Market Overview

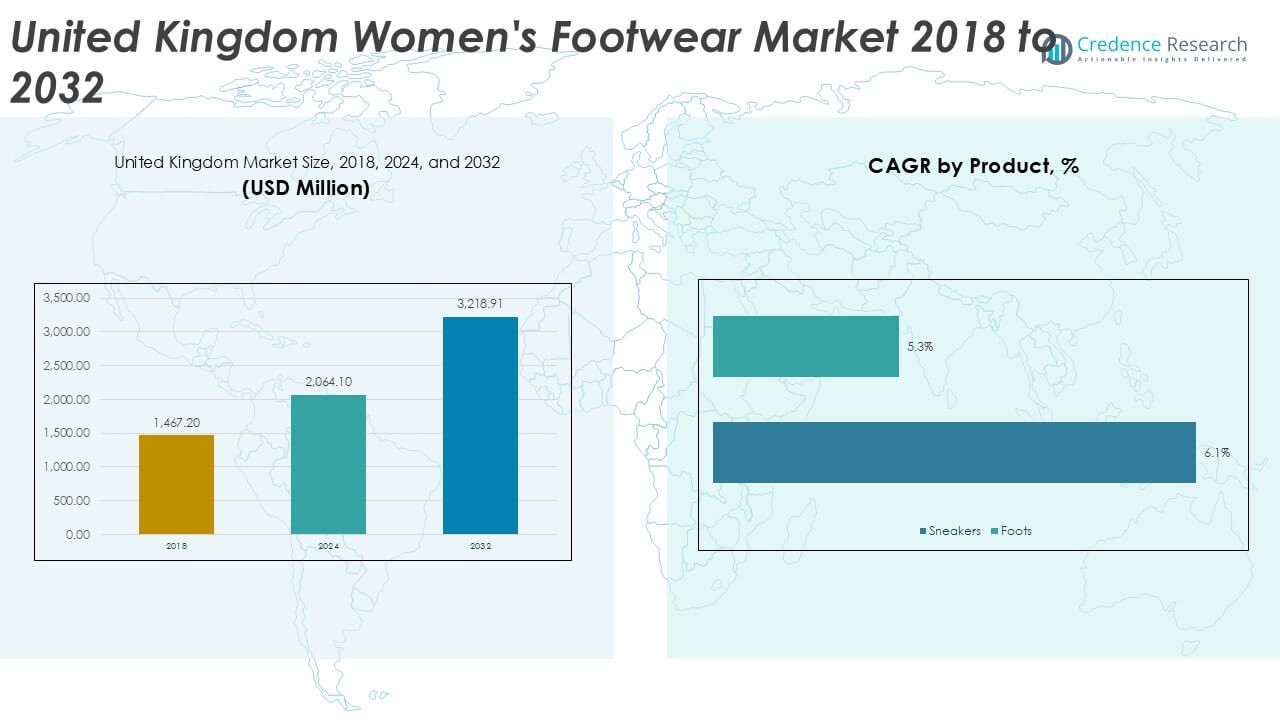

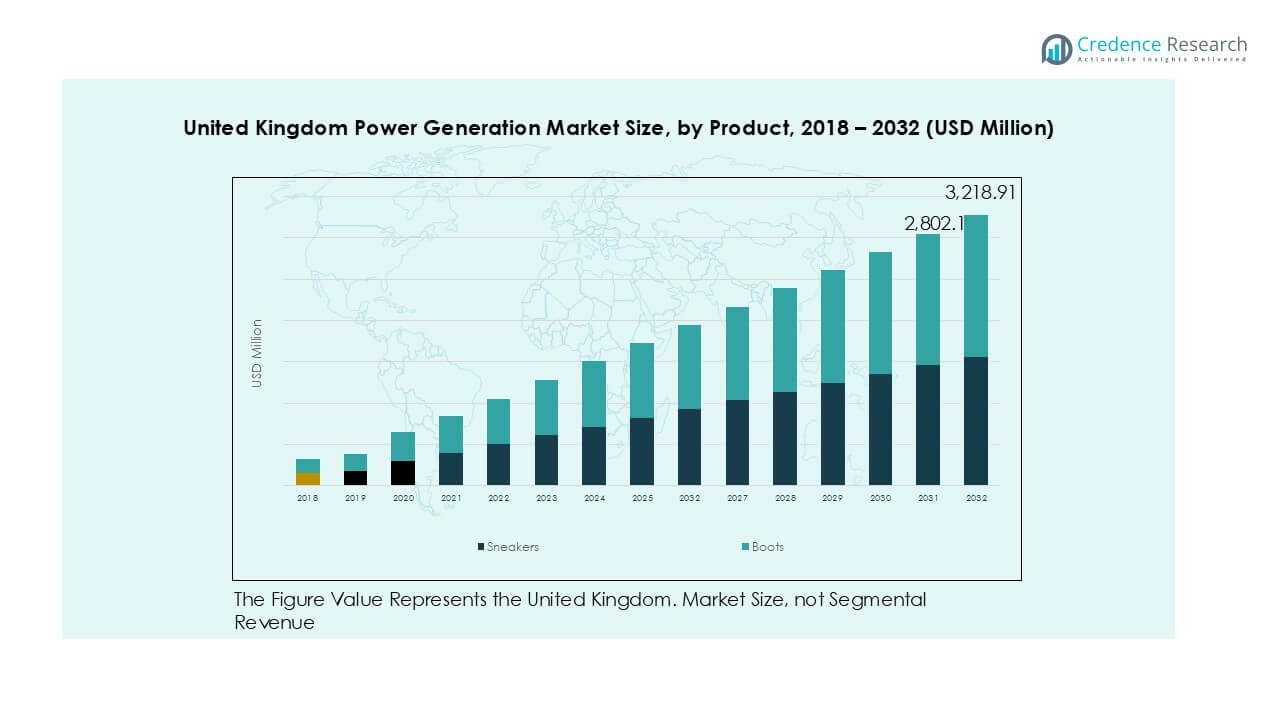

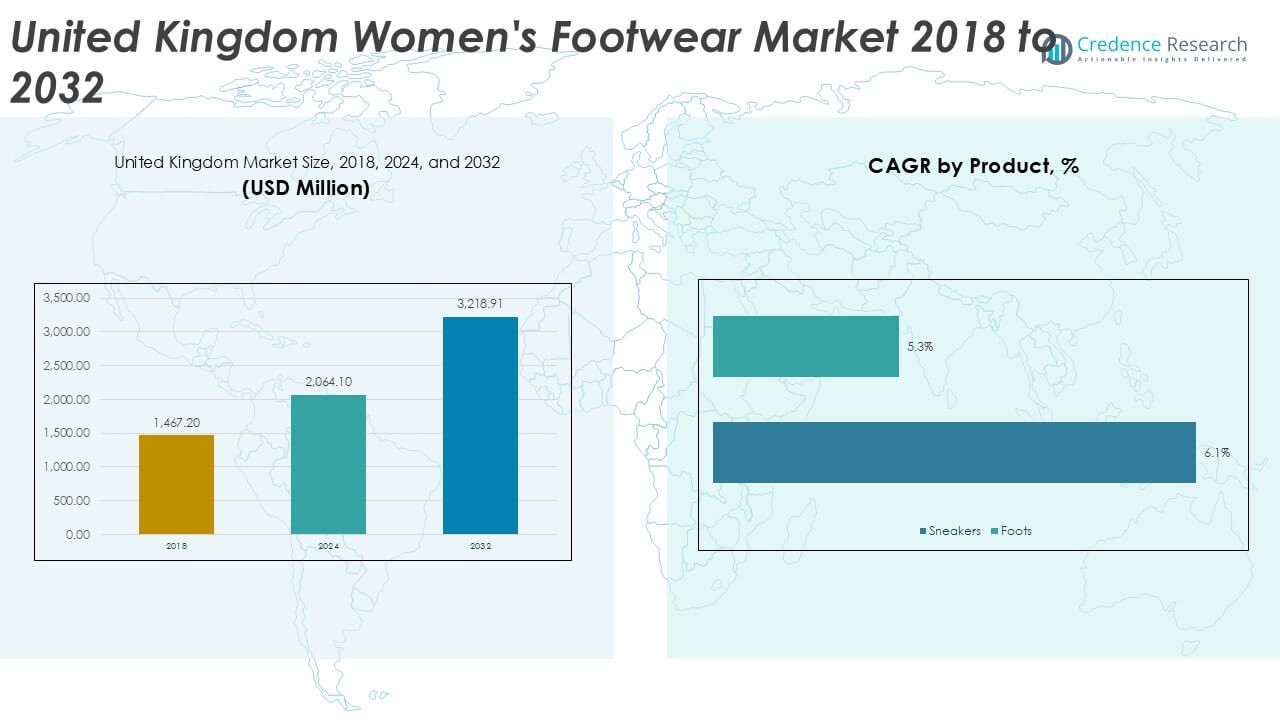

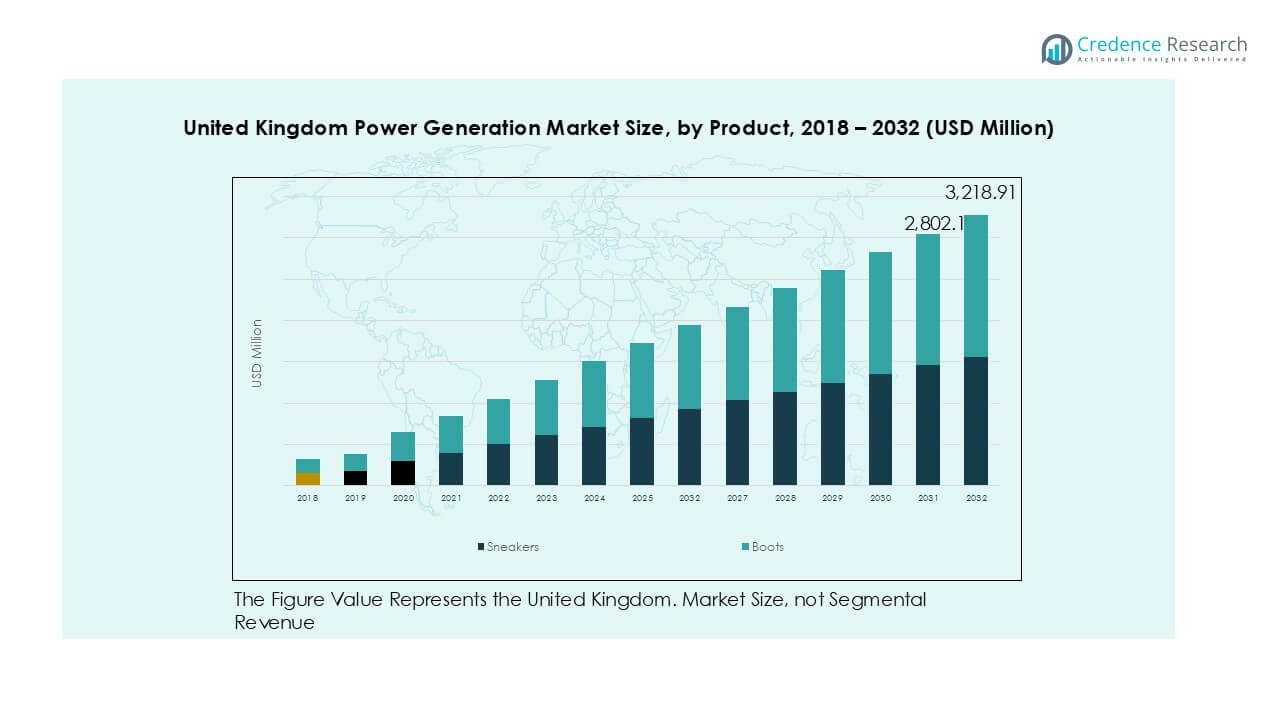

The United Kingdom Women’s Footwear market size was valued at USD 1,467.20 million in 2018, growing to USD 2,064.10 million in 2024, and is anticipated to reach USD 3,218.91 million by 2032, at a CAGR of 5.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| United Kingdom Women’s Footwear Market Size 2024 |

USD 2,064.10 Million |

| United Kingdom Women’s Footwear Market, CAGR |

5.72% |

| United Kingdom Women’s Footwear Market Size 2032 |

USD 3,218.91 Million |

The United Kingdom women’s footwear market is shaped by leading players such as Adidas AG, Clarks, Converse Inc., Dr. Martens Group, Marks & Spencer, and BIRKENSTOCK Digital GmbH. These companies collectively drive innovation across sneakers, boots, and premium leather footwear, catering to both mass and niche consumer segments. Adidas and Converse dominate the sneaker category through athleisure trends, while Clarks and Marks & Spencer retain strong positions in formal and everyday wear. Dr. Martens and Fairfax and Favor Ltd. strengthen the premium and heritage segments with iconic designs. Regionally, England accounted for 65% of the total market share in 2024, supported by urban centers and high consumer spending. Scotland held 15%, with strong demand for outdoor and winter boots, while Wales and Northern Ireland each captured 10%, driven by growing online adoption and cross-border shopping. This concentration highlights England’s dominance, complemented by steady growth in the smaller regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The United Kingdom women’s footwear market was valued at USD 2,064.10 million in 2024 and is projected to reach USD 3,218.91 million by 2032, growing at a CAGR of 5.72%.

- Rising demand for sneakers, especially athletic sneakers holding over 30% share, and premium leather boots is driving market expansion, supported by lifestyle changes and fashion-conscious consumers.

- Sustainability and eco-friendly materials such as recycled textiles and vegan leather are key trends, while omni-channel strategies enhance accessibility across both offline and online platforms.

- The market is highly competitive, with Adidas AG, Clarks, Converse Inc., Dr. Martens Group, and BIRKENSTOCK Digital GmbH leading through innovation, brand heritage, and diversified portfolios, alongside pressure from fast fashion retailers.

- Regionally, England leads with 65% share in 2024, followed by Scotland at 15%, while Wales and Northern Ireland each hold 10%, reflecting strong urban demand and growing online adoption across smaller regions.

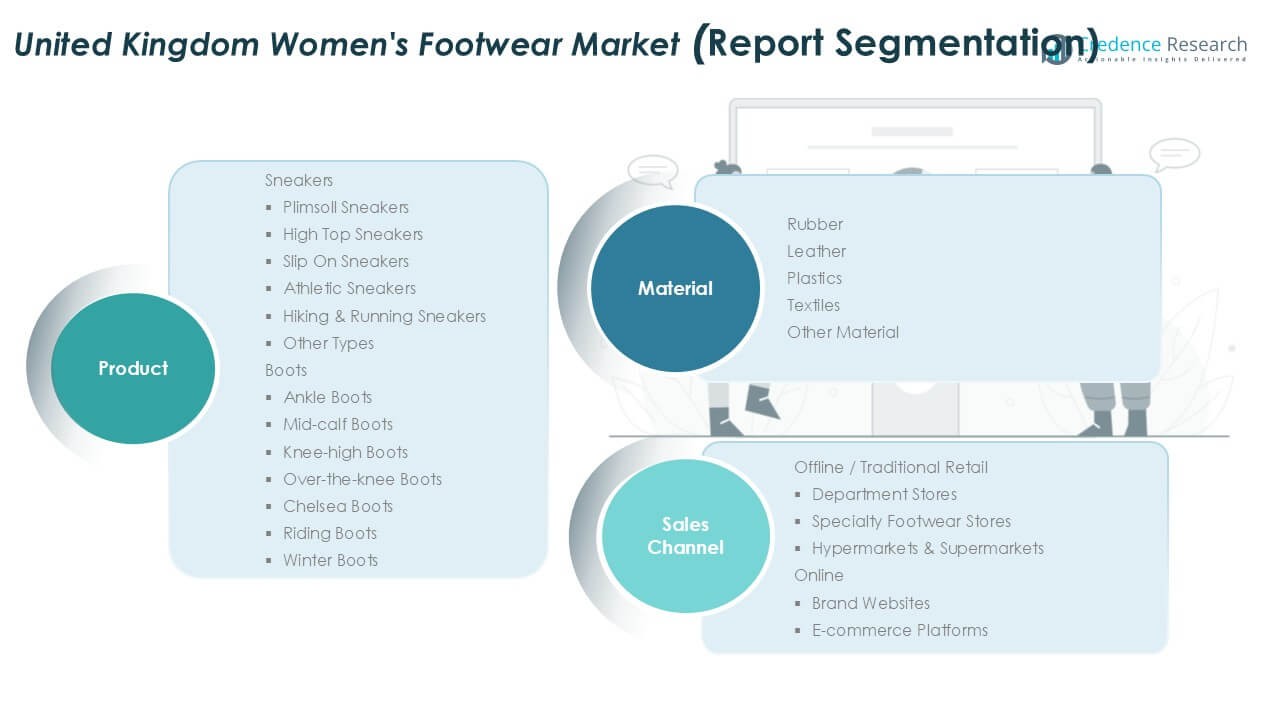

Market Segmentation Analysis:

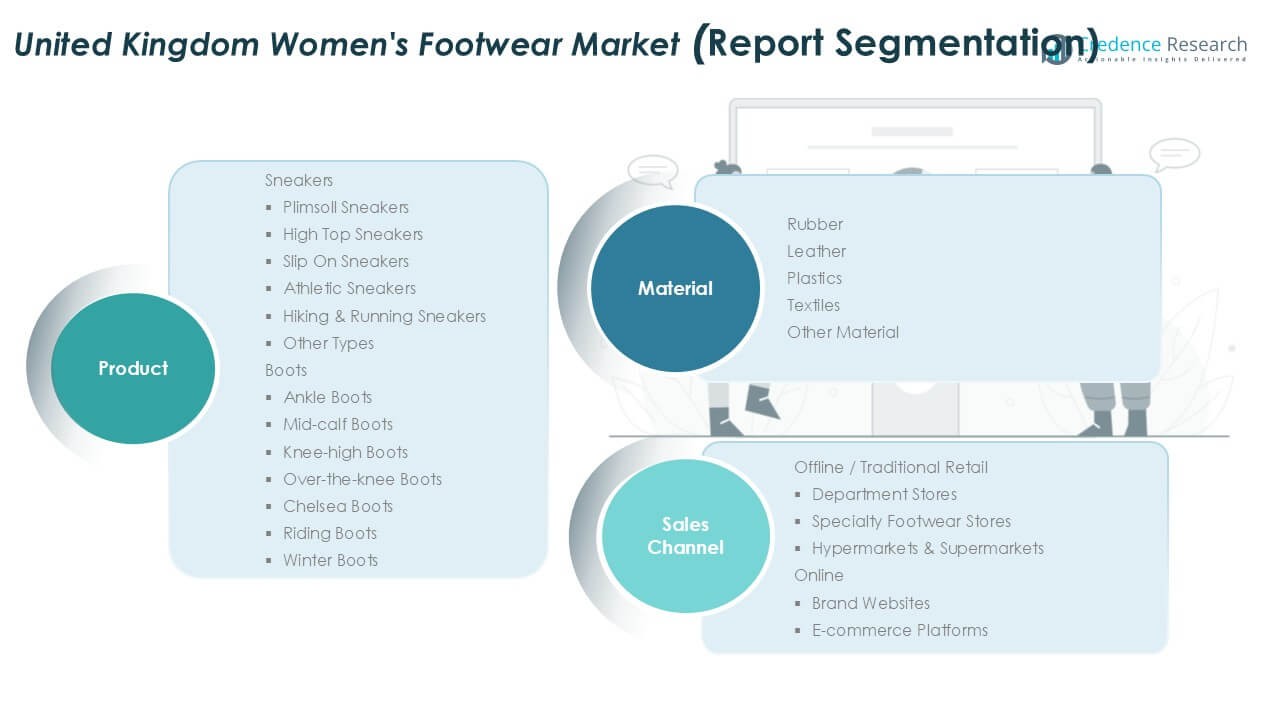

By Product

In the United Kingdom women’s footwear market, sneakers represent the most dynamic product category, with athletic sneakers leading the sub-segment, holding more than 30% share in 2024. Rising health awareness, gym memberships, and athleisure fashion trends are driving this demand. Plimsoll and slip-on sneakers also maintain popularity due to comfort and casual use, while high-top and hiking sneakers serve niche needs. Boots remain a strong secondary segment, with ankle boots dominating due to their versatility across formal and casual wear. Seasonal demand for winter boots further supports the boots category’s steady growth.

- For instance, in fiscal year 2023, Nike’s EMEA region (Europe, Middle East, and Africa) generated $13.4 billion in revenue, driven by strong growth in its footwear category. This sales growth reflects the overall expansion of the athleisure market in Europe, where the UK is a significant segment.

By Material

Leather continues to dominate the material segment, accounting for nearly 40% share in 2024, supported by consumer preference for durability, style, and premium appeal. Leather footwear remains a staple for both sneakers and boots, appealing to the mid-to-high-income demographic. Rubber holds a solid share in sportswear and waterproof boots, while textiles are increasingly adopted in casual sneakers due to lightweight designs. Plastic-based materials, often used in cost-efficient or fast-fashion footwear, retain moderate demand. Other materials, including eco-friendly alternatives, are gaining traction as sustainability trends reshape consumer purchasing choices in the UK.

- For instance, Dr. Martens manufactures a small portion of its products, including the “Made in England” collection, at its UK facility in Wollaston. The vast majority of its boots are made overseas. In 2025, Allbirds began selling a new “Remix” sneaker that features recycled textiles and foam, though most of its shoes use a combination of sustainable materials like eucalyptus tree fiber, merino wool, and sugarcane.

By Sales Channel

Offline retail remains dominant in the United Kingdom women’s footwear market, capturing over 60% share in 2024. Department stores lead within this channel, offering wide product ranges and trusted brands, while specialty footwear stores cater to style-conscious buyers. Hypermarkets and supermarkets also contribute by providing affordability and convenience. Online sales are expanding quickly, driven by brand websites and major e-commerce platforms, which together capture rising digital demand. Enhanced logistics, free returns, and exclusive online collections have made e-commerce a fast-growing segment, appealing to younger and tech-savvy consumers seeking ease of access and variety.

Key Growth Drivers

Rising Influence of Athleisure and Casual Fashion

The growing preference for athleisure and casual fashion has significantly shaped the women’s footwear market in the United Kingdom. Consumers are increasingly favoring sneakers and casual shoes over traditional formal footwear, driven by changing work cultures, remote working trends, and greater focus on comfort. Athletic sneakers and slip-on models have become everyday essentials, blending performance with fashion appeal. The younger demographic, in particular, is driving this shift by adopting fashion that is versatile and suitable for multiple occasions. Global sportswear brands are capitalizing on this demand through product innovation and high-profile marketing collaborations. As a result, sneakers have secured a leading share in the product category, establishing athleisure as a long-term growth driver.

- For instance, Adidas sold millions of women’s sneakers in the UK and Western Europe in 2023, influenced by key marketing efforts like the Adidas x Stella McCartney collaboration.

Premiumization and Demand for Leather Footwear

Premiumization trends are reinforcing the dominance of leather footwear in the United Kingdom women’s footwear market. Consumers are willing to invest in high-quality, durable shoes that combine style with longevity, especially within boots and formalwear categories. Leather continues to account for the highest revenue share among material types, supported by its premium image and association with top fashion brands. Rising disposable incomes and aspirational buying patterns further encourage the adoption of luxury brands. Mid-range players are also launching affordable leather products to capture a wider audience, expanding the consumer base. Sustainability-certified leather and eco-friendly tanning processes are strengthening trust among conscious buyers, reinforcing leather’s market leadership. This premium demand is expected to remain stable, supported by established fashion culture in the UK.

- For instance, Clarks parent company, C&J Clark (No 1) Limited, sold a total of 30.7 million pairs of footwear in 2023.

Digital Commerce Expansion and E-Retail Growth

The rapid adoption of online retail platforms has emerged as a major growth driver for women’s footwear in the UK. E-commerce has captured a growing market share due to convenience, wider assortments, and competitive pricing. Brand websites and global platforms offer exclusive collections, personalization, and targeted promotions that attract younger buyers. Improved logistics, flexible payment systems, and free returns have further boosted consumer confidence in online purchases. Social media-driven shopping habits, particularly among Gen Z and millennials, are accelerating digital adoption. Established footwear brands are investing in omnichannel strategies to integrate in-store and online experiences. This transition is not only expanding market reach but also enabling real-time consumer engagement, making digital commerce a critical driver of future growth.

Key Trends & Opportunities

Sustainability and Eco-Friendly Materials

Sustainability has become a defining trend in the UK women’s footwear market, creating opportunities for innovation. Consumers are increasingly conscious of environmental impacts, leading to demand for footwear made from recycled plastics, organic textiles, and responsibly sourced leather. Several global and local brands are launching vegan and biodegradable shoe collections, aligning with rising ethical consumption patterns. Certifications such as Leather Working Group (LWG) approvals and carbon-neutral product lines are gaining consumer attention. This shift is not only expanding product portfolios but also differentiating brands in a competitive market. Companies adopting sustainable production and transparent supply chains are expected to capture loyal customer bases, making eco-friendly footwear one of the most significant opportunities ahead.

- For instance, in 2023, Veja continued its success by expanding its eco-friendly sneaker line made from materials like organic cotton, Amazonian rubber, and recycled polyester. By the end of 2023, Veja had reached a milestone of selling 12 million pairs of sneakers cumulatively, generating $283 million in revenue that year, and maintaining a strong market presence, including in the UK.

Rise of Omni-Channel Retail Strategies

The convergence of online and offline sales channels is shaping new growth opportunities in the women’s footwear market. Brands are integrating digital features such as virtual try-ons, augmented reality fitting rooms, and click-and-collect services to enhance the consumer experience. Department stores and specialty retailers are also building stronger online presence, while e-commerce giants are opening physical pop-ups to engage buyers. This hybrid strategy increases brand visibility, supports personalized shopping, and improves accessibility. Consumers benefit from both convenience and the tactile assurance of in-store experiences. The trend is enabling brands to cater to diverse shopping behaviors, making omni-channel retail a critical opportunity to expand customer reach in the UK market.

Key Challenges

Rising Competition from Fast Fashion Retailers

One of the key challenges in the UK women’s footwear market is the intense competition from fast fashion retailers. Brands such as Zara, H&M, and Primark are aggressively expanding their footwear lines, offering trend-driven products at low prices. While these products appeal to cost-sensitive buyers, they place pressure on established brands that emphasize quality and durability. Fast fashion models thrive on speed to market, which can quickly shift consumer preferences away from traditional players. This challenge forces premium and mid-range brands to balance pricing with differentiation strategies, including sustainability certifications and unique designs. Maintaining consumer loyalty in such a competitive landscape remains a pressing issue for market participants.

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating raw material prices and global supply chain disruptions pose another significant challenge for the UK women’s footwear industry. Leather, rubber, and textile costs often vary due to global demand, energy prices, and regulatory restrictions, directly impacting production costs. Supply chain issues, particularly post-Brexit complexities and global shipping delays, have disrupted timely imports of materials and finished products. These uncertainties strain margins and limit inventory availability, affecting both traditional retailers and e-commerce platforms. Brands are being forced to adopt local sourcing, advanced inventory planning, and strategic supplier partnerships to mitigate risks. Despite these efforts, price volatility and supply chain disruptions remain critical challenges for sustained growth.

Regional Analysis

England

England dominates the women’s footwear market in the United Kingdom, holding nearly 65% share in 2024. The region’s leadership comes from its large population base, high urbanization, and strong presence of global and domestic fashion brands. London, Manchester, and Birmingham serve as key retail hubs, supported by department stores, luxury boutiques, and expanding e-commerce adoption. Rising demand for sneakers and leather boots among working professionals and young consumers further strengthens the region’s growth. Premiumization, fashion-conscious buyers, and robust online retail penetration will ensure England maintains its leading role in the market.

Scotland

Scotland accounts for around 15% of the market share in 2024, supported by rising consumer interest in outdoor and functional footwear. The popularity of hiking and winter boots is particularly strong due to Scotland’s cold climate and outdoor culture. Retail activity is concentrated in urban centers such as Edinburgh and Glasgow, where both global and local brands operate. Online retail is expanding, especially for casual sneakers and affordable fashion footwear. The market is also benefiting from increased tourist shopping, adding demand for both luxury and mid-range products. Scotland remains a key growth region with steady expansion prospects.

Wales

Wales contributes nearly 10% of the UK women’s footwear market in 2024, driven by growing retail expansion and rising online adoption. While smaller in population compared to England and Scotland, Wales shows strong demand for affordable sneakers and boots suitable for everyday wear. Cardiff and Swansea are major retail hubs, where specialty footwear stores and hypermarkets attract consumers. Outdoor and athletic footwear is gaining traction due to active lifestyle trends. The online channel is expanding rapidly, providing wider access to branded footwear. Wales offers growth potential through e-commerce and mid-range product categories targeting younger buyers.

Northern Ireland

Northern Ireland holds approximately 10% of the market share in 2024, with demand concentrated in Belfast and surrounding urban areas. The region shows strong preference for casual sneakers and ankle boots, reflecting younger demographics and changing fashion influences. Cross-border shopping with the Republic of Ireland adds additional sales opportunities, especially for premium footwear brands. Retail stores remain dominant, but digital adoption is accelerating through e-commerce platforms and brand websites. Rising disposable incomes and increased focus on fashion trends are supporting gradual growth. Northern Ireland, though the smallest regional market, offers long-term opportunities through digital retail and cross-border trade.

Market Segmentations:

By Product

- Sneakers

- Plimsoll Sneakers

- High Top Sneakers

- Slip On Sneakers

- Athletic Sneakers

- Hiking & Running Sneakers

- Other Types

- Boots

- Ankle Boots

- Mid-calf Boots

- Knee-high Boots

- Over-the-knee Boots

- Chelsea Boots

- Riding Boots

- Winter Boots

By Material

- Rubber

- Leather

- Plastics

- Textiles

- Other Materials

By Sales Channel

- Offline / Traditional Retail

- Department Stores

- Specialty Footwear Stores

- Hypermarkets & Supermarkets

- Online

- Brand Websites

- E-commerce Platforms

By Geography

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The United Kingdom women’s footwear market is highly competitive, with a mix of global sportswear giants, luxury brands, and domestic retailers shaping the industry. Adidas AG and Converse Inc. dominate the sneaker category, leveraging strong brand recognition, innovation, and widespread retail networks. BIRKENSTOCK Digital GmbH and Blundstone Australia Pty Ltd focus on comfort and durability, appealing to consumers seeking functional yet stylish footwear. Traditional players such as Clarks and Marks & Spencer maintain strong positions in mid-range and formal categories, supported by their established retail presence. Premium brands like Fairfax and Favor Ltd. and Dr. Martens Group capture aspirational buyers through heritage designs and unique styling. Bata Brands SA serves value-conscious customers with affordable collections across multiple channels. Intense competition is further amplified by fast fashion retailers offering trend-driven products at lower prices. To sustain market share, leading players emphasize sustainability, omni-channel retail strategies, and innovative collaborations with influencers and designers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Adidas AG

- Bata Brands SA

- BIRKENSTOCK Digital GmbH

- Blundstone Australia Pty Ltd

- Converse Inc.

- Clarks

- Marks & Spencer

- Martens Group

- Fairfax and Favor Ltd.

- Other Key Players

Recent Developments

- In August 2023, Wolverine World Wide, Inc. made a strategic business decision by divesting Hush Puppies intellectual property rights in China, Hong Kong, and Macau. While this development wasn’t directly related to modular substations, it represented a significant restructuring of the company’s Asian market presence and operational capabilities.

- In April 2022, Timberland LLC launched an ambitious renewable energy initiative called the Timberland Solar Project. A key component of this project was the construction of a new 345kV substation, with MYR Group Inc. securing the contract for its development. The project commenced with groundbreaking ceremonies in spring 2022, with plans for completion set for late 2023, marking a significant step in the company’s commitment to sustainable energy infrastructure.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, driven by rising demand for sneakers and casual footwear.

- Athleisure fashion will continue to shape product innovation and consumer buying behavior.

- Leather footwear will maintain dominance, supported by premiumization and durability preferences.

- Eco-friendly and vegan materials will gain traction as sustainability becomes a core focus.

- Online sales will grow faster than offline channels, fueled by digital adoption and e-commerce.

- Omni-channel strategies will strengthen, combining physical stores with digital retail experiences.

- Competition from fast fashion retailers will intensify, challenging established brands on price and speed.

- Personalization and customization options will attract younger consumers seeking unique designs.

- Scotland and Wales will see growth in outdoor and functional footwear demand.

- Leading brands will invest in influencer collaborations and limited editions to capture fashion-conscious buyers.