Market Overview

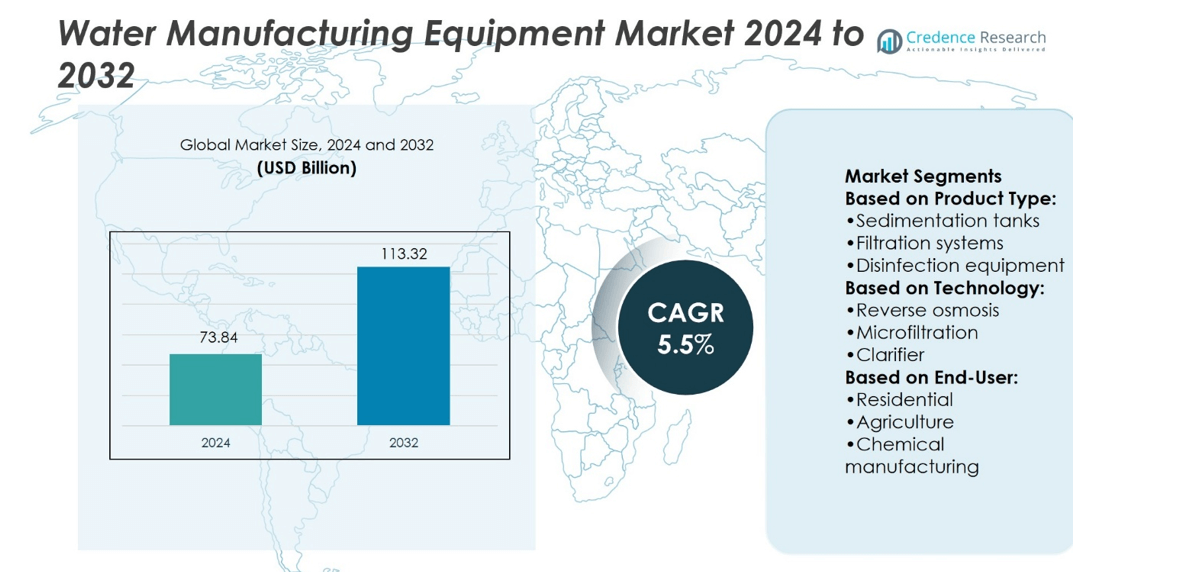

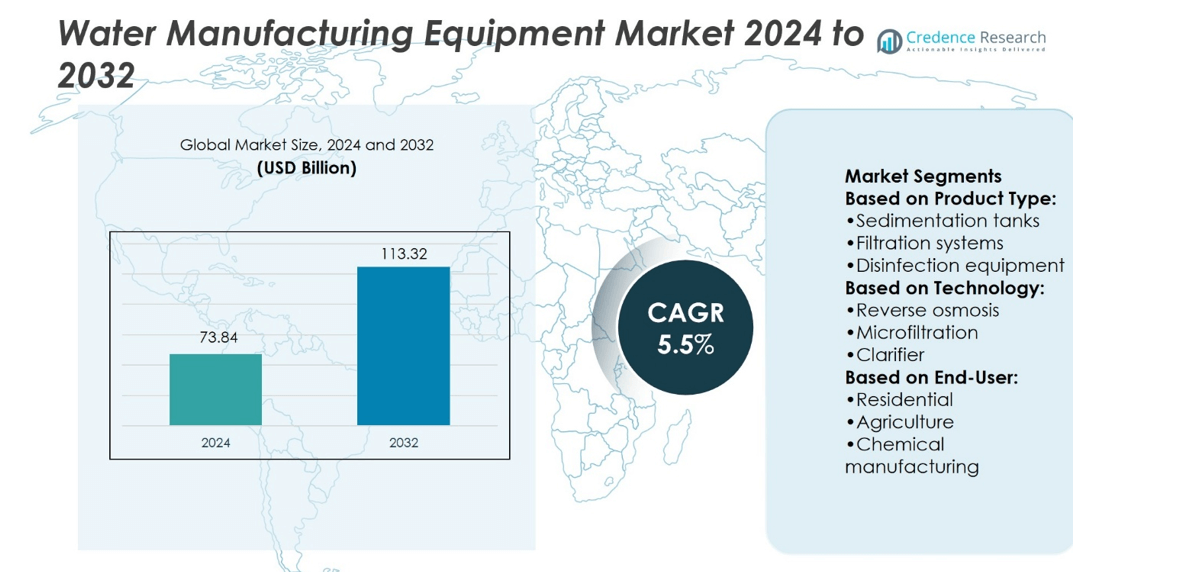

Water Manufacturing Equipment Market size was valued at USD 73.84 billion in 2024 and is anticipated to reach USD 113.32 billion by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Manufacturing Equipment Market Size 2024 |

USD 73.84 billion |

| Water Manufacturing Equipment Market, CAGR |

5.5% |

| Water Manufacturing Equipment Market Size 2032 |

USD 113.32 billion |

The Water Manufacturing Equipment Market grows through strong drivers and evolving trends that reshape global demand. Rising urbanization and industrial expansion increase the need for advanced water treatment and supply systems. Governments enforce strict regulations, pushing industries and municipalities to adopt efficient and eco-friendly equipment. Digital integration with IoT and AI supports predictive maintenance, real-time monitoring, and higher operational efficiency. Growing focus on sustainability accelerates the adoption of energy-efficient and modular solutions. Expanding wastewater recycling and reuse practices further enhance market opportunities. These factors together strengthen the market’s long-term growth potential and encourage continuous innovation across applications.

North America holds the largest share of the Water Manufacturing Equipment Market, supported by strict regulatory frameworks and strong industrial adoption, while Europe follows with advanced infrastructure and sustainability initiatives. Asia Pacific shows rapid growth driven by urbanization, industrialization, and rising investment in water infrastructure. Latin America and the Middle East & Africa record steady expansion through municipal and industrial projects. Key players shaping this market include Pall Corporation, AO Smith, Evoqua Water Technologies, Culligan, and Kurita Europe GmbH.

Market Insights

- Water Manufacturing Equipment Market size was USD 73.84 billion in 2024 and will reach USD 113.32 billion by 2032 at a CAGR of 5.5%.

- Strong drivers include urbanization, industrial growth, and demand for advanced water treatment systems.

- Key trends focus on IoT integration, AI-based monitoring, and modular energy-efficient designs.

- Competitive landscape highlights innovation in membrane systems, smart solutions, and sustainable technologies.

- High capital costs and complex installation remain key restraints in market adoption.

- North America leads with strict regulations, Europe follows with sustainability focus, and Asia Pacific grows rapidly.

- Latin America and Middle East & Africa record steady growth with rising infrastructure and industrial projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Clean and Safe Water

Growing population density and industrial expansion create pressure on freshwater resources. The need for efficient purification systems drives investment in advanced water equipment. Municipal bodies seek reliable technologies to ensure safe water distribution. Industries such as pharmaceuticals and food rely on consistent supply quality. The Water Manufacturing Equipment Market benefits from stricter regulatory frameworks. It responds to increasing health concerns by enabling higher purification efficiency and lower contamination risk.

- For instance, Pall’s pilot microfiltration system successfully treated raw water with turbidity levels as high as 450 NTU, yet still delivered filtrate turbidity under 0.1 NTU across extended operations. This performance minimized downtime and reduced the reliance on chemical pre-treatment in municipal facilities.

Technological Innovation in Treatment Processes

Rapid advancement in membrane filtration, UV treatment, and smart monitoring supports market growth. Companies integrate IoT sensors to deliver predictive maintenance and real-time water quality control. Such innovations improve equipment reliability and reduce operating costs for industries. It enables scalability across urban and rural projects. Manufacturers adopt modular designs that offer flexible installation in diverse settings. Continuous research in sustainable materials strengthens system durability and efficiency.

- For instance, ChemREADY’s Intuition-9™ controller includes 16 virtual inputs and outputs and 4 I/O slots for sensors or analog outputs. It also offers between 3 and 12 relay control outputs, Wi-Fi, Ethernet, BACnet, and Modbus/TCP interfaces, making it adaptable for various system scales.

Industrial and Agricultural Applications Expansion

Rising water consumption across heavy industries, textiles, and agriculture increases reliance on specialized equipment. Power plants demand large-scale solutions to support cooling and operational safety. Agriculture depends on water-efficient technologies to sustain irrigation and crop yield. It creates opportunities for equipment designed to manage both high-capacity and low-resource settings. Food and beverage producers integrate advanced systems to meet global safety standards. This expanding scope accelerates investments from both private and public sectors.

Environmental Regulations and Sustainability Goals

Global policies encourage industries to adopt energy-efficient and eco-friendly solutions. Strict discharge norms create demand for advanced wastewater treatment equipment. It supports water recycling and reuse, reducing overall environmental impact. Governments fund infrastructure upgrades to promote sustainable water management. Companies align with net-zero commitments by deploying low-emission technologies. These factors collectively strengthen market momentum while enhancing long-term operational resilience.

Market Trends

Integration of Smart and Connected Technologies

Manufacturers focus on smart equipment that enables real-time monitoring and predictive analytics. IoT sensors and AI-driven platforms improve water quality management and reduce downtime. Automated systems support cost efficiency and operational control for industries and municipalities. The Water Manufacturing Equipment Market sees growing demand for digital integration. It ensures higher transparency in compliance reporting and maintenance planning. Companies invest in data-driven solutions to gain a competitive edge.

- For instance, EcoWater’s latest home systems feature smart leak detection through its exclusive partnership with Phyn. These units detect pressure changes as small as a 0.03 bar variation, enabling alerts before serious issues arise.

Shift Toward Sustainable and Energy-Efficient Designs

Global emphasis on sustainability encourages adoption of energy-saving equipment. Manufacturers develop low-emission pumps, filters, and treatment systems to meet eco-regulations. Compact modular designs reduce energy use while increasing productivity. It supports industries aiming to lower carbon footprints and operational costs. Wastewater recycling technologies gain traction, reflecting the push toward circular water management. The trend aligns equipment design with long-term environmental goals.

- For instance, Kurita’s Dropwise Condensation Technology improves heat exchanger efficiency by up to 30%, which helps to reduce emissions and lower steam consumption in industrial dryers. This technology has successfully been implemented in multiple facilities, delivering significant energy savings.

Rising Adoption in Decentralized Water Systems

Growing demand for localized solutions drives interest in decentralized water treatment systems. These systems deliver flexibility for rural, industrial, and emergency use cases. Compact and mobile designs gain acceptance in regions with poor infrastructure. The market benefits from partnerships between governments and private firms to expand deployment. It allows rapid response to both planned and unplanned water supply needs. This trend reshapes investment focus toward portable and scalable technologies.

Increased Role of Advanced Filtration and Membrane Technologies

High-performance membranes dominate new product launches across multiple applications. Manufacturers refine nanofiltration and reverse osmosis solutions for better efficiency and durability. The Water Manufacturing Equipment Market leverages these innovations to meet rising purity standards. It enables industries like pharmaceuticals and food to maintain strict quality benchmarks. Growing urbanization increases demand for advanced filtration in municipal projects. Continuous improvement in membrane cost-effectiveness strengthens adoption across regions.

Market Challenges Analysis

High Capital Costs and Complex Installation Requirements

Water treatment systems demand significant upfront investments that deter small and medium enterprises. High procurement and installation costs limit adoption, particularly in developing economies. The Water Manufacturing Equipment Market faces resistance from stakeholders with limited budgets. It requires specialized infrastructure and skilled labor, further adding to overall expenses. Long payback periods discourage rapid upgrades despite growing demand. These financial barriers slow adoption in cost-sensitive industries and municipalities.

Operational Inefficiencies and Regulatory Compliance Pressure

Frequent maintenance needs and operational inefficiencies create major challenges for equipment operators. Unexpected breakdowns increase downtime and raise total ownership costs. It becomes more difficult to balance energy efficiency with strict performance requirements. Evolving global regulations demand constant technological upgrades to remain compliant. Smaller manufacturers struggle to keep pace with changing standards. The market experiences pressure to deliver reliable solutions without raising operational costs significantly.

Market Opportunities

Growing Investment in Smart and Sustainable Solutions

Rising global focus on sustainability creates strong opportunities for innovative equipment providers. Energy-efficient pumps, filtration units, and modular treatment systems meet both regulatory and corporate goals. Governments invest heavily in water infrastructure, supporting upgrades and replacements in urban and rural areas. The Water Manufacturing Equipment Market benefits from demand for smart systems with IoT integration. It allows predictive maintenance, efficient monitoring, and compliance reporting for industries. Growing interest in renewable energy integration further expands opportunities for sustainable equipment designs.

Expanding Adoption in Emerging Economies and Industrial Sectors

Emerging economies invest in water infrastructure to meet urbanization and industrialization demands. Food and beverage, pharmaceuticals, and power generation industries drive adoption of high-capacity equipment. Decentralized water treatment systems gain traction in regions with limited centralized infrastructure. It creates opportunities for compact, mobile, and scalable technologies. Rising agricultural water needs open new avenues for specialized irrigation-focused solutions. Expanding industrial applications strengthen long-term growth prospects for global equipment manufacturers.

Market Segmentation Analysis:

By Product Type

Sedimentation tanks remain a key component for large-scale water treatment projects due to their ability to remove suspended solids effectively. Filtration systems dominate adoption across residential and industrial sectors, offering reliable removal of impurities and supporting diverse applications. Disinfection equipment, particularly UV and chlorination units, gains traction with rising health concerns. Softening equipment addresses scale buildup in both residential and industrial pipelines, protecting infrastructure from long-term damage. Membrane systems, including ultrafiltration and nanofiltration, achieve strong growth with their precision and efficiency. The Water Manufacturing Equipment Market also includes other specialized systems such as aerators and advanced chemical dosing units that support niche applications.

- For instance, one configuration of the Parkson DynaSand® ENR filtration system comprises two cells, with each cell containing three 50 ft² modules for a total of 300 ft² of filtration surface area. It integrates a ChemScan nutrient analyzer to monitor parameters like nitrate, phosphate, and ammonia. Additional instrumentation is provided to monitor dissolved oxygen (DO), oxidation-reduction potential (ORP), pH, and turbidity.

By Technology

Reverse osmosis continues to lead adoption due to its effectiveness in desalination and industrial applications. Microfiltration technology supports industries requiring fine particulate removal, particularly in food and beverage processing. Clarifiers remain integral to municipal projects for primary and secondary treatment stages. Distillation, though energy intensive, retains importance in industries requiring ultra-pure water. Ion exchange technology is widely used in power generation and chemical manufacturing to ensure water quality consistency. It also includes other emerging technologies such as advanced oxidation, which enhance efficiency and align with sustainability targets.

- For instance, Evoqua’s Modulab® High Flow Water Purification System provides ultra-pure, Type 1 water at a flow rate of up to 14 liters per minute at point-of-use—ideal for applications demanding high throughput and purity.

By End-User

Residential demand grows with rising awareness of safe drinking water and rapid urbanization. Agriculture represents a major growth area, driven by the need for efficient irrigation and water recycling solutions. Chemical manufacturing depends on advanced treatment systems to ensure compliance with safety and environmental regulations. Food processing industries prioritize systems that meet strict hygiene and quality requirements, supporting adoption of disinfection and membrane equipment. Construction projects integrate water treatment systems to manage on-site needs and comply with regulatory standards. It highlights how the end-user base remains broad, reinforcing steady demand across multiple industries.

Segments:

Based on Product Type:

- Sedimentation tanks

- Filtration systems

- Disinfection equipment

Based on Technology:

- Reverse osmosis

- Microfiltration

- Clarifier

Based on End-User:

- Residential

- Agriculture

- Chemical manufacturing

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads with a 32.4 % share of the global market. Demand grows from strict water quality standards and infrastructure modernization in the US and Canada. The Water Manufacturing Equipment Market gains from high adoption of advanced filtration and monitoring systems. It supports industries such as power, pharmaceuticals, and food processing with reliable supply and regulatory compliance. Manufacturers benefit from strong private and public sector investment. It drives continuous innovation in energy-efficient and smart water solutions.

Europe

Europe holds a 27.1 % share of the global market. Governments push toward sustainability and smart water grids across Germany, France, and the UK. The Water Manufacturing Equipment Market responds with low-loss distribution systems and membrane reuse technologies. It enhances wastewater reuse and reduces environmental impact. Suppliers leverage mature infrastructure to scale tech deployment. It fosters collaboration between public utilities and private firms to boost system resilience.

Asia Pacific

Asia Pacific accounts for 22.8 % of the market. Rapid urban growth and industrialization in China, India, and Southeast Asia fuel demand for scalable water treatment solutions. The Water Manufacturing Equipment Market benefits from large-scale municipal projects and decentralized systems in peri-urban locales. It supports reverse osmosis, MBRs, and smart filtration to tackle scarcity and pollution. Investors back infrastructure upgrades and innovation in low-cost treatment. It opens strong growth potential across both developed and developing markets.

Latin America

Latin America holds the remaining share, estimated near 9 %, balancing the global total. Countries such as Brazil, Argentina, and Mexico expand water treatment capacity amid industrial and urban growth. The Water Manufacturing Equipment Market supports these developments with tailored solutions for municipal and industrial clients. It supports modernization of aging infrastructure and adoption of modular technologies. Investors focus on decentralized treatment and reuse systems. It strengthens regional capability to meet evolving water demands.

Middle East & Africa

Middle East & Africa contributes 8.8 % to the global water treatment equipment market share. The region invests in desalination, wastewater reuse, and infrastructure for water-scarce environments. The Water Manufacturing Equipment Market supplies reverse osmosis, chemical treatment, and membrane systems to support these needs. It supports government projects across Saudi Arabia, UAE, and North Africa. Manufacturers tailor solutions for resilience in harsh climates. It drives regional specialization in industrial-scale water solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Water Manufacturing Equipment Market players sech as ALAR Water Treatment, AO Smith, ChemREADY, Culligan, Evoqua Water Technologies, Ecowater, Kurita Europe GmbH, LennTech B.V., Pall Corporation, Parkson Corporation. The Water Manufacturing Equipment Market is shaped by innovation, sustainability, and digital integration. Companies focus on developing energy-efficient, modular, and smart systems that meet both regulatory and customer demands. Strong investment in research supports advancements in membrane technologies, real-time monitoring, and predictive maintenance. Competition intensifies as global and regional firms expand portfolios to serve municipal, industrial, and residential applications. Partnerships, mergers, and acquisitions play a vital role in strengthening market presence and expanding global reach. The emphasis on eco-friendly and cost-effective solutions ensures long-term growth opportunities for players across diverse end-use sectors.

Recent Developments

- In April 2025, Coca-Cola FEMSA completed seven new bottling lines, a 3.5% boost in capacity, and opened four distribution centers, while launching PLANETA PET-recycling in Mexico.

- In October 2024, WABAG secured an INR contract to establish a 100 MLD seawater desalination plant at Indosol Solar’s solar PV manufacturing site in Andhra Pradesh, India.

- In January 2024, Culligan acquired Primo Water Corporation’s international businesses across Europe. The transaction included all Primo Water EMEA businesses, except for those in the UK, Portugal, and Israel, and Aimia Foods. Due to this, Culligan now services installed water coolers, with a workforce employees and strategic locations and production sites across EMEA.

- In September 2023, A.O. Smith Corporation acquired Water Tec of Tucson, an Arizona-based water treatment company, in an all-cash transaction. Water Tec is a manufacturer and dealer of water-treatment equipment for residential, commercial, institutional, and industrial use.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for clean and safe water.

- Smart technologies and IoT integration will drive adoption across industries.

- Energy-efficient systems will gain preference due to sustainability goals.

- Membrane technologies will advance for higher efficiency and durability.

- Decentralized water systems will see greater use in rural and remote areas.

- Wastewater recycling will increase adoption in agriculture and industrial sectors.

- Regulatory pressure will encourage continuous upgrades in treatment equipment.

- Modular and portable systems will grow in popularity for flexible deployment.

- Investments in emerging economies will create new growth opportunities.

- Collaboration between governments and private firms will strengthen market presence.