| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anise Extract Market Size 2024 |

USD 773.37 million |

| Anise Extract Market, CAGR |

5.24% |

| Anise Extract Market Size 2032 |

USD 1,198.36 million |

Market Overview:

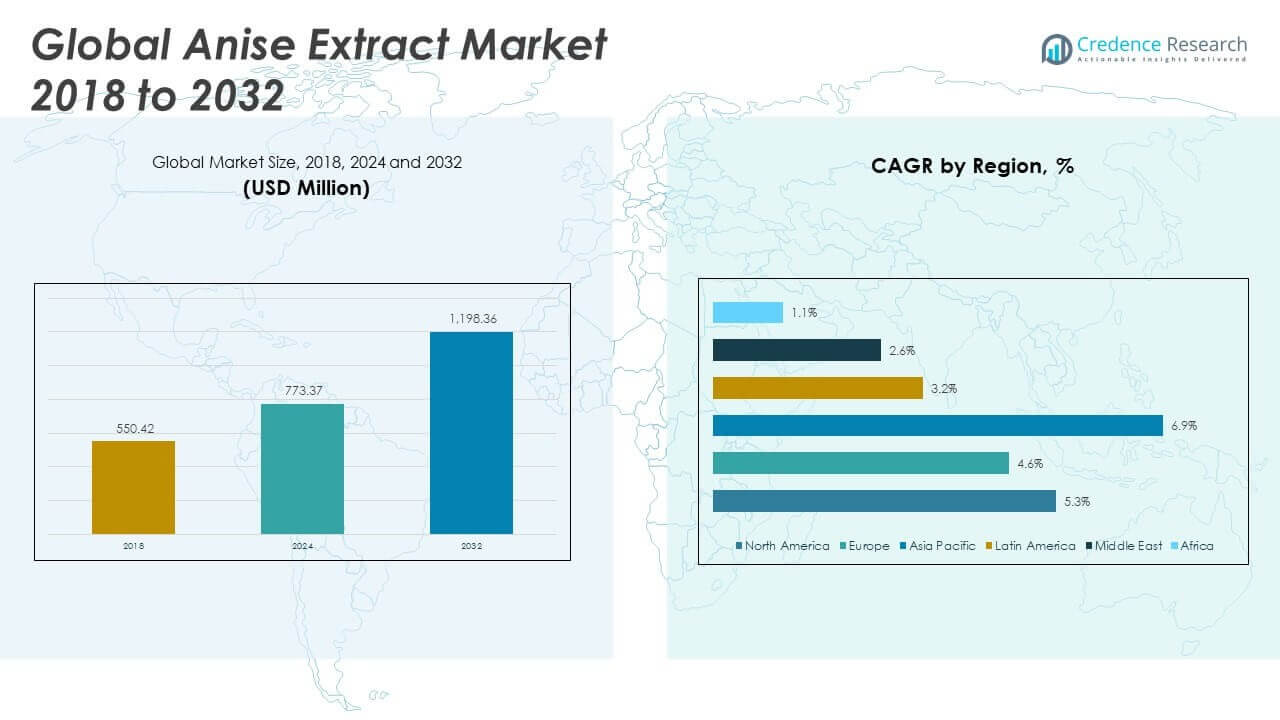

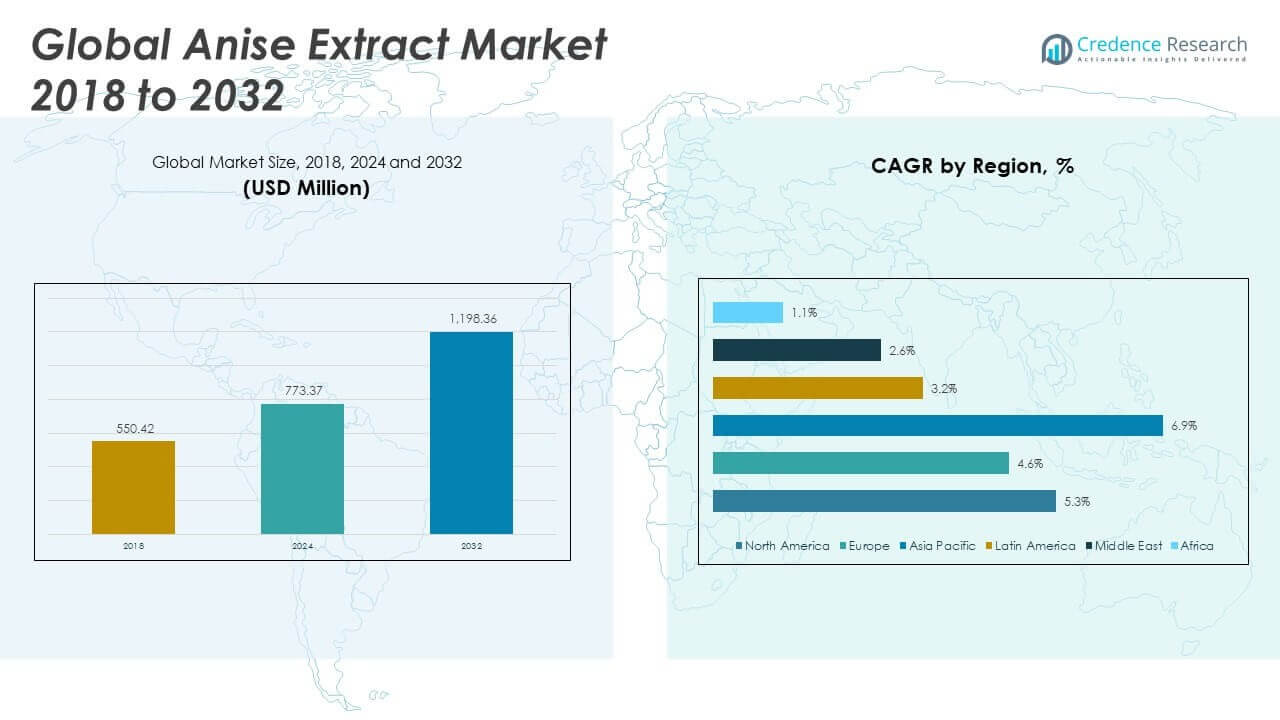

The Global Anise Extract Market size was valued at USD 550.42 million in 2018 to USD 773.37 million in 2024 and is anticipated to reach USD 1,198.36 million by 2032, at a CAGR of 5.24% during the forecast period.

The growth of the global anise extract market is primarily driven by the increasing consumer shift toward natural, plant-based, and clean-label ingredients. Anise extract, known for its distinct licorice flavor and health-promoting properties, is gaining popularity in the food and beverage industry for use in baked goods, candies, liqueurs, and sauces. Its medicinal benefits—including antimicrobial, carminative, and digestive properties—make it a preferred component in herbal teas, over-the-counter digestive products, and natural cough remedies. The rise in demand for herbal and botanical supplements further boosts the market, especially among health-conscious consumers seeking alternatives to synthetic additives. Technological advancements in extraction methods, such as steam distillation and solvent-free processing, are enhancing product quality, purity, and shelf life. Additionally, the expansion of e-commerce and direct-to-consumer channels has improved accessibility to premium anise extract products. Regulatory support for natural food additives and the rising popularity of functional foods are expected to further accelerate market expansion.

North America currently dominates the global anise extract market, accounting for the largest revenue share due to strong consumer awareness of natural ingredients and a mature food processing industry. The U.S. market, in particular, benefits from high demand for clean-label flavorings in both packaged foods and health products. Europe follows closely, driven by traditional culinary usage and a rich heritage of anise-flavored alcoholic beverages like ouzo, sambuca, and pastis. The region’s stringent food safety regulations and consumer preference for organic, traceable ingredients have encouraged the inclusion of anise extract in various premium products. Asia-Pacific is the fastest-growing region, fueled by increased utilization of herbal and botanical ingredients in Ayurveda, Traditional Chinese Medicine, and functional foods. Rising disposable incomes, health awareness, and urbanization contribute to the growing demand in China, India, and Southeast Asia. Latin America and the Middle East & Africa are emerging markets, benefiting from expanding food processing sectors and rising interest in traditional, plant-based remedies.

Market Insights:

- The Global Anise Extract Market was valued at USD 550.42 million in 2018 and reached USD 773.37 million in 2024; it is projected to grow to USD 1,198.36 million by 2032, registering a CAGR of 5.24% during the forecast period.

- Consumer demand for clean-label, plant-based ingredients is driving the use of anise extract in food and beverage products such as baked goods, candies, and herbal teas due to its natural origin and distinct flavor.

- Anise extract is increasingly used in pharmaceutical and nutraceutical products for its antimicrobial, antispasmodic, and digestive properties, contributing to its popularity in natural healthcare remedies.

- Modern extraction techniques like CO₂ extraction and low-temperature distillation have improved the consistency, potency, and shelf life of anise extract, enhancing its appeal across industries.

- The expansion of e-commerce and direct-to-consumer models has increased accessibility and brand visibility, enabling smaller producers to reach health-conscious buyers globally.

- Climatic variability and reliance on specific cultivation regions for anise seeds lead to unstable raw material supply and quality, limiting large-scale production and affecting pricing.

- Varying international regulations regarding classification and labeling of anise extract pose compliance challenges for global brands, increasing operational costs and requiring constant adaptation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Natural and Clean-Label Ingredients Across Food and Beverage Industry

Consumers are actively seeking clean-label and plant-based products in everyday consumption. Anise extract, with its natural origin and minimal processing, meets this demand effectively. Food and beverage manufacturers are using it in baked goods, candies, herbal teas, and ethnic dishes to deliver a distinctive licorice flavor. The shift away from artificial additives is reinforcing the market position of botanical extracts. The Global Anise Extract Market benefits from this trend, especially in premium and organic product segments. Consumers associate anise with authenticity, quality, and traceability, driving its wider adoption in health-conscious food choices.

- For example, Apex Flavorsoffers Pure Anise Extract, Natural, specifically marketed for clean-label baking and food applications. This extract contains only ethyl alcohol, water, and anise oil no sugar or gluten and is recommended for use at 0.5% by weight in baking mixes.

Expansion of Functional and Herbal Supplement Categories in Healthcare Sector

Pharmaceutical and nutraceutical companies are incorporating anise extract into digestive aids, expectorants, and calming remedies. Its antispasmodic, antimicrobial, and antioxidant properties support diverse applications in herbal formulations. The extract is also used in syrups and lozenges for respiratory relief. Demand is rising in both over-the-counter and traditional medicine products. It aligns well with consumer interest in non-synthetic alternatives for mild health conditions. The Global Anise Extract Market is expanding steadily due to its dual functionality in flavoring and wellness.

- For example, Herbal Terraproduces a certified organic Anise (Pimpinella anisum) tincture, with a concentration of 1 ml extract equaling 270–330 mg of dried herb. Their extraction process uses only natural ingredients and cold maceration to preserve a broad spectrum of plant compounds.

Technological Advancements in Extraction Processes Supporting Product Consistency

Modern extraction technologies have improved the purity, potency, and consistency of anise extract. Techniques such as supercritical CO₂ extraction and low-temperature distillation are helping manufacturers retain essential oil content and aromatic compounds. These advancements support longer shelf life and better flavor stability. They also make the product more appealing to formulators in food, pharma, and personal care sectors. It is easier to maintain quality standards and scale production efficiently with current methods. The Global Anise Extract Market is responding positively to these developments with higher manufacturing efficiency and quality control.

E-Commerce and Direct-to-Consumer Channels Increasing Product Accessibility

Online platforms have broadened access to specialty botanical ingredients, including anise extract. Consumers are purchasing herbal products directly from branded websites and marketplaces, bypassing traditional distribution models. This shift has enabled small-scale producers and niche brands to reach health-conscious buyers globally. It has also contributed to brand differentiation based on product purity, origin, and ethical sourcing. It supports consumer education on functional ingredients, which strengthens repeat purchases. The Global Anise Extract Market is leveraging digital commerce to build loyalty and expand its consumer base across emerging markets.

Market Trends:

Growing Interest in Anise Extract as a Flavor Modifier in Plant-Based Alternatives

Food manufacturers are exploring new ways to improve the taste profiles of plant-based products, and anise extract has emerged as a unique flavor modifier. Its sweet, mildly spicy profile helps mask bitterness in plant proteins and enhances the sensory experience. In dairy-free beverages, vegan yogurts, and meat substitutes, it complements natural flavor systems and improves product appeal. Brands are using it to differentiate product offerings and build a premium identity. It serves as a natural solution to common taste challenges in plant-based innovation. The Global Anise Extract Market is seeing new demand from producers targeting flexitarian and vegan consumers who seek clean-label flavor enhancements.

Use of Anise Extract in Niche Personal Care and Aromatherapy Formulations

The demand for botanical ingredients in personal care is expanding into niche segments, including aromatherapy oils, handmade soaps, and natural fragrances. Anise extract, valued for its soothing aroma and mild antimicrobial properties, is being formulated into artisanal wellness products. It supports natural fragrance trends and fits within clean beauty formulations without synthetic additives. Small and mid-sized personal care brands are introducing products that highlight anise as a key botanical. It also appeals to consumers who associate traditional herbs with authenticity and heritage. The Global Anise Extract Market is gaining attention in the wellness category as brands explore sensory-driven experiences in personal care.

Wider Adoption in Alcoholic Beverages Inspired by Regional and Ethnic Traditions

Craft distilleries and specialty liquor brands are incorporating anise extract into beverages rooted in cultural heritage. Products like absinthe, ouzo, sambuca, and arak use it to maintain authentic flavor profiles. Interest in regional spirits has revived demand for traditional botanicals, with anise extract playing a central role. It offers consistency in aroma and taste, making it ideal for high-volume and small-batch productions alike. Craft mixologists and bar programs are also experimenting with it to develop signature cocktails. The Global Anise Extract Market is benefiting from the resurgence of traditional liqueurs and the global fascination with artisanal alcoholic drinks.

- For example, Sigma-Aldrich supplies trans-anethole for research and industrial use, with a certified purity of 99%. The compound is used as a flavoring agent in baked goods, candy, ice cream, chewing gum, and alcoholic beverages.

Innovative Blends Combining Anise with Complementary Botanical Extracts

Manufacturers are developing multi-botanical formulations that combine anise extract with complementary herbs such as fennel, clove, ginger, and licorice. These blends are being used in functional teas, digestive drops, and infused syrups. Anise’s compatibility with other aromatic herbs allows companies to create layered flavor experiences and multifunctional products. Product launches reflect a trend toward heritage-inspired combinations that deliver both taste and therapeutic value. This blending approach supports product storytelling and branding based on traditional remedies. The Global Anise Extract Market is evolving to support holistic formulations that align with consumer interest in wellness and natural complexity.

- For example, Givaudan develops both natural and synthetic anise flavor compounds for use in food, beverage, and pharmaceutical products. Their solutions are tailored for stability, flavor intensity, and regulatory compliance in diverse industry applications.

Market Challenges Analysis:

Volatility in Raw Material Availability and Quality Due to Climatic and Regional Factors

The supply of anise seeds, the primary raw material for anise extract, is highly dependent on specific growing regions with favorable climates such as parts of the Mediterranean and Asia. Unpredictable weather patterns, droughts, and poor harvests can disrupt supply chains and cause sharp price fluctuations. Inconsistent quality in raw materials affects extract yield and aroma consistency, creating challenges for large-scale processors. Manufacturers often struggle to secure reliable sources that meet both volume and quality specifications. The Global Anise Extract Market faces limitations in scaling production due to these raw material constraints. It must navigate procurement risks and invest in supplier diversification to ensure product stability.

Regulatory Complexities and Standardization Issues Across International Markets

Anise extract, while widely accepted as a natural flavoring, is subject to different regulatory classifications across countries. In some regions, it is categorized as a food additive, while in others, it falls under herbal supplement or cosmetic ingredient regulations. This variation complicates labeling, formulation, and compliance for exporters and global brands. Companies must invest in legal expertise and product testing to meet safety and documentation standards, which increases operational costs. The Global Anise Extract Market must also address the lack of global standardization in extract concentration and purity benchmarks. It remains essential for producers to maintain transparency and adapt quickly to regulatory changes to preserve market access.

Market Opportunities:

Rising Demand for Natural Flavoring in Functional Beverages and Health Drinks

The shift toward low-sugar, herbal, and functional beverages presents strong growth potential for anise extract as a natural flavoring. Beverage brands are incorporating botanical ingredients to enhance both flavor and health appeal. Anise extract fits well in formulations targeting digestion, relaxation, and respiratory health. It offers a recognizable aroma and therapeutic properties without the need for synthetic additives. The Global Anise Extract Market can expand its footprint by catering to startups and established companies developing next-generation health drinks. It stands to gain from innovation in wellness beverages and clean-label positioning.

Product Development in Specialty Foods, Pet Nutrition, and Ethnic Cuisine

The expansion of specialty food categories and global ethnic cuisine is opening new applications for anise extract. Chefs and food formulators are using it in artisanal sauces, spice blends, and premium baked goods. In pet nutrition, natural flavoring agents like anise are gaining interest due to rising demand for clean, functional pet foods. The Global Anise Extract Market has an opportunity to engage with pet product manufacturers seeking botanical ingredients. It can also leverage its cultural relevance in Mediterranean, Middle Eastern, and Asian dishes to penetrate niche but growing food segments.

Market Segmentation Analysis:

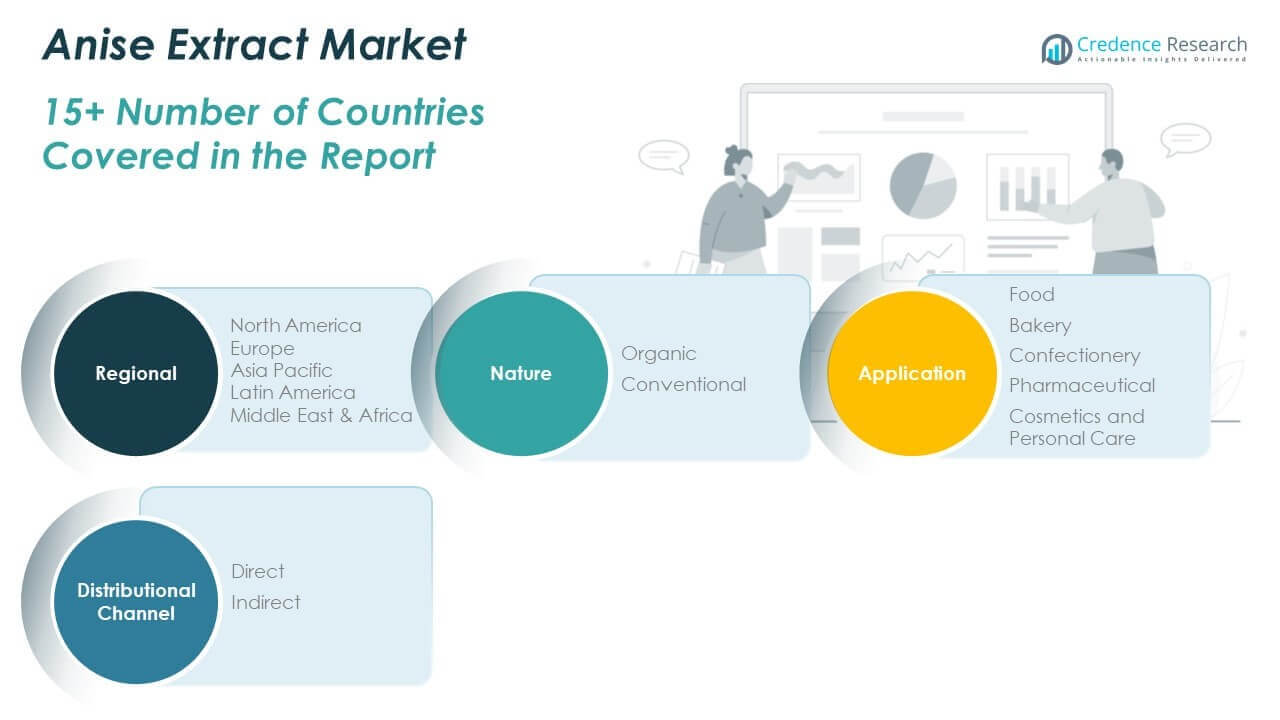

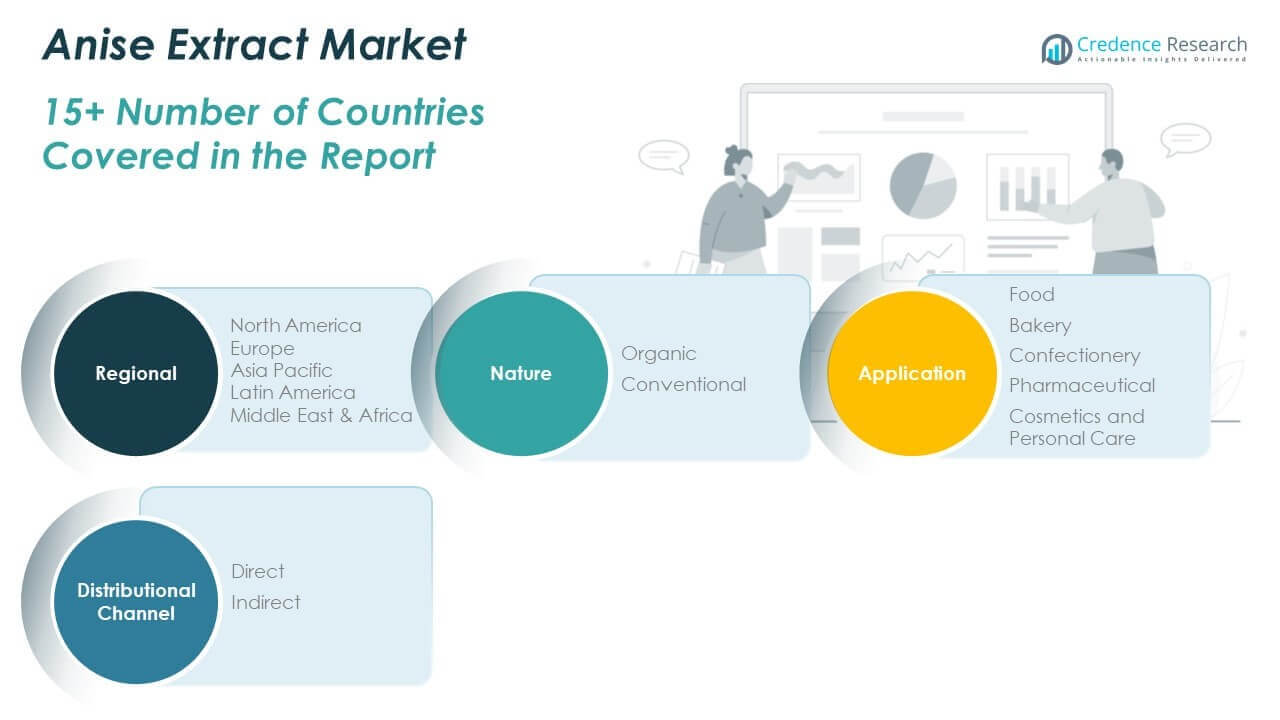

The Global Anise Extract Market is segmented by nature, application, and distribution channel, reflecting its diverse end-use potential across industries.

By nature, the market is divided into organic and conventional segments. Conventional anise extract holds a larger share due to its wide availability and cost-effectiveness. However, organic variants are gaining momentum, supported by rising demand for clean-label and chemical-free products.

- For example, High Plains Spice Companyoffers a natural anise extract made with alcohol, water, and anise oil, marketed for use in baked goods and savory dishes.

By application, the market covers food, bakery, confectionery, pharmaceutical, and cosmetics and personal care. Food and bakery remain the dominant segments, driven by traditional and contemporary culinary uses. Confectionery applications benefit from the extract’s sweet, licorice-like flavor. Pharmaceutical use is growing steadily, supported by the extract’s carminative and antimicrobial properties. It also finds use in cosmetics and personal care, where natural ingredients are replacing synthetic additives.

- For example, Beanillaoffers Pure Anise Extract, used to flavor cakes, cookies, and breads; it contains alcohol, water, and anise oil, and is gluten-free and kosher

By distribution channel, the market is segmented into direct and indirect sales. Indirect channels, including retail and e-commerce, lead the market due to broad consumer reach. Direct sales cater primarily to industrial clients seeking bulk supply and customized formulations.

Segmentation:

By Nature

By Application

- Food

- Bakery

- Confectionery

- Pharmaceutical

- Cosmetics and Personal Care

By Distribution Channel

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Anise Extract Market size was valued at USD 226.90 million in 2018 to USD 315.30 million in 2024 and is anticipated to reach USD 490.00 million by 2032, at a CAGR of 5.3% during the forecast period. North America holds the largest share of the Global Anise Extract Market, accounting for 38% of total revenue. The region benefits from a strong food and beverage sector that actively incorporates botanical ingredients into gourmet products, beverages, and herbal supplements. U.S. consumers increasingly prefer clean-label, natural flavors, boosting the inclusion of anise in health and wellness applications. The presence of major nutraceutical and food brands drives consistent demand for premium-grade extracts. It also enjoys mature distribution channels and high awareness of functional food ingredients. Product innovation in craft beverages and plant-based alternatives continues to support its leadership position in the market.

The Europe Anise Extract Market size was valued at USD 180.23 million in 2018 to USD 245.33 million in 2024 and is anticipated to reach USD 360.97 million by 2032, at a CAGR of 4.6% during the forecast period. Europe represents 30% of the Global Anise Extract Market, with high usage rooted in traditional liqueurs, bakery, and herbal remedies. Countries like France, Italy, and Greece use anise extract in regional spirits such as ouzo, sambuca, and pastis. The extract is also common in natural cough syrups and digestive aids across European pharmacies. Food manufacturers prioritize traceability and sustainable sourcing, which strengthens the market for natural extracts. It benefits from stringent regulations that favor clean-label ingredients. Consumer interest in heritage-inspired and botanically enriched foods further supports demand in both Western and Eastern Europe.

The Asia Pacific Anise Extract Market size was valued at USD 102.63 million in 2018 to USD 156.67 million in 2024 and is anticipated to reach USD 275.89 million by 2032, at a CAGR of 6.9% during the forecast period. Asia Pacific holds 19% of the Global Anise Extract Market and is the fastest-growing region. China and India are key contributors due to their deep-rooted use of anise in Traditional Chinese Medicine and Ayurveda. It is widely used in soups, spice blends, and digestive formulations. Rising disposable income and increased interest in traditional health practices drive consumption in urban areas. Demand is also growing in functional beverages and herbal personal care products. The region presents strong potential for local cultivation and value-added processing of anise-based ingredients.

The Latin America Anise Extract Market size was valued at USD 21.16 million in 2018 to USD 29.28 million in 2024 and is anticipated to reach USD 38.95 million by 2032, at a CAGR of 3.2% during the forecast period. Latin America accounts for 4% of the Global Anise Extract Market. Brazil and Mexico lead the region due to strong culinary and herbal traditions. The extract is used in regional dishes, teas, and natural remedies for digestion. Growing interest in ethnic cuisine and export-oriented food production supports demand. It benefits from expanding specialty food and wellness markets in urban centers. Small-scale manufacturers are incorporating it into local craft beverages and health-focused food products. The market remains underpenetrated but shows steady upward momentum.

The Middle East Anise Extract Market size was valued at USD 13.34 million in 2018 to USD 16.88 million in 2024 and is anticipated to reach USD 21.36 million by 2032, at a CAGR of 2.6% during the forecast period. The Middle East contributes 2% to the Global Anise Extract Market. Anise has historical use in herbal drinks and traditional medicine throughout the region. It features in teas, syrups, and desserts commonly found in Gulf and Levantine cuisines. Growing awareness of botanical wellness products is supporting demand in premium food segments. Regional beverage manufacturers are beginning to explore its use in health-focused formulations. Imports dominate the market, although interest in domestic sourcing is rising. It is positioned for moderate growth with potential in foodservice and wellness retail channels.

The Africa Anise Extract Market size was valued at USD 6.16 million in 2018 to USD 9.91 million in 2024 and is anticipated to reach USD 11.18 million by 2032, at a CAGR of 1.1% during the forecast period. Africa holds 1% of the Global Anise Extract Market and remains in an early development stage. The extract is present in traditional herbal practices, but commercial use remains limited. Urbanization and rising consumer exposure to global food trends are expanding interest in natural ingredients. South Africa and Nigeria are key markets, driven by growing retail and food processing sectors. Imports fill most of the demand due to limited domestic production. It has potential in natural medicine and flavoring applications, but infrastructure and awareness must improve to unlock full market value.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- McCormick & Company, Inc.

- Watkins Incorporated

- Red Stick Spice Company

- Cook Flavoring Co

- Tone Brothers, Inc.

- The Kroger Co.

- Marshalls Creek Spices

- Specialty World Foods

- Shanghai Huibo International Trade Co., Ltd.

- Butler’s Extracts

Competitive Analysis:

The Global Anise Extract Market features a mix of multinational flavor houses, regional extract manufacturers, and specialty ingredient suppliers. Leading companies focus on maintaining product purity, sourcing transparency, and consistent supply through vertically integrated operations. It is characterized by moderate competition, with firms investing in improved extraction technologies and clean-label certifications to meet global demand. Product innovation, particularly in food, beverage, and nutraceutical applications, plays a critical role in gaining market share. Smaller players compete by offering organic and region-specific variants, often catering to niche health and wellness brands. Key companies include McCormick & Company, Symrise AG, Nielsen-Massey Vanillas Inc., Firmenich SA, and Berje Inc. It continues to evolve through strategic partnerships with herbal supplement brands and specialty food manufacturers. Competitive success depends on strong distribution networks, regulatory compliance, and the ability to deliver consistent flavor and therapeutic quality across diverse applications.

Recent Developments:

- In January 2025, McCormick & Company, Inc.unveiled its 2025 Flavor of the Year, Aji Amarillo, a South American pepper known for its fruity, tropical notes and moderate heat, as part of its 25th annual Flavor Forecast.

Market Concentration & Characteristics:

The Global Anise Extract Market exhibits moderate concentration, with a few key players holding significant market share while regional manufacturers serve niche segments. It remains highly fragmented across developing economies due to the availability of local raw materials and small-scale processing units. The market is characterized by a strong emphasis on natural sourcing, clean-label claims, and product traceability. It supports both industrial-scale production for food and beverage manufacturers and small-batch formulations for herbal and wellness brands. Consumer demand for authenticity and functional benefits drives innovation in formulation and packaging. It relies heavily on seasonal raw material availability, which influences pricing and supply consistency.

Report Coverage:

The research report offers an in-depth analysis based on nature, application, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for natural flavoring agents will drive growth across food, beverage, and nutraceutical industries.

- Functional beverages and herbal teas will emerge as key application areas for anise extract.

- E-commerce platforms will expand global access to specialty and organic anise products.

- Technological advancements in extraction will enhance product quality and scalability.

- Clean-label trends will encourage broader use of anise in personal care and cosmetics.

- Growth in ethnic and gourmet cuisines will create new opportunities in foodservice channels.

- Strategic partnerships between extract suppliers and wellness brands will shape innovation.

- Asia Pacific will lead in growth rate due to traditional medicinal use and rising urban demand.

- Regulatory alignment and product standardization will support international trade expansion.

- Sustainability and ethical sourcing will become key differentiators in competitive positioning.