Market Overview:

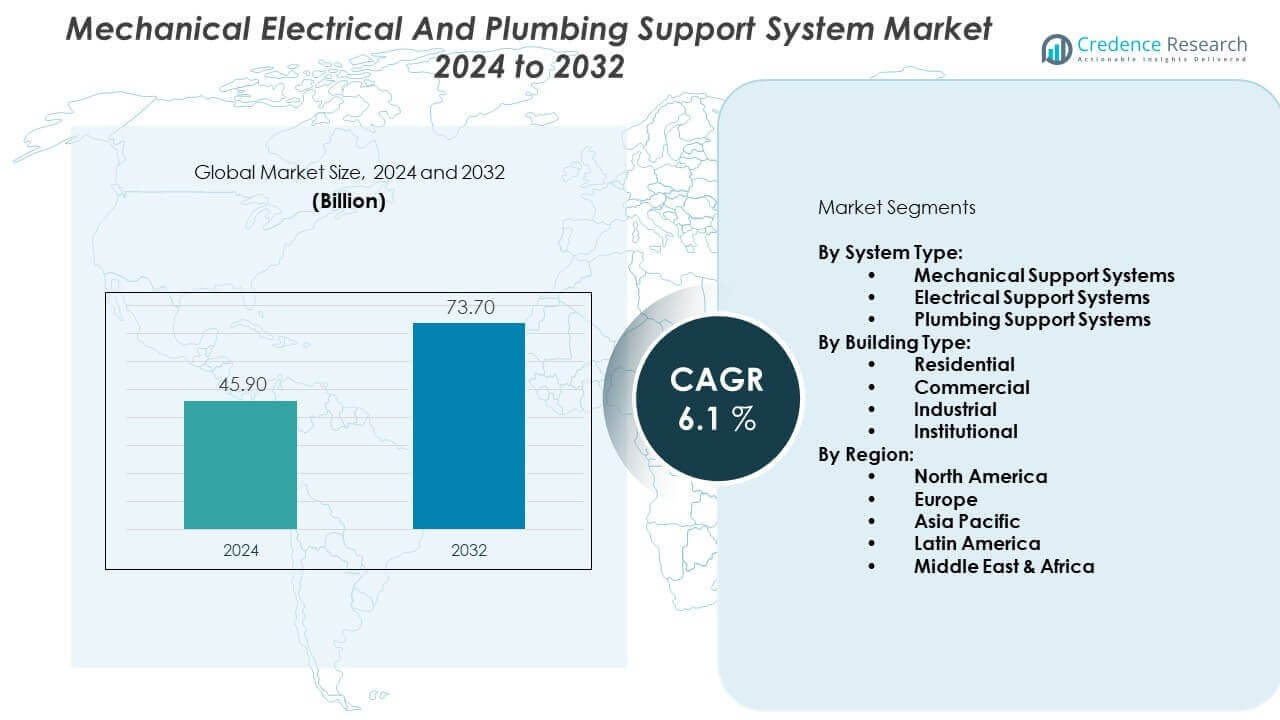

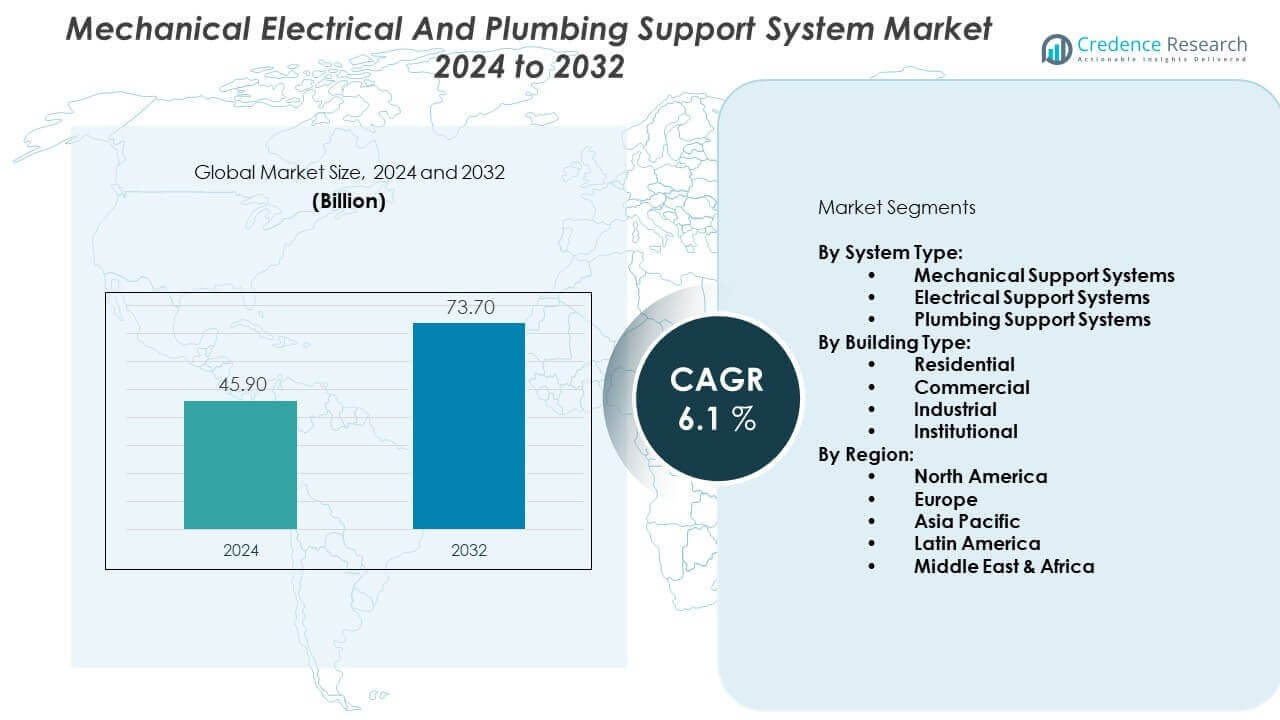

The Mechanical Electrical and Plumbing Services market is projected to grow from USD 45.9 billion in 2024 to an estimated USD 73.7 billion by 2032, with a compound annual growth rate (CAGR) of 6.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mechanical Electrical and Plumbing Services Market Size 2024 |

USD 45.9 billion |

| Mechanical Electrical and Plumbing Services Market, CAGR |

6.1% |

| Mechanical Electrical and Plumbing Services Market Size 2032 |

USD 73.7 billion |

Market drivers are shaped by rising construction investments, smart building development, and government initiatives promoting sustainable infrastructure. Increasing adoption of modular construction and prefabricated systems enhances installation speed and reduces costs, making MEP Services a preferred choice. Growing awareness about energy conservation and strict compliance with safety regulations are further accelerating demand. Expanding industrial activities and high-rise construction projects continue to provide opportunities for advanced support solutions.

Regionally, North America leads the MEP Services market due to advanced construction practices, strong regulatory compliance, and high investment in commercial buildings. Europe follows, supported by renovation projects and adoption of energy-efficient systems. Asia Pacific is the fastest-growing region, driven by rapid urbanization, infrastructure expansion, and government-backed smart city initiatives in China, India, and Southeast Asia. Latin America and the Middle East & Africa are emerging markets, with rising construction activities and infrastructure modernization fueling gradual adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Mechanical Electrical and Plumbing Services market is projected to grow from USD 45.9 billion in 2024 to USD 73.7 billion by 2032, at a CAGR of 6.1%.

- Growth is driven by rising infrastructure investments, commercial building projects, and demand for reliable building frameworks.

- Increasing focus on energy-efficient, sustainable, and green-certified construction supports wider adoption across global projects.

- High raw material costs, budget constraints, and supply chain disruptions act as major restraints for the market.

- Skilled labor shortages and complex regulatory compliance further challenge contractors and manufacturers in system integration.

- North America leads the market due to advanced construction practices and strong regulatory compliance.

- Asia Pacific is the fastest-growing region, fueled by rapid urbanization, industrial expansion, and government-backed smart city projects.

Market Drivers:

Rising Infrastructure Investments and Expansion of Commercial Projects:

The Mechanical Electrical and Plumbing Services market is gaining momentum through consistent infrastructure investments and growing commercial projects worldwide. Expanding urban populations and rising commercial construction are driving the adoption of reliable and scalable MEP solutions. Governments are focusing on large-scale infrastructure programs, including airports, metro rail, and smart cities, where support systems are essential. Developers prefer advanced MEP systems that ensure safety, reduce maintenance, and improve building efficiency. It benefits from modern construction trends such as prefabrication and modular development. The demand for robust frameworks across healthcare, hospitality, and corporate facilities further strengthens its position. MEP integration supports complex electrical, HVAC, and plumbing networks within multi-story buildings. The emphasis on sustainable and energy-efficient infrastructure reinforces the expansion of the market.

- For instance, Mason Industries has advanced low dynamic stiffness (LDS) compounds used in vibration isolators that demonstrate dynamic stiffness below 1.3 in 50 durometer tests, significantly improving vibration isolation and noise reduction in complex building support systems.

Increasing Demand for Energy-Efficient and Sustainable Construction Practices:

Sustainability has become central in construction, directly influencing the growth of the Mechanical Electrical and Plumbing Services market. Building owners and developers are shifting toward energy-efficient systems that meet strict environmental regulations. The need to reduce operational costs and carbon footprints enhances adoption of reliable support systems. It plays a crucial role in ensuring effective resource utilization and long-term building performance. Stricter building codes in North America and Europe push contractors to adopt innovative support systems. In Asia Pacific, rapid urbanization and energy challenges are boosting demand for efficient infrastructure solutions. Global corporations demand green-certified buildings, further amplifying the use of MEP frameworks. The synergy between sustainability goals and compliance requirements strengthens demand for modern support solutions.

- For instance, Legrand Group has pioneered smart electrical technologies incorporated in MEP systems that optimize power distribution with real-time monitoring capabilities, enhancing energy management and compliance with environmental standards.

Growth in Industrial Facilities and High-Tech Manufacturing Clusters:

The expansion of industrial hubs and manufacturing clusters drives significant demand for Mechanical Electrical and Plumbing Services market adoption. Industrial facilities require durable and flexible support systems to manage utilities, piping, and heavy electrical networks. It ensures the smooth operation of high-load machinery and compliance with safety standards. High-tech industries such as semiconductors, pharmaceuticals, and data centers need precise and reliable support systems. Rapid industrialization in Asia Pacific and Latin America boosts demand for advanced MEP solutions. Strong investments in logistics centers, cold storage, and processing plants create new opportunities. Support frameworks improve operational reliability and reduce downtime, making them essential for critical industries. The rise of automation and industrial IoT further amplifies system integration requirements across industrial environments.

Adoption of Modular and Prefabricated Construction Methods:

The growing shift toward modular and prefabricated construction is a strong driver for the Mechanical Electrical and Plumbing Services market. Modular methods allow faster project execution, reduced labor dependency, and minimal site disruption. Prefabricated MEP systems provide high precision and cost efficiency for large-scale projects. It supports advanced installation techniques that align with modern construction workflows. The demand for housing, commercial spaces, and public facilities encourages contractors to adopt prefabricated solutions. Developers prefer ready-to-install systems that reduce project delays and material wastage. Modular construction also enhances worker safety by minimizing onsite complexities. The integration of prefabricated support structures ensures consistency in quality and faster project delivery across different sectors.

Market Trends:

Integration of Digital Technologies and Building Information Modelling (BIM):

The Mechanical Electrical and Plumbing Services market is experiencing strong momentum from digital adoption and BIM integration. Contractors increasingly use BIM platforms to design, simulate, and optimize support systems before execution. It improves accuracy, reduces conflicts between systems, and lowers project delays. The digital twin concept is gaining popularity, enabling lifecycle management and predictive maintenance. Advanced software solutions allow real-time monitoring and remote adjustments of MEP installations. Cloud-based collaboration platforms streamline communication between architects, engineers, and contractors. Companies leverage 3D modelling to improve cost estimation and material optimization. The integration of digital workflows reflects a fundamental shift in modern construction practices.

- For instance, ABB Ltd Uses IoT-enabled MEP solutions including variable speed drives connected via 5G for HVAC optimization, enabling real-time monitoring of energy consumption and predictive maintenance, verified by factory implementation.

Rising Popularity of Smart Buildings and Intelligent Infrastructure Solutions:

Growing investments in smart buildings strongly influence the growth of the Mechanical Electrical and Plumbing Services market. Smart facilities demand advanced support systems that integrate with IoT devices and automation networks. It ensures seamless functioning of lighting, HVAC, security, and plumbing. Intelligent support solutions help achieve energy optimization, reduce waste, and maintain regulatory compliance. Developers focus on high-performance buildings that deliver comfort and operational savings. Smart city projects in Asia Pacific and Middle East further strengthen adoption. Commercial real estate owners invest in intelligent frameworks to attract tenants and meet sustainability certifications. The transition toward digital and smart ecosystems is reshaping MEP installations globally.

- For instance, ABB Ltd. deploys IoT-enabled MEP systems with integrated sensors for HVAC and lighting control, enabling detailed energy usage data capture and automation for smart building performance management.

Shift Toward Lightweight and Corrosion-Resistant Materials:

Material innovation is shaping the Mechanical Electrical and Plumbing Services market, with increasing use of lightweight and durable materials. Contractors adopt advanced alloys, coated metals, and composites to extend the life of MEP frameworks. It improves resistance to corrosion, temperature fluctuations, and structural stress. Lightweight solutions reduce handling costs and enhance installation efficiency. Demand is strong in coastal and industrial regions where exposure to chemicals and humidity is high. Manufacturers are introducing eco-friendly materials that align with green building goals. The emphasis on long-term durability and sustainability drives widespread adoption. This trend ensures reliability while addressing lifecycle costs for large projects.

Increasing Customization and Flexible Support Solutions:

The need for customizable and adaptable support frameworks drives trends in the Mechanical Electrical and Plumbing Services market. Different projects demand unique configurations, which accelerates the demand for flexible solutions. It allows contractors to integrate systems in diverse structures, from residential towers to data centers. Adjustable designs support scalability, making them suitable for future expansions. Manufacturers are offering modular kits that fit varied project requirements. Flexible support systems also reduce onsite adjustments and save installation time. Contractors benefit from simplified logistics, while developers gain efficiency. This trend strengthens adaptability, ensuring better alignment with modern construction needs.

Market Challenges Analysis:

Rising Cost Pressures and Budget Constraints:

The Mechanical Electrical and Plumbing Services market faces significant challenges due to rising cost pressures and budget constraints. Raw material costs for steel, aluminum, and composites fluctuate frequently, impacting project economics. It creates difficulties for contractors who must balance quality with cost efficiency. Inflation and supply chain disruptions increase financial uncertainty for large-scale projects. Small and medium contractors often struggle to adopt advanced systems due to limited resources. Budget restrictions in developing regions slow down adoption of high-quality frameworks. Delays in payments and funding cycles further affect system integration. Competitive pricing pressure reduces profit margins, making sustained growth more difficult.

Workforce Shortages and Complex Regulatory Environment:

The shortage of skilled labor poses a challenge to the Mechanical Electrical and Plumbing Services market. Lack of trained technicians’ delays projects and increases installation errors. It becomes more critical in advanced installations that require technical expertise. Regulatory compliance also creates hurdles, with varying codes across regions demanding constant adaptation. Contractors face challenges in meeting safety, environmental, and energy standards simultaneously. Complex approval processes often extend project timelines and increase costs. Disparities in regulations across countries complicate global expansion for manufacturers. Balancing skilled labor needs and regulatory complexity remains a key challenge for the industry.

Market Opportunities:

Expansion in Emerging Economies and Urbanization Growth:

Rapid urbanization and infrastructure development create strong opportunities for the Mechanical Electrical and Plumbing Services market. Emerging economies such as India, China, and Brazil are investing heavily in commercial and residential projects. It benefits from rising government spending on transportation, healthcare, and smart city development. The surge in middle-class housing demand and urban migration boosts adoption. Contractors prefer reliable support systems to ensure sustainability and efficiency. Industrial parks and logistics hubs add further demand in growing economies. International players explore partnerships to expand presence in these fast-growing regions. Urbanization trends continue to drive steady opportunities for market expansion.

Rising Adoption of Green and Smart Infrastructure Projects:

The global shift toward green and smart infrastructure provides significant opportunities for the Mechanical Electrical and Plumbing Services market. Governments encourage green-certified buildings, where efficient support systems are critical. It aligns with investor interest in sustainable construction practices. Adoption of IoT-enabled frameworks and intelligent monitoring systems adds value. Contractors leverage opportunities in retrofitting older structures with modern MEP supports. Corporate real estate developers push adoption to meet sustainability goals and enhance building performance. Demand for high-tech facilities like data centers, healthcare complexes, and research labs strengthens opportunities. The focus on future-ready infrastructure creates long-term growth potential.

Market Segmentation Analysis:

By System Type

The Mechanical Electrical and Plumbing Services market is segmented into mechanical, electrical, and plumbing support systems. Mechanical support systems maintain strong demand with HVAC duct supports, vibration isolation, seismic bracing, and fire protection frameworks. Electrical support systems are expanding with the need for cable trays, conduits, power distribution frameworks, and smart electrical controls. Plumbing support systems are gaining traction due to the rising use of pipe hangers, brackets, water-efficient fixtures, and smart leak detection technologies. Each system type plays a vital role in ensuring safety, energy efficiency, and operational reliability across construction projects.

- For instance, Atkore International has introduced modular electrical cable tray systems with advanced corrosion resistance and load-bearing specifications, improving installation speed and durability in diverse construction environments.

By Building Type

The market spans residential, commercial, industrial, and institutional buildings, reflecting diverse adoption patterns. Residential demand is driven by urban housing expansion and smart home integration. Commercial projects such as malls, hospitals, offices, and hotels account for a major share due to high utility needs. Industrial facilities including factories, logistics hubs, and data centers depend on durable and scalable MEP Services. Institutional structures such as schools, universities, airports, and public infrastructure adopt MEP frameworks to enhance compliance and sustainability. This diverse building demand highlights the adaptability and relevance of MEP systems across sectors.

- For instance, Hilti Corporation provides seismic bracing and fast fastening solutions widely utilized in institutional and industrial buildings, validated through performance tests aligning with regional seismic codes ensuring structural safety in critical infrastructure.

Segmentation:

By System Type:

- Mechanical Support Systems

- Electrical Support Systems

- Plumbing Support Systems

By Building Type:

- Residential

- Commercial

- Industrial

- Institutional

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America and Europe

North America holds the largest share of the Mechanical Electrical and Plumbing Services market with 32%. Strong regulatory frameworks, adoption of sustainable construction practices, and renovation of aging infrastructure support its leadership. It benefits from large-scale commercial projects, high-rise residential buildings, and data center expansions. Europe follows with a 27% share, supported by strict energy regulations, green building certifications, and retrofitting activities. The region shows strong demand in institutional projects such as hospitals, universities, and government facilities. Both regions remain mature markets with steady demand for advanced and energy-efficient MEP solutions.

Asia Pacific

Asia Pacific accounts for 29% of the Mechanical Electrical and Plumbing Services market, making it the fastest-growing region. Rapid urbanization, population growth, and government-backed smart city initiatives drive adoption. It benefits from large-scale infrastructure investments in China, India, and Southeast Asia. Expanding industrial facilities, logistics hubs, and residential developments further fuel demand. Contractors in the region adopt prefabricated and modular MEP solutions to meet strict timelines. Rising demand for high-tech facilities such as data centers and manufacturing clusters strengthens the growth outlook across Asia Pacific.

Latin America and Middle East & Africa

Latin America represents 6% of the Mechanical Electrical and Plumbing Services market, driven by modernization of urban infrastructure and rising industrial investment in Brazil and Mexico. Demand grows steadily in commercial and residential segments, though budget constraints affect adoption in some projects. The Middle East & Africa holds another 6% share, fueled by large-scale infrastructure programs, airport expansions, and institutional developments in GCC countries. It gains from government investment in mega projects, including healthcare and education facilities. Both regions show long-term potential as construction activity expands and sustainable building practices gain traction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mason Industries

- Eaton Corporation

- Atkore International

- Legrand Group

- Hilti Corporation

- Schneider Electric

- ABB Ltd.

- Thomas & Betts (ABB)

- Unistrut (Atkore)

- Gripple

- Walraven Group

- MEFA Befestigungs- und Montagesysteme GmbH

- Fischer Group

Competitive Analysis:

The Mechanical Electrical and Plumbing Services market is highly competitive, with leading players focusing on material innovation, modular designs, and compliance with international building codes. Companies such as Mason Industries, Eaton Corporation, Atkore International, Legrand Group, Hilti Corporation, and ABB Ltd. dominate with strong product portfolios and global distribution networks. It is marked by intense competition where firms pursue acquisitions, partnerships, and product launches to expand their presence. Manufacturers invest in R&D to introduce lightweight, corrosion-resistant materials and smart monitoring capabilities. Regional players strengthen competition by offering cost-effective solutions tailored to local building standards. The market rewards companies that balance performance, sustainability, and cost-efficiency.

Recent Developments:

- In Eaton Corporation, in 2025, Eaton announced acquisitions of Fibrebond Corporation, strengthening modular power enclosures for data centers, and Ultra PCS Limited to expand aerospace electronic control capabilities. Eaton also acquired Resilient Power Systems to enhance solid-state transformer technology for EV charging infrastructure in 2025.

- In Atkore International, the company provided positive business updates in 2025, highlighting operational improvements and manufacturing productivity with ongoing portfolio growth.

- Legrand Group unveiled several new products in early 2025, including the Chief® Velocity Outdoor Pedestal System for audiovisual mounting and the Wattstopper i3 platform for intelligent building lighting control.

- Schneider Electric showcased new automation products like the Modicon M660 industrial PC controller and partnered with Microsoft to integrate AI-driven industrial productivity tools in 2025.

- ABB Ltd. acquired BrightLoop in 2025 to expand power electronics and marine electrification solutions and Bel Products Inc. to broaden enclosure offerings in North America. ABB also formed a joint venture with Niedax Group to strengthen cable tray manufacturing in North America.

Market Concentration & Characteristics:

The Mechanical Electrical and Plumbing Services market demonstrates moderate to high concentration, with global leaders controlling a significant portion of revenue. It is characterized by steady innovation, focus on energy-efficient systems, and compliance with regional safety codes. Demand is diverse across residential, commercial, industrial, and institutional projects, ensuring consistent growth opportunities. The market shows strong regional variation, with North America and Asia Pacific leading adoption while Latin America and the Middle East & Africa are emerging. Long product lifecycles, combined with increasing adoption of modular and prefabricated systems, define its competitive characteristics.

Report Coverage:

The research report offers an in-depth analysis based on system type and building type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable construction materials will expand across all system types.

- Modular and prefabricated MEP solutions will gain stronger adoption in global projects.

- Smart monitoring technologies will enhance safety and efficiency in installations.

- Asia Pacific will continue to record the fastest growth supported by urbanization.

- Retrofitting projects will boost demand in Europe and North America.

- Industrial expansion will increase reliance on durable and heavy-duty systems.

- Green building certifications will drive wider adoption of advanced MEP solutions.

- Partnerships and acquisitions will remain central to market consolidation.

- Lightweight, corrosion-resistant materials will reshape product offerings.

- Institutional infrastructure projects will strengthen long-term demand.