Market Overview

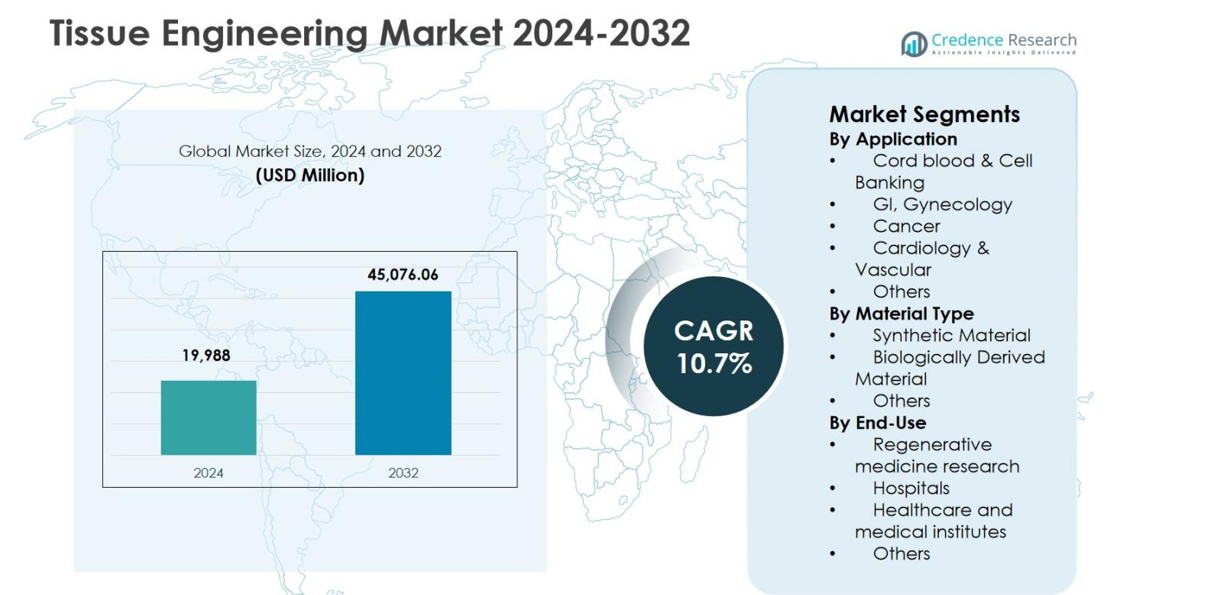

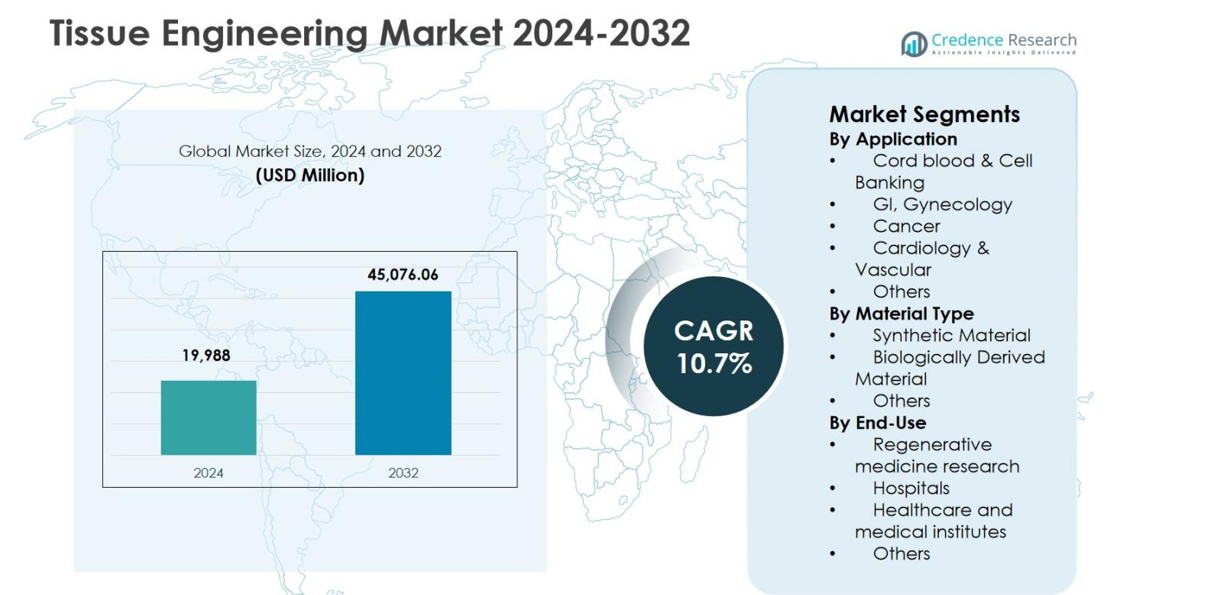

The Tissue Engineering Market size was valued at USD 19,988 million in 2024 and is anticipated to reach USD 45,076.06 million by 2032, expanding at a CAGR of 10.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tissue Engineering Market Size 2024 |

USD 19,988 million |

| Tissue Engineering Market, CAGR |

10.7% |

| Tissue Engineering Market Size 2032 |

USD 45,076.06 million |

The Tissue Engineering Market is shaped by strong participation from leading players such as Stryker Corporation, Medtronic, Zimmer Biomet, Integra LifeSciences Corporation, Organogenesis Inc., Baxter International Inc., B. Braun Melsungen AG, Cook Biotech Inc., AbbVie Inc., 3M, and DePuy Synthes (Johnson & Johnson Services, Inc.), which focus on advanced biomaterials, scaffold technologies, and regenerative therapies. These companies actively expand product portfolios through research investments, partnerships with academic institutions, and clinical trial advancements. Regionally, North America leads the Tissue Engineering Market with a 41.2% share in 2024, supported by robust healthcare infrastructure, high research funding, and early adoption of regenerative medicine. Europe follows with strong institutional research support, while Asia Pacific continues to gain momentum through expanding biotechnology capabilities.

Market Insights

- The Tissue Engineering Market was valued at USD 19,988 million in 2024, is projected to reach USD 45,076.06 million by 2032, and is expected to grow at a CAGR of 10.7% during the forecast period.

- Market growth is driven by rising prevalence of cardiovascular diseases, cancer, and organ failure, alongside increasing demand for regenerative therapies, with Cardiology & Vascular holding a 34.6% segment share in 2024 due to strong clinical adoption.

- Technological progress in biologically derived materials, stem cell engineering, and 3D bioprinting is shaping market trends, while leading players focus on R&D investment, portfolio expansion, and strategic collaborations to strengthen market positioning.

- High development costs, complex manufacturing processes, and stringent regulatory requirements act as key restraints, limiting rapid commercialization and restricting adoption in cost-sensitive healthcare systems.

- Regionally, North America led with a 41.2% share in 2024, followed by Europe at 28.6% and Asia Pacific at 21.9%, while Latin America and the Middle East & Africa together accounted for the remaining market share, supported by gradual healthcare advancements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application:

The Tissue Engineering Market by application is led by Cardiology & Vascular, which accounted for 34.6% market share in 2024, driven by the high prevalence of cardiovascular diseases and increasing adoption of engineered tissues for vascular grafts and cardiac repair. Strong clinical demand for regenerative solutions to address heart failure, ischemic conditions, and vascular damage supports segment dominance. Cancer applications follow due to growing oncology research, while cord blood & cell banking benefits from rising stem cell preservation. GI and gynecology applications expand steadily, supported by advancements in scaffold-based tissue regeneration.

- For instance, Artivion’s SynerGraft technology produces decellularized CryoValve SG pulmonary human heart valves, which virtually eliminate allogeneic donor cells while preserving biological matrix integrity, achieving 82% freedom from reintervention at 10 years versus 50% for standard cryopreserved allografts.

By Material Type:

By material type, Biologically Derived Material dominated the Tissue Engineering Market with a 52.3% share in 2024, supported by superior biocompatibility, enhanced cell adhesion, and improved tissue integration outcomes. Materials such as collagen, fibrin, and decellularized matrices closely mimic native extracellular environments, accelerating clinical adoption. Synthetic materials maintain strong demand due to scalability and controlled mechanical properties, particularly in research applications. However, increasing regulatory approvals and clinical success rates of biologically derived scaffolds continue to reinforce their leadership across therapeutic and research-based tissue engineering applications.

- For instance, fibrinogen-based precision microporous scaffolds (PFn) from enzymatic conversion maintained excellent fibrin nanostructure with controlled pore sizes, supporting cellular attachment and nutrient diffusion for tissue replacement.

By End-Use:

The Regenerative Medicine Research segment held the largest share at 41.8% in 2024, driven by extensive academic, government, and private-sector investments in tissue regeneration and stem cell research. Growing funding for translational research, coupled with rising collaboration between biotech firms and research institutes, supports segment dominance. Hospitals represent a significant share due to increasing clinical trials and surgical adoption of engineered tissues. Healthcare and medical institutes also contribute steadily, supported by expanding infrastructure and rising demand for advanced regenerative therapies worldwide.

Key Growth Drivers

Rising Burden of Chronic and Degenerative Diseases

The Tissue Engineering Market is strongly driven by the increasing prevalence of chronic and degenerative diseases, including cardiovascular disorders, cancer, musculoskeletal conditions, and organ failure. Aging populations and sedentary lifestyles are elevating demand for regenerative therapies that can restore damaged tissues and organs. Tissue-engineered solutions reduce reliance on donor organs and offer long-term therapeutic benefits. Growing clinical demand for effective alternatives to conventional treatments continues to stimulate adoption across hospitals, research institutions, and regenerative medicine centers worldwide.

- For instance, LifeNet Health introduced ViviGen MIS, an advanced cellular allograft delivery device for minimally invasive surgeries targeting orthopedic and spine conditions. Showcased at the 2022 North American Spine Society meeting, it aids bone and tissue repair in musculoskeletal disorders.

Advancements in Biomaterials and Scaffold Technologies

Ongoing advancements in biomaterials and scaffold technologies are accelerating growth in the Tissue Engineering Market. Innovations in biologically derived materials, hybrid scaffolds, and bioactive matrices improve cell adhesion, tissue integration, and regeneration outcomes. Enhanced control over scaffold architecture, degradation rates, and mechanical properties supports wider clinical applications. These technological improvements increase procedural success rates and expand the use of tissue engineering in complex therapeutic areas, strengthening market penetration.

- For instance, Epibone engineers personalized bone grafts from patient stem cells on scaffolds, maturing them into living bone that integrates rapidly with native tissue for craniofacial and orthopedic repairs.

Expanding Investment in Regenerative Medicine Research

Rising investments in regenerative medicine research significantly support the Tissue Engineering Market. Government funding programs, academic initiatives, and private-sector investments are accelerating innovation and clinical translation. Collaborations between biotechnology companies, universities, and healthcare providers are strengthening research pipelines and advancing clinical trials. This expanding research ecosystem enhances product development efficiency, accelerates commercialization, and supports long-term market growth across multiple therapeutic applications.

Key Trends & Opportunities

Integration of 3D Bioprinting Technologies

The integration of 3D bioprinting is a key trend creating new opportunities in the Tissue Engineering Market. Bioprinting enables precise fabrication of complex tissue structures using living cells and biomaterials, improving customization and reproducibility. This technology supports patient-specific tissue constructs and enhances scalability for research and clinical use. Increasing adoption of bioprinting platforms is accelerating innovation in personalized regenerative therapies and organ development.

- For instance, Aspect Biosystems leverages its Lab-on-a-Printer microfluidic technology to fabricate complex living tissues, such as airway smooth muscle constructs that contract in response to histamine, replicating asthma responses for disease modeling and therapeutic development.

Growing Focus on Personalized and Precision Medicine

The increasing focus on personalized and precision medicine presents significant opportunities for the Tissue Engineering Market. Customized tissue constructs tailored to individual patient profiles improve treatment outcomes and reduce immune rejection risks. Advances in cell engineering and patient-specific scaffold design support this trend. As healthcare systems emphasize precision-based therapies, demand for personalized tissue engineering solutions continues to expand across clinical and research settings.

- For instance, EpiBone develops patient-specific bone grafts for craniofacial and orthopedic surgeries using patient-derived stem cells on 3D-printed scaffolds.

Key Challenges

High Development Costs and Complex Manufacturing

High development costs and complex manufacturing processes remain major challenges for the Tissue Engineering Market. Tissue-engineered products require advanced materials, specialized infrastructure, and skilled expertise, increasing production expenses. Scaling from laboratory research to commercial manufacturing while maintaining quality and regulatory compliance remains difficult. These factors can limit participation from smaller companies and restrict widespread adoption in cost-sensitive healthcare environments.

Regulatory and Ethical Constraints

Regulatory and ethical constraints pose ongoing challenges for the Tissue Engineering Market. Strict regulatory requirements for safety, efficacy, and quality lead to extended approval timelines. Ethical considerations related to cell sourcing and tissue manipulation further complicate product development. Inconsistent regulatory frameworks across regions increase compliance complexity, potentially delaying commercialization and limiting global market expansion despite strong clinical demand.

Regional Analysis

North America

The Tissue Engineering Market in North America held the leading position with a 41.2% market share in 2024, driven by advanced healthcare infrastructure, strong funding for regenerative medicine, and high adoption of innovative therapies. The United States dominates regional growth due to extensive clinical research activity, favorable reimbursement frameworks, and the presence of major biotechnology and medical device companies. Strong collaboration between academic institutions and industry players accelerates product development and commercialization. Rising prevalence of chronic diseases and increasing organ transplant shortages further support sustained demand for tissue-engineered solutions across hospitals and research centers.

Europe

Europe accounted for a 28.6% market share in 2024, supported by robust government funding, established research institutions, and increasing clinical adoption of regenerative therapies. Countries such as Germany, the United Kingdom, and France drive regional growth through strong regulatory frameworks and rising investments in tissue engineering research. Expanding clinical trials and growing acceptance of biologically derived materials enhance market penetration. Additionally, rising aging populations and increasing incidence of chronic conditions strengthen demand for advanced tissue regeneration solutions across healthcare and academic settings.

Asia Pacific

The Asia Pacific region captured a 21.9% market share in 2024, driven by rapid healthcare infrastructure development, rising research investments, and growing awareness of regenerative medicine. Countries including China, Japan, South Korea, and India contribute significantly through expanding biotechnology sectors and increasing government support. Growth in medical tourism, rising prevalence of cardiovascular and orthopedic conditions, and improving access to advanced therapies support regional expansion. Increasing collaborations between research institutions and global players further accelerate adoption of tissue engineering technologies across the region.

Latin America

Latin America represented a 5.1% market share in 2024, supported by improving healthcare infrastructure and increasing investments in medical research. Brazil and Mexico lead regional growth due to expanding hospital networks and rising adoption of advanced therapeutic technologies. Growing awareness of regenerative medicine and increasing prevalence of chronic diseases drive demand for tissue-engineered solutions. Government initiatives aimed at strengthening biotechnology research and healthcare access continue to enhance market potential, although limited funding and regulatory challenges moderate overall growth rates.

Middle East & Africa

The Middle East & Africa region accounted for a 3.2% market share in 2024, driven by gradual improvements in healthcare infrastructure and increasing focus on advanced medical technologies. Countries such as Saudi Arabia, the UAE, and South Africa support regional growth through healthcare modernization initiatives and rising investments in medical research. Growing demand for advanced treatments for chronic and trauma-related conditions contributes to market expansion. However, limited local manufacturing capabilities and regulatory constraints continue to restrict broader adoption across the region.

Market Segmentations:

By Application

- Cord blood & Cell Banking

- GI, Gynecology

- Cancer

- Cardiology & Vascular

- Others

By Material Type

- Synthetic Material

- Biologically Derived Material

- Others

By End-Use

- Regenerative medicine research

- Hospitals

- Healthcare and medical institutes

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Stryker Corporation, Medtronic, Zimmer Biomet, Integra LifeSciences Corporation, AbbVie Inc., Baxter International Inc., B. Braun Melsungen AG, Cook Biotech Inc., Organogenesis Inc., 3M, and DePuy Synthes (Johnson & Johnson Services, Inc.) form the core of competition in the Tissue Engineering Market. The competitive landscape is characterized by strong focus on product innovation, biologically derived materials, and advanced scaffold technologies to address complex regenerative applications. Leading players invest heavily in research and development to expand therapeutic indications and improve clinical outcomes. Strategic partnerships with academic institutions and hospitals accelerate clinical validation and commercialization. Mergers and acquisitions are used to strengthen technology portfolios and expand geographic reach. Companies also emphasize regulatory approvals and manufacturing scalability to gain competitive advantage. Growing competition is further supported by expansion into emerging markets and increased focus on personalized regenerative solutions, reinforcing long-term market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zimmer Biomet

- Organogenesis Inc.

- B. Braun Melsungen AG

- Medtronic

- Cook Biotech Inc.

- DePuy Synthes (Johnson & Johnson Services, Inc.)

- Baxter International Inc.

- Integra Life Sciences Corporation

- 3M

- Stryker Corporation

Recent Developments

- In December 2025, LifeNet Health acquired Tissue Testing Technologies LLC (T3), a biotechnology firm specializing in biopreservation, to advance regenerative medicine capabilities and expand global access to preserved tissue therapies.

- In December 2025, LifeNet Health acquired Tissue Testing Technologies LLC, enhancing biopreservation for clinical and research tissue applications.

- In November 2024, RTI Surgical completed its acquisition of Collagen Solutions, enhancing its portfolio of allograft and xenograft biomaterials for tissue engineering in areas like orthopedics and cardiac surgery.

Report Coverage

The research report offers an in-depth analysis based on Application, Material,Type, End–Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Tissue Engineering Market will witness sustained expansion driven by rising demand for regenerative therapies across cardiovascular, orthopedic, and oncology applications.

- Advancements in biomaterials and scaffold engineering will improve tissue integration and long-term clinical outcomes.

- Increasing adoption of biologically derived materials will support broader clinical acceptance and regulatory approvals.

- Integration of 3D bioprinting technologies will enhance customization and scalability of tissue-engineered products.

- Growing focus on personalized medicine will accelerate development of patient-specific tissue constructs.

- Expanding research funding will strengthen innovation pipelines and speed up clinical translation.

- Strategic collaborations between biotechnology firms, hospitals, and research institutes will intensify.

- Emerging economies will present strong growth opportunities due to improving healthcare infrastructure.

- Regulatory frameworks will gradually evolve to support faster approval of regenerative therapies.

- Competitive intensity will increase as companies expand portfolios and invest in advanced manufacturing capabilities.