Market Overview:

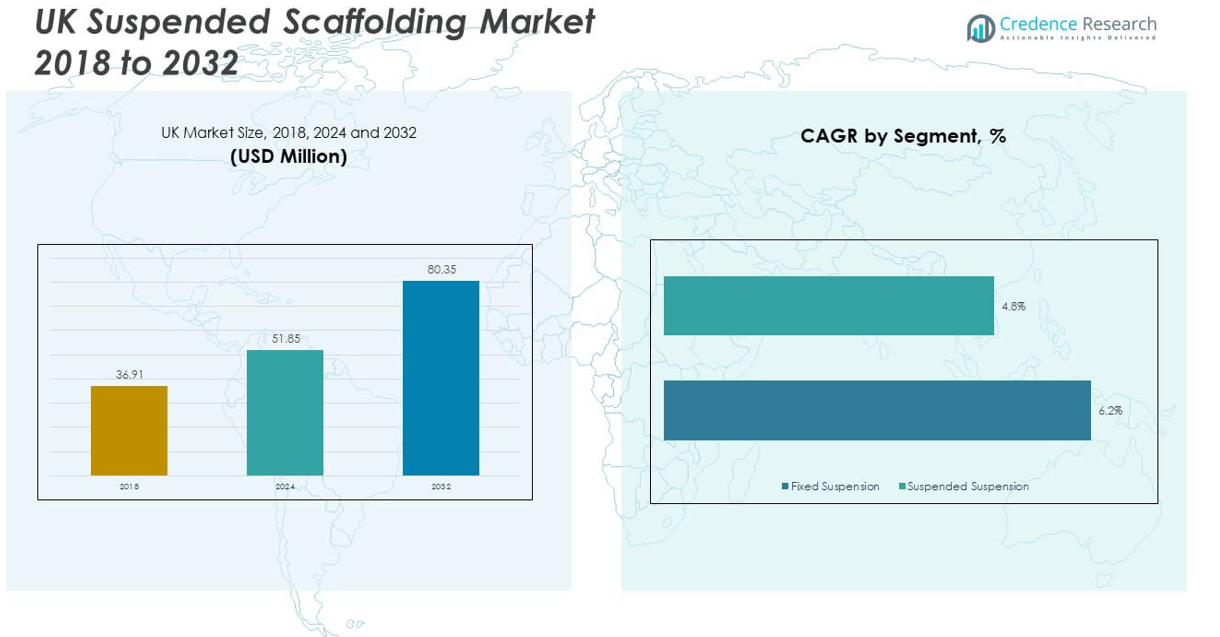

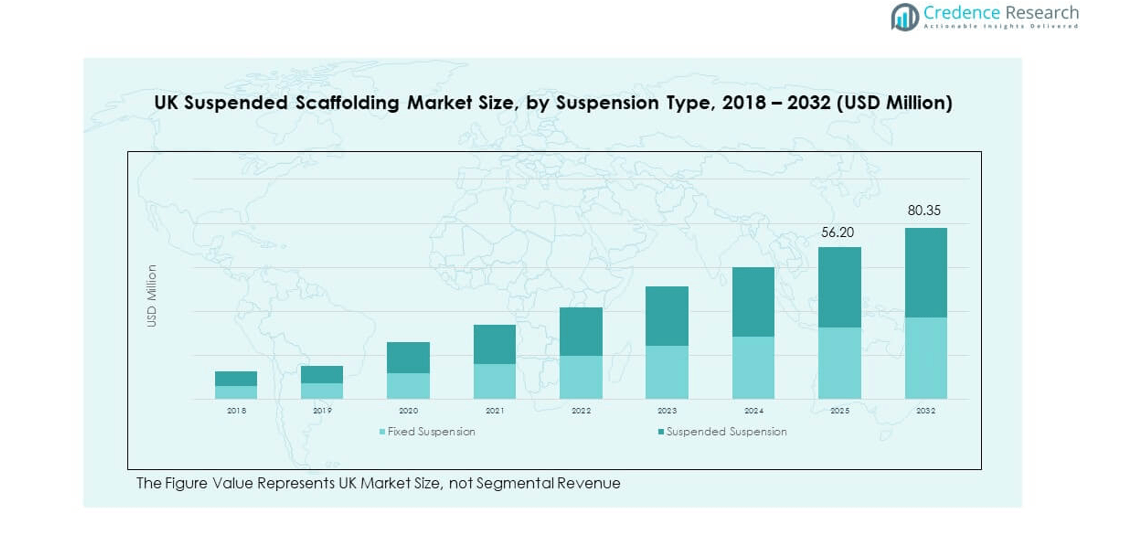

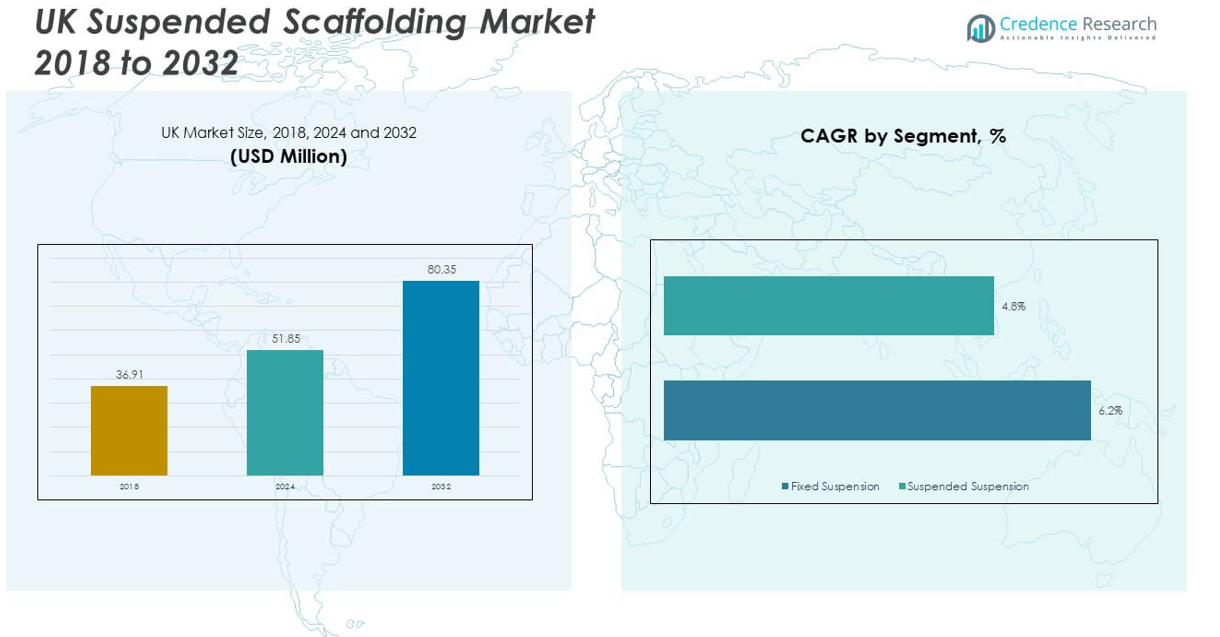

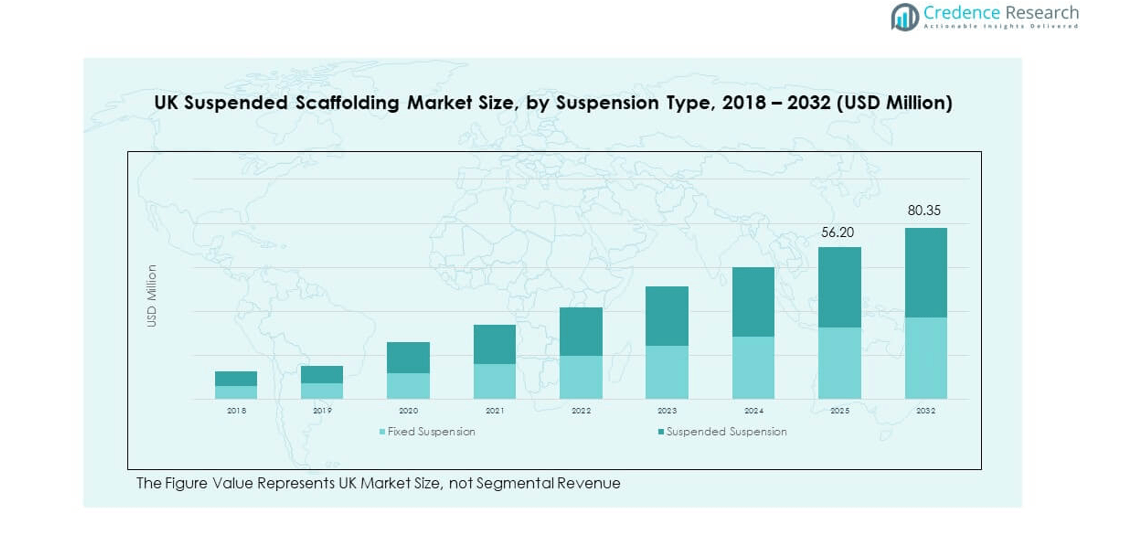

The UK Suspended Scaffolding Market size was valued at USD 36.91 million in 2018 to USD 51.85 million in 2024 and is anticipated to reach USD 80.35 million by 2032, at a CAGR of 5.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Suspended Scaffolding Market Size 2024 |

USD 51.85 million |

| UK Suspended Scaffolding Market, CAGR |

5.72% |

| UK Suspended Scaffolding Market Size 2032 |

USD 80.35 million |

The UK Suspended Scaffolding Market is witnessing growth due to rising infrastructure renovation, increased maintenance of heritage structures, and expanding high-rise construction activities. Market demand is further fueled by the growing emphasis on worker safety and the adoption of modular and lightweight suspended scaffolding systems. Strict regulatory compliance across the UK construction sector has encouraged contractors to opt for reliable access systems, supporting the market expansion. Additionally, technological advancements in scaffolding equipment and enhanced load-bearing capabilities are improving efficiency and fostering adoption in commercial and industrial projects.

Regionally, the demand for suspended scaffolding is most prominent in urban centers like London, Manchester, and Birmingham, driven by the concentration of commercial construction and urban redevelopment. These cities are at the forefront due to large-scale infrastructure projects and vertical expansion. Meanwhile, growth is gradually emerging in secondary cities and regions across Wales and Scotland, where increasing investments in residential and public infrastructure are beginning to stimulate market penetration. The presence of established construction firms and regulatory enforcement contributes to consistent market development across the UK.

Market Insights:

- The UK Suspended Scaffolding Market was valued at USD 51.85 million in 2024 and is expected to reach USD 80.35 million by 2032, growing at a CAGR of 5.72%.

- The Global Suspended Scaffolding Market size was valued at USD 882.70 million in 2018 to USD 1,240.25 million in 2024 and is anticipated to reach USD 1,921.79 million by 2032, at a CAGR of 5.24% during the forecast period.

- Rising demand for high-rise construction and façade access systems continues to drive adoption across commercial and infrastructure projects.

- Stringent health and safety regulations are pushing contractors to shift toward certified suspended scaffolding systems for compliance and worker protection.

- High initial investment and cost sensitivity among small and mid-sized contractors remain key barriers to widespread adoption.

- England dominates the market with a 68.2% share, supported by dense urban development in London, Manchester, and Birmingham.

- Scotland and Wales are emerging regions, gaining traction through public infrastructure upgrades and regional refurbishment programs.

- Limited availability of skilled labor for system installation and operation restricts scalability in some regional pockets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expansion of Commercial Infrastructure and High-Rise Construction Activities

The growing number of commercial complexes, office spaces, and high-rise buildings is significantly contributing to the demand in the UK Suspended Scaffolding Market. Developers and contractors prefer suspended scaffolding systems for better vertical access and improved worker safety in complex structures. It offers efficient mobility, particularly in constrained or crowded urban construction zones. With city skylines evolving and vertical expansion increasing, the need for advanced scaffolding equipment has risen. The system’s ability to facilitate external façade works, glass panel installations, and maintenance boosts its application scope. Infrastructure modernisation initiatives by both public and private entities sustain growth momentum. The trend of urban densification across major UK cities encourages vertical developments, reinforcing suspended scaffolding usage. The UK Suspended Scaffolding Market is set to benefit from consistent demand across ongoing and planned construction projects.

Strict Safety Regulations and Compliance Requirements in Construction

The UK construction industry operates under stringent health and safety regulations, which significantly drive the adoption of suspended scaffolding systems. Employers are mandated to provide secure working platforms for elevated tasks, promoting the use of certified scaffolding solutions. It ensures reduced workplace accidents and aligns with regulatory standards set by bodies like HSE. Contractors increasingly choose suspended systems to meet compliance while maintaining operational flexibility. Safety-focused procurement decisions are creating higher demand for technologically superior, tested platforms. The rising awareness of legal liabilities and insurance implications further influences the scaffolding equipment selection process. The UK Suspended Scaffolding Market experiences growth due to this regulatory-driven shift. It enables safer, compliant work environments for facade renovations, painting, and repairs.

- For instance, BrandSafway (formerly Lyndon SGB in the UK) promotes a strong safety culture through its Employee Intervention System (EIS), enabling workers to stop unsafe acts on-site. Its UK operations hold SafeContractor certification and have demonstrated award-winning safety performance on several large-scale industrial access projects.

Increase in Maintenance and Refurbishment of Aged Structures

A large segment of the UK’s urban infrastructure comprises ageing buildings that require periodic maintenance and refurbishment. Suspended scaffolding provides flexible and temporary access to façades and roofing of heritage and older structures. It supports preservation efforts without invasive structural modifications. The system’s modularity and ease of assembly attract firms handling restoration projects. Refurbishment contracts across public and private sectors are being awarded with strict timeline expectations, boosting reliance on suspended platforms. It reduces time, optimises workforce movement, and ensures high safety standards in retrofit environments. The UK Suspended Scaffolding Market benefits from steady demand in these non-new construction segments. Restoration initiatives in heritage-heavy zones continue to support market development.

Rising Preference for Lightweight, Modular, and Portable Access Solutions

Contractors across the UK increasingly seek scaffolding systems that offer ease of transport, quick installation, and adaptability to project demands. Suspended scaffolding systems meet these requirements with lightweight materials and modular design features. It offers flexibility across project types, from compact urban spaces to expansive commercial builds. The use of aluminium and other light alloys supports efficient setup without heavy machinery. This mobility advantage has gained preference among contractors handling multiple small-to-mid-size projects. The UK Suspended Scaffolding Market is responding to this trend with innovative product variants. Manufacturers are integrating ergonomic designs to reduce manual labour requirements. It improves productivity and reduces total project costs.

- For instance, Combisafe’s Hanging Platform system is widely used in UK construction for hard-to-reach structures like bridges and viaducts. It supports up to 200 kg/m² with a 2.4 m span between consoles and meets EN 12811-1 standards, offering lightweight, modular components for fast manual installation in confined spaces.

Market Trends:

Integration of Smart Safety Monitoring and Load Sensing Technologies

The integration of IoT and smart sensor technologies is emerging as a defining trend in the UK Suspended Scaffolding Market. Systems now incorporate load sensing, real-time weight distribution alerts, and stability monitoring. It enables operators and site managers to maintain operational safety while reducing the risk of overload failures. Smart scaffolding features also allow remote diagnostics and performance tracking. This trend is gaining traction in complex construction environments and high-rise building projects. With construction companies digitising site operations, demand for connected scaffolding systems is rising. The UK Suspended Scaffolding Market is expected to witness increased adoption of these technologies across premium project sites. It reflects the industry’s shift towards automation and predictive maintenance.

- For instance, Tacuna Systems provides wireless strain gauge-based load monitoring solutions capable of transmitting real-time weight data over distances up to 100 meters. With load capacities exceeding 45,000 kg and accuracy within ±0.25% FS, these systems are suited for integration into suspended platforms and access systems where real-time load awareness enhances safety and operational control.

Customization and Project-Specific Scaffolding Design Innovations

There is a growing trend toward custom-built suspended scaffolding systems tailored to specific project requirements. Contractors increasingly demand solutions that address unique façade layouts, access challenges, and weight-bearing constraints. Manufacturers are responding by offering bespoke platforms with adjustable spans and anchoring systems. It allows enhanced compatibility across architectural variations, especially in restoration and retrofit projects. This trend enhances operational efficiency and aligns with evolving construction demands. The UK Suspended Scaffolding Market is evolving through product customisation, offering competitive differentiation. Modular expansion and design adaptability now define product portfolios across leading brands. It supports wider market penetration across specialised and high-value applications.

- For instance, Air Scaffolding Ltd delivers bespoke suspended scaffolding solutions tailored to complex project requirements, including heritage sites and high-rise buildings. Their certified designers customize each system based on height, load, and architectural constraints, ensuring full compliance with the Work at Height Regulations and supporting safer, project-specific access.

Sustainable and Eco-Friendly Scaffolding Material Preferences

Environmental considerations are influencing procurement practices across the UK construction sector. Suspended scaffolding systems made from recyclable metals and sustainable materials are gaining favour. It aligns with green building certifications and environmental regulations. Manufacturers are reducing the carbon footprint by adopting cleaner manufacturing techniques and lightweight, durable materials. Clients now prioritise products with end-of-life recyclability and minimal environmental impact. The UK Suspended Scaffolding Market is reflecting this shift with an increasing number of eco-compliant offerings. It aligns with national sustainability goals in construction and infrastructure. Demand for environmentally conscious solutions is expected to continue growing.

Rental-Based Business Models and On-Demand Scaffolding Services

The growing inclination toward cost-efficient operations is driving the adoption of rental-based scaffolding services. Construction companies and contractors are shifting away from large capital investments in ownership. It allows them to optimise costs, especially for short-term or specialised projects. On-demand availability of suspended platforms through rental contracts offers flexibility and scalability. Service providers offer logistics, installation, and dismantling, further reducing operational burdens. The UK Suspended Scaffolding Market is witnessing strong growth in this rental and leasing segment. Small and mid-size contractors benefit significantly from such access models. This trend is influencing business strategies and distribution networks across the market.

Market Challenges Analysis:

High Initial Investment and Cost Sensitivity Among SMEs

Despite operational advantages, the high initial cost of suspended scaffolding systems continues to hinder adoption among smaller contractors and construction firms. Many SMEs operate under tight budgets and prioritise upfront cost over long-term value. The equipment’s pricing, transportation, and skilled labour requirements raise total project costs. It leads to hesitation in adopting modern suspended platforms, especially in low-margin projects. The UK Suspended Scaffolding Market faces limitations in penetrating price-sensitive customer segments. Rental options partially alleviate this issue, but capital expenditure remains a barrier for ownership. Firms operating in suburban and rural regions often rely on traditional scaffolding due to cost advantages. This price perception challenge affects market uniformity.

Limited Skilled Workforce for Assembly and Operation

Suspended scaffolding systems require technically trained personnel for safe assembly, operation, and disassembly. The availability of such a skilled workforce is limited across various regions of the UK. Construction firms frequently report shortages of certified scaffolding technicians, affecting adoption rates. It raises the risk of improper installation, which can compromise worker safety and project timelines. The UK Suspended Scaffolding Market encounters delays in project execution due to this workforce gap. Although training programs and certifications exist, uptake remains uneven. Companies face added costs and logistical hurdles in arranging skilled teams across diverse project locations. The skill deficit continues to restrict market scalability.

Market Opportunities:

Emerging Demand from Restoration and Heritage Preservation Projects

The UK’s extensive inventory of heritage buildings and historical infrastructure creates strong demand for suspended scaffolding solutions. These projects require non-invasive, adaptable access systems that ensure structural preservation. It provides significant growth opportunities in cultural and public renovation initiatives. The UK Suspended Scaffolding Market is well-positioned to serve restoration firms with heritage-compliant platforms. Customised configurations and low-impact anchoring support broader usage in these niche sectors. This demand remains stable and is expected to increase with government-funded heritage conservation efforts.

Untapped Potential in Regional Construction and Institutional Contracts

While major cities dominate current demand, smaller towns and public sector institutions represent emerging opportunity zones. Schools, hospitals, and municipal buildings require maintenance and upgrades that benefit from suspended access systems. It opens avenues for suppliers to expand reach into underpenetrated geographic and sectoral pockets. The UK Suspended Scaffolding Market can grow by targeting regional contractors and local councils. Strong marketing and rental-based solutions will accelerate this expansion, tapping into diverse applications.

Market Segmentation Analysis:

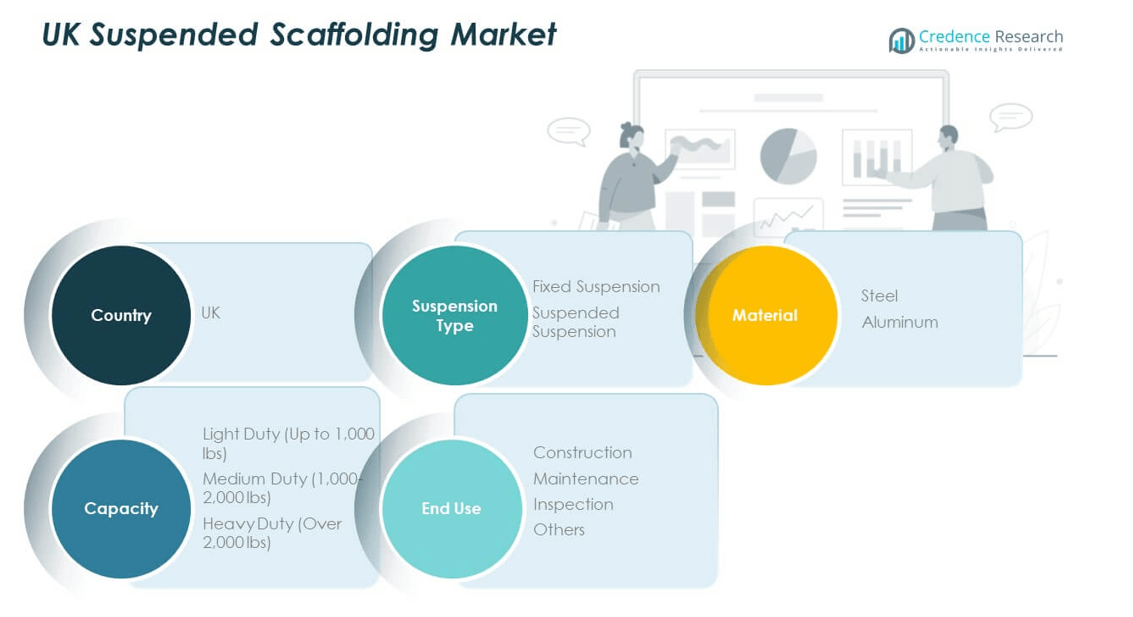

The UK Suspended Scaffolding Market is segmented

By suspension type into fixed suspension and suspended suspension systems. Suspended suspension holds a dominant share due to its flexibility in high-rise construction and refurbishment projects. Fixed suspension is preferred in long-term or repetitive access operations, particularly in industrial settings.

- For instance, Layher UK has supplied modular suspended scaffolding systems for major infrastructure projects such as the Forth Road Bridge, enabling safe access in sections spanning up to 120 meters. These solutions demonstrate the system’s adaptability for high-elevation and complex restoration work.

By material, steel remains the preferred choice owing to its strength, durability, and load-bearing capacity. However, aluminum is gaining traction for projects requiring portability and faster installation. It appeals to contractors working under tight schedules and space constraints.

By capacity, medium-duty systems dominate the UK Suspended Scaffolding Market due to their suitability for a wide range of façade and maintenance applications. Light-duty systems are used in residential and smaller-scale projects, while heavy-duty scaffolding supports large infrastructure and industrial builds.

- For instance, George Roberts Ltd offers medium‑duty suspended scaffolding systems rated for loads of up to 450 kg per platform, tailored for façade refurbishment projects.

By end use, construction leads in revenue share, driven by commercial and high-rise developments. Maintenance and inspection segments also show steady demand, supported by ongoing repair and retrofitting activities across the UK.

Segmentation:

By Suspension Type:

- Fixed Suspension

- Suspended Suspension

By Material:

By Capacity:

- Light Duty (Up to 1,000 lbs)

- Medium Duty (1,000–2,000 lbs)

- Heavy Duty (Over 2,000 lbs)

By End Use:

- Construction

- Maintenance

- Inspection

- Others

Regional Analysis:

England dominates the UK Suspended Scaffolding Market, holding a market share of 68.2% in 2024. The presence of major urban centers such as London, Manchester, and Birmingham fuels strong demand due to dense high-rise construction and extensive refurbishment projects. It benefits from higher infrastructure investment, regulatory enforcement, and a concentration of commercial developments. London leads in adopting technologically advanced suspended systems for large-scale projects, including office towers, transport hubs, and healthcare facilities. The demand remains high in both new construction and heritage building restoration. Contractors in England continue to prefer suspended scaffolding systems for efficiency and compliance. The market’s growth is further supported by consistent public sector spending and private redevelopment initiatives.

Scotland accounts for 14.6% of the UK Suspended Scaffolding Market in 2024. Demand in this region stems from government-backed infrastructure upgrades and institutional renovations. Edinburgh and Glasgow serve as key hubs, with active commercial and public sector projects. It exhibits growth potential in the education, cultural, and tourism sectors where scaffolding solutions are required for building maintenance. The presence of older architectural structures supports the market through ongoing restoration works. Firms in Scotland increasingly adopt suspended scaffolding to comply with safety standards and access challenges. The market shows upward momentum as regional investments gain traction.

Wales and Northern Ireland collectively hold 17.2% of the UK Suspended Scaffolding Market in 2024. These regions are gradually witnessing increased adoption, driven by housing modernization programs and public facility improvements. While market size is smaller, construction activity is diversifying across municipal and commercial applications. It responds to local initiatives aimed at upgrading aging infrastructure and supporting urban renewal. Contractors operating in these regions rely on rental-based models to access suspended systems cost-effectively. Market penetration is expected to strengthen through supplier partnerships and awareness campaigns. Wales and Northern Ireland represent emerging areas for sustained growth in scaffolding solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Premier Scaffolding Solutions Ltd

- Capital Access Systems

- London Bridge Scaffolders

- Elite Tower Access

- Skyline Scaffold Services

- Thames Professional Access

- Metropolitan Access Solutions

- Connolly Scaffolding

- GKR Scaffolding

- Altrad UK

Competitive Analysis:

The UK Suspended Scaffolding Market features a competitive landscape dominated by both domestic providers and international players offering certified, safety-compliant solutions. Key companies such as Harsco Infrastructure, Brogan Group, BrandSafway, Layher UK, and TRAD Group lead the market through wide service coverage, rental offerings, and technical support. It emphasizes innovation, product customization, and turnkey access services to meet complex project demands. Players compete based on quality, response time, safety features, and compliance with UK regulations. Strategic partnerships with construction firms and government contractors enhance market presence. Companies invest in workforce training and digital capabilities to improve service delivery. Competition remains strong in urban areas where infrastructure density demands high-performance solutions.

Recent Developments:

- In May 2025, AT‑PAC, a major supplier of industrial scaffold products, renewed its commitment to Habitat for Humanity in May 2025, supporting the organization’s affordable homeownership initiatives with $50,000 in funding and active volunteer participation

- In January 2025, Peri-USA announced the launch of its new SKYFLEX and LEVO formwork systems at the World of Concrete 2025 event. The SKYFLEX system introduces an innovative 8’x8′ grid beam design, aimed at enhancing efficiency for construction and scaffolding professionals in the U.S. market. This move highlights Peri-USA’s commitment to advancing scaffolding technology and safety standards in the industry.

Market Concentration & Characteristics:

The UK Suspended Scaffolding Market displays moderate concentration, with a few established companies holding significant market share across major cities. It is characterized by high regulatory compliance, technical service support, and increasing adoption of rental-based models. The market shows consistent demand for modular, lightweight platforms suited to varied applications. Firms differentiate through safety certifications, operational reliability, and responsiveness to site-specific needs. It is influenced by construction trends, heritage preservation, and commercial development cycles. Digital integration and remote monitoring capabilities are emerging as value-added features. Competitive dynamics are expected to intensify as new players enter with flexible service models.

Report Coverage:

The research report offers an in-depth analysis based on Suspension Type, Material, Capacity and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Suspended Scaffolding Market is projected to expand steadily, supported by continued investments in urban infrastructure and high-rise construction.

- Growing demand for efficient façade access systems will drive innovation in modular and lightweight scaffolding solutions.

- Restoration of heritage buildings and public infrastructure will remain a consistent growth driver across regional markets.

- Adoption of rental-based scaffolding services will rise, especially among small and mid-sized contractors seeking cost flexibility.

- Integration of IoT-enabled safety and load monitoring systems will gain momentum in premium construction projects.

- Skilled workforce development and certification programs will become a priority to address operational gaps.

- Regional market penetration will improve with targeted supplier outreach in underserved areas like Wales and Northern Ireland.

- Product customization tailored to project-specific architectural requirements will enhance supplier competitiveness.

- Sustainability initiatives will influence material choices, encouraging the use of recyclable and low-impact scaffolding components.

- Market players will focus on expanding service portfolios with training, installation, and maintenance to enhance client retention.