| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Yarn Lubricants Market Size 2024 |

USD 1,783.2 million |

| Yarn Lubricants Market, CAGR |

6.30% |

| Yarn Lubricants Market Size 2032 |

USD 2,907.1 million |

Market overview

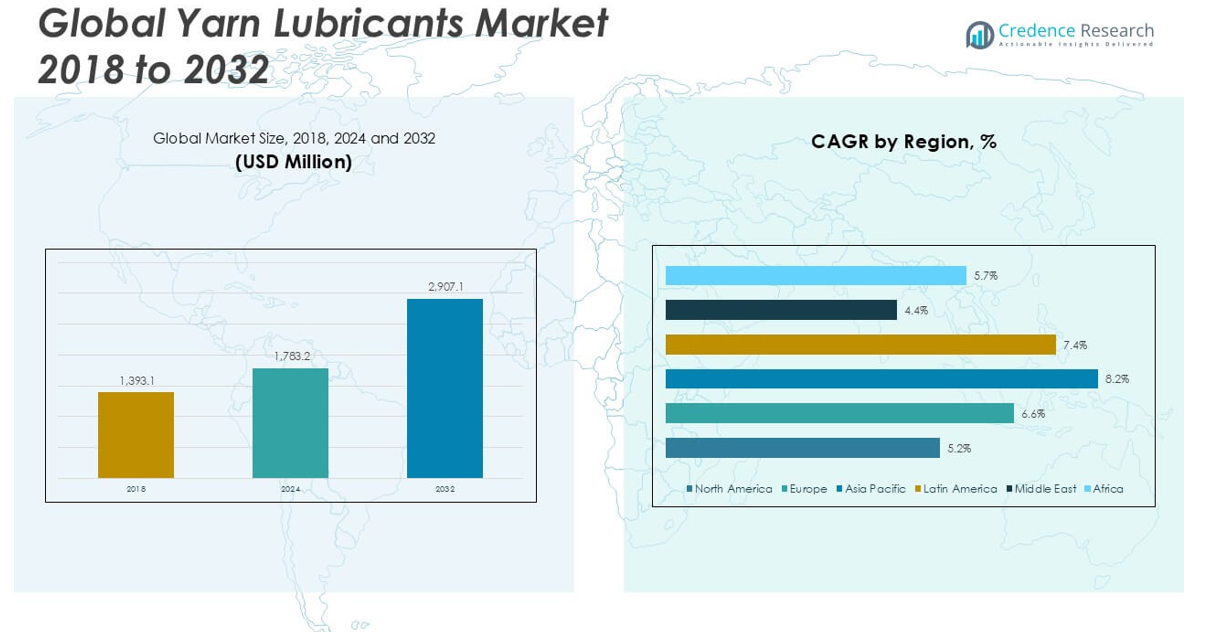

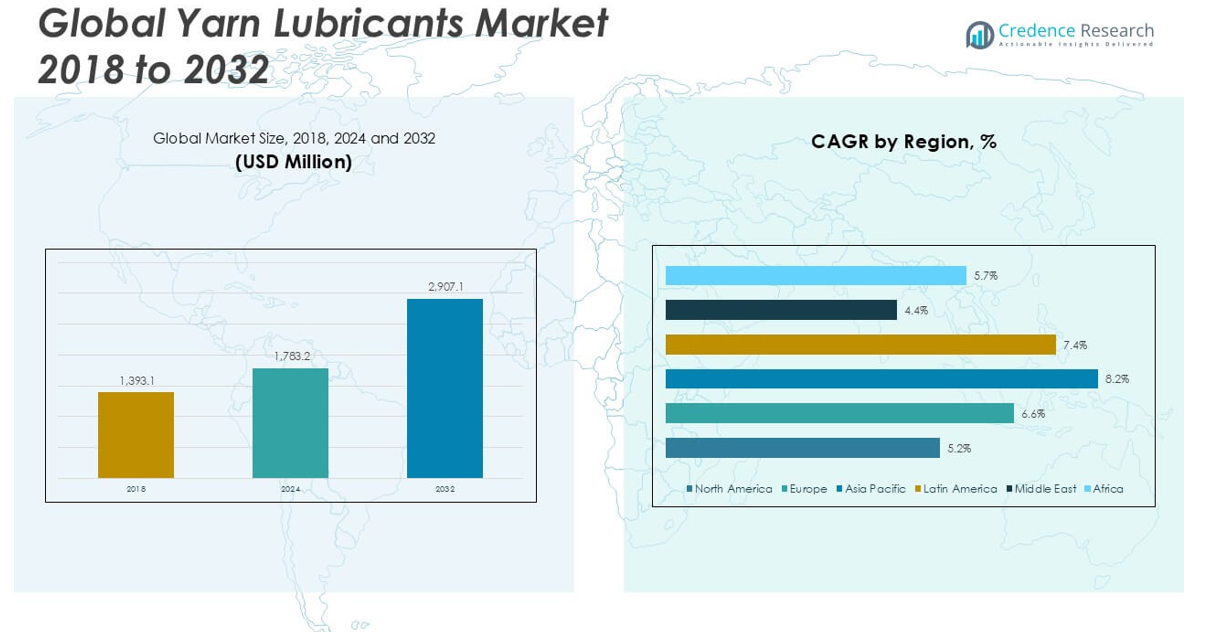

The Yarn Lubricants market size was valued at USD 1,393.1 million in 2018, reached USD 1,783.2 million in 2024, and is anticipated to reach USD 2,907.1 million by 2032, at a CAGR of 6.30% during the forecast period.

The Yarn Lubricants market is highly competitive, with major players including Achitex Minerva, Clearco Products, Rudolf GmbH, SIAM PRO DYECHEM, Sirio Pharma, Bozzetto Group, Klüber Lubrication, SAR Lubricants, Robinson Pharma, Inc., Schill+Seilacher, Takemoto Oil & Fat, Matsumoto Yushi-Seiyaku, Total S.A., and Zhejiang Communication. These companies actively invest in product innovation, sustainability, and market expansion to strengthen their global footprint. North America leads the market with a 38.4% share, driven by advanced textile manufacturing, followed by Europe at 29.6%, focusing on eco-friendly solutions. Asia Pacific holds 19.2%, emerging as the fastest-growing region, while Latin America (4.6%), the Middle East (5.0%), and Africa (3.2%) contribute to the growing global demand.

Market Insights

- The Yarn Lubricants market was valued at USD 1,393.1 million in 2018, reached USD 1,783.2 million in 2024, and is projected to reach USD 2,907.1 million by 2032, growing at a CAGR of 6.30% during the forecast period.

- Growing demand for synthetic fibers, particularly polyester, is a key driver fueling market growth, supported by advancements in high-speed spinning and increasing focus on machine efficiency.

- The market is witnessing a rising trend toward eco-friendly and biodegradable yarn lubricants, with companies focusing on sustainable product development to meet environmental regulations.

- Intense competition exists among leading players like Achitex Minerva, Klüber Lubrication, Total S.A., Bozzetto Group, and Rudolf GmbH, with innovation and product diversification shaping competitive strategies.

- North America leads with a 38.4% market share, followed by Europe at 29.6% and Asia Pacific at 19.2%; spin finish dominates the product segment, driven by its essential use in synthetic fiber processing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The spin finish product type dominates the yarn lubricants market, holding the largest share due to its essential role in synthetic fiber processing, particularly polyester. Spin finish lubricants reduce friction and static build-up, ensuring smooth yarn movement and maintaining fiber integrity during high-speed operations. The increasing global demand for synthetic textiles, driven by the growth of the apparel, automotive, and home furnishing sectors, significantly supports this segment. Additionally, the expansion of textile manufacturing hubs in countries like China, India, and Vietnam, along with the need for high-performance lubricants compatible with modern machinery, continues to propel the spin finish segment’s growth.

- For instance, Klüber Lubrication developed Klüberoil Tex 1-68 N, a spin finish lubricant that operates efficiently at yarn processing speeds up to 15,000 meters per minute, supporting modern high-speed textile production.

By Application:

Polyester stands as the dominant segment in the yarn lubricants market, capturing the largest market share. Polyester’s cost-effectiveness, durability, and widespread use across apparel, industrial fabrics, and home textiles drive substantial lubricant consumption in this segment. The high-speed processing required for polyester yarns necessitates effective lubrication to minimize yarn breakage and optimize production efficiency. The rising demand for polyester-based products, especially in Asia-Pacific, combined with ongoing advancements in fiber technology, strengthens the need for specialized yarn lubricants. This trend ensures the continued growth of lubricant usage in polyester applications throughout the forecast period.

- For instance, Total S.A. provides the Evolube SP series, which supports polyester yarn production at processing speeds exceeding 12,000 meters per minute, significantly reducing machine downtime and yarn breakage.

Market Overview

Growing Demand for Synthetic Fibers

The rapid expansion of synthetic fiber production, particularly polyester, is a primary growth driver in the yarn lubricants market. Synthetic fibers dominate global textile consumption due to their cost-efficiency, versatility, and durability. Yarn lubricants are essential in synthetic fiber processing to reduce friction, static electricity, and fiber damage, especially at high speeds. The increasing use of polyester in fashion, home textiles, and industrial applications significantly elevates the demand for high-quality lubricants to ensure smooth, efficient, and high-volume yarn manufacturing.

- For instance, Achitex Minerva reported its synthetic fiber lubricants are now used in over 350 polyester production lines globally, enhancing yarn processing efficiency across major manufacturing hubs.

Expansion of Textile Manufacturing in Asia-Pacific

The Asia-Pacific region has emerged as a global textile manufacturing hub, with countries like China, India, Bangladesh, and Vietnam leading production. The region’s low labor costs, increasing foreign investments, and the presence of large-scale textile mills drive lubricant consumption. Yarn lubricants are critical for ensuring operational efficiency and machine longevity in these high-output environments. Continuous capacity expansions, coupled with rising exports of textiles from Asia-Pacific, contribute to sustained lubricant demand, making this geographic shift a key growth catalyst for the market.

- For instance, Bozzetto Group supplies lubricants to more than 120 textile plants in Asia-Pacific, including key partnerships with manufacturers producing over 500,000 tons of polyester yarn annually.

Technological Advancements in Yarn Processing

Innovations in textile machinery and yarn processing techniques are boosting the adoption of advanced yarn lubricants. Modern high-speed spinning and knitting machines require specialized lubricants that can perform under intense conditions without causing residue build-up or fiber contamination. The development of eco-friendly and biodegradable lubricants further enhances market growth, aligning with the global push for sustainable textile production. These technological advancements enable higher productivity, reduced maintenance, and improved yarn quality, driving manufacturers to invest in superior lubricant solutions.

Key Trends & Opportunities

Rising Preference for Sustainable and Eco-Friendly Lubricants

Environmental regulations and consumer demand for sustainable products are driving the development of biodegradable and non-toxic yarn lubricants. Textile manufacturers are increasingly adopting lubricants that comply with environmental standards and reduce wastewater pollution. This shift presents an opportunity for lubricant producers to innovate and capture market share through green formulations. The trend toward sustainability is expected to create long-term growth potential for eco-conscious lubricant solutions in the yarn production industry.

- For instance, Rudolf GmbH launched the RUCO®-SPIN eco series, which meets Oeko-Tex® Standard 100 and offers biodegradability levels above 90% within 28 days, gaining rapid adoption in European textile mills.

Increasing Use of Blended Yarns

The growing popularity of blended yarns, combining natural and synthetic fibers, is shaping lubricant requirements. Blended yarns are widely used in performance wear, home textiles, and fashion due to their ability to offer improved comfort, strength, and elasticity. These yarns require lubricants that can cater to varying friction levels and fiber interactions. The increasing complexity of yarn compositions offers lubricant manufacturers an opportunity to develop tailored solutions that address the specific needs of multi-fiber processing, further driving market differentiation and growth.

- For instance, Matsumoto Yushi-Seiyaku developed the MINAX® series specifically for blended yarns, now used in over 80 textile factories processing complex cotton-polyester and wool-acrylic yarn blends.

Key Challenges

Environmental Compliance and Regulatory Restrictions

The yarn lubricants market faces growing pressure from stringent environmental regulations related to chemical usage and waste management. Lubricants that fail to meet safety and sustainability standards risk restricted usage, particularly in developed regions with strict compliance norms. Manufacturers must invest in reformulating products to meet evolving environmental guidelines, which can increase production costs and complexity. This regulatory landscape poses a significant challenge, especially for companies relying on conventional, petroleum-based lubricant solutions.

Price Volatility of Raw Materials

Fluctuations in the prices of key raw materials, such as base oils and specialty additives, present an ongoing challenge for yarn lubricant manufacturers. Sudden cost increases can erode profit margins and disrupt supply chain stability. Companies must strategically manage procurement and pricing to remain competitive in a market where price sensitivity is high. Inconsistent raw material availability, particularly in geopolitically unstable regions, adds further risk to sustained production and cost efficiency.

Limited Awareness in Emerging Markets

While the demand for high-performance yarn lubricants is growing, several emerging textile markets still rely on traditional lubricants due to limited awareness of advanced alternatives. Small and mid-sized textile manufacturers may prioritize cost over quality, delaying the adoption of specialized or eco-friendly lubricants. This knowledge gap can hinder market penetration for premium lubricant producers. Expanding educational initiatives and demonstrating long-term cost benefits remain crucial to overcoming this challenge in less mature markets.

Regional Analysis

North America

North America held the largest market share of 38.4%, with a market size of USD 535.0 million in 2018, which grew to USD 642.0 million in 2024 and is projected to reach USD 944.8 million by 2032, expanding at a CAGR of 5.2%. The region’s growth is driven by the strong presence of advanced textile industries and continuous investment in modern spinning technologies. The demand for high-performance yarn lubricants in the U.S. and Canada is rising, supported by the growing emphasis on improving yarn quality, machine efficiency, and sustainable production practices.

Europe

Europe accounted for 29.6% of the global yarn lubricants market in 2018, with a market size of USD 412.4 million, which increased to USD 501.1 million in 2024 and is expected to reach USD 738.4 million by 2032, growing at a CAGR of 6.6%. The region benefits from a well-established textile industry with a strong focus on quality and environmental compliance. The increasing shift toward eco-friendly and biodegradable lubricants, especially in Germany, Italy, and France, is fueling market expansion. Europe’s high adoption of advanced spinning machinery continues to drive demand for specialized lubricant solutions.

Asia Pacific

Asia Pacific held a 19.2% market share in 2018, with a market size of USD 267.5 million, growing significantly to USD 406.6 million in 2024 and projected to reach USD 822.7 million by 2032, the highest CAGR of 8.2% among all regions. The rapid expansion of textile manufacturing hubs in China, India, Bangladesh, and Vietnam is the key growth driver. Increasing investments in high-speed yarn production, combined with the growing demand for synthetic and blended yarns, significantly contribute to the region’s market growth. Asia Pacific is emerging as the most dynamic and fastest-growing market for yarn lubricants.

Latin America

Latin America captured 4.6% of the global yarn lubricants market in 2018, with a market size of USD 64.1 million, which rose to USD 74.9 million in 2024 and is forecasted to reach USD 148.3 million by 2032, expanding at a robust CAGR of 7.4%. Brazil and Mexico are the key contributors to the regional market, supported by the growth of local textile production and increasing adoption of modern machinery. Rising investments in the fashion and home textiles sectors are further driving the demand for efficient yarn lubricants across the region.

Middle East

The Middle East held a 5.0% market share in 2018, valued at USD 69.7 million, growing to USD 103.4 million in 2024 and anticipated to reach USD 191.9 million by 2032, at a CAGR of 4.4%. The region’s growth is moderately paced, supported by expanding textile industries in countries like Turkey and the United Arab Emirates. Increasing demand for technical textiles and synthetic fibers is boosting lubricant consumption. However, market growth is somewhat limited by the region’s dependence on imports for advanced textile machinery and high-quality yarn lubricants.

Africa

Africa accounted for 3.2% of the global yarn lubricants market in 2018, with a market size of USD 44.6 million, reaching USD 55.3 million in 2024 and projected to grow to USD 61.0 million by 2032, at a CAGR of 5.7%. The African market remains nascent but is steadily developing, driven by local textile production growth in countries like Egypt, South Africa, and Ethiopia. Increasing government initiatives to strengthen domestic manufacturing and rising foreign investments in textile parks are expected to gradually boost lubricant demand in the region, despite limited technological infrastructure.

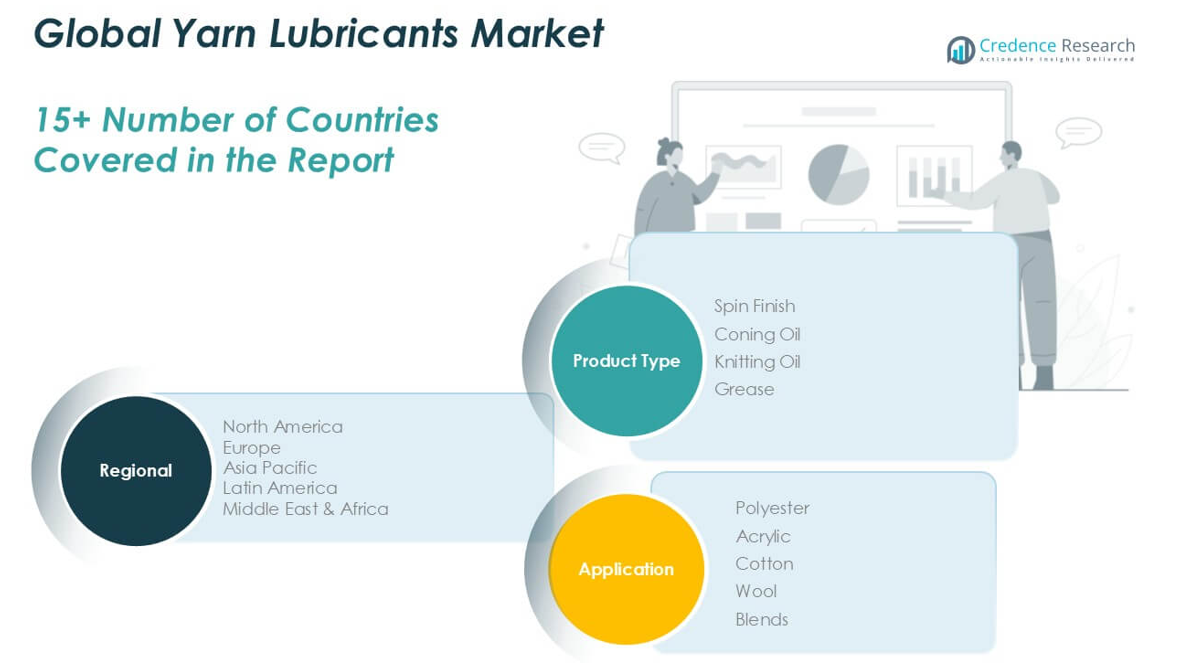

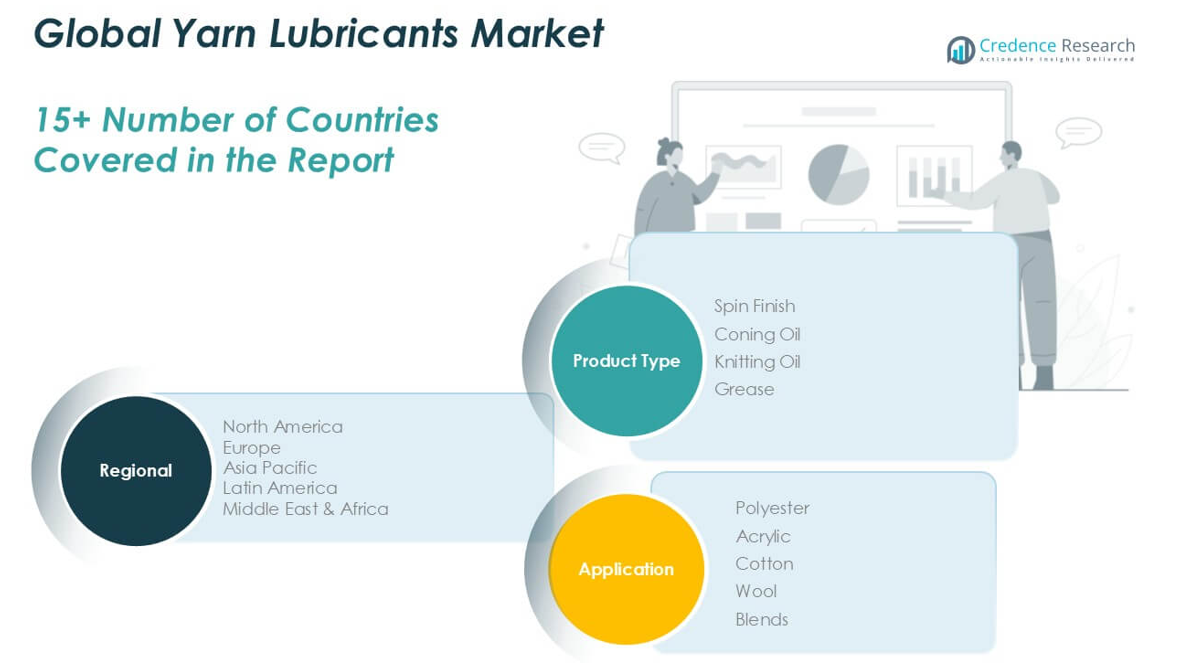

Market Segmentations:

By Product Type

- Spin Finish

- Coning Oil

- Knitting Oil

- Grease

By Application

- Polyester

- Acrylic

- Cotton

- Wool

- Blends

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The yarn lubricants market is moderately fragmented, with the presence of several established players and regional manufacturers competing based on product quality, innovation, and pricing strategies. Key companies such as Achitex Minerva, Rudolf GmbH, Klüber Lubrication, and Bozzetto Group focus on expanding their product portfolios with advanced, eco-friendly, and high-performance lubricants to meet evolving industry requirements. Strategic collaborations, product launches, and regional expansions are common growth tactics to strengthen market positioning and capture emerging opportunities, particularly in Asia-Pacific and Latin America. Companies like Total S.A. and Matsumoto Yushi-Seiyaku leverage their global distribution networks to maintain competitive advantage. Additionally, market players are investing in research and development to develop sustainable and biodegradable lubricant solutions in response to increasing environmental regulations. The competitive landscape is also shaped by smaller players such as SIAM PRO DYECHEM and SAR Lubricants, which focus on serving niche markets and providing customized lubricant formulations. Continuous innovation remains essential for sustaining market relevance and competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Achitex Minerva

- Clearco Products

- Rudolf GmbH

- SIAM PRO DYECHEM

- Sirio Pharma

- Bozzetto Group

- Klüber Lubrication

- SAR Lubricants

- Robinson Pharma, Inc.

- Schill+Seilacher

- Takemoto Oil & Fat

- Matsumoto Yushi-Seiyaku

- Total S.A.

- Zhejiang Communication

Recent Developments

- In March 2025, Klüber Lubrication was awarded the EcoVadis GOLD medal for sustainability for the fourth consecutive year, placing it in the top 3% of companies globally. While this recognition underscores their commitment to sustainable practices, there are no specific new yarn lubricant product launches reported in the latest period.

- In January 2024, Rudolf introduced major bio-based innovations for its textile auxiliaries, notably RUCO®-PUR BIO SLB and FERAN® BIO ICR, under its HYDROCOOL® technology line. These products use renewable raw materials, significantly reducing environmental impact while maintaining high performance and durability. RUCO®-PUR BIO SLB contains 43% bio-based content, and FERAN® BIO ICR, designed for polyester and blends, boasts 87% bio-based content. These launches mark a significant shift towards sustainable yarn and fabric treatments in the industry.

- In 2023, Textilchemie Dr. Petry acquired the textile auxiliary division of Industrie-Chemie Stein GmbH.

- In 2023, Rudolf GmbH opened a new location in Nantong, China, to strengthen the company’s competitive position both locally and globally.

Market Concentration & Characteristics

The Yarn Lubricants Market is moderately concentrated, with several global and regional players competing across key markets. It features a balanced mix of large multinational corporations and specialized local manufacturers, each focusing on product performance and compliance with environmental standards. Companies like Achitex Minerva, Klüber Lubrication, Total S.A., Bozzetto Group, and Rudolf GmbH hold significant shares through strong distribution networks and continuous product innovation. It is characterized by steady demand from the textile industry, driven by the need for high-speed processing, reduced machine wear, and improved yarn quality. The market shows a growing preference for sustainable and eco-friendly lubricants, prompting companies to invest in green formulations. Strong regional demand variations exist, with Asia Pacific emerging as the fastest-growing market and North America maintaining the largest market share. Price competition is significant, especially in emerging markets, where cost-sensitive buyers often prioritize affordability. Long-term supplier relationships and consistent product quality remain critical competitive factors.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for high-performance yarn lubricants will continue to grow with the expansion of synthetic fiber production.

- Eco-friendly and biodegradable lubricants will gain significant market traction due to strict environmental regulations.

- Asia Pacific will remain the fastest-growing region, driven by large-scale textile manufacturing in China, India, and Bangladesh.

- North America and Europe will maintain steady demand, supported by advanced textile technologies and a focus on product quality.

- Spin finish lubricants will retain a dominant market share due to their essential role in synthetic yarn processing.

- The adoption of modern high-speed spinning and knitting machinery will increase the need for specialized lubricants.

- Price sensitivity in emerging markets will continue to influence the demand for cost-effective lubricant solutions.

- Continuous innovation in lubricant formulations will be necessary to meet complex requirements of blended and specialty yarns.

- Companies will strengthen their regional distribution networks to improve market accessibility and customer service.

- The focus on reducing machine maintenance and enhancing yarn durability will drive long-term lubricant usage.