| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Military Grade Fiberglass Market Size 2024 |

USD 8,539.95 Million |

| Military Grade Fiberglass Market, CAGR |

4.33% |

| Military Grade Fiberglass Market Size 2032 |

USD 12,284.40 Million |

Market Overview

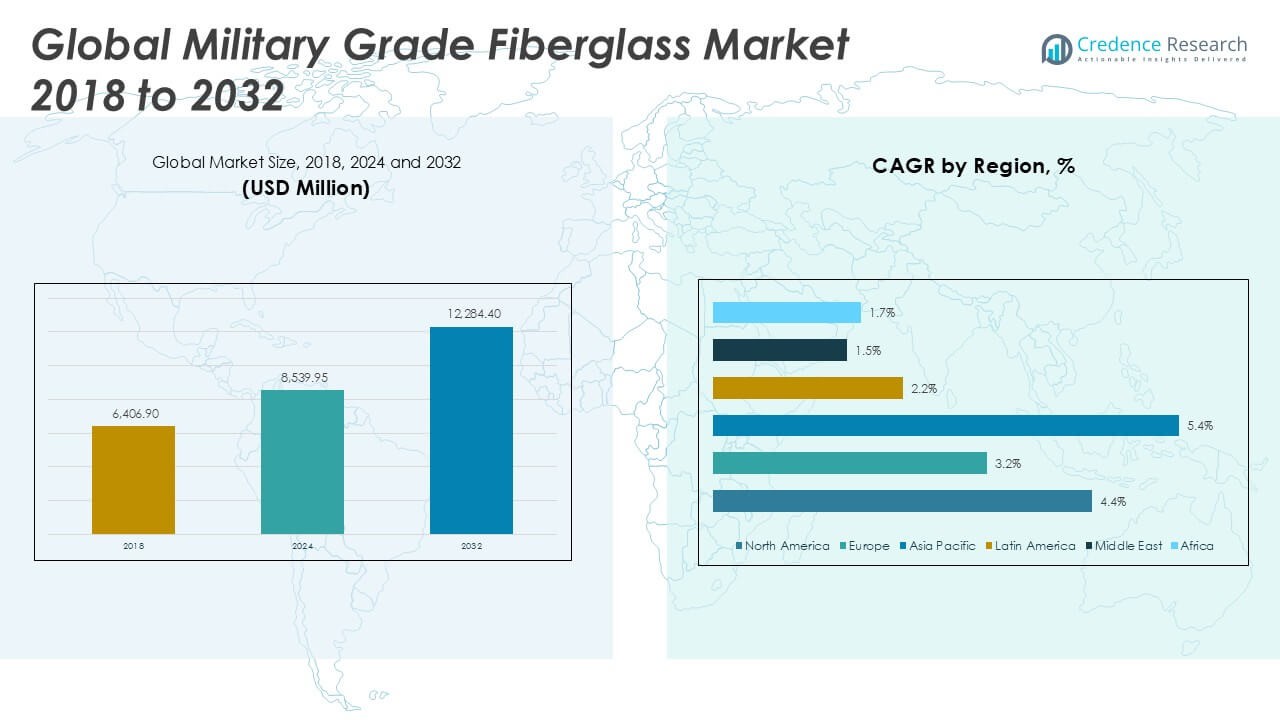

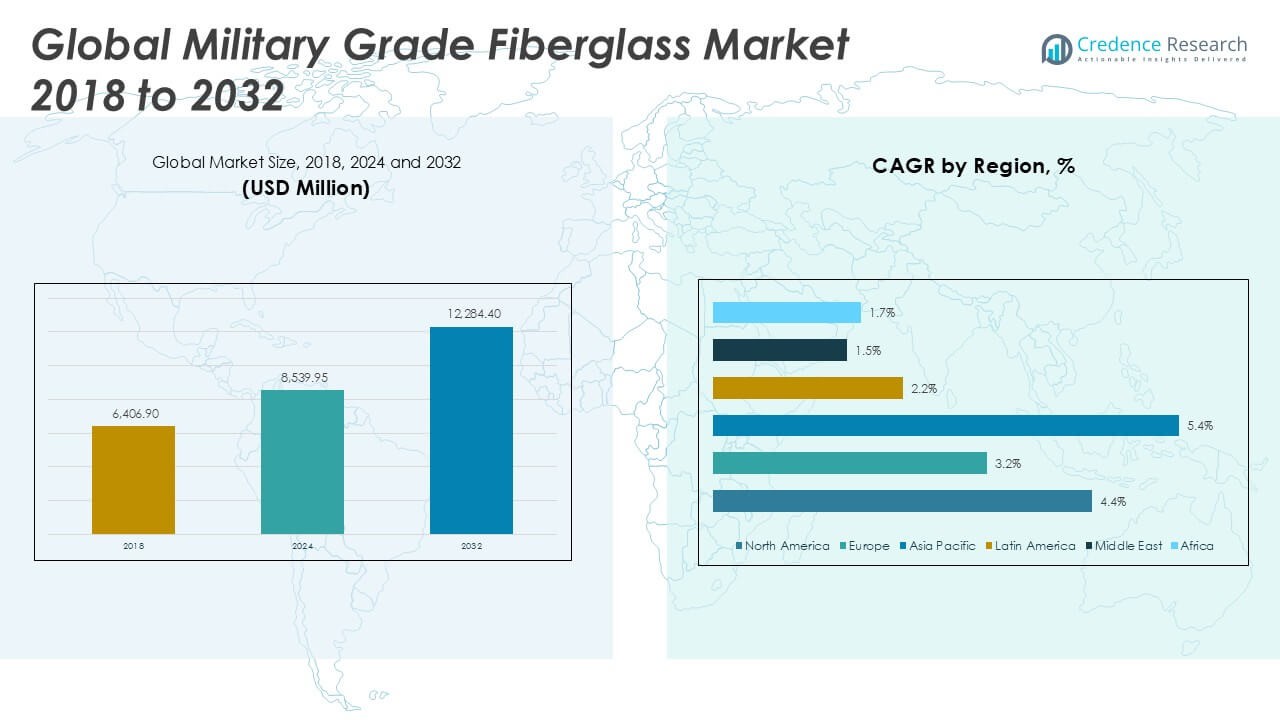

Military Grade Fiberglass Market size was valued at USD 6,406.90 million in 2018 to USD 8,539.95 million in 2024 and is anticipated to reach USD 12,284.40 million by 2032, at a CAGR of 4.33% during the forecast period.

The Military Grade Fiberglass market is driven by increasing demand for lightweight, durable, and corrosion-resistant materials across various defense applications, including armored vehicles, aircraft, and naval vessels. Rising investments in military modernization programs, especially in emerging economies, continue to support market growth as armed forces seek advanced composite solutions to enhance operational efficiency and survivability. The shift towards improved ballistic protection and structural reinforcement further boosts the adoption of fiberglass in the sector. Additionally, ongoing advancements in manufacturing technologies are enabling the production of high-performance fiberglass with superior mechanical properties, supporting broader use in next-generation defense systems. Market trends include a focus on sustainable and cost-effective composite materials, integration of smart technologies within military components, and heightened collaboration between defense agencies and composite manufacturers to innovate new applications. The steady increase in global defense budgets and the need for enhanced military mobility continue to shape the market’s upward trajectory.

The geographical analysis of the Military Grade Fiberglass Market highlights strong demand in North America, Europe, and Asia Pacific, where advanced defense manufacturing and modernization initiatives drive significant market activity. The United States, Germany, China, and India remain at the forefront due to sustained investments in military infrastructure, aerospace, and armored vehicle production. Rapid technological advancements and local production incentives in Asia Pacific further accelerate the adoption of high-performance fiberglass composites. Key players in the Military Grade Fiberglass Market include Armortex, Strongwell Corporation, and Fiber-Tech Industries, each recognized for their expertise in advanced composite materials and innovative defense solutions. These companies focus on product development, expanding their portfolios to meet evolving military requirements, and forging partnerships with defense agencies worldwide. Their continued commitment to quality, durability, and operational reliability ensures a competitive edge in a dynamic global market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Military Grade Fiberglass Market reached USD 8,539.95 million in 2024 and is projected to hit USD 12,284.40 million by 2032, reflecting a CAGR of 4.33%.

- Rising demand for lightweight, durable, and corrosion-resistant materials in defense applications is driving market growth globally.

- Advancements in composite technologies and the integration of smart materials are shaping new trends, supporting the shift toward high-performance, mission-specific fiberglass solutions.

- North America, Asia Pacific, and Europe represent major regional markets, supported by ongoing military modernization programs and investments in advanced defense manufacturing.

- Intense competition characterizes the market, with key players like Armortex, Strongwell Corporation, and Fiber-Tech Industries focusing on product innovation and strategic partnerships with defense agencies.

- Stringent regulatory requirements, complex certification processes, and fluctuating raw material costs present notable restraints, impacting both new entrants and established manufacturers.

- Asia Pacific stands out for its rapid growth and expanding defense budgets, while North America leads in technological innovation and adoption of advanced military composites.

Market Drivers

Rising Demand for Lightweight and Durable Materials in Defense Applications

A major driver for the Military Grade Fiberglass Market is the ongoing requirement for lightweight and durable materials in modern defense systems. Military vehicles, aircraft, and naval vessels need advanced composites that offer high strength-to-weight ratios, resistance to corrosion, and long service life. Fiberglass fulfills these needs by providing robust structural integrity without increasing the overall weight of equipment. Defense organizations are selecting fiberglass to improve fuel efficiency, mobility, and payload capacity. Enhanced survivability and protection against harsh environments also contribute to its growing use. The pursuit of operational advantages keeps defense contractors focused on advanced material solutions, positioning fiberglass as a preferred choice.

For instance, military-grade fiberglass composites are increasingly used in armored vehicles and aircraft to enhance durability while reducing weight.

Expansion of Military Modernization and Upgradation Programs Globally

Global military modernization programs and fleet upgrades significantly influence the Military Grade Fiberglass Market. Many nations allocate larger portions of defense budgets to updating outdated platforms and integrating advanced technologies. Fiberglass composites find application in retrofitting armor, reinforcing vehicle hulls, and upgrading protective panels, meeting the evolving needs of defense forces. Governments in Asia Pacific, the Middle East, and Europe are increasing investments in new defense infrastructure, opening fresh opportunities for market players. It meets the demand for adaptable, mission-specific components while supporting the transition to next-generation military assets. Continuous upgrades stimulate steady market growth.

For instance, defense agencies in Asia-Pacific and Europe are investing in fiberglass-reinforced composites for next-generation military assets.

Technological Advancements in Fiberglass Manufacturing and Performance

Technological progress in the manufacturing of fiberglass composites remains a key market driver. Advanced production techniques, including automated fiber placement and precision molding, are improving both performance and cost efficiency. Innovations in resin chemistry and fiber architecture are yielding composites with better mechanical properties, fire resistance, and durability. The Military Grade Fiberglass Market benefits from ongoing R&D activities that focus on creating materials tailored for extreme military environments. The integration of nanomaterials and hybrid composite structures further enhances application versatility. Investment in technology supports higher-quality end products and expands possible use cases.

Sustainability Initiatives and Regulatory Compliance in Defense Materials

Growing attention to sustainability and regulatory compliance in defense procurement influences the Military Grade Fiberglass Market. Defense agencies are prioritizing eco-friendly and recyclable materials, prompting suppliers to innovate in sustainable composite development. Regulations aimed at reducing environmental impact are driving adoption of fiberglass solutions with lower lifecycle emissions and improved recyclability. It aligns with defense industry goals for responsible sourcing and resource conservation. Meeting stringent regulatory standards ensures continued approval for use in military projects, reinforcing fiberglass’s position in defense supply chains. Sustainability initiatives are shaping procurement preferences across global defense markets.

Market Trends

Adoption of Advanced Composite Technologies in Military Applications

The Military Grade Fiberglass Market reflects a growing trend toward the adoption of advanced composite technologies across defense sectors. New fiberglass composites with enhanced mechanical properties are gaining preference in armor systems, radomes, and vehicle panels. Manufacturers are incorporating innovative resin systems and multi-axial fabric architectures to boost strength and impact resistance. Defense agencies are adopting these advanced materials to achieve superior protection and longer equipment lifespans. The integration of composite technologies is driving a shift from traditional metals to high-performance fiberglass. This trend supports military objectives for increased agility and operational effectiveness.

For instance, advancements in resin systems and multi-axial fabric architectures have improved impact resistance in military-grade fiberglass applications.

Emphasis on Customization and Application-Specific Solutions

A key trend shaping the Military Grade Fiberglass Market is the emphasis on customization for mission-specific requirements. Defense contractors and manufacturers are collaborating to develop tailored fiberglass solutions that address unique operational demands. The market supports the production of components with variable thickness, optimized shapes, and specialized coatings to meet different protection and mobility needs. Rapid prototyping and computer-aided engineering enable faster design iterations and deployment of custom products. It allows end-users to implement bespoke solutions across diverse platforms, from personnel armor to aerospace structures. The move toward customization strengthens partnerships throughout the defense supply chain.

For instance, rapid prototyping and computer-aided engineering are enabling faster design iterations for military-grade fiberglass components.

Integration of Smart Materials and Sensor Technologies

The integration of smart materials and sensor technologies is influencing trends in the Military Grade Fiberglass Market. Research initiatives are yielding fiberglass composites that can embed sensors for real-time monitoring of structural integrity, damage, or environmental exposure. Defense programs benefit from this innovation by gaining actionable data for maintenance and mission planning. The convergence of smart technologies with traditional fiberglass broadens the scope of its applications, including unmanned vehicles and next-generation protective systems. Market players are investing in advanced sensor integration to provide added value. This trend aligns with military modernization goals for improved performance and safety.

Focus on Sustainability and Lifecycle Management in Defense Procurement

Sustainability and lifecycle management have emerged as leading trends in the Military Grade Fiberglass Market. Defense organizations are prioritizing materials that support recyclability, lower carbon footprints, and compliance with evolving environmental regulations. Manufacturers are introducing eco-friendly resin systems and developing end-of-life recycling programs for fiberglass components. It aligns with global defense industry efforts to minimize environmental impact without sacrificing performance. Attention to lifecycle management ensures long-term value and compliance with international procurement standards. The market responds to this demand by innovating greener solutions and transparent supply chain practices.

Market Challenges Analysis

Complexity in Meeting Stringent Military Standards and Specifications

The Military Grade Fiberglass Market faces significant challenges related to meeting stringent military standards and evolving specifications. Defense procurement often requires materials that achieve exceptional performance across a wide range of operational environments, which creates barriers for manufacturers. The development process for high-grade fiberglass involves rigorous testing and certification, increasing lead times and costs. Custom requirements for each military application further complicate production workflows and demand precise quality control. Manufacturers must continuously invest in advanced research to address the specific needs of defense agencies. It raises entry barriers for new players and limits rapid adaptation to emerging military requirements.

For instance, military-grade fiberglass undergoes rigorous testing and certification to meet defense specifications.

Supply Chain Constraints and Fluctuating Raw Material Costs

Supply chain constraints and volatile raw material prices present ongoing obstacles in the Military Grade Fiberglass Market. Disruptions in the supply of essential raw materials, such as specialized glass fibers and resins, can delay project timelines and increase operational costs. Global supply chain disruptions, driven by geopolitical tensions and transport bottlenecks, impact the availability and pricing of key components. It pressures manufacturers to maintain buffer stocks and seek diversified sourcing strategies, which can reduce margins. Complex logistics and dependence on specific suppliers limit the flexibility to respond quickly to sudden demand shifts. The market remains vulnerable to fluctuations in both global trade policies and raw material costs.

Market Opportunities

Expanding Use of Advanced Fiberglass Composites in Next-Generation Defense Systems

The Military Grade Fiberglass Market holds strong opportunities in the development and deployment of next-generation defense platforms. Demand for advanced composites is rising as armed forces seek solutions that deliver lightweight strength, improved survivability, and enhanced mobility. Ongoing modernization efforts by global militaries create new opportunities for innovative fiberglass applications in armored vehicles, drones, protective gear, and naval vessels. Research partnerships between defense agencies and material science companies are accelerating the introduction of specialized fiberglass products. It enables broader integration of these materials into complex systems, supporting mission-critical applications. This dynamic supports long-term growth prospects across both established and emerging defense markets.

Strategic Focus on Sustainability and Circular Economy Initiatives

Sustainability and circular economy practices are opening new avenues for growth in the Military Grade Fiberglass Market. Defense organizations are increasingly prioritizing environmentally responsible procurement and recyclable materials to align with global sustainability goals. Opportunities exist for manufacturers to differentiate through the introduction of eco-friendly fiberglass composites and innovative end-of-life recycling solutions. Government incentives and stricter regulations for sustainable sourcing create favorable conditions for suppliers with advanced environmental practices. It positions the market to capitalize on rising demand for green materials and transparent supply chains. Adoption of circular economy models strengthens the market’s appeal to both military and commercial clients seeking responsible solutions.

Market Segmentation Analysis:

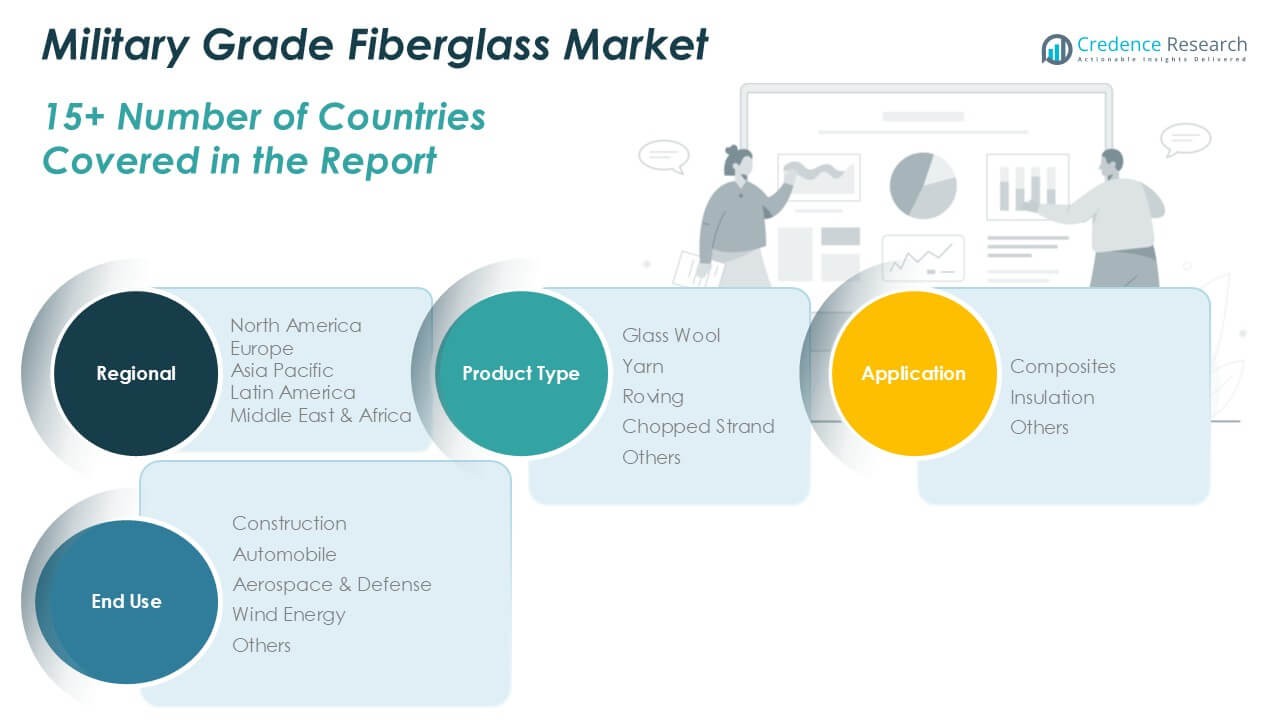

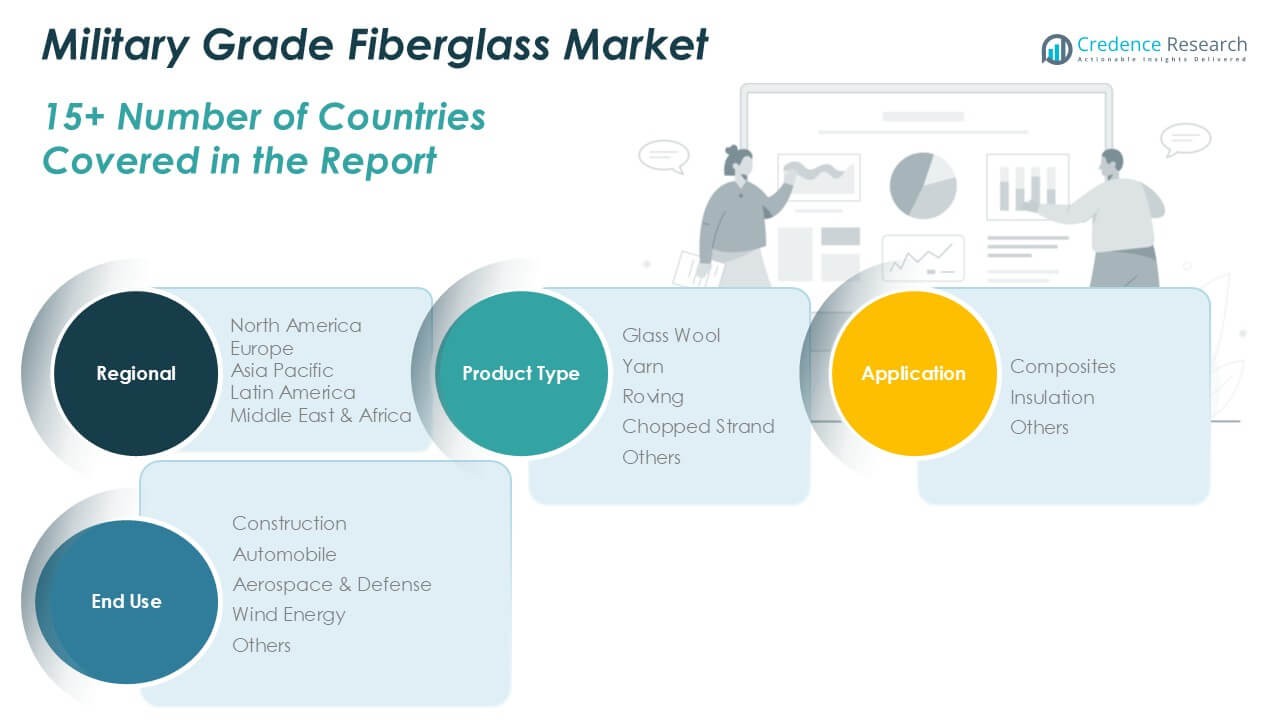

By Product Type

The Military Grade Fiberglass Market demonstrates strong diversity across its product type segment, including glass wool, yarn, roving, chopped strand, and others. Glass wool holds a significant share due to its superior thermal insulation properties and ability to withstand high temperatures, making it an ideal material for both structural and protective applications. Yarn and roving segments cater to the manufacturing of high-strength composites used in defense vehicles, aircraft, and personal protective equipment. Chopped strand finds relevance in reinforcing lightweight panels and ballistic armor, while the “others” category captures specialized forms tailored for unique military specifications. Each product type supports a broad spectrum of performance requirements, reinforcing the overall resilience and adaptability of military fiberglass solutions.

By Application:

The Military Grade Fiberglass Market is segmented into composites, insulation, and others. Composites represent the dominant application, reflecting widespread adoption in the fabrication of armored vehicles, aircraft fuselages, and structural defense components. The composites segment benefits from fiberglass’s high strength-to-weight ratio and resistance to environmental degradation, which are critical attributes in demanding military environments. Insulation applications leverage fiberglass’s non-conductive and fire-retardant characteristics, which protect sensitive equipment and personnel from extreme conditions. The “others” application segment covers niche uses, including signal shielding and non-traditional military structures, highlighting the versatility of fiberglass in military engineering.

By End Use:

End use segmentation in the Military Grade Fiberglass Market spans construction, automobile, aerospace & defense, wind energy, and others. Aerospace & defense remain the largest end use segment, with strong demand for lightweight yet durable materials in both new and retrofit defense projects. Construction incorporates fiberglass for blast-resistant buildings, secure facilities, and military infrastructure, driven by its robustness and energy efficiency. The automobile segment utilizes fiberglass in the production of armored vehicles and specialty transport, prioritizing protection and agility. Wind energy, though a smaller segment, benefits from defense sector investments in renewable power generation, employing fiberglass in turbine blades and related systems. The “others” category includes maritime, communications, and specialty defense applications, reflecting the broad and evolving role of fiberglass across military operations.

Segments:

Based on Product Type:

- Glass Wool

- Yarn

- Roving

- Chopped Strand

- Others

Based on Application:

- Composites

- Insulation

- Others

Based on End Use:

- Construction

- Automobile

- Aerospace & Defense

- Wind Energy

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Military Grade Fiberglass Market

North America Military Grade Fiberglass Market grew from USD 2,628.09 million in 2018 to USD 3,464.33 million in 2024 and is projected to reach USD 4,998.05 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.4%. North America is holding a 41% market share. The United States leads regional demand, driven by high defense budgets, large-scale modernization programs, and robust investments in advanced materials. Canada contributes through strong defense partnerships and technology adoption in aerospace applications. The region benefits from a well-established composite materials industry, with a focus on innovation, supply chain security, and stringent military standards.

Europe Military Grade Fiberglass Market

Europe Military Grade Fiberglass Market grew from USD 1,258.74 million in 2018 to USD 1,590.46 million in 2024 and is projected to reach USD 2,091.27 million by 2032, with a CAGR of 3.2%. Europe is holding a 19% market share. Key contributors include Germany, France, and the United Kingdom, where investments in defense modernization, aircraft manufacturing, and armored vehicle development remain strong. European Union initiatives for collaborative defense projects and sustainability also support demand for advanced fiberglass solutions. The market emphasizes environmental compliance and high-performance materials for strategic applications.

Asia Pacific Military Grade Fiberglass Market

Asia Pacific Military Grade Fiberglass Market grew from USD 2,028.73 million in 2018 to USD 2,841.95 million in 2024 and is projected to reach USD 4,427.57 million by 2032, showing a CAGR of 5.4%. Asia Pacific is holding a 36% market share. China, India, Japan, and South Korea dominate regional demand due to rising military expenditure, indigenous defense manufacturing, and expanding aerospace sectors. Government policies encouraging local production and technological self-reliance propel market growth. The region experiences rapid infrastructure upgrades and increasing adoption of lightweight composite materials.

Latin America Military Grade Fiberglass Market

Latin America Military Grade Fiberglass Market grew from USD 230.50 million in 2018 to USD 302.22 million in 2024 and is expected to reach USD 368.89 million by 2032, with a CAGR of 2.2%. Latin America is holding a 3% market share. Brazil and Mexico lead with military procurement programs and modernization initiatives in armored vehicles and border security. Budget constraints slow market expansion, but rising collaboration with global defense suppliers provides growth potential. The market focuses on adapting global technologies for regional requirements.

Middle East Military Grade Fiberglass Market

Middle East Military Grade Fiberglass Market grew from USD 148.74 million in 2018 to USD 177.71 million in 2024 and is projected to reach USD 206.49 million by 2032, reflecting a CAGR of 1.5%. The Middle East is holding a 2% market share. Saudi Arabia and the United Arab Emirates drive regional demand, prioritizing military infrastructure upgrades and localized composite manufacturing. Regional instability and shifting procurement strategies influence fiberglass adoption. Government investments target advanced defense capabilities, supporting steady but moderate growth.

Africa Military Grade Fiberglass Market

Africa Military Grade Fiberglass Market grew from USD 112.11 million in 2018 to USD 163.28 million in 2024 and is expected to reach USD 192.12 million by 2032, with a CAGR of 1.7%. Africa is holding a 2% market share. South Africa stands out for its established defense industry, while Nigeria and Egypt gradually expand military procurement and infrastructure projects. Limited funding and resource availability challenge broader adoption, but targeted initiatives and international partnerships help drive regional growth. The market is shaped by evolving security priorities and localized composite applications.

Key Player Analysis

- Armortex

- Strongwell Corporation

- Fiber-Tech Industries

- Waco Composites (ArmorCore)

- Intelligent Fiber Glass Solutions (IFGS)

- Performance Composites Inc.

- SilicaPro New Material Co. Ltd.

- ArmorPoxy

Competitive Analysis

The competitive landscape of the Military Grade Fiberglass Market features a robust mix of established and emerging players focused on innovation, reliability, and market expansion. Leading companies such as Armortex, Strongwell Corporation, Fiber-Tech Industries, Waco Composites (ArmorCore), Intelligent Fiber Glass Solutions (IFGS), Performance Composites Inc., SilicaPro New Material Co. Ltd., and ArmorPoxy drive market dynamics through advanced product offerings and specialized solutions. These players invest significantly in research and development to enhance the mechanical properties, durability, and versatility of their fiberglass composites, addressing the demanding requirements of military applications. Strategic collaborations with defense agencies and OEMs allow them to secure long-term contracts and tap into evolving defense projects globally. Product differentiation and tailored solutions for applications ranging from armored vehicles to protective infrastructure underpin their competitive strategies. The market sees frequent new product launches and material upgrades, aimed at meeting stringent military standards and regulatory requirements. These companies emphasize operational efficiency, sustainable manufacturing practices, and global distribution networks to strengthen their market positions. With a focus on quality and compliance, leading players maintain an edge by anticipating changing military needs and responding rapidly to technological shifts within the industry.

Recent Developments

- In February 2025, ArmorPoxy introduced the ArmorUltra Military Grade Topcoat, a high-performance, two-part polyurethane coating designed for extreme durability and resistance in heavy-duty environments. It’s specifically built to withstand chemicals, UV rays, salts, oils, and acids, and offers customizable finishes and high abrasion resistance. This topcoat is particularly suited for applications like military bases and other demanding locations.

- In June 2022, Owens Corning and Pultron Composites signed an agreement to create a joint venture to manufacture industry-leading fiberglass rebar.

Market Concentration & Characteristics

The Military Grade Fiberglass Market displays a moderate to high level of market concentration, with a few prominent players dominating global supply, supported by a network of specialized manufacturers and suppliers. It is characterized by stringent quality standards, high entry barriers, and a strong emphasis on innovation and material performance. Market leaders maintain a competitive advantage through advanced research and development, close collaboration with defense agencies, and a consistent focus on tailored solutions for demanding military environments. The market features long product life cycles and recurring demand driven by military modernization programs and infrastructure upgrades. Key characteristics include rigorous certification processes, high cost sensitivity, and a growing preference for sustainable and technologically advanced composite materials. It remains influenced by geopolitical developments, regulatory compliance, and ongoing investments in next-generation defense systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for lightweight and durable materials will continue to drive the adoption of military grade fiberglass in defense applications.

- Increasing investments in defense modernization programs across developed and developing countries will support market growth.

- The use of fiberglass in ballistic protection systems and armored vehicles is expected to expand steadily.

- Advancements in composite manufacturing technologies will enhance the strength and performance of military fiberglass products.

- Rising geopolitical tensions are likely to fuel military spending, indirectly boosting the demand for fiberglass-based components.

- The growing use of unmanned systems and drones will create new opportunities for lightweight fiberglass materials.

- Environmental regulations will encourage the development of recyclable and eco-friendly fiberglass variants for military use.

- Collaborations between defense contractors and composite material manufacturers will accelerate product innovation.

- Increased focus on troop safety and mobility will encourage the integration of fiberglass in personal protective gear.

- Expansion of naval and air defense sectors will further strengthen the application scope of military grade fiberglass.