Market Overview

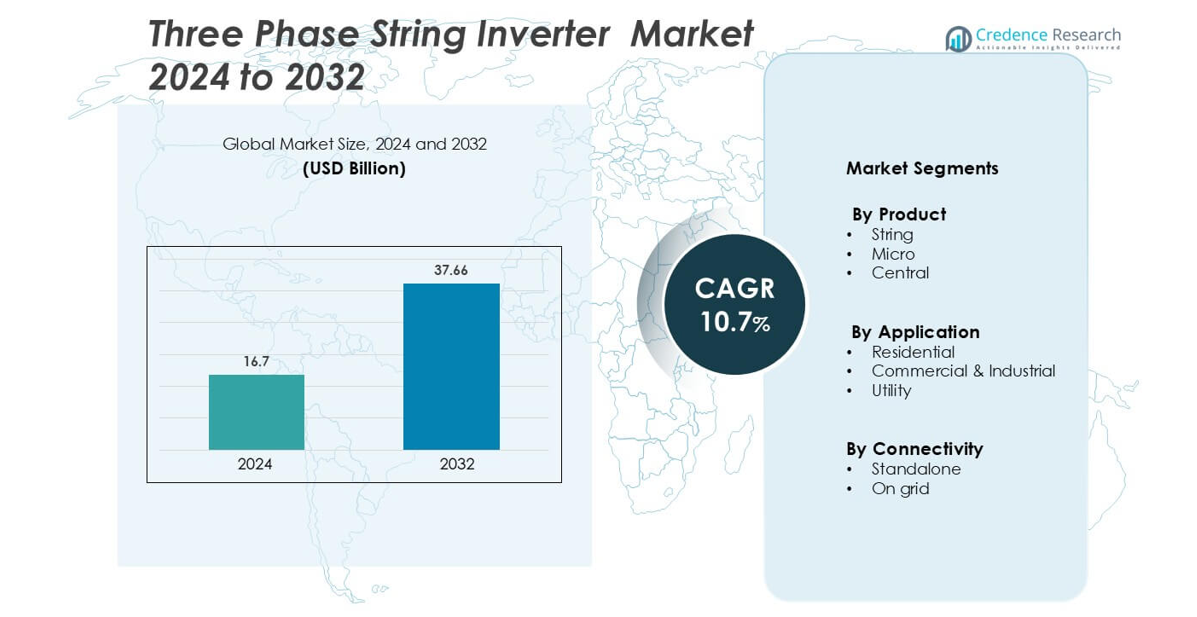

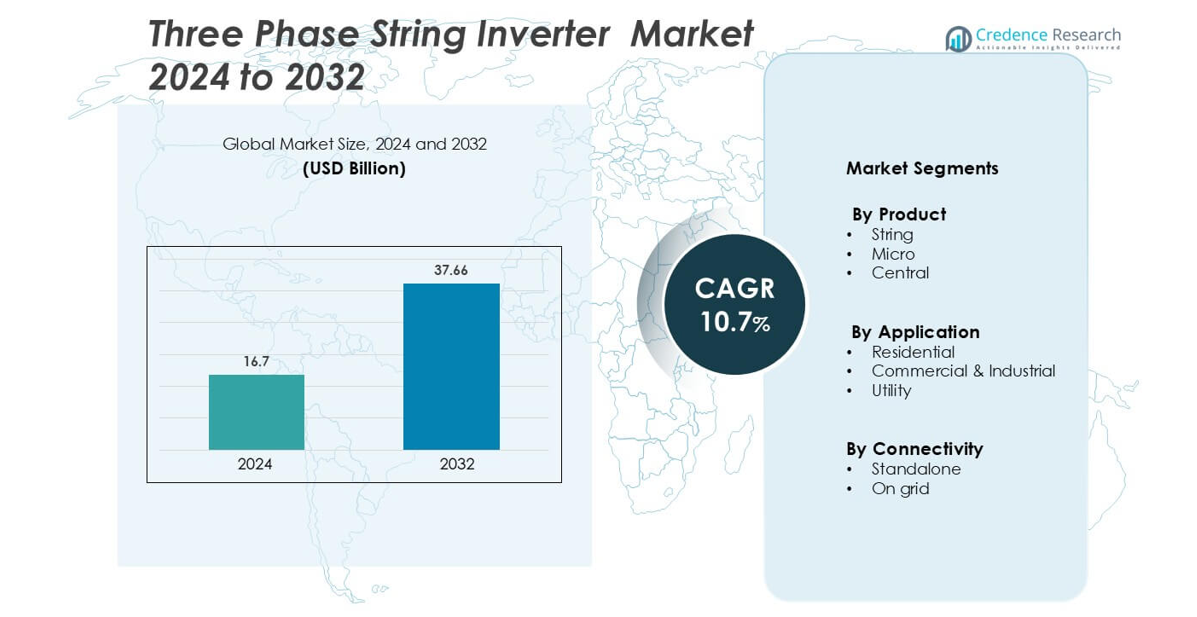

Three Phase String Inverter Market size was valued USD 16.7 billion in 2024 and is anticipated to reach USD 37.66 billion by 2032, at a CAGR of 10.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Three Phase String Inverter Market Size 2024 |

USD 16.7 billion |

| Three Phase String Inverter Market, CAGR |

10.7% |

| Three Phase String Inverter Market Size 2032 |

USD 37.66 billion |

The three phase string inverter market is highly competitive, with key players focusing on innovation, product efficiency, and regional expansion. Leading companies include Sungrow, Veichi Electric, NingBo Deye Inverter Technology, Canadian Solar, LEDVANCE, INVTSolar, Solis Inverters, Huawei Technologies, Goldi Solar, Chint Power Systems, Fimer, and UTL Solar. These companies are strengthening their portfolios with advanced MPPT technology, digital monitoring, and smart grid compatibility to meet rising global demand. Asia Pacific leads the market with a 34% share, supported by large-scale solar installations, cost-effective manufacturing, and strong policy frameworks. North America and Europe follow closely, driven by robust renewable infrastructure. Strategic partnerships, R&D investments, and energy storage integration remain key competitive strategies.

Market Insights

- The three phase string inverter market was valued at USD 16.7 in 2024 and is projected to reach USD 37.66 by 2032, growing at a CAGR of 10.7% during the forecast period.

- Strong government incentives, renewable energy targets, and utility-scale solar projects are driving rapid market expansion across key regions.

- Smart inverter integration, digital monitoring, and advanced MPPT technology are emerging as major trends shaping product innovation and adoption.

- Asia Pacific leads the market with a 34% share, followed by North America at 32% and Europe at 29%, while the string segment holds the highest share among product types.

- High upfront installation costs and grid integration complexities remain key restraints, but supportive regulatory frameworks and infrastructure development are helping offset these challenges.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

String inverters dominate the Three Phase String Inverter Market with the highest market share. Their popularity is driven by low installation costs, easy maintenance, and scalability. String inverters are widely adopted in small to medium-scale solar installations, offering high conversion efficiency and quick fault detection. Micro inverters are gaining traction in residential projects for their panel-level optimization, while central inverters remain preferred for large-scale utility projects. However, the flexible design, cost-effectiveness, and improved monitoring of string inverters continue to secure their lead in overall adoption across multiple applications.

- For instance, some Huawei’s own data sheets and product specifications confirm that certain models, such as the SUN2000-8KTL to SUN2000-20KTL three-phase inverters, have three Maximum Power Point Trackers (MPPTs).

By Application

The utility segment holds the dominant share of the market due to rising investments in large-scale solar farms and grid integration projects. High efficiency, robust performance, and lower Levelized Cost of Energy (LCOE) make three-phase string inverters ideal for utility installations. Commercial and industrial applications are also expanding, driven by sustainability targets and energy cost reductions. Residential use is growing steadily with rooftop solar adoption. Government incentives and favorable net metering policies further boost demand in the utility segment, supporting long-term capacity expansion and deployment.

- For instance, Sungrow’s SG320HX utility-scale string inverter provides a 320 kW output with 99 MPPT efficiency and supports 16 strings, enhancing energy harvesting on large solar farms.

By Connectivity

On-grid systems lead the market, supported by growing grid-tied solar projects and smart grid integration. These systems enable efficient energy export, better utilization of generated power, and enhanced return on investment. On-grid inverters are preferred for their reliability, grid-support functionalities, and compliance with evolving energy standards. Standalone systems cater to remote and off-grid locations, but their adoption remains lower due to higher storage costs. The increasing push for renewable grid stability and supportive regulatory frameworks drive the strong market position of on-grid connectivity solutions.

Key Growth Drivers

Rising Solar Energy Installations Globally

The increasing deployment of solar energy projects is a primary growth driver for the three phase string inverter market. Governments worldwide are investing heavily in renewable energy infrastructure to reduce carbon emissions and meet net-zero targets. Solar farms and distributed generation projects rely on high-efficiency inverters for grid integration, making string inverters a preferred option. These inverters support flexible system design, fast installation, and real-time monitoring. Emerging economies are adopting utility-scale solar projects to address power shortages, further boosting demand. Supportive policies, such as tax incentives, feed-in tariffs, and net metering programs, continue to drive large-scale adoption. In addition, rapid urbanization and increasing energy demand are encouraging commercial and industrial users to shift to solar power systems. This growing demand for clean energy infrastructure is strengthening the market position of string inverters across regions.

- For instance, Huawei’s SUN2000-330KTL string inverter delivers a 330 kW output with 6 MPPT inputs, enabling efficient energy capture across uneven terrains.

Technological Advancements in Inverter Efficiency

Technological innovation is significantly enhancing the performance and reliability of three phase string inverters. Manufacturers are introducing advanced features such as high maximum power point tracking (MPPT) accuracy, improved grid management, and real-time fault detection. These innovations enable better energy yield and reduce system downtime. High-efficiency inverters with compact designs are becoming popular in utility and industrial applications due to their cost-effectiveness and ease of installation. Digital monitoring platforms and IoT integration allow operators to track system performance remotely, optimizing energy generation. These advancements lower operational costs and improve grid stability, driving adoption across multiple sectors. The growing focus on energy security and grid modernization further supports the integration of smart inverter solutions in both developed and developing markets.

- For instance, Solis Inverters’ 255K-EHV-5G features an LCD display and RS485 communication, enabling real-time data collection across 28 strings.

Supportive Government Policies and Incentives

Government policies and financial incentives are playing a crucial role in accelerating the adoption of three phase string inverters. Many countries are offering subsidies, tax credits, and renewable energy certificates to promote solar power installations. Net metering policies allow consumers to sell excess energy back to the grid, improving project economics. Additionally, renewable energy targets and decarbonization commitments are encouraging utilities and industries to invest in large-scale solar projects. Standardization of grid interconnection codes and favorable regulatory frameworks ensure smoother integration of solar power systems. Public-private partnerships and funding programs further support infrastructure development, especially in emerging markets. These government-led initiatives provide long-term stability and enhance investor confidence, strengthening market growth prospects.

Key Trend & Opportunity

Integration of Digital and Smart Inverter Solutions

The integration of digital technologies is reshaping the inverter landscape, offering new opportunities for growth. Smart three phase string inverters with IoT connectivity enable real-time monitoring, predictive maintenance, and grid support functions. Advanced data analytics help optimize energy output, reduce downtime, and extend system lifespan. The adoption of AI-driven algorithms for performance optimization is increasing in utility and industrial applications. As smart grids expand globally, the demand for intelligent inverter systems that can support dynamic grid management continues to grow. This trend aligns with the broader shift toward digital energy infrastructure and creates new revenue opportunities for manufacturers. Companies investing in smart inverter technologies are well-positioned to capitalize on future market demand.

- For instance, Huawei’s FusionSolar Smart PV Management System can monitor over 10,000 inverters simultaneously, enabling centralized fault management and automated grid support.

Expansion of Utility-Scale and C&I Solar Projects

The rapid growth of utility-scale and commercial & industrial (C&I) solar projects presents significant opportunities for the three phase string inverter market. Businesses and governments are prioritizing renewable energy to meet sustainability goals and reduce operational costs. String inverters are gaining preference due to their scalability, reliability, and ease of maintenance in large installations. The shift toward decentralized power generation is driving demand in regions with growing grid infrastructure. Investments in solar parks, corporate power purchase agreements (PPAs), and green energy financing are supporting this expansion. As energy-intensive industries seek stable and clean power sources, utility-scale projects will continue to be a key growth area, creating sustained demand for advanced string inverters.

- For instance, the inverter supports a maximum DC input voltage of 1500 V and an AC output power of 330 kW, enabling large solar farms to achieve higher energy yields.

Key Challenge

High Initial Installation and Integration Costs

High upfront costs remain a major barrier to market growth, especially in price-sensitive regions. While three phase string inverters offer long-term savings, the initial investment for equipment, installation, and grid integration can be substantial. Smaller businesses and residential users often find it difficult to adopt these systems without financial support. Additional costs related to permitting, cabling, and protection devices further increase the overall project cost. In some regions, limited access to financing options restricts market penetration. Although long-term operational savings are significant, the high capital expenditure continues to impact adoption rates. Addressing this challenge through cost reduction, improved financing models, and government subsidies is essential for wider market uptake.

Grid Integration and Regulatory Barriers

Regulatory complexities and grid integration issues pose significant challenges to the deployment of three phase string inverters. In many regions, outdated grid infrastructure and inconsistent interconnection standards create delays in project approvals. Utilities often face difficulties in managing large volumes of distributed solar power, which affects grid stability. Compliance with evolving safety, performance, and cybersecurity standards adds further complexity for manufacturers and project developers. Additionally, fragmented policy frameworks can slow down project implementation. Overcoming these barriers requires coordinated regulatory reforms, investment in smart grid technologies, and clear standardization measures. Addressing grid-related challenges is critical to supporting market scalability and long-term growth.

Regional Analysis

North America

North America holds a market share of 32% in the three phase string inverter market. The region benefits from strong solar energy adoption in the U.S. and Canada, driven by federal incentives, tax credits, and corporate renewable energy commitments. Utility-scale projects dominate installations, with growing demand from commercial and industrial users. Technological advancements and smart grid integration further accelerate adoption. Companies are investing in energy storage integration and grid modernization, supporting long-term growth. Favorable policies such as the Investment Tax Credit (ITC) continue to make the region a key market hub for string inverter deployment.

Europe

Europe accounts for 29% of the market share, supported by strong renewable energy targets and climate-neutral goals. Countries like Germany, Spain, and Italy lead in solar capacity expansion. The European Green Deal and subsidy schemes encourage both residential and utility-scale projects. Three phase string inverters are widely used for their grid stability features and efficiency. Smart inverters with advanced grid-support capabilities are seeing rapid uptake. High rooftop solar penetration, net metering policies, and grid modernization initiatives strengthen market growth. The region’s focus on energy independence and decarbonization continues to create new opportunities.

Asia Pacific

Asia Pacific leads the global market with a 34% share, driven by rapid solar energy deployment in China, India, Japan, and Australia. Governments are actively investing in large-scale solar farms and distributed generation programs. Rising industrialization and growing energy demand further accelerate adoption. Cost-effective manufacturing in the region drives competitive pricing for string inverters. Policy support, subsidies, and renewable energy targets are boosting utility and commercial installations. Asia Pacific also witnesses growing rooftop solar adoption, especially in urban centers. The region’s dominance is expected to continue due to its expanding solar infrastructure and manufacturing capacity.

Latin America

Latin America represents 3% of the market share and is steadily growing, supported by increasing solar investments in Brazil, Mexico, and Chile. Governments are promoting renewable energy through auctions, incentives, and favorable power purchase agreements. Utility-scale projects dominate the market, with a rising focus on decentralized energy solutions. The region benefits from high solar irradiation, enabling efficient power generation. However, market expansion is moderated by policy variations and financing barriers. As regulatory frameworks improve, more projects are expected to integrate three phase string inverters for grid stability and improved energy output.

Middle East & Africa

The Middle East & Africa holds a 2% market share, driven by large-scale solar projects in the UAE, Saudi Arabia, and South Africa. Governments are diversifying energy sources to reduce fossil fuel dependency. High solar potential supports strong utility-scale deployment, where three phase string inverters are preferred for efficiency and scalability. Grid infrastructure upgrades and renewable energy targets are encouraging project development. While adoption is still emerging, growing foreign investments and regional initiatives like Vision 2030 are driving steady progress. The market is expected to expand as grid integration and regulatory frameworks strengthen.

Market Segmentations:

By Product

By Application

- Residential

- Commercial & Industrial

- Utility

By Connectivity

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the three-phase string inverter market is characterized by strong participation from global and regional players, each focusing on technological innovation and capacity expansion. Key companies include Sungrow, Veichi Electric, NingBo Deye Inverter Technology, Canadian Solar, LEDVANCE, INVTSolar, Solis Inverters, Huawei Technologies, Goldi Solar, Chint Power Systems, Fimer, and UTL Solar. These players emphasize product efficiency, grid compatibility, and smart inverter features to strengthen their market presence. Asia Pacific leads the market with a 34% share, driven by robust manufacturing capabilities and large-scale solar deployments. North America and Europe collectively account for 61%, supported by advanced grid infrastructure and favorable renewable energy policies. Strategic initiatives such as product launches, partnerships, and R&D investments are intensifying competition. Companies are also focusing on integrating digital technologies and energy storage solutions to enhance system reliability and performance, positioning themselves for long-term growth in the rapidly evolving solar energy sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sungrow

- Veichi Electric

- NingBo Deye Inverter Technology

- Canadian Solar

- LEDVANCE

- INVTSolar

- Solis Inverters

- Huawei Technologies

- Goldi Solar

- Chint Power Systems

- Fimer

- UTL Solar

Recent Developments

- In January 2025, Solis launched the S6-EH3P K-H Series, a range of three phase energy storage inverters designed for commercial solar applications. Offering power capacities from 29.9 kW to 50 kW, these inverters integrate both on-grid and off-grid functionalities.

- In July 2023, Goldi Solar introduced its VAMA range of smart string inverters specifically for on-grid applications. The series includes both single-phase and three phase variants, catering to diverse residential and commercial energy needs.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Connectivity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-efficiency three phase string inverters will grow with expanding solar projects.

- Asia Pacific will continue to lead market adoption due to large-scale solar installations.

- Integration of smart and digital inverter solutions will increase grid reliability.

- Advanced MPPT and monitoring technologies will drive performance optimization.

- Utility-scale solar projects will remain the primary demand driver for inverters.

- Supportive government incentives will accelerate renewable energy investments.

- Hybrid inverter systems with storage integration will gain strong traction.

- Manufacturers will focus on compact designs and cost-effective solutions.

- Strategic partnerships and M&A activities will intensify competition.

- Regulatory standardization will support faster grid integration and market expansion.