Market Overview

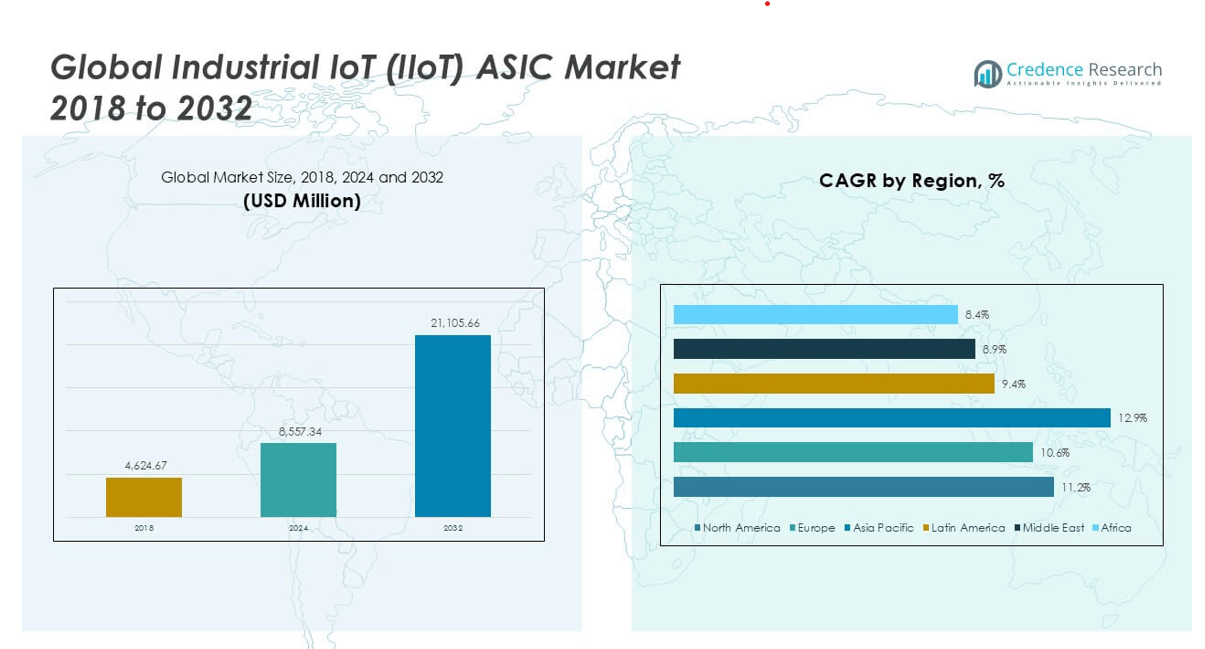

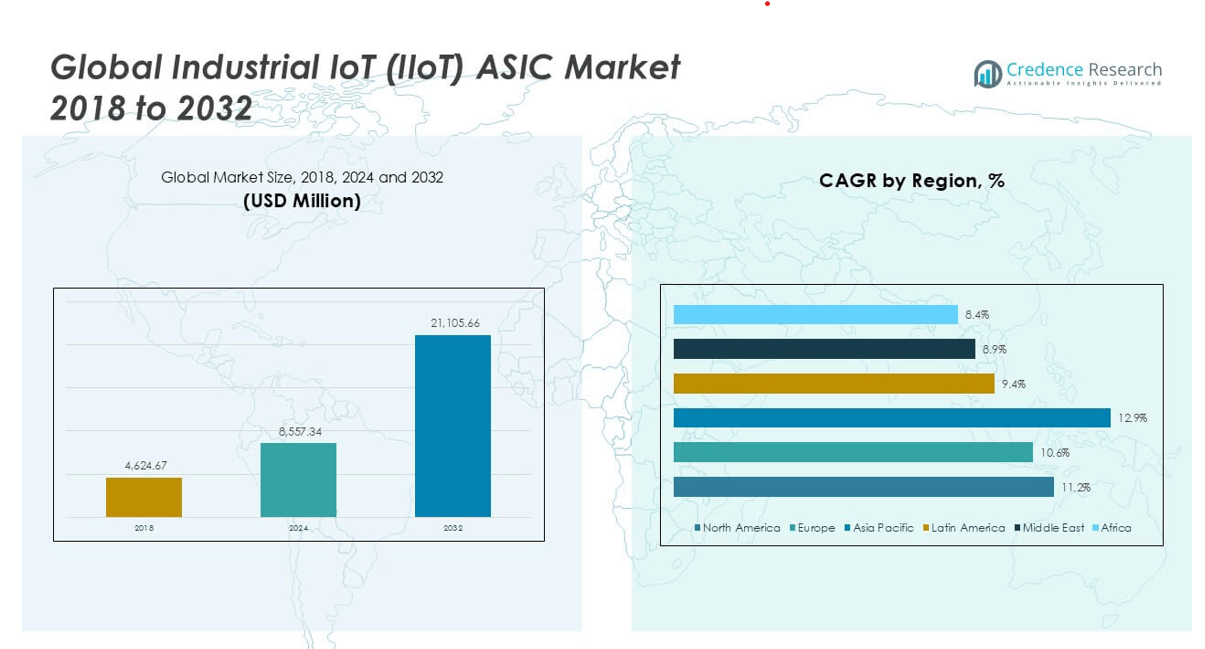

The Industrial IoT (IIoT) ASIC market size was valued at USD 4,624.67 million in 2018, reached USD 8,557.34 million in 2024, and is anticipated to reach USD 21,105.66 million by 2032, at a CAGR of 11.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial IoT (IIoT) ASIC Market Size 2024 |

USD 8,557.34 million |

| Industrial IoT (IIoT) ASIC Market, CAGR |

11.13% |

| Industrial IoT (IIoT) ASIC Market Size 2032 |

USD 21,105.66 million |

The Industrial IoT (IIoT) ASIC market is led by prominent players such as Cisco Systems, Intel Corporation, Siemens AG, Honeywell International, IBM, ABB Group, Rockwell Automation, Huawei Technologies, General Electric, and Bosch. These companies dominate through robust R&D capabilities, strategic collaborations, and a diversified portfolio of ASIC-enabled industrial solutions. They focus on enhancing system efficiency, connectivity, and real-time data processing in automation, energy, and manufacturing applications. Regionally, Europe holds the largest market share at 29.4% in 2024, supported by strong industrial infrastructure and widespread adoption of Industry 4.0 initiatives. North America and Asia Pacific follow closely, driven by advanced manufacturing ecosystems and rising investments in smart factories.

Market Insights

- The Industrial IoT (IIoT) ASIC market was valued at USD 8,557.34 million in 2024 and is projected to reach USD 21,105.66 million by 2032, growing at a CAGR of 11.13% during the forecast period.

- Growth is driven by increasing industrial automation, rising demand for edge computing, and the integration of AI and machine learning into industrial processes.

- A key trend includes the adoption of 5G-enabled IIoT networks and the development of AI-powered ASICs for real-time processing and predictive analytics.

- The market is highly competitive, with major players like Cisco, Intel, Siemens, and Honeywell leading through innovation, partnerships, and vertically integrated solutions.

- Europe holds the largest regional share at 29.4%, followed by North America at 28.3%, while the hardware segment leads by component, accounting for over 40% of the total market share due to its critical role in enabling IIoT infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

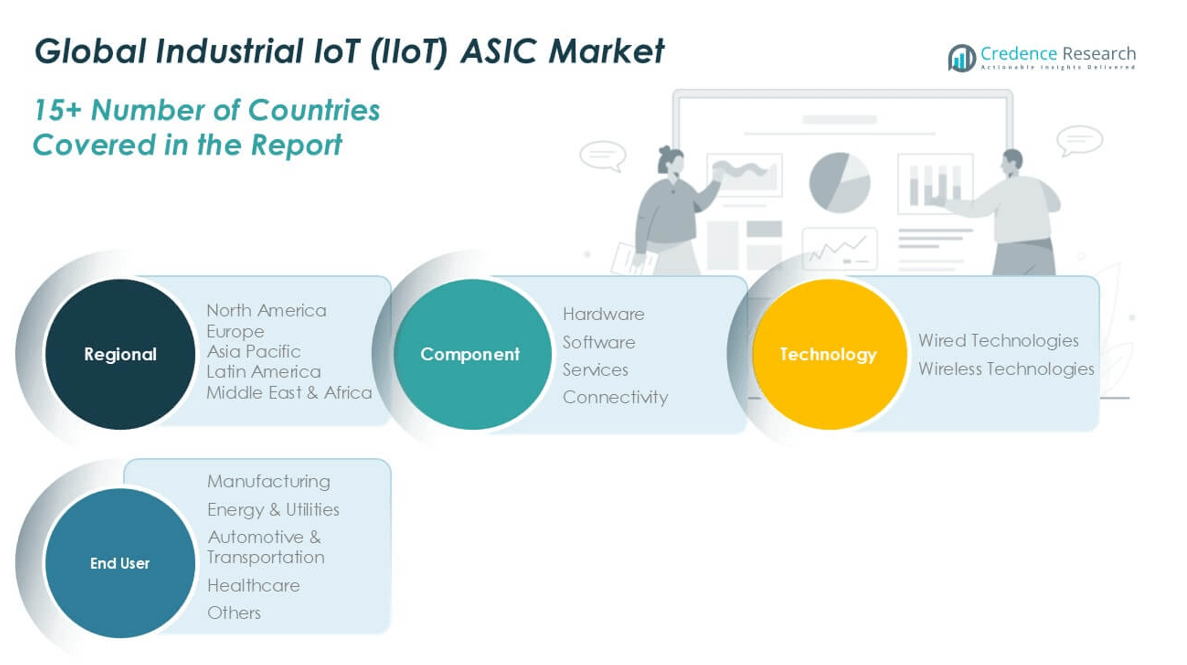

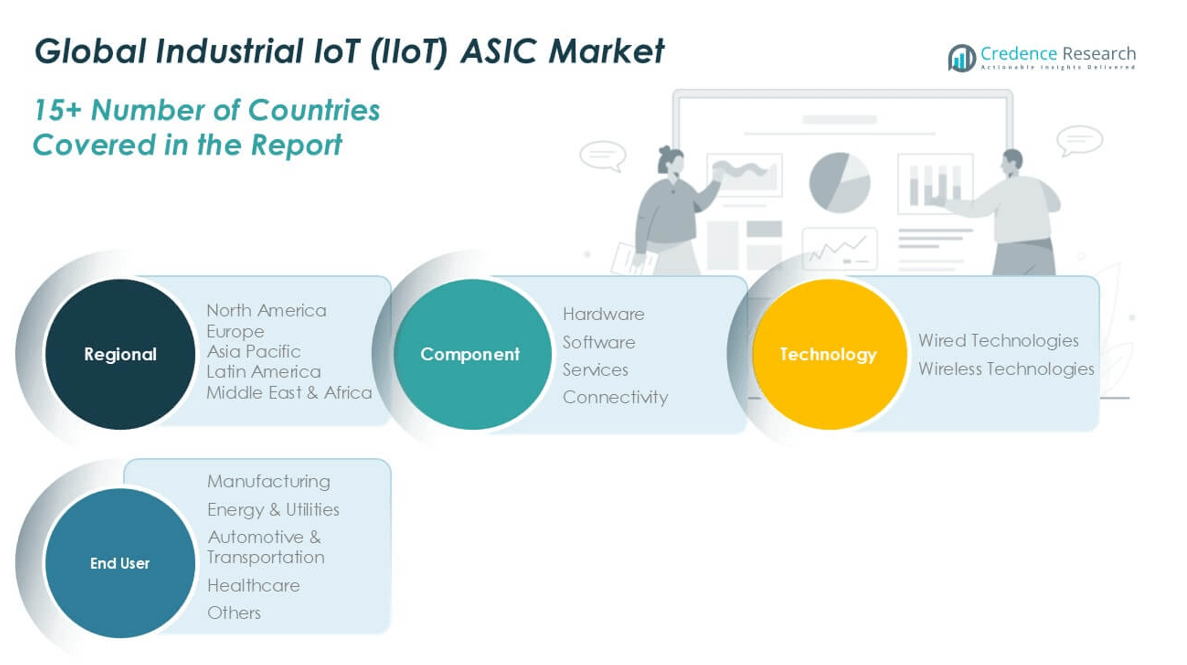

Market Segmentation Analysis:

By Component

In the Industrial IoT (IIoT) ASIC market, the hardware segment dominates with the largest market share in 2024, accounting for over 40% of the total revenue. This dominance is attributed to the growing demand for advanced sensors, edge computing devices, and custom-designed ASICs that support high-speed data processing and energy efficiency in industrial settings. Hardware remains a critical enabler for IIoT systems, ensuring reliable connectivity and real-time responsiveness. The increasing deployment of automation equipment, smart meters, and industrial robotics further drives growth in this segment, while software and services are steadily gaining traction for enhancing system scalability and management.

- For instance, Texas Instruments has shipped over 1 billion analog and embedded processing chips for industrial automation applications, supporting real-time sensing and control in harsh environments.

By Technology

Among technology segments, wireless technologies lead the market with a majority share, driven by the rising adoption of flexible and scalable IIoT networks. Wireless protocols such as Wi-Fi, Zigbee, LoRaWAN, and 5G are increasingly preferred in modern industrial environments due to their ease of installation, lower infrastructure cost, and ability to support mobile and remote operations. The growing need for real-time monitoring, predictive maintenance, and cloud-based analytics in distributed industrial sites fuels demand for wireless connectivity. Although wired technologies continue to offer stability and speed, particularly in high-risk or high-interference environments, their share is comparatively lower due to limitations in flexibility.

- For instance, Semtech’s LoRa devices have connected over 300 million end nodes globally, demonstrating the scalability of low-power wireless technology in industrial environments.

By End User

The manufacturing sector dominates the Industrial IoT ASIC market by end user, contributing more than 35% of the market share in 2024. This dominance is driven by the increasing integration of smart manufacturing practices, including predictive maintenance, process automation, and real-time asset tracking. Industries are investing heavily in ASIC-enabled IIoT systems to optimize production efficiency, reduce operational costs, and improve equipment uptime. Energy & utilities and automotive & transportation also show significant growth, propelled by smart grid modernization and connected vehicle ecosystems respectively. Meanwhile, healthcare and other sectors are adopting IIoT ASIC solutions to enhance operational visibility and patient care systems.

Market Overview

Rising Adoption of Industrial Automation

The increasing shift toward automation across manufacturing and industrial sectors is a major growth driver for the Industrial IoT (IIoT) ASIC market. Industries are rapidly embracing automated systems to improve operational efficiency, reduce downtime, and optimize resource usage. Custom ASICs play a vital role in enabling real-time processing, data acquisition, and communication among connected devices. This demand for high-performance and energy-efficient chips is further fueled by the need for predictive maintenance, robotics integration, and smart machinery in Industry 4.0 environments.

- For instance, Siemens reported integrating over 2,000 automation-ready ASICs in its Simatic automation platform, enhancing real-time control across multiple manufacturing lines.

Surge in Demand for Edge Computing Solutions

Edge computing has become integral to IIoT deployments, pushing the need for specialized ASICs capable of supporting localized data processing. With industries prioritizing reduced latency, real-time analytics, and data privacy, edge-based IIoT systems are gaining traction. ASICs enhance edge capabilities by delivering high-speed computation with lower power consumption, which is essential for real-time monitoring and control. As industries seek decentralized computing frameworks to manage large volumes of sensor-generated data, the demand for advanced ASICs continues to rise.

- For instance, NVIDIA’s Jetson AGX Orin delivers up to 275 trillion operations per second (TOPS) for edge AI workloads, enabling robust IIoT edge analytics.

Expansion of Smart Infrastructure and Connected Ecosystems

The global push toward smart infrastructure, including smart factories, grids, and logistics systems, is driving the growth of the IIoT ASIC market. ASICs provide the customized processing power needed to support scalable and reliable IIoT networks. Governments and private enterprises are investing in intelligent infrastructure for energy efficiency, resource management, and seamless connectivity. These developments are creating a favorable environment for ASIC deployment in sensors, actuators, gateways, and other edge devices that enable real-time operations and integrated communication.

Key Trends & Opportunities

Integration of AI and ML in IIoT ASICs

A growing trend in the market is the integration of artificial intelligence (AI) and machine learning (ML) capabilities directly into IIoT ASICs. These intelligent chips allow industrial systems to analyze data at the edge, detect anomalies, and make decisions without relying on cloud infrastructure. This development enhances system responsiveness and operational autonomy. As industries strive for smarter machines and self-optimizing processes, the demand for AI-embedded ASICs presents a significant opportunity for semiconductor designers and industrial solution providers.

- For instance, Intel’s Movidius Myriad X ASIC integrates a neural compute engine that performs over 1 trillion operations per second (1 TOPS), supporting real-time vision processing for industrial systems.

Growing Adoption of 5G-Enabled IIoT Networks

The rollout of 5G technology offers a transformative opportunity for the IIoT ASIC market. 5G networks enable ultra-reliable, low-latency communication, which is essential for time-sensitive industrial applications such as remote machinery control, smart grids, and connected transportation. ASICs optimized for 5G communication protocols are expected to witness rising demand as companies invest in future-proofing their infrastructure. This trend is opening avenues for ASIC manufacturers to develop customized chipsets tailored for high-speed industrial connectivity.

- For instance, Qualcomm’s FSM100xx series supports over 10 Gbps throughput and sub-1 millisecond latency for 5G small cells used in industrial private networks.

Key Challenges

High Design and Development Costs

One of the primary challenges in the IIoT ASIC market is the high cost associated with designing and developing application-specific integrated circuits. The customization process requires significant R&D investment, advanced design tools, and time-consuming validation phases. These factors can limit market entry for smaller firms and reduce the pace of innovation. Moreover, the high upfront costs may deter end users with limited budgets from adopting ASIC-based IIoT solutions, especially in cost-sensitive industries.

Complexity in Integration and Standardization

Integrating ASICs into diverse industrial environments poses technical challenges due to the lack of universal communication standards and interoperability frameworks. Industries often use a mix of legacy systems and new technologies, making seamless ASIC integration difficult. The absence of standardized protocols can lead to compatibility issues, increased deployment time, and higher system integration costs. Addressing these complexities requires collaborative efforts among hardware developers, software providers, and industry regulators to establish common interoperability guidelines.

Cybersecurity Concerns in Connected Systems

As IIoT ecosystems expand, cybersecurity has emerged as a critical concern. ASICs embedded in industrial devices are potential targets for cyberattacks if not properly secured. Vulnerabilities in chip design or communication protocols can lead to data breaches, operational disruptions, and financial losses. Ensuring robust security features within ASICs—such as hardware-level encryption and secure boot mechanisms—adds complexity to chip design. The ongoing challenge is to balance performance, cost, and security to safeguard critical infrastructure against evolving cyber threats.

Regional Analysis

North America

North America accounted for approximately 28.3% of the global Industrial IoT (IIoT) ASIC market in 2024, with a market size of USD 2,420.06 million, up from USD 1,328.85 million in 2018. The region is projected to reach USD 5,994.11 million by 2032, expanding at a CAGR of 11.2%. The U.S. leads the regional market due to its strong presence of technology providers, early adoption of automation, and well-established industrial infrastructure. Robust investments in smart manufacturing and increasing deployment of AI-integrated ASIC solutions across industries such as automotive, energy, and aerospace continue to support market expansion.

Europe

Europe held a 29.4% share of the Industrial IoT ASIC market in 2024, with revenues rising from USD 1,966.05 million in 2018 to USD 3,550.40 million. The market is anticipated to reach USD 8,418.96 million by 2032, growing at a CAGR of 10.6%. Growth in the region is driven by a strong industrial base in Germany, France, and the UK, along with progressive regulations promoting industrial digitization and energy efficiency. The adoption of smart factory initiatives under Industry 4.0 and the push for sustainable technologies are major contributors to Europe’s consistent demand for IIoT ASIC solutions.

Asia Pacific

Asia Pacific is emerging as the fastest-growing region in the Industrial IoT ASIC market, with a CAGR of 12.9% and a market share of 21% in 2024. The regional market expanded from USD 894.64 million in 2018 to USD 1,793.49 million in 2024 and is projected to reach USD 5,006.79 million by 2032. Rapid industrialization, strong manufacturing sectors in China, Japan, and South Korea, and increased investments in 5G and automation technologies are key growth drivers. The shift toward smart factories and high-volume ASIC adoption in industrial robotics and edge devices are further boosting regional demand.

Latin America

Latin America captured 3.3% of the global Industrial IoT ASIC market in 2024, with the market size increasing from USD 218.42 million in 2018 to USD 399.14 million. It is forecast to reach USD 871.30 million by 2032, registering a CAGR of 9.4%. Growth in the region is supported by gradual modernization of manufacturing facilities and increased adoption of automation in countries like Brazil and Mexico. Although still nascent, IIoT infrastructure investments and the growing need for energy efficiency and productivity improvements are fostering the adoption of ASIC-enabled IIoT systems in key industrial applications.

Middle East

The Middle East accounted for 2.7% of the IIoT ASIC market in 2024, with market revenue increasing from USD 134.67 million in 2018 to USD 228.60 million. By 2032, it is projected to reach USD 479.38 million, growing at a CAGR of 8.9%. Countries like the UAE and Saudi Arabia are promoting industrial diversification and smart infrastructure development, boosting the adoption of IIoT technologies. The region’s focus on energy, oil & gas modernization, and smart city initiatives supports demand for ASIC-driven IIoT systems, despite challenges in ecosystem maturity and integration capabilities.

Africa

Africa held a 1.9% share in the global Industrial IoT ASIC market in 2024, with the market value growing from USD 82.03 million in 2018 to USD 165.65 million. It is projected to reach USD 335.12 million by 2032, expanding at a CAGR of 8.4%. Industrial growth is gradual due to infrastructure limitations; however, rising awareness about automation benefits and investments in smart energy projects are encouraging IIoT adoption. Countries like South Africa and Egypt are showing increasing interest in digital manufacturing, creating moderate but steady opportunities for ASIC-based IIoT deployment across energy and logistics sectors.

Market Segmentations:

By Component:

- Hardware

- Software

- Services

- Connectivity

By Technology:

- Wired Technologies

- Wireless Technologies

By End User:

- Manufacturing

- Energy & Utilities

- Automotive & Transportation

- Healthcare

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Industrial IoT (IIoT) ASIC market is characterized by the presence of several global technology giants and specialized semiconductor providers. Leading companies such as Cisco Systems, Intel Corporation, Siemens AG, and Honeywell International continue to dominate through innovation, strategic acquisitions, and partnerships aimed at expanding their IIoT capabilities. These players focus on developing energy-efficient, application-specific integrated circuits tailored for industrial applications such as automation, predictive maintenance, and real-time data analytics. Additionally, firms like ABB Group, Rockwell Automation, and Bosch are leveraging their deep-rooted industrial expertise to integrate custom ASICs into their automation solutions, enhancing performance and connectivity. Emerging players and regional manufacturers are also entering the market, focusing on cost-effective and niche solutions. The market is witnessing increased collaboration between chipmakers, software vendors, and industrial OEMs to ensure seamless integration and interoperability across IIoT ecosystems. Continuous R&D investment remains key for maintaining competitiveness and meeting evolving industrial demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cisco Systems

- General Electric

- Honeywell International

- Intel Corporation

- IBM

- ABB Group

- Rockwell Automation

- Siemens AG

- Huawei Technologies

- Bosch

Recent Developments

- In February 2025, Cisco received the “Industrial IoT Company of the Year 2025” award from IoT Breakthrough for its integrated industrial networking solutions. These solutions, including secure switches, routers, and wireless equipment, are specifically designed for IIoT applications, enabling AI/ML capabilities like predictive maintenance and digital twins. While the announcement doesn’t detail specific ASIC launches, Cisco’s hardware design is crucial for IIoT deployments. Cisco’s platform emphasizes IT-OT integration, network segmentation, and provides validated architectural guides.

- In February 2025, Honeywell launched a collaboration with ForwardEdge ASIC (a Lockheed Martin company) to develop reliable and radiation-hardened microelectronics, including ASICs for space and defense, leveraging their proven foundry capabilities for mission-critical applications.

- In January 2025, Honeywell expanded its partnership with NXP Semiconductors to accelerate next-gen aviation technology, using advanced NXP processors in platforms that drive real-time, AI-powered insights — relevant for IIoT in aerospace and building automation, though not directly ASIC-specific for general IIoT applications.

Market Concentration & Characteristics

The Industrial IoT (IIoT) ASIC market is moderately concentrated, with a few global players holding significant shares due to their technological leadership and established customer bases. Key companies such as Cisco Systems, Intel Corporation, Siemens AG, and Honeywell International drive the market by offering tailored ASIC solutions that support industrial automation, real-time analytics, and connected infrastructure. It reflects a strong focus on custom chip development, energy efficiency, and integration into smart manufacturing environments. Large enterprises dominate high-value contracts in sectors like manufacturing, energy, and transportation, while smaller firms target niche applications and cost-sensitive regions. The market favors players with robust R&D capabilities and cross-industry collaboration networks. Entry barriers remain high due to the capital-intensive nature of ASIC design and manufacturing. It shows strong alignment with broader Industry 4.0 goals, including system interoperability and decentralized control. Regional dynamics also shape competition, with Europe and North America leading in adoption, and Asia Pacific showing the fastest growth in demand.

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Industrial IoT (IIoT) ASIC market will witness strong growth driven by increasing automation across manufacturing sectors.

- Edge computing will continue to influence ASIC design, with a focus on low-latency and energy-efficient processing.

- Integration of AI and machine learning into ASICs will enhance predictive maintenance and real-time decision-making.

- The demand for wireless technologies will rise, supporting flexible and scalable IIoT deployments.

- Industry 4.0 adoption in developed regions will create sustained demand for advanced ASIC solutions.

- Emerging economies in Asia Pacific will drive new growth through industrial modernization and infrastructure expansion.

- ASICs tailored for 5G connectivity will gain momentum as industrial networks transition to high-speed, low-latency communication.

- Security features in ASICs will become critical to counter growing cybersecurity risks in connected systems.

- Companies will invest in partnerships and acquisitions to enhance ASIC capabilities and expand into new industrial applications.

- Continued innovation in miniaturization and integration will shape the next generation of IIoT ASICs.