Market Overview:

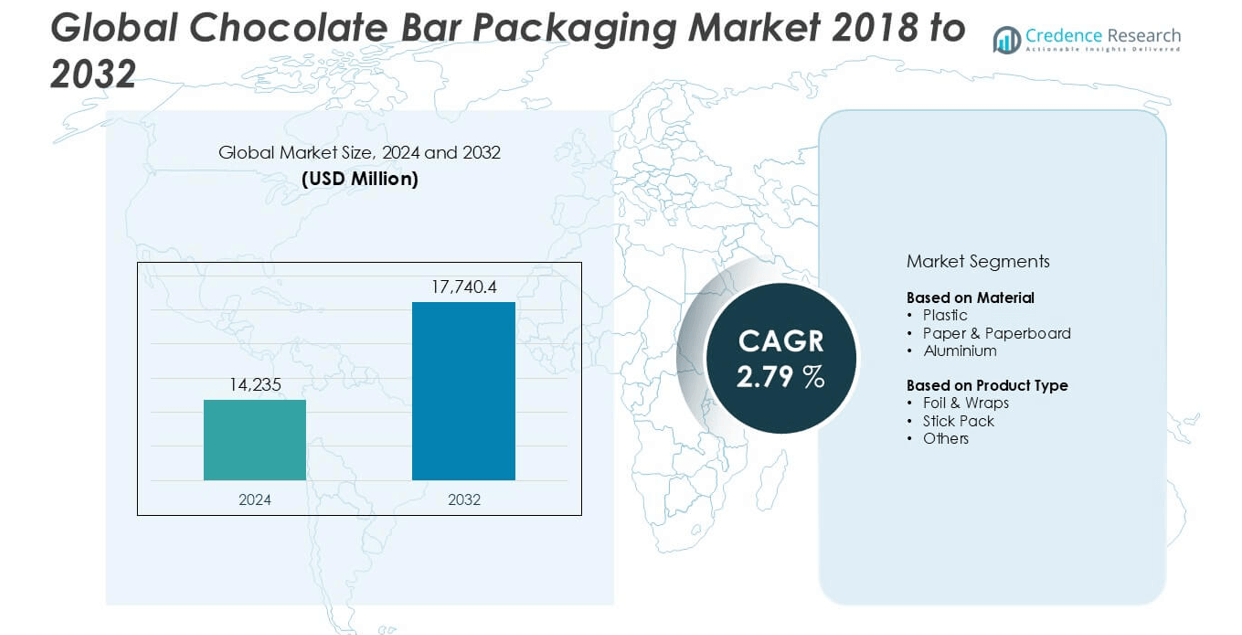

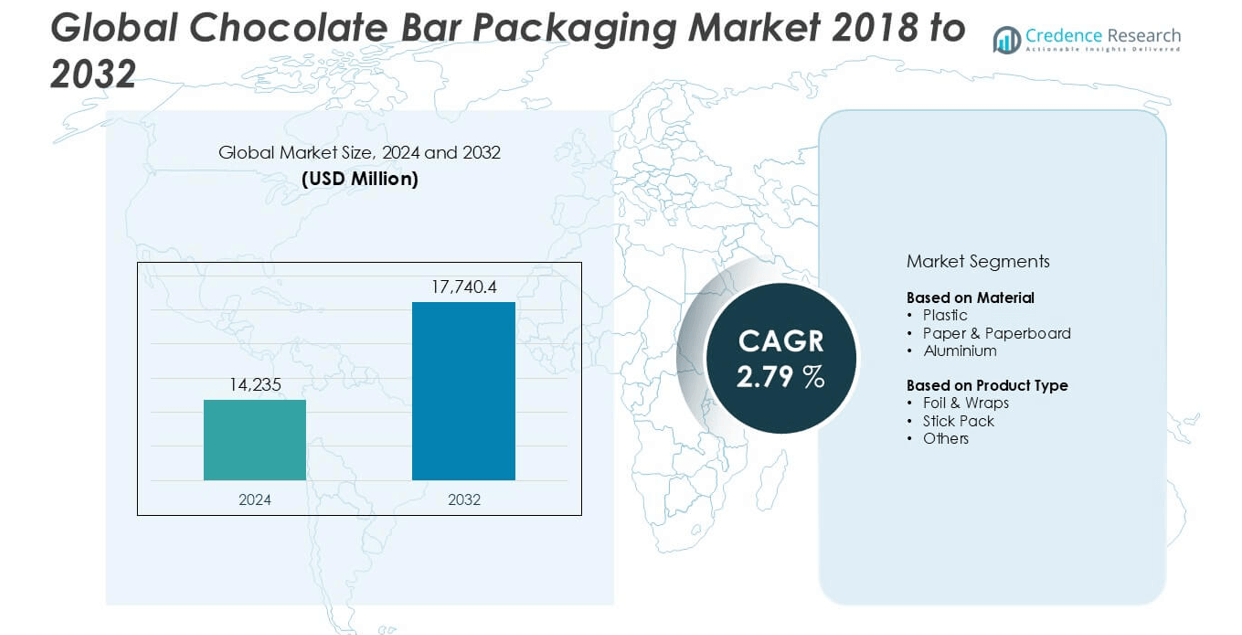

The Chocolate Bar Packaging market size was valued at USD 14,235 million in 2024 and is anticipated to reach USD 17,740.4 million by 2032, growing at a CAGR of 2.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chocolate Bar Packaging Market Size 2024 |

USD 14,235 million |

| Chocolate Bar Packaging Market, CAGR |

2.79% |

| Chocolate Bar Packaging Market Size 2032 |

USD 17,740.4 million |

The chocolate bar packaging market is highly competitive, led by prominent players such as Amcor plc, Berry Global, Huhtamaki, Constantia Flexibles, Mondi, and Uflex, among others. These companies focus on innovation, sustainability, and efficient supply chain management to strengthen their market positions. They offer a range of materials and packaging formats to cater to both premium and mass-market chocolate brands. Europe emerged as the leading region in 2024, accounting for 30% of the global market share, driven by strong demand for premium chocolates and stringent sustainability regulations. North America and Asia Pacific closely follow, supported by rising chocolate consumption and expanding retail networks.

Market Insights

- The chocolate bar packaging market was valued at USD 14,235 million in 2024 and is projected to reach USD 17,740.4 million by 2032, growing at a CAGR of 2.79% during the forecast period.

- Market growth is driven by increasing global chocolate consumption, rising demand for premium and sustainable packaging, and the shift toward single-serve and on-the-go formats.

- Trends such as the adoption of smart packaging, personalized branding, and eco-friendly materials are shaping product innovation and consumer engagement strategies.

- The market is highly competitive, with key players like Amcor, Berry Global, Huhtamaki, and Mondi investing in recyclable and high-barrier solutions, while regional companies focus on cost efficiency and customization.

- Europe held the largest regional share at 30%, followed by North America at 28% and Asia Pacific at 24%; by material, plastic led the segment, while foil & wraps dominated the product type category.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The chocolate bar packaging market, when segmented by material, is led by plastic, which accounted for the largest market share in 2024. Plastic’s dominance stems from its cost-effectiveness, superior barrier properties against moisture and contaminants, and ease of customization for branding. Its widespread use in mass-market chocolate products has further reinforced its position. However, rising environmental concerns and regulations on single-use plastics have spurred growth in paper & paperboard alternatives, especially among premium and sustainable brands. Aluminum remains a niche material, favored for its excellent protective qualities and recyclability in specific regional markets.

- For instance, Amcor launched its AmLite Ultra Recyclable packaging for chocolate applications, enabling recyclability in existing polyethylene streams and reducing carbon footprint by 64 grams of CO₂ per chocolate bar wrapper compared to traditional materials.

By Product Type:

Among the product types, foil & wraps emerged as the dominant sub-segment in 2024, capturing the highest market share due to their extensive use in both artisanal and mass-produced chocolate bars. Their flexibility, ability to preserve flavor and aroma, and compatibility with multiple packaging materials drive their popularity. Foil & wraps also support creative designs and branding, making them attractive to manufacturers. Stick packs are gaining momentum, especially in the single-serve and snack-sized chocolate bar segment, while the “others” category, including cartons and pouches, serves niche and promotional packaging needs.

- For instance, Constantia Flexibles developed EcoLamHighPlus, a high-barrier monomaterial laminate ideal for chocolate wrapping, achieving an oxygen barrier of less than 0.1 cm³/(m²·d), supporting both product freshness and recyclability.

Market Overview

Rising Global Chocolate Consumption

The increasing global demand for chocolate products, particularly in emerging economies such as India, China, and Brazil, is a key driver of chocolate bar packaging growth. A growing middle-class population, urbanization, and rising disposable incomes have boosted chocolate consumption, directly influencing the need for efficient and appealing packaging solutions. As consumers increasingly seek indulgent and convenient snacks, manufacturers are scaling up production and, in turn, investing more in high-quality and differentiated packaging to maintain product freshness and enhance brand visibility.

- For instance, Uflex commissioned a new 40,000 metric ton per annum capacity BOPET film plant to support growing chocolate packaging demand in Southeast Asia, enhancing supply chain responsiveness.

Focus on Brand Differentiation and Shelf Appeal

Intense competition among chocolate brands has led to a growing emphasis on packaging as a tool for brand identity and consumer engagement. Companies are prioritizing visually attractive and innovative packaging designs to stand out on crowded retail shelves. Premium packaging materials, personalized branding, and limited-edition designs are gaining traction. This emphasis on shelf appeal not only boosts consumer purchase intent but also fuels demand for high-quality printing, embossing, and sustainable material innovations in the chocolate bar packaging segment.

- For instance, Berry Global installed 10-color high-definition flexographic printing presses across its packaging facilities, enabling chocolate brands to achieve vivid imagery and foil-stamped effects for stronger shelf impact.

Increased Demand for Sustainable Packaging

Environmental concerns and regulatory pressures are driving the adoption of sustainable packaging in the chocolate bar market. Consumers are increasingly aware of the ecological impact of single-use plastics, prompting brands to switch to biodegradable, recyclable, or compostable materials such as paper, board, and plant-based films. Regulatory frameworks in Europe and North America particularly encourage green packaging initiatives. This shift not only addresses consumer expectations but also aligns with corporate sustainability goals, thus acting as a major growth catalyst for the market.

Key Trends & Opportunities

Growth in Single-Serve and On-the-Go Packaging Formats

Changing consumer lifestyles and increasing snacking behavior are fueling demand for single-serve and on-the-go packaging formats in chocolate bars. Stick packs and compact wrappers offer convenience, portion control, and portability, especially appealing to busy urban consumers and children. This trend opens opportunities for packaging innovations that enhance usability while maintaining barrier protection. As health-conscious consumers seek smaller indulgent treats, manufacturers are investing in compact, resealable, and visually distinct packaging formats to capture this growing market segment.

- For instance, Huhtamaki introduced Push Tab® blister packaging with a compact form factor and easy-open seal, reducing material usage by 70 milligrams per unit while maintaining product safety for confectionery products.

Adoption of Smart and Interactive Packaging

The integration of smart packaging technologies, such as QR codes, augmented reality, and digital storytelling, presents a significant opportunity in the chocolate bar packaging market. Brands are leveraging these technologies to provide consumers with transparency on sourcing, nutritional information, and traceability. Interactive packaging enhances engagement and loyalty, particularly among digitally savvy consumers. Additionally, smart packaging can support anti-counterfeiting measures and help track supply chains, making it a promising trend in premium and ethical chocolate segments.

- For instance, Nestlé incorporated scannable codes on its KitKat bars in Japan, enabling consumers to access real-time blockchain-verified data on cocoa sourcing and processing across 74 different farms via the OpenSC platform.

Key Challenges

High Cost of Sustainable Materials

While demand for eco-friendly packaging is growing, the high cost of sustainable materials poses a challenge for manufacturers, especially smaller brands with limited budgets. Recyclable and biodegradable materials often require specialized production processes and are priced higher than conventional plastic alternatives. These cost barriers can hinder widespread adoption and may lead to higher product prices, affecting competitiveness in price-sensitive markets. Balancing sustainability goals with cost-efficiency remains a critical hurdle for many players in the chocolate bar packaging industry.

Regulatory and Compliance Pressures

Packaging regulations related to food safety, labeling, and environmental impact vary across countries and regions, creating complexity for global chocolate manufacturers. Complying with diverse and evolving packaging standards—including restrictions on plastic use, mandates for recyclability, and detailed nutritional disclosures—adds to operational costs and logistical challenges. Non-compliance risks include fines, product recalls, and reputational damage. These regulatory hurdles can delay product launches and increase time-to-market, posing strategic challenges in the competitive chocolate sector.

Regional Analysis

North America

North America held a significant share of the chocolate bar packaging market in 2024, accounting for approximately 28% of global revenue. The region benefits from a well-established confectionery industry, high consumer demand for premium and sustainable chocolate products, and strong retail distribution networks. Manufacturers are investing in eco-friendly materials and advanced packaging technologies to align with regulatory frameworks and consumer preferences. The growing popularity of organic and artisanal chocolates further fuels demand for creative, high-quality packaging. The United States remains the dominant contributor, supported by large-scale production and brand-driven innovation in packaging.

Europe

Europe captured nearly 30% of the global chocolate bar packaging market in 2024, making it the leading regional contributor. The region’s stronghold in luxury and artisanal chocolates, along with stringent environmental regulations, drives demand for sustainable and recyclable packaging solutions. Countries like Germany, Switzerland, and Belgium are at the forefront of premium chocolate production, encouraging the use of paper-based and biodegradable materials. Increasing consumer consciousness regarding ethical sourcing and eco-friendly packaging supports innovation and market expansion. The European Union’s packaging waste directives are also compelling companies to adopt greener alternatives, solidifying the region’s leadership in sustainable packaging practices.

Asia Pacific

Asia Pacific accounted for approximately 24% of the global chocolate bar packaging market in 2024 and is projected to witness the fastest growth during the forecast period. Rising urbanization, a growing middle class, and increasing chocolate consumption—particularly in China, India, and Southeast Asia—are key growth drivers. Multinational and local brands are expanding production, prompting higher demand for cost-effective yet visually appealing packaging formats. With the region’s evolving retail landscape and e-commerce penetration, flexible packaging formats such as wraps and stick packs are gaining popularity. Investments in automated and scalable packaging systems are also shaping regional market dynamics.

Latin America

Latin America held about 10% of the chocolate bar packaging market share in 2024, supported by rising consumption in countries like Brazil, Mexico, and Argentina. While traditionally known as a cocoa-producing region, the region is witnessing a steady rise in chocolate product consumption, driven by urban lifestyle shifts and growing disposable incomes. Packaging demand in the region leans toward economical and functional materials like plastic and aluminum foil. However, there is growing interest in sustainable packaging as regional governments tighten environmental policies. Local brands are also exploring premium packaging to cater to niche urban segments and exports.

Middle East & Africa (MEA)

The Middle East & Africa region accounted for around 8% of the global chocolate bar packaging market in 2024. While still emerging, the market is growing due to increased chocolate consumption driven by tourism, retail expansion, and Western influence in countries like the UAE, Saudi Arabia, and South Africa. The demand for attractive and durable packaging is growing, especially for premium imported products. However, cost sensitivity remains a major factor influencing packaging choices. Gradual adoption of sustainable materials and a rise in domestic chocolate production are expected to support future market development across MEA.

Market Segmentations:

By Material:

- Plastic

- Paper & Paperboard

- Aluminium

By Product Type:

- Foil & Wraps

- Stick Pack

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the chocolate bar packaging market is characterized by the presence of several global and regional players competing on innovation, sustainability, and cost efficiency. Leading companies such as Amcor plc, Huhtamaki, Mondi, and Berry Global continue to invest in advanced packaging technologies and sustainable material development to strengthen their market positions. These players focus on offering high-barrier, visually appealing, and environmentally responsible packaging solutions to meet evolving consumer demands. Regional firms like Uflex and JBM Packaging are also gaining traction through cost-effective offerings and localized service networks. Mergers, acquisitions, and strategic collaborations are common as companies aim to expand geographic reach and enhance production capabilities. The market also sees growing competition in premium and single-serve segments, prompting innovation in design, recyclability, and convenience. Overall, the competitive environment remains dynamic, with companies striving to align with shifting regulatory standards, consumer preferences, and branding strategies in an increasingly sustainability-driven market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Uflex (India)

- Mondi (U.K.)

- KM Packaging (U.S.)

- Huhtamaki (Finland)

- Amcor plc (Switzerland)

- Catty Corporation (U.S.)

- Constantia Flexibles (Austria)

- Berry Global (U.S.)

- JBM Packaging (U.S.)

- Coveris (Austria)

Recent Developments

- In June 2024, Constantia Flexibles launched EcoTwistPaper, which is an innovative packaging solution for the confectionery industry. The new product is a wax-free twist-wrap made completely from paper, prioritizing recyclability and helping the global shift toward sustainable products.

- In June 2024, Constantia Flexibles launched EcoTwistPaper, which is an innovative packaging solution for the confectionery industry. The new product is a wax-free twist-wrap made completely from paper, prioritizing recyclability and helping the global shift toward sustainable products.

- In July 2023, Amcor announced the availability of AmFiber™ Performance Paper packaging in Latin America, which is a high-barrier, recyclable paper-based packaging solution. Launched for the confectionery market, this packaging has more than 80% paper fiber content and is PVDC-free. The material innovation is recyclable in the existing paper recycling stream.

Market Concentration & Characteristics

The Chocolate Bar Packaging Market exhibits moderate to high market concentration, with a mix of global packaging giants and regionally focused players. Large companies such as Amcor plc, Mondi, and Berry Global hold significant market shares due to their advanced manufacturing capabilities, broad geographic presence, and strong client relationships with major chocolate brands. These firms drive innovation through investments in sustainable materials, smart packaging technologies, and automated production lines. The market is characterized by high product differentiation, evolving consumer preferences, and increasing regulatory oversight on packaging waste and recyclability. Demand patterns vary by region, influenced by chocolate consumption trends, disposable incomes, and sustainability expectations. While Europe leads in eco-friendly packaging adoption, North America and Asia Pacific display strong momentum in single-serve and convenience-oriented formats. Entry barriers remain moderately high due to capital-intensive equipment requirements and strict food safety standards. Pricing pressure and the need for rapid design customization shape competitive dynamics. Companies compete not only on cost efficiency but also on visual appeal, functional integrity, and compliance with regional packaging norms.

Report Coverage

The research report offers an in-depth analysis based on Material, Product Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The chocolate bar packaging market is expected to witness steady growth driven by rising global chocolate consumption.

- Demand for sustainable and recyclable packaging materials will continue to shape product innovation.

- Flexible packaging formats such as wraps and stick packs will gain popularity due to convenience and portability.

- Brand owners will increasingly adopt premium packaging to enhance shelf appeal and consumer engagement.

- Smart packaging technologies like QR codes and augmented reality will become more common in premium product segments.

- Regulatory pressure on plastic use will accelerate the shift toward paper-based and biodegradable alternatives.

- Growth in online chocolate sales will influence packaging design with a focus on durability and presentation.

- Emerging markets in Asia Pacific and Latin America will offer significant expansion opportunities for packaging suppliers.

- Automation and digital printing in packaging production will improve speed-to-market and customization.

- Strategic collaborations and mergers will intensify as companies aim to expand capabilities and global presence.