Market Overview:

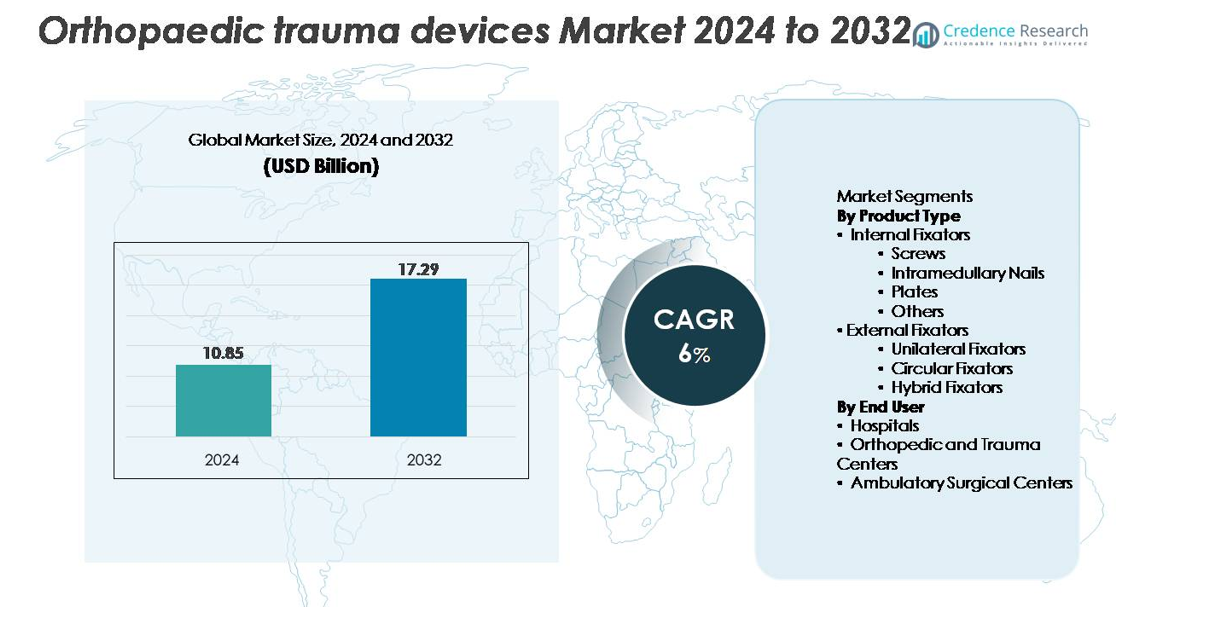

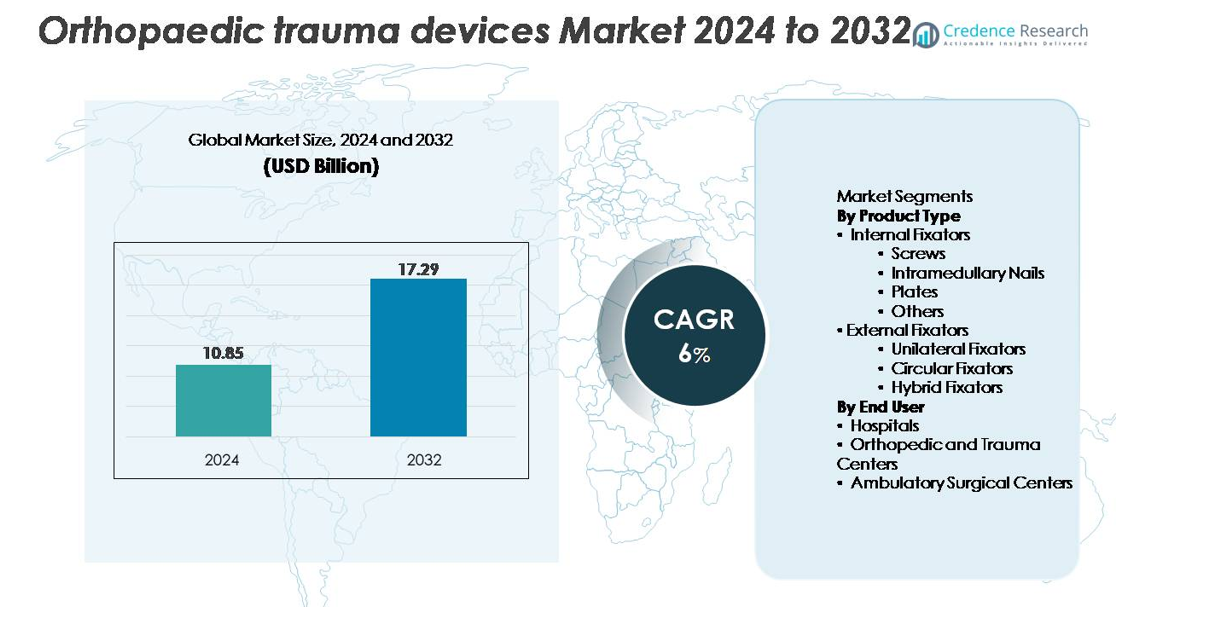

The global orthopaedic trauma devices market was valued at USD 10.85 billion in 2024 and is projected to reach USD 17.29 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6% over the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopaedic Trauma Devices Market Size 2024 |

USD 10.85 billion |

| Orthopaedic Trauma Devices Market, CAGR |

6% |

| Orthopaedic Trauma Devices Market Size 2032 |

USD 17.29 billion |

The orthopaedic trauma devices market is shaped by strong competition among leading global manufacturers, including Zimmer Holding Inc., Arthrex, Inc., NuVasive, Weigao Group Co Ltd., Medtronic, Inc., Stryker Corporation, OsteoMed, CONMED/Tornier, Johnson & Johnson, and Invibio Ltd. These companies maintain leadership through advanced fixation systems, robust R&D pipelines, and extensive surgeon training programs. Many players are expanding portfolios with minimally invasive implants, anatomically contoured plates, and next generation intramedullary nails to strengthen clinical outcomes. North America remains the leading region with approximately 40% market share, supported by high procedure volumes, strong reimbursement structures, and rapid adoption of technologically advanced trauma solutions.

Market Insights

- The orthopaedic trauma devices market was valued at USD 10.85 billion in 2024 and is projected to reach USD 17.29 billion by 2032, expanding at a 6% CAGR during the forecast period.

- Growth is driven by rising global fracture incidence, expanding geriatric populations, and strong adoption of internal fixation systems where internal fixators hold the dominant segment share due to their superior stability and clinical reliability.

- Market trends highlight increasing use of minimally invasive procedures, anatomically contoured plates, and advanced intramedullary nails, alongside growing demand for digital surgical planning and enhanced biocompatible materials.

- Competition intensifies as major players focus on product innovation, surgeon training, and expansion across high growth emerging markets, though high implant costs and regulatory complexities remain key restraints limiting faster adoption.

- Regionally, North America leads with ~40% share, followed by Europe at ~30%, while Asia Pacific accounts for ~20% and represents the fastest growing region due to expanding trauma care infrastructure and rising accident related injuries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Internal fixators account for the dominant share of the orthopaedic trauma devices market, driven by their strong clinical outcomes, high stability, and suitability for a wide range of fracture types. Screws and plates lead within this category due to their extensive use in both simple and complex fracture repairs. Intramedullary nails continue to gain adoption for long bone injuries, supported by minimally invasive surgical techniques. While external fixators including unilateral, circular, and hybrid systems remain essential for severe, open, and reconstructive trauma, their overall share is comparatively smaller due to higher procedural complexity.

- For instance, DePuy Synthes’ Locking Compression Plate (LCP) System incorporates 5.0 mm locking screws designed for use in large bone fragments, while its variable angle locking technology provides up to 15° of angulation (or a 30° total cone of angulation) per screw hole. The specific axial load strength is dependent on the overall surgical construct and is often measured in biomechanical studies, rather than a universal manufacturer published value of “above 1,000 N.

By End User

Hospitals hold the largest market share among end users, supported by high patient volumes, specialized orthopaedic departments, and access to advanced trauma care infrastructure. Their ability to perform complex fixation procedures and manage emergency trauma cases reinforces their dominant position. Orthopedic and trauma centers follow closely as demand rises for dedicated fracture management facilities offering focused expertise. Ambulatory surgical centers are expanding steadily with the growing shift toward outpatient fixation procedures enabled by minimally invasive implants, although their share remains moderate compared to large hospital systems.

- For instance, Zimmer Biomet’s ROSA® Knee System provides sub millimeter level assistance for bone resections and uses real time optical tracking, enabling surgeons to achieve precise implant positioning during total knee arthroplasty (TKA) procedures in patients with end stage osteoarthritis.

Key Growth Drivers:

Rising Global Burden of Fractures and Trauma Cases

The orthopaedic trauma devices market is expanding significantly due to the rising incidence of fractures driven by road traffic accidents, occupational injuries, falls in the elderly, and increasing sports related trauma. Rapid urbanization and higher mobility in emerging economies contribute to greater trauma exposure, increasing surgical intervention rates. Aging populations, particularly in Europe, Japan, and North America, experience higher susceptibility to osteoporotic fractures, driving demand for fixation implants such as plates, screws, and intramedullary nails. Additionally, increased awareness and improved access to emergency care are enabling earlier diagnosis and treatment, which further accelerates implant utilization. The growth of specialized trauma centers and the adoption of standardized fracture management protocols support a consistent need for trauma fixation solutions. As healthcare systems worldwide invest in strengthening acute care capabilities, the demand for efficient, durable, and clinically reliable orthopaedic trauma devices continues to rise across both developed and developing regions.

- For instance, DePuy Synthes reports that its VA LCP™ (Variable Angle Locking Compression Plate) technology provides up to 15° of multidirectional screw angulation per hole and maintains locking strength even under axial loads exceeding 1,000 N, supporting complex fracture management.

Advancements in Fixation Technologies and Minimally Invasive Procedures

Technological innovation is a major growth catalyst, reshaping the adoption landscape for internal and external fixation systems. Advancements such as anatomically contoured plates, locking compression systems, and next generation intramedullary nails are enhancing surgical outcomes and reducing complication rates. Innovations in biomaterials including titanium alloys, bioresorbable polymers, and carbon fiber composites offer improved biocompatibility, higher strength to weight ratios, and greater radiolucency, enabling better intraoperative imaging. Minimally invasive fixation techniques are also gaining prominence due to reduced tissue disruption, faster recovery times, and shorter hospital stays. Digital surgical planning tools, intraoperative navigation, and robotics assisted fracture fixation are further supporting precision driven treatment pathways. As surgeons increasingly prefer implants that improve stability, accelerate union, and minimize revision rates, manufacturers benefit from sustained demand for advanced device platforms. Continuous R&D investment and product upgrades enable companies to enhance their competitive positioning and offer clinically differentiated solutions.

- For instance, DePuy Synthes’ VA LCP™ Technology provides 15° of multidirectional variable angle locking per screw hole while maintaining locking integrity under axial loads above 1,000 N, enabling secure fixation in complex fracture geometries.

Growing Hospital Infrastructure and Access to Trauma Care

Expanding trauma care infrastructure, particularly in Asia Pacific, Latin America, and the Middle East, is fueling market growth as more patients gain access to specialized orthopaedic services. Governments are investing in emergency departments, trauma units, and surgical facilities to address rising accident related injuries and improve public health outcomes. The increasing number of orthopedic surgeons, improved training programs, and wider penetration of advanced surgical tools also boost adoption rates. Public and private hospitals are prioritizing high quality fixation systems with proven durability and postoperative recovery benefits. Integrated care pathways, insurance coverage improvements, and higher procedural volumes in large multispecialty hospitals further reinforce demand. Additionally, telemedicine based pre-operative assessments and remote monitoring technologies are streamlining patient flows and increasing surgery throughput. As healthcare systems modernize and expand, access to reliable, standardized orthopaedic trauma solutions increases, contributing directly to sustained market growth.

Key Trends & Opportunities:

Increased Adoption of Smart, Sensor Enabled, and Patient Specific Implants

A major emerging trend is the shift toward intelligent orthopaedic trauma devices equipped with sensors and digital monitoring capabilities. These technologies enable real time assessment of healing progress, load distribution, and implant integrity, allowing surgeons to adjust treatment plans proactively. Patient specific implants designed using 3D printing and advanced imaging are becoming increasingly feasible, offering tailored anatomical fit, reduced surgical time, and better postoperative outcomes. Additive manufacturing enables rapid, cost effective customization of plates, screws, and external fixation components for complex fractures or deformities. Growing interest in personalized orthopaedics is opening new avenues for manufacturers capable of integrating digital design tools, rapid prototyping, and advanced materials. As healthcare systems emphasize precision medicine and outcome based reimbursement, the demand for smart and customized trauma implants is expected to expand rapidly.

- For instance, Zimmer Biomet’s Persona IQ® implant developed with Canary Medical contains an FDA cleared inertial sensor module capturing data such as step count, walking speed, cadence, and range of motion at a frequency of up to 50 measurements per minute, transmitting information automatically via a base station.

Expansion of Outpatient and Ambulatory Surgical Procedures

The global movement toward outpatient and minimally invasive orthopaedic procedures is creating strong opportunities for compact, easy to use fixation systems. As surgical techniques improve and implants become more refined, many fracture repair procedures are shifting from inpatient hospitals to ambulatory surgical centers. These settings demand devices that support shorter operative times, reduced post-operative complications, and faster patient recovery. Opportunities arise for manufacturers to develop lightweight, ergonomic implants and instruments that align with ambulatory workflows and cost structures. The shift is further supported by rising healthcare cost pressures, insurance incentives for outpatient procedures, and improvements in anesthesia and pain management. As ambulatory centers continue expanding their trauma surgery capabilities, they represent a fast growing customer base for next generation fixation systems.

- For instance, the Stryker T2 Alpha® Nailing System includes streamlined targeting instrumentation that provides potential benefits for surgical workflow, such as the potential to reduce total operative time and fluoroscopy exposure when compared to freehand methods.

Key Challenges:

High Cost of Advanced Fixation Systems and Surgical Procedures

Despite technological advances, the cost of orthopaedic trauma devices remains a major barrier, especially in price sensitive markets. High end implants made from titanium, bioresorbable polymers, or carbon fiber composites significantly increase overall procedural costs. Smaller hospitals and outpatient centers often face budget constraints, limiting access to premium systems. Patients in low and middle income countries also encounter affordability challenges due to limited insurance coverage and high out of pocket expenditure. Reimbursement restrictions in certain regions further delay device adoption, particularly for newer or specialized fixation platforms. As cost containment becomes a priority across healthcare systems, manufacturers must balance innovation with price competitiveness to avoid limiting market penetration.

Regulatory Complexity and Stringent Clinical Validation Requirements

Orthopaedic trauma devices must comply with rigorous regulatory standards due to their invasive nature and direct impact on patient recovery. Manufacturers face complex approval pathways involving extensive biomechanical testing, multi-phase clinical trials, and post market surveillance obligations. Regulatory tightening in the U.S., Europe, and emerging markets increases the time and financial investment required for product commercialization. Any delays in certification can slow market entry and affect competitiveness, particularly for smaller firms with limited resources. Additionally, increasing scrutiny around implant safety, long term performance, and material biocompatibility demands more robust documentation and compliance systems. These challenges place pressure on companies to strengthen quality management processes and navigate evolving regulatory landscapes efficiently.

Regional Analysis:

North America

North America leads the orthopaedic trauma devices market with around 40% share, driven by high trauma incidence, advanced surgical capabilities, and strong adoption of technologically sophisticated fixation systems. The region benefits from widespread availability of specialized trauma centers, well established reimbursement frameworks, and extensive utilization of minimally invasive and navigation assisted fracture repair procedures. High rates of geriatric fractures, sports injuries, and road accidents strengthen device demand. The presence of major global manufacturers further accelerates innovation and product accessibility. Continued investments in emergency care infrastructure and digital surgical technologies reinforce North America’s dominant position.

Europe

Europe accounts for approximately 30% of the global market, supported by a strong healthcare system, rising geriatric population, and well developed trauma management protocols. Countries such as Germany, the U.K., France, and Italy drive implant adoption due to high procedure volumes and strong clinical focus on internal fixation systems. The increasing prevalence of osteoporotic fractures and the availability of specialized orthopaedic centers further sustain demand. Regulatory emphasis on implant safety and quality encourages the adoption of premium fixation solutions. Technology driven advancements, including anatomical plating and titanium based systems, continue to support steady regional market expansion.

Asia Pacific

Asia Pacific holds nearly 20% of the market, emerging as the fastest growing region due to rapid urbanization, rising accident related trauma, and expanding hospital infrastructure. China, India, Japan, and South Korea are major contributors, supported by increasing surgical capacity and growing awareness of advanced fixation procedures. Rising healthcare expenditure and expanding access to orthopaedic specialists are accelerating adoption of internal fixators and minimally invasive implants. Government backed trauma care improvements and increasing private sector investments also strengthen regional growth. Despite pricing sensitivities, the availability of cost effective devices supports large scale adoption across both urban and semi urban settings.

Latin America

Latin America represents about 6% of the orthopaedic trauma devices market, driven by a growing burden of road injuries, improving hospital infrastructure, and wider adoption of standardized fracture management practices. Brazil, Mexico, Argentina, and Colombia account for the majority of regional demand, with internal fixators being the preferred treatment modality. Limited reimbursement coverage and variable access to advanced implants pose challenges, but increasing private healthcare investments and rising procedural volumes are improving adoption rates. Training initiatives for orthopaedic surgeons and partnerships with global device manufacturers support steady, incremental growth across the region.

Middle East & Africa

The Middle East & Africa region accounts for roughly 4% of the global market, supported by expanding trauma care systems and increasing investments in modern surgical facilities. The UAE, Saudi Arabia, and South Africa lead demand due to higher accident rates and growing availability of specialized orthopaedic services. Market growth is reinforced by improving medical tourism and government led healthcare modernization programs. However, limited access to high end implants and disparities in care availability between urban and rural areas temper faster expansion. Gradual adoption of advanced internal fixation systems is expected as surgical capabilities continue to improve.

Market Segmentations:

By Product Type

- Internal Fixators

- Screws

- Intramedullary Nails

- Plates

- Others

- External Fixators

- Unilateral Fixators

- Circular Fixators

- Hybrid Fixators

By End User

- Hospitals

- Orthopedic and Trauma Centers

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the orthopaedic trauma devices market is characterized by a mix of global manufacturers and specialized regional players competing through product innovation, clinical performance, and portfolio diversification. Leading companies focus on advanced internal fixation systems such as anatomically contoured plates, locking screws, and high strength intramedullary nails to strengthen their clinical relevance and surgeon preference. Strategic initiatives include R&D investments, regulatory approvals, trauma system upgrades, and the introduction of minimally invasive instrumentation. Key firms are also expanding their footprint in fast growing markets across Asia Pacific and Latin America through distribution partnerships and localized manufacturing. Many players emphasize surgeon training, digital surgical planning tools, and evidence backed outcomes to reinforce brand credibility. Mergers, acquisitions, and product line expansions remain central strategies as companies seek competitive differentiation in durability, biomechanical stability, and patient recovery outcomes. Overall, competition intensifies as manufacturers prioritize faster healing implants and cost efficient solutions tailored to diverse healthcare environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Zimmer Holding Inc.

- Arthrex, Inc.

- NuVasive

- Weigao Group Co Ltd.

- Medtronic, Inc.

- Stryker Corporation

- OsteoMed

- CONMED, Tornier, Inc.

- Johnson & Johnson Company

- Invibio Ltd.

Recent Developments:

- In October 2025, Zimmer Biomet further highlighted robotics and musculoskeletal product innovations including integration of robotics technology via its acquisition of Monogram Technologies underscoring a strategic pivot toward digital, high precision trauma and reconstruction systems.

- In March 2025, Zimmer Biomet showcased a broad portfolio of orthopedic and musculoskeletal care innovations at the AAOS 2025 Annual Meeting including foot & ankle trauma solutions and new offerings tailored for ambulatory surgery centers.

- In March 2025, Stryker Corporation showcased the latest generation of its robotic system Mako SmartRobotics™ at the AAOS 2025 Annual Meeting

Report Coverage:

The research report offers an in depth analysis based on Product type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of minimally invasive fixation procedures will continue to rise as hospitals prioritize faster recovery and reduced surgical trauma.

- Demand for advanced internal fixators will strengthen due to growing preference for stable, long lasting fracture repair solutions.

- Integration of smart implants and sensor enabled monitoring technologies will expand as digital orthopaedics becomes mainstream.

- 3D printing and patient specific implants will gain wider acceptance for complex anatomical reconstructions.

- Emerging markets will experience faster adoption supported by improved trauma care infrastructure and surgeon training.

- Biocompatible and lightweight materials such as titanium alloys and carbon fiber composites will see higher utilization.

- Robotics assisted fracture fixation and navigation guided procedures will increase precision and surgical consistency.

- External fixation systems will continue evolving with modular, customizable designs suitable for severe trauma cases.

- Strategic collaborations and acquisitions will accelerate portfolio expansion among leading device manufacturers.

- Growing emphasis on cost efficient trauma solutions will drive innovation in standardized, value focused implant systems