Market Overview

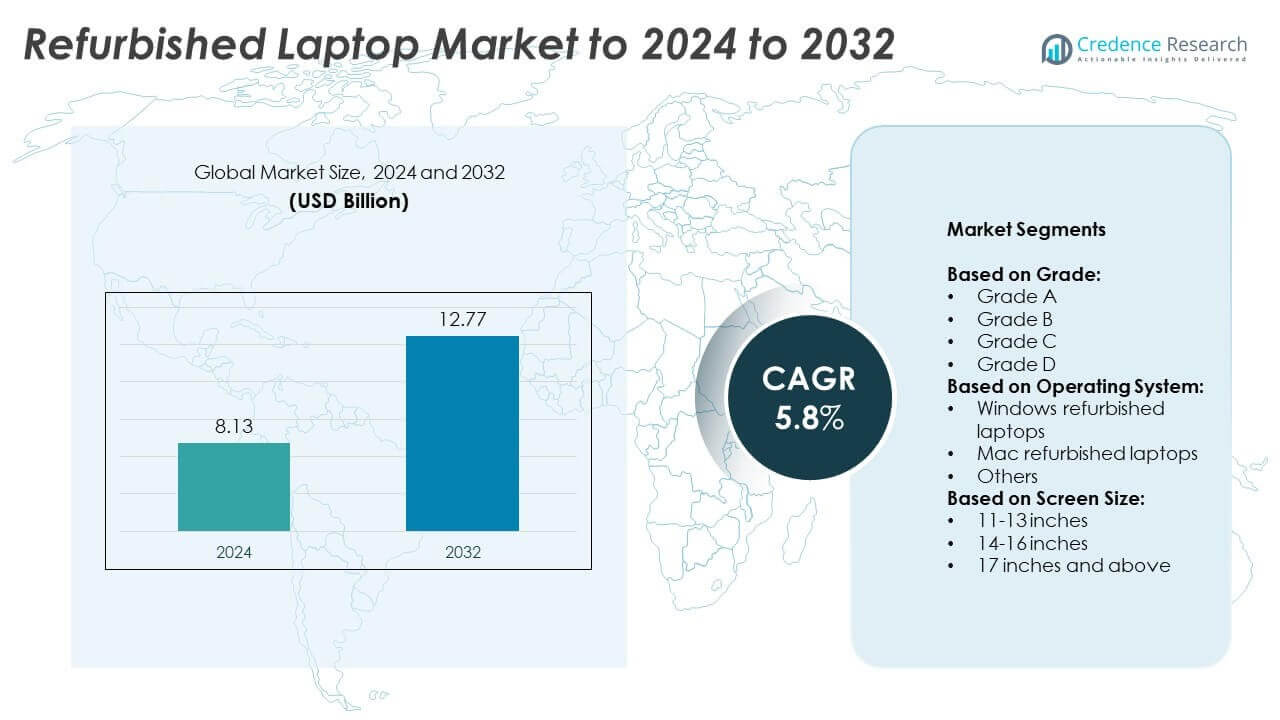

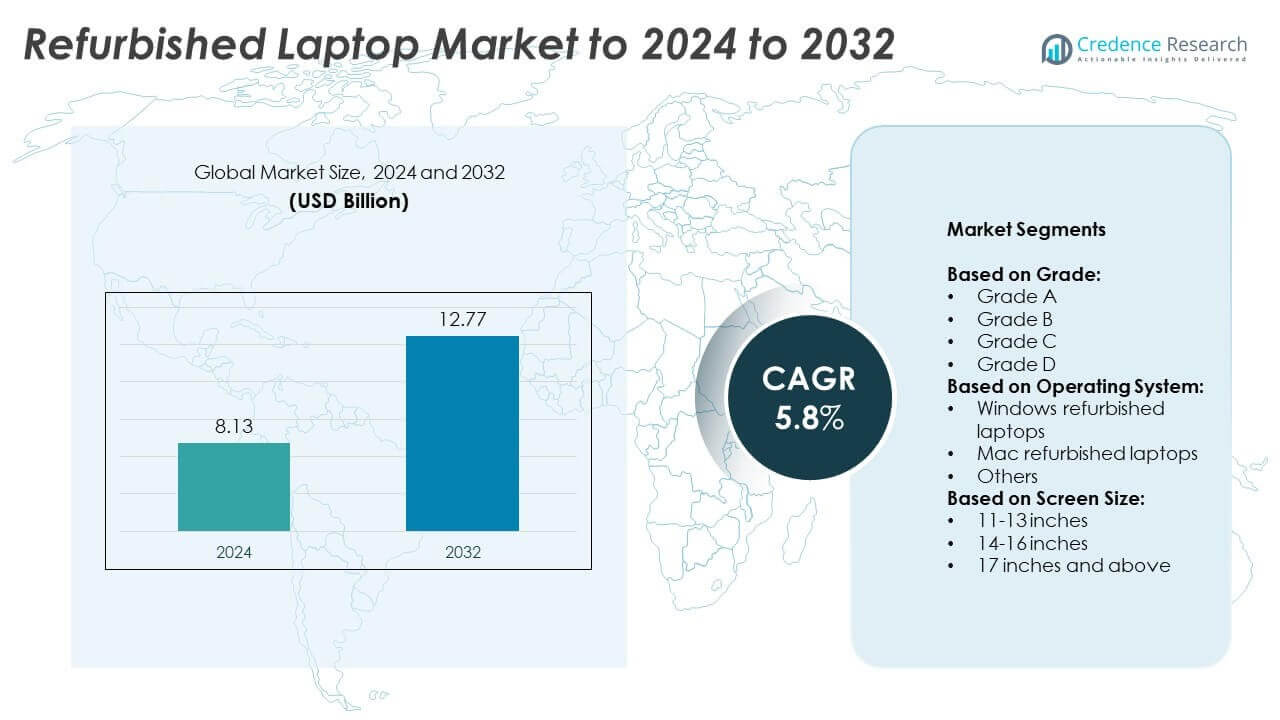

The Refurbished Laptop Market size was valued at USD 8.13 billion in 2024 and is anticipated to reach USD 12.77 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Refurbished Laptop Market Size 2024 |

USD 8.13 Billion |

| Refurbished Laptop Market, CAGR |

5.8% |

| Refurbished Laptop Market Size 2032 |

USD 12.77 Billion |

The refurbished laptop market is shaped by leading players such as Refurbees, Dell Refurbished, Back Market, Laptop Outlet, HP Renew, Amazon Renewed, Apple Certified Refurbished, Lenovo Outlet, and Walmart Renewed. These companies drive growth through certified refurbishment programs, quality assurance, and competitive pricing strategies that attract both enterprises and individual buyers. Their focus on sustainability and circular economy initiatives further strengthens market adoption. Regionally, North America led the market in 2024 with a 34% share, supported by strong enterprise demand, mature e-commerce channels, and robust consumer trust in certified refurbished products.

Market Insights

Market Insights

- The refurbished laptop market was valued at USD 8.13 billion in 2024 and is projected to reach USD 12.77 billion by 2032, growing at a CAGR of 5.8%.

- Cost-effectiveness, sustainability, and growing supply from corporate IT refresh cycles are the main drivers supporting the adoption of refurbished laptops across enterprises, education, and consumer markets.

- The market is witnessing strong trends such as the expansion of e-commerce channels, rising demand in the education sector, and increased consumer trust in certified refurbishment programs offering warranties and quality checks.

- The competitive landscape includes global refurbishers and OEM-certified programs competing on quality standards, pricing, and customer service, with players focusing on sustainability and partnerships to strengthen their presence.

- North America led with 34% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while Grade A laptops dominated by holding over 45% share due to their near-new quality and strong demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The refurbished laptop market is segmented into Grade A, Grade B, Grade C, and Grade D devices. Grade A laptops held the dominant share in 2024, accounting for over 45% of the market. Their appeal lies in near-new condition, minimal cosmetic wear, and reliable performance at lower prices than new models. Growing adoption by businesses, educational institutions, and cost-sensitive consumers further supports demand. Grade A products benefit from extended warranties and strict quality checks, making them a preferred choice over lower-grade categories that show visible wear or limited lifespan.

- For instance, Back Market recorded over €2.157 billion in gross merchandise volume in 2023, marking a 32% increase over the previous year. As of September 2024, the company was operating across 18 countries and had accumulated 15 million customers globally, with nearly 30 million devices sold since its inception.

By Operating System

The operating system segment includes Windows refurbished laptops, Mac refurbished laptops, and others. Windows refurbished laptops dominated in 2024 with nearly 60% share. Their strong position stems from widespread enterprise adoption, compatibility with diverse software ecosystems, and high availability in secondary markets. Businesses replacing fleets of devices contribute significantly to supply. Demand is also fueled by cost-conscious students and professionals requiring budget-friendly yet reliable systems. While Mac laptops hold strong appeal among design-focused users, Windows remains the mainstream choice due to affordability, accessibility, and large-scale deployment across multiple industries.

- For instance, Apple accounted for 56% of the global refurbished smartphone shipments in 2024, up from 51% in 2023, showing consumer confidence in premium refurbished brands which also influences refurbished laptop demand.

By Screen Size

Screen size segmentation covers 11–13 inches, 14–16 inches, and 17 inches and above. The 14–16 inches category commanded the largest share in 2024, exceeding 50% of the market. This size balances portability with productivity, appealing to professionals, students, and remote workers seeking multitasking efficiency. Higher demand for mid-range models, which are widely available in corporate refurbishments, supports this segment’s dominance. Rising popularity of hybrid work and e-learning continues to drive preference for mid-size screens, as they provide better ergonomics compared to smaller displays while being lighter and more practical than larger 17-inch laptops.

Key Growth Drivers

Cost-Effectiveness Driving Adoption

Affordability is the primary growth driver in the refurbished laptop market, with devices priced 20–40% lower than new models. This cost advantage attracts price-sensitive consumers, small businesses, and educational institutions. Buyers gain access to branded laptops with warranties at reduced costs, making refurbished products highly competitive against new low-cost alternatives. The growing global demand for budget-friendly computing solutions amid inflationary pressures continues to strengthen this driver, ensuring widespread adoption across both developed and emerging economies.

- For instance, Apple’s refurbishment and recycling programs, along with supplier facility programs, have shown significant sustainability efforts. Through its Zero Waste Program with suppliers, Apple helped divert 600,000 metric tons of waste from landfills in 2024.

Sustainability and Circular Economy Push

The rising focus on sustainability is another key driver of the refurbished laptop market. Governments, enterprises, and consumers are increasingly prioritizing eco-friendly practices that extend product lifecycles and reduce e-waste. Refurbished laptops directly support circular economy initiatives by reusing devices instead of discarding them. Companies offering certified refurbishment also highlight reduced carbon footprints, appealing to environmentally conscious buyers. Global regulations on e-waste management and consumer awareness of sustainability benefits are accelerating adoption, making this a critical factor shaping long-term industry growth.

- For instance, E-waste global stats: in 2019, 53.6 million tons of e-waste were generated globally, of which only ~17.4% was recycled.

High Supply from Corporate Upgrades

Corporate IT refresh cycles act as a major growth driver, generating consistent supply for the refurbished laptop market. Enterprises often replace laptops every three to five years to ensure compatibility with new technologies. This replacement cycle creates a steady flow of high-quality Grade A devices available for refurbishment. Many businesses also partner with certified refurbishers to monetize older assets. As hybrid work models expand, organizations are investing in newer models, further fueling the availability of enterprise-grade laptops in the refurbished market.

Key Trends & Opportunities

Rising Demand in Education Sector

Education remains a key opportunity for the refurbished laptop market, with institutions prioritizing affordable digital access. Governments and NGOs are increasingly supporting initiatives to provide low-cost laptops to students. Refurbished devices meet this demand by offering reliable computing at scale. The rise of online learning platforms, especially in emerging economies, accelerates adoption. Bulk procurement by schools and colleges not only boosts market growth but also creates awareness of refurbished products as viable alternatives to new laptops in academic settings.

- For instance, Back Market reports over 17 million customers, has sold over 30 million devices, and connects with professional refurbishers across 18 markets.

Growth of Online Refurbishment Platforms

Digital marketplaces are emerging as a significant trend, reshaping how refurbished laptops are sold. E-commerce channels, including certified refurbisher websites and global marketplaces, provide greater transparency and trust through quality guarantees, return policies, and extended warranties. Consumers benefit from easy comparisons, wider selections, and doorstep delivery. This trend is particularly strong among younger, tech-savvy buyers who prioritize convenience. The rapid growth of online platforms is expanding the customer base and strengthening global demand, positioning e-commerce as a key opportunity for industry players.

- For instance, Circular Computing cites approximately 316 kg of CO₂ avoided per remanufactured laptop, a figure supported by its BSI Kitemark certification for remanufactured laptops. Additionally, the company highlights that by avoiding new manufacturing, over 190,000 litres of water are saved for each device.

Key Challenges

Perception of Quality and Reliability

One major challenge in the refurbished laptop market is consumer skepticism about quality and reliability. Many buyers still associate refurbished products with defects or short lifespans compared to new devices. Limited awareness of certification standards and inconsistent refurbishing practices across markets fuel this perception. While Grade A products often deliver near-new performance, negative experiences with uncertified sellers can damage consumer trust. Overcoming this barrier requires strict quality assurance, warranties, and better communication from vendors to ensure long-term acceptance.

Competition from Low-Cost New Laptops

Another key challenge comes from low-cost new laptops that compete directly with refurbished models. Entry-level devices, often priced competitively by global brands, appeal to cost-conscious consumers who prefer new warranties and latest specifications. These new alternatives reduce the price advantage of refurbished products, particularly in emerging markets. To counter this, refurbishers must emphasize added value, including premium brand appeal, durability, and sustainability benefits. Without differentiation, the refurbished laptop market risks losing price-sensitive buyers to inexpensive new models.

Regional Analysis

North America

North America accounted for the largest share of the refurbished laptop market in 2024, representing 34%. The region’s strong presence is driven by high adoption of certified refurbished products among enterprises, schools, and individual consumers. Strict quality standards, along with established refurbishment programs from major OEMs and retailers, enhance consumer trust. The U.S. leads demand, supported by a mature e-commerce sector that facilitates large-scale distribution. Growth in sustainable IT practices and rising awareness of e-waste reduction continue to strengthen market penetration across both commercial and educational sectors in this region.

Europe

Europe captured 28% of the refurbished laptop market share in 2024, making it a key regional contributor. The region’s leadership in sustainability and strict e-waste directives significantly boost adoption of refurbished electronics. Countries such as Germany, the U.K., and France drive demand through enterprise procurement and educational programs. The presence of certified refurbishers and strong government-backed recycling initiatives enhance reliability and consumer confidence. Growing interest in affordable computing solutions, coupled with regulatory emphasis on circular economy models, continues to support market growth across Europe. Online sales channels further amplify accessibility and awareness among consumers.

Asia Pacific

Asia Pacific held a 25% share of the refurbished laptop market in 2024, supported by fast-growing demand in emerging economies. Rising digitalization in India, China, and Southeast Asia, combined with price-sensitive consumer bases, drives strong adoption. The expansion of e-learning and hybrid work culture significantly contributes to growth. Availability of devices through global refurbishment chains and local players has improved product accessibility. However, the region faces challenges due to fragmented quality standards. With growing middle-class populations and government focus on digital inclusion, Asia Pacific is expected to remain one of the fastest-expanding markets.

Latin America

Latin America represented 7% of the refurbished laptop market share in 2024, supported by increasing affordability needs and rising digital transformation. Countries like Brazil and Mexico are major contributors, driven by adoption in the education and public sectors. Limited purchasing power in many parts of the region makes refurbished laptops an attractive alternative to new devices. Growth is further encouraged by expanding online retail platforms and vendor initiatives offering warranties. However, limited awareness and inconsistent quality assurance hinder broader adoption. Despite these challenges, the region shows steady demand growth as technology access widens.

Middle East and Africa

The Middle East and Africa collectively accounted for 6% of the refurbished laptop market in 2024. Growing digital inclusion efforts and cost-conscious consumer demand support adoption. Markets such as South Africa, the UAE, and Saudi Arabia are driving regional growth, with refurbished laptops gaining traction in both educational and small business applications. However, the region remains in early stages of development due to limited certified refurbisher networks and weaker regulatory frameworks. Increasing availability through e-commerce platforms and partnerships with global suppliers are gradually enhancing access, making the region a promising but developing market.

Market Segmentations:

By Grade:

- Grade A

- Grade B

- Grade C

- Grade D

By Operating System:

- Windows refurbished laptops

- Mac refurbished laptops

- Others

By Screen Size:

- 11-13 inches

- 14-16 inches

- 17 inches and above

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The refurbished laptop market is shaped by leading players such as Refurbees, Dell Refurbished, Back Market, Laptop Outlet, TechSoup, HP Renew, TigerDirect Refurbished, CarMax, Apple Certified Refurbished, Refurb.io, Newegg Renewed, Walmart Renewed, Amazon Renewed, Lenovo Outlet, Arrow Direct, and Refurb That. These companies compete by offering certified products, quality testing, and extended warranties to build consumer trust. Their focus remains on delivering affordability, reliability, and sustainability while leveraging e-commerce platforms to expand global reach. Many firms invest in refurbishing standards and certifications to counter consumer skepticism about product durability. The competitive landscape is further defined by strategic partnerships with OEMs, growing supply from enterprise IT upgrades, and rising demand across education and small business sectors. Online sales channels, coupled with transparent return policies, play a critical role in strengthening brand positioning. Collectively, these players are shaping the market with innovations in refurbishment processes, customer service, and sustainable product offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Refurbees

- Dell Refurbished

- Back Market

- Laptop Outlet

- TechSoup

- HP Renew

- TigerDirect Refurbished

- CarMax

- Apple Certified Refurbished

- io

- Newegg Renewed

- Walmart Renewed

- Amazon Renewed

- Lenovo Outlet

- Arrow Direct

- Refurb That

Recent Developments

- In 2024, Apple continued to promote the environmental benefits of extending device lifecycles, aligning its refurbished program with broader corporate environmental, social, and governance (ESG) targets.

- In 2023, HP introduced its refurbished program in India. The initial focus was on providing laptops to businesses via a subscription model, with plans to expand transactional sales to retail and small businesses.

- In 2023, CarMax collaborated with UVeye Inc. to use automated vehicle inspection technology, creating more detailed and AI-driven condition reports for its wholesale auction business.

Report Coverage

The research report offers an in-depth analysis based on Grade, Operating System, Screen Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The refurbished laptop market will expand steadily with rising global digital adoption.

- Sustainability initiatives will continue to drive demand through e-waste reduction efforts.

- Certified refurbishment programs will enhance consumer trust and reliability.

- Online platforms will dominate sales channels with transparent warranties and policies.

- Education sector demand will rise due to affordable device accessibility.

- Corporate IT refresh cycles will ensure a consistent supply of high-grade devices.

- Emerging markets will show strong growth from cost-sensitive buyers.

- Competition from low-cost new laptops will remain a key challenge.

- Improved quality standards will reduce consumer hesitation toward refurbished products.

- Partnerships between OEMs and refurbishers will strengthen long-term industry growth.

Market Insights

Market Insights