Market Overview

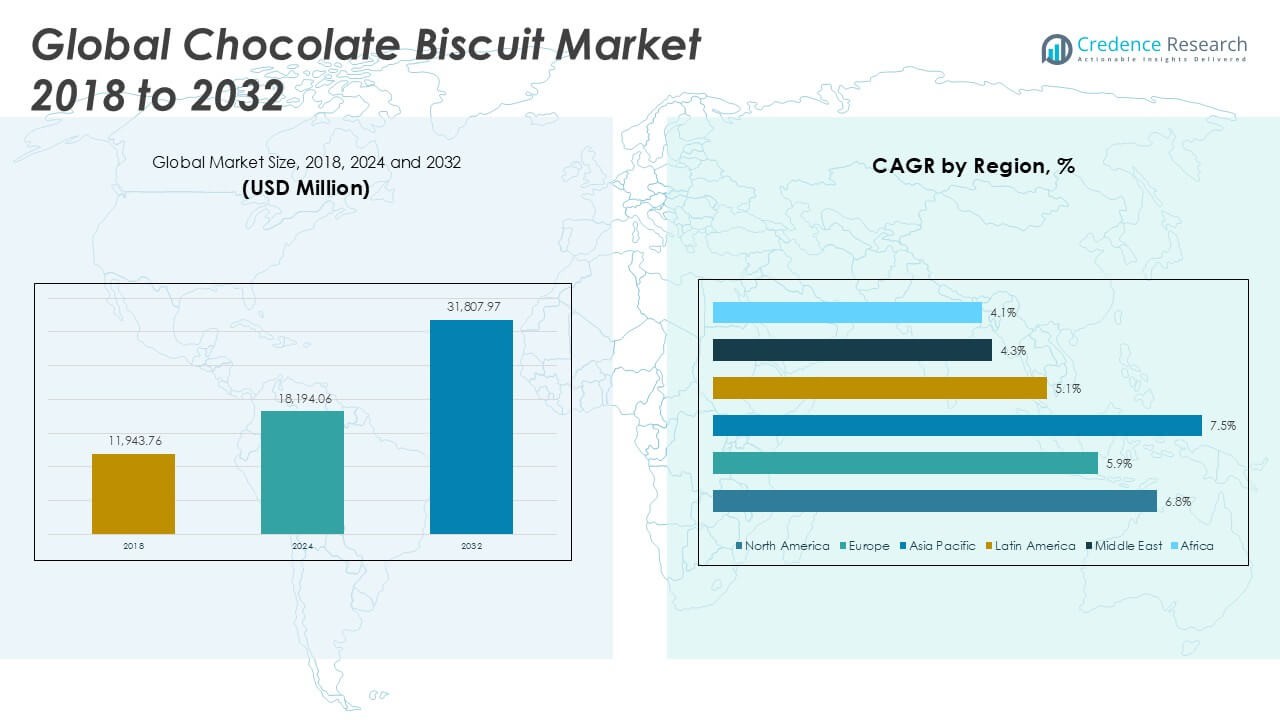

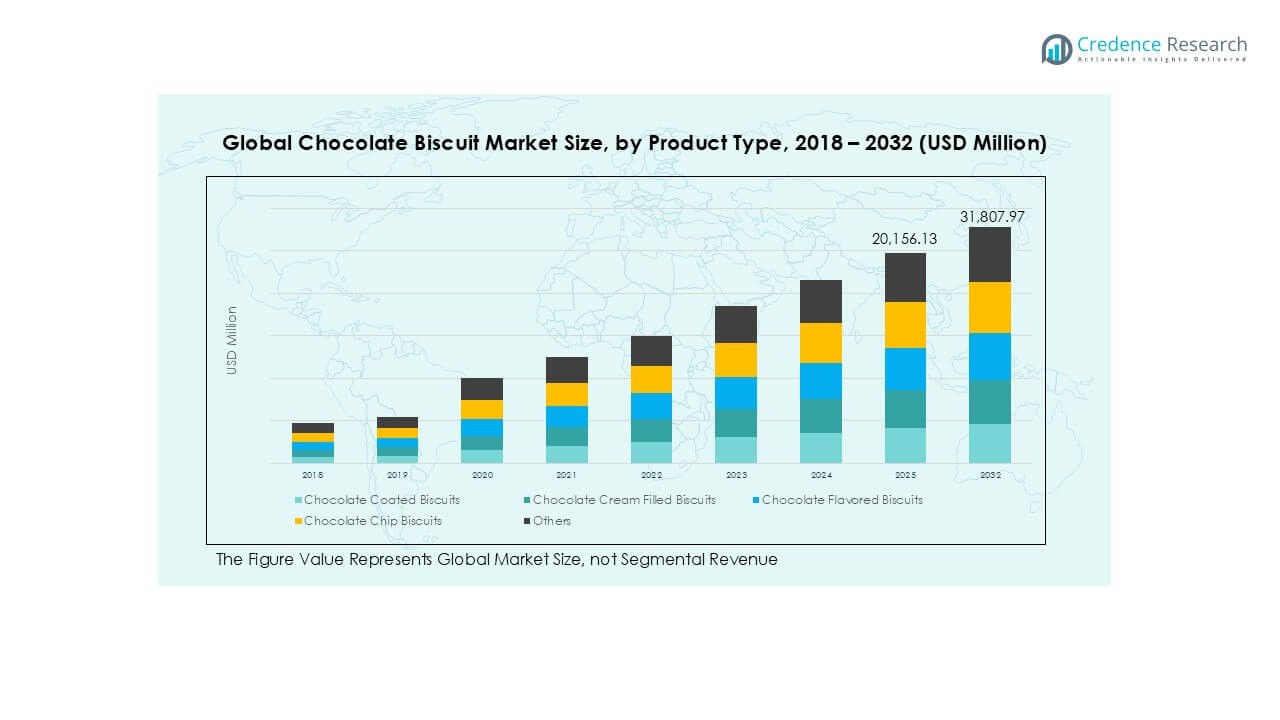

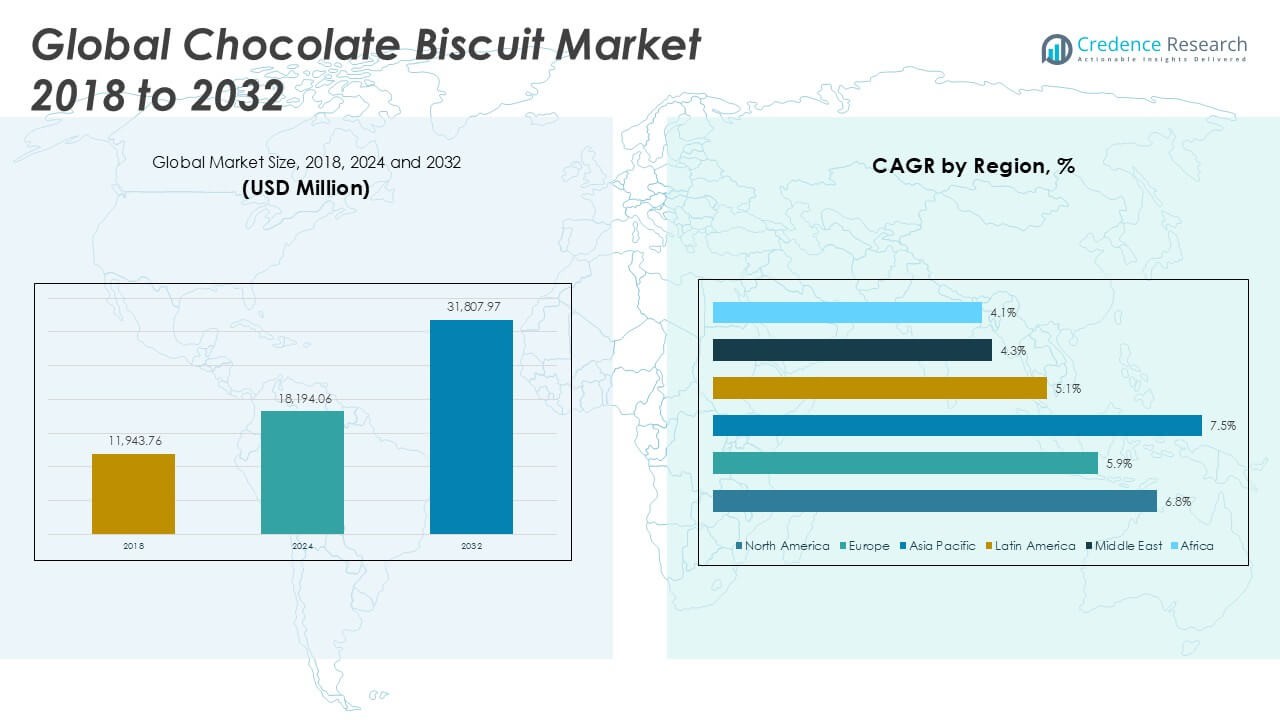

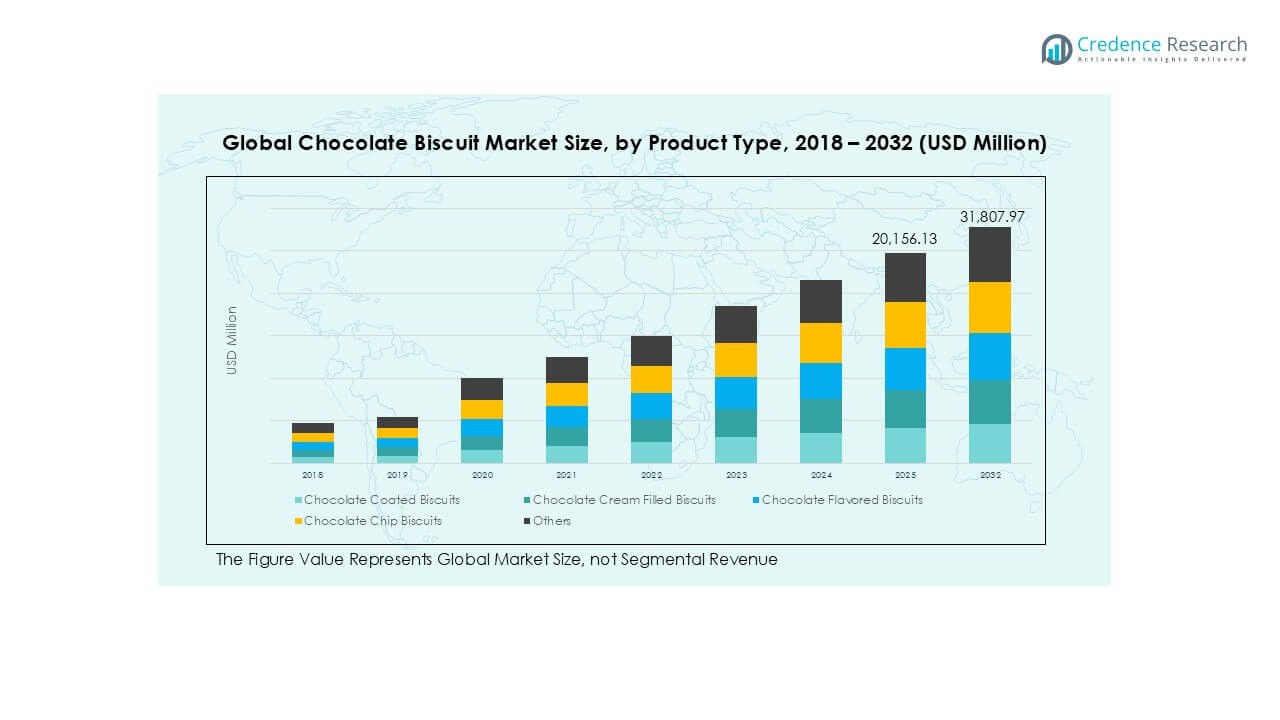

The Global Chocolate Biscuit market size was valued at USD 11,943.76 million in 2018, growing to USD 18,194.06 million in 2024, and is anticipated to reach USD 31,807.97 million by 2032, at a CAGR of 6.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chocolate Biscuit Market Size 2024 |

USD 18,194.06 Million |

| Chocolate Biscuit Market, CAGR |

6.73% |

| Chocolate Biscuit Market Size 2032 |

USD 31,807.97 Million |

The global chocolate biscuit market is led by multinational players such as Mondelez International, Nestlé S.A., Britannia Industries, Parle Products, and Ferrero Group, alongside strong regional brands like Grupo Bimbo, ITC Limited, and Pepperidge Farm. These companies maintain their positions through wide product portfolios, innovation in flavors, and expansion across retail and e-commerce channels. In terms of regional performance, Asia Pacific dominates with over 46% share in 2024, supported by rising urbanization and income growth, while Europe holds 27% with strong premium and seasonal demand. North America contributes 18%, driven by preference for indulgent snacking and premium variants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global chocolate biscuit market was valued at USD 18,194.06 million in 2024 and is projected to reach USD 31,807.97 million by 2032, growing at a CAGR of 6.73%.

- Rising consumer demand for indulgent snacking, convenience, and premium chocolate-based products drives steady market growth across both developed and emerging economies.

- Key trends include innovation in flavors, healthier low-sugar and fortified variants, and premiumization supported by gifting culture and e-commerce expansion.

- The market is highly competitive, with leading players such as Mondelez, Nestlé, Britannia, Parle, and Ferrero competing through product launches, sustainability initiatives, and strategic retail partnerships.

- Asia Pacific held the largest share with over 46% in 2024, followed by Europe at 27% and North America at 18%; by product type, chocolate-coated biscuits dominated with more than 35% share, while milk chocolate led the flavor segment with over 40% contribution.

Market Segmentation Analysis:

By Product Type

Chocolate coated biscuits held the dominant share of the global chocolate biscuit market in 2024, accounting for over 35% of total sales. Their popularity stems from strong consumer preference for indulgent snacking options that combine crisp textures with rich chocolate layers. Brands continue to expand coated biscuit varieties with premium ingredients and innovative coatings, such as caramel-infused or nut-enriched chocolate layers. Rising consumption in both developed and emerging economies, driven by gifting traditions and impulse buying, further strengthens this segment. Meanwhile, chocolate cream-filled and chip-based biscuits also show steady growth, supported by younger consumer demand for fun flavors.

- For instance, Mondelez expanded its Cadbury Chocobakes range in India in 2023 with the launch of Cadbury Chocobakes Chocochip Cookies. Mondelez also announced investments in India, including expanding manufacturing capacity at its Sri City facility, which is a significant production hub for the company and is adding chocolate-making capacity.

By Flavor

Milk chocolate led the chocolate biscuit market by flavor in 2024, capturing more than 40% share. Its dominance is driven by widespread acceptance across all age groups and its balanced sweetness profile, making it suitable for mainstream consumption. Manufacturers focus on reformulating milk chocolate biscuits with healthier options such as reduced sugar and fortified variants to attract health-conscious buyers. Dark chocolate biscuits are gaining traction, especially in developed markets, due to rising awareness of cocoa’s antioxidant benefits. White chocolate, although smaller in share, is witnessing demand growth in premium and seasonal offerings, while “Others” include mixed and innovative flavors.

- For instance, Britannia’s Bourbon biscuits, a milk-chocolate filled variety, remains one of the brand’s most popular products in India, reflecting its mass appeal and strong brand recognition among consumers.

By Distribution Channel

Supermarkets and hypermarkets dominated the chocolate biscuit market in 2024, holding over 45% share. Their strong position comes from wide product availability, attractive promotions, and bulk packaging options that appeal to families. These retail outlets remain the primary choice for consumers seeking variety and competitive pricing in a single purchase point. Online retail, however, is growing rapidly, fueled by expanding e-commerce penetration and rising preference for doorstep delivery. Convenience stores continue to attract on-the-go buyers, while specialty stores focus on premium, artisanal, and imported chocolate biscuits. Together, these diverse channels create a balanced distribution landscape for global players.

Key Growth Drivers

Rising Consumer Preference for Indulgent Snacking

Consumers increasingly prefer indulgent and convenient snacking options, making chocolate biscuits a go-to choice. Their combination of sweetness, crunch, and portability appeals to both children and adults. Global demand is supported by shifting lifestyles where quick snacks replace traditional meals. Premium chocolate coatings and fillings further enhance appeal, especially in urban areas. Seasonal gifting and festive promotions also boost consumption, particularly in regions like Europe and Asia-Pacific. This driver is amplified by the growing penetration of multinational biscuit brands, which continually expand portfolios with innovative and localized flavor combinations.

- For instance, in 2023, Ferrero expanded its Kinder product offerings by launching the new Kinderini biscuit line in Europe. During the same fiscal year, the company also increased production capacity for its existing Kinder Bueno line with a new manufacturing facility in the US.

Expansion of Retail and E-commerce Channels

The availability of chocolate biscuits across diverse retail formats drives significant market growth. Supermarkets and hypermarkets dominate with strong product variety and in-store promotions. At the same time, online retail has rapidly gained traction due to digitalization and increasing consumer preference for convenience. E-commerce platforms now offer direct-to-consumer delivery, subscription snack boxes, and customizable assortments. This accessibility broadens consumer reach in both developed and emerging markets. Retailers also leverage bundling strategies and loyalty programs to encourage higher sales volumes. The continuous expansion of organized retail networks ensures strong product visibility and consumer engagement globally.

- For instance, Walmart’s online catalog and inventory frequently include numerous types of chocolate biscuit multipacks, such as Nutella Biscuits and McVitie’s Digestive Wheat Biscuits.

Innovation in Flavors and Health-Oriented Variants

Innovation is central to sustaining consumer interest in chocolate biscuits. Brands are actively introducing new flavors, formats, and packaging styles to attract different age groups. For instance, limited-edition seasonal products and fusion flavors such as dark chocolate with sea salt or white chocolate with fruit fillings appeal to experimental buyers. Additionally, the growing health-conscious population drives demand for low-sugar, high-fiber, or fortified variants. Manufacturers also incorporate clean-label claims, sustainable cocoa sourcing, and environmentally friendly packaging to align with consumer values. This innovation not only retains existing consumers but also captures new demographics seeking healthier indulgences.

Key Trends & Opportunities

Premiumization and Gifting Culture

Premium chocolate biscuits are gaining popularity as consumers associate them with quality, luxury, and special occasions. The growth of gifting culture during holidays, birthdays, and festivals has boosted demand for attractively packaged premium assortments. Limited-edition releases and collaborations with luxury chocolate brands create exclusivity, further elevating product appeal. Emerging markets like India and China show high growth potential, as rising disposable incomes encourage consumers to spend more on premium snacks. This trend presents opportunities for global players to position chocolate biscuits as affordable luxuries, bridging the gap between mass-market and luxury confectionery.

- For instance, Pladis is the parent company of Godiva, having been formed by Yıldız Holding in 2016 to combine several of its snack and confectionery brands, including Godiva.

Growth in Emerging Markets

Emerging economies present lucrative opportunities for the chocolate biscuit market, supported by rising urbanization and growing middle-class populations. Increased exposure to Western snacking habits, coupled with improved distribution networks, has accelerated product adoption. Manufacturers target these regions with localized flavors and affordable packaging sizes to suit diverse income levels. Strong growth is observed in Asia-Pacific and Latin America, where young demographics and digital shopping platforms boost accessibility. Expanding cold-chain logistics also allows broader availability of chocolate-based products in tropical regions. These factors position emerging markets as key growth frontiers for both global and regional biscuit manufacturers.

Key Challenges

Rising Health Concerns and Sugar Reduction Pressure

Growing awareness of obesity, diabetes, and lifestyle-related diseases poses a major challenge for chocolate biscuit manufacturers. Consumers are becoming increasingly critical of products high in sugar, fat, and calories. Regulatory authorities in several countries are imposing stricter labeling requirements and even sugar taxes. This environment pushes brands to reformulate products with healthier alternatives without compromising taste, which is technically and economically challenging. Balancing indulgence with health expectations requires substantial investment in R&D. Companies that fail to adapt risk losing market share to healthier snack alternatives, such as fruit-based or protein-rich snacks.

Fluctuating Raw Material Prices and Supply Chain Issues

Volatility in raw material prices, especially cocoa, wheat, and sugar, creates significant challenges for chocolate biscuit producers. Cocoa prices, in particular, are highly sensitive to climate conditions and political instability in producing countries. Rising transportation costs and supply chain disruptions further increase production expenses. Manufacturers often struggle to absorb these fluctuations without passing costs to consumers, which can affect demand. Smaller players face higher risks, as they lack the scale to manage supply shocks effectively. Securing sustainable and traceable sourcing of cocoa also adds pressure, requiring investment in ethical supply chain practices.

Regional Analysis

North America

North America accounted for USD 2,221.54 million in 2018 and reached USD 3,301.58 million in 2024. It is projected to grow to USD 5,810.20 million by 2032, expanding at a CAGR of 6.8%. The region holds nearly 18% of the global market in 2024, driven by strong consumer demand for indulgent snacking and premium chocolate products. Growing health-conscious populations are fueling interest in low-sugar and organic chocolate biscuits, while e-commerce channels enhance availability. Innovation in flavors and convenience packaging continues to attract younger consumers, securing steady market growth across the U.S. and Canada.

Europe

Europe generated USD 3,333.78 million in 2018 and increased to USD 4,892.30 million in 2024. By 2032, the market is expected to reach USD 8,044.10 million at a CAGR of 5.9%. The region contributed around 27% of global revenue in 2024, supported by established consumption patterns and premium gifting culture. Strong demand for seasonal chocolate assortments, coupled with sustainability-focused product innovation, boosts market adoption. Countries like Germany, the UK, and France lead with diverse product portfolios. The emphasis on clean-label, fair-trade cocoa, and environmentally friendly packaging further shapes regional growth opportunities.

Asia Pacific

Asia Pacific dominated the chocolate biscuit market, recording USD 5,283.26 million in 2018 and USD 8,341.61 million in 2024. It is projected to reach USD 15,462.49 million by 2032, with the highest CAGR of 7.5%. The region captured over 46% of the global market in 2024, driven by rising urbanization, growing disposable incomes, and exposure to Western snacking habits. China, India, and Japan are major markets with strong youth-driven consumption. Expanding retail networks, localized flavor innovation, and growing online sales boost market penetration. Affordable packaging formats also fuel adoption in middle-income groups.

Latin America

Latin America recorded USD 574.77 million in 2018 and expanded to USD 864.87 million in 2024. By 2032, it is expected to reach USD 1,341.53 million at a CAGR of 5.1%. The region held nearly 5% of the global chocolate biscuit market in 2024. Brazil and Mexico are leading markets, supported by growing snack consumption and improving retail infrastructure. Rising middle-class populations, coupled with increased product availability in supermarkets and online platforms, enhance growth. Innovation in chocolate biscuits with tropical flavors and competitive pricing strategies further support regional demand.

Middle East

The Middle East chocolate biscuit market was valued at USD 314.66 million in 2018 and grew to USD 435.54 million in 2024. It is projected to reach USD 634.20 million by 2032, advancing at a CAGR of 4.3%. The region contributed around 2.5% of global revenue in 2024, supported by expanding urban populations and rising preference for premium snacks. Saudi Arabia and the UAE are major markets with high demand for imported chocolate biscuits. Retail expansion, duty-free outlets, and gifting traditions during festivals continue to strengthen growth, though price sensitivity limits broader penetration.

Africa

Africa accounted for USD 215.75 million in 2018 and increased to USD 358.15 million in 2024. The market is forecast to reach USD 515.45 million by 2032, growing at a CAGR of 4.1%. In 2024, the region represented nearly 2% of global revenue, reflecting gradual adoption of chocolate biscuits. South Africa and Nigeria drive regional demand, supported by expanding modern retail and urban middle-class growth. Affordability remains critical, leading manufacturers to introduce smaller, low-cost packaging formats. Rising awareness of Western snacks and increasing distribution channels are gradually expanding product acceptance across African markets.

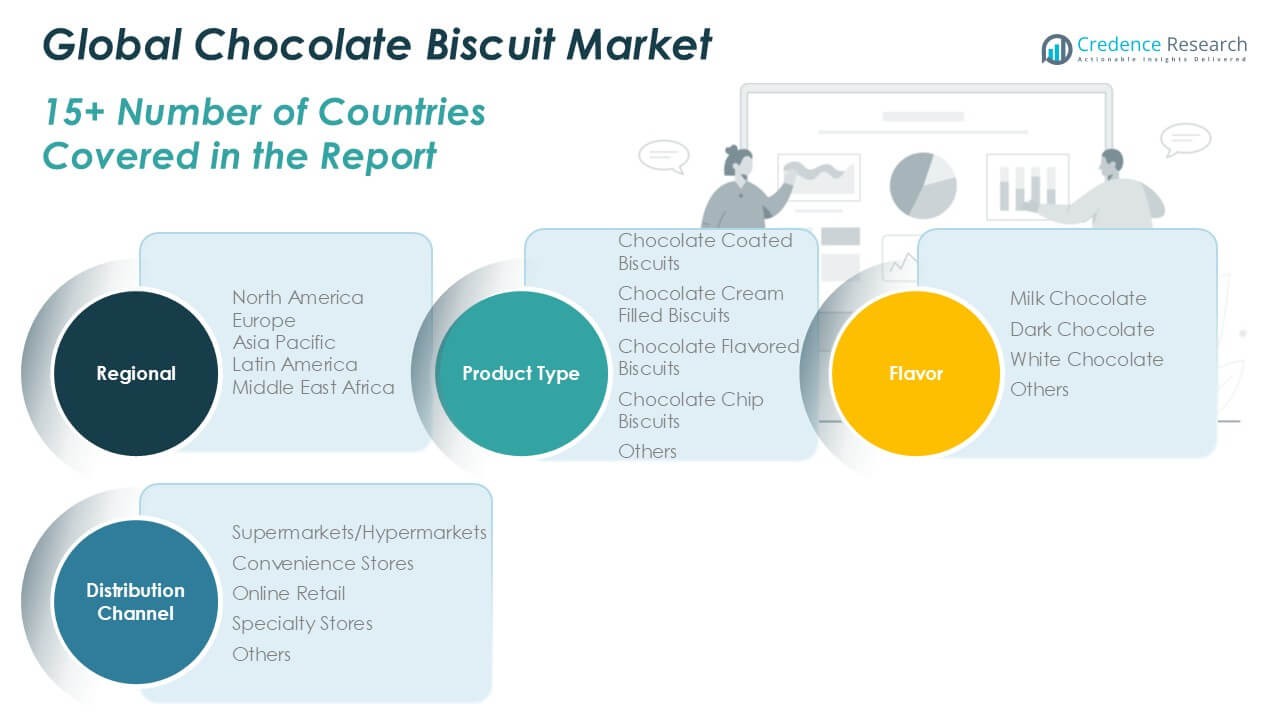

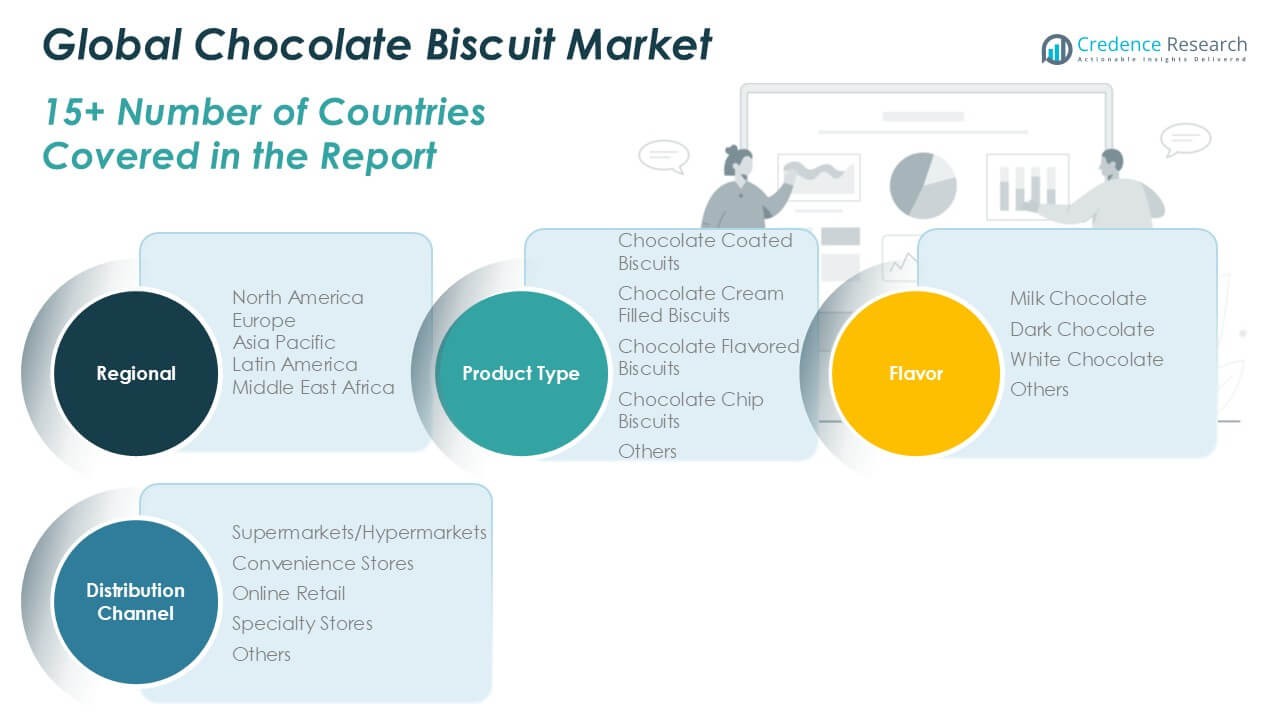

Market Segmentations:

By Product Type

- Chocolate Coated Biscuits

- Chocolate Cream Filled Biscuits

- Chocolate Flavored Biscuits

- Chocolate Chip Biscuits

- Others

By Flavor

- Milk Chocolate

- Dark Chocolate

- White Chocolate

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global chocolate biscuit market is highly competitive, with leading multinational and regional players driving growth through diverse product offerings, innovation, and distribution strategies. Mondelez International, Nestlé S.A., Britannia Industries, Parle Products, and Pladis Global are among the dominant companies with extensive brand portfolios and strong global reach. Ferrero Group, ITC Limited, Grupo Bimbo, and Mars, Incorporated also maintain significant market positions by investing in product innovation and marketing. Players focus on expanding premium and health-oriented chocolate biscuits to capture evolving consumer demand. Strategic initiatives such as mergers, acquisitions, product launches, and partnerships strengthen their presence across key markets. Additionally, companies emphasize digital retail channels and sustainable sourcing practices to align with consumer preferences and regulatory trends. Intense competition continues to encourage diversification, pricing strategies, and innovation, ensuring sustained consumer engagement in both mature and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2024, Mondelēz International partnered with Lotus Bakeries to manufacture and distribute Biscoff biscuits in India. Leveraging Mondelēz’s extensive local production and distribution network, this collaboration aims to significantly expand market reach within India’s growing chocolate biscuit sector. The partnership is likely to accelerate product availability and consumer access, supporting both companies’ growth objectives by capitalizing on the increasing demand for premium biscuit varieties in the Indian market

- In November 2023, Fox’s Burton launched a multi-million-dollar marketing campaign for its Maryland Cookies brand. This comprehensive initiative, which included revamped packaging and an extensive advertising strategy, is aimed at enhancing customer loyalty and increasing brand awareness. The campaign is expected to strengthen Maryland Cookies’ market position by attracting new consumers and reinforcing the brand’s identity in a competitive biscuit market, thereby driving higher sales and expanding market share

- In February 2023, The Hershey Company launched limited-edition chocolate bars to commemorate International Women’s Day. This strategic move signals a growing trend toward seasonal and thematic product launches, which can drive consumer engagement and boost sales through targeted marketing efforts. Such initiatives, if mirrored in the biscuit segment, could encourage biscuit manufacturers to explore thematic releases, thereby stimulating demand and differentiating their product offerings in a crowded market

- In November 2022, specialty delivery coordination service Next Bite partnered with Nestlé to deliver fresh-baked Toll House cookies across the U.S. This partnership addresses the rising consumer demand for convenient, fresh, and on-demand snack options, enhancing Nestlé’s distribution capabilities and market penetration. By integrating delivery services, Nestlé is positioned to tap into evolving consumer behaviors favoring quick access to fresh products, thereby strengthening its foothold in the competitive U.S. biscuit and cookie market

Report Coverage

The research report offers an in-depth analysis based on Product Type, Flavor, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global chocolate biscuit market will continue to expand at a steady growth rate.

- Asia Pacific will remain the largest market, supported by urbanization and rising incomes.

- Europe will sustain strong demand due to premiumization and seasonal gifting culture.

- North America will grow steadily, driven by indulgent snacking and healthier product innovations.

- Supermarkets and hypermarkets will maintain dominance, but online retail will grow the fastest.

- Chocolate-coated biscuits will retain leadership, while cream-filled and chip-based formats will expand.

- Milk chocolate variants will lead, while dark chocolate will gain popularity for health benefits.

- Companies will invest more in sustainable sourcing and eco-friendly packaging to meet regulations.

- Health-focused innovations such as low-sugar and fortified biscuits will attract new consumers.

- Competition will intensify as global brands and regional players expand with localized strategies.