Market Overview:

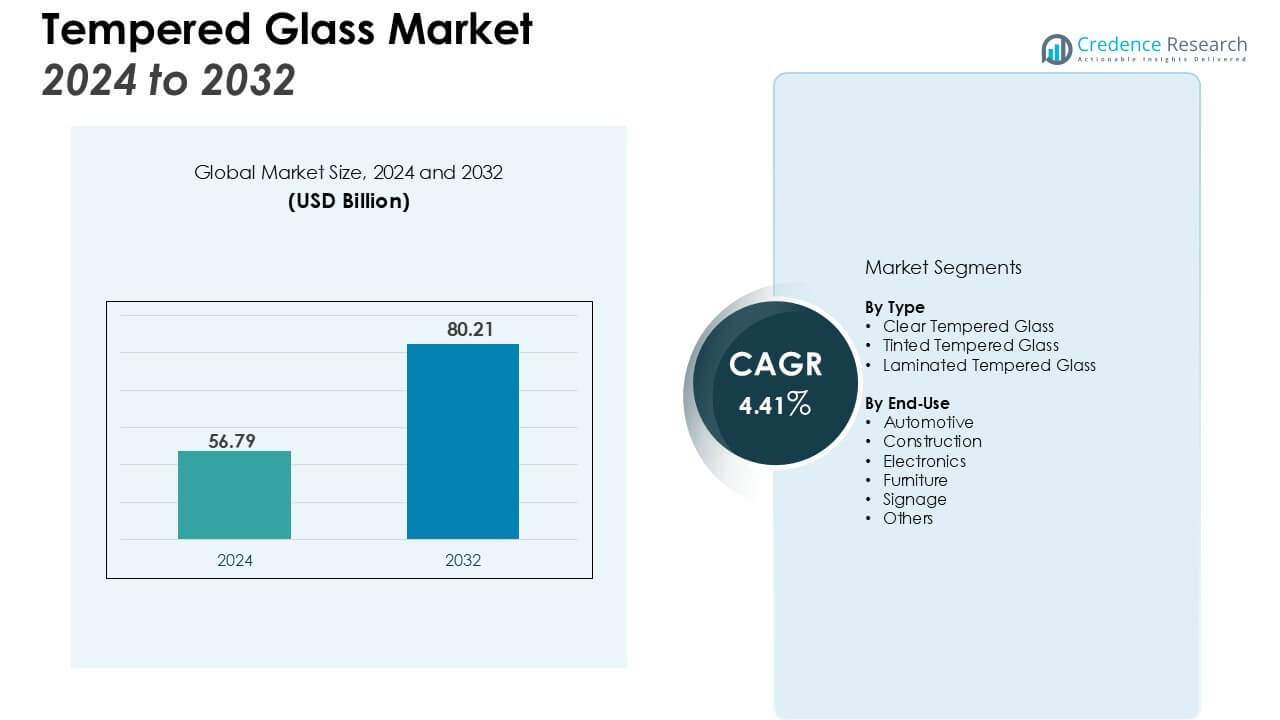

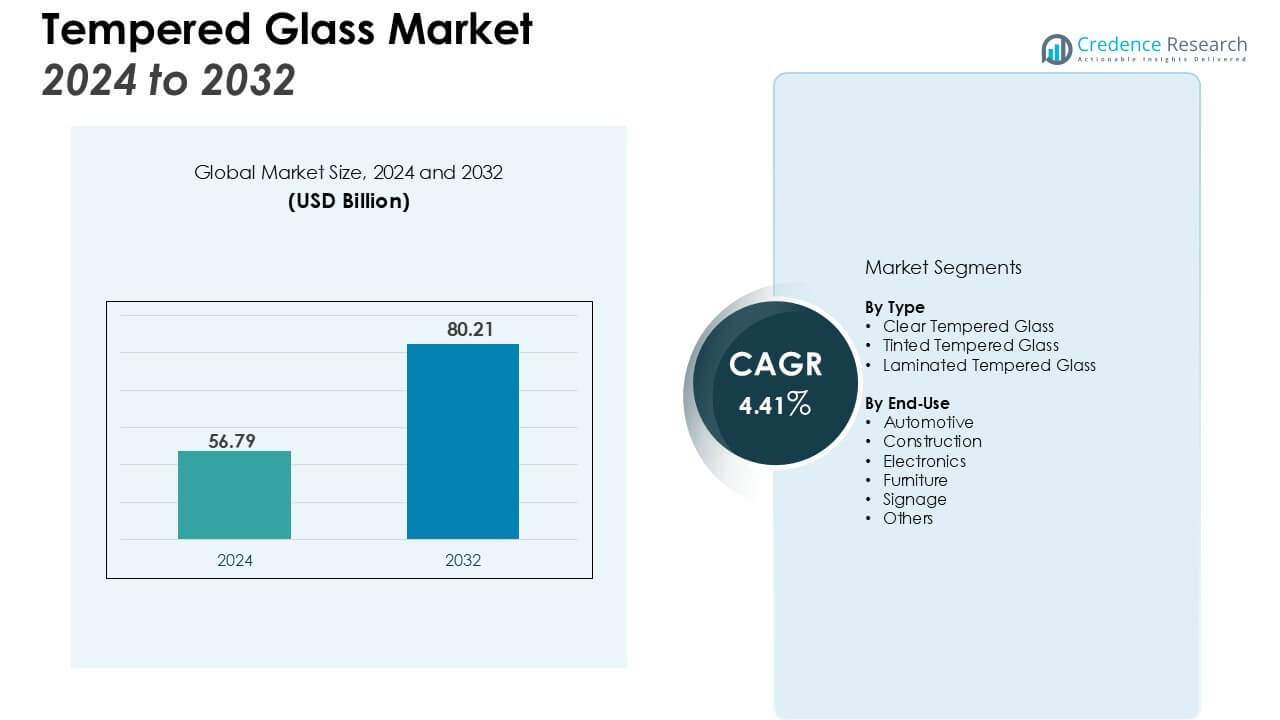

The Tempered Glass Market size was valued at USD 56.79 billion in 2024 and is anticipated to reach USD 80.21 billion by 2032, at a CAGR of 4.41% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tempered Glass Market Size 2024 |

USD 56.79 Billion |

| Tempered Glass Market, CAGR |

4.41% |

| Tempered Glass Market Size 2032 |

USD 80.21 Billion |

Key drivers of the tempered glass market include the growing adoption of energy-efficient and durable glass solutions in the construction sector, particularly for windows, doors, and facades. In the automotive industry, tempered glass is increasingly used in windshields, side windows, and sunroofs due to its ability to withstand high impact and temperature variations. Moreover, the rise in consumer demand for smartphones, tablets, and other electronic devices is further fueling the market’s growth, as tempered glass is used in screen protection.

Regionally, North America holds the largest market share, driven by technological advancements in the automotive and construction sectors. Europe follows closely, with high demand for tempered glass in commercial buildings and automotive manufacturing. The Asia Pacific region is expected to witness the highest growth, fueled by rapid industrialization, urbanization, and increasing infrastructure development in countries like China and India.

Market Insights:

Market Insights:

- The Tempered Glass Market was valued at USD 56.79 billion in 2024 and is expected to reach USD 80.21 billion by 2032, with a CAGR of 4.41%.

- The automotive industry drives demand, with tempered glass used in windshields and side windows for its durability and safety.

- The construction sector boosts growth due to the increasing need for energy-efficient and durable tempered glass in buildings.

- Consumer electronics fuel market growth as tempered glass is favored for its durability and scratch resistance in devices like smartphones.

- Technological advancements in glass manufacturing enhance strength, clarity, and energy efficiency, expanding its market potential.

- North America leads the market with a 40% share, driven by demand in automotive and construction sectors and green building initiatives.

- Asia Pacific represents 25% of the market and is experiencing rapid growth due to urbanization and rising demand in construction and automotive.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand in the Automotive Industry

The automotive industry is a significant driver for the tempered glass market. It is used extensively in vehicle windshields, side windows, and sunroofs due to its strength, durability, and safety features. Tempered glass enhances vehicle safety by reducing the risk of sharp edges when broken. As the automotive industry continues to innovate, there is a rising preference for lightweight yet strong materials, further driving demand for tempered glass.

For instance, Magna International’s ClearView vision technology, which debuted on the Ram 2500 and 3500 trucks in January 2023, is a first-of-its-kind system that can display up to three camera views simultaneously.

Expanding Construction Sector and Infrastructure Development

The construction and infrastructure sectors are key contributors to the growth of the tempered glass market. With increasing urbanization, tempered glass is becoming a popular choice for windows, facades, and partitions in both residential and commercial buildings. Its ability to withstand high temperatures, its aesthetic appeal, and its contribution to energy efficiency in buildings make it a preferred material for architects and builders.

For instance, Saint-Gobain’s acquisition of The Bailey Group of Companies in June 2024 integrated a team of approximately 690 employees into its Canadian operations, strengthening its position in the light construction market.

Rise in Consumer Electronics Demand

The growing demand for consumer electronics, including smartphones, tablets, and televisions, is fueling the use of tempered glass for screen protection. The need for more durable and scratch-resistant screens has prompted manufacturers to adopt tempered glass as a key component in electronic device design. As consumer preferences shift towards higher-quality, long-lasting products, tempered glass continues to see increased application in the electronics sector.

Technological Advancements in Glass Manufacturing

Technological innovations in glass manufacturing techniques have significantly enhanced the properties of tempered glass, including improved strength, clarity, and energy efficiency. Advances in production processes, such as chemical tempering and heat treatment, have made tempered glass more cost-effective and versatile. These developments have expanded its use across various industries, further boosting market growth.

Market Trends:

Sustainability and Energy Efficiency in Building Design

The trend toward sustainable and energy-efficient building designs is boosting the demand for tempered glass. Increasingly, architects and builders are incorporating energy-efficient materials into their projects, and tempered glass plays a crucial role in improving thermal insulation. Its ability to reflect heat while allowing natural light to enter makes it ideal for modern green buildings. As energy conservation becomes a central focus in construction projects worldwide, tempered glass is being increasingly chosen for windows and facades. This trend aligns with global environmental goals, particularly in regions with stringent energy regulations.

For instance, Guardian Glass has developed its ClimaGuard 55 coated glass, which helps residential window manufacturers meet new energy standards.

Technological Advancements in Smart Glass Integration

Another key trend shaping the tempered glass market is the integration of smart glass technologies. Smart tempered glass, which can change its transparency or tint in response to external conditions or user input, is gaining popularity in both residential and commercial applications. This technology is especially valuable in automotive and architectural designs, where temperature control and light management are essential. The growing demand for smart homes and offices further supports the adoption of this innovative glass type. The ability of smart tempered glass to enhance user comfort and reduce energy consumption makes it a promising trend in the market.

For instance, the manufacturing of tempered smart glass involves advanced thermal processes. Companies like Guardian Glass produce heat-treated glass by heating panes to over 600 degrees Celsius and then rapidly cooling them, a process that creates the durability and safety features essential for automotive smart glass applications.

Market Challenges Analysis:

High Production Costs and Manufacturing Complexities

One of the main challenges in the tempered glass market is the high production cost associated with its manufacturing process. The heat treatment and chemical tempering processes required to enhance the glass’s strength can be expensive and energy-intensive. This increases the overall cost of production, making tempered glass less competitive compared to other types of glass in certain applications. Manufacturers must invest in advanced technology and skilled labor, which can further add to operational costs. These high production costs can limit its widespread adoption, especially in price-sensitive markets.

Vulnerability to Breakage and Safety Concerns

Despite its strength and durability, tempered glass remains susceptible to breakage under certain conditions. While it shatters into small, rounded pieces rather than sharp shards, the possibility of breakage still presents safety concerns, particularly in high-impact applications. Additionally, the risk of thermal stress cracking due to extreme temperature fluctuations can compromise the material’s integrity. These vulnerabilities may deter some industries from fully embracing tempered glass, particularly in applications where safety is paramount. Addressing these issues with more advanced, robust materials could present a challenge for manufacturers aiming to improve the glass’s overall reliability.

Market Opportunities:

Growing Demand for Smart and Sustainable Construction Materials

A significant opportunity in the tempered glass market lies in the growing demand for smart and sustainable construction materials. The increasing adoption of energy-efficient and eco-friendly building designs creates a favorable environment for tempered glass, particularly in green buildings. Its thermal insulation properties and ability to contribute to energy savings make it a preferred choice for modern construction. As governments and organizations around the world focus on sustainability, the demand for materials like tempered glass is expected to rise, especially in regions with stringent energy regulations. This trend provides manufacturers with ample opportunities to expand their product offerings in the building and construction sector.

Expansion of Automotive and Consumer Electronics Applications

The automotive and consumer electronics industries present vast growth opportunities for the tempered glass market. In the automotive sector, the shift toward lightweight vehicles and advanced safety features continues to drive the need for stronger, more durable materials like tempered glass. Similarly, the increasing use of smartphones, tablets, and other electronic devices fuels demand for tempered glass in screen protection applications. As technology continues to advance, manufacturers can capitalize on these opportunities by developing innovative tempered glass solutions tailored to the needs of these rapidly evolving industries.

Market Segmentation Analysis:

By Type:

The tempered glass market is segmented by type, including clear tempered glass, tinted tempered glass, and laminated tempered glass. Clear tempered glass holds the largest market share, driven by its widespread use in the automotive and construction industries. It offers superior strength and safety features, making it ideal for windows, facades, and automotive applications. Tinted tempered glass is gaining popularity in automotive and architectural applications due to its aesthetic appeal and ability to reduce glare. Laminated tempered glass is commonly used in areas requiring enhanced safety and sound insulation, such as skylights and security windows.

For instance, Guardian Industries manufactures tempered glass that meets the ASTM C 1048 standard, requiring a surface compression of over 10,000 PSI.

By End-Use:

The tempered glass market is segmented by end-use into automotive, construction, electronics, and others. The automotive sector dominates the market due to the increasing adoption of tempered glass for windshields, side windows, and sunroofs. It offers impact resistance, safety, and thermal stability. The construction sector follows closely, with tempered glass being used in windows, facades, and partitions for both residential and commercial buildings. In electronics, tempered glass is used for screen protection in smartphones, tablets, and televisions. As consumer demand for durable and scratch-resistant screens rises, tempered glass remains a key material in the electronics market. Other applications include furniture, signage, and decorative glass.

For instance, in the electronics industry, Corning’s Gorilla Glass Armor sets a high standard for screen durability. This specialized glass achieves a scratch resistance level of 8 on the Mohs scale of mineral hardness.

Segmentations:

By Type:

- Clear Tempered Glass

- Tinted Tempered Glass

- Laminated Tempered Glass

By End-Use:

- Automotive

- Construction

- Electronics

- Furniture

- Signage

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America accounts for 40% of the global tempered glass market, leading the demand in both automotive and construction sectors. The growing emphasis on vehicle safety and lightweight materials drives the adoption of tempered glass in automotive windows and sunroofs. In the construction industry, there is an increasing preference for energy-efficient and durable glass for windows, facades, and building interiors. The region’s strong focus on green building initiatives and renewable energy investments further boosts the market’s growth. North America’s dominance is expected to continue as sustainability and safety remain key priorities.

Europe

Europe holds a 30% market share in the global tempered glass market, with significant growth driven by the automotive and architectural sectors. The automotive industry benefits from strict safety regulations, increasing the demand for tempered glass in vehicle windows and sunroofs. In the construction industry, there is rising demand for tempered glass in commercial and residential buildings, particularly as energy-efficient building designs gain popularity. Countries such as Germany, the UK, and France are investing heavily in green building projects, which will further enhance the demand for tempered glass in the region.

Asia Pacific

Asia Pacific represents 25% of the global tempered glass market and is expected to witness the fastest growth during the forecast period. Rapid urbanization and expanding manufacturing industries in countries like China, India, and Japan are driving the demand for tempered glass in construction and automotive applications. The growing construction of residential and commercial buildings in urban areas is increasing the need for high-performance glass materials. As the region also sees growth in automotive production and consumer electronics, the tempered glass market in Asia Pacific is poised for significant expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The tempered glass market is highly competitive, with major players such as Saint-Gobain, AGC Glass, and Guardian Industries leading the sector. These companies focus on technological innovations, product diversification, and strategic partnerships to strengthen their market position. They invest in research and development to improve the strength, clarity, and energy efficiency of tempered glass, catering to automotive, construction, and electronics sectors. Smaller players are expanding their presence by offering customized solutions, particularly in niche markets like laminated and tinted glass. E-commerce platforms are playing a key role in broadening distribution channels, while competitive pricing, product quality, and efficient manufacturing processes remain essential for success.

Recent Developments:

- In July 2025, AGC Inc. announced that Sumitomo Bakelite Co., Ltd. agreed to acquire its polycarbonate business.

- In July 2025, Nippon Sheet Glass launched a new production line at its St Helens, UK facility to manufacture the Pilkington UK’s Texture glass range.

Report Coverage:

The research report offers an in-depth analysis based on Type, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for tempered glass is expected to increase with the rising adoption of energy-efficient building materials in the construction industry.

- Automotive manufacturers will continue to drive market growth due to the increasing use of tempered glass in vehicle windows, windshields, and sunroofs.

- The trend toward smart glass technologies will create new opportunities for tempered glass in both residential and commercial applications.

- Consumer electronics, particularly smartphones, tablets, and wearables, will maintain strong demand for tempered glass for screen protection.

- Technological advancements in manufacturing processes will improve production efficiency and reduce costs, making tempered glass more accessible to diverse industries.

- Growing awareness of environmental sustainability will encourage the use of recycled tempered glass in construction and other applications.

- The Asia Pacific region will experience the highest growth, driven by urbanization, increasing infrastructure projects, and the expansion of automotive and electronics industries.

- Expansion of e-commerce platforms will open new sales channels for tempered glass products, especially in emerging markets.

- The rise in demand for durable, scratch-resistant materials in everyday products will further fuel the growth of tempered glass in various sectors.

- Increased focus on safety standards in both automotive and construction sectors will continue to support the widespread use of tempered glass.

Market Insights:

Market Insights: