Market Overview

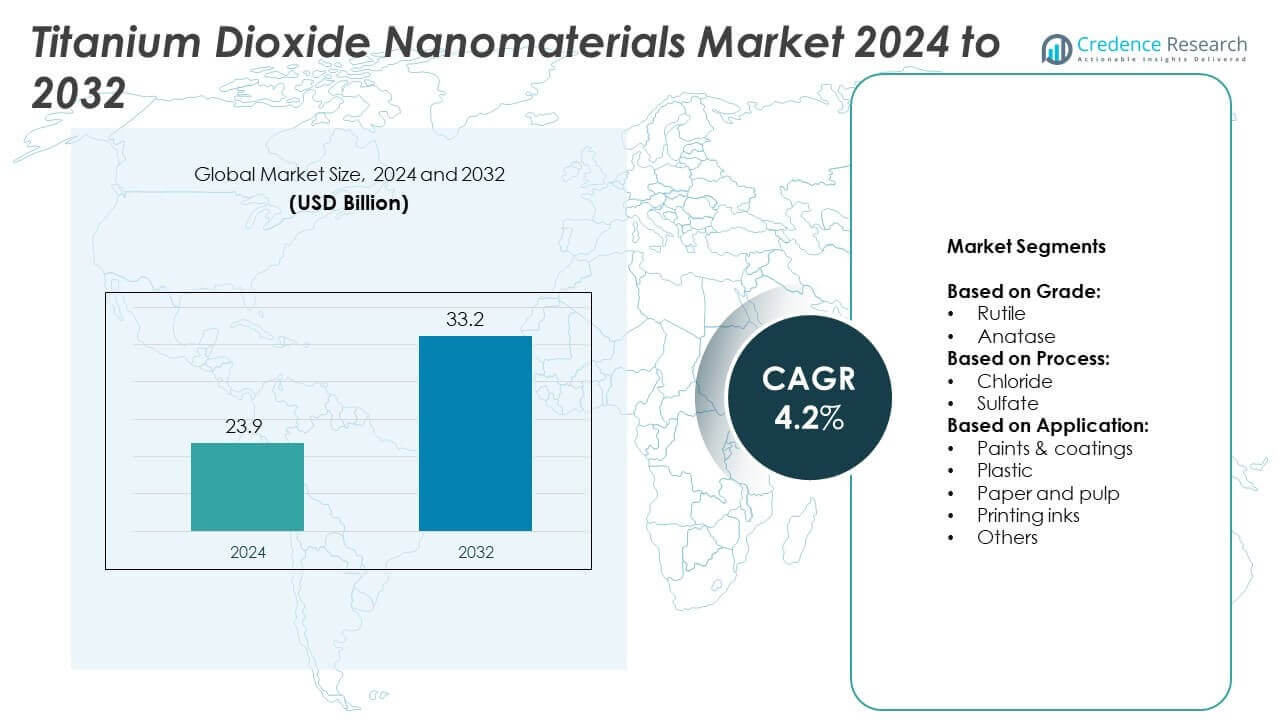

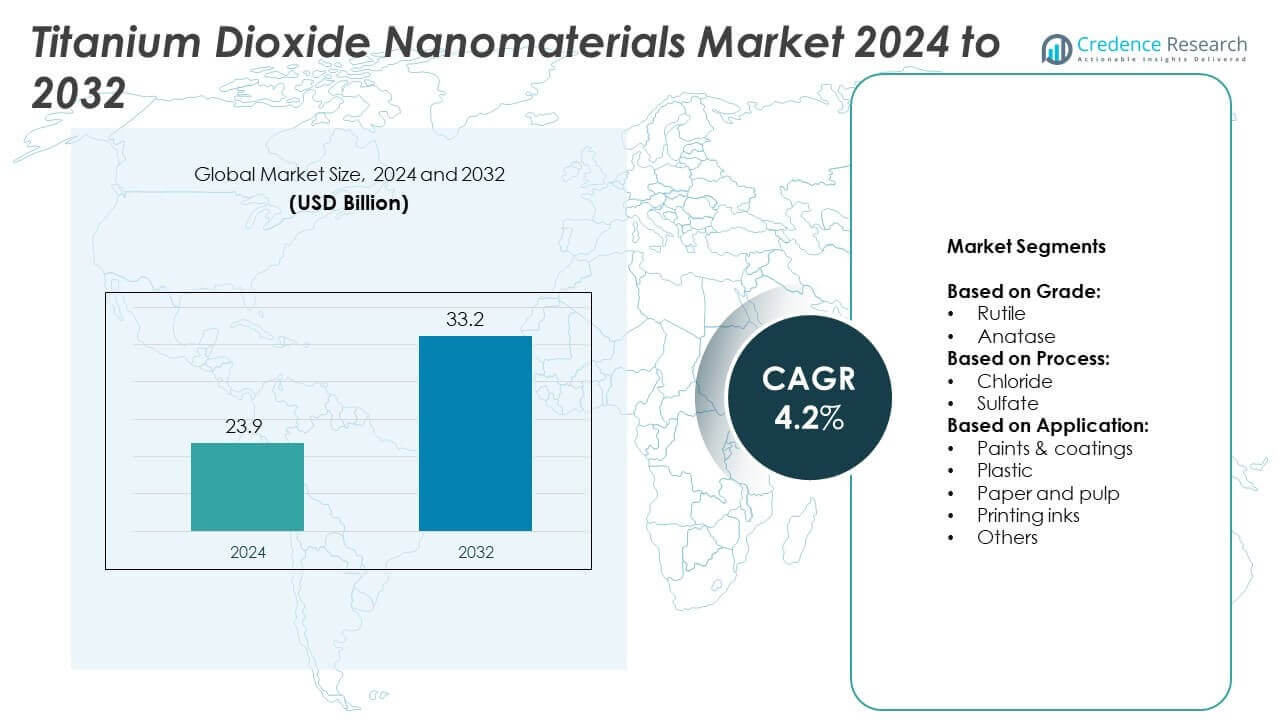

The Titanium Dioxide Nanomaterials Market size was valued at USD 23.9 billion in 2024 and is anticipated to reach USD 33.2 billion by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Titanium Dioxide Nanomaterials Market Size 2024 |

USD 23.9 Billion |

| Titanium Dioxide Nanomaterials Market, CAGR |

4.2% |

| Titanium Dioxide Nanomaterials Market Size 2032 |

USD 33.2 Billion |

The Titanium Dioxide Nanomaterials market grows with rising demand from paints, coatings, plastics, and cosmetics, supported by superior UV resistance, durability, and photocatalytic properties. Increasing use in renewable energy, water purification, and self-cleaning surfaces strengthens adoption. Healthcare applications such as implants and drug delivery also drive expansion. Trends highlight a shift toward sustainable production methods, eco-friendly formulations, and advanced nanotechnology innovations. Rising investments in R&D and regulatory focus on safe, high-performance materials position the market for steady long-term growth.

North America and Europe demonstrate strong demand for titanium dioxide nanomaterials, driven by advanced infrastructure, strict environmental regulations, and innovation in coatings and cosmetics. Asia Pacific leads in production and consumption with rapid industrialization, construction growth, and expanding electronics applications. Latin America and the Middle East & Africa show steady adoption through infrastructure and healthcare investments. Key players such as Tronox Holdings, Evonik Industries, Kronos Worldwide, and Showa Denko strengthen global presence with innovation, sustainable production methods, and expanding product portfolios.

Market Insights

- The Titanium Dioxide Nanomaterials market was valued at USD 23.9 billion in 2024 and is projected to reach USD 33.2 billion by 2032, expanding at a CAGR of 4.2%.

- Rising demand from paints, coatings, plastics, and cosmetics industries drives market growth due to superior UV resistance, durability, and opacity.

- Strong trends include adoption in renewable energy, water purification, and self-cleaning surfaces, supported by advanced nanotechnology innovations.

- Competition remains intense with key players focusing on R&D, sustainable production, and global distribution networks to expand presence.

- Market restraints include health and environmental concerns related to nanoparticle exposure and high production costs limiting mass-scale adoption.

- North America and Europe show strong growth through advanced infrastructure and strict regulatory standards, while Asia Pacific leads consumption through large-scale manufacturing and industrial expansion.

- Latin America and the Middle East & Africa show steady growth with applications in construction, packaging, and healthcare, supported by rising investments and gradual adoption of sustainable solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Paints and Coatings Industry

The paints and coatings industry drives strong demand for titanium dioxide nanomaterials. It enhances opacity, brightness, and UV resistance in architectural and industrial coatings. Construction and infrastructure projects worldwide increase the need for high-performance coatings. Growing urbanization fuels the consumption of decorative paints in residential and commercial buildings. The product’s ability to provide long-lasting protection supports its preference over alternatives. Environmental regulations also encourage the use of advanced materials with lower toxicity. The Titanium Dioxide Nanomaterials market benefits significantly from this widespread industrial reliance.

- For instance, Chemours is one of the world’s largest producers of titanium dioxide (TiO₂), with an annual capacity of over 1.25 million tonnes. Its Ti-Pure™ TS-6300 grade was specifically developed for high-hiding flat (matte) architectural coatings.

Expanding Applications in Cosmetics and Personal Care

Cosmetics and personal care products represent a major growth driver for titanium dioxide nanomaterials. It is widely used in sunscreens due to excellent UV-blocking properties. Skincare formulations adopt it to protect against photoaging and skin cancer risks. Rising consumer awareness about harmful UV radiation strengthens market demand. The preference for non-toxic, transparent formulations further accelerates adoption. Growing middle-class populations in emerging markets increase product consumption in personal care. The Titanium Dioxide Nanomaterials market gains traction from these expanding applications.

- For instance, Evonik supplies ultrafine titanium dioxide under its TEGO® Sun range for use as a UV filter in sunscreen formulations. The particles are typically below 100 nanometers, which is the standard size for producing transparent mineral-based sunscreens.

Increasing Use in Environmental and Energy Applications

Environmental applications significantly influence titanium dioxide nanomaterials adoption. It serves as a photocatalyst in air and water purification systems. Governments focus on pollution control solutions to ensure cleaner environments. The product also supports self-cleaning surfaces in construction and automotive industries. Renewable energy sectors adopt it in solar cells for improved efficiency. Rising awareness of sustainability enhances its role in green technologies. The Titanium Dioxide Nanomaterials market sees steady expansion from these environmental benefits.

Growing Utilization in Electronics and Healthcare

Electronics and healthcare sectors offer diverse opportunities for titanium dioxide nanomaterials. It improves performance of sensors, batteries, and other electronic components. Demand for miniaturized, efficient devices accelerates material adoption. In healthcare, the product is used in drug delivery, implants, and antibacterial coatings. Rising investments in nanomedicine strengthen its role in medical applications. Expanding R&D supports innovation across both industries. The Titanium Dioxide Nanomaterials market secures long-term growth through this multi-sector adoption.

Market Trends

Advancements in Nanotechnology and Product Innovation

Nanotechnology innovation is reshaping demand for titanium dioxide nanomaterials. It enables manufacturers to design products with enhanced photocatalytic efficiency and improved particle stability. Research focuses on tailoring particle size for targeted applications in coatings, energy, and healthcare. Advanced production techniques reduce environmental impact while ensuring high purity levels. Companies invest in surface modification technologies to enhance compatibility with polymers and cosmetics. Continuous innovation strengthens adoption across industries. The Titanium Dioxide Nanomaterials market evolves with these advancements.

- For instance, Kronos Worldwide is a major producer of titanium dioxide (TiO₂) and operates production plants across five countries: Germany, Norway, Belgium, Canada, and the United States. The company’s annual production capacity is approximately 550,000 metric tonnes. Kronos offers a wide variety of TiO₂ pigment grades, including those used in plastics and cosmetic formulations, which can be surface-modified for specific performance enhancements

Growing Focus on Sustainable and Eco-Friendly Solutions

Sustainability trends strongly influence the development of titanium dioxide nanomaterials. It is increasingly used in green building materials and water treatment systems. Eco-friendly formulations align with global regulations promoting safer industrial practices. Demand rises for recyclable coatings and low-VOC products supported by titanium dioxide nanostructures. Solar energy applications highlight its role in renewable power generation. Industry players prioritize sustainable sourcing and cleaner manufacturing processes. The Titanium Dioxide Nanomaterials market adapts to these evolving sustainability goals.

- For instance, Pilkington (a part of NSG Group) has integrated a titanium dioxide nanocoating into its Activ™ self-cleaning glass product line. This glass is widely installed in residential and commercial buildings globally. The company publicly announced a sales milestone of 10 million square meters of Activ™ self-cleaning glass in February 2018.

Rising Adoption in High-Performance Consumer Goods

Consumer goods industries increasingly integrate titanium dioxide nanomaterials into product design. It enhances durability, brightness, and UV resistance in packaging, textiles, and plastics. Cosmetic companies adopt transparent grades for advanced sun protection. Consumer electronics also benefit from improved functional properties offered by nanoscale coatings. Urban lifestyles and rising disposable incomes drive demand for premium products. The trend supports broader use of titanium dioxide nanostructures in daily-use goods. The Titanium Dioxide Nanomaterials market expands with this consumer-driven adoption.

Integration into Healthcare and Biomedical Applications

Healthcare innovations highlight emerging uses of titanium dioxide nanomaterials. It demonstrates antibacterial, photocatalytic, and biocompatible properties suited for medical implants. Nanostructured coatings improve sterilization and reduce infection risks in healthcare environments. Drug delivery systems adopt it for controlled release and targeted therapies. Medical device manufacturers explore advanced composites for enhanced safety. Growing investment in nanomedicine accelerates its biomedical integration. The Titanium Dioxide Nanomaterials market strengthens through this healthcare-focused trend.

Market Challenges Analysis

Health and Environmental Concerns Associated with Nanoparticles

Health and environmental risks remain a key challenge for titanium dioxide nanomaterials. Inhalation of nanoparticles may cause respiratory issues, leading to strict workplace regulations. It also raises concerns about long-term effects on human health. Environmental impact from disposal of nanomaterials in soil and water further complicates adoption. Governments enforce stricter safety assessments before approving large-scale applications. Compliance with these regulatory standards increases production costs and slows commercialization. The Titanium Dioxide Nanomaterials market faces significant hurdles in balancing growth with safety concerns.

High Production Costs and Technical Limitations

Production complexity poses another barrier to titanium dioxide nanomaterials expansion. It requires advanced synthesis methods that are costly and energy-intensive. Limited scalability restricts affordable supply for mass-market applications. Small particle sizes also demand specialized handling to avoid agglomeration and maintain stability. Manufacturers face challenges in ensuring consistent quality across industries such as healthcare and electronics. Limited awareness among end-users about technical benefits reduces wider adoption. The Titanium Dioxide Nanomaterials market must overcome these cost and technology limitations to sustain growth.

Market Opportunities

Expansion in Renewable Energy and Environmental Applications

Renewable energy and environmental sectors create strong opportunities for titanium dioxide nanomaterials. It is widely used in solar cells to enhance energy conversion efficiency. Photocatalytic properties also enable applications in water and air purification systems. Governments support clean energy and pollution control initiatives, driving demand for advanced nanomaterials. Adoption of self-cleaning surfaces in construction and transportation expands its utility. Growing focus on sustainability ensures consistent funding for R&D projects. The Titanium Dioxide Nanomaterials market gains momentum from these environmentally driven opportunities.

Emerging Potential in Healthcare and Advanced Electronics

Healthcare and electronics sectors offer promising growth avenues for titanium dioxide nanomaterials. It is increasingly applied in antibacterial coatings, medical implants, and drug delivery systems. Rising investment in nanomedicine supports further innovation in healthcare solutions. Electronics benefit from improved performance of batteries, sensors, and semiconductors enhanced by nanostructures. Demand for lightweight and efficient devices continues to grow across global markets. Collaborations between research institutions and manufacturers strengthen product development pipelines. The Titanium Dioxide Nanomaterials market secures long-term potential through these advanced applications.

Market Segmentation Analysis:

By Grade:

The Titanium Dioxide Nanomaterials market is segmented into rutile and anatase grades. Rutile dominates due to its higher stability, UV resistance, and strong optical properties. It is widely used in paints, coatings, and plastics where durability is critical. Anatase, on the other hand, offers superior photocatalytic activity, making it suitable for environmental and energy applications. Demand for anatase rises in solar cells, water purification, and self-cleaning surfaces. Both grades maintain strong growth trajectories, driven by industry-specific performance needs. The Titanium Dioxide Nanomaterials market benefits from the complementary advantages of these two grades.

- For instance, Tronox Holdings operates eight titanium dioxide (TiO₂) production facilities globally, following the announcement in March 2025 that it would be idling its Botlek plant in the Netherlands. The company reported a total nameplate capacity of 1.1 million metric tonnes of TiO₂ pigment in its 2023 annual report.

By Process:

Production processes are divided into chloride and sulfate methods. The chloride process is preferred in developed markets due to its ability to produce high-purity titanium dioxide nanomaterials with lower environmental impact. It ensures consistency in particle size, which is essential for advanced coatings and electronics. The sulfate process remains important in price-sensitive regions, offering cost advantages despite higher waste generation. Emerging economies continue to rely on the sulfate route due to infrastructure limitations. Investments in cleaner technologies strengthen the adoption of chloride-based production worldwide. The Titanium Dioxide Nanomaterials market adapts its processes to balance cost efficiency and sustainability.

- For instance, Lomon Billions (now known as LB Group) is a major global titanium dioxide (TiO₂) producer, ranked among the top three worldwide. The company has invested significantly in expanding its chloride-process capacity. As of a January 2024 announcement, LB Group’s total chloride-process capacity across all sites was 660,000 tonnes per year. The company continues to operate sulfate-based production, with a total capacity of 850,000 tonnes per year, to serve various applications and meet market demand. Its total TiO₂ production capacity as of January 2024 was approximately 1.51 million tonnes per year.

By Application:

Applications span paints and coatings, plastic, paper and pulp, printing inks, and others. Paints and coatings account for the largest share, supported by construction, automotive, and industrial growth. It enhances opacity, brightness, and weather resistance, making it indispensable in architectural coatings. Plastics represent another significant segment where nanomaterials improve strength, UV resistance, and durability. The paper and pulp industry leverages titanium dioxide nanostructures for brightness and smooth finish. Printing inks adopt it for high-quality printing and improved adhesion on multiple substrates. Other applications include cosmetics, textiles, and electronics, where specialized uses continue to expand. The Titanium Dioxide Nanomaterials market secures broad relevance through these diverse end-use sectors.

Segments:

Based on Grade:

Based on Process:

Based on Application:

- Paints & coatings

- Plastic

- Paper and pulp

- Printing inks

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 32% in the Titanium Dioxide Nanomaterials market, supported by strong demand from construction, automotive, and industrial coatings industries. The United States leads the region with advanced infrastructure and significant investments in high-performance paints and coatings. It also demonstrates high adoption in cosmetics and personal care due to rising awareness of UV protection. The presence of leading nanotechnology research centers accelerates product innovation and commercialization. Canada and Mexico contribute through expanding manufacturing sectors and rising consumer demand for sustainable solutions. Stringent environmental regulations in the region further drive the adoption of chloride-based production methods, ensuring high-quality output. The market in North America benefits from a mix of technological leadership, consumer awareness, and strong industrial bases.

Europe

Europe accounts for 27% of the Titanium Dioxide Nanomaterials market, driven by stringent environmental policies and advanced research facilities. Germany, France, and the United Kingdom dominate regional demand with strong emphasis on sustainable construction materials and eco-friendly coatings. It is also widely adopted in cosmetics, where regulatory standards promote safer and non-toxic formulations. Growth in automotive coatings and printing inks further strengthens demand across the region. European companies prioritize sustainable sourcing and invest heavily in nanotechnology R&D. The sulfate process has lower preference here, with a shift toward chloride-based production for efficiency and reduced environmental impact. Europe maintains strong momentum through innovation, regulatory support, and high-value end-user industries.

Asia Pacific

Asia Pacific captures the largest share at 30% of the Titanium Dioxide Nanomaterials market, supported by rapid industrialization and urbanization. China leads with significant consumption across paints, coatings, plastics, and printing inks. It also emerges as a global hub for low-cost production supported by large-scale manufacturing infrastructure. Japan and South Korea drive innovation with strong investments in electronics and healthcare applications. India contributes through rising construction and packaging industries that heavily depend on advanced nanomaterials. Growing middle-class populations across Southeast Asia further boost demand for personal care and household products. Asia Pacific secures its leadership position through a combination of manufacturing strength, expanding end-use sectors, and increasing research initiatives.

Latin America

Latin America represents 6% of the Titanium Dioxide Nanomaterials market, reflecting moderate growth supported by specific industries. Brazil dominates the region with expanding demand from paints, coatings, and packaging sectors. It also invests in water treatment and environmental applications where photocatalytic properties are essential. Mexico contributes with growing adoption in automotive coatings and industrial applications. Rising consumer awareness in cosmetics and personal care supports gradual expansion across the region. Limited infrastructure for advanced production processes remains a challenge, but international collaborations help bridge technology gaps. Latin America maintains steady demand while moving toward adoption of more sustainable and high-value applications.

Middle East & Africa

The Middle East & Africa account for 5% of the Titanium Dioxide Nanomaterials market, supported by growing construction and industrial sectors. The United Arab Emirates and Saudi Arabia drive demand through large-scale infrastructure projects that rely on durable coatings. It is also applied in packaging and plastics, reflecting rising consumer product demand. South Africa contributes with steady adoption in healthcare and environmental applications. Limited production capabilities in the region create reliance on imports from Asia Pacific and Europe. Governments are investing in nanotechnology R&D to diversify industrial capabilities beyond oil and gas. The region shows long-term potential as infrastructure expansion and healthcare investments accelerate adoption of titanium dioxide nanomaterials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tronox Holdings

- Kronos Worldwide

- Evonik Industries

- Showa Denko

- American Elements

- Sakai Chemical Industry

- Huntsman International

- Cristal

- Nanoptek

- CINKARNA Celje

- Reinste Nano Ventures

- Altairnano

- Catalysis

- DuPont

- Ishihara Sangyo Kaisha

Competitive Analysis

The leading players in the Titanium Dioxide Nanomaterials market include Tronox Holdings, Kronos Worldwide, Evonik Industries, Showa Denko, DuPont, Huntsman International, Cristal, Sakai Chemical Industry, American Elements, CINKARNA Celje, Altairnano, Catalysis, Reinste Nano Ventures, Nanoptek, and Ishihara Sangyo Kaisha. These companies compete through advanced product innovation, capacity expansion, and sustainability-driven strategies. The focus remains on producing high-purity nanomaterials with tailored properties for paints, coatings, plastics, and healthcare applications. Investment in R&D plays a crucial role, with firms prioritizing surface modification technologies and enhanced photocatalytic activity to meet diverse industrial needs. Strong distribution networks and strategic partnerships enable global players to secure a competitive edge in both developed and emerging markets. Regional diversification also strengthens market reach, as companies adapt to regulatory environments and consumer preferences across North America, Europe, and Asia Pacific. Price competitiveness continues to matter, but innovation and quality consistency drive long-term positioning. With growing demand in renewable energy, environmental purification, and advanced electronics, these companies are investing in next-generation applications. The Titanium Dioxide Nanomaterials market is therefore shaped by a balance of technological leadership, regulatory compliance, and sustained industry collaboration, ensuring steady growth and increasing opportunities across end-use industries.

Recent Developments

- In 2025, Tronox Holdings published its 2024 sustainability report, highlighting progress in responsible operations and environmental performance

- In August 2025, Kronos Worldwide was listed in industry reports for experiencing decreased production volumes due to weak market demand and general global uncertainty. The company is a producer of titanium dioxide (TiO₂) pigments, a key ingredient for the coatings and plastics industries, and does not sell end-product coatings.

- In 2024, ISK’s “Vision 2030 Stage II” plan, which began in fiscal year 2024, the company is focused on “accelerating development of new products”. Its official research and development (R&D) strategy leverages its proprietary titanium dioxide technology to create new value in functional materials that address social issues like sustainable development.

Report Coverage

The research report offers an in-depth analysis based on Grade, Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand from construction and automotive coatings.

- Sustainable and eco-friendly production methods will gain wider adoption.

- Advanced photocatalytic applications in water and air purification will strengthen usage.

- Growth in solar energy will drive higher demand for nanostructured materials.

- Healthcare innovations will create opportunities in implants and drug delivery.

- Cosmetics and personal care industries will continue to adopt transparent grades.

- Electronics and sensor technologies will integrate nanomaterials for better efficiency.

- Emerging economies will increase consumption through infrastructure and industrial growth.

- Strategic collaborations in R&D will accelerate product innovation.

- Regulatory compliance and safety standards will shape market competitiveness.