Market Overview:

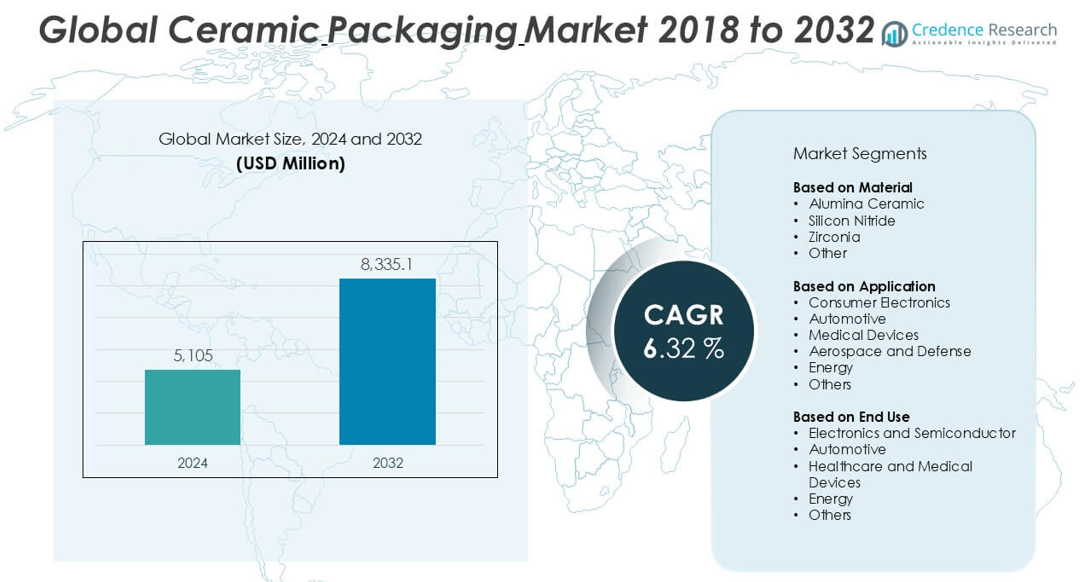

The Ceramic Packaging market size was valued at USD 5,105 million in 2024 and is anticipated to reach USD 8,335.1 million by 2032, growing at a CAGR of 6.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Packaging Market Size 2024 |

USD 5,105 million |

| Ceramic Packaging Market, CAGR |

6.32% |

| Ceramic Packaging Market Size 2032 |

USD 8,335.1 million |

The ceramic packaging market is driven by key players such as KYOCERA Corporation, MATERION CORPORATION, AdTech Ceramics, AGC Inc., StratEdge, KOA Corporation, and Remtec, Inc., each offering specialized solutions across electronics, medical, and aerospace sectors. These companies maintain a competitive edge through advanced ceramic technologies, global manufacturing capabilities, and strategic partnerships. In terms of regional dominance, Asia Pacific led the global market in 2024 with a 36% share, supported by its robust semiconductor and consumer electronics industries, particularly in China, Japan, and South Korea. North America followed with a 28% share, driven by strong demand in defense, aerospace, and medical applications.

Market Insights

- The Ceramic Packaging market was valued at USD 5,105 million in 2024 and is projected to reach USD 8,335.1 million by 2032, growing at a CAGR of 6.32% during the forecast period.

- Market growth is primarily driven by rising demand for compact, thermally stable packaging solutions in consumer electronics, power electronics, and medical devices.

- A key trend is the growing adoption of Low-Temperature Co-fired Ceramic (LTCC) and High-Temperature Co-fired Ceramic (HTCC) technologies, which enable miniaturization and improved heat dissipation in advanced applications like 5G and EVs.

- Competitive dynamics are shaped by major players such as KYOCERA Corporation, MATERION CORPORATION, AGC Inc., and AdTech Ceramics, who focus on R&D and industry-specific ceramic solutions; however, high production costs and limited design flexibility restrain broader market penetration.

- Asia Pacific led the market with a 36% share in 2024, followed by North America (28%) and Europe (24%); Alumina Ceramic dominated the material segment due to its cost-efficiency and thermal properties.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In the Ceramic Packaging market, Alumina Ceramic held the dominant market share in 2024 due to its superior thermal conductivity, mechanical strength, and cost-effectiveness. It is widely used in high-performance electronic applications, offering excellent insulation properties and resistance to corrosion. The material’s compatibility with standard fabrication processes further enhances its adoption across various industries. Rising demand for miniaturized electronic components and robust packaging solutions in semiconductor manufacturing is a key driver. While Silicon Nitride and Zirconia are gaining traction for their high temperature resistance and biocompatibility, Alumina Ceramic remains the preferred choice due to its balanced performance and affordability.

- For instance, Kyocera Corporation manufactures alumina ceramic substrates with a thermal conductivity of 24 W/m·K, and their packaging solutions support 200°C continuous operating temperature, making them suitable for power semiconductor devices and high-reliability automotive modules.

By Application:

Consumer Electronics emerged as the leading application segment in 2024, accounting for the largest share of the Ceramic Packaging market. This growth is driven by increasing demand for compact, reliable, and thermally stable packaging solutions in smartphones, tablets, and wearable devices. The miniaturization trend in consumer electronics is pushing manufacturers to adopt ceramic packaging for its ability to provide high-frequency signal integrity and heat dissipation. Moreover, the integration of advanced features such as 5G connectivity and high-performance chipsets has accelerated the need for durable packaging materials. Other applications like medical devices and aerospace are also expanding, though at a relatively moderate pace.

- For instance, Murata Manufacturing supplies ceramic-based multilayer packages for RF modules used in smartphones, with package thickness as low as 0.18 mm, enabling manufacturers to significantly reduce device size while ensuring thermal stability and electromagnetic compatibility.

By End Use:

The Electronics and Semiconductor segment dominated the Ceramic Packaging market by end use in 2024, supported by the growing production of integrated circuits, MEMS devices, and power electronics. Ceramic packaging’s ability to withstand high temperatures and harsh environments makes it ideal for advanced semiconductor devices. The rise of electric vehicles, AI-based systems, and industrial automation is also fueling demand within this segment. Additionally, increasing investments in semiconductor fabrication facilities worldwide are strengthening its market position. Although the healthcare and energy sectors are showing growth potential, electronics and semiconductor applications remain the primary driver of ceramic packaging demand.

Market Overview

Rising Demand for Miniaturized and High-Performance Electronics

The increasing demand for compact and high-performance consumer electronics, including smartphones, tablets, and wearables, is a major driver for the ceramic packaging market. Ceramic materials provide excellent thermal management, electrical insulation, and mechanical strength, which are essential for miniaturized electronic devices operating at high frequencies. As manufacturers focus on integrating more functions into smaller form factors, ceramic packaging solutions are being widely adopted to meet the stringent requirements of modern microelectronic devices.

- For instance, TDK Corporation developed embedded package modules using LTCC substrates, supporting devices with operating frequencies up to 100 GHz, enabling their integration into ultra-compact modules used in millimeter-wave communication systems.

Expansion of the Semiconductor and Power Electronics Industry

The global growth of the semiconductor and power electronics industries is significantly propelling the ceramic packaging market. Ceramic packaging is crucial for protecting semiconductor devices from thermal and mechanical stress, especially in high-power and high-frequency applications. With increasing demand for power modules in electric vehicles, renewable energy systems, and industrial automation, ceramic-based packages are becoming indispensable. The expansion of semiconductor fabrication facilities and investment in advanced IC packaging technologies further drive market growth.

- For instance, Rogers Corporation offers ceramic-based substrates with breakdown voltages exceeding 1,000 V/mm, and their curamik® HT ceramic substrate supports power densities above 200 W/cm², making them highly suitable for EV inverter and IGBT module applications.

Growing Adoption in Aerospace and Medical Devices

The aerospace and medical device sectors are increasingly adopting ceramic packaging due to its reliability in extreme environments. In aerospace applications, ceramic materials offer resistance to high temperatures, vibrations, and radiation, making them suitable for mission-critical systems. In the medical field, their biocompatibility, hermetic sealing, and miniaturization capabilities make them ideal for implantable devices and diagnostics equipment. As both sectors continue to prioritize safety, precision, and durability, the demand for ceramic packaging is expected to accelerate.

Key Trends & Opportunities

Advancements in Ceramic Packaging Technologies

Innovations in ceramic packaging processes, such as Low-Temperature Co-fired Ceramic (LTCC) and High-Temperature Co-fired Ceramic (HTCC), are creating new growth opportunities. These technologies allow the integration of multiple functions into a single compact package while enhancing thermal management and signal performance. As devices become more complex, manufacturers are investing in advanced ceramic packaging techniques to improve efficiency and reduce costs. This trend is opening up new avenues in 5G infrastructure, automotive electronics, and high-speed data transmission systems.

- For instance, Heraeus Electronics produces HTCC packages capable of integrating up to 50 metallized layers with via densities reaching 300 vias/cm², enabling compact RF modules for automotive radar and satellite communication systems.

Rising Focus on 5G and AI Applications

The proliferation of 5G networks and artificial intelligence technologies is shaping the ceramic packaging market landscape. These technologies require high-speed data processing and robust thermal management, which ceramic packages are well-suited to support. The increasing deployment of 5G base stations and edge AI devices creates a strong demand for reliable and durable electronic packaging. As industries transition to more intelligent and connected systems, ceramic packaging is becoming a critical enabler of next-generation communication and computing infrastructure.

- For instance, NGK Spark Plug Co., Ltd. (NTK Technologies) offers LTCC-based antenna modules that operate up to 86 GHz and maintain a signal loss below 0.2 dB/cm, making them suitable for mmWave 5G beamforming and AI-enhanced wireless sensing devices.

Key Challenges

High Production Costs and Complex Manufacturing Processes

One of the primary challenges in the ceramic packaging market is the high cost of raw materials and complex manufacturing processes. Unlike plastic or metal packaging, ceramics require specialized processing, including sintering and precision machining, which increases production costs. Small and mid-sized manufacturers often face barriers in adopting these technologies due to limited budgets and technical expertise. This cost factor restricts market penetration in cost-sensitive applications and regions.

Limited Design Flexibility Compared to Other Materials

Ceramic materials, while offering superior performance, often lack the design flexibility provided by polymers or metals. Their brittle nature can limit customizability and make them more prone to damage under mechanical stress during assembly or transportation. This limitation affects their suitability in applications requiring intricate shapes or high mechanical resilience. As device geometries become more complex, ceramic packaging must evolve to offer more adaptable and resilient design solutions.

Competition from Alternative Packaging Materials

The ceramic packaging market faces strong competition from alternative materials such as plastics, metals, and organic substrates. These alternatives offer lower production costs and easier manufacturability for a wide range of electronic applications. In low- to mid-performance segments, where high-end material properties are not essential, manufacturers often prefer these cost-effective options. This competitive pressure can constrain the growth potential of ceramic packaging, especially in regions with price-sensitive manufacturing ecosystems.

Regional Analysis

North America:

North America held a significant share of the ceramic packaging market in 2024, accounting for approximately 28% of global revenue. The region’s strong foothold in the semiconductor and aerospace sectors drives demand for high-reliability ceramic components. The United States, in particular, leads in advanced microelectronics and defense technologies, which require robust and thermally stable packaging solutions. Additionally, increased investments in healthcare and implantable medical devices are contributing to market growth. The region benefits from the presence of key industry players and research institutions focused on material innovation, positioning North America as a crucial hub for ceramic packaging development.

Europe:

Europe accounted for nearly 24% of the global ceramic packaging market in 2024, driven by its well-established automotive and medical device manufacturing sectors. Countries like Germany and France lead the regional market due to high R&D investments and stringent quality standards in electronics and healthcare. The growing adoption of electric vehicles and renewable energy technologies has also boosted the use of ceramic components in power modules and energy storage systems. Europe’s focus on sustainable and energy-efficient solutions, combined with advancements in industrial automation, continues to support the steady expansion of ceramic packaging across the region.

Asia Pacific:

Asia Pacific dominated the ceramic packaging market in 2024, commanding a 36% share, primarily fueled by its expansive electronics and semiconductor manufacturing base. China, Japan, South Korea, and Taiwan are major contributors, hosting leading chipmakers and consumer electronics producers. The rapid growth of 5G infrastructure, AI applications, and electric vehicle adoption further drives demand for high-performance ceramic packaging. Favorable government policies, cost-effective labor, and strong domestic demand make Asia Pacific a key production and consumption hub. As regional players continue to invest in fabrication facilities and innovation, the market is projected to maintain its lead throughout the forecast period.

Latin America:

Latin America represented around 6% of the global ceramic packaging market in 2024, with moderate growth driven by expanding electronics and automotive industries in countries such as Mexico and Brazil. The region is increasingly integrating into global semiconductor supply chains through contract manufacturing and assembly. Mexico’s proximity to North American markets enhances its attractiveness for electronics production, while Brazil is investing in healthcare infrastructure that indirectly supports ceramic component demand. However, limited domestic manufacturing capabilities and dependence on imports pose challenges. Strategic investments in infrastructure and partnerships with global players could enhance Latin America’s future market position.

Middle East & Africa:

The Middle East & Africa (MEA) accounted for nearly 6% of the ceramic packaging market in 2024. Growth in the region is primarily driven by the increasing focus on industrial diversification, particularly in the UAE and Saudi Arabia. Investment in medical technology, defense systems, and infrastructure is contributing to the gradual adoption of ceramic-based solutions. Additionally, the energy sector’s need for reliable electronic packaging in harsh environments supports regional demand. However, limited local production and technology access restrain faster adoption. International collaborations and government-led industrial initiatives are expected to create opportunities for long-term growth in MEA’s ceramic packaging market.

Market Segmentations:

By Material:

- Alumina Ceramic

- Silicon Nitride

- Zirconia

- Other

By Application:

- Consumer Electronics

- Automotive

- Medical Devices

- Aerospace and Defense

- Energy

- Others

By End Use:

- Electronics and Semiconductor

- Automotive

- Healthcare and Medical Devices

- Energy

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ceramic packaging market is characterized by the presence of several established players and specialized manufacturers focusing on innovation, reliability, and application-specific solutions. Key companies such as KYOCERA Corporation, MATERION CORPORATION, and AdTech Ceramics maintain a strong foothold through extensive product portfolios and advanced manufacturing capabilities. These players invest heavily in R&D to develop high-performance ceramic packaging for semiconductors, medical devices, and aerospace applications. Additionally, companies like KOA Corporation, AGC Inc., and StratEdge focus on expanding their market presence by offering customized solutions tailored to evolving end-user requirements. Strategic partnerships, mergers, and global expansion initiatives are common as firms aim to enhance their technological competencies and geographic reach. Smaller players and regional manufacturers contribute to market diversity by serving niche applications and offering cost-effective alternatives. Overall, the market remains moderately consolidated, with innovation, quality assurance, and end-use alignment being key differentiators driving competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AdTech Ceramics

- KOA Corporation

- StratEdge

- Croxsons

- MATERION CORPORATION

- Remtec, Inc.

- KYOCERA Corporation

- AGC Inc.

- E Pack Polymers Private Limited

- Innova Maquinaria Industrial

Recent Developments

- In October 2024, CeramTec, the high-performance ceramics specialist, introduced a BNT-BT-based piezo ceramic that performs similarly to conventional PZT piezo ceramics for several applications as it does not contain lead. The company showcased its lead-free piezo ceramic solutions from Enlit Europe in Milan.

- In October 2024, RAK Ceramics, the world’s leading lifestyle solutions provider in the ceramics industry, declared the signing of a framework agreement with Sobha Constructions LLC, a leading multinational construction company. With this agreement, RAK Ceramics will be the exclusive partner offering premium ceramics and porcelain tiles for Sobha’s future projects.

- In August 2024, Kyocera Corporation held a groundbreaking ceremony to commence construction of its innovative production facility at the Minami Isahaya Industrial Park in Isahaya City, Nagasaki Prefecture. The company acquired about 150,000 square meters of land for factory construction in the industrial park area.

- In March 2023, StratEdge launched its innovative molded ceramic semiconductor packages at the IMAPS Device Packaging, APEC, and GOMACTech conferences, which held in Arizona, U.S. These packages are designed for high-frequency applications and are particularly suited for demanding gallium arsenide (GaAs) and gallium nitride (GaN) devices. The showcased products emphasize thermal efficiency and reliability, catering to various markets including telecommunications, military, and clean energy.

- In March 2023, Kyocera Corporation has announced that it will be acquiring 100% ownership of NIXKA S.A.S., an inkjet prints engine and system manufacturer. As a result of this acquisition, NIXKA will be renamed to KYOCERA NIXKA Inkjet Systems S.A.S. and will be headquartered in Aubagne, France.”

Market Concentration & Characteristics

The Ceramic Packaging Market exhibits moderate to high market concentration, with a few global players holding significant shares. Companies such as KYOCERA Corporation, MATERION CORPORATION, and AGC Inc. dominate due to their strong technical expertise, broad product portfolios, and established customer bases across industries. It features high entry barriers, driven by complex manufacturing processes, capital-intensive production, and stringent quality requirements. The market prioritizes reliability, thermal stability, and miniaturization, which makes it particularly attractive to sectors like semiconductors, aerospace, and medical devices. Demand remains driven by technological innovation, particularly in applications requiring high performance under extreme conditions. Regional clusters in Asia Pacific, especially in Japan, South Korea, and China, contribute significantly to global output. North America and Europe continue to lead in R&D activities and specialized applications. Price sensitivity varies across end-use sectors, with consumer electronics demanding cost-effective solutions, while aerospace and healthcare focus on performance. The market maintains a steady growth trajectory due to increasing demand for advanced electronic packaging and robust component protection.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ceramic packaging market is expected to witness steady growth driven by advancements in high-frequency and power electronics.

- Demand for compact, durable, and thermally efficient packaging solutions will continue to rise with the proliferation of 5G and AI technologies.

- The semiconductor industry will remain a major consumer of ceramic packaging due to the need for heat resistance and signal integrity.

- Increasing adoption of electric vehicles will boost the use of ceramic components in power modules and battery systems.

- Medical device manufacturers will increasingly prefer ceramic packaging for its biocompatibility and reliability in implantable devices.

- Emerging technologies such as quantum computing and photonics will create new application avenues for ceramic packaging.

- Growth in aerospace and defense sectors will drive demand for hermetic and high-temperature packaging solutions.

- Asia Pacific will continue to lead the market due to large-scale electronics manufacturing and expanding infrastructure.

- Manufacturers will invest more in LTCC and HTCC technologies to meet evolving performance and miniaturization requirements.

- Environmental regulations and sustainable manufacturing practices will shape future innovations in ceramic packaging materials.