Market Overview:

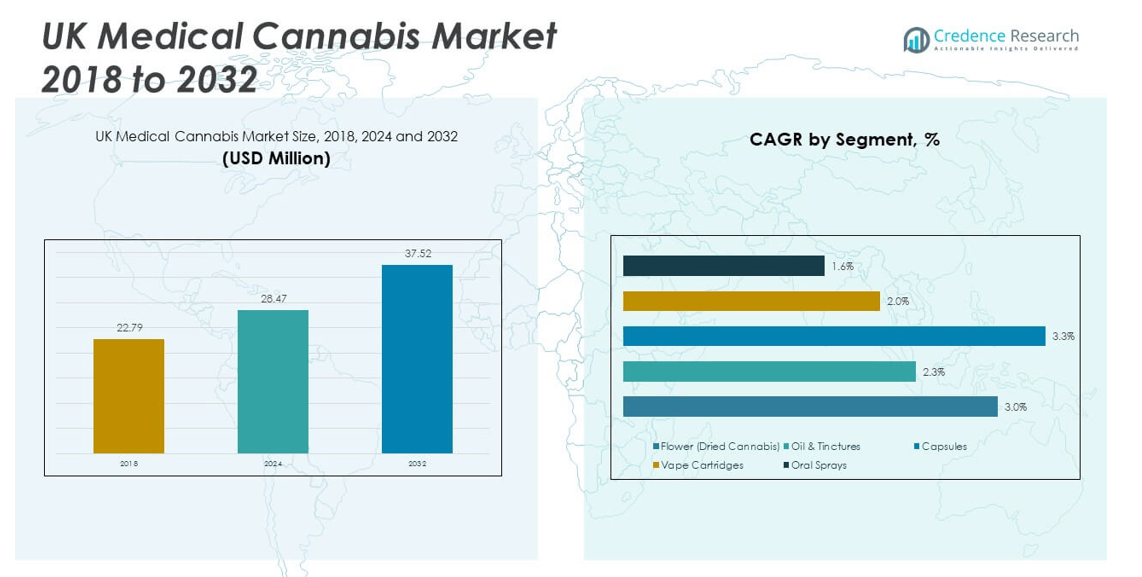

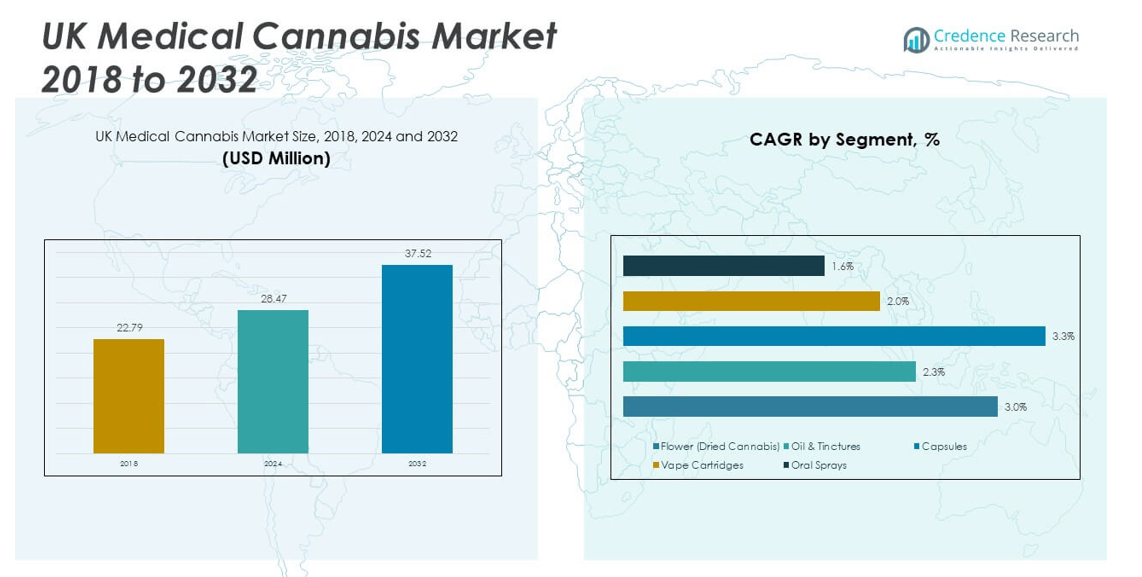

The UK Medical Cannabis Market size was valued at USD 22.79 million in 2018 to USD 28.47 million in 2024 and is anticipated to reach USD 37.52 million by 2032, at a CAGR of 3.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Medical Cannabis Market Size 2024 |

USD 28.47 million |

| UK Medical Cannabis Market, CAGR |

3.27% |

| UK Medical Cannabis Market Size 2032 |

USD 37.52 million |

The growth of the UK medical cannabis market is primarily fueled by increasing patient demand, expanding clinical awareness, and evolving regulatory frameworks. Since legalization, more individuals have sought treatment for chronic and neurological conditions through private clinics, supported by improved access to prescribers and a broader range of product formats such as oils, capsules, and dried flower. Rising acceptance among healthcare professionals, driven by ongoing clinical studies and patient outcome data, has further encouraged adoption. Regulatory developments have allowed for the establishment of domestic cultivation facilities, which help reduce reliance on imports and ensure more consistent product availability. The shift toward evidence-based prescribing, alongside the growth of patient registries and support programs, has also played a role in improving confidence across the healthcare ecosystem. These combined factors are shaping a more stable and accessible environment for medical cannabis within the UK healthcare landscape.

The UK medical cannabis market is evolving within a dynamic European context, where it is increasingly recognized as a key regional player. Major urban centers across the country serve as hubs for patient access, with private clinics and telehealth services expanding their reach to underserved areas. London, in particular, has become a focal point for clinic growth and product distribution. The development of domestic cultivation capabilities is beginning to decentralize the supply chain, improving product availability across more regions. While access through the National Health Service remains limited, the private sector has filled a critical gap in meeting patient needs. Regional variations still exist, especially in rural or less connected areas, but efforts to broaden prescriber education and streamline patient onboarding are gradually enhancing access. Continued investment in local infrastructure and regulatory clarity will be essential for creating a more equitable and consistent regional market across the UK.

Market Insights:

- The UK Medical Cannabis Market reached USD 28.47 million in 2024 and is projected to grow to USD 37.52 million by 2032 at a CAGR of 3.27%.

- Private clinics continue to dominate patient access, offering faster consultations and a broader range of cannabis-based treatments compared to limited NHS availability.

- Oils, tinctures, and dried flower remain the most prescribed product formats, with capsules and sprays gaining traction for their convenience and precision.

- Rising demand for alternative therapies is driving patient adoption, especially for managing chronic pain, neurological disorders, and mental health conditions.

- Domestic cultivation is reducing import reliance, improving supply chain stability, and supporting a more self-sufficient cannabis ecosystem.

- Regulatory clarity and structured pilot programs are encouraging prescriber confidence and reinforcing evidence-based cannabis prescribing practices.

- London and other major urban centers lead in clinic growth and access, while regional disparities persist, highlighting the need for broader infrastructure and clinical outreach.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Alternative Therapies and Expanding Patient Awareness

The UK Medical Cannabis Market is experiencing significant growth due to increasing patient demand for alternative therapies to manage chronic conditions. Many individuals suffering from pain, neurological disorders, and mental health issues are exploring cannabis-based medical treatments where conventional options fall short. The shift toward more personalized and holistic approaches is influencing patient choices across the country. Growing awareness, supported by online platforms, advocacy groups, and educational initiatives, is encouraging patients to seek private prescriptions through specialized clinics. It is gradually reshaping patient attitudes and increasing acceptance of cannabis-based medicines in mainstream healthcare. The market benefits from a steady rise in patient registrations and consultations through digital health providers and in-person clinics.

Supportive Policy Environment and Evolving Regulatory Framework

The regulatory landscape in the UK continues to evolve, supporting the steady expansion of medical cannabis accessibility. While NHS prescriptions remain limited, private sector pathways have become more structured and reliable for eligible patients. The establishment of regulated supply chains and improved product quality standards are enhancing patient safety and prescriber confidence. Government-recognized pilot projects and patient registries are building a foundation for policy advancement. It allows stakeholders to collect valuable data on treatment outcomes and patient experiences, reinforcing the case for broader integration. These changes are reinforcing the legitimacy of the sector and enabling a more stable operational environment for market participants.

- For instance, in 2023, Celadon Pharmaceuticals became the first British manufacturer licensed to sell medical cannabis domesticallyafter its 100,000 sq ft Birmingham facility received Good Manufacturing Practice (GMP) registration from the Medicines and Healthcare products Regulatory Agency (MHRA).

Growing Clinical Acceptance and Evidence-Based Prescribing Trends

The medical community in the UK is showing greater openness to prescribing cannabis-based medicines supported by growing clinical literature and patient success stories. Initiatives such as Project Twenty21 are generating structured real-world evidence that influences prescriber attitudes. Medical professionals are increasingly participating in training programs and workshops to understand the clinical application of cannabis-based therapies. This shift is improving trust in the safety and efficacy of available products. It is helping to address the long-standing hesitation associated with limited peer-reviewed research and regulatory uncertainty. The market is expected to benefit further from increasing alignment between clinical practices and patient needs.

Expansion of Domestic Cultivation and Strengthening Supply Chain Infrastructure

Domestic cultivation efforts are strengthening the UK’s medical cannabis supply chain and improving product availability. Licensed producers are now operating under strict regulatory guidelines to ensure consistent quality and compliance. It reduces the UK’s dependence on imported products and shortens delivery timelines, enhancing patient access. Local production supports economic development while enabling better traceability and inventory control. Investments in processing, packaging, and distribution facilities are laying the groundwork for a self-reliant ecosystem. This infrastructure development supports scalability and positions the market for long-term sustainability.

- For example, from January to September 2023, 24 tonnes of medical cannabis were imported, but local production is expected to reduce dependency on imports, enhance traceability, and improve delivery timelines.

Market Trends:

Surge in Product Diversification to Cater to Varied Patient Needs

One of the most noticeable trends in the UK Medical Cannabis Market is the expansion of product offerings across multiple formats. Companies are introducing oils, capsules, oral sprays, and dried flowers to accommodate different patient preferences and treatment requirements. This diversification allows clinicians to tailor prescriptions based on condition type, dosage needs, and patient tolerance levels. It improves patient adherence and satisfaction by offering more convenient and manageable options. The variety also reflects a maturing market that is responding to consumer feedback and clinical insights. It strengthens the competitive landscape and encourages innovation in formulation and delivery methods.

- For example, STENOCARE’s ASTRUM OIL demonstrated a 15x higher cannabinoid uptake without foodand 6x higher with food compared to standard MCT oil, with a reduced time to peak concentration from 2–4 hours to just 1 hour, according to company-led pharmacokinetic studies.

Proliferation of Telehealth Platforms Supporting Patient Access

The adoption of telehealth services has significantly impacted how patients in the UK access medical cannabis consultations and prescriptions. Virtual platforms enable remote assessments, follow-up appointments, and streamlined prescriptions, reducing geographic barriers for patients outside major cities. The trend aligns with the broader digital health transformation and enhances market reach across underserved regions. Clinics are partnering with technology providers to create user-friendly portals that simplify the application and documentation process. It allows for more efficient onboarding of new patients and improves continuity of care. The use of secure, compliant telemedicine tools is now a standard feature across many leading cannabis clinics.

Branding and Lifestyle Positioning of Medical Cannabis Products

Medical cannabis products are gradually incorporating wellness-oriented branding strategies, positioning themselves at the intersection of healthcare and lifestyle. This trend reflects changing consumer perceptions, where cannabis is increasingly seen as a legitimate therapeutic solution rather than a stigmatized substance. Brands are investing in packaging, marketing language, and educational content to build trust and resonate with wellness-conscious users. It has led to the emergence of premium product lines that emphasize quality, sustainability, and transparency. Companies are also targeting specific use cases such as stress relief, sleep improvement, or focus enhancement to appeal to broader demographics. The UK Medical Cannabis Market is embracing this approach to differentiate offerings and build brand loyalty.

Collaboration Between Clinics and Academic Institutions for Research

Collaborative initiatives between cannabis clinics and academic research institutions are gaining momentum in the UK. These partnerships aim to generate robust clinical evidence that can support regulatory evolution and public health acceptance. Universities are engaging in joint trials, data analysis, and long-term studies to assess safety, efficacy, and usage patterns. It strengthens the scientific foundation of cannabis-based medicine and helps standardize treatment protocols. Clinics benefit from research-backed credibility, while institutions gain access to real-world patient data. The trend contributes to the overall professionalization and validation of the medical cannabis industry.

- For instance, Curaleaf Clinic’s UK Medical Cannabis Registry, the largest of its kind, has captured data from over 30,000 patients, enabling the publication of 30 peer-reviewed studies on indications ranging from chronic pain to neurological disorders.

Market Challenges Analysis:

Limited NHS Participation and Affordability Barriers for Patients

One of the most persistent challenges in the UK Medical Cannabis Market is the limited integration within the National Health Service (NHS). Despite legalization for medical use, NHS prescriptions remain extremely rare, forcing the majority of patients to rely on private clinics. This model creates affordability issues, especially for individuals managing chronic conditions that require long-term treatment. High out-of-pocket costs prevent widespread access and contribute to socioeconomic disparities in patient care. The lack of NHS involvement also limits public confidence and slows mainstream acceptance. It places the burden of access and cost entirely on patients, restricting the market’s potential to scale equitably across all demographics.

Prescriber Hesitancy and Gaps in Clinical Training and Guidelines

Another key challenge affecting the UK Medical Cannabis Market is the hesitancy among healthcare professionals to prescribe cannabis-based medicines. Many general practitioners and specialists lack adequate training, clear clinical guidelines, or experience in dosing and monitoring patients. Regulatory ambiguity and the absence of comprehensive national protocols discourage prescribers from engaging with cannabis therapies. This gap slows patient onboarding and limits the reach of legitimate treatment pathways. It also reinforces outdated stigmas surrounding medical cannabis, despite growing evidence supporting its use. Addressing this challenge will require structured medical education programs and stronger alignment between regulators, academic bodies, and clinical practitioners.

Market Opportunities:

Expansion of Domestic Production and Vertical Integration Potential

The UK Medical Cannabis Market presents strong opportunities through the expansion of domestic cultivation and manufacturing capabilities. Licensed producers can reduce import dependency, lower costs, and ensure consistent product quality by developing end-to-end supply chains. Vertical integration enables tighter control over production, distribution, and clinical delivery, improving patient outcomes and operational efficiency. It also positions companies to respond faster to regulatory changes and market demands. The development of local infrastructure creates room for job creation, investment, and innovation. Companies that establish comprehensive, compliant supply ecosystems will gain a competitive advantage in shaping the next phase of market growth.

Integration into Public Healthcare and Prescription Reimbursement Models

Broader integration of medical cannabis into the NHS represents a major opportunity for the sector. If national guidelines evolve to support cannabis prescribing, more patients will gain affordable access through general practitioners and hospital networks. It will encourage clinical adoption and elevate cannabis therapies to parity with other pharmaceutical treatments. Reimbursement pathways and insurance models can further ease patient cost burdens and increase prescription volumes. The UK Medical Cannabis Market stands to benefit significantly if regulators, insurers, and health authorities align on clear frameworks. It will open new channels for distribution and establish cannabis as a normalized part of mainstream healthcare.

Market Segmentation Analysis:

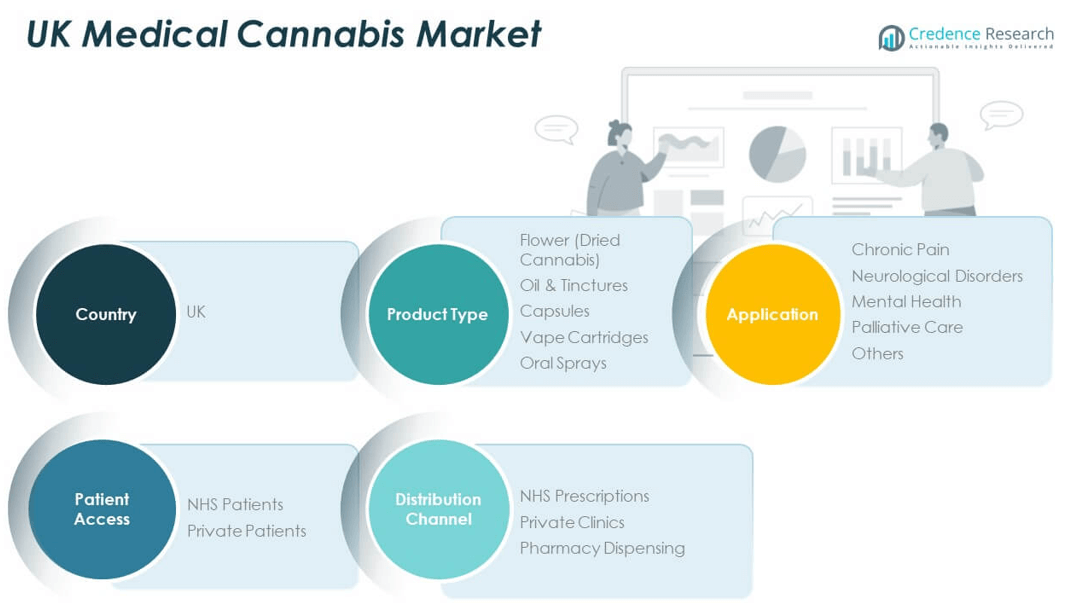

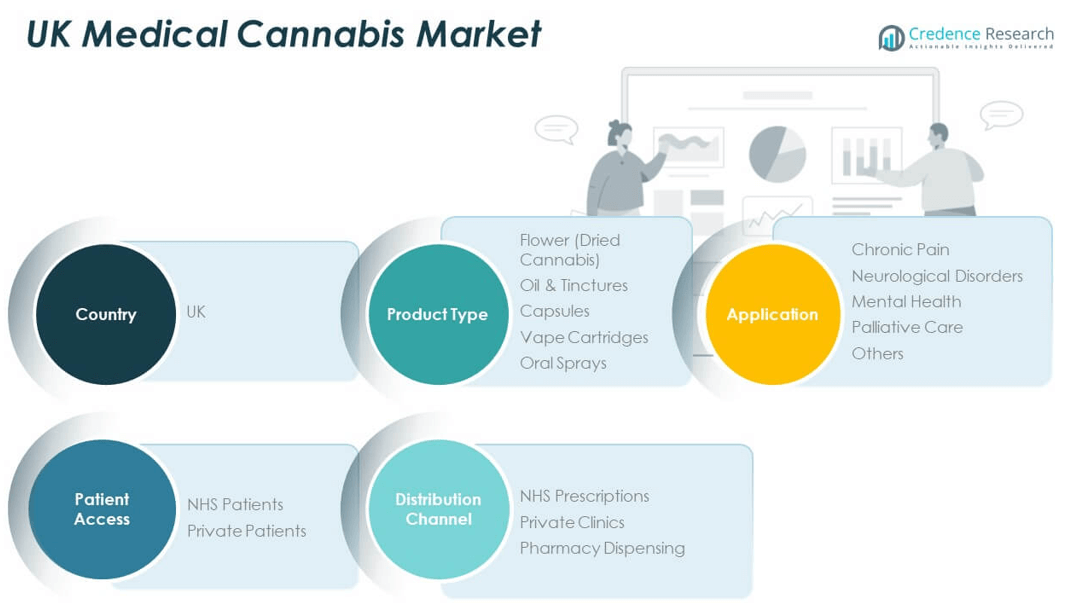

The UK Medical Cannabis Market is segmented by product type, application, patient access, and distribution channel.

By product type, oil and tinctures account for a substantial share due to their ease of use, precise dosing, and growing physician preference. Flower (dried cannabis) remains popular among patients seeking inhalable formats, while capsules and oral sprays are gaining traction for their discreet use and controlled administration. Vape cartridges are emerging in niche applications, appealing to patients requiring fast-acting relief.

By application, chronic pain dominates the market, supported by strong demand from patients with musculoskeletal and inflammatory conditions. Neurological disorders, including epilepsy and multiple sclerosis, represent a significant segment, followed by mental health conditions such as anxiety and PTSD. Palliative care is a growing application area, offering relief for end-of-life symptoms.

- For example, Mamedica Prescribes cannabis for chronic pain, psychiatry, neurology, palliative care, and cancer, with all consultations and follow-ups conducted online for accessibility.

By Patient Access, private patients form the majority, driven by limited NHS coverage and faster access through private clinics. The UK Medical Cannabis Market shows similar patterns in distribution, where private clinics lead over NHS prescriptions and pharmacy dispensing, reflecting broader access and flexibility. It continues to evolve with patient preference, regulatory progress, and clinical support.

- For example, Releaf Offers private prescriptions for a wide range of cannabis products, including oils and flower, and provides a medical cannabis card for patient reassurance; recently signed a multi-million-pound supply contract with Glass Pharms, a domestic producer.

By distribution channel, private clinics lead in patient volume and product variety, offering faster consultations and tailored treatment plans. NHS prescriptions remain limited and highly regulated, while pharmacy dispensing is growing gradually, supporting continuity of care and expanding availability. The UK Medical Cannabis Market is adjusting to demand through diversification in delivery and access models, supported by regulatory evolution and patient-centered care.

Segmentation:

By Product Type:

- Flower (Dried Cannabis)

- Oil & Tinctures

- Capsules

- Vape Cartridges

- Oral Sprays

By Application:

- Chronic Pain

- Neurological Disorders

- Mental Health

- Palliative Care

- Others

By Patient Access:

- NHS Patients

- Private Patients

By Distribution Channel:

- NHS Prescriptions

- Private Clinics

- Pharmacy Dispensing

Regional Analysis:

England dominates the UK Medical Cannabis Market with a market share of 78%. The region benefits from a dense concentration of private clinics, telehealth platforms, and specialist prescribers, particularly in cities like London, Manchester, and Birmingham. These urban centers have seen faster adoption due to higher awareness, better access to healthcare services, and stronger commercial presence. London serves as the central hub for many licensed clinics and digital prescription services, contributing significantly to the region’s leadership position. The presence of educational institutions and research partnerships in England also supports clinical acceptance and innovation. It continues to attract the highest number of patients seeking cannabis-based treatments and is likely to remain the most active market.

Scotland holds 11% of the UK Medical Cannabis Market, with slow but steady growth driven by increasing public interest and emerging private healthcare initiatives. Patient access remains limited outside major cities like Edinburgh and Glasgow, where telemedicine is beginning to fill service gaps. Regulatory conservatism and low prescriber volume still hinder broad market development. However, ongoing efforts to expand educational outreach among healthcare providers may encourage wider uptake. The region shows potential for growth if supported by more targeted infrastructure and policy support. It currently serves a smaller, more localized patient base with restricted access to product variety.

Wales accounts for 7% of the market and remains underdeveloped due to lower clinic availability and fewer trained prescribers. Patients in rural areas often depend on virtual consultations and cross-border services from England. Efforts to promote patient education and awareness are underway but face logistical challenges in implementation. The market remains underserved, although demand is slowly growing in urban centers like Cardiff and Swansea. It requires stronger investment in clinical infrastructure to unlock its full potential.

Northern Ireland holds the smallest share at 4%, constrained by limited medical cannabis infrastructure and low patient penetration. The region faces regulatory ambiguity and lacks a robust network of cannabis-focused clinics. While demand exists, access remains uneven and heavily reliant on external providers. Greater clarity in regional policy and the introduction of training programs for local prescribers could support growth. It remains a largely untapped segment of the UK Medical Cannabis Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- GW Pharmaceuticals

- Celadon Pharmaceuticals

- Kanabo Group

- British Sugar

- Curaleaf Laboratories

- Ananda Developments

- Dalgety

- Releaf

- Integro Clinics

- Mamedica

Competitive Analysis:

The UK Medical Cannabis Market features a growing number of specialized players competing across cultivation, distribution, and clinical services. Companies such as Mamedica, Sapphire Medical Clinics, and Lyphe Group have established strong brand presence through vertically integrated models and digital prescription platforms. These firms focus on patient education, telehealth access, and streamlined prescribing pathways to build loyalty and scale operations. New entrants are investing in domestic cultivation and product innovation to reduce reliance on imports and enhance supply consistency. The market remains fragmented, with no single player holding dominant market share, creating room for strategic partnerships and consolidation. It continues to evolve with a focus on clinical credibility, quality assurance, and regulatory compliance. Competitive positioning depends on the ability to deliver reliable care, maintain affordability, and align with changing patient expectations. The UK Medical Cannabis Market encourages innovation through differentiation in product offerings and service delivery.

Recent Developments:

- In June 2025, Dalgety announced a strategic partnership with Curaleaf Laboratories to enhance access to medical cannabis in the UK. This collaboration aims to strengthen both companies’ positions in the rapidly growing UK market and improve patient access to cannabis-based treatments.

- In October 2024, Celadon Pharmaceuticals announced a five-year sales contract with Valeos Pharma AS, a Danish producer of medicinal cannabis. The agreement, valued at up to £10.5 million, will see Celadon supply pharmaceutical-grade cannabis to European customers, with volumes increasing over time. This partnership is pivotal for Celadon’s expansion in Europe and its ability to meet growing demand.

- In November 2023, Kanabo Group entered a partnership with BRITISH CANNABIS™ to supply pharmacy-grade CBD health supplements via prescription through Kanabo’s Treat It platform. This partnership expands access to CBD products for pain management and will be integrated into Canndr, an online medicinal cannabis app, enhancing patient choice and care.

- In March 2023, Ananda Developments acquired MRX Global for £2 million. This acquisition provides Ananda with a CBD formulation approved for two Phase II clinical trials in the UK, supported by £1.55 million in grant funding. The move accelerates Ananda’s path to revenue and could lead to NHS funding for its products if trials are successful.

Market Concentration & Characteristics:

The UK Medical Cannabis Market remains moderately fragmented, with a mix of established private clinics, licensed producers, and emerging digital health platforms. No single company holds a dominant share, allowing space for new entrants and niche players. The market is characterized by a patient-led model, with private prescriptions driving the majority of demand due to limited NHS participation. It features a high-touch service structure focused on telemedicine, personalized care, and product transparency. Regulatory oversight ensures strict compliance in cultivation and distribution, creating high entry barriers for unlicensed operators. The pace of innovation and clinical engagement defines competitive advantage. The UK Medical Cannabis Market reflects early-stage growth, shaped by evolving patient expectations and ongoing infrastructure development.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, patient access, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of domestic cultivation will reduce reliance on imports and improve supply stability.

- Increased prescriber training will enhance clinical confidence and broaden patient access.

- Telehealth platforms will continue to streamline consultations and prescription services.

- Wider product innovation will cater to diverse patient needs and improve adherence.

- Regulatory clarity may support integration into NHS pathways and public reimbursement.

- Investment in research partnerships will generate stronger clinical evidence and standardization.

- Urban clinics will expand into underserved regions through hybrid service models.

- Competitive differentiation will depend on quality assurance, pricing, and care delivery.

- Public perception will shift positively as education and awareness efforts intensify.

- Strategic collaborations across pharma, tech, and healthcare sectors will shape market scalability.