Market Overview:

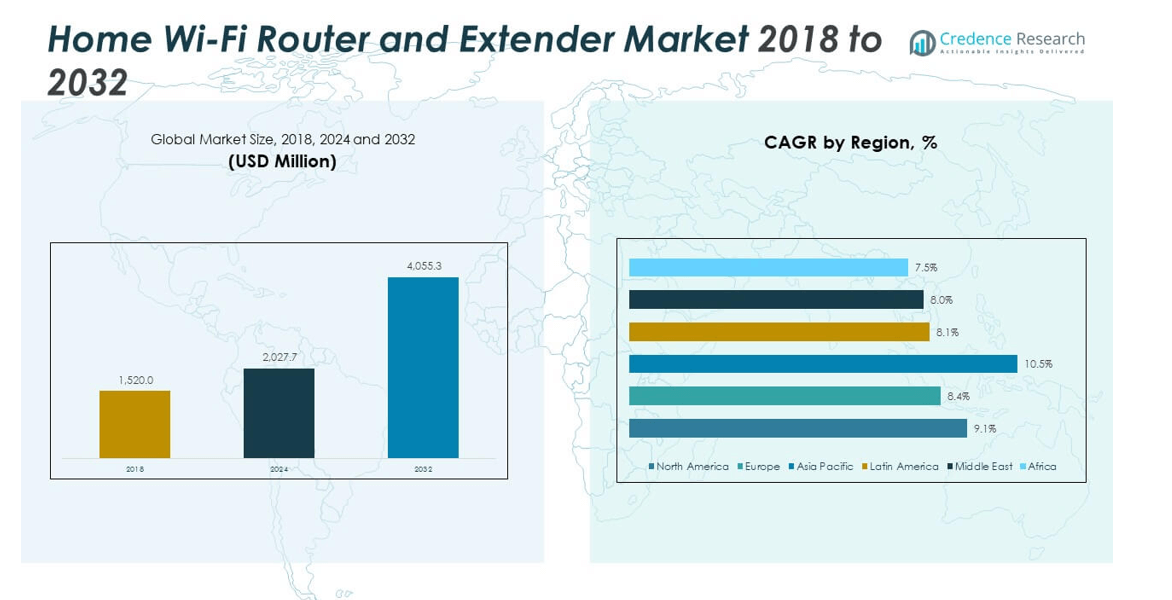

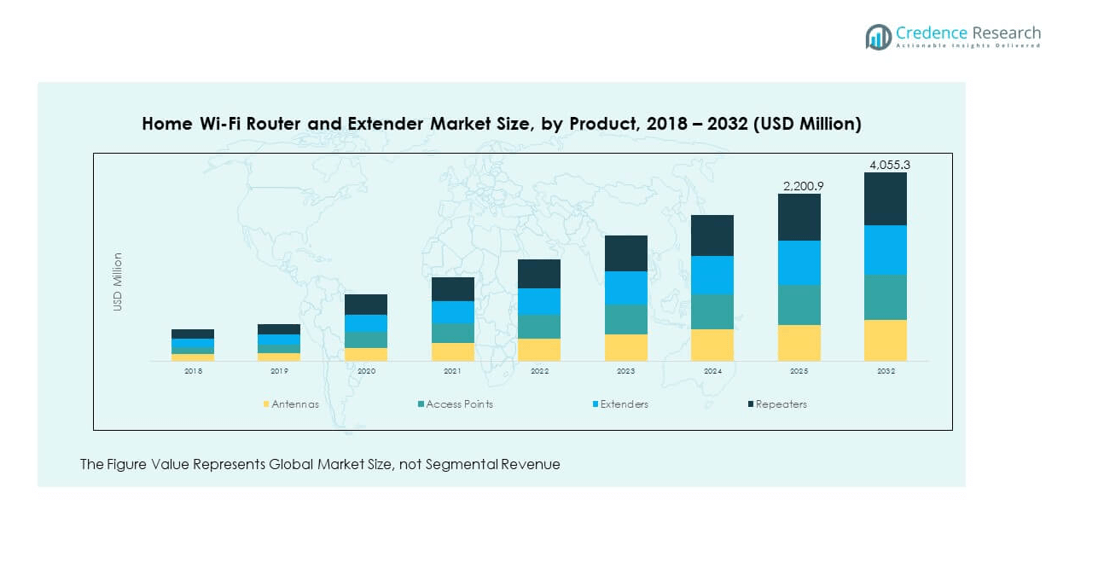

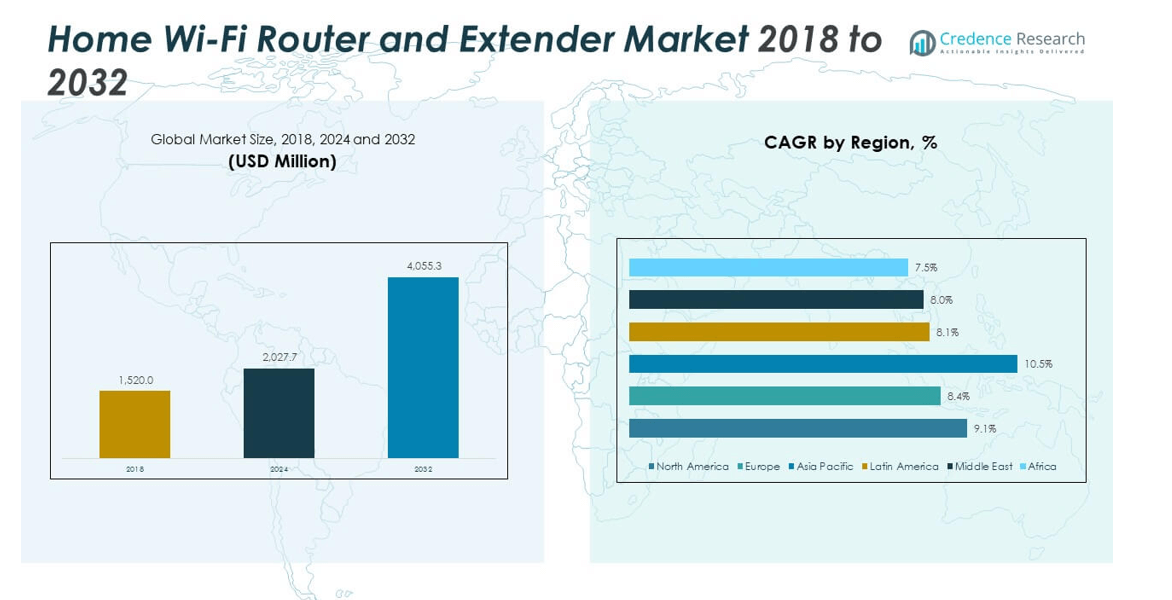

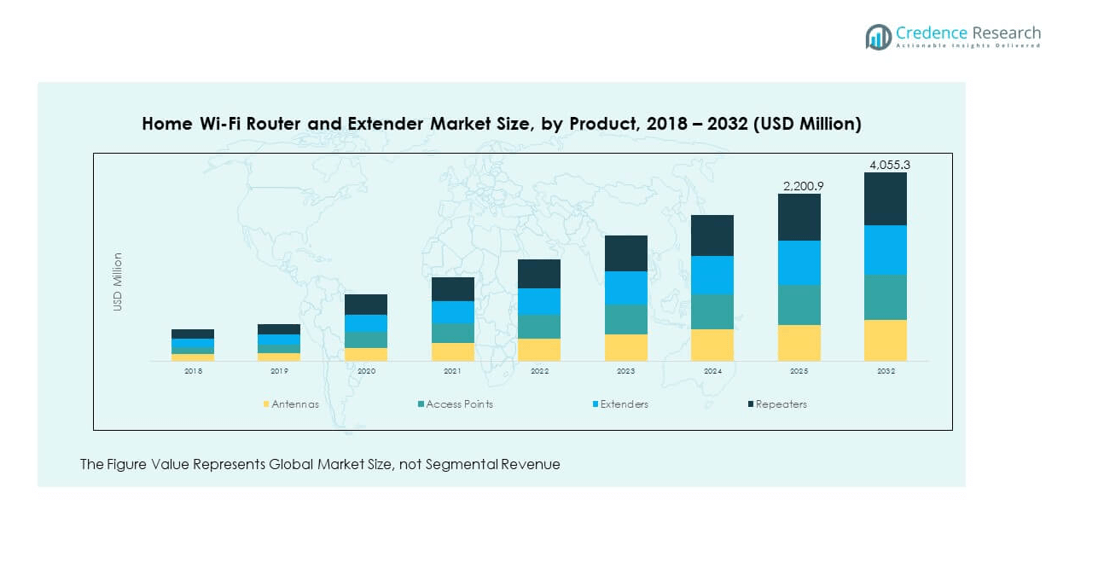

The Home Wi-Fi Router and Extender Market size was valued at USD 1,520.0 million in 2018 to USD 2,027.7 million in 2024 and is anticipated to reach USD 4,055.3 million by 2032, at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Home Wi-Fi Router and Extender Market Size 2024 |

USD 2,027.7 million |

| Home Wi-Fi Router and Extender Market, CAGR |

9.1% |

| Home Wi-Fi Router and Extender Market Size 2032 |

USD 4,055.3 million |

The market growth is driven by rising internet penetration, increasing smart home adoption, and higher demand for seamless connectivity. Consumers are upgrading to dual-band and tri-band routers to support multiple devices, online streaming, and gaming. Work-from-home trends and e-learning requirements have further accelerated the need for advanced routers and extenders that deliver stronger coverage and reliable high-speed internet across households.

Regionally, North America leads the market due to widespread broadband adoption and rapid deployment of advanced wireless technologies. Europe shows strong growth supported by smart home integration and network modernization. The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization, rising middle-class households, and expanding digital infrastructure in countries like China, India, and Japan.

Market Insights:

- The Home Wi-Fi Router and Extender Market was valued at USD 1,520.0 million in 2018, reached USD 2,027.7 million in 2024, and is projected to achieve USD 4,055.3 million by 2032, growing at a CAGR of 9.1%.

- North America held 35.2% share in 2024, Europe 27.4%, and Asia Pacific 23.7%, supported by broadband penetration, smart home integration, and digital infrastructure growth across these regions.

- Asia Pacific is the fastest-growing region with 23.7% share in 2024, driven by rapid urbanization, middle-class expansion, and government-led broadband initiatives.

- By product, extenders accounted for the largest share of the market in 2024 with 35%, followed by access points at 28%.

- Antennas contributed 22% while repeaters captured 15% of the market in 2024, showing balanced adoption across both cost-effective and advanced connectivity solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Internet Penetration and Smart Home Connectivity

The Home Wi-Fi Router and Extender Market benefits from rapid internet adoption and higher broadband subscriptions. It is gaining strength as households rely on wireless connections for daily activities. Growing demand for smart TVs, voice assistants, and IoT devices increases the need for strong home networks. Work-from-home and online education trends strengthen consumer focus on reliable connectivity. Dual-band and tri-band routers are preferred for multi-device use. It supports gaming, streaming, and digital communication without disruptions. Rural areas adopting broadband services further expand product demand. It remains a key driver shaping sustained market expansion.

- For example, the TP-Link Archer AXE300 (AXE16000) is a quad-band Wi-Fi 6E router delivering up to 15.6 Gbps throughputs across four bands (6 GHz, two 5 GHz bands, and 2.4 GHz), equipped with dual 10 Gbps ports (one RJ45 and one RJ45/SFP+ combo), a 2.0 GHz quad-core CPU, and 1 GB RAM for robust, high-performance connectivity.

Demand for Enhanced Coverage and Network Performance

The Home Wi-Fi Router and Extender Market experiences strong growth due to coverage improvement needs. Consumers seek solutions for eliminating dead zones and supporting multi-room connectivity. Mesh Wi-Fi systems create consistent internet access across larger households. It enhances productivity by maintaining seamless online access in all spaces. Increased video conferencing and online entertainment increase the demand for reliable routers. Performance features like MU-MIMO and beamforming attract buyers seeking advanced technology. It enables stable bandwidth distribution for heavy internet users. Improved network performance continues to drive widespread adoption.

Rising Dependence on Connected Devices and Cloud Services

The Home Wi-Fi Router and Extender Market expands with the surge of connected devices. Smartphones, tablets, wearables, and appliances increase pressure on household networks. Cloud storage and streaming services drive the need for higher capacity routers. It supports smooth transfer of large files, high-definition streaming, and secure backups. Growing interest in online gaming highlights demand for low latency connections. Smart appliances require continuous internet support, further boosting network upgrades. It ensures households can manage multiple digital tasks without slowdowns. Expanding device ecosystems remain a central growth catalyst.

Innovation in Wireless Technology and Product Development

The Home Wi-Fi Router and Extender Market advances through innovation in wireless standards and product features. Wi-Fi 6 and Wi-Fi 6E routers provide faster speeds and efficient connections. It improves power management and ensures longer device battery life. Manufacturers invest in compact designs with advanced firmware and user-friendly controls. AI-based routers adapt to user behavior and optimize traffic management. Security features address growing concerns over cyber threats in smart homes. It encourages adoption among consumers seeking advanced protection and performance. Product innovation ensures the market maintains strong forward momentum.

- For example, the Cisco Wi-Fi 7 access points support the Wi-Fi 7 (802.11be) standard, including 4K-QAM, Multi-Link Operation (MLO), 320 MHz channel widths, OFDMA, and redundant uplinks via dual 10 Gbps multigigabit Ethernet ports. They offer high-throughput performance and secure, flexible deployment for enterprise environments.

Market Trends:

Adoption of Mesh Wi-Fi Systems for Seamless Household Coverage

The Home Wi-Fi Router and Extender Market shows increasing demand for mesh systems. Consumers choose mesh setups to avoid weak signals in larger homes. It offers smooth roaming and consistent speeds across multiple floors. Setup simplicity attracts households with limited technical expertise. Mesh adoption aligns with growing home automation and entertainment needs. Vendors position these systems as premium, user-friendly solutions. It ensures uninterrupted streaming and gaming experiences. Mesh networks have become a clear trend defining home connectivity. Growing affordability of mesh solutions is further accelerating adoption across residential markets.

- For instance, the Netgear Orbi RBK853 Mesh WiFi system uses Wi-Fi 6, provides up to 7,500 sq. ft. of coverage, and supports more than 100 connected devices in a single installation, as stated in official product specifications.

Integration of Artificial Intelligence and Network Optimization

The Home Wi-Fi Router and Extender Market trends include AI-enabled features for smarter performance. AI-based routers analyze user behavior to improve bandwidth allocation. It allows automatic prioritization for video calls, streaming, or gaming. Machine learning enhances predictive network adjustments. Intelligent assistants simplify troubleshooting and improve user experiences. It supports automated parental controls and cybersecurity enhancements. Consumers value the hands-free approach to managing networks. AI integration marks a significant advancement shaping product appeal. Rising interest in self-optimizing networks highlights AI’s growing influence on household connectivity.

Growing Popularity of App-Based Router Management Solutions

The Home Wi-Fi Router and Extender Market benefits from mobile app-based controls. Consumers demand remote management through smartphones and tablets. It enables users to monitor speed, connected devices, and data use. Quick setup processes improve customer satisfaction. Apps provide alerts on unusual activity or security issues. It empowers households with greater control over network efficiency. Gamers and heavy users leverage apps for real-time adjustments. This app-driven trend continues to shape consumer expectations. The growing integration of cloud support within apps enhances overall usability and scalability.

- For example, the Eero app has over 5 million downloads on the Google Play Store and allows users to remotely set up, monitor, pause internet access, share network access, and manage connected devices on their Eero Wi-Fi mesh network.

Focus on Energy Efficiency and Sustainable Network Equipment

The Home Wi-Fi Router and Extender Market observes emphasis on energy-efficient models. Manufacturers design routers with lower power consumption features. It appeals to eco-conscious households aiming to reduce energy costs. Compact, recyclable hardware supports sustainability goals. Green certifications increase product acceptance in developed regions. It ensures compliance with strict environmental standards. Energy-efficient routers also align with long-term consumer savings. This sustainability trend reinforces demand in the market. Vendors adopting circular economy practices will strengthen their position in eco-driven markets.

Market Challenges Analysis:

Cybersecurity Risks and Rising Threats to Home Networks

The Home Wi-Fi Router and Extender Market faces challenges from growing cybersecurity risks. Hackers exploit unsecured routers to access personal data. It raises concerns for households relying on smart devices. Outdated firmware and weak encryption expose users to threats. Frequent software updates are necessary, but not all consumers adopt them. It limits protection and increases vulnerability across connected ecosystems. The challenge extends as IoT devices multiply. Security lapses remain a significant barrier for market expansion.

Price Sensitivity and Competition in Consumer Segments

The Home Wi-Fi Router and Extender Market encounters issues with price-sensitive buyers. Consumers in developing regions often prioritize affordability over advanced features. It restricts adoption of high-performance routers in some markets. Low-cost local brands intensify competition with established global vendors. It pressures margins and reduces opportunities for premium sales. Marketing advanced features becomes difficult in budget-driven segments. Strong rivalry creates fragmentation and limits brand loyalty. Price sensitivity remains a notable challenge shaping market growth patterns.

Market Opportunities:

Expansion Through Smart Home Integration and IoT Growth

The Home Wi-Fi Router and Extender Market gains opportunities from smart home adoption. Households add connected devices, creating demand for advanced routers. It supports IoT growth by enabling smooth interaction among devices. Smart lighting, thermostats, and appliances depend on reliable networks. Premium router systems cater to advanced automation needs. It positions vendors to capitalize on growing IoT ecosystems. Integration with home assistants’ boosts sales appeal. Expanding smart home ecosystems strengthen future opportunities.

Growth in Emerging Economies and Rural Connectivity Expansion

The Home Wi-Fi Router and Extender Market benefits from expanding broadband access in developing regions. Rural internet projects increase adoption potential. It improves digital access in underserved communities. Rising middle-class populations enhance demand for better home connectivity. Vendors target these markets with affordable yet capable solutions. It supports education, telemedicine, and digital communication growth. Government-led connectivity programs provide added momentum. Emerging economies remain a strong source of new opportunities.

Market Segmentation Analysis:

By product includes antennas, access points, extenders, and repeaters. Antennas remain critical for signal transmission and coverage improvement, supporting both standard and advanced routers. Access points are widely deployed in larger households and offices where dedicated connections ensure stability. Extenders continue to drive adoption in residential setups, providing affordable solutions to eliminate dead zones. Repeaters play a significant role in environments requiring simple signal boosting, though demand is gradually shifting toward advanced mesh-based systems. Each product segment strengthens overall market growth by addressing diverse consumer needs.

- For example, the Ubiquiti UniFi U7 Pro is a Wi-Fi 7 access point capable of handling over 300 devices and providing wide coverage, making it suitable for offices, schools, and large households where multiple dedicated connections are needed for stability.

By end use spans public, commercial, enterprise, residential, and other applications. Residential remains the dominant segment, fueled by rising internet penetration, e-learning, and smart home adoption. Enterprises demand high-performance routers and extenders to support large-scale digital operations. Commercial establishments such as retail outlets and hospitality spaces prioritize reliable coverage for customer experiences. Public deployments include airports, libraries, and community spaces where seamless connectivity is critical. Other applications represent niche demand, often linked with specialized environments. It benefits from broad adoption across both individual and institutional users, ensuring stable long-term growth.

- For example, Cisco’s Catalyst 9800-L wireless controllers deliver high-capacity, secure Wi-Fi 6 deployments when integrated with Catalyst 9100AX access points. These configurations enable enterprise-class resiliency, simplified management, and support for modern hybrid work environments.

Segmentation:

By Product

- Antennas

- Access Points

- Extenders

- Repeaters

By End Use

- Public

- Commercial

- Enterprise

- Residential

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Home Wi-Fi Router and Extender Market size was valued at USD 541.1 million in 2018 to USD 712.9 million in 2024 and is anticipated to reach USD 1,423.5 million by 2032, at a CAGR of 9.1% during the forecast period. North America accounts for 35.2% of the global market share in 2024. The region benefits from widespread broadband penetration and early adoption of advanced wireless technologies. High demand arises from remote work, e-learning, and the growing number of connected devices. The U.S. leads growth with strong household adoption of dual-band and mesh Wi-Fi systems. Canada and Mexico contribute through expanding broadband infrastructure and rising digital services. It remains a key growth region supported by high consumer spending and technology innovation. The competitive landscape includes leading global players with strong product portfolios. Continuous investment in network upgrades ensures long-term market strength.

Europe

The Europe Home Wi-Fi Router and Extender Market size was valued at USD 431.7 million in 2018 to USD 555.1 million in 2024 and is anticipated to reach USD 1,053.4 million by 2032, at a CAGR of 8.4% during the forecast period. Europe holds 27.4% of the global market share in 2024. Demand is driven by growing smart home adoption, video streaming, and digital transformation across enterprises. Countries like Germany, the UK, and France are leading adopters, supported by robust broadband networks. Southern and Eastern Europe show emerging demand as infrastructure investments expand. It benefits from government-backed initiatives promoting digital inclusion. Enterprises in Europe prioritize secure and advanced router systems. Vendors introduce energy-efficient models aligned with sustainability goals. Strong consumer and enterprise adoption maintains steady market momentum.

Asia Pacific

The Asia Pacific Home Wi-Fi Router and Extender Market size was valued at USD 344.3 million in 2018 to USD 481.3 million in 2024 and is anticipated to reach USD 1,066.3 million by 2032, at a CAGR of 10.5% during the forecast period. Asia Pacific represents 23.7% of the global market share in 2024. The region experiences rapid growth from urbanization, rising middle-class households, and digital transformation. China and India drive expansion through large-scale broadband deployment and smart device penetration. Japan and South Korea support advanced adoption with high-speed internet demand. It benefits from government-led connectivity programs and expanding e-commerce. Rural connectivity projects accelerate router and extender adoption in underserved areas. Vendors expand product ranges tailored to cost-sensitive buyers. Growing IoT integration strengthens long-term opportunities in the region.

Latin America

The Latin America Home Wi-Fi Router and Extender Market size was valued at USD 94.7 million in 2018 to USD 125.1 million in 2024 and is anticipated to reach USD 231.9 million by 2032, at a CAGR of 8.1% during the forecast period. Latin America contributes 6.2% of the global market share in 2024. Brazil leads adoption with strong demand for home connectivity and entertainment services. Mexico and Argentina follow with increasing investments in digital infrastructure. It faces challenges from affordability constraints but benefits from expanding broadband coverage. Rising internet penetration fuels residential and small enterprise demand. Vendors introduce budget-friendly solutions to capture price-sensitive buyers. The market shows growing adoption of mesh Wi-Fi and extenders. Regional growth continues with rising consumer dependence on digital platforms.

Middle East

The Middle East Home Wi-Fi Router and Extender Market size was valued at USD 67.3 million in 2018 to USD 84.9 million in 2024 and is anticipated to reach USD 155.7 million by 2032, at a CAGR of 8.0% during the forecast period. The Middle East accounts for 4.2% of the global market share in 2024. GCC countries dominate growth with high smart home adoption and digital transformation programs. Saudi Arabia and the UAE drive demand with strong internet penetration rates. Israel and Turkey contribute through expanding consumer and enterprise digital usage. It benefits from government investments in broadband and digital infrastructure. High disposable income supports demand for premium routers and mesh systems. Enterprises adopt advanced Wi-Fi solutions to enable workplace digitization. Rising consumer awareness of smart connectivity strengthens regional adoption.

Africa

The Africa Home Wi-Fi Router and Extender Market size was valued at USD 40.9 million in 2018 to USD 68.3 million in 2024 and is anticipated to reach USD 124.5 million by 2032, at a CAGR of 7.5% during the forecast period. Africa holds 3.4% of the global market share in 2024. Demand is supported by rising internet penetration and expanding mobile connectivity. South Africa leads adoption with higher broadband access and digital household growth. Egypt contributes through increasing enterprise and residential connectivity needs. It faces barriers from infrastructure gaps and affordability concerns. Vendors target the region with cost-effective products to support adoption. Community Wi-Fi projects expand public access to internet services. The region shows strong potential as digital inclusion programs advance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ZyXEL Communications Corp.

- TP-Link Technologies Co. Ltd.

- Tenda Technology Inc.

- Netgear Inc.

- Legrand SA

- Intel Corporation

- Huawei Technologies Co. Ltd.

- D-Link Corp.

- Devolo AG

- Dell Inc.

- Cisco

- Belkin International Inc.

- ASUS TeK Computer Inc.

- Shenzhen KuWFi Technology Co. Ltd.

Competitive Analysis:

The Home Wi-Fi Router and Extender Market is characterized by strong competition among global and regional players offering diverse product portfolios. Leading companies such as TP-Link, Netgear, Huawei, D-Link, and ASUS focus on innovation in wireless standards, including Wi-Fi 6 and mesh systems, to capture higher market share. It emphasizes product differentiation through speed, coverage, security, and user-friendly interfaces. Vendors adopt strategies such as mergers, partnerships, and regional expansion to strengthen their presence. The market also witnesses growing participation from emerging brands targeting price-sensitive segments with cost-effective solutions. It shows intense rivalry due to rapid technological advancements and shifting consumer preferences toward smart home integration. Established firms invest heavily in research and development to maintain competitiveness. Pricing pressure and constant upgrades push players to balance innovation with affordability, ensuring sustainable growth in a dynamic market environment.

Recent Developments:

- In August 2025. D-Link launched its Wi-Fi 7 router lineup, introducing the M95 BE9500 Wi-Fi 7 Smart Mesh Router, which won a 2025 Red Dot Design Award. The new range includes models supporting tri-band Wi-Fi 7, 8K streaming, AI mesh networking, and integrated 5G for enhanced smart home experiences.

- In July 2025, NETGEAR launched the Orbi 370 Series, expanding its Wi-Fi 7 mesh family to make high-performance, secure, and privacy-focused Wi-Fi 7 mesh systems more accessible to a broader household segment. This solution delivers Wi-Fi speeds up to 5 Gbps and is designed for easy expansion and futureproofing of home connectivity.

- In May 2025, ZyXEL Communications showcased its latest Wi-Fi 7 routers and wireless extenders at Fiber Connect 2025, marking its commitment to next-generation broadband innovations. The new portfolio includes Tri-Band 10G Ethernet gateways and mesh solutions based on prplOS and OPAL 3 platform, designed for fast, seamless whole-home coverage and easy deployment for broadband service providers.

Report Coverage:

The research report offers an in-depth analysis based on Product and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for seamless connectivity will continue driving adoption of advanced routers and extenders.

- Growing penetration of smart homes and IoT ecosystems will strengthen opportunities for product innovation.

- Mesh Wi-Fi systems are expected to dominate household adoption with superior coverage and scalability.

- Vendors will integrate AI-driven features to optimize bandwidth allocation and improve network performance.

- Security-focused product development will gain traction with rising concerns over cyber threats in connected homes.

- Energy-efficient and eco-friendly designs will see higher demand in markets focused on sustainability.

- Emerging economies will fuel strong growth through expanding broadband access and rural connectivity initiatives.

- Cloud-based router management and mobile applications will enhance user control and customer experience.

- Competition will intensify as established brands and regional players expand product offerings aggressively.

- Continuous investments in R&D and strategic partnerships will shape the long-term trajectory of the market.