Market Overview

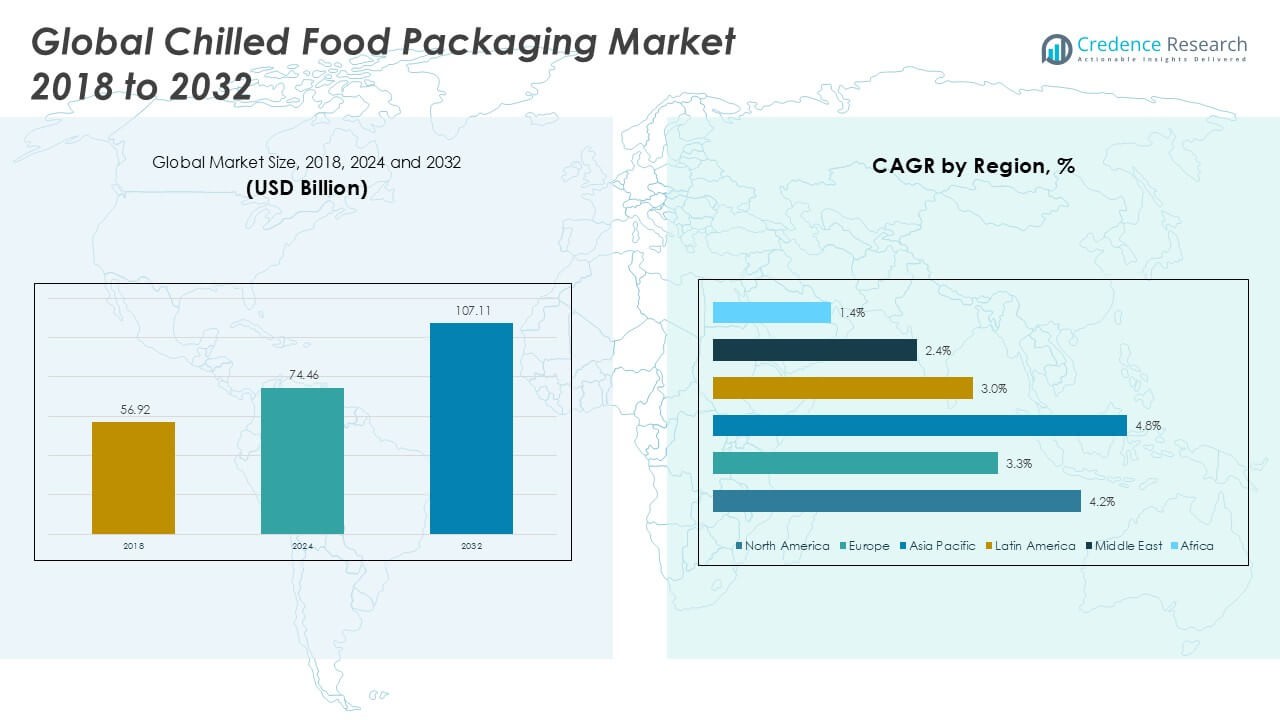

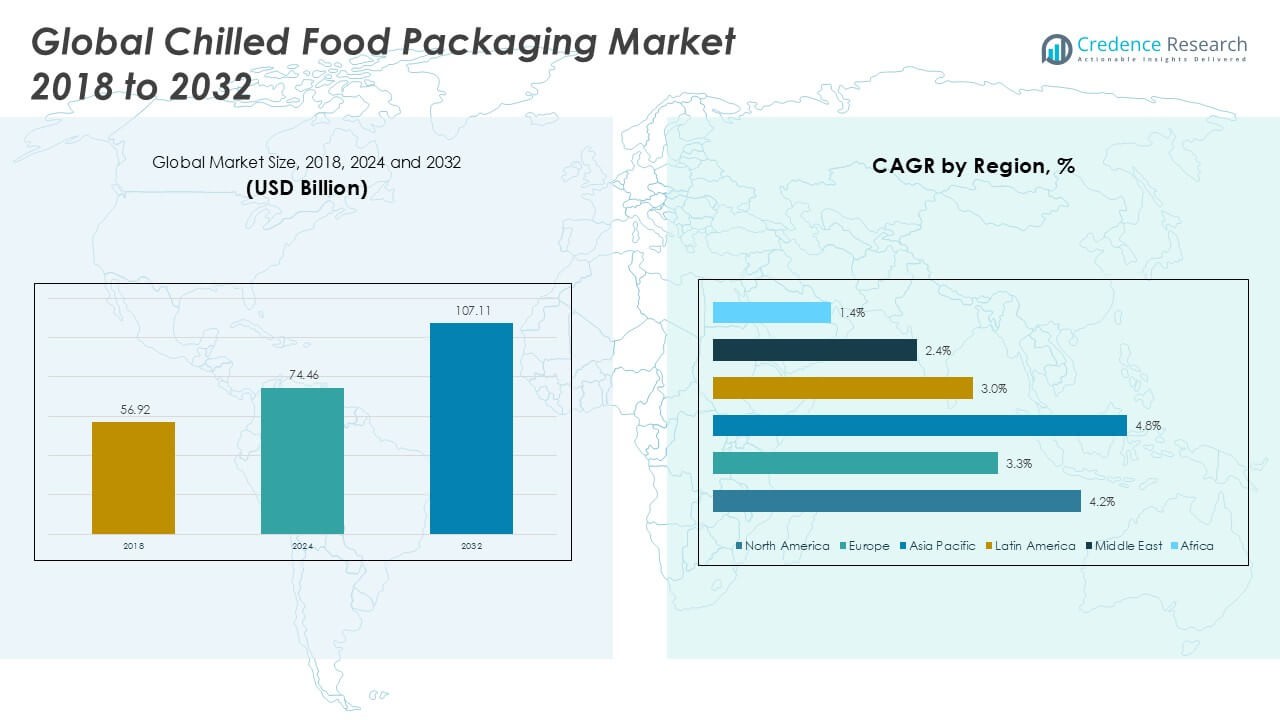

Chilled Food Packaging market size was valued at USD 56.92 billion in 2018, reached USD 74.46 billion in 2024, and is anticipated to reach USD 107.11 billion by 2032, at a CAGR of 4.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chilled Food Packaging Market Size 2024 |

USD 74.46 Billion |

| Chilled Food Packaging Market, CAGR |

4.33% |

| Chilled Food Packaging Market Size 2032 |

USD 107.11 Billion |

The chilled food packaging market is led by major players such as Amcor Limited, Berry Global, Sealed Air Corporation, Mondi Group, Tetra Pak International, Huhtamaki Oyj, WestRock Company, DS Smith Plc, Sonoco Products, and Oji Holdings Corporation. These companies focus on sustainable materials, high-barrier films, and innovative packaging formats to meet growing demand for fresh and ready-to-eat foods. North America holds the largest market share at 44%, driven by strong demand for packaged meat, dairy, and convenience foods supported by advanced cold-chain infrastructure. Europe follows with 28% share, emphasizing recyclable and compostable solutions under strict EU regulations. Asia Pacific, with 18%, is the fastest-growing region due to rising retail expansion, e-commerce, and investments in cold-chain logistics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chilled food packaging market was valued at USD 56.92 billion in 2018, reached USD 74.46 billion in 2024, and is projected to hit USD 107.11 billion by 2032, growing at a CAGR of 4.33%.

- Rising demand for fresh, convenient, and ready-to-eat foods drives adoption of advanced packaging formats such as MAP trays, vacuum packs, and resealable pouches to extend shelf life.

- Key trends include a strong shift toward recyclable PET trays, compostable films, and automation-friendly packaging, alongside growing investment in smart packaging technologies.

- The market is competitive, with Amcor, Berry Global, Sealed Air, Mondi, and Tetra Pak leading through product innovation and sustainability strategies, while regional players focus on cost-effective and localized solutions.

- North America holds 44% share, followed by Europe at 28% and Asia Pacific at 18%; meat, poultry, and seafood packaging remain the dominant product segment globally.

Market Segmentation Analysis:

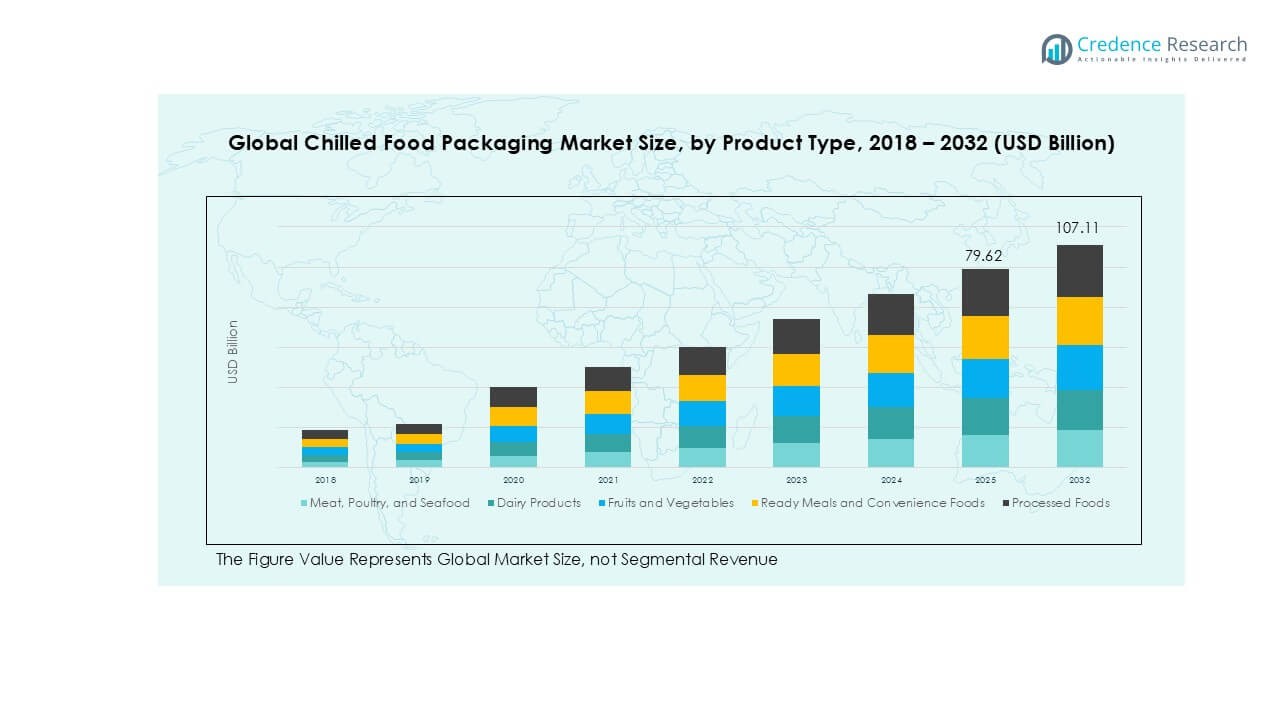

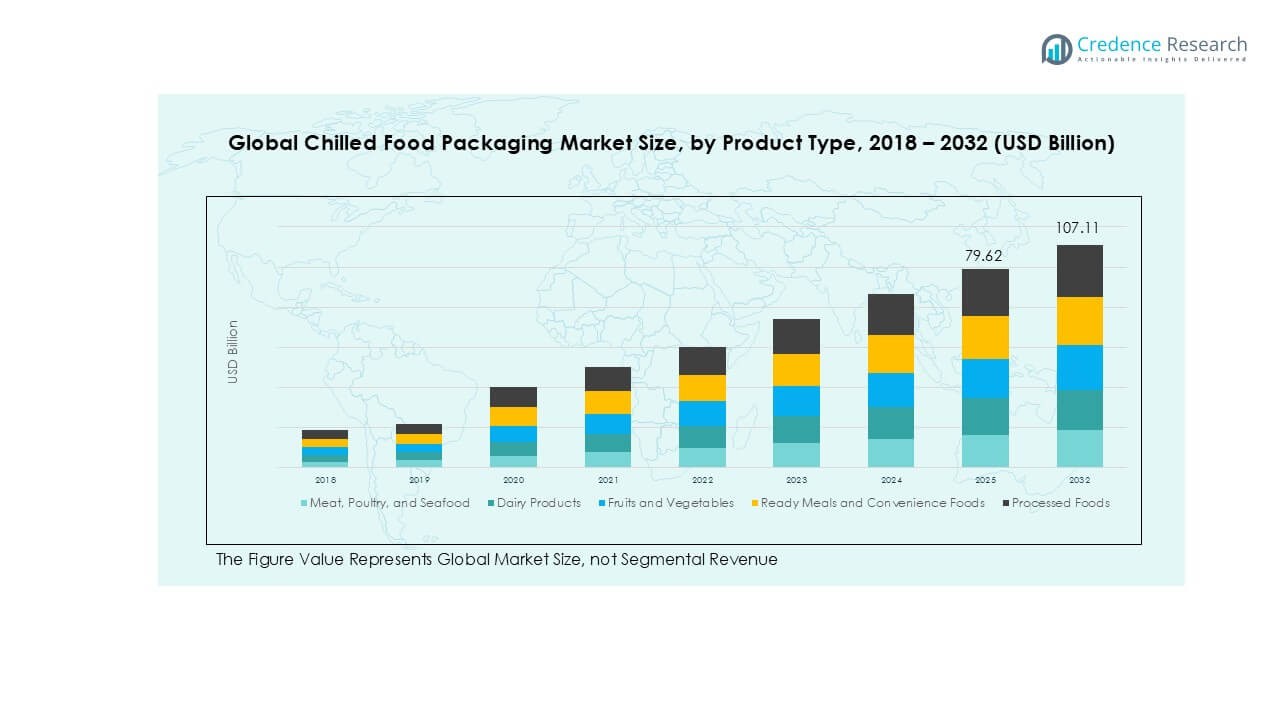

By Product Type

Meat, poultry, and seafood lead the chilled food packaging market, accounting for the largest revenue share. This dominance is driven by the high perishability of animal protein products, requiring advanced packaging solutions to extend shelf life and ensure food safety. Modified atmosphere packaging (MAP) and vacuum-sealed trays are widely used to preserve freshness during transport and retail display. Demand for packaged ready-to-cook meat and seafood products continues to rise with changing consumer lifestyles. Dairy products and ready meals follow as key segments, supported by growth in urban consumption and demand for convenient, portioned packaging formats.

- For instance, in 2023, Tetra Pak delivered 179 billion food and beverage packages worldwide, a figure that includes both chilled and shelf-stable cartons. This large volume of packaging reflects strong demand in the ready-to-drink (RTD) market for products like milk and yogurt, among other segments.

By Material

Plastic remains the most widely used material, holding the largest share of the chilled food packaging market. PET and HDPE dominate due to their durability, transparency, and ability to maintain product integrity under chilled conditions. The segment benefits from cost-effectiveness, lightweight properties, and compatibility with automation-friendly packaging lines. Sustainability initiatives encourage the use of recyclable and bio-based plastics, which attract investments from major packaging producers. Paper and paperboard gain traction in secondary packaging, while aluminum foil serves high-barrier applications. Glass and other materials hold niche demand in premium food segments.

- For instance, in 2023, Amcor’s AmPrima™ range of recycle-ready flexible packaging received recognition for its work with Cathedral City cheese and was also named a winner in the Australian Financial Review Sustainability Leaders List for replacing non-recyclable materials in Australia and New Zealand.

By Packaging Type

Rigid packaging dominates the chilled food packaging market, driven by its strength, stackability, and ability to protect products during transit. Plastic trays, tubs, and clamshells are extensively used for meat, seafood, and ready meals where tamper evidence and leak resistance are critical. Growth in flexible packaging is supported by lightweight pouches and films, offering cost savings and reduced environmental footprint. Semi-rigid and vacuum packaging cater to extended shelf-life applications, particularly for processed meats and cheeses. The demand for sustainable rigid packaging made from recycled content is also rising, driven by retailer commitments and consumer preference for eco-friendly solutions.

Key Growth Drivers

Rising Demand for Fresh and Convenient Foods

The growing preference for fresh, ready-to-eat, and minimally processed foods fuels market demand. Urban consumers increasingly seek convenience without compromising product quality. This drives adoption of advanced chilled packaging solutions like vacuum-sealed trays, modified atmosphere packaging (MAP), and resealable pouches. These solutions extend shelf life while maintaining taste and nutrition. Rising working populations and dual-income households boost demand for quick meal options, directly supporting the growth of chilled packaging solutions across meat, dairy, and ready meal categories.

- For instance, Sealed Air’s CRYOVAC brand of food packaging provides solutions for meat and poultry products to extend freshness for customers worldwide.

Expansion of Retail and E-commerce Distribution

Supermarkets, hypermarkets, and online grocery platforms are expanding chilled food availability, driving packaging demand. Efficient cold-chain infrastructure allows safe transportation and storage of perishable products. Packaging plays a critical role in maintaining temperature control and product appeal across diverse retail channels. Growth in e-commerce food delivery services further boosts demand for leak-proof, tamper-evident, and insulated packaging formats. This trend is especially strong in emerging markets where organized retail penetration is increasing.

- For instance, in 2024, Walmart operated over 4,600 stores in the U.S., with plans to expand and improve its grocery pickup and delivery services. The company is modernizing its supply chain with new and expanded high-tech distribution centers, and expanding its InHome delivery service to more households. For its online grocery services, temperature-controlled packaging is necessary for fresh and frozen items to ensure safety and quality.

Advances in Packaging Materials and Technology

Innovations in barrier materials, biodegradable plastics, and smart packaging technologies support market growth. High-performance plastics like PET and LDPE improve product protection, while recyclable materials meet sustainability goals. Smart packaging solutions with temperature indicators and QR codes enhance supply chain transparency and consumer trust. Automation-friendly designs also enable cost-efficient large-scale production. These advancements improve operational efficiency for manufacturers while aligning with global regulations on food safety and waste reduction.

Key Trends & Opportunities

Shift Toward Sustainable Packaging Solutions

Growing regulatory pressure and consumer awareness drive adoption of eco-friendly chilled packaging materials. Companies invest in recyclable PET trays, compostable films, and paper-based solutions to reduce plastic waste. Circular economy initiatives encourage packaging manufacturers to use recycled content and design for reusability. This trend presents opportunities for players to differentiate through sustainable innovation and capture environmentally conscious customers.

- For instance, Huhtamaki introduced its Push Tab® blister lid, made with 100% mono-material PET, in 2022. The product improves sustainability by replacing the aluminum in traditional blister packs and making the packaging recyclable.

Growth of Ready Meals and Plant-Based Products

Demand for convenient, healthy, and plant-based meal options is rising globally, creating strong opportunities for chilled packaging suppliers. Packaging formats that support extended shelf life without preservatives, such as vacuum-sealed pouches and MAP trays, are in high demand. Manufacturers offering tailored packaging for plant-based proteins, vegan meals, and premium ready-to-eat products can capture a growing niche segment with higher margins.

- For instance, in 2023, Nestlé launched several new plant-based products, including fish alternatives under its Garden Gourmet brand in Europe. However, the company also scaled back some of its plant-based retail offerings in certain markets, such as the UK and Ireland, during the same year due to slower market growth.

Key Challenges

High Cost of Sustainable Materials

While demand for eco-friendly solutions is rising, the cost of recyclable and biodegradable materials remains high. Manufacturers face challenges in balancing sustainability goals with price-sensitive consumer markets. The higher cost of innovation and material sourcing can limit adoption, particularly in developing regions with lower purchasing power.

Stringent Food Safety and Regulatory Compliance

Compliance with global food safety standards, labeling laws, and environmental regulations is becoming more complex. Manufacturers must invest in high-quality materials and testing processes to meet safety requirements. Failure to comply can result in recalls, penalties, and brand reputation damage, creating operational and financial risks for packaging companies.

Regional Analysis

North America

North America leads the chilled food packaging market with a 44% share in 2018, valued at USD 25.12 billion. The market grew to USD 32.52 billion in 2024 and is projected to reach USD 46.91 billion by 2032, at a CAGR of 4.4%. Growth is driven by strong demand for packaged meat, dairy, and ready meals, supported by advanced cold-chain systems. High adoption of modified atmosphere packaging (MAP) and focus on sustainable materials strengthen market expansion. Regulatory compliance and consumer preference for eco-friendly packaging continue to drive innovation across the region.

Europe

Europe accounted for 28% of the market in 2018 with USD 15.84 billion and reached USD 19.97 billion in 2024. It is expected to hit USD 27.01 billion by 2032 at a CAGR of 3.5%. Market growth is influenced by rising consumption of dairy, processed foods, and convenience meals. EU circular economy initiatives push adoption of recyclable and compostable packaging materials. Western Europe remains the largest contributor, with strong demand from large retailers and strict food waste reduction policies encouraging advanced chilled food packaging solutions.

Asia Pacific

Asia Pacific held an 18% share in 2018, valued at USD 10.51 billion, and increased to USD 14.94 billion in 2024. The market is forecast to reach USD 24.46 billion by 2032, growing at the highest CAGR of 6.0%. Rising disposable incomes, urbanization, and retail expansion drive consumption of packaged chilled foods. Growing online food delivery platforms boost demand for tamper-evident and secure packaging. Investments in cold-chain logistics and sustainable solutions across China, India, and Japan are key contributors to regional market growth.

Latin America

Latin America contributed 5% of the global market in 2018 with USD 2.76 billion and expanded to USD 3.56 billion in 2024. It is projected to reach USD 4.55 billion by 2032, growing at a CAGR of 2.8%. Demand is supported by rising consumption of chilled meat, dairy, and processed foods in Brazil, Argentina, and Mexico. Retail expansion and quick-service restaurants drive packaging demand. However, infrastructure gaps and economic fluctuations remain key challenges, prompting suppliers to focus on cost-efficient, durable packaging formats.

Middle East

The Middle East represented 3% of the market in 2018, valued at USD 1.66 billion, and rose to USD 1.99 billion in 2024. It is expected to reach USD 2.43 billion by 2032, registering a CAGR of 2.2%. Growth is supported by strong demand for imported chilled foods and expanding retail infrastructure in GCC countries. Investment in cold storage facilities and packaging that withstands high temperatures drives adoption. High-barrier films and temperature-resistant packaging formats remain in focus for long-distance transportation and food quality maintenance.

Africa

Africa accounted for 2% of the market in 2018 with a value of USD 1.04 billion and reached USD 1.48 billion in 2024. It is forecast to achieve USD 1.76 billion by 2032 at a CAGR of 1.8%. Rising urbanization and increasing awareness of packaged food safety contribute to market growth. South Africa dominates regional demand due to expanding organized retail and higher chilled food consumption. Infrastructure challenges and price sensitivity slow adoption, creating opportunities for affordable, durable, and easy-to-distribute chilled food packaging solutions.

Market Segmentations:

By Product Type

- Meat, Poultry, and Seafood

- Dairy Products

- Fruits and Vegetables

- Ready Meals and Convenience Foods

- Processed Foods

By Material

- Plastic (PET, HDPE, PVC, LDPE)

- Paper & Paperboard

- Aluminum Foil

- Glass

- Others

By Packaging Type

- Rigid Packaging

- Flexible Packaging

- Semi-Rigid Packaging

- Vacuum Packaging

- Others

By End Use

- Food Service

- Retail

- Online Food Delivery and E-commerce

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The chilled food packaging market is highly competitive, with global and regional players focusing on product innovation, sustainability, and strategic partnerships. Leading companies such as Amcor Limited, Berry Global, Sealed Air Corporation, Mondi Group, and Tetra Pak International dominate the market with strong distribution networks and diversified product portfolios. These players invest heavily in recyclable and compostable packaging solutions to meet rising sustainability demands. Mergers, acquisitions, and collaborations are common strategies to expand geographic presence and strengthen technological capabilities. Regional players such as Huhtamaki Oyj, WestRock Company, and DS Smith Plc compete by offering cost-efficient, customized solutions for local markets. Continuous R&D efforts drive innovation in high-barrier films, lightweight materials, and automation-friendly formats. Competitive intensity remains high as companies strive to balance cost efficiency, regulatory compliance, and consumer demand for eco-friendly, high-performance packaging formats across meat, dairy, and ready-meal segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor Limited

- Berry Global, Inc.

- Sealed Air Corporation

- Mondi Group

- Sonoco Products Company

- Tetra Pak International S.A.

- Huhtamaki Oyj

- WestRock Company

- DS Smith Plc

- Oji Holdings Corporation

Recent Developments

- In June 2025, Mondi Group launched a product named ‘Grow&Go’. This innovative packaging theme was introduced specially for agricultural products. Right from farms, the products can be kept fresh throughout their shelf-life. The innovative product has received enormous demand.

- In May 2025, Amcor and Metsä Group announced a partnership to develop molded fiber-based food packaging, focusing on sustainability and recyclability for chilled and frozen products.

- In 2025, Berry Global outlined circular packaging solutions at Foodex 2025, including mono-materials for enhanced recyclability and increased recycled content in shrink films and stretch wrap for pallets.

- In June 2023, Amcor Ltd. acquired Bemis Company Inc., where the acquisition of Bemis Company brings additional capabilities, scale and footprint that strengthened Amcor’s industry leading value proposition. Amcor is responsible for food packaging, beverage, pharmaceutical, personal care and consumer products.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Packaging Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and recyclable packaging will rise due to strict environmental regulations.

- Adoption of bio-based plastics and compostable films will expand across major food categories.

- Smart packaging with freshness indicators and QR codes will gain popularity for transparency.

- Automation in packaging lines will grow to improve efficiency and reduce operational costs.

- Flexible packaging formats will see higher adoption for ready meals and convenience foods.

- Cold-chain infrastructure investments will strengthen in Asia Pacific and emerging markets.

- E-commerce and online food delivery will create demand for tamper-evident and secure packaging.

- Lightweight packaging materials will gain traction to reduce transportation and logistics costs.

- Regional players will collaborate with retailers to offer cost-effective, localized solutions.

- Circular economy initiatives will drive innovation in reusable and recyclable chilled packaging systems