Market Overview

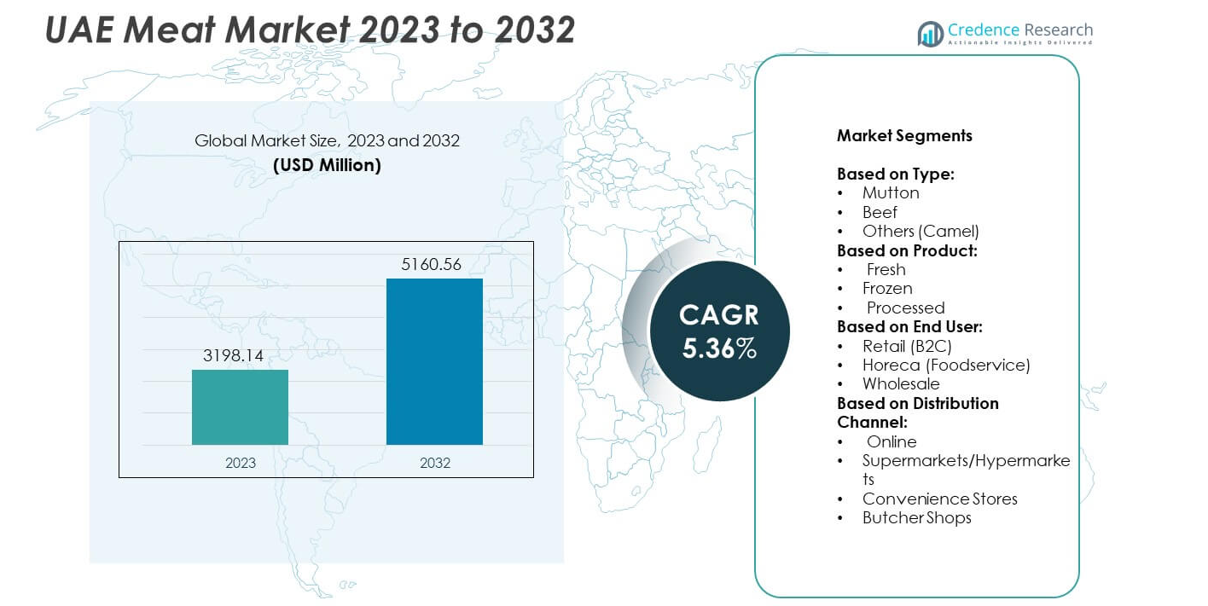

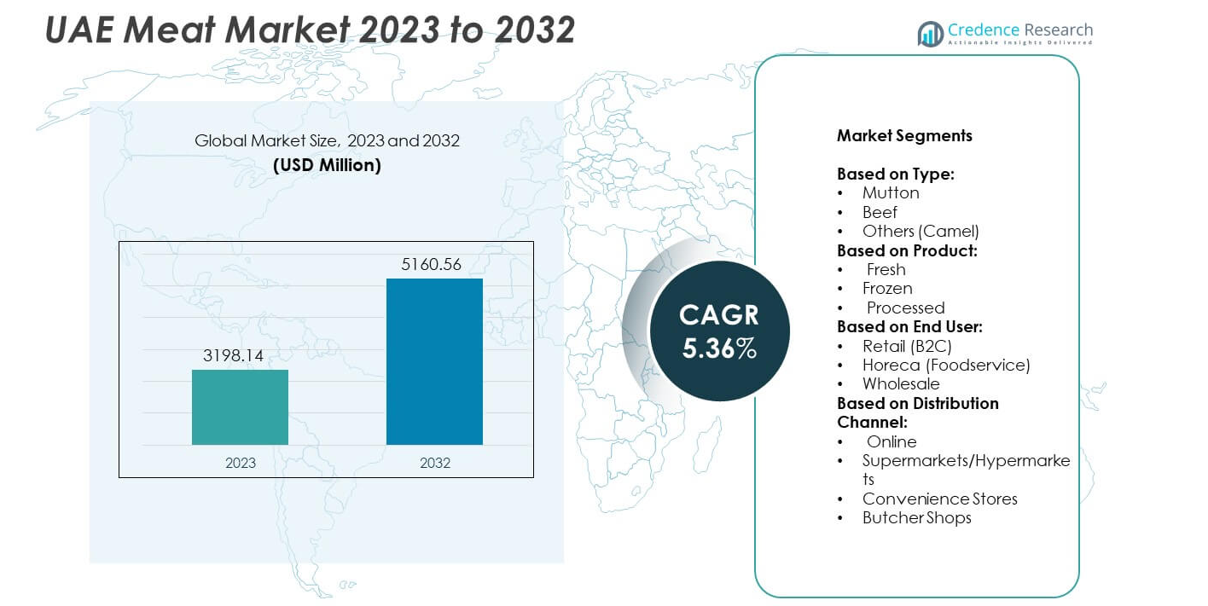

UAE Meat Market size was valued at USD 3198.14 million in 2023 and is anticipated to reach USD 5160.56 million by 2032, at a CAGR of 5.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Meat Market Size 2024 |

USD 3198.14 million |

| UAE Meat Market, CAGR |

5.36% |

| UAE Meat Market Size 2032 |

USD 5160.56 million |

The UAE Meat market experiences strong growth driven by rising consumer demand for high-quality and halal-certified meat products, supported by expanding retail chains and foodservice outlets. It benefits from increasing awareness of protein-rich diets and international cuisine adoption. The market trends include the shift toward ready-to-cook and value-added meat products, integration of advanced cold chain logistics, and expansion of e-commerce platforms for convenient ordering.

The UAE Meat market demonstrates significant regional diversification, with Dubai and Abu Dhabi serving as primary hubs for imports and distribution, while northern emirates like Sharjah, Ajman, and Ras Al Khaimah support local retail and foodservice demand. It relies on efficient cold chain logistics to ensure consistent supply of fresh, frozen, and processed meat across all regions. Key players driving the market include Agthia Group, Americana Foods Inc., Al Ain Farms, and Tanmiah Food Company, which focus on quality, halal certification, and product innovation. It benefits from strong partnerships between suppliers, distributors, and retail networks to meet evolving consumer preferences.

Market Insights

- The UAE Meat market was valued at USD 3,198.14 million in 2023 and is projected to reach USD 5,160.56 million by 2032, registering a CAGR of 5.36% during the forecast period.

- Rising consumer demand for high-quality and halal-certified meat products drives market growth, supported by increasing awareness of protein-rich diets and adoption of international cuisines.

- The market trends include growing popularity of ready-to-cook and value-added meat products, expansion of e-commerce platforms for convenient purchasing, and investment in advanced cold chain logistics to maintain product quality.

- Competitive analysis indicates that leading players such as Agthia Group, Americana Foods Inc., Al Ain Farms, and Tanmiah Food Company focus on product innovation, strict quality standards, and partnerships with retailers and foodservice operators to maintain market share.

- Market restraints involve dependence on imports, supply chain disruptions, and rising operational costs due to stringent food safety, halal certification, and cold storage requirements.

- Regional analysis shows Dubai and Abu Dhabi as primary hubs for distribution and retail, while northern emirates such as Sharjah, Ajman, and Ras Al Khaimah support local consumption, ensuring diversified supply channels across the UAE.

- The UAE Meat market benefits from cultural preferences, premium and specialty meat demand, and increasing adoption of sustainable sourcing practices, which collectively support long-term growth opportunities for both domestic and international players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Quality Protein Products Among Consumers

The UAE Meat market experiences strong growth driven by increasing consumer preference for high-quality protein sources. Urbanization and rising disposable incomes encourage the adoption of diversified diets that include beef, lamb, and poultry. It benefits from the growing awareness of nutritional benefits associated with meat consumption, including muscle development and energy support. Retailers and foodservice providers respond by offering premium cuts and branded products to meet evolving expectations. The popularity of international cuisines also supports higher meat consumption across restaurants and home kitchens. It maintains consistent demand throughout festive seasons and cultural celebrations, reinforcing its role in dietary habits.

- For instance, Al Ain Farms, a major UAE food producer, processes over 1,200 tons of fresh beef and lamb monthly to supply retail and Horeca (hotels, restaurants, and cafes) businesses throughout the UAE. This significant production volume highlights their role in the local meat supply chain, demonstrating their scale and contribution to food security in the region

Expansion of Cold Chain Infrastructure and Logistics Capabilities

The development of modern cold storage facilities and efficient logistics networks strengthens the UAE Meat market. It enables the safe transportation of perishable products from local farms and international suppliers. Retail chains and wholesalers invest in advanced refrigeration technologies to ensure freshness and extend shelf life. Efficient logistics reduce spoilage and improve supply reliability across urban and semi-urban regions. It allows for the introduction of imported meat products that cater to diverse consumer preferences. The presence of temperature-controlled distribution hubs also supports large-scale retail expansion and export-import operations.

- For instance, Agthia Group upgraded its refrigerated distribution network in Abu Dhabi to handle 2,500 tons of meat per month, improving delivery reliability.

Government Regulations and Food Safety Standards Driving Market Confidence

Strict regulations and safety protocols enhance consumer trust in the UAE Meat market. It follows quality certifications and halal compliance standards to meet both domestic and expatriate demands. Authorities enforce rigorous inspection and traceability measures throughout the supply chain. Compliance with international food safety norms strengthens market credibility and encourages foreign investment. Retailers and processors implement modern monitoring systems to ensure adherence to hygiene standards. It encourages continuous improvement in production, processing, and distribution practices. These measures boost consumer confidence and sustain consistent demand across all segments.

Technological Integration in Meat Processing and Retail Operations

Technology adoption transforms production, processing, and retail efficiency in the UAE Meat market. It leverages automation, robotics, and digital tracking systems to enhance operational accuracy and reduce waste. Retailers implement advanced point-of-sale and inventory management solutions to streamline product availability. Online platforms and e-commerce channels expand market reach and convenience for consumers. It also supports data-driven decisions in sourcing, pricing, and demand forecasting. Innovations in packaging extend shelf life while maintaining product quality. Technology integration ensures a more responsive and resilient supply chain across the country.

Market Trends

Growing Preference for Halal-Certified and Premium Meat Products

The UAE Meat market reflects a strong shift toward halal-certified and premium-quality offerings. Consumers prioritize ethically sourced and certified products to ensure compliance with religious and safety standards. It encourages suppliers and retailers to maintain stringent quality controls and traceability systems. High-income households seek imported and branded cuts that guarantee freshness and superior taste. Retailers expand their product portfolios to include specialty meats and value-added options. It drives competition among suppliers to innovate in packaging, presentation, and certification standards. These trends reinforce consumer trust and brand loyalty across the market.

- For instance, Tanmiah Food Company implements full-chain traceability for over 1,500 tons of processed meat per month, ensuring halal certification and compliance with international hygiene standards.

Rising Adoption of Online Meat Sales and E-Commerce Platforms

E-commerce channels gain traction in the UAE Meat market, providing convenient access to fresh and frozen products. It enables retailers to reach urban and remote consumers efficiently while maintaining quality standards. Delivery services ensure temperature-controlled transportation to preserve product integrity. Digital platforms facilitate subscription models, pre-order services, and bulk purchases for households and businesses. It allows suppliers to collect real-time consumer data and adjust inventory and pricing strategies. The integration of online payments and mobile applications enhances customer experience and engagement. This trend accelerates market penetration and creates new growth opportunities.

- For instance, Americana Foods Inc. installed automated portioning machines capable of processing 800 tons of meat per month, improving consistency and reducing manual handling errors.

Increased Focus on Sustainable and Traceable Meat Supply Chains

Sustainability and traceability drive innovation within the UAE Meat market. It motivates producers to implement environmentally responsible practices in livestock management and processing. Traceability systems track products from farm to table, ensuring quality and safety standards. Retailers highlight sustainable sourcing to attract conscious consumers and differentiate their offerings. It supports reduced waste through efficient logistics and improved inventory management. Consumer preference for transparency encourages brands to communicate sourcing practices clearly. These initiatives strengthen market reputation and encourage long-term investment.

Integration of Advanced Processing Technologies and Packaging Solutions

Technological advancements redefine operations and product presentation in the UAE Meat market. It incorporates automation, smart refrigeration, and hygienic processing equipment to enhance efficiency. Vacuum-sealed and modified-atmosphere packaging extends freshness and reduces spoilage. Retailers implement digital inventory systems to optimize stock rotation and availability. It facilitates compliance with health regulations while improving operational productivity. Innovation in processing allows the development of ready-to-cook and marinated products. These technological trends increase consumer convenience and drive higher consumption levels.

Market Challenges Analysis

Volatility in Import Dependency and Global Supply Constraints Affecting Market Stability

The UAE Meat market faces challenges due to heavy reliance on imported products from multiple countries. It exposes the market to fluctuations in international prices, geopolitical tensions, and trade restrictions. Suppliers encounter delays in shipments that disrupt consistent availability across retail and foodservice channels. It compels businesses to maintain higher inventory levels, increasing operational costs and storage requirements. Variability in quality and certification standards from different sources can affect consumer confidence. Retailers and distributors must implement rigorous inspection and quality assurance measures to mitigate risks. These factors collectively create uncertainty in supply reliability and pricing stability across the market.

Rising Operational Costs and Compliance Requirements Impacting Profit Margins

High operational costs and stringent regulatory standards present ongoing challenges for the UAE Meat market. It requires investment in advanced cold chain infrastructure, transportation, and storage facilities to preserve product quality. Compliance with halal certifications, food safety regulations, and traceability mandates adds administrative and operational burdens. Fluctuating energy prices and labor expenses further increase overall costs for processors and retailers. It limits flexibility in pricing strategies and can constrain market expansion efforts. Retailers must balance affordability with quality assurance to maintain consumer trust. These challenges demand strategic planning and resource allocation to sustain profitability in a competitive environment.

Market Opportunities

Expansion of Value-Added and Ready-to-Cook Meat Products to Capture Consumer Convenience Trends

The UAE Meat market presents opportunities through the growth of value-added and ready-to-cook products. It allows retailers and processors to cater to busy consumers seeking convenient meal solutions without compromising quality. Product innovation in marinated cuts, pre-portioned packs, and frozen ready meals can drive higher consumption. It encourages investment in modern processing facilities and advanced packaging technologies to extend shelf life. Retailers can differentiate their offerings through premium branding and tailored product assortments. It also enables partnerships with e-commerce platforms to expand reach and accessibility. These opportunities support both revenue growth and enhanced consumer engagement.

Development of Local Production and Sustainable Sourcing Practices to Strengthen Market Presence

Investing in local meat production and sustainable sourcing offers significant potential within the UAE Meat market. It reduces dependency on imports while ensuring supply chain reliability and compliance with quality standards. It enables producers to implement environmentally responsible farming methods and efficient resource utilization. Retailers can promote locally sourced and traceable products to appeal to health- and eco-conscious consumers. It supports collaborations with farms and processing facilities to enhance supply efficiency and cost-effectiveness. Consumer demand for transparency and ethical practices reinforces market positioning for brands adopting these strategies. These opportunities encourage long-term growth and strengthen market resilience.

Market Segmentation Analysis:

By Type:

The UAE Meat market shows significant diversification across meat types, with mutton and beef dominating consumption. Mutton maintains strong demand due to cultural and traditional preferences, particularly during festivals and family gatherings. It supports premium pricing and encourages suppliers to offer high-quality cuts to attract discerning consumers. Beef consumption grows steadily, driven by increasing awareness of protein benefits and international cuisine adoption in restaurants and homes. It allows importers and local distributors to expand product portfolios and meet evolving taste preferences. Camel meat, categorized under others, caters to niche demand and specialty culinary applications. It strengthens market variety and provides opportunities for artisanal and premium offerings.

- For instance, Golden Meat distributes 150 tons of camel meat monthly to specialty stores and gourmet restaurants, supporting artisanal and premium offerings.

By Product:

Fresh meat continues to dominate the UAE Meat market due to consumer preference for quality and taste. It requires efficient supply chains and temperature-controlled distribution to maintain product integrity. It supports retailers and foodservice providers in offering daily or seasonal selections that meet demand patterns. Frozen meat provides flexibility in inventory management and extends product shelf life, enabling broader distribution across urban and semi-urban areas. It allows importers to handle large volumes efficiently while catering to retail chains and bulk buyers. Processed meat, including ready-to-cook and value-added products, captures the convenience-focused segment. It encourages innovation in packaging, portioning, and flavors to attract time-conscious consumers.

- For instance, BRF S.A. processes approximately 1,000 tons of fresh beef per month, enabling supply to high-end restaurants and retail chains. Camel meat, categorized under others, caters to niche demand and specialty culinary applications.

By End-User:

Retail channels dominate the UAE Meat market by providing direct access to households through hypermarkets, supermarkets, and specialty stores. It supports consistent consumption and enables product differentiation through branded offerings. Horeca or foodservice channels drive demand through restaurants, hotels, and catering businesses, emphasizing quality, variety, and presentation. It encourages suppliers to maintain consistent supply and meet specific culinary standards. Wholesale distribution facilitates bulk procurement for retailers and institutional buyers, optimizing cost efficiency and inventory management. It strengthens the market ecosystem by connecting producers, importers, and end users across multiple channels.

Segments:

Based on Type:

- Mutton

- Beef

- Others (Camel)

Based on Product:

Based on End User:

- Retail (B2C)

- Horeca (Foodservice)

- Wholesale

Based on Distribution Channel:

- Online

- Supermarkets/Hypermarkets

- Convenience Stores

- Butcher Shops

- Others

Based on the Geography:

- Dubai

- Abu Dhabi

- Sharjah

- Ajman, Fujairah, and Ras Al Khaimah

- Umm Al Quwain and Al Ain

Regional Analysis

Dubai

Dubai holds a market share of 35% in the UAE Meat market. It serves as the primary hub for meat imports and distribution due to its advanced logistics infrastructure and strategic port connectivity. It supports both retail and Horeca channels with a wide range of fresh, frozen, and processed meat products. It attracts premium and international brands to meet diverse consumer demands, particularly in high-income and expatriate populations. Retailers leverage modern cold chain systems to maintain product quality and extend shelf life. It also facilitates trade exhibitions and partnerships that strengthen supplier relationships. Dubai remains a key driver for market growth, offering a concentrated platform for consumer engagement and product innovation.

Abu Dhabi

Abu Dhabi contributes a market share of 25% to the UAE Meat market. It emphasizes quality and safety, with strict compliance to halal and food safety regulations. It supplies high-demand beef and mutton products to households, hotels, and restaurants. It supports large-scale cold storage and distribution networks, enabling consistent product availability across the emirate. It encourages investment in ready-to-cook and value-added meat segments to cater to time-conscious consumers. It also attracts international and regional suppliers seeking reliable distribution channels. Abu Dhabi maintains a balanced market presence, combining premium offerings with accessibility across retail and Horeca segments.

Sharjah

Sharjah accounts for a market share of 15% in the UAE Meat market. It acts as an important feeder market, supplying both retail stores and local foodservice outlets. It relies on efficient logistics and cold chain solutions to handle imported fresh and frozen meat. It benefits from demand driven by growing urban populations and cultural preferences for lamb and mutton. It encourages smaller retailers and wholesalers to expand product portfolios with processed and packaged meat. It supports niche markets through specialty cuts and regional meat varieties. Sharjah continues to strengthen its role in the distribution and accessibility of diverse meat products.

Ajman, Fujairah, and Ras Al Khaimah

Combined, these northern emirates hold a market share of 25% in the UAE Meat market. They rely heavily on imported meat products distributed through regional wholesalers and retail chains. It supports fresh, frozen, and processed meat segments, ensuring availability for households and small-scale foodservice operations. Efficient logistics and storage networks maintain product quality across longer transit distances. It encourages regional suppliers to offer specialized products, including camel and premium mutton cuts. Demand grows steadily due to urbanization and rising disposable income. These emirates provide opportunities for market expansion through localized retail strategies and targeted distribution channels.

Umm Al Quwain and Al Ain

Umm Al Quwain and Al Ain together contribute a market share of 10% to the UAE Meat market. They primarily depend on regional supply networks and small-scale importers to meet local demand. It focuses on supplying fresh and frozen meat products to households, retail stores, and smaller foodservice providers. It benefits from culturally specific consumption patterns, particularly during festive periods and family gatherings. Retailers implement basic cold chain solutions to maintain freshness and product quality. These areas offer potential for growth through modern retail expansion and partnerships with larger distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Key players in the UAE Meat market include Agthia Group, Americana Foods Inc., Al Ain Farms, Tanmiah Food Company, Siniora Food Industries, The Savola Group, Albatha Group, Golden Meat, Halwani Bros Company, and Forsan Foods. These companies focus on maintaining product quality, halal certification, and diversified meat offerings to meet consumer demand. They invest in modern processing facilities and cold chain infrastructure to ensure freshness and safety across fresh, frozen, and processed meat segments. It allows them to efficiently supply both retail and foodservice channels.It leverages strategic partnerships with distributors, hypermarkets, and e-commerce platforms to enhance reach and accessibility across urban and semi-urban regions. It also emphasizes innovation in value-added and ready-to-cook products, catering to convenience-focused consumers and premium segments. Competitive pricing, consistent supply, and compliance with food safety regulations strengthen their market positioning. Market leaders monitor consumer preferences and seasonal demand fluctuations to optimize product portfolios and maintain brand loyalty. It enables rapid response to emerging trends and regulatory requirements, ensuring sustainable growth in a highly competitive environment.

Recent Developments

- In March 2025, Golden Meat implemented advanced meat processing equipment to enhance efficiency and product consistency for fresh and frozen meat offerings.

- In May 2022, JBS has acquired two plants in the MENA (the Middle East and North Africa) region to produce prepared foods. They are located in Saudi Arabia and the United Arab Emirates and produce value-added products. This expansion helps increase market penetration, strengthening distribution channels and client relationships.

- In February 2022, Seara introduced Shawaya chicken, an innovative product under the frozen category. The chicken preparation is tailored according to the local taste and flavor preference.

- In February 2022, Al Ain Farms has announced the launch of its 2270 sq. m. facility in Abu Dhabi. Al Ain Farms has increased its storage capacity for handling products, including chicken, to enhance its operational efficiency.

Market Concentration & Characteristics

The UAE Meat market exhibits a moderately concentrated structure with a mix of large multinational corporations and regional players dominating the supply chain. It relies heavily on imports from North America, Europe, Asia-Pacific, and the Middle East to meet domestic demand for fresh, frozen, and processed meat products. It demonstrates strong integration between production, processing, and distribution, supported by advanced cold chain logistics that ensure product quality and compliance with halal certification standards. It caters to diverse consumer segments, including retail, Horeca, and wholesale channels, offering premium, value-added, and specialty meat cuts. The market emphasizes traceability, food safety, and quality assurance to build consumer trust and strengthen brand loyalty. It remains highly responsive to changing dietary preferences, rising demand for protein-rich products, and growing interest in ready-to-cook and processed offerings. Competitive players focus on technological adoption, efficient supply chains, and strategic partnerships with distributors and retailers to enhance market reach. It also reflects cultural and regional preferences, including demand for camel meat and specialty lamb cuts. The market maintains dynamic pricing strategies influenced by import costs, logistics efficiency, and consumer purchasing power. It demonstrates resilience through diversified sourcing and strong collaboration among key stakeholders, ensuring consistent availability across urban and semi-urban regions. These characteristics collectively define a structured, growth-oriented, and strategically managed UAE Meat marke

Report Coverage

The research report offers an in-depth analysis based on Type, Product, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UAE Meat market will continue expanding due to rising demand for high-quality and halal-certified meat products.

- It will see increased adoption of ready-to-cook and value-added meat offerings across retail and Horeca channels.

- E-commerce platforms will play a larger role in meat distribution, improving accessibility and convenience for consumers.

- Technological advancements in cold chain logistics will enhance product quality and shelf life across all regions.

- Demand for specialty meats, including camel and premium lamb cuts, will grow in urban and high-income areas.

- Market players will focus on sustainability and traceability to meet consumer expectations and regulatory requirements.

- Strategic partnerships between suppliers, distributors, and retailers will strengthen supply chain efficiency.

- Innovation in packaging and portioning will cater to convenience-focused and health-conscious consumers.

- Expansion of domestic production and regional imports will reduce dependence on single-source suppliers.

- Competitive strategies will emphasize product differentiation, premium offerings, and enhanced consumer engagement.