Market Overview

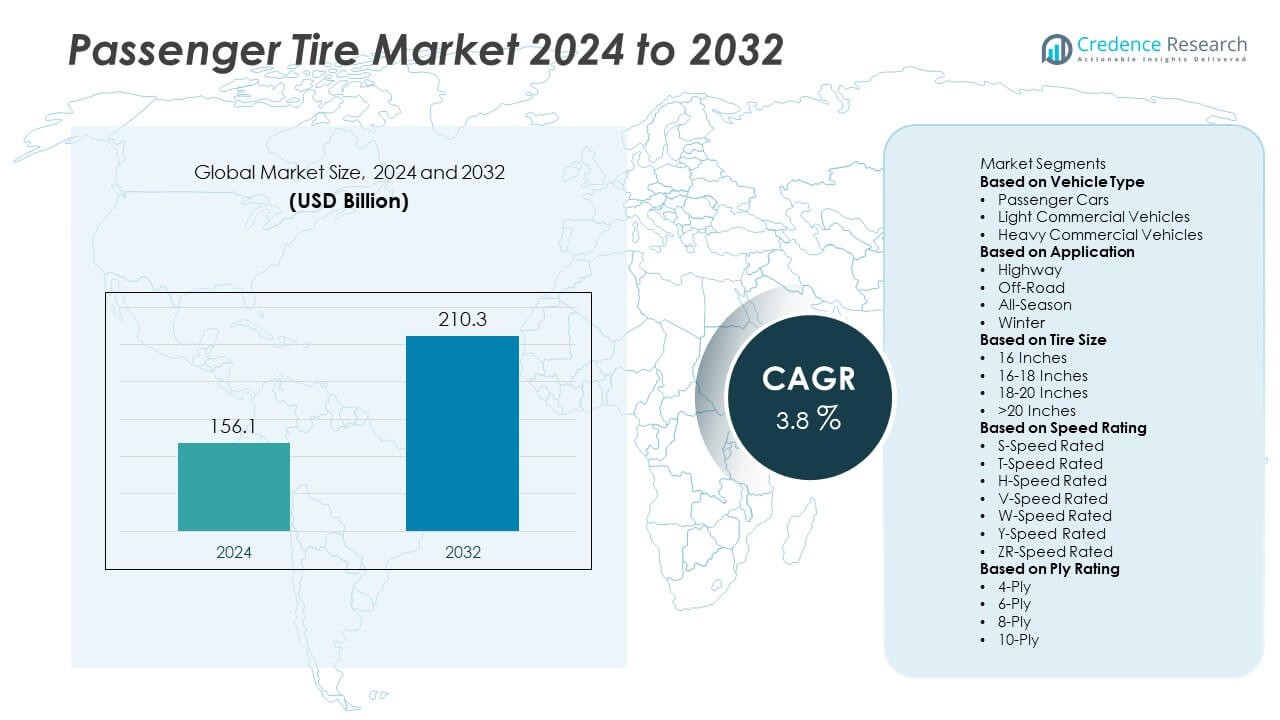

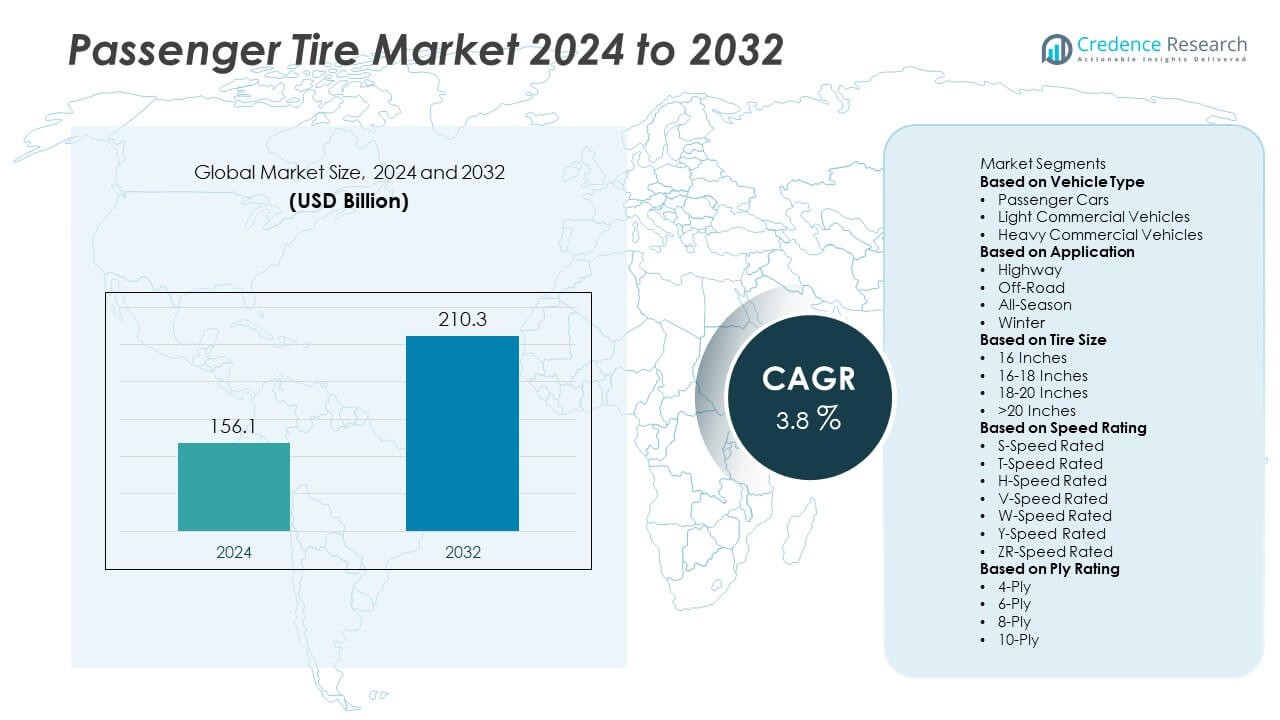

The Passenger Tire Market was valued at USD 156.1 billion in 2024 and is projected to reach USD 210.3 billion by 2032, expanding at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Passenger Tire Market Size 2024 |

USD 156.1 Billion |

| Passenger Tire Market, CAGR |

3.8% |

| Passenger Tire Market Size 2032 |

USD 210.3 Billion |

The Passenger Tire Market grows on the back of rising vehicle ownership, expanding urbanization, and increasing consumer preference for personal mobility. It benefits from strong replacement demand, supported by higher awareness of safety and maintenance practices.. It gains momentum from sustainability initiatives promoting eco-friendly materials and fuel-efficient products.

The Passenger Tire Market shows strong regional presence with diverse growth drivers across key geographies. Asia-Pacific leads with rising vehicle ownership in China, India, and Southeast Asia, supported by rapid urbanization and expanding middle-class populations. North America demonstrates consistent demand for replacement tires driven by high commuting distances and consumer preference for SUVs and crossovers. Europe emphasizes sustainability and innovation, with demand for winter and premium tires influenced by strict regulations and luxury car adoption. Latin America and the Middle East & Africa present steady opportunities fueled by infrastructure development and increasing aftermarket demand, though affordability remains central in these regions. Prominent companies shaping the competitive landscape include Michelin, Bridgestone Corporation, Continental AG, and The Goodyear Tire & Rubber Company, all of which continue to strengthen their portfolios through innovation, distribution networks, and strategic collaborations, ensuring wide product accessibility across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Passenger Tire Market was valued at USD 156.1 billion in 2024 and is projected to reach USD 210.3 billion by 2032, expanding at a CAGR of 3.8% during the forecast period.

- Growth is fueled by rising vehicle ownership, rapid urbanization, and increasing consumer preference for personal mobility across both developed and emerging economies.

- Trends highlight the shift toward fuel-efficient, low rolling resistance tires, the adoption of smart tire technologies with embedded sensors, and higher demand for all-season and premium performance tires.

- Leading players such as Michelin, Bridgestone Corporation, Continental AG, and The Goodyear Tire & Rubber Company invest in innovation, sustainability, and partnerships to strengthen their competitive edge.

- Market restraints include volatile raw material prices, supply chain disruptions, and compliance costs linked to stringent environmental and safety regulations worldwide.

- Asia-Pacific records the strongest growth momentum supported by expanding middle-class populations and vehicle sales, while Europe emphasizes premium tires and sustainability, and North America maintains steady demand from SUVs and replacements.

- Latin America and the Middle East & Africa provide emerging opportunities through aftermarket expansion and infrastructure growth, though affordability and distribution remain critical to long-term success.

Market Drivers

Rising Vehicle Ownership and Mobility Demand

The Passenger Tire Market benefits from a steady increase in global vehicle ownership driven by expanding middle-class populations and rapid urbanization. It gains momentum from rising consumer preference for personal mobility over shared transport. Strong demand in emerging economies fuels replacement and new tire sales. It reflects higher disposable incomes and supportive financing options that make vehicle purchases more accessible. It also aligns with infrastructure development projects that expand road networks and encourage long-distance travel. This factor strengthens consistent demand for diverse tire categories across regions.

- For instance, Bridgestone supplied over 25 million passenger tires annually to the North American market in 2023, supporting demand from SUVs and crossovers, which remain top-selling vehicle categories in the region.

Advancements in Tire Technology and Performance

It experiences growth from continuous innovation in tire design, materials, and manufacturing processes. The adoption of advanced tread patterns, silica-based compounds, and run-flat technologies enhances durability, fuel efficiency, and safety. Increasing focus on low rolling resistance tires supports regulatory compliance with emission norms. It benefits from the rising adoption of all-season and performance tires that appeal to consumer expectations for versatility and comfort. Companies invest in smart tire technology that enables pressure monitoring and predictive maintenance, adding value to customers. This driver positions innovation as a central force in shaping competitive differentiation.

- For instance, Continental introduced its ContiSense and ContiAdapt technologies with sensors capable of monitoring tread depth and temperature, tested across more than 100,000 kilometers of road trials to improve predictive maintenance efficiency.

Strong Replacement Demand and Aftermarket Expansion

It secures significant revenue from the large replacement segment, which outpaces sales of original equipment tires. High road usage, variable driving conditions, and consumer preference for enhanced performance encourage frequent replacements. Growth in e-commerce platforms accelerates aftermarket accessibility and widens consumer reach. It also reflects heightened awareness of tire safety and periodic maintenance. Rising penetration of branded tire service centers improves trust and brand loyalty. These factors sustain recurring demand cycles across developed and developing economies.

Sustainability Goals and Regulatory Compliance

It grows under the influence of global sustainability agendas and stringent regulatory frameworks. Governments encourage adoption of fuel-efficient tires to reduce carbon emissions. Rising environmental awareness pushes manufacturers to invest in eco-friendly materials and recycling initiatives. It also responds to labeling regulations that emphasize energy efficiency, noise levels, and wet grip performance. Companies align their strategies with circular economy practices to enhance market acceptance. This driver highlights the importance of balancing performance with environmental responsibility to meet evolving consumer expectations.

Market Trends

Growing Preference for Fuel-Efficient and Low Rolling Resistance Tires

The Passenger Tire Market reflects a strong trend toward tires that enhance fuel efficiency and reduce emissions. It aligns with stricter environmental regulations and consumer awareness of sustainability. Low rolling resistance tires gain traction due to their ability to optimize fuel consumption and extend vehicle performance. It supports automakers in meeting emission targets while addressing consumer demand for cost savings. This trend encourages tire manufacturers to invest in advanced materials and tread designs. The shift underscores efficiency as a leading factor influencing purchase decisions across regions.

- For instance, Michelin’s Energy Saver tire line reduced rolling resistance by up to 20%, which allowed drivers to save nearly 80 liters of fuel over a distance of 45,000 kilometers, based on real-world performance testing.

Expansion of Smart and Connected Tire Solutions

It demonstrates momentum in the adoption of smart tire technologies that improve safety and predictive maintenance. Tire pressure monitoring systems and embedded sensors provide real-time performance data to drivers and fleet operators. The trend expands opportunities for connectivity in both passenger vehicles and mobility services. It highlights growing interest in digital integration that improves convenience and operational efficiency. Manufacturers focus on leveraging data analytics to strengthen product value. This evolution positions connected tires as an important trend shaping future market dynamics.

- For instance, Goodyear tested its intelligent tire prototype on more than 3,000 vehicles across 67 million kilometers of fleet operations, proving that data-driven insights from tire sensors can extend tire life by up to 30% while improving safety outcomes.

Rising Popularity of All-Season and High-Performance Tires

It sees higher demand for all-season and high-performance tires that offer versatility and durability. Consumers seek products that deliver strong grip, comfort, and stability across varying road conditions. This trend strengthens the appeal of premium tire segments that combine innovation with performance. It responds to growing adoption of SUVs and luxury cars where demand for advanced tires remains high. The trend also expands aftermarket opportunities, as consumers increasingly choose specialized products for replacements. Companies emphasize R&D to align with changing preferences for safety and driving comfort.

Shift Toward Sustainable Materials and Circular Economy Practices

It records rising interest in eco-friendly tires designed with recyclable and renewable materials. Manufacturers focus on reducing reliance on synthetic rubber and promoting bio-based alternatives. This trend supports alignment with global sustainability goals and circular economy initiatives. It also encourages investment in recycling infrastructure to reduce tire waste. Companies highlight environmental performance through transparent labeling and certifications. This direction establishes sustainability as a defining trend influencing long-term market strategies.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions

The Passenger Tire Market faces persistent challenges from fluctuations in raw material costs, particularly natural rubber, synthetic rubber, and crude oil derivatives. It struggles when unpredictable pricing erodes manufacturer margins and raises consumer prices. Supply chain disruptions triggered by geopolitical tensions, trade restrictions, and shipping delays intensify the challenge. It often requires companies to adopt flexible sourcing strategies and manage inventory risks. Rising transportation costs and uneven global distribution networks complicate timely product availability. These factors create uncertainty in production planning and weaken profitability for industry participants.

Environmental Regulations and Competitive Pressures

It encounters mounting challenges from stringent environmental regulations that demand significant investment in research, eco-friendly materials, and compliance measures. Tire manufacturers must adapt to labeling standards that emphasize rolling resistance, noise levels, and wet grip performance. It also faces competitive pressures as new entrants and regional players introduce lower-cost alternatives. Global leaders must balance innovation with affordability to maintain consumer loyalty. Rapid technological changes and shifting consumer expectations place constant pressure on product development cycles. These conditions highlight regulatory compliance and cost competitiveness as significant hurdles shaping market performance.

Market Opportunities

Expansion in Emerging Economies and Aftermarket Potential

The Passenger Tire Market creates significant opportunities through rising demand in emerging economies where vehicle ownership continues to grow. It benefits from increasing urbanization, rising disposable incomes, and government investment in road infrastructure. Expanding middle-class populations in Asia-Pacific, Latin America, and Africa strengthen new vehicle sales and replacement tire demand. It also gains opportunities from a growing aftermarket segment supported by digital sales channels and expanding tire service networks. Rising consumer preference for premium and performance tires further boosts revenue potential in these markets. Companies that build strong distribution partnerships in these regions stand to capture sustainable growth.

Innovation in Sustainable and Smart Tire Technologies

It offers strong opportunities through innovation in sustainable tire manufacturing and connected mobility solutions. Growing focus on eco-friendly materials, recyclable compounds, and bio-based alternatives enhances brand positioning with environmentally conscious consumers. It also aligns with regulatory initiatives promoting fuel-efficient and low-emission technologies. Advancements in smart tire solutions, including real-time monitoring and predictive analytics, present new revenue streams for manufacturers. The integration of intelligent tire systems with electric and autonomous vehicles expands possibilities for premium product segments. These innovations highlight the role of technology and sustainability as key enablers of long-term opportunity.

Market Segmentation Analysis:

By Vehicle Type

The Passenger Tire Market demonstrates clear segmentation by vehicle type, covering sedans, hatchbacks, SUVs, and crossovers. It records high demand from SUVs and crossovers, which dominate due to their rising global adoption and consumer preference for safety, comfort, and utility. Sedans continue to hold a considerable share, supported by steady demand in urban markets where fuel efficiency and affordability matter. Hatchbacks gain traction in emerging economies where compact vehicles remain cost-effective for daily commuting. It also reflects premiumization in luxury cars that drives specialized demand for performance-oriented tires. This segment highlights diverse consumer preferences and underlines the need for tailored tire solutions across vehicle categories.

- For instance, Bridgestone supplied more than 12 million tires for SUV models globally in 2023, while Pirelli reported that over 55% of its premium tire sales were linked to high-performance luxury cars such as BMW and Mercedes-Benz.

By Application

It shows strong variation by application, primarily divided into OEM and replacement segments. The replacement segment leads growth, driven by rising awareness of tire maintenance, safety standards, and the impact of road conditions. It benefits from higher replacement cycles in regions with poor road infrastructure, while developed markets witness demand for premium replacement products. OEM demand remains consistent, supported by growth in new vehicle sales and technological integration of advanced tire systems. It gains strength from collaborations between automakers and tire manufacturers to develop customized solutions. This segment emphasizes the recurring nature of aftermarket sales as a critical revenue stream.

- For instance, Goodyear reported supplying nearly 5 million original equipment tires to Ford and General Motors in North America in 2022, while Michelin’s replacement tire division serviced more than 200 million units globally across passenger vehicles during the same year.

By Tire Size

It exhibits strong differentiation by tire size, with 13–15 inches, 16–18 inches, and above 18 inches categories. Smaller sizes remain popular in compact and mid-sized vehicles where affordability drives adoption, particularly in Asia-Pacific. The 16–18-inch segment records growing demand from sedans and mid-size SUVs, balancing comfort, performance, and cost. It also shows rapid growth in above 18 inches, reflecting the rising penetration of premium SUVs, crossovers, and luxury cars. Consumers seek larger tires that deliver better grip, durability, and advanced performance features. This segment reflects the influence of vehicle design evolution and consumer preference for high-performance driving experiences.

Segments:

Based on Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Based on Application

- Highway

- Off-Road

- All-Season

- Winter

Based on Tire Size

- 16 Inches

- 16-18 Inches

- 18-20 Inches

- >20 Inches

Based on Speed Rating

- S-Speed Rated

- T-Speed Rated

- H-Speed Rated

- V-Speed Rated

- W-Speed Rated

- Y-Speed Rated

- ZR-Speed Rated

Based on Ply Rating

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for nearly 21% of the global Passenger Tire Market share, supported by a strong demand base in the United States and Canada. It benefits from high vehicle ownership levels and steady replacement cycles driven by long-distance commuting patterns. The region reflects strong adoption of SUVs and light trucks, which require larger and more durable passenger tires. It also shows a preference for all-season and high-performance tires that address varied climatic conditions. Regulatory frameworks encouraging fuel efficiency and safety standards strengthen demand for advanced tire technologies. Manufacturers invest heavily in research and distribution networks to maintain competitiveness in this mature yet evolving market.

Europe

Europe contributes about 25% of the Passenger Tire Market share, making it one of the leading regions globally. It demonstrates robust demand driven by stringent regulations on fuel efficiency, noise levels, and carbon emissions. The region emphasizes premium and performance-oriented tires, aligning with the dominance of luxury and high-performance vehicles. It also reflects strong demand for winter tires in northern and central countries where harsh weather necessitates seasonal replacements. Replacement demand remains dominant, supported by well-established service networks and high consumer awareness of tire safety. It positions Europe as a market where innovation, sustainability, and regulatory compliance define growth trajectories.

Asia-Pacific

Asia-Pacific leads the global Passenger Tire Market with an estimated 42% market share, supported by rapid vehicle ownership growth in China, India, and Southeast Asia. It benefits from expanding middle-class populations, urbanization, and rising disposable incomes, which drive demand for both new vehicles and replacement tires. The region records strong traction in compact cars and hatchbacks, while SUVs gain momentum in urban centers. It also shows significant demand for affordable tires, though premium and performance categories are expanding among upper-income groups. Strong manufacturing presence, cost advantages, and infrastructure expansion make Asia-Pacific the most dynamic regional contributor. Tire companies invest in local production and partnerships to capture long-term growth in this high-potential market.

Latin America

Latin America holds about 6% of the Passenger Tire Market share, driven primarily by Brazil, Mexico, and Argentina. It reflects steady demand for replacement tires due to varied road conditions and high levels of wear and tear. It also shows strong adoption of affordable passenger tires, with premium tire penetration still limited to higher-income urban markets. The region faces challenges from economic volatility and import dependency, yet it remains attractive for global tire makers due to its sizable vehicle population. Demand growth is reinforced by expanding e-commerce platforms that improve aftermarket access. This market segment highlights opportunities in building strong distribution channels and offering cost-effective solutions.

Middle East & Africa

The Middle East & Africa region accounts for nearly 6% of the Passenger Tire Market share, characterized by diverse consumer preferences across subregions. It benefits from rising vehicle ownership in Gulf countries where premium and performance tires dominate due to luxury car adoption. In contrast, African markets show demand for affordable and durable tires that withstand challenging road conditions. It reflects increasing importance of replacement demand, particularly in markets with high import penetration. Infrastructure projects and urbanization encourage rising vehicle use, which supports steady tire demand. Tire companies that tailor products to local needs capture opportunities in this growing region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Passenger Tire Market features intense competition among global leaders including Michelin, Bridgestone Corporation, Continental AG, The Goodyear Tire & Rubber Company, Pirelli C. S.p.A, Yokohama Rubber, Sumitomo Rubber Industries, Toyo, Nexen Tire Corporation, and Giti Tire, which collectively shape the industry through innovation, sustainability initiatives, and extensive distribution networks. The market is defined by advanced tire technologies emphasizing fuel efficiency, smart connectivity, and eco-friendly materials, alongside investments in intelligent tire solutions and premium performance products. Growing demand for electric vehicle-compatible tires and digital services adds new avenues for differentiation, while high-performance and luxury segments remain significant growth areas. Regional expansion in Asia-Pacific, affordability in emerging markets, and strong partnerships with automakers enhance competitiveness. Continuous R&D efforts ensure a balance between innovation, sustainability, and cost-effectiveness, reflecting the diverse needs of global consumers and sustaining long-term market growth.

Recent Developments

- In June 2025, Yokohama Rubber began supplying ADVAN FLEVA V701 tires as original equipment for Toyota’s new Corolla Cross GR SPORT, slated for launch from August 2025.

- In June 2025, Pirelli C. S.p.A released a limited-edition reissue of the first-ever P Zero for the Lancia Delta S4 Stradale, enhancing handling and braking performance.

- In March 2025, Yokohama Rubber unveiled its 2025 motorsports activity plan, emphasizing participation in global motorsports, using higher ratios of renewable and recycled materials in ADVAN racing tires, and promoting sustainable production at its Mishima Plant.

- In March 2025, Pirelli C. S.p.A launched the fifth-generation P Zero tire, featuring AI-driven virtual development and improved handling, braking, and wet grip performance across sizes from 18 to 23 inches.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Tire Size, Speed Rating, Ply Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- It will benefit from ongoing rise in vehicle ownership and expanding urban mobility trends.

- It will shift toward fuel-efficient and low rolling resistance tire designs to meet regulatory and consumer demands.

- It will adopt smart and connected tire technologies to enable predictive maintenance and real-time performance monitoring.

- It will move toward greater use of eco-friendly and bio-based materials driven by sustainability goals.

- It will see growth in premium tires that deliver high comfort, performance, and safety.

- It will expand in emerging markets where middle-class populations and road infrastructure continue to grow.

- It will expand aftermarket services and digital sales channels to improve customer reach and service convenience.

- It will face tighter environmental and safety regulations requiring more innovation and certification.

- It will encourage collaboration between automakers and tire manufacturers on integrated solutions for electric and autonomous vehicles.

- It will sustain competitive pressure, driving R&D investment to balance performance, cost, and sustainability.