Market Overview

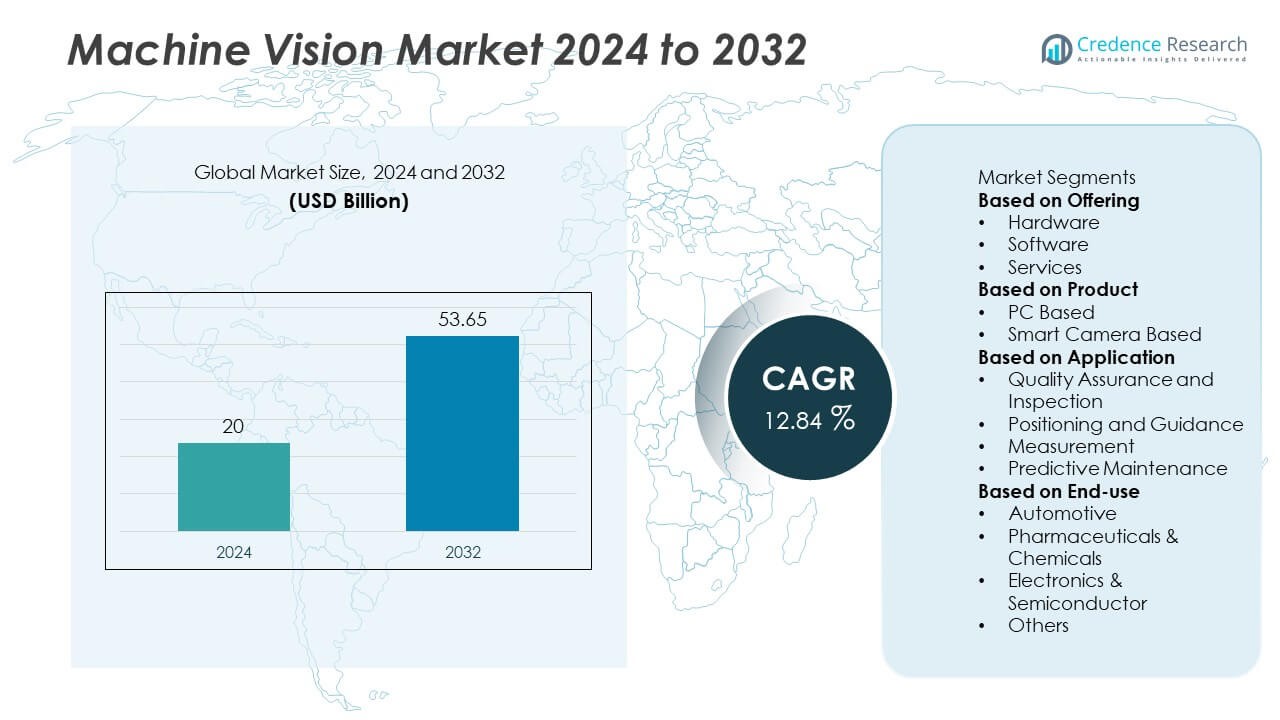

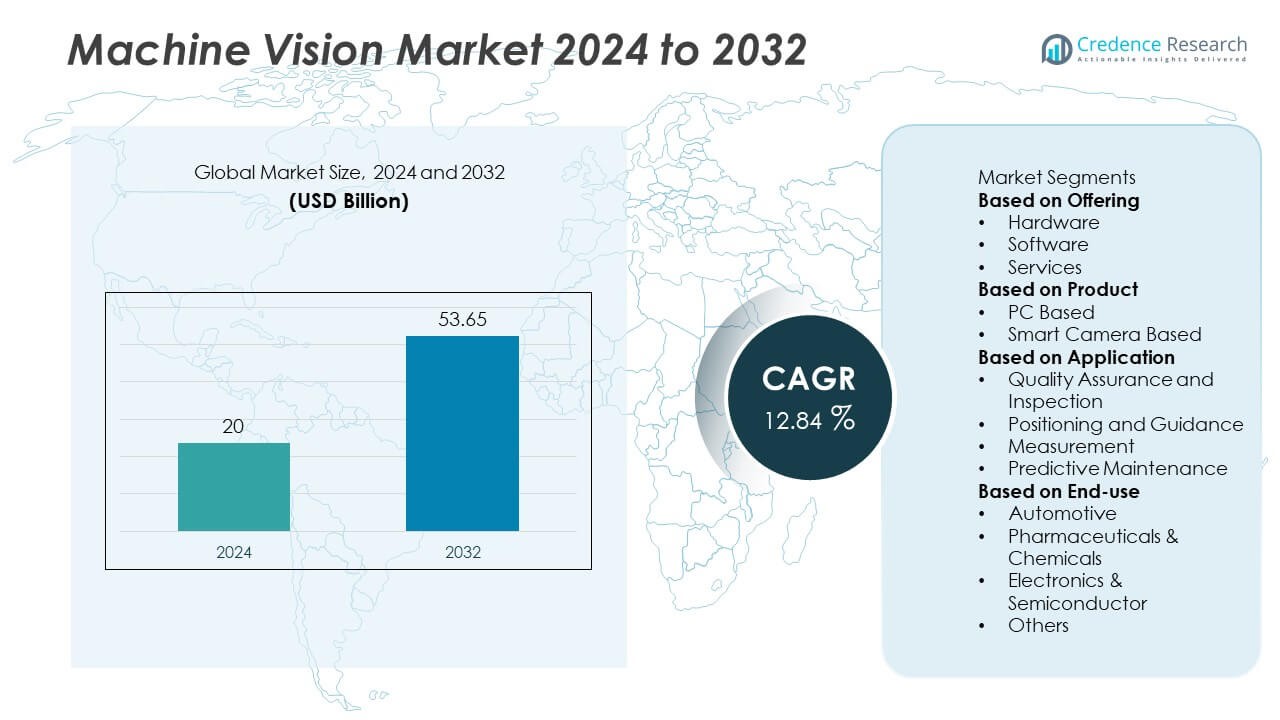

The global Machine Vision Market was valued at USD 20 billion in 2024 and is projected to reach USD 53.65 billion by 2032, expanding at a CAGR of 12.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Machine Vision Market Size 2024 |

USD 20 Billion |

| Machine Vision Market, CAGR |

12.84% |

| Machine Vision Market Size 2032 |

USD 53.65 Billion |

The machine vision market is led by key players such as Cognex Corporation, OMRON Corporation, Basler AG, Keyence Corporation, Sick AG, LMI Technologies Inc. (a subsidiary of TKH Group NV), National Instruments Corporation, Stemmer Imaging, Tordivel AS, and Teledyne Technologies Incorporated. These companies drive market growth through advancements in AI-integrated vision systems, 3D imaging, and smart cameras. North America leads the global market with a 39.8% share in 2024, driven by strong industrial automation and early adoption of intelligent inspection systems. Europe follows with a 27.5% share, while Asia-Pacific is the fastest-growing region, accounting for 26.9% share, fueled by rapid industrialization and expansion of manufacturing infrastructure.

Market Insights

- The machine vision market was valued at USD 20 billion in 2024 and is projected to reach USD 53.65 billion by 2032, growing at a CAGR of 12.84%.

- Rising demand for automation in manufacturing, electronics, and automotive industries is driving adoption of machine vision systems for inspection, measurement, and quality control.

- The market is witnessing trends toward AI-based imaging, 3D vision technology, and edge computing, enhancing speed, precision, and decision-making capabilities.

- Leading companies such as Cognex Corporation, Keyence Corporation, and Basler AG are focusing on innovation, product expansion, and partnerships to strengthen their competitive presence.

- North America holds a 39.8% share, followed by Europe with 27.5%, while Asia-Pacific, with 26.9% share, remains the fastest-growing region; hardware dominates by offering with 61.7% share driven by widespread adoption of high-resolution cameras and sensors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering

Hardware dominates the machine vision market, accounting for 61.7% share in 2024. This dominance is driven by growing deployment of high-resolution cameras, sensors, frame grabbers, and optics in industrial automation. The demand for compact, energy-efficient, and AI-integrated components further boosts adoption across manufacturing and electronics sectors. Software and services segments are expanding steadily as companies integrate deep learning algorithms, edge computing, and cloud-based analytics to enhance performance, predictive accuracy, and real-time defect detection capabilities in automated inspection systems.

- For instance, Cognex Corporation launched its In-Sight 3800 vision system, which offers twice the processing speeds of some previous systems, and proved to be 50% faster in certain applications compared to the In-Sight 7900.

By Product

PC-based machine vision systems lead the market with a 54.2% share in 2024. Their strong position is supported by superior processing power, scalability, and flexibility for complex imaging applications. These systems are preferred in industries such as automotive, semiconductor, and packaging, where multi-camera setups and high-speed analysis are essential. Smart camera-based systems are gaining traction due to compact design, simplified installation, and lower maintenance, making them ideal for small- and mid-sized manufacturing environments focusing on cost-effective automation.

- For instance, OMRON Corporation integrated AI-based pattern recognition into its FH Vision System, which improves defect classification accuracy by learning from a limited number of non-defective product images to quickly acquire the “expertise” of experienced human inspectors and reduce over-detection.

By Application

Quality assurance and inspection dominate the market with 47.8% share in 2024. The segment’s leadership stems from the widespread use of machine vision for defect detection, assembly verification, and surface inspection in high-volume production lines. Increasing demand for precision and zero-defect manufacturing in electronics, pharmaceuticals, and food & beverage industries strengthens this dominance. Positioning and guidance applications are growing rapidly due to robotics integration, while predictive maintenance is emerging as a key area driven by AI-powered vision analytics enabling early fault detection and reduced equipment downtime.

Key Growth Drivers

Rising Automation Across Industries

The increasing adoption of automation in manufacturing, automotive, and electronics sectors is a key growth driver for the machine vision market. Machine vision enables real-time quality inspection, defect detection, and operational precision, reducing human error and improving production efficiency. Its integration with industrial robots supports faster assembly and inspection lines, making it vital to Industry 4.0. Growing demand for non-contact measurement and advanced imaging solutions is accelerating adoption across high-precision applications worldwide.

- For instance, Keyence Corporation’s VS Series smart camera achieves 25-megapixel AI inspection capability, enabling use in sectors demanding ultra-high image resolution for automated anomaly detection.

Advancements in AI and Deep Learning Technologies

Artificial intelligence and deep learning are transforming the capabilities of machine vision systems. These technologies enable systems to recognize complex patterns, adapt to varying conditions, and make intelligent decisions without manual intervention. AI-driven vision solutions are being deployed for predictive quality control, object recognition, and automated sorting. This evolution improves accuracy, flexibility, and speed, driving greater use in smart factories, logistics automation, and medical imaging applications globally.

- For instance, LMI Technologies, Inc.’s FactorySmart® AI platform deploys on a GPU-accelerated edge controller and supports high-precision inspection in 2D/3D tasks

Growing Demand for Quality Assurance and Inspection

Increasing focus on product quality and regulatory compliance is boosting the use of machine vision in inspection applications. Industries such as electronics, pharmaceuticals, and food processing rely on vision systems for detecting micro-defects, labeling accuracy, and packaging integrity. High-speed vision sensors ensure consistency in production while reducing operational costs. The shift toward zero-defect manufacturing and predictive maintenance further drives market expansion in both discrete and process industries.

Key Trends and Opportunities

Integration with Robotics and Smart Manufacturing

The integration of machine vision with industrial robotics is revolutionizing automation workflows. Vision-guided robots improve flexibility in assembly, material handling, and inspection tasks. The trend supports smart manufacturing initiatives under Industry 4.0 and 5.0, enabling seamless human-machine collaboration. Adoption of collaborative robots (cobots) with embedded vision systems enhances precision and safety, creating new opportunities for small and medium-sized manufacturers.

- For instance, ABB Robotics introduced its vision-guided “Integrated Vision” system where setup time was reduced to 25 % of traditional camera-robot integration time.

Emergence of 3D Vision and Edge Computing

3D vision systems and edge computing are emerging as significant technological trends in the market. 3D vision enhances depth perception, enabling accurate dimensional analysis and complex object recognition. Combined with edge computing, these systems reduce latency and processing time by analyzing data locally. The combination enhances real-time decision-making in dynamic environments such as autonomous vehicles, logistics automation, and high-speed production lines.

- For instance, Zivid AS launched their “Zivid 3” 3D camera which captures full-scene point clouds with trueness error under 0.2 % and supports full image+3D capture in under 500 ms for mixed-SKU depalletising

Key Challenges

High Implementation and Integration Costs

Despite strong potential, the high cost of machine vision hardware, installation, and integration limits adoption among small enterprises. Complex systems require specialized components like high-speed cameras, processors, and lighting, increasing capital investment. Additionally, integrating vision systems with existing manufacturing setups demands technical expertise and downtime, creating barriers for cost-sensitive industries.

Shortage of Skilled Professionals and Technical Complexity

The machine vision market faces a shortage of skilled professionals capable of designing, programming, and maintaining complex systems. The increasing sophistication of AI-driven and 3D imaging solutions requires advanced technical knowledge. A lack of trained personnel leads to suboptimal deployment and reduced return on investment. Addressing this challenge through training programs and user-friendly vision platforms will be essential for sustaining long-term market growth.

Regional Analysis

North America

North America dominates the machine vision market with a 39.8% share in 2024. The region’s leadership is driven by strong adoption of automation across manufacturing, automotive, and electronics industries. The United States remains the primary contributor, supported by advanced R&D capabilities and the presence of major vision system manufacturers. Increasing investments in AI-driven vision technologies and Industry 4.0 initiatives are further accelerating market growth. Widespread integration of smart cameras, robotics, and inspection systems strengthens the region’s competitive edge and ensures continuous demand for high-performance vision solutions.

Europe

Europe holds a 27.5% share in the machine vision market in 2024. The region benefits from a robust industrial automation ecosystem and stringent manufacturing quality standards. Germany, the United Kingdom, and France are key contributors, with strong automotive and electronics production bases. The growing focus on precision manufacturing and sustainability encourages the adoption of energy-efficient and AI-enabled vision systems. Increasing demand for automated inspection and robotics-based assembly lines supports steady market growth, while EU initiatives promoting digital transformation further enhance technology penetration across industrial sectors.

Asia-Pacific

Asia-Pacific accounts for 26.9% of the global machine vision market in 2024 and is the fastest-growing region. Rapid industrialization, large-scale manufacturing, and expanding electronics and semiconductor industries drive growth. China, Japan, South Korea, and India lead regional demand due to government support for smart factories and technological innovation. The region’s cost-effective production capabilities and increasing deployment of vision-guided robotics in automotive and packaging industries enhance market expansion. Continuous advancements in AI and image processing technologies are expected to sustain strong momentum throughout the forecast period.

Latin America

Latin America captures 3.7% share of the machine vision market in 2024. Growth is supported by increasing automation in food processing, packaging, and automotive sectors. Brazil and Mexico lead adoption, driven by expanding industrial output and foreign investments in manufacturing. The growing presence of regional system integrators and distributors is improving access to advanced imaging technologies. However, limited technical expertise and high implementation costs pose challenges to broader market penetration. Ongoing digital transformation initiatives and government efforts to modernize industrial operations are expected to foster steady growth.

Middle East & Africa

The Middle East & Africa region holds a 2.1% share in the machine vision market in 2024. Rising investment in industrial automation, logistics, and infrastructure development drives regional demand. The United Arab Emirates and Saudi Arabia lead adoption, focusing on smart manufacturing and quality control technologies. The expansion of food, pharmaceutical, and electronics industries further supports machine vision system integration. Although growth remains moderate due to limited local manufacturing and high import dependency, increasing government initiatives toward industrial modernization are expected to enhance future market adoption.

Market Segmentations:

By Offering

- Hardware

- Software

- Services

By Product

- PC Based

- Smart Camera Based

By Application

- Quality Assurance and Inspection

- Positioning and Guidance

- Measurement

- Predictive Maintenance

By End-use

- Automotive

- Pharmaceuticals & Chemicals

- Electronics & Semiconductor

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the machine vision market is defined by the presence of major players such as Cognex Corporation, OMRON Corporation, Basler AG, Keyence Corporation, Sick AG, LMI Technologies Inc. (a subsidiary of TKH Group NV), National Instruments Corporation, Stemmer Imaging, Tordivel AS, and Teledyne Technologies Incorporated. These companies focus on developing advanced imaging solutions, including AI-powered vision systems, 3D cameras, and smart sensors that enhance industrial automation and inspection accuracy. Strategic initiatives such as product innovation, mergers, acquisitions, and partnerships with robotics and semiconductor firms are central to their market growth. Continuous investments in research and development are enabling improved speed, resolution, and reliability of vision systems. Furthermore, increasing adoption of edge computing and embedded vision technologies positions these players at the forefront of Industry 4.0, strengthening their global presence across automotive, electronics, packaging, and logistics sectors.

Key Player Analysis

Recent Developments

- In October 2025, OMRON Corporation opened a new Automation Center in Bengaluru, India, strengthening its machine-vision & automation ecosystem in a key growth market.

- In September 2025, SICK AG unveiled Visionary AI-Assist, a new solution combining high-res 2D/3D imaging for outdoor people detection and collision avoidance in machine-vision contexts.

- In June 2025, Cognex Corporation introduced OneVision, a cloud-based AI platform for industrial machine-vision that accelerates deployment and scales across its In-Sight 3800 & 8900 systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Offering, Product, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- AI and deep learning integration will continue to enhance image recognition accuracy and speed.

- The adoption of 3D vision systems will expand across manufacturing and logistics sectors.

- Edge computing will improve data processing efficiency and reduce latency in inspection systems.

- Increasing use of vision-guided robotics will strengthen automation in smart factories.

- Miniaturized and embedded vision systems will gain traction in electronics and healthcare applications.

- Demand for non-contact quality inspection will rise across precision-driven industries.

- Strategic partnerships between camera manufacturers and AI software providers will boost innovation.

- Asia-Pacific will experience the fastest growth due to large-scale industrial automation initiatives.

- Cloud-based vision analytics will enable real-time monitoring and remote process optimization.

- Continuous R&D investments will lead to more cost-effective, high-performance machine vision solutions globally.