Market Overview

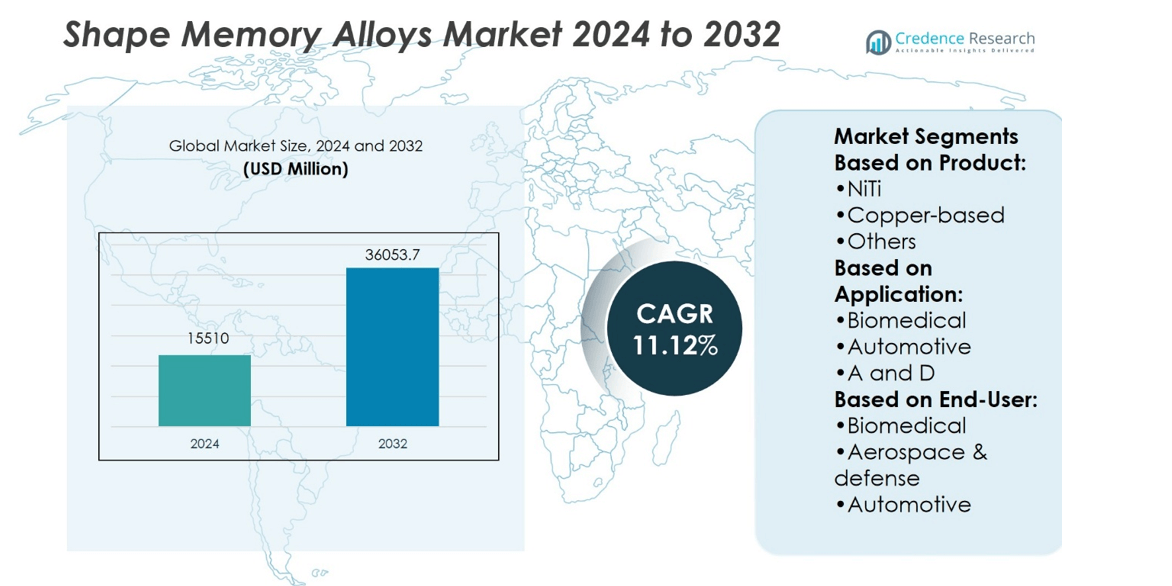

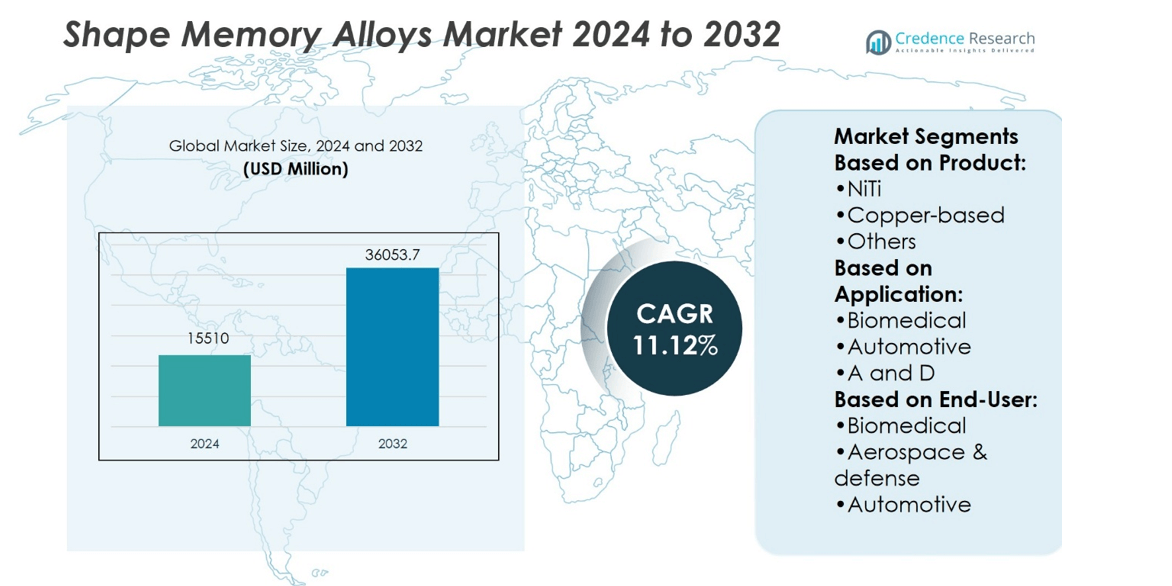

Shape Memory Alloys Market size was valued at USD 15510 million in 2024 and is anticipated to reach USD 36053.7 million by 2032, at a CAGR of 11.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shape Memory Alloys Market Size 2024 |

USD 15510 million |

| Shape Memory Alloys Market, CAGR |

11.12% |

| Shape Memory Alloys Market Size 2032 |

USD 36053.7 million |

The Shape Memory Alloys Market grows through strong demand in biomedical, aerospace, automotive, and consumer electronics applications. Rising adoption in stents, guidewires, and orthopedic implants drives healthcare growth, while aerospace integrates alloys for adaptive structures and vibration control. Automotive manufacturers use them in actuators, valves, and safety systems to improve efficiency. Consumer electronics and robotics adopt compact actuators for precision movement. The market trends toward sustainable production, recycling, and improved fatigue resistance, supported by digital tools and advanced testing methods. It reflects continuous innovation and expanding applications across both established and emerging industries, ensuring broad long-term relevance.

The Shape Memory Alloys Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with advanced healthcare and aerospace adoption, while Europe benefits from robust automotive and industrial use. Asia-Pacific records rapid growth from expanding healthcare and manufacturing sectors. Latin America and the Middle East & Africa show steady adoption with infrastructure improvements. Key players include Nippon Steel Corporation, SAES Getters, Fort Wayne Metals, Johnson Matthey, and Furukawa Electric Co., Ltd.

Market Insights

- The Shape Memory Alloys Market was valued at USD 15,510 million in 2024 and is projected to reach USD 36,053.7 million by 2032, at a CAGR of 11.12%.

- Strong demand in biomedical applications, including stents, guidewires, and implants, drives consistent growth.

- Aerospace and defense sectors adopt alloys for adaptive structures, actuators, and vibration control systems.

- Automotive use expands through actuators, valves, and safety features, enhancing efficiency and reliability.

- The market faces restraints from high material costs and technical limits such as fatigue and temperature range.

- North America leads with healthcare and aerospace adoption, while Asia-Pacific grows fastest with rising manufacturing and medical demand.

- Competitive landscape includes key players focusing on advanced materials and sustainable production, such as Nippon Steel Corporation, SAES Getters, Fort Wayne Metals, Johnson Matthey, and Furukawa Electric Co., Ltd.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Medical Applications

The Shape Memory Alloys Market gains strength from widespread use in medical devices. It supports stents, guidewires, and orthopedic implants that require flexibility and biocompatibility. Hospitals and clinics adopt these materials to improve patient outcomes and reduce recovery times. Growing surgical procedures worldwide create consistent demand for reliable alloy solutions. It delivers high performance under stress, making it vital in minimally invasive surgeries. The push for advanced healthcare tools secures its role in the medical sector.

- For instance, Fort Wayne Metals is a manufacturer of nitinol tubing known for its superelastic and shape-memory properties, enabling recoverable strains of up to 6–8%. This high-performance material supports applications in medical devices, such as expanding stents that must maintain their integrity under repeated mechanical loads.

Expansion in Aerospace and Defense

The Shape Memory Alloys Market benefits from its integration into aerospace and defense systems. It powers actuators, couplings, and fasteners that operate under extreme conditions. Aircraft manufacturers adopt these alloys to reduce weight and enhance fuel efficiency. Defense applications use them for adaptive wings and vibration control. It supports operational safety while ensuring durability in critical missions. This integration elevates demand in high-value engineering sectors.

- For instance, SAES Getters’ SmartFlex Wires, crafted for aerospace, come in diameters from 20 µm to 500 µm. These wires operate under stress from 50 MPa up to 400 MPa, and generate forces in the range of 0.1 N to 40 N.

Growth in Consumer Electronics

The Shape Memory Alloys Market expands with its adoption in smartphones, wearables, and robotics. Manufacturers integrate these alloys into compact actuators and responsive components. It enables thinner devices without compromising performance. Consumer interest in smart gadgets drives continuous product launches using advanced materials. Robotics companies adopt it for flexible movement in compact systems. This trend sustains strong growth within the technology landscape.

Industrial and Automotive Applications

The Shape Memory Alloys Market shows steady demand across industrial automation and automotive design. Automakers use these alloys for actuators in adaptive headlights, valves, and safety systems. It improves efficiency by replacing traditional mechanical parts with lighter solutions. Industrial automation adopts them for precise motion control and energy savings. Renewable projects employ these alloys in sensors for efficiency improvements. Its broad use across heavy and light industries reinforces long-term market potential.

Market Trends

Rising Use in Minimally Invasive Healthcare

The Shape Memory Alloys Market shows a strong trend toward minimally invasive healthcare solutions. Medical device makers design stents, guidewires, and surgical tools with precise flexibility. It supports smaller incisions and faster patient recovery. Hospitals expand adoption of alloys that adapt to body conditions. Increasing preference for advanced medical procedures sustains momentum. This trend secures the market’s role in future healthcare innovations.

- For instance, Seabird offers a 3 mm Nitinol wire with tensile strength of 1100 MPa and recovery stress of 185 MPa, activating at 90 °C; compliant with ASTM F2063 and ISO 9001:2015.

Integration into Smart Consumer Devices

The Shape Memory Alloys Market gains traction with its role in consumer electronics. Manufacturers embed these alloys in actuators for smartphones, wearables, and smart home devices. It allows compact designs with reliable motion control. Rising demand for responsive and lightweight materials fuels new product development. Companies adopt alloys to enhance user experience through precision movements. This trend strengthens links between materials science and consumer technology.

- For instance, Sumitomo Metal Mining produces ultra-fine nickel powder with sub-micron particle sizes, typically less than 0.1 µm, which is ideal for conductive pastes and multi-layer ceramic capacitors. The company also produces a fine iron-nickel-cobalt alloy powder with particle sizes from 0.2 µm to 2.0 µm, suited for applications in inductors and catalysts.

Advancements in Aerospace Engineering

The Shape Memory Alloys Market benefits from continuous advancements in aerospace design. Engineers apply these alloys to adaptive wing structures, couplings, and vibration controls. It ensures performance in high-stress flight conditions. Lightweight properties contribute to improved efficiency and lower fuel use. Defense programs integrate alloys into systems requiring reliability under extreme environments. This trend highlights the growing role of advanced alloys in modern aerospace.

Growth of Automotive Innovation

The Shape Memory Alloys Market aligns with automotive innovation across adaptive systems. Automakers introduce alloys in valves, actuators, and safety mechanisms. It supports compact designs with improved energy efficiency. Electric vehicle development increases reliance on lightweight and flexible components. The industry embraces alloys for precision in thermal and mechanical controls. This trend positions the market as a contributor to the future of mobility.

Market Challenges Analysis

High Material and Manufacturing Costs

The Shape Memory Alloys Market faces challenges linked to high production and raw material costs. Nickel and titanium, core elements for these alloys, experience frequent price fluctuations. It raises expenses for manufacturers and impacts pricing strategies. Advanced processes such as vacuum melting and precision machining demand significant investment. Small-scale companies struggle to compete with established players due to high entry barriers. The cost factor limits wider adoption in price-sensitive applications, slowing market expansion.

Technical Limitations and Performance Concerns

The Shape Memory Alloys Market also confronts technical challenges related to durability and operational limits. Alloys can suffer from fatigue under repeated stress cycles, reducing lifespan in critical systems. It creates reliability concerns in aerospace, medical, and automotive applications. Limited temperature range for transformation further restricts use in extreme environments. Engineers must address issues of repeatability and structural integrity through continuous testing. These hurdles create obstacles for broader integration of the technology across industries.

Market Opportunities

Expanding Role in Advanced Medical Devices

The Shape Memory Alloys Market holds strong opportunities in advanced medical applications. Rising demand for minimally invasive surgeries fuels the use of stents, guidewires, and orthopedic implants. It enables devices to adapt within the human body, improving treatment efficiency and patient recovery. Healthcare providers seek innovative materials that balance biocompatibility with durability. Growing investment in medical technology research supports wider adoption. This trend positions the market to capture long-term growth within healthcare innovation.

Adoption Across Emerging Industrial Sectors

The Shape Memory Alloys Market also sees opportunities in industrial automation, robotics, and renewable energy. Manufacturers deploy these alloys in actuators, sensors, and adaptive systems requiring flexibility and reliability. It supports next-generation robotics with compact motion control solutions. Renewable projects employ the material in energy-efficient sensors and smart grid components. Automotive electrification opens avenues for lightweight and precise alloy-based parts. These sectors expand the potential for wider commercial use beyond traditional industries.

Market Segmentation Analysis:

By Product

The Shape Memory Alloys Market divides into NiTi, copper-based, and other alloys. NiTi dominates due to its superior superelasticity and biocompatibility, making it the preferred choice for medical devices. It finds strong use in stents, dental wires, and orthopedic implants where precision and reliability matter. Copper-based alloys appeal for cost efficiency, offering acceptable mechanical performance in lower-demand applications. They are widely integrated into actuators and couplings across industrial and automotive sectors. The “others” category includes iron-based and newer alloy blends under research, offering potential in niche uses. This segmentation highlights material performance as a key factor in adoption.

- For instance, ATI’s NiTi SMA 1™ alloy shows an austenite finish (Af) transformation range of 30 °C to 75 °C, with a melting point of 1310 °C, and ultimate tensile strength exceeding 1070 MPa with a minimum elongation of 10%—meeting ASTM F2005, F2004, and F2082 standards.

By Application

The Shape Memory Alloys Market shows significant application diversity across biomedical, automotive, aerospace and defense, and other fields. Biomedical applications hold a leading share, driven by implants and surgical tools that require flexibility and endurance. It delivers measurable benefits for minimally invasive procedures. Automotive applications continue to expand with adoption in adaptive headlights, valves, and safety systems. Aerospace and defense segments employ these alloys for vibration damping, actuators, and morphing structures, ensuring durability in extreme conditions. Other applications span robotics and consumer electronics, reflecting versatility and steady innovation. This spread secures long-term relevance across industries.

- For instance, Furukawa’s Ni-Ti alloy spring auto-adjusts oil flow in the transmission systems of certain Shinkansen trains, working reliably at engine oil temperatures exceeding 100 °C.

By End-User

The Shape Memory Alloys Market segments into biomedical, aerospace and defense, automotive, and household appliances. Biomedical end-users lead due to consistent demand for medical implants and surgical equipment. It reflects growing emphasis on patient safety and advanced care. Aerospace and defense follow with steady integration of alloys into structural components and mission-critical devices. Automotive manufacturers adopt them to improve efficiency and support lightweight design trends. Household appliances incorporate alloys in actuators and temperature control systems, adding value through reliability and compactness. These diverse end-user groups demonstrate how alloy adaptability ensures widespread commercial traction.

Segments:

Based on Product:

Based on Application:

- Biomedical

- Automotive

- A and D

Based on End-User:

- Biomedical

- Aerospace & defense

- Automotive

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Shape Memory Alloys Market at 36%. The region benefits from advanced medical infrastructure and strong demand for biomedical devices. It demonstrates high adoption in stents, dental applications, and orthopedic implants due to favorable healthcare spending. Aerospace and defense sectors also drive usage, as the alloys support vibration control, morphing structures, and safety systems in aircraft. Automotive companies integrate the materials into adaptive headlights and thermal control systems, further strengthening regional demand. Research and development investments by universities and technology firms enhance material performance and broaden applications. The concentration of key manufacturers ensures consistent supply and innovation, sustaining leadership in the market.

Europe

Europe accounts for 27% of the Shape Memory Alloys Market, supported by its robust automotive and aerospace sectors. Automakers adopt these alloys to improve efficiency, reduce weight, and enhance safety features. The aerospace industry employs them in actuator systems and fatigue-resistant components, aligning with regional goals for sustainability and efficiency. Biomedical adoption is steady, with growing use of minimally invasive surgical tools across advanced healthcare systems in Germany, France, and the United Kingdom. Regulations promoting eco-friendly materials and energy-efficient technologies support further integration into consumer electronics and industrial automation. Academic research institutions contribute by exploring new alloy blends for extreme conditions, which strengthens innovation pipelines. This balance of industrial demand and scientific development anchors Europe’s strong position.

Asia-Pacific

Asia-Pacific captures 23% of the Shape Memory Alloys Market and is the fastest-growing region. Expanding healthcare access across China, India, and Southeast Asia drives demand for stents, guidewires, and orthopedic implants. The automotive industry adopts these alloys for cost-efficient and reliable solutions in adaptive components, driven by rising vehicle production. Aerospace and defense programs in Japan, China, and South Korea also invest in advanced alloys for mission-critical applications. Consumer electronics, particularly in Japan and China, integrate the materials into compact actuators and robotics, adding new growth opportunities. Regional manufacturers focus on cost-effective production, which strengthens accessibility for diverse end-users. Increasing investments in industrial automation further boost adoption across multiple sectors, supporting rapid expansion in market share.

Latin America

Latin America represents 8% of the Shape Memory Alloys Market, supported by growing medical device imports and expanding healthcare infrastructure. Brazil and Mexico lead in adopting stents and surgical tools that rely on reliable alloy performance. The automotive industry also contributes, with manufacturers adopting these alloys for thermal control and safety applications in regional assembly plants. Aerospace applications remain limited but show gradual development in Brazil’s aviation sector. Governments support healthcare modernization programs, which promote the integration of advanced surgical devices. Local suppliers expand partnerships with global players to improve supply chain resilience. This steady adoption pattern ensures moderate but consistent regional growth.

Middle East & Africa

The Middle East & Africa hold 6% of the Shape Memory Alloys Market, with demand centered on healthcare and limited industrial adoption. Hospitals in Gulf nations invest in advanced implants and surgical tools, driving biomedical use. Aerospace and defense applications remain in early stages, but government programs encourage technological development. Automotive adoption is modest, with focus on imported components. Universities and research institutions in South Africa and the UAE conduct studies to improve regional expertise in materials engineering. Strategic healthcare investments strengthen opportunities for greater adoption. While market share is the lowest, it shows potential for future expansion with targeted investments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nippon Steel Corporation

- SAES Getters

- Seabird Metal Material Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Allegheny Technologies Incorporated

- Xi’an Saite Metal Materials Development Co., Ltd.

- Johnson Matthey

- Nippon Seisen Co., Ltd.

- Fort Wayne Metals

- Furukawa Electric Co., Ltd.

Competitive Analysis

The Shape Memory Alloys Market features including Nippon Steel Corporation, SAES Getters, Seabird Metal Material Co., Ltd., Sumitomo Metal Mining Co., Ltd., Allegheny Technologies Incorporated, Xi’an Saite Metal Materials Development Co., Ltd., Johnson Matthey, Nippon Seisen Co., Ltd., Fort Wayne Metals, and Furukawa Electric Co., Ltd. The Shape Memory Alloys Market is defined by intense competition, driven by continuous innovation and expanding applications across biomedical, aerospace, automotive, and industrial sectors. Companies focus on advancing alloy performance through improved fatigue resistance, higher transformation efficiency, and precise control of mechanical properties. Research efforts target cost reduction in production while maintaining superior quality standards. Strategic partnerships and global supply chain optimization strengthen the ability to meet rising demand in both developed and emerging markets. Competitors emphasize sustainable manufacturing practices and invest in advanced testing facilities to ensure long-term reliability of alloy products. The market reflects a balance between established firms with strong R&D and new entrants offering cost-effective solutions, creating a dynamic environment of growth and innovation.

Recent Developments

- In April 2025, SAES Getters Group announced the expansion of its Nitinol production line in the U.S. to meet rising demand for biomedical and aerospace, focusing on biomedical device applications and electronics, investing heavily in product innovation and sustainability.

- In April 2024, ATI Inc. (NYSE: ATI) recently marked the completion of its expansion at Vandergrift Operations, recognized as the most advanced materials finishing facility of its kind. This milestone event, attended by government and community leaders, underscores ATI’s strategic shift in Specialty Rolled Products toward becoming a leader in high-quality titanium and nickel-based alloys.

- In March 2024, Montagu, a private equity firm, announced its plans to acquire the Medical Device Components (MDC) business from Johnson Matthey. MDC develops and manufactures specialized components for minimally invasive medical devices. It focuses on the development of complex and high-precision parts made from platinum group metals and nitinol.

- In December 2023, Fluid-o-Tech, an Italy-based manufacturer of magnetic pumps and drives, announced the expansion of its product offerings beyond traditional magnetic systems. The company has made strategic investments and collaborations to develop new products, including piezo valves, pumps, and SMA-actuated valves.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for minimally invasive medical devices will drive continuous alloy adoption.

- Automotive electrification will expand the use of lightweight alloy components.

- Aerospace programs will integrate alloys into adaptive wings and vibration controls.

- Consumer electronics will adopt compact actuators made from advanced alloys.

- Industrial automation will benefit from alloys in precision motion control systems.

- Research will enhance fatigue resistance and broaden operational temperature ranges.

- Sustainability goals will encourage recycling and eco-friendly alloy production methods.

- Emerging economies will boost demand through expanding healthcare and automotive sectors.

- Strategic partnerships will strengthen innovation pipelines and global supply networks.

- Ongoing digitalization will support smart alloy applications in robotics and IoT devices.