| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Book Paper Market Size 2024 |

USD 516.31 Million |

| UK Book Paper Market, CAGR |

4.13% |

| UK Book Paper Market Size 2032 |

USD 713.75 Million |

Market Overview:

The UK Book Paper Market is projected to grow from USD 516.31 million in 2024 to an estimated USD 713.75 million by 2032, with a compound annual growth rate (CAGR) of 4.13% from 2024 to 2032.

The UK book paper market is influenced by a combination of industry trends and consumer demands. One of the primary drivers is the growing environmental consciousness among both publishers and consumers, pushing for sustainable and eco-friendly paper options. As a result, paper manufacturers are increasingly focusing on using recycled and sustainably sourced materials. Additionally, despite the rise of digital media, there remains a steady demand for printed books, especially in educational and academic sectors. The preference for physical books among certain demographics and in specific genres, such as textbooks, literature, and children’s books, continues to sustain the need for book paper. Economic factors also play a role, as rising production costs and inflation can impact paper prices, which in turn influences the overall market. The ongoing shift towards more specialized, high-quality paper for premium book publications, along with innovations in paper manufacturing processes, further drives demand.

Regionally, the UK book paper market is heavily influenced by the dynamics of its major publishing hubs. London, as a global publishing center, remains the dominant region, where a large portion of the demand for book paper originates. The city houses major publishing houses, distributors, and retailers, all of which contribute significantly to the demand for book paper. Additionally, regions such as the Midlands and North West, with their proximity to paper mills and distribution networks, are crucial in the logistics and supply chain of the book paper market. The UK government’s policies on sustainability and waste management are also shaping regional growth, with certain areas incentivized to adopt green manufacturing practices. Furthermore, the market is affected by international trade, especially with EU countries, which influences the cost and availability of raw materials for paper production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Book Paper Market is projected to grow from USD 516.31 million in 2024 to USD 713.75 million by 2032, at a CAGR of 4.13% from 2024 to 2032.

- The Global Book Paper Market is projected to grow from USD 10,203.76 million in 2024 to USD 14,364.15 million by 2032, with a CAGR of 4.37%, driven by increasing demand for printed educational materials and books worldwide.

- A key driver of market growth is the increasing environmental consciousness, pushing for sustainable and eco-friendly paper, leading manufacturers to focus on recycled and sustainably sourced materials.

- Despite the rise of digital media, there is still a steady demand for printed books, especially in the educational and academic sectors, maintaining the need for physical book paper.

- Economic factors such as rising production costs and inflation influence paper prices, which in turn impact the overall market, pushing for more cost-efficient production methods.

- Advancements in paper manufacturing technologies, such as improved processes and the use of alternative fibers, allow manufacturers to produce higher-quality paper at more competitive prices.

- The continued rise of digital media presents a challenge to the traditional print book market, with e-books and digital subscriptions reducing the demand for physical books and paper consumption.

- Regional dynamics play a significant role, with London and the South East holding a dominant share, while the Midlands and North West contribute through proximity to paper mills and distribution networks.

Market Drivers:

Sustainability and Environmental Concerns

One of the primary drivers in the UK book paper market is the increasing emphasis on sustainability and environmental responsibility. For instance, Bonnier Books reports that 100% of the paper used in its UK trade and mass market division books is FSC™ certified, ensuring that all paper is sourced from responsibly managed forests. As environmental awareness grows, there is a notable shift towards using eco-friendly and recyclable paper in the publishing industry. Consumers and publishers alike are increasingly prioritizing sustainable products, leading to a rise in demand for paper made from recycled materials or sustainably sourced fibers. The UK’s commitment to reducing its carbon footprint has also driven this trend, with many publishers actively seeking green alternatives to traditional paper. This shift towards sustainability not only meets consumer demand but also aligns with the broader environmental goals set by both the UK government and the publishing industry.

Digital Disruption and Market Adaptation

Despite the digital transformation in the publishing industry, which has led to a rise in e-books and digital reading materials, the demand for physical books remains resilient. The shift towards digital platforms has caused a decline in print sales, yet there continues to be a significant demand for printed books, especially in specific segments such as academic publishing, children’s literature, and specialty genres. Publishers are adapting by offering high-quality, niche print editions that appeal to consumers seeking tactile experiences and collectible items. This adaptation ensures that physical books continue to play a critical role in the market, thereby sustaining the demand for book paper in the UK.

Economic Factors and Cost of Production

Economic conditions, including inflation and production costs, also have a significant impact on the UK book paper market. As raw material costs rise, paper manufacturers are faced with increased production expenses, which can, in turn, affect the pricing of book paper. This creates challenges for both paper suppliers and publishers, particularly small and independent publishers who may struggle with fluctuating material costs. However, this issue also drives innovation, with paper manufacturers seeking more cost-efficient production methods and exploring alternative materials that can lower production costs without compromising quality. The economic climate, therefore, influences both the cost structure of book paper and the strategic decisions made by market players.

Innovation in Paper Manufacturing Technologies

Advancements in paper manufacturing technologies are another key driver propelling the growth of the UK book paper market. Innovations such as improved papermaking processes, enhanced paper coatings, and the use of alternative fibers are allowing paper manufacturers to produce higher-quality paper at more competitive prices. Additionally, the ability to produce paper with specialized properties—such as increased durability or printability—has opened up new opportunities in niche publishing segments. For instance, Palm Paper’s Kings Lynn mill, with an investment exceeding £500 million, produces around 400,000 tonnes of 100% recycled newsprint annually using a paper machine that runs at nearly 2,000 meters per minute. These technological advancements not only meet the evolving needs of publishers but also contribute to making the paper production process more sustainable and efficient. As manufacturers continue to innovate, the UK book paper market is likely to see further growth driven by these technological improvements.

Market Trends:

Shift Towards Digitalization and Hybrid Publishing Models

One of the prominent trends shaping the UK book paper market is the ongoing shift towards digitalization, which is influencing both publishers and consumers. The rise of e-books and audiobooks has transformed how people consume literature, and this trend has been accelerated by technological advancements and the convenience of digital formats. However, despite the growth of digital media, hybrid publishing models are emerging, combining both print and digital offerings to meet diverse consumer preferences. Publishers are increasingly providing print-on-demand services and offering digital editions alongside traditional print versions, enabling them to cater to a broader audience while minimizing production costs and waste. This dual approach is helping to sustain the demand for book paper, albeit at a lower volume than traditional print-only models.

Rise of Short-Run and Print-on-Demand Publishing

Another notable trend in the UK book paper market is the growing adoption of short-run and print-on-demand publishing. Advances in digital printing technology have made it economically feasible for publishers to produce smaller print runs of books, reducing excess inventory and waste. This trend has become particularly popular among independent publishers, self-published authors, and niche markets where demand for specific titles is lower but still significant. By adopting print-on-demand services, publishers can print only the required quantity of books, lowering production costs and allowing for greater flexibility in the types of books produced. This shift has resulted in an increase in the demand for book paper, as it allows publishers to print high-quality books without the need for large-scale production.

Consumer Preference for Premium and Sustainable Products

There is a noticeable shift in consumer preferences toward premium, high-quality books, which often use superior paper grades and finishes. Consumers are increasingly willing to invest in printed books that offer unique design elements, tactile appeal, and longevity. This trend is particularly evident in the growing popularity of luxury editions, collectible books, and limited-edition releases. As a result, there is a higher demand for specialized book paper that enhances the visual and tactile quality of the printed product. In addition, sustainability remains a key consideration in consumer decision-making, with more readers seeking books printed on recycled or sustainably sourced paper. For instance, Holmen, provides mono paper with the lowest carbon footprint among all their papers, due to the use of renewable energy and efficient integrated mills. This preference is pushing publishers to use eco-friendly materials and environmentally responsible printing processes, which is driving demand for book paper that aligns with these values.

Technological Advancements in Paper Production

Technological innovations in paper manufacturing are another significant trend in the UK book paper market. Manufacturers are increasingly focusing on improving the efficiency and sustainability of the paper production process. For instance, Smurfit Kappa’s Townsend Hook paper mill, for instance, introduced a state-of-the-art drying process that reduced steam energy consumption by 6% and total CO2 emissions by 5%. Developments such as the use of alternative fibers, including hemp and bamboo, are gaining traction as more sustainable materials for paper production. Additionally, advancements in recycling technologies have made it easier to produce high-quality recycled paper, which is contributing to the growing demand for eco-friendly paper products. These innovations are also enhancing the durability and printability of book paper, which allows for better quality and longer-lasting printed materials. As technology continues to evolve, the UK book paper market is likely to see further advancements that will improve the overall production process while addressing environmental concerns.

Market Challenges Analysis:

Impact of Digital Media on Traditional Print

A significant restraint on the UK book paper market is the continued rise of digital media, which has led to a decline in traditional print sales. With the increasing adoption of e-books, audiobooks, and digital subscriptions, many consumers are opting for digital content over physical books. This shift has directly affected the demand for printed books, leading to reduced paper consumption in the publishing industry. While physical books remain popular in specific sectors, the overall market for book paper faces ongoing pressure as digital formats continue to gain traction, especially among younger readers and tech-savvy consumers.

Rising Production Costs and Supply Chain Disruptions

The rising costs of raw materials and production processes present another challenge for the UK book paper market. Factors such as increased prices for wood pulp, energy costs, and transportation expenses contribute to higher production costs for paper manufacturers. These rising costs are often passed on to publishers, which can affect the pricing of books. Additionally, disruptions in global supply chains, exacerbated by geopolitical events or natural disasters, can further impact the availability of raw materials, leading to production delays or higher prices for paper. Such challenges pose significant barriers to maintaining profitability and sustainability within the market.

Environmental Regulations and Compliance

While sustainability is an essential driver, stringent environmental regulations and compliance requirements can also present challenges for the book paper market. As environmental standards become more stringent, paper manufacturers are required to invest in cleaner, more efficient production technologies. Compliance with these regulations can be costly, particularly for smaller paper producers who may struggle with the financial burden of upgrading equipment or implementing new sustainable practices. For instance, UK government standards mandate that all paper for printed publications must have a minimum of 75% recycled content, with the recycling process being Elemental Chlorine Free (ECF) and AOX emissions below 0.25kg per air dried tonnes. These regulatory challenges can increase operational costs, potentially limiting the growth potential for paper manufacturers and publishers relying on traditional book printing.

Market Opportunities:

One of the most significant opportunities in the UK book paper market lies in the growing demand for sustainable and eco-friendly paper solutions. As environmental concerns continue to rise, there is an increasing shift towards recyclable and sustainably sourced materials in the paper industry. Publishers and consumers are becoming more conscious of the environmental impact of paper production, and this has led to a heightened demand for paper made from recycled content or certified sustainable fibers. The UK’s commitment to reducing carbon emissions and promoting green practices creates a favorable environment for manufacturers who can innovate and provide eco-friendly alternatives. By adopting sustainable production methods and offering environmentally responsible paper products, companies can tap into a growing market of eco-conscious consumers and publishers.

Another opportunity for the UK book paper market is the increasing demand for niche and premium printed products. While the overall demand for traditional print books has faced challenges due to the rise of digital media, there is still a robust market for high-quality, collectible, and specialty books. This includes luxury editions, limited prints, and artisanal publications that appeal to discerning consumers. These segments often require premium-grade book paper, creating an opportunity for manufacturers to specialize in high-quality paper products that cater to this demand. Additionally, as print-on-demand technologies advance, smaller, independent publishers and self-published authors can access tailored paper solutions without the need for large print runs, further expanding opportunities in the market.

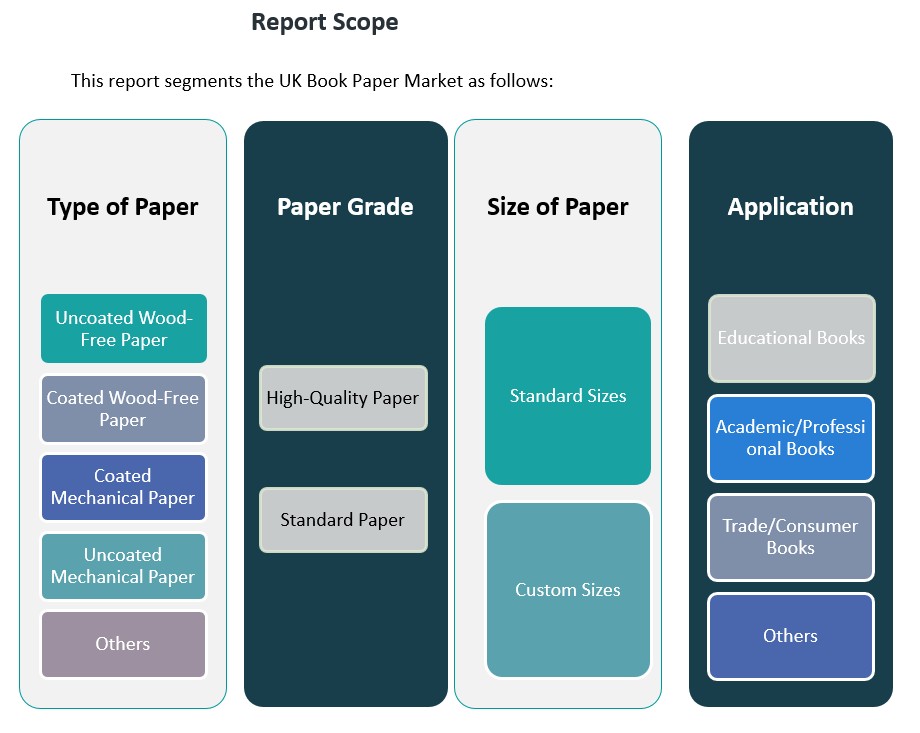

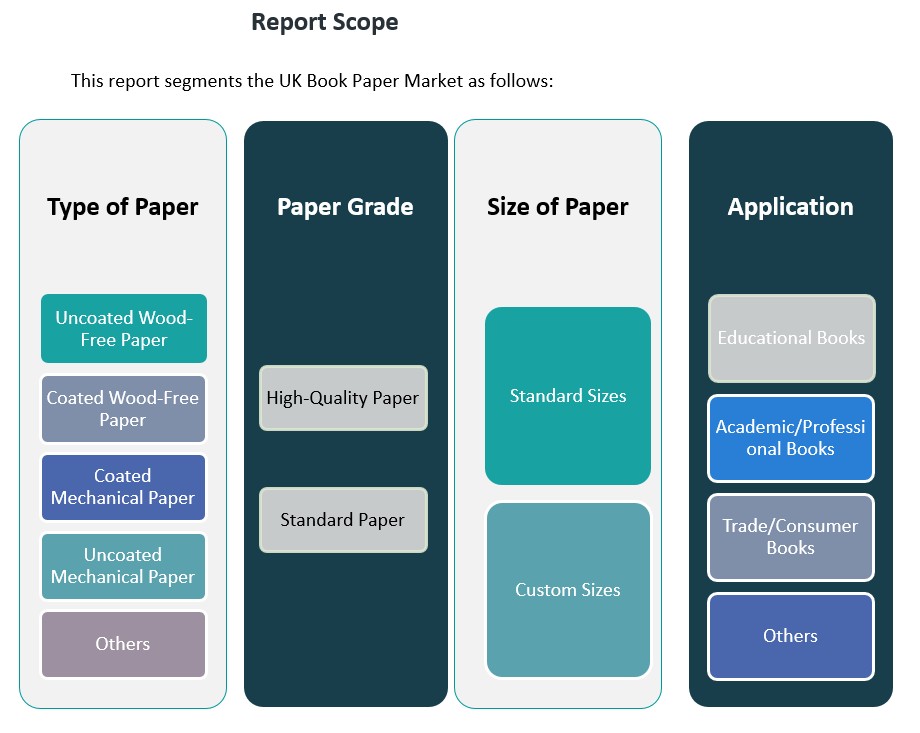

Market Segmentation Analysis:

The UK book paper market is divided into several key segments based on paper type, paper grade, paper size, and application, each with distinct characteristics and demand patterns.

By Type of Paper

The market is primarily segmented into four main types of paper: uncoated wood-free paper, coated wood-free paper, coated mechanical paper, and uncoated mechanical paper. Uncoated wood-free paper, valued for its high-quality finish and smooth texture, is commonly used in premium book publications. Coated wood-free paper, offering higher print quality and finish, is preferred for high-end books such as art and photography books. Coated mechanical paper and uncoated mechanical paper are generally used for standard trade and consumer books where print quality demands are moderate, making them cost-effective options for mass-market publications.

By Paper Grade

The paper grade segment is divided into high-quality paper and standard paper. High-quality paper is in demand for luxury editions, collector’s books, and academic publications that require superior print clarity and durability. Standard paper, more economical in comparison, is commonly used for mass-market trade books and educational materials.

By Size of Paper

The paper size segment includes standard and custom sizes. Standard sizes are used for most commercial book printing, while custom sizes cater to specific niche publications or bespoke publishing projects.

By Application

The market is also segmented by application, including educational books, academic/professional books, trade/consumer books, and others. Educational and academic books often require high-quality or standard paper, while trade and consumer books predominantly use cost-effective options to balance production costs with quality. The demand for premium paper is also seen in specialized or niche book applications.

Segmentation:

By Type of Paper:

- Uncoated Wood-Free Paper

- Coated Wood-Free Paper

- Coated Mechanical Paper

- Uncoated Mechanical Paper

- Others

By Paper Grade:

- High-Quality Paper

- Standard Paper

By Size of Paper:

- Standard Sizes

- Custom Sizes

By Application:

- Educational Books.

- Academic/Professional Books

- Trade/Consumer Books

- Others

Regional Analysis:

The UK book paper market is influenced by various regional dynamics, each contributing uniquely to the overall demand and supply of book paper. The market is primarily driven by major publishing hubs and their proximity to paper production and distribution networks. While the market share of each region fluctuates based on publishing activity, consumer demand, and logistical considerations, certain regions dominate in terms of market contribution.

London and South East England

London, as the heart of the UK publishing industry, holds a significant share of the market, accounting for approximately 40% of the total demand for book paper. The city is home to the majority of the UK’s leading publishers, printing houses, and book retailers. This high concentration of publishing activity drives a large portion of the demand for both high-quality and standard paper types, particularly for academic, professional, and trade books. The proximity of paper mills and distribution centers in the South East further enhances the region’s dominant position in the market.

Midlands and North West England

The Midlands and North West England, with their strategic location and well-established industrial base, contribute around 25% of the UK book paper market. These regions benefit from a mix of large printing and publishing companies, coupled with a robust network of paper mills. The demand in these areas is primarily driven by educational books and trade publications, which often require standard paper grades. Furthermore, these regions have been significant players in the growing trend of short-run and print-on-demand publishing, benefiting from technological advancements in digital printing.

North East and Yorkshire

North East and Yorkshire account for approximately 15% of the UK book paper market. While this region has a smaller share compared to London and the Midlands, it remains essential due to the presence of several smaller publishers and independent printing companies. The demand here is mostly driven by niche publishing sectors, including independent and self-published authors. Custom sizes and premium paper are more commonly used for specialized books in these areas, where higher quality and tailored production are valued.

Scotland and Wales

Scotland and Wales together hold around 10% of the UK book paper market. In these regions, the book paper demand is closely tied to the cultural and literary heritage, with a strong focus on academic books, local publishers, and specialized publications. The demand for both standard and high-quality paper grades is seen in educational institutions and trade books focused on regional themes and local literature.

South West England and Other Regions

The South West and other smaller regions contribute to the remaining 10% of the market. This area has a diverse publishing base, including agricultural and regional literature, as well as a growing self-publishing community. While the volume of paper demand is smaller, there is a rising trend in eco-friendly and sustainable paper options, driven by local consumer preferences for environmentally conscious publishing.

Key Player Analysis:

- DS Smith Paper Ltd

- Smurfit Kappa UK Ltd

- Sappi Lanaken Mill

- Tullis Russell

- Spicers Paper

Competitive Analysis:

The UK book paper market is highly competitive, with several key players driving innovation and responding to evolving consumer demands. Leading paper manufacturers, such as UPM-Kymmene, Sappi, and Stora Enso, dominate the market, offering a wide range of paper products, including sustainable and high-quality book paper. These companies invest heavily in sustainable production methods to meet the growing demand for eco-friendly paper, positioning themselves as leaders in green manufacturing. Additionally, regional players such as The Northern Paper Company and James Cropper Paper provide specialized solutions tailored to the UK market, focusing on niche demands like premium, custom-sized paper and environmentally responsible products. Competition is further intensified by the increasing popularity of print-on-demand and short-run publishing, which has led to a rise in smaller, independent suppliers offering flexible and cost-efficient solutions. The market remains dynamic as both large corporations and smaller players strive to meet the growing demands for sustainable, high-quality, and customizable book paper.

Recent Developments:

- In June 2024, National Book Tokens, the UK’s leading book gift card retailer, announced a partnership with Love Paper for the Love Paper 2024 Competition. This collaboration aims to inform consumers about the sustainability of paper, books, and related products, reinforcing both organizations’ commitment to environmental responsibility. National Book Tokens has emphasized its ongoing efforts to reduce plastic usage by producing its gift cards on FSC-certified board and further minimizing plastic in packaging.

- In February 2025, Nippon Paper Industries, together with Sumitomo Corporation and Green Earth Institute, announced the establishment of a joint venture named Morisora Bio Refinery LLC. The new company, scheduled to be established in March 2025, will focus on the production and sale of bioethanol and other biochemicals derived from woody biomass. The joint venture will construct a semi-commercial plant at Nippon Paper’s Iwanuma Mill, aiming to begin production in 2027, with ambitions to support the adoption of sustainable aviation fuel in Japan by 2030. Additionally, in August 2024, Nippon Paper agreed to transfer all shares of its subsidiary Daishowa Uniboard Co., Ltd. to A&A Material Corporation, with the transaction set for October 1, 2024, as part of its strategy to shift management resources to growth businesses.

- In November 2024, when the European Commission approved the takeover of Asia Pulp & Paper Group by Jackson Wijaya Limantara, owner of Paper Excellence Group (now rebranded as Domtar). This acquisition brings APP, a major player in pulp, paper, and packaging, under the control of the same group that owns Domtar, further consolidating the global paper industry.

Market Concentration & Characteristics:

The UK book paper market exhibits a moderate to high concentration, with a few large players dominating the production of paper. Global paper manufacturers such as UPM-Kymmene, Sappi, and Stora Enso control a significant portion of the market, benefiting from extensive production capabilities and economies of scale. These companies offer a wide range of products, including both high-quality and standard book papers, catering to the diverse needs of publishers. At the same time, the market also features a number of regional players, such as The Northern Paper Company and James Cropper Paper, who focus on specialized, sustainable, and custom solutions. The presence of smaller, independent producers reflects the growing demand for niche products, including eco-friendly and premium-grade papers. The market is characterized by a strong emphasis on sustainability, technological innovation, and adaptability to the shifting trends in digital and print-on-demand publishing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type of paper, paper grade, size of paper, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK book paper market is expected to grow steadily as demand for print-on-demand services increases.

- Consumer preference for high-quality and eco-friendly paper products will drive innovation in sustainable production methods.

- Digital publishing will continue to impact traditional print, but demand for premium and collectible books will sustain paper use.

- The shift towards recycled and sustainably sourced paper will gain momentum, influenced by environmental policies.

- Smaller, independent publishers will expand, contributing to niche paper demands, including custom and specialty grades.

- Technological advancements in paper production will improve efficiency and reduce environmental impact.

- The rising popularity of short-run printing and self-publishing will support the demand for more flexible paper solutions.

- Increased government regulations around sustainability will push manufacturers towards greener practices.

- Consumer awareness of the environmental footprint of paper production will lead to a more conscious paper purchasing market.

- The growth of e-commerce and online bookstores will continue to influence the distribution and demand for printed materials.