| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Pump Market Size 2023 |

USD 55,454.00 million |

| Water Pump Market,, CAGR |

4.2% |

| Water Pump Market Size 2032 |

USD 80,304.96 million |

Market Overview:

Global Water Pump Market size was valued at USD 55,454.00 million in 2023 and is anticipated to reach USD 80,304.96 million by 2032, at a CAGR of 4.2% during the forecast period (2023-2032).

Several key factors are propelling the growth of the water pump market. Rapid urbanization and industrialization, particularly in emerging economies, are increasing the demand for efficient water supply and wastewater management systems. Additionally, the agricultural sector’s need for reliable irrigation solutions is driving the adoption of water pumps. Technological advancements, such as the development of energy-efficient and smart pumps, are further contributing to market expansion. Moreover, stringent environmental regulations and a growing focus on sustainability are encouraging the use of eco-friendly pumping solutions. The rising need for flood control and water conservation in response to climate change also boosts demand for advanced pumping systems. Furthermore, the continuous development of infrastructure and the ongoing replacement of outdated systems globally are reinforcing the growth trajectory of the market.

Asia-Pacific dominates the global water pump market, accounting for a significant share due to rapid industrialization, urbanization, and substantial infrastructure investments in countries like China and India. The region’s demand for water pumps is further fueled by the need for efficient water management systems and agricultural irrigation solutions. North America and Europe, while mature markets, continue to exhibit steady growth driven by the replacement of aging infrastructure and the adoption of energy-efficient technologies. The Middle East and Africa are witnessing increased demand for water pumps, particularly in desalination and irrigation projects, as governments invest in water infrastructure to address water scarcity issues. This region’s growth is further accelerated by the significant investment in infrastructure for water treatment and distribution in arid areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Rapid urbanization and industrialization in emerging economies are driving the demand for efficient water management systems, which increases the need for water pumps for distribution and wastewater treatment.

- The agricultural sector remains a key driver, with rising demand for efficient irrigation solutions to ensure reliable water flow to crops, particularly in response to irregular rainfall and climate change impacts.

- Technological advancements in water pumps, such as energy-efficient models and smart pumps with remote monitoring and predictive maintenance capabilities, are further boosting market growth by enhancing operational efficiency.

- Stringent environmental regulations and sustainability concerns are encouraging the adoption of eco-friendly water pumps, particularly solar-powered models, as governments and industries focus on reducing environmental impact.

- High initial investment costs and ongoing maintenance expenses for advanced pump systems remain significant challenges, particularly for small businesses and regions with limited access to skilled labor and service centers.

- Asia-Pacific dominates the market, driven by rapid industrialization, urbanization, and large-scale infrastructure investments, while regions like North America and Europe show steady growth due to infrastructure upgrades and adoption of energy-efficient technologies.

Report Scope

This report segments the Water Pumps Market as follow

Market Drivers:

Increasing Demand for Efficient Water Management Systems

The global water pump market is being significantly driven by the increasing demand for efficient water management systems across industries. Rapid urbanization and industrialization, especially in emerging economies, are creating an urgent need for reliable and sustainable water supply systems. Cities and industrial hubs are expanding, requiring advanced water distribution, wastewater management, and storm water drainage systems to support the growing population and economic activity. For instance, smart water meters implemented in urban areas can monitor consumption patterns and detect anomalies, reducing water wastage. This rising need for water infrastructure, along with the growing focus on improving the efficiency of existing systems, is pushing the demand for water pumps that can manage large volumes of water quickly and reliably.

Growth in Agricultural and Irrigation Applications

Agriculture remains one of the primary sectors driving the growth of the water pump market. With increasing concerns about food security and a growing global population, there is a heightened need for modern irrigation systems to ensure efficient water usage in farming. Water pumps play a vital role in agricultural irrigation by providing the necessary water flow to crops. As climate change impacts weather patterns, leading to irregular rainfall and prolonged droughts in some areas, the reliance on irrigation pumps has surged. In addition, governments in many countries are investing in irrigation infrastructure to optimize water use in farming and improve agricultural productivity, further boosting the demand for water pumps.

Technological Advancements and Energy Efficiency

Technological advancements in water pump systems are another key driver of market growth. Innovations, such as the development of energy-efficient and smart pumps, are addressing the increasing demand for sustainable and cost-effective solutions. For example, Prakash Pump has introduced smart pumps equipped with sensors and control systems that enable real-time monitoring and adjustments, optimizing performance based on demand while reducing energy consumption and operational costs. These pumps consume less energy, which is crucial for reducing operational costs, especially in large-scale operations like municipal water supply systems and industrial applications. Smart water pumps that integrate digital technologies, such as remote monitoring and predictive maintenance, are gaining traction. These pumps provide enhanced performance, reduce downtime, and offer better efficiency, thus attracting businesses that aim to reduce their carbon footprint and improve operational efficiency. The evolution of pump technology has significantly contributed to the market’s expansion by catering to diverse needs across sectors.

Environmental Regulations and Sustainability Concerns

Stringent environmental regulations and a growing global focus on sustainability are major factors driving the water pump market. Governments and organizations are increasingly recognizing the importance of sustainable water management solutions to address water scarcity and environmental degradation. As part of their environmental commitments, many countries are enforcing regulations that promote the use of energy-efficient and eco-friendly pumping systems. In addition, industries are seeking sustainable solutions that minimize the environmental impact of their operations. Water pumps that use renewable energy sources, such as solar-powered pumps, are gaining popularity, particularly in regions with abundant sunlight but limited access to electricity. The push toward green technologies is motivating the adoption of advanced water pumps that are not only efficient but also environmentally friendly, thus driving further market growth.

Market Trends:

Shift Toward Smart and Connected Water Pumps

One of the notable trends in the global water pump market is the increasing adoption of smart and connected water pumps. The integration of the Internet of Things (IoT) and advanced sensor technologies into water pump systems is transforming how these systems are monitored and managed. Smart water pumps offer real-time data collection, allowing for predictive maintenance, performance optimization, and remote monitoring. For instance, WaterApp leverages IoT-based solutions to automate pump operations, monitor water quality, and track energy consumption in real time. These features ensure efficient water usage and reduce operational costs by enabling predictive maintenance and remote monitoring. This trend is particularly prominent in industrial applications, municipal water management systems, and large-scale agricultural projects. The ability to monitor and control water pumps remotely not only improves efficiency but also reduces operational costs by minimizing downtime and ensuring timely maintenance. As digital transformation continues across industries, the demand for these intelligent pumping systems is expected to rise significantly.

Focus on Energy-Efficient Solutions

Energy efficiency is a key trend that is shaping the water pump market. As global energy costs continue to rise, industries are increasingly prioritizing the use of energy-efficient water pumps to reduce operational expenses. Modern water pumps are being designed to consume less energy while maintaining high performance, making them an attractive option for large-scale facilities, such as power plants, water treatment facilities, and industrial plants. This shift is driven by both economic and environmental factors, as businesses seek to lower their carbon footprints in response to stricter environmental regulations. Additionally, advancements in variable frequency drives (VFD) and high-efficiency motors are contributing to the development of energy-efficient water pumps that can be tailored to specific applications, further enhancing their appeal.

Rising Demand for Solar-Powered Water Pumps

In regions with limited access to reliable power grids, solar-powered water pumps are gaining traction. These pumps, which harness solar energy to pump water for agricultural irrigation, drinking water supply, and industrial applications, are becoming increasingly popular in rural and remote areas. The growing interest in renewable energy solutions, combined with the need for sustainable water management systems, is driving the adoption of solar-powered pumps. The availability of government incentives and subsidies for renewable energy projects is also contributing to the growth of this trend. For instance, the Ministry of New and Renewable Energy (MNRE) in India has implemented programs to promote solar pumping systems. Solar-powered water pumps are seen as a reliable, cost-effective solution for areas that face frequent power shortages or have no access to conventional electricity infrastructure.

Customization and Tailored Pump Solutions

Another significant trend in the water pump market is the growing demand for customized and application-specific pumping solutions. As industries and municipalities require more specialized systems to meet their unique needs, water pump manufacturers are focusing on offering tailor-made solutions that cater to specific applications, such as wastewater treatment, desalination, or irrigation. This trend is particularly evident in the industrial sector, where varying conditions such as temperature, pressure, and water quality demand pumps with specialized features. Customization options, such as material selection for corrosion resistance or pumps designed for specific fluid types, are helping companies optimize pump performance and enhance reliability. As businesses continue to seek solutions that provide greater efficiency and functionality, the trend toward customized pumps is expected to grow.

Market Challenges Analysis:

High Initial Investment Costs

One of the significant challenges faced by the global water pump market is the high initial investment required for advanced water pump systems, especially for industrial and municipal applications. While water pumps are crucial for efficient water management, the upfront cost of purchasing and installing high-performance systems can be a barrier for businesses, particularly small and medium-sized enterprises (SMEs) and organizations in developing regions. Additionally, the complexity of installation and the need for specialized maintenance and training add to the overall cost. These factors often discourage companies from upgrading their existing pump systems, despite the long-term operational benefits of more efficient, sustainable solutions.

Maintenance and Operational Costs

Another key challenge in the water pump market is the high maintenance and operational costs associated with certain types of pumps. For instance, energy-efficient pumps with VFDs or smart features often demand regular servicing and specialized parts, which can increase annual maintenance costs significantly. In wastewater treatment facilities, maintenance costs for pump stations can range from $4,000 annually per station plus additional costs based on the number of pumps installed. In remote or rural areas, where service centers may be scarce, the cost of maintaining and repairing sophisticated pumps can be prohibitively expensive. Moreover, unexpected breakdowns or downtime of water pump systems can lead to significant operational disruptions, especially in critical applications like water supply and wastewater treatment, resulting in added costs for businesses and municipalities. These factors make it difficult for some organizations to fully embrace advanced water pump solutions.

Market Opportunities:

The global water pump market presents significant growth opportunities driven by increasing industrialization, urbanization, and rising demand for efficient water management solutions. In particular, the expansion of sectors such as agriculture, municipal water supply, and wastewater treatment offers substantial potential for market growth. As water scarcity and environmental concerns continue to rise, industries are focusing on adopting energy-efficient and eco-friendly water pumps. Innovations in pump technology, including the development of smart pumps with integrated IoT capabilities, are expected to further drive market demand, particularly in regions with stringent energy efficiency and sustainability regulations.

Furthermore, the growing emphasis on infrastructure development, particularly in emerging markets, presents substantial opportunities. As developing nations continue to invest in water infrastructure, including irrigation systems and water treatment plants, the demand for reliable and durable water pumping solutions will increase. The industrial sector’s continued expansion, particularly in mining, construction, and oil & gas, also drives the need for specialized water pumps to manage water flow, pressure, and drainage in these environments. With ongoing advancements in automation and digitalization, the market is poised for increased demand for water pumps with enhanced operational efficiency and lower maintenance costs, creating a favorable environment for manufacturers to capitalize on these opportunities.

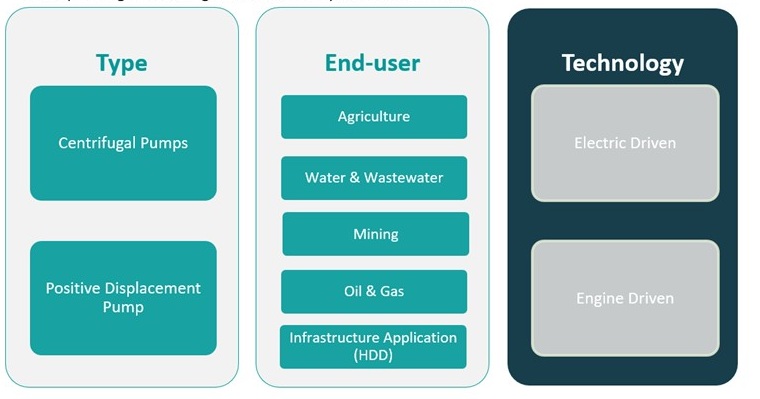

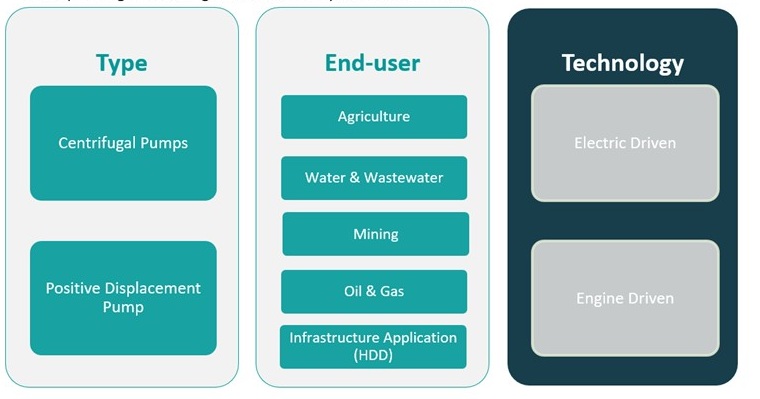

Market Segmentation Analysis:

The global water pump market is divided into various segments based on type, end-user, and technology.

By Type Segment:

The market is primarily segmented into centrifugal pumps and positive displacement pumps. Centrifugal pumps are widely used due to their efficiency in handling large volumes of liquids and are commonly employed in industrial applications, water supply systems, and irrigation. Positive displacement pumps, on the other hand, are preferred for handling viscous fluids or when precise flow control is required. This type is commonly found in sectors such as chemical processing and food production.

By End-User Segment:

The agriculture sector remains a significant end-user, driving the adoption of water pumps for irrigation and water management in farming. The water and wastewater industry, which requires efficient pumping systems for treatment and distribution, is another major segment. The mining industry relies on robust water pumps for dewatering and handling liquids during extraction processes. Additionally, the oil and gas industry requires specialized pumps for fluid transfer in exploration and production activities. Infrastructure applications (HDD) require water pumps for handling fluids in construction and tunneling projects, contributing to the growing demand for advanced pumping systems.

By Technology Segment:

The electric-driven pumps dominate the market due to their energy efficiency and ease of maintenance, making them ideal for both residential and industrial applications. Engine-driven pumps are also gaining popularity in areas where electricity is not readily available, especially in rural or off-grid regions, providing a reliable solution for water pumping in such areas.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The global water pump market is experiencing varying growth rates across different regions, influenced by factors such as industrialization, infrastructure development, and technological advancements. The key regions driving the market include Asia-Pacific, North America, Europe, the Middle East, and Africa.

Asia-Pacific

Asia-Pacific holds the largest market share in the global water pump market, accounting for over 40% of the total revenue. The region’s dominance is driven by rapid industrialization, urbanization, and infrastructure development, particularly in countries like China, India, and Japan. The increasing demand for efficient water management solutions in agriculture, municipal systems, and industrial applications fuels the adoption of water pumps. In addition, governments in Asia-Pacific are heavily investing in water infrastructure, irrigation systems, and wastewater treatment plants, which further boosts market growth. The demand for energy-efficient and solar-powered pumps is also on the rise, particularly in rural and remote areas, where access to conventional power sources may be limited.

North America

North America is the second-largest market for water pumps, holding around 25% of the global market share. The growth in this region is driven by the replacement of aging infrastructure, especially in the United States and Canada. The need for modernization of water distribution systems, wastewater treatment facilities, and flood control mechanisms has spurred demand for advanced water pumps. Additionally, energy efficiency and environmental sustainability are key priorities for industries in North America, prompting the adoption of energy-efficient water pump solutions. The market is also benefiting from the growth in industrial sectors such as oil and gas, mining, and power generation, which rely heavily on robust water pumping systems for operations.

Europe

Europe holds a significant share of the global market, accounting for approximately 20%. The region’s demand for water pumps is largely driven by the ongoing investments in upgrading aging infrastructure, particularly in Western and Eastern European countries. The adoption of energy-efficient and smart water pump solutions is a key trend in Europe, as environmental regulations are becoming stricter and sustainability is a major focus. The water pump market in Europe is also being propelled by the agricultural sector’s need for efficient irrigation systems and the rising adoption of solar-powered pumps in rural areas.

Middle East and Africa

The Middle East and Africa region represents a smaller, but rapidly growing, segment of the global water pump market, contributing to around 10% of the market share. The demand for water pumps in this region is primarily driven by the need for desalination plants, irrigation systems, and water supply infrastructure, particularly in water-scarce countries like Saudi Arabia, UAE, and South Africa. The region is heavily investing in water infrastructure to address water scarcity challenges, making it an important market for water pumps. Furthermore, the adoption of solar-powered water pumps is expected to increase in these regions, where sunlight is abundant, and the cost of traditional electricity may be a barrier.

Latin America

Latin America holds around 5% of the global water pump market share. The demand for water pumps in this region is driven by infrastructure development, particularly in Brazil, Mexico, and Argentina, where there is a growing need for water supply systems and wastewater treatment plants. In addition, the agricultural sector in Latin America, one of the largest in the world, significantly contributes to the demand for water pumps for irrigation purposes. With increasing investments in agriculture and water management, the Latin American market is expected to experience steady growth over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation.

- ITT INC.

- EBARA CORPORATION

Competitive Analysis:

The global water pump market is highly competitive, with numerous players vying for market share across various regions. Leading companies such as Grundfos, Xylem Inc., KSB SE & Co. KGaA, and Flowserve Corporation are key contributors to market growth. These companies are focusing on innovation, particularly in energy-efficient and smart water pump solutions, to cater to the growing demand for sustainability and operational efficiency. Additionally, mergers and acquisitions, strategic partnerships, and investments in research and development are common strategies employed to expand product offerings and strengthen market positions. Regional players are also enhancing their capabilities by developing cost-effective and tailored water pump solutions to meet local demand, particularly in emerging economies. As water scarcity and infrastructure challenges continue to rise globally, the competition among these companies will intensify, driving further technological advancements and market growth in the coming years.

Recent Developments:

- Servotech Power Systems Ltd.launched solar pump controllers on October 28, 2024, designed for 2HP to 10HP water pumps. This aligns with initiatives like PM-KUSUM to promote sustainable farming practices through water-efficient solutions.

- Roto Pumps Ltd.announced the launch of its subsidiary, Roto Energy Systems Ltd., in Feb 2024. This new division focuses on solar-powered water pumping solutions, including submersible and surface pumps, catering to eco-friendly water management needs.

- Grundfos’ commitment to the Water Resilience Coalition in March 2025 aligns with the water pump market’s focus on sustainability and efficient water management. The coalition’s goals include measurable improvements in global water sustainability by 2030.

- On February 28, 2025, KSB launched the MultiTec Plus pump series, specifically optimized for drinking water transport. This product integrates energy-saving technologies and real-time monitoring capabilities, emphasizing advancements in smart and sustainable water pumping solutions.

Market Concentration & Characteristics:

The global water pump market exhibits moderate to high market concentration, with a few major players dominating the industry. Leading companies, such as Grundfos, Xylem Inc., KSB SE & Co. KGaA, and Flowserve Corporation, hold significant market shares and are recognized for their advanced technology, extensive product portfolios, and strong global presence. These companies invest heavily in research and development to drive innovation, particularly in energy-efficient and smart pumping solutions. Despite the dominance of key players, the market also consists of numerous regional and local players, which contribute to market fragmentation. This allows for the customization of water pumps to meet specific regional needs, especially in agricultural and infrastructure applications. As environmental concerns and regulatory demands grow, the market is shifting toward more sustainable solutions, leading to increased competition around energy-efficient and eco-friendly pump technologies.

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The global water pump market is expected to grow steadily due to increasing demand for efficient water management systems across industries.

- Technological innovations, such as smart and energy-efficient pumps, will drive market growth and enhance operational efficiency.

- The shift towards renewable energy solutions, particularly solar-powered pumps, will gain momentum, especially in rural and off-grid regions.

- Industrial and municipal water infrastructure upgrades will continue to fuel demand for advanced pumping systems.

- Increasing urbanization and population growth, particularly in emerging economies, will drive the need for robust water supply and wastewater systems.

- The agricultural sector’s growing reliance on irrigation systems will remain a significant driver of water pump adoption.

- Rising environmental regulations and sustainability goals will promote the development and adoption of eco-friendly water pump solutions.

- Expansion of desalination projects in water-scarce regions will create new growth opportunities for water pump manufacturers.

- Enhanced focus on predictive maintenance and digital technologies will transform water pump management and performance.

- Competitive pressure will lead to consolidation through mergers and acquisitions as companies strive to expand their product offerings and market share.