| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Trauma Fixation Market Size 2024 |

USD 6,490.95 million |

| Trauma Fixation Market, CAGR |

6.66% |

| Trauma Fixation Market Size 2032 |

USD 10,871.72 million |

Market Overview:

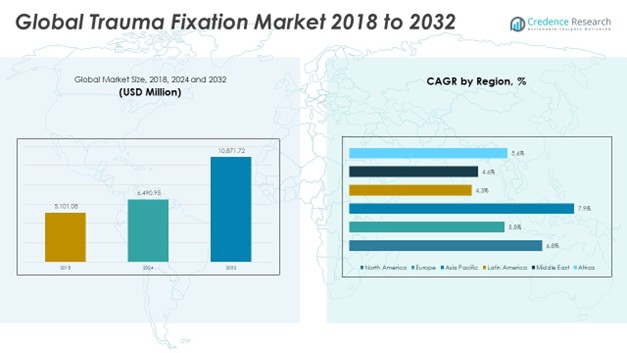

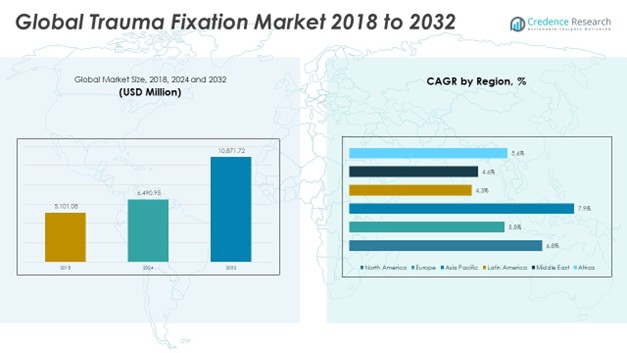

The Global Trauma Fixation Market size was valued at USD 5,101.08 million in 2018 to USD 6,490.95 million in 2024 and is anticipated to reach USD 10,871.72 million by 2032, at a CAGR of 6.66% during the forecast period.

Several factors are propelling the growth of the trauma fixation market. The increasing number of road accidents, sports injuries, and falls, particularly among the aging population, has led to a higher prevalence of fractures and musculoskeletal injuries requiring surgical intervention. According to the World Health Organization, road traffic injuries are a leading cause of death globally, contributing significantly to the demand for trauma fixation devices. Technological advancements have also played a crucial role in market expansion. The development of bioabsorbable implants, minimally invasive surgical techniques, and smart implants equipped with sensors for real-time monitoring have enhanced patient outcomes and reduced recovery times. These innovations have increased the adoption of trauma fixation devices among healthcare providers. Furthermore, the growing geriatric population, which is more susceptible to conditions like osteoporosis, has heightened the need for effective fracture management solutions. The emphasis on improving patient quality of life and the increasing healthcare expenditure in emerging economies are additional factors contributing to market growth.

Regionally, North America holds the largest share of the trauma fixation market, accounting for approximately 47% in 2024. This dominance is attributed to well-established healthcare infrastructure, high incidence of trauma cases, and the presence of key market players. The United States, in particular, has seen a surge in demand for trauma fixation devices due to the prevalence of sports-related injuries and an aging population. Asia-Pacific is anticipated to be the fastest-growing region during the forecast period. Factors such as rapid urbanization, increasing road traffic accidents, and improving healthcare facilities are driving market growth in countries like China and India. The rising awareness about advanced treatment options and the expanding medical tourism industry further bolster the market in this region.

Market Insights:

- The Global Trauma Fixation Market is expected to grow from USD 6,490.95 million in 2024 to USD 10,871.72 million by 2032, registering a CAGR of 6.66% during the forecast period.

- Rising road accidents, falls, and sports injuries, especially among the elderly, continue to drive the need for trauma fixation devices globally.

- Technological advancements such as bioabsorbable implants, smart sensors, and minimally invasive surgical tools are improving surgical precision and patient recovery.

- The aging global population, particularly those suffering from osteoporosis, is creating sustained demand for fracture management systems.

- Increased healthcare spending and expanding trauma infrastructure in emerging economies are unlocking new market opportunities for global manufacturers.

- High procedural costs and limited insurance coverage in lower-income countries remain key challenges to widespread adoption of trauma fixation devices.

- North America leads with 47% market share in 2024, while Asia-Pacific is projected to be the fastest-growing region due to rising trauma cases and improving healthcare access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Incidence of Traumatic Injuries Fueling Product Demand

The steady rise in traffic accidents, falls, and sports injuries globally has significantly increased the number of trauma cases requiring surgical intervention. The World Health Organization reports that road traffic injuries are a leading cause of death, particularly in low- and middle-income countries. Urbanization and increased vehicular density have contributed to the growing frequency of such incidents. This growing burden of musculoskeletal trauma has strengthened the demand for internal and external fixation devices. Hospitals and trauma centers are witnessing a continuous influx of fracture cases, driving the adoption of advanced surgical solutions. The Global Trauma Fixation Market is benefiting from this consistent demand for effective fracture management systems. It continues to gain traction among healthcare providers due to its ability to restore mobility and improve recovery outcomes.

Technological Advancements Enhancing Clinical Outcomes

Innovations in implant materials and surgical technologies are playing a critical role in the market’s growth trajectory. Manufacturers are developing bioabsorbable implants, hybrid fixation systems, and minimally invasive devices that improve surgical precision and reduce recovery time. These advancements support better alignment, enhanced fixation strength, and lower post-operative complications. Smart implants with embedded sensors are enabling real-time monitoring of healing processes, offering data-driven support to both surgeons and patients. These features appeal to hospitals aiming to improve patient outcomes and reduce hospital stays. Healthcare providers are increasingly investing in advanced trauma fixation solutions that combine precision with patient-centric design. It contributes to an improved standard of care in orthopedic trauma management.

Expanding Geriatric Population Driving Fracture Treatments

The global population aged 65 and above continues to grow, creating a larger demographic segment susceptible to fractures. Age-related conditions such as osteoporosis significantly weaken bone structure, increasing the likelihood of hip and spine fractures. Elderly patients often require surgical fixation due to delayed healing and limited regenerative capacity. Governments and healthcare organizations are focusing on preventive care and early intervention, which encourages the use of trauma fixation devices. The demand for stable and long-lasting implant systems is rising in geriatric care, leading to higher procedural volumes in hospitals and ambulatory surgical centers. It ensures strong market potential for vendors providing customized solutions for age-related trauma injuries.

- For instance, the International Osteoporosis Foundation (IOF) estimates that worldwide, one in three women and one in five men over age 50 will experience osteoporotic fractures in their lifetime

Rising Healthcare Expenditure and Infrastructure Development in Emerging Economies

Developing regions such as Asia-Pacific, Latin America, and parts of the Middle East are experiencing significant growth in healthcare spending. Public and private sector investments are expanding trauma care infrastructure and enabling greater access to surgical treatments. Medical tourism in countries like India and Thailand is also creating new demand for high-quality trauma fixation procedures. Rising insurance penetration and awareness of advanced orthopedic care are encouraging patients to opt for surgical interventions over conservative treatments. International medical device companies are establishing manufacturing and distribution networks in these regions to meet growing local demand. It is accelerating the penetration of trauma fixation devices across emerging markets.

- For instances, in Thailand, the Ministry of Public Health announced in 2023 that over 500,000 medical tourists sought orthopedic trauma care, reflecting the country’s growing reputation for high-quality surgical services.

Market Trends:

Adoption of Minimally Invasive Surgical Techniques Gaining Momentum

Orthopedic surgeons are increasingly adopting minimally invasive techniques for trauma fixation procedures. These methods reduce incision size, minimize tissue damage, and accelerate recovery time, improving overall patient satisfaction. The demand for smaller, anatomically contoured implants supports this shift in surgical approach. Medical device manufacturers are launching trauma fixation systems designed for percutaneous insertion and guided screw placement. Hospitals and surgical centers prefer these techniques for reducing infection risks and shortening hospital stays. The Global Trauma Fixation Market is witnessing growing traction for products compatible with minimally invasive procedures. It continues to evolve in response to the clinical need for faster, less invasive treatment pathways.

- For instance, DePuy Synthes’ VA-LCP® (Variable Angle Locking Compression Plate) system is specifically designed for minimally invasive percutaneous plate osteosynthesis (MIPPO).

Integration of Smart Technologies in Fixation Devices

Technological integration is transforming trauma fixation devices with the emergence of smart implants. These devices incorporate sensors to monitor healing parameters such as load distribution, alignment, and bone integration in real time. Surgeons can use this data to make informed post-operative decisions and detect complications early. Companies are investing in digital health platforms that support remote monitoring and follow-up care. Smart trauma fixation systems align with the broader trend of connected healthcare and personalized treatment. It improves patient outcomes by offering greater insight into recovery progression. The market is embracing sensor-enabled implants as a differentiator in product innovation.

- For example, the OrthoSensor VERASENSE™ system, used in knee arthroplasty, provides intraoperative data on soft tissue balance and has been shown in a 2021 multicenter study (The Journal of Arthroplasty, PMID: 33712345) to reduce the rate of post-operative complications by enabling more precise implant positioning.

Growing Preference for Biodegradable and Hybrid Materials

The preference for biodegradable and hybrid implants is gaining strength due to their compatibility with the body and elimination of secondary removal surgeries. These materials gradually dissolve or integrate into the bone structure, reducing long-term complications. Polymers and magnesium-based composites are being adopted to replace traditional metal implants in specific applications. Pediatric and craniofacial trauma segments are particularly benefiting from these advancements. Manufacturers are focusing on developing biocompatible materials that offer adequate strength and predictable resorption timelines. It enables more effective and less invasive trauma care, especially in vulnerable patient groups. The Global Trauma Fixation Market is moving toward sustainable and patient-friendly material solutions.

Custom-Designed and Patient-Specific Implant Solutions on the Rise

Surgeons are increasingly requesting implants tailored to individual anatomy, particularly in complex fracture cases. The use of 3D printing and digital modeling allows manufacturers to produce custom plates and screws with high precision. These patient-specific solutions improve implant fit, reduce surgical time, and enhance fixation stability. Hospitals are partnering with technology providers to integrate such solutions into trauma workflows. The trend is especially strong in cranial, maxillofacial, and pelvic trauma applications where standard implants often fall short. It reflects a shift toward personalized care in orthopedic trauma management. The Global Trauma Fixation Market is seeing increased demand for customized and adaptive implant technologies.

Market Challenges Analysis:

High Cost of Trauma Fixation Procedures and Devices Limiting Accessibility

The cost of trauma fixation surgeries and advanced implant systems remains a significant barrier, especially in low- and middle-income countries. Many healthcare facilities struggle to adopt premium fixation technologies due to limited budgets and resource constraints. Patients often face high out-of-pocket expenses for trauma surgeries, particularly where insurance coverage is inadequate or absent. Reimbursement inconsistencies across regions further complicate access to timely surgical care. Hospitals may delay adopting technologically advanced implants due to budgetary limitations, despite their clinical benefits. The Global Trauma Fixation Market continues to face resistance in expanding into underfunded healthcare systems. It must address cost-efficiency concerns to ensure broader adoption and equitable treatment access.

- For example, a 2021 OECD health policy brief noted that reimbursement for trauma implants in Eastern Europe covered only 40–60% of total device costs, leaving patients to pay the remainder.

Stringent Regulatory Environment Delaying Product Approvals

Regulatory requirements for trauma fixation devices are becoming more rigorous, impacting the speed of product development and market entry. Manufacturers must navigate complex approval pathways, conduct extensive clinical trials, and maintain high standards for quality and safety. The process increases time-to-market and raises operational costs, especially for smaller companies with limited resources. Any delays in certification from regulatory bodies such as the FDA or CE can stall commercialization plans. Post-market surveillance obligations also place pressure on companies to invest in ongoing compliance and reporting systems. It challenges industry players to balance innovation with strict regulatory adherence. The Global Trauma Fixation Market must continuously adapt to evolving compliance frameworks without compromising product pipeline efficiency.

Market Opportunities:

Emerging economies across Asia-Pacific, Latin America, and Africa present substantial growth potential due to rising trauma cases and expanding healthcare infrastructure. Increasing road traffic accidents and workplace injuries are creating steady demand for trauma fixation solutions. Governments are investing in public healthcare facilities and surgical capabilities, making trauma care more accessible. Medical tourism in countries like India, Mexico, and Thailand is further increasing the volume of orthopedic procedures. The Global Trauma Fixation Market can capitalize on these developments by introducing cost-effective and scalable product lines. It can achieve deeper penetration by partnering with local distributors and adapting to regional clinical practices.

The development of 3D printing technologies is opening new avenues for personalized trauma care. Custom-designed implants improve anatomical fit, reduce surgical time, and enhance clinical outcomes in complex fracture cases. Surgeons are increasingly demanding patient-specific solutions in craniofacial, pelvic, and joint trauma applications. Companies that invest in additive manufacturing and digital modeling can gain a competitive edge. The Global Trauma Fixation Market stands to benefit by aligning product offerings with surgeon preferences for tailored devices. It enables better patient care and drives innovation-led growth across high-value segments.

Market Segmentation Analysis:

The Global Trauma Fixation Market is segmented by type, surgical site, end user, and application, reflecting the diverse clinical needs and technological advancements in orthopedic care.

By Type, the market comprises internal and external fixators. Internal fixators, including plates, screws, and nails, dominate due to their widespread use in stabilizing complex fractures. External fixators, such as circular and hybrid systems, are essential for managing open fractures and cases requiring temporary stabilization.

By Surgical Site, the market is divided into upper and lower extremities. Lower extremity procedures, encompassing hip, pelvis, knee, foot, and ankle, account for a significant share, driven by the high incidence of lower limb fractures. Upper extremity fixation, covering shoulder, elbow, hand, and wrist, also contributes substantially, particularly in sports and occupational injuries.

By End User, the market includes hospitals, ambulatory surgical centers, trauma centers, and others. Hospitals lead in adoption, offering comprehensive trauma care. Ambulatory surgical centers and trauma centers are gaining traction due to their efficiency and specialized services.

By Application, the market spans shoulder and elbow, hand and wrist, hip and pelvis, knee, foot and ankle, spinal, and others. The knee segment holds a prominent position, reflecting the prevalence of knee injuries and advancements in fixation techniques. Spinal applications are growing, supported by innovations in spinal fixation devices.

Segmentation:

By Type:

- Internal Fixators

- External Fixators

By Surgical Site:

- Upper Extremities

- Lower Extremities

By End User:

- Hospitals

- Ambulatory Surgical Centers

- Trauma Centers

- Others

By Application:

- Shoulder and Elbow

- Hand and Wrist

- Hip & Pelvis

- Knee

- Foot and Ankle

- Spinal

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Trauma Fixation Market size was valued at USD 2,178.16 million in 2018 to USD 2,742.20 million in 2024 and is anticipated to reach USD 4,605.97 million by 2032, at a CAGR of 6.8% during the forecast period. North America holds a 23.5% share of the Global Chip Resistor Market, driven by strong demand from the consumer electronics and automotive industries. The region benefits from advanced semiconductor manufacturing capabilities, particularly in the United States. High adoption of electric vehicles and the integration of resistors in ADAS systems contribute to stable market growth. Companies based in North America are investing in R&D to develop compact, high-precision resistors to meet industry-specific requirements. Industrial automation and IoT deployment in Canada and the U.S. further increase the consumption of chip resistors. It supports innovation in next-generation connectivity and computing platforms.

Europe

The Europe Trauma Fixation Market size was valued at USD 943.70 million in 2018 to USD 1,134.44 million in 2024 and is anticipated to reach USD 1,726.13 million by 2032, at a CAGR of 5.5% during the forecast period. Europe accounts for 18.9% of the Global Chip Resistor Market, supported by established automotive and industrial electronics sectors. Countries such as Germany, France, and the UK lead in integrating chip resistors into EVs, renewable energy systems, and medical equipment. The region emphasizes miniaturization and sustainability in component manufacturing. Regulatory policies promoting electrification and energy efficiency are driving demand for high-reliability resistor components. European manufacturers focus on producing RoHS-compliant and high-performance resistors for critical applications. It sustains steady market expansion despite economic pressures.

Asia Pacific

The Asia Pacific Trauma Fixation Market size was valued at USD 1,476.76 million in 2018 to USD 1,972.09 million in 2024 and is anticipated to reach USD 3,603.55 million by 2032, at a CAGR of 7.9% during the forecast period. Asia Pacific dominates the Global Chip Resistor Market with a 42.7% market share, fueled by large-scale production and consumption of consumer electronics. China, Japan, South Korea, and Taiwan act as manufacturing hubs for semiconductors and passive components. The rising demand for smartphones, laptops, and electric vehicles continues to strengthen regional growth. Government initiatives to boost domestic electronics production support further industry expansion. Key players in the region are scaling up production capacities and investing in automation to meet global demand. It remains the most dynamic and competitive market globally.

Latin America

The Latin America Trauma Fixation Market size was valued at USD 165.78 million in 2018 to USD 207.14 million in 2024 and is anticipated to reach USD 288.67 million by 2032, at a CAGR of 4.3% during the forecast period. Latin America represents a 5.1% share of the Global Chip Resistor Market, with moderate growth driven by consumer electronics and telecommunication infrastructure. Brazil and Mexico lead the regional demand, particularly in mobile devices and automotive electronics. The region’s growing middle class is increasing the adoption of digital technologies. Challenges such as supply chain dependency and import costs affect local manufacturing competitiveness. Regional governments are focusing on building electronics capabilities through investment incentives and trade partnerships. It provides emerging opportunities for chip resistor manufacturers targeting new end-user bases.

Middle East

The Middle East Trauma Fixation Market size was valued at USD 145.38 million in 2018 to USD 169.37 million in 2024 and is anticipated to reach USD 240.19 million by 2032, at a CAGR of 4.6% during the forecast period. The Middle East holds a 4.3% share of the Global Chip Resistor Market, supported by infrastructure development and smart city projects. Countries like the UAE and Saudi Arabia are integrating advanced electronics into public services and transportation systems. Growth in industrial automation and renewable energy projects is creating new demand for durable resistor components. The region’s reliance on imports limits local production but presents opportunities for global suppliers. Technological collaborations and digital transformation agendas are key market enablers. It positions the region as a growing consumer of advanced electronic components.

Africa

The Africa Trauma Fixation Market size was valued at USD 191.29 million in 2018 to USD 265.71 million in 2024 and is anticipated to reach USD 407.20 million by 2032, at a CAGR of 5.6% during the forecast period. Africa contributes 2.5% to the Global Chip Resistor Market, with demand emerging from telecom expansion, consumer devices, and automotive assembly. Countries such as South Africa, Kenya, and Nigeria are witnessing increased penetration of smartphones and connectivity infrastructure. Limited local manufacturing poses a challenge, but imports continue to meet growing demand. International companies are exploring the region for long-term market development. Government-led digital inclusion programs are expanding access to electronic technologies. It remains a nascent but promising market for chip resistor deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DePuy Synthes

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew PLC

- Medtronic

- Biomet Inc

- Orthofix Medical Inc.

- Conformis

- Globus Medical, Inc.

- MicroPort

- Conmed Corporation

- Acumed

- Zealmax Ortho

- Arthrex

Competitive Analysis:

The Global Trauma Fixation Market features intense competition, led by major medical device companies focusing on innovation, product diversification, and geographic expansion. Key players such as DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet Holdings, and Smith & Nephew dominate through extensive product portfolios and strong distribution networks. These companies invest in research and development to introduce bioresorbable implants, smart fixation systems, and minimally invasive technologies. Mid-sized firms and emerging players are entering the market with cost-effective and specialized solutions targeting niche applications. Strategic collaborations, acquisitions, and regulatory approvals are core tactics for expanding market presence. The Global Trauma Fixation Market continues to evolve through product innovation and regional penetration, as companies seek to meet rising demand across developed and emerging economies. It remains competitive due to the need for technologically advanced, patient-centric solutions in trauma care.

Recent Developments:

- In March 2024, TELA Bio, Inc. introduced the LIQUIFIX FIX8 Laparoscopic and LIQUIFIX Precision Open Hernia Mesh Fixation Devices in the United States. These devices are notable for being the only FDA-cleared fixation solutions employing liquid anchors for mesh fixation and peritoneal tissue closure. The LIQUIFIX FIX8 is intended for minimally invasive inguinal and femoral hernia repair, while the LIQUIFIX Precision is designed for open procedures, addressing the significant volume of hernia surgeries performed annually in the U.S.

- In October 2023, Johnson & Johnson MedTech officially launched DePuy Synthes’ VELYS™ Robotic-Assisted Solution in Europe. This technology has been successfully used to support total knee surgeries in Germany, Belgium, and Switzerland, further expanding DePuy Synthes’ digital surgery platform with advanced orthopedic robotics solutions.

Market Concentration & Characteristics:

The Global Trauma Fixation Market exhibits moderate to high market concentration, with a few multinational corporations controlling a significant share of global revenue. Leading players maintain dominance through proprietary technologies, established surgeon networks, and regulatory compliance capabilities. The market is characterized by high entry barriers due to strict regulatory requirements, capital-intensive R&D, and the need for clinical validation. It demands continuous innovation to address evolving surgical techniques and patient-specific needs. The market favors companies that offer comprehensive trauma systems, including plates, screws, rods, and external fixators. It supports long product life cycles and stable demand, driven by the ongoing need for orthopedic trauma care across all regions.

Report Coverage:

The research report offers an in-depth analysis based on Type, Surgical Site, End User and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Trauma Fixation Market is projected to experience stable growth driven by rising trauma cases worldwide.

- Demand for bioresorbable and smart implants will increase as personalized medicine gains traction.

- Minimally invasive fixation techniques will continue to reshape surgical protocols across healthcare systems.

- Emerging economies will offer strong growth potential due to improving trauma care infrastructure.

- Technological integration, including sensor-enabled implants, will expand post-operative monitoring capabilities.

- Strategic partnerships and M&A activity will intensify to accelerate product innovation and market entry.

- Custom and 3D-printed implants will see wider adoption in complex fracture management.

- Aging populations will sustain demand for fracture fixation solutions, particularly in developed markets.

- Regulatory harmonization across regions will streamline product approvals and enhance global distribution.

- Market players will focus on cost-effective solutions to improve access in underpenetrated regions.