardiovascular therapies.

Asia Pacific

Asia Pacific holds 23% share in 2024, worth USD 157.56 billion, growing from USD 94.21 billion in 2018, and is the fastest-growing region with a 7.5% CAGR. Rising chronic disease prevalence, expanding healthcare infrastructure, and increasing biosimilar penetration drive demand. China, India, and Japan lead the market, supported by government programs and rising investments in biologics manufacturing. Affordable production capabilities and a growing patient pool fuel regional expansion. By 2032, the market is forecasted to reach USD 280.55 billion, establishing Asia Pacific as a key driver of global growth in sterile injectables.

Latin America

Latin America accounts for 8% share in 2024, valued at USD 52.98 billion, up from USD 32.86 billion in 2018. Growth is supported by rising diabetes and cardiovascular cases, alongside government initiatives to expand healthcare access. Brazil dominates regional demand, followed by Argentina, due to strong hospital networks and improved biologics availability. Local partnerships and imports support market expansion across smaller economies. With a 7.0% CAGR, the market is expected to reach USD 90.90 billion by 2032, making Latin America a steadily expanding region in sterile injectables.

Middle East

The Middle East contributes 5% share in 2024, valued at USD 30.72 billion, rising from USD 18.04 billion in 2018, and shows strong momentum with the highest regional CAGR of 7.9%. GCC countries and Israel drive demand through advanced healthcare systems and increased biologics adoption. Rising government spending on healthcare modernization and expansion of cold-chain facilities strengthen growth. Oncology and infectious disease treatments remain primary demand drivers. By 2032, the market is expected to reach USD 56.22 billion, positioning the Middle East as a rapidly expanding market within the global sterile injectables landscape.

Africa

Africa represents 3% share in 2024, valued at USD 21.71 billion, up from USD 14.30 billion in 2018, with growth driven by improving healthcare infrastructure and rising prevalence of infectious diseases. South Africa and Egypt serve as leading contributors, while other regions depend heavily on imports of biologics and vaccines. Limited access and high costs challenge broader adoption, yet government and NGO-led health initiatives are expanding reach. The market is projected to grow at a 6.1% CAGR, reaching USD 34.90 billion by 2032, highlighting steady but constrained progress in the region.

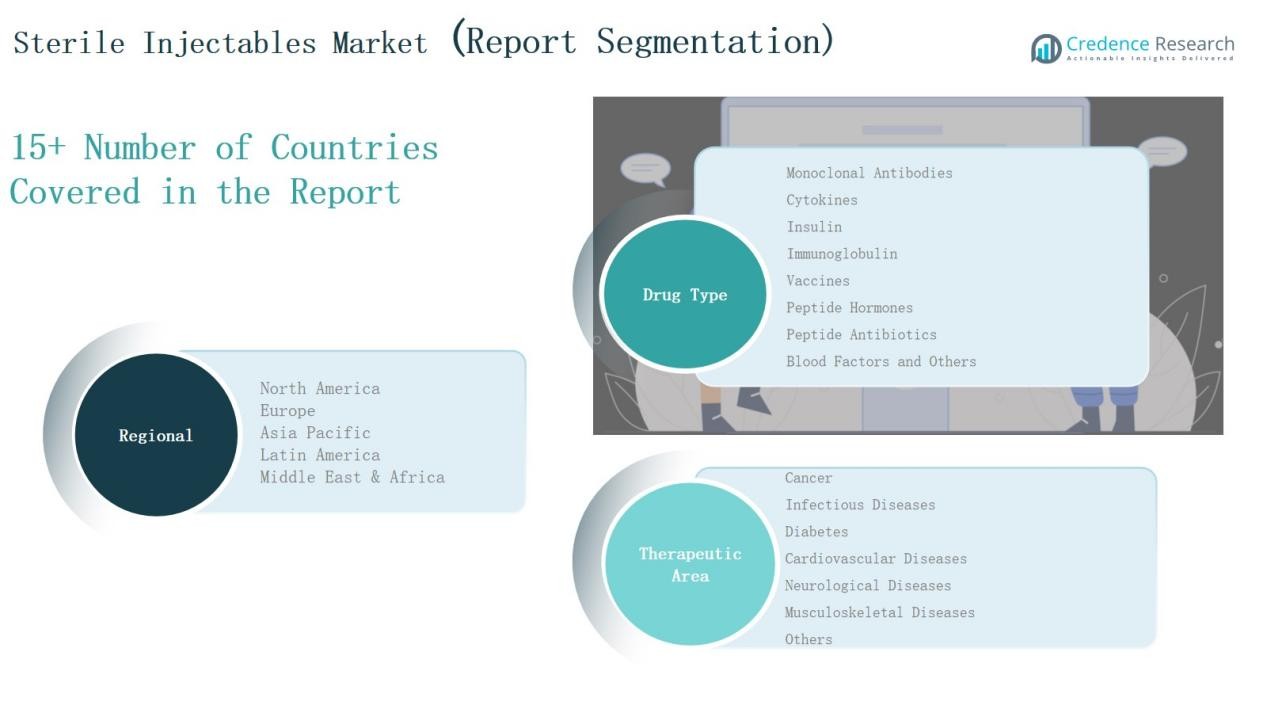

Market Segmentations:

By Drug Type

- Monoclonal Antibodies

- Cytokines

- Insulin

- Immunoglobulin

- Vaccines

- Peptide Hormones

- Peptide Antibiotics

- Blood Factors

- Others

By Therapeutic Area

- Cancer

- Infectious Diseases

- Diabetes

- Cardiovascular Diseases

- Neurological Diseases

- Musculoskeletal Diseases

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Global Sterile Injectables Market is highly competitive, characterized by the presence of leading multinational pharmaceutical companies alongside regional players. Key participants such as Pfizer, Amgen, Sanofi, Johnson & Johnson, AstraZeneca, Eli Lilly, Merck, Baxter, and Mylan dominate with strong portfolios in biologics, vaccines, and oncology therapies. These companies leverage extensive R&D pipelines, strategic acquisitions, and global distribution networks to maintain leadership. Patent expirations of blockbuster biologics are encouraging biosimilar development, intensifying competition and expanding access in cost-sensitive markets. Regional manufacturers, particularly in Asia-Pacific, are gaining momentum by offering affordable biosimilars and contract manufacturing services, further reshaping the competitive dynamics. Strategic collaborations with contract manufacturing organizations and technology partnerships also play a vital role in sustaining supply efficiency and innovation. The market reflects moderate concentration, with top players holding significant revenue share, while smaller firms compete in niche therapeutic areas and emerging regions, creating a dynamic and evolving competitive landscape.

Key Players

- Amgen Limited

- AstraZeneca plc

- Baxter International, Inc.

- Eli Lilly and Company

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Mylan N.V.

- Pfizer, Inc.

- Sanofi

- Nichi-Iko Pharmaceutical Co.

- Other Key Players

Recent Developments

- In March 2025, Eli Lilly, Merck, and Purdue University launched the Young Institute Pharmaceutical Manufacturing Consortium to advance sterile injectable manufacturing through AI, robotics, and aseptic processing innovation.

- In March 2025, Mallinckrodt and Endo announced the merger of their generics and sterile injectables businesses, forming Par Health, with a planned spin-off in Q4 2025.

- In May 2025, Amneal partnered with Apiject to install dedicated manufacturing lines supporting Apiject’s advanced delivery systems in the U.S., with annual production capacity scalable up to 400 Billion units to aid emergency and commercial readiness.

- In January 2025, Akums Drugs & Pharmaceuticals initiated the development of a new facility dedicated to lyophilized and sterile dosage manufacturing, with a focus on injectables and biologics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Therapeutic Area and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biologics and biosimilars will continue to drive sterile injectable adoption.

- Oncology and immunology therapies will remain the largest contributors to injectable growth.

- Vaccines and infectious disease treatments will see consistent demand from global health initiatives.

- Contract manufacturing organizations will gain a stronger role in large-scale production.

- Personalized and targeted therapies will expand the use of advanced injectable formulations.

- Emerging markets will witness rapid growth due to healthcare infrastructure improvements.

- Cold-chain logistics and supply chain investments will enhance global accessibility of injectables.

- Strategic partnerships and acquisitions will remain central to competitive positioning.

- Regulatory harmonization efforts will streamline biosimilar approvals and accelerate market entry.

- Technological advances in delivery systems will improve patient compliance and treatment outcomes.

Market Insights

Market Insights