Market Overview:

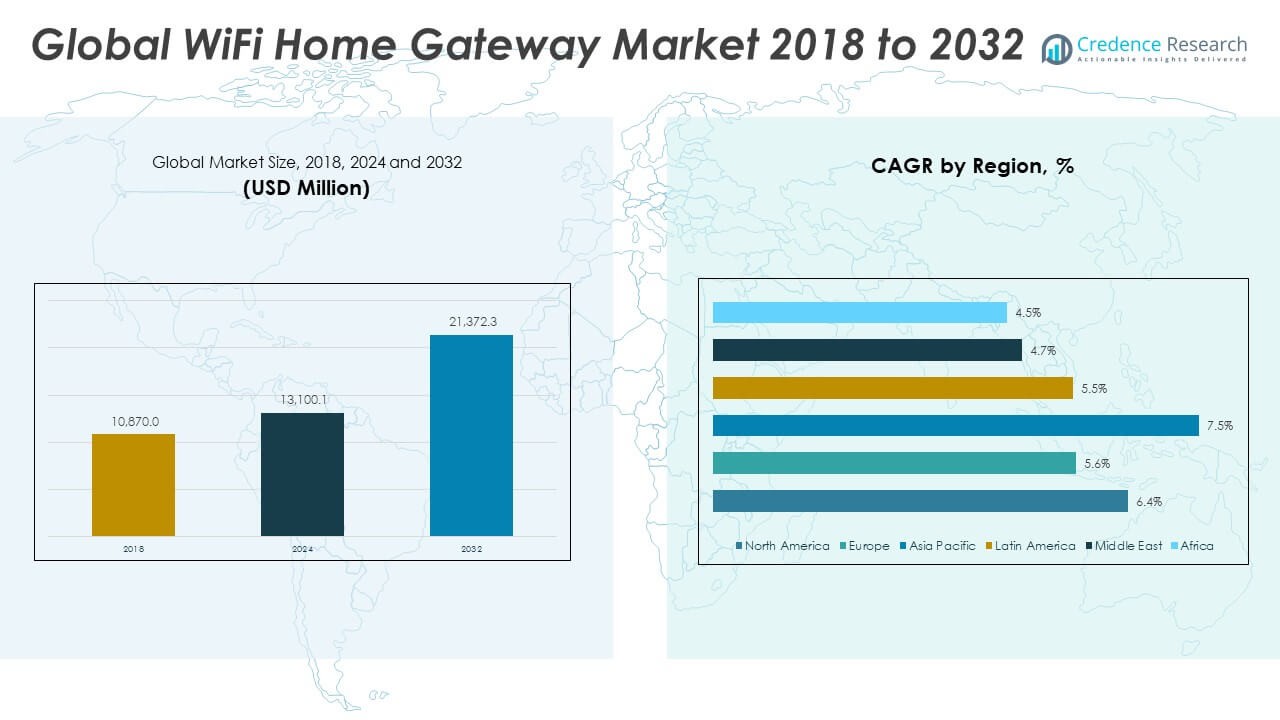

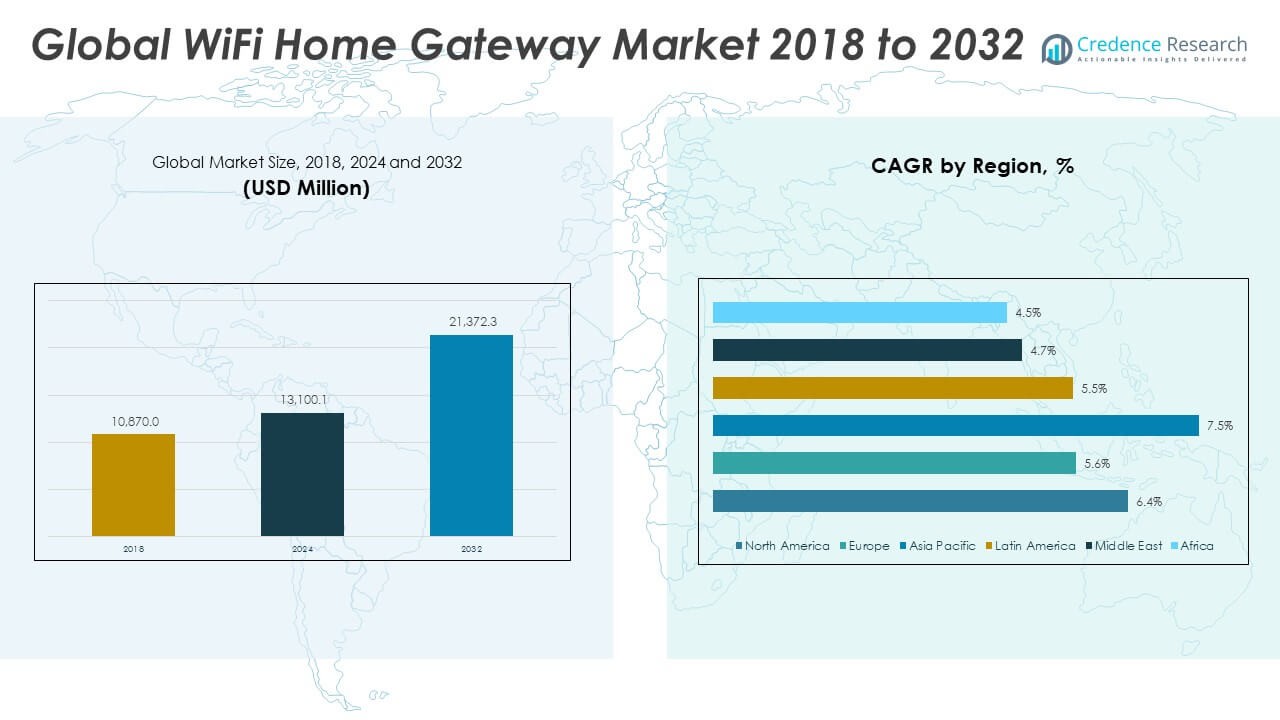

The WiFi Home Gateway Market size was valued at USD 10,870.00 million in 2018 to USD 13,100.09 million in 2024 and is anticipated to reach USD 21,372.30 million by 2032, at a CAGR of 6.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| WiFi Home Gateway Market Size 2024 |

USD 13,100.09 Million |

| WiFi Home Gateway Market, CAGR |

6.38% |

| WiFi Home Gateway Market Size 2032 |

USD 21,372.30 Million |

The growth of the WiFi Home Gateway Market is driven by the increasing number of connected devices in households, rising demand for high-speed internet, and the ongoing shift toward smart homes. Consumers are increasingly relying on home networks for work, education, streaming, and IoT-enabled automation, all of which require robust, high-bandwidth connectivity. Advancements in WiFi standards, such as WiFi 6 and WiFi 6E, are also supporting market expansion by enhancing performance and reducing latency. Additionally, telecom operators are bundling advanced gateways with their broadband services, accelerating consumer adoption across both developed and developing regions.

North America leads the WiFi Home Gateway Market due to widespread broadband penetration, high smart device adoption, and strong presence of key technology providers. Europe follows closely, supported by government initiatives for digital infrastructure development. Asia-Pacific is emerging rapidly, with countries like China, India, and South Korea witnessing surging demand fueled by expanding middle-class populations, growing internet users, and increasing investments in smart city and digital home projects. Latin America and the Middle East & Africa are gradually adopting WiFi gateways, driven by improving connectivity infrastructure and rising digital awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The WiFi Home Gateway Market was valued at USD 13,100.09 million in 2024 and is projected to reach USD 21,372.30 million by 2032, growing at a CAGR of 6.38%.

- Increasing smart home adoption and the proliferation of connected devices are significantly boosting gateway demand globally.

- Telecom operators are driving market growth by bundling advanced gateways with broadband and fiber subscription plans.

- Rapid advancements in WiFi technologies, including WiFi 6 and WiFi 6E, are enabling higher-speed, low-latency home networks.

- High competition and rapid technological obsolescence are restraining long-term product differentiation and profit margins.

- North America led the market in 2024, holding 32.1% of the global share, supported by high-speed infrastructure and early technology adoption.

- Asia Pacific is the fastest-growing region, driven by expanding internet penetration, affordable product offerings, and digital infrastructure investment.

Market Drivers

Rising Smart Home Adoption is Fueling Demand for High-Performance Connectivity Solutions

Smart home technologies have expanded rapidly across urban households, increasing the need for seamless wireless internet connectivity. Consumers are integrating smart TVs, voice assistants, security systems, and IoT appliances into their daily routines. These devices rely on stable WiFi networks, prompting a surge in the deployment of home gateways with better throughput and multi-device support. The WiFi Home Gateway Market benefits from this shift toward fully connected living environments. Telecom companies are capitalizing on this demand by bundling high-speed internet services with modern gateways. Homeowners expect uninterrupted connectivity throughout their premises. This expectation drives the preference for gateways that offer better range, speed, and device management features. Manufacturers are responding by innovating with mesh-compatible, dual-band, and tri-band gateways to serve expanding in-home networks.

- For instance,Netgear’s Orbi mesh WiFi system supports over 250 connected devices per network, delivering speeds up to 6 Gbps with tri-band technology, exemplifying innovation for high device density households.

Proliferation of Connected Devices Across Households Demands Network Upgrades

The number of connected devices per home has increased dramatically, particularly in regions with high broadband penetration. Smartphones, laptops, smart speakers, and wearable devices consistently require reliable, fast wireless access. Existing routers often fall short of meeting these bandwidth-intensive needs. The WiFi Home Gateway Market addresses this challenge by introducing products with enhanced processing power and frequency support. Consumers now demand higher upload and download speeds to support simultaneous video calls, streaming, and gaming. The evolving expectations force ISPs to upgrade their hardware offerings. Gateways now feature advanced Quality of Service (QoS) management to prioritize traffic. These factors accelerate market adoption and replacement cycles for legacy routers.

- For instance,TP-Link’s Deco X90 gateway integrates a powerful quad-core CPU and supports WiFi 6, enabling concurrent connections with 4.8 Gbps speed on 5 GHz and advanced QoS for smooth multi-application traffic handling.

Ongoing Advancements in WiFi Standards Encourage Technological Upgrades

The introduction of WiFi 6 and WiFi 6E standards has brought significant improvements in network efficiency, capacity, and security. These enhancements have enabled gateway manufacturers to develop products that offer faster data rates and better performance in congested environments. Enterprises and households are investing in future-proof networking infrastructure. The WiFi Home Gateway Market responds with devices that incorporate OFDMA, MU-MIMO, and beamforming technologies. These capabilities help deliver higher throughput and better reliability for multiple users. Manufacturers also embed cybersecurity features and parental controls, aligning with rising consumer expectations. ISPs use these advancements to differentiate their service bundles. The rollout of next-gen gateways helps improve customer satisfaction and reduces service-related complaints.

Telecom Operator Initiatives for Bundled Services and Customer Retention Drive Growth

Telecommunication companies play a crucial role in shaping consumer gateway adoption. They deploy bundled offerings that include WiFi home gateways as part of their broadband or fiber plans. This strategy reduces consumer friction while expanding the market reach. The WiFi Home Gateway Market benefits from this push as ISPs replace legacy hardware with modern, pre-configured gateways. Operators ensure these devices are compatible with their infrastructure and customer support systems. These partnerships often include firmware updates and remote diagnostics capabilities. Gateway manufacturers align their product development cycles with service providers’ upgrade schedules. Such initiatives improve customer retention and foster long-term revenue growth for both hardware vendors and network operators.

Market Trends

Integration of AI-Based Features to Enable Predictive and Adaptive Network Management

Vendors are embedding artificial intelligence into gateways to enhance network performance without user intervention. These AI-powered solutions optimize bandwidth allocation, detect intrusions, and resolve connectivity issues in real-time. AI features help identify patterns in device usage, enabling predictive load management. The WiFi Home Gateway Market is seeing growing traction in AI-enabled mesh networking systems. These smart gateways continuously self-optimize based on environmental factors and user behavior. Consumers benefit from adaptive quality-of-service enhancements and automatic channel switching. AI capabilities are becoming standard in mid to high-end product segments. Operators use this technology to reduce customer complaints and support costs through proactive maintenance tools.

- For instance, Singtel and Qualcomm demonstrated an AI-powered Wi-Fi gateway that achieved up to a 50% reduction in latency for gaming, streaming, and video calls in congested environments using Qualcomm’s Smart Traffic Classifier embedded in the Dragonwing Wi-Fi 7 platform.

Growing Popularity of Mesh-Compatible Gateways for Whole-Home Coverage

Households increasingly prioritize full-premise connectivity without dead zones or signal drops. Mesh-compatible WiFi home gateways offer scalable solutions that eliminate the need for separate extenders. The WiFi Home Gateway Market is witnessing strong demand for such systems, especially in large or multi-story homes. Mesh gateways offer seamless roaming and consistent signal strength across all connected devices. Users prefer unified network names and simple app-based setup and control. Vendors now design gateways with integrated mesh capabilities or companion nodes. Retail and ISP channels are both promoting these bundled mesh kits. The growing trend enhances user experience and supports the addition of more smart home devices.

Enhanced Emphasis on Cybersecurity and Parental Control in Gateway Design

Consumers are becoming more aware of network vulnerabilities, especially with the rise in connected devices and remote work setups. Manufacturers now include robust firewalls, encryption protocols, and access management tools in gateways. The WiFi Home Gateway Market increasingly reflects this focus by offering secure device onboarding and automatic threat detection. Parents seek tools to monitor online activity and limit screen time across devices. These requirements influence the software interface and hardware architecture of new products. Gateway vendors promote security features as core selling points. ISPs market their devices based on safety, compliance, and protection levels, especially for families and remote professionals.

- For instance, Google Nest Wi-Fi features built-in parental controls, device prioritization, and automatic security updates through the Google Home app, enabling tailored connectivity and basic network protection for smart home environments.

Shift Toward Cloud-Based Management and Remote Troubleshooting Capabilities

Consumers expect intuitive interfaces to monitor and manage their home networks. Gateway manufacturers respond with companion apps and cloud dashboards that simplify device configuration and network diagnostics. The WiFi Home Gateway Market shows a transition from manual setup to app-based onboarding and AI-assisted troubleshooting. Cloud platforms allow ISPs and users to push firmware updates, monitor usage, and reset gateways remotely. This approach reduces the need for physical service calls. It also enhances user satisfaction through real-time performance metrics. The market embraces remote management as a default feature in modern gateway offerings.

Market Challenges Analysis

Rapid Technology Obsolescence and Compatibility Issues Impact Upgrade Cycles

The WiFi Home Gateway Market faces consistent pressure from fast-paced innovation in wireless standards and protocols. Devices quickly become outdated, creating frustration for consumers and inventory challenges for vendors. Not all consumers are aware of compatibility between gateways and their ISP or connected devices. Gateways that do not support backward or forward compatibility risk shorter lifespans. Manufacturers must invest heavily in R&D to keep up with emerging protocols like WiFi 7. ISPs are cautious with upgrades due to long-term support concerns. Disruptions in chipset supply chains also slow the adoption of newer standards. Consumers often delay upgrades due to uncertainty around futureproofing and actual performance gains.

High Competition and Price Sensitivity Reduce Profit Margins for Manufacturers

The WiFi Home Gateway Market experiences high saturation, with several established and emerging players offering similar hardware specifications. This competition drives prices down and compresses margins, especially in the entry-level and mid-tier segments. Many ISPs procure devices in bulk, applying further pressure on pricing strategies. Manufacturers often compete on price instead of innovation, which limits product differentiation. Brand loyalty remains low in retail markets where consumers seek low-cost replacements. Marketing costs and warranty services further add to operational expenses. These factors make it difficult for companies to sustain profitability while meeting growing performance expectations.

Market Opportunities

Expansion into Emerging Markets with Growing Internet Penetration Offers Untapped Demand

Several emerging economies in Asia, Africa, and Latin America present promising growth avenues for gateway manufacturers and service providers. The WiFi Home Gateway Market stands to gain from expanding internet infrastructure and government initiatives promoting digital access. Rising middle-class populations in these regions drive demand for home connectivity. Consumers in semi-urban and rural areas are beginning to adopt smart devices. Vendors that offer cost-effective, easy-to-install gateways with localized support can penetrate these untapped segments. Distribution partnerships with regional ISPs enhance accessibility and brand presence in emerging markets.

Product Diversification into Hybrid Gateways Supporting 5G and Fiber Boosts Adoption

Hybrid gateways that support multiple connectivity modes—such as 5G, DSL, and fiber—open new revenue streams for manufacturers. The WiFi Home Gateway Market benefits from consumer interest in flexible, failover-ready devices. These gateways ensure uninterrupted access by automatically switching to available networks. Telecom operators also prefer such hardware for regions transitioning from copper to fiber or mobile broadband. The rising availability of affordable 5G networks further supports this trend. Vendors that offer modular gateway designs can cater to diverse use cases and infrastructure conditions.

Market Segmentation Analysis:

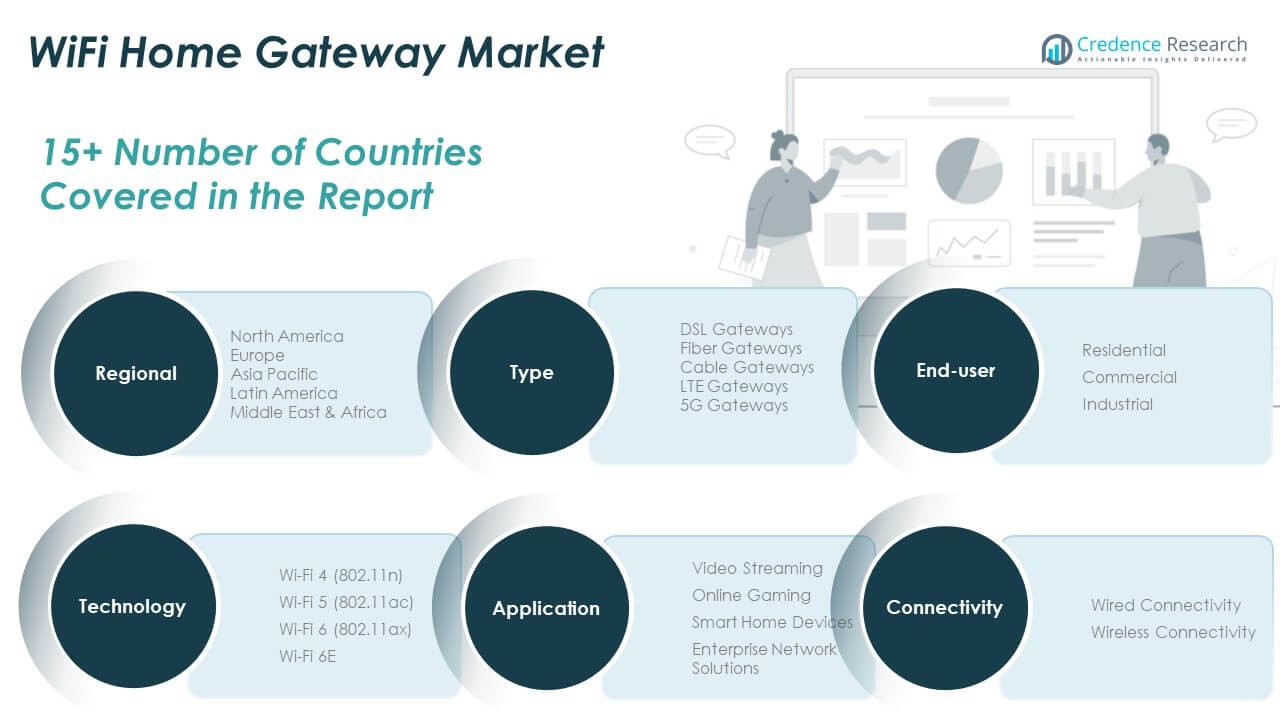

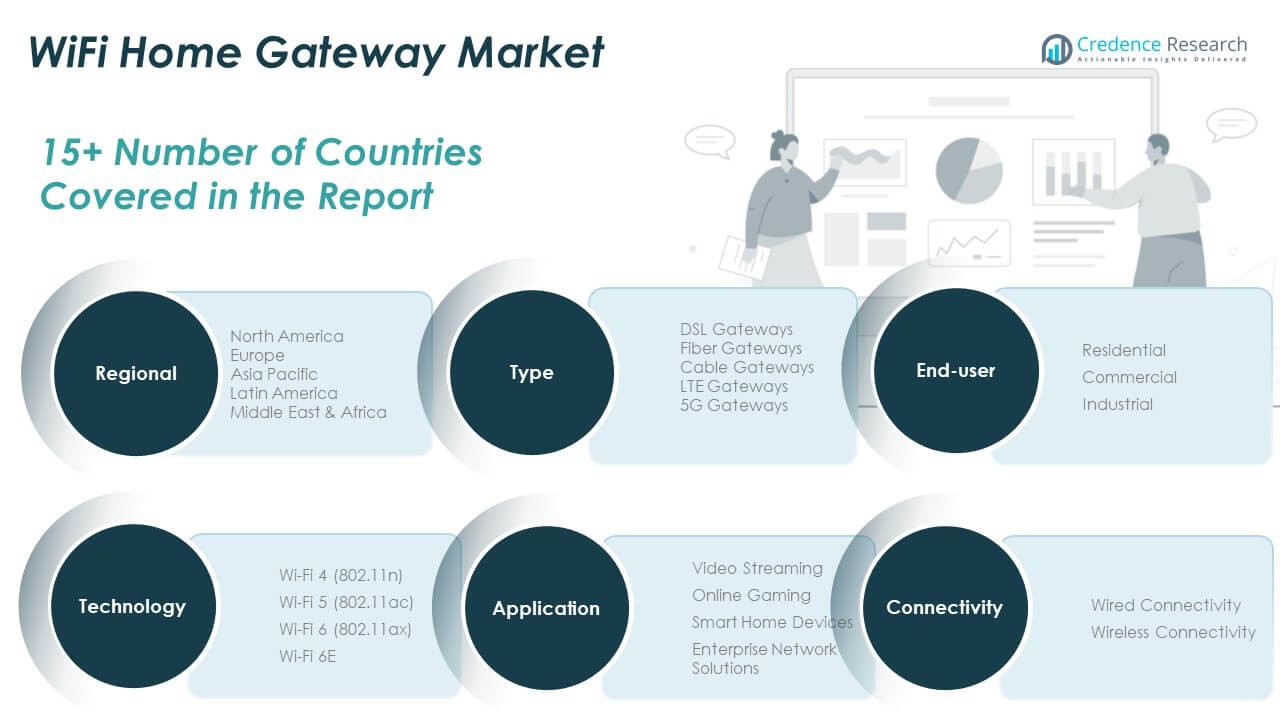

The WiFi Home Gateway Market is segmented into five core categories: type, application, end-user, technology, and connectivity.

By types, fiber gateways dominate due to their superior bandwidth capacity and growing fiber broadband infrastructure. DSL and cable gateways continue to serve legacy users, while LTE and 5G gateways gain traction in regions lacking wired infrastructure. The market supports hybrid setups where consumers seek flexibility and reliability in network access.

- For instance, Altice USA increased its fiber customer base by 58% after widening multi-gigabit fiber coverage, targeting 65% service availability by 2028.

By application, video streaming holds the largest share, driven by rising OTT consumption and HD content demand. Online gaming follows, requiring low-latency and stable connections. Smart home devices fuel gateway adoption due to constant connectivity needs. Enterprise network solutions see moderate growth, supported by remote work environments and small office setups.

- For instance, fiber broadband plans delivering 1 Gbps speeds help maintain gamer-desired latencies below 20 ms, ensuring smooth gameplay and live streaming.

By end-user, residential users form the largest segment, accounting for most gateway deployments worldwide. Commercial and industrial users invest in higher-capacity gateways to manage internal networks and automation systems.

By technology segment is transitioning rapidly. Wi-Fi 5 remains widely used, while Wi-Fi 6 and Wi-Fi 6E are gaining market share with their enhanced throughput, efficiency, and performance in dense environments. Wi-Fi 4 is gradually phasing out.

By connectivity, wireless dominates due to ease of use, scalability, and multi-device support. Wired connectivity remains relevant in enterprise environments that prioritize stable and secure network architecture. The WiFi Home Gateway Market aligns its innovations to meet performance, range, and security demands across these segments.

Segmentation:

By Type

- DSL Gateways

- Fiber Gateways

- Cable Gateways

- LTE Gateways

- 5G Gateways

By Application

- Video Streaming

- Online Gaming

- Smart Home Devices

- Enterprise Network Solutions

By End-User

- Residential

- Commercial

- Industrial

By Technology

- Wi-Fi 4 (802.11n)

- Wi-Fi 5 (802.11ac)

- Wi-Fi 6 (802.11ax)

- Wi-Fi 6E

By Connectivity

- Wired Connectivity

- Wireless Connectivity

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America WiFi Home Gateway Market

size was valued at USD 3,543.62 million in 2018 to USD 4,212.91 million in 2024 and is anticipated to reach USD 6,862.68 million by 2032, at a CAGR of 6.4% during the forecast period. North America accounts for 32.1% of the global market share in 2024, driven by strong broadband infrastructure, high smart home penetration, and aggressive service bundling by telecom operators. The U.S. leads adoption due to demand for uninterrupted video streaming, remote work, and smart device integration. Consumers in the region prefer WiFi 6 and mesh-enabled gateways for better coverage. ISPs offer pre-configured gateways with advanced features to reduce customer support costs. Network security and parental controls remain key purchase factors. The commercial segment also contributes, especially in small offices and remote setups. The region benefits from continuous innovation by leading vendors and regulatory support for broadband expansion.

The Europe WiFi Home Gateway Market

size was valued at USD 2,674.02 million in 2018 to USD 3,088.64 million in 2024 and is anticipated to reach USD 4,739.37 million by 2032, at a CAGR of 5.6% during the forecast period. Europe represents 23.6% of the global market share in 2024. Key drivers include smart city initiatives, widespread fiber deployments, and rising demand for high-speed internet across households. Countries like Germany, the UK, and France lead gateway installations. Operators focus on value-added features such as remote diagnostics and AI-based optimization. Consumers seek low-latency gateways that support HD streaming and multi-device environments. The commercial segment is growing due to remote work trends and digital business operations. EU regulations promoting consumer data protection also influence gateway specifications. Adoption of WiFi 6E continues to rise across urban regions.

The Asia Pacific WiFi Home Gateway Market

size was valued at USD 3,195.78 million in 2018 to USD 3,993.51 million in 2024 and is anticipated to reach USD 7,080.66 million by 2032, at a CAGR of 7.5% during the forecast period. Asia Pacific holds 30.5% of the global market share in 2024. Rapid urbanization, increasing internet users, and government-backed digital infrastructure projects drive adoption. China, Japan, South Korea, and India are the top-performing markets. Consumers demand affordable, high-performance gateways to support data-heavy applications and smart home systems. Vendors offer entry-level and mid-range products to match varied purchasing capacities. Growth in 5G and fiber coverage accelerates demand for hybrid and future-ready devices. E-commerce platforms enable wide distribution and competitive pricing. Smart home trends further influence gateway feature preferences.

The Latin America WiFi Home Gateway Market

size was valued at USD 789.16 million in 2018 to USD 943.08 million in 2024 and is anticipated to reach USD 1,441.99 million by 2032, at a CAGR of 5.5% during the forecast period. Latin America contributes 7.2% to the global market share in 2024. Demand is rising due to expanding internet penetration and a growing middle class. Brazil and Mexico lead regional growth with support from both public and private broadband initiatives. Consumers seek value-oriented gateways with basic security and ease of use. Telecom providers bundle gateways with budget broadband plans. The region sees increasing demand for WiFi 5 and dual-band devices. Online learning and remote work influence usage patterns. Vendors with local distribution networks gain competitive advantage. Growth remains steady but varies across urban and rural zones.

The Middle East WiFi Home Gateway Market

size was valued at USD 347.84 million in 2018 to USD 387.68 million in 2024 and is anticipated to reach USD 557.93 million by 2032, at a CAGR of 4.7% during the forecast period. The region represents 3.0% of the global market share in 2024. Demand is concentrated in countries like the UAE, Saudi Arabia, and Israel, where smart city initiatives and 5G rollouts are prominent. Households invest in WiFi 6 gateways for smart surveillance and streaming. Commercial properties deploy high-throughput devices to support IoT and guest connectivity. Consumers prefer bundled solutions from telecom companies. Product differentiation depends on range, security, and bandwidth. Import reliance poses challenges for smaller players. Rising e-learning and entertainment consumption contributes to residential segment growth.

The Africa WiFi Home Gateway Market

size was valued at USD 319.58 million in 2018 to USD 474.28 million in 2024 and is anticipated to reach USD 689.67 million by 2032, at a CAGR of 4.5% during the forecast period. Africa holds 3.6% of the global market share in 2024. Market expansion is supported by improving mobile broadband infrastructure and urban internet access. South Africa, Egypt, and Nigeria are leading adopters of home gateways. Consumers prioritize affordability and basic connectivity features. ISPs focus on LTE and hybrid gateways to overcome wired limitations. Wireless connectivity dominates due to limited fiber access. Educational demand and mobile-first households shape purchasing trends. Vendors that offer localized support and rugged designs find more acceptance. The market is still emerging but shows strong long-term potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The WiFi Home Gateway Market features strong competition among global players such as TP-Link, Netgear, Huawei, D-Link, ASUS, Tenda, and Xiaomi. These companies invest in product innovation, feature enhancement, and partnerships with telecom operators to maintain market share. It is characterized by fast-paced technology upgrades, driving companies to adopt WiFi 6 and WiFi 6E standards across their product lines. Recent developments include Huawei’s focus on AI-integrated gateways and Netgear’s launch of mesh-enabled devices for home users. TP-Link continues to expand its global reach through affordable offerings and smart ecosystem integration. Companies compete on design, range, device capacity, and security features to meet evolving consumer expectations. Strategic moves include acquisitions, regional expansion, and the development of remote management tools.

Recent Developments:

- In August 2025, TP-Link Technologies Co., Ltd. unveiled its first Wi-Fi 7 travel router, the TL-WR3602BE, designed to redefine on-the-go performance and security. This router offers blazing-fast Wi-Fi 7 speeds up to 3.6 Gbps, built-in VPN apps, and seven versatile operating modes to accommodate various travel scenarios.

Market Concentration & Characteristics:

The WiFi Home Gateway Market displays moderate to high market concentration, with a few dominant players capturing a significant share globally. It operates in a highly dynamic environment driven by rapid technological advancements and shifting consumer demands. Product lifecycles remain short due to frequent upgrades in WiFi standards and features. Leading brands differentiate through smart functionality, mesh compatibility, and cybersecurity tools. Price sensitivity shapes competitive strategies in emerging markets, while performance and reliability drive decisions in developed regions. Vendor success depends on partnerships with ISPs, effective distribution channels, and post-sale support.

Report Coverage:

The research report offers an in-depth analysis based on type, application, end-user, technology, and connectivity. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced WiFi home gateways will increase with the expansion of smart home ecosystems.

- WiFi 6E and WiFi 7 adoption will drive innovation in product design and performance.

- Telecom operators will continue bundling gateways with broadband plans to improve customer retention.

- AI integration in gateways will enable intelligent traffic management and enhanced user experience.

- Growth in hybrid work environments will boost demand for high-capacity, low-latency connectivity at home.

- Emerging markets will offer strong growth potential due to improving internet infrastructure and rising digital adoption.

- Security and privacy features will become standard expectations across all product tiers.

- Mesh networking systems will gain further traction in large residential and multi-story environments.

- Cloud-based remote management tools will shape after-sales services and customer support models.

- Environmental sustainability and energy efficiency will influence design and manufacturing practices.