Market Overview:

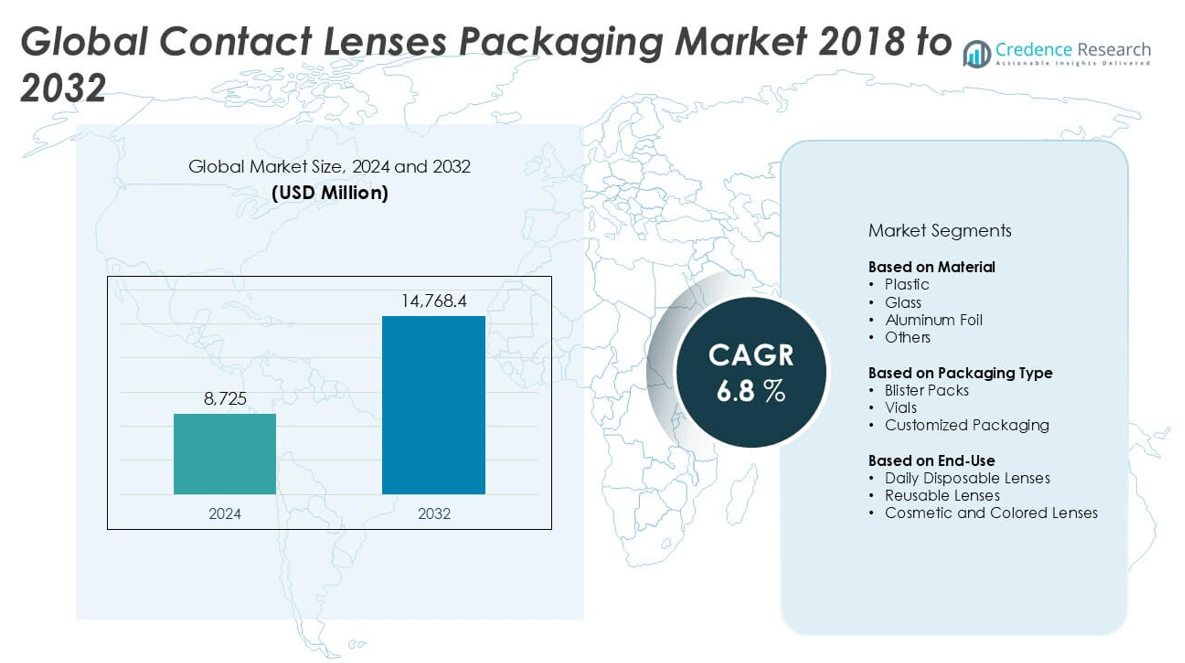

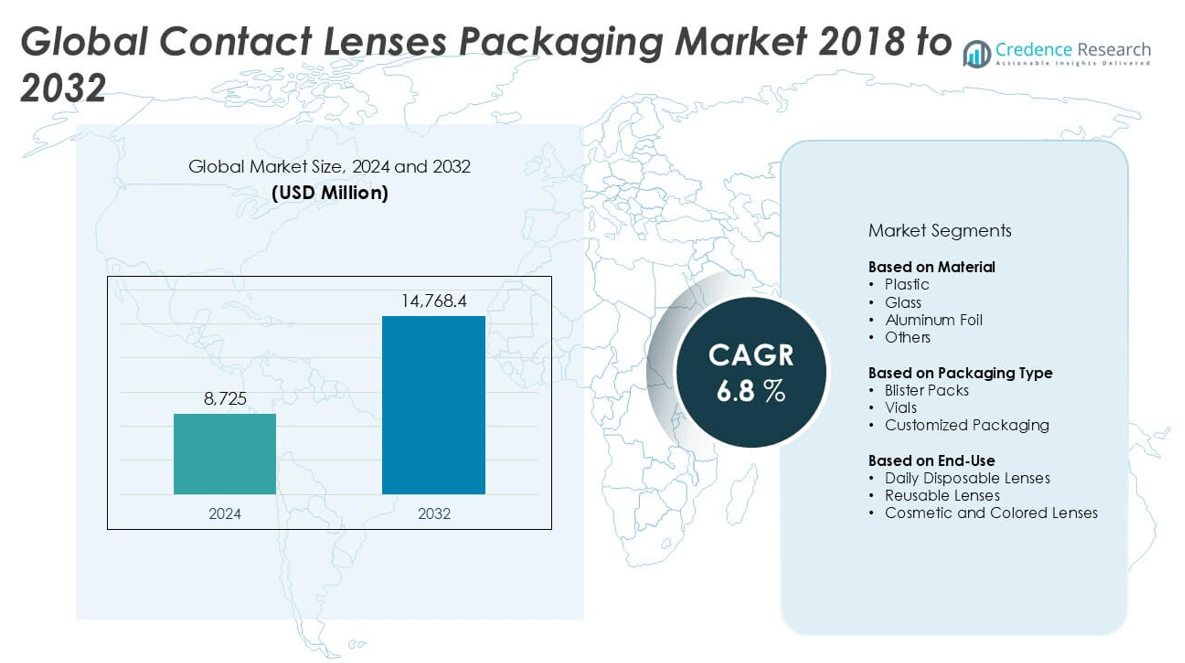

The Contact Lenses Packaging market size was valued at USD 8,725 million in 2024 and is anticipated to reach USD 14,768.4 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connected Packaging Market Size 2024 |

USD 8,725 million |

| Connected Packaging Market, CAGR |

6.8% |

| Connected Packaging Market Size 2032 |

USD 14,768.4 million |

The Contact Lenses Packaging market is led by key players such as Johnson & Johnson Vision Care, CooperVision, Bausch + Lomb, Alcon Inc., Menicon Co., Ltd., HOYA Corporation, and SEED Co., Ltd. These companies maintain strong market positions through product innovation, global distribution, and emphasis on sustainable packaging solutions. North America emerged as the leading region in 2024, capturing over 30% of the global market share, driven by high adoption of daily disposable lenses, advanced healthcare infrastructure, and strong presence of major manufacturers. Europe and Asia Pacific follow closely, supported by rising consumer awareness, increasing demand for cosmetic lenses, and expanding vision care access.

Market Insights

- The Contact Lenses Packaging market was valued at USD 8,725 million in 2024 and is projected to reach USD 14,768.4 million by 2032, growing at a CAGR of 6.8% during the forecast period.

- Growth is primarily driven by the rising demand for daily disposable lenses due to hygiene benefits, convenience, and increased consumer awareness of eye health.

- Sustainability trends are reshaping the market, with manufacturers shifting towards eco-friendly materials and smart packaging solutions, especially in the cosmetic and premium lens categories.

- The market is moderately consolidated, with leading players like Johnson & Johnson Vision Care, CooperVision, Bausch + Lomb, and Alcon dominating through innovation, global reach, and strategic collaborations.

- North America held the largest share in 2024 at over 30%, followed by Asia Pacific with 28%, while plastic material and blister packs emerged as the dominant segments due to cost-efficiency and user convenience.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In the Contact Lenses Packaging market, the plastic segment holds the dominant position, accounting for the largest market share in 2024. This is primarily due to plastic’s lightweight nature, low cost, and high flexibility in manufacturing, making it the preferred material for mass production of blister packs and vials. Moreover, its compatibility with various sterilization methods supports its widespread use. While glass and aluminum foil are utilized in niche applications for their barrier properties and durability, their higher cost and fragility limit broader adoption compared to plastic alternatives.

- For instance, Alcon’s manufacturing facilities in Texas and Singapore utilize over 2,000 metric tons of high-grade polypropylene annually for their blister pack production lines, specifically designed to handle daily disposable lenses.

By Packaging Type

Blister packs emerge as the leading packaging type, commanding a significant market share owing to their user convenience, tamper-evidence, and cost-effective production. These packs are extensively used for daily disposable lenses, allowing easy, sterile single-use application. Vials, although traditionally popular, are now limited to reusable lenses due to their bulkier form and higher material usage. Customized packaging is gaining traction, particularly in premium and cosmetic lenses, driven by brand differentiation and consumer preferences, but it still represents a smaller market share compared to blister packs.

- For instance, CooperVision operates an automated production system in their Costa Rica facility that produces approximately 240,000 blister packs per hour using high-throughput thermoforming lines.

By End-Use

Daily disposable lenses dominate the end-use segment, capturing the largest market share due to increasing consumer demand for convenience, hygiene, and reduced risk of eye infections. The growth of the urban population and improved awareness of eye health further fuel this trend. Reusable lenses hold a moderate share, preferred by long-term users seeking cost-efficiency. Meanwhile, cosmetic and colored lenses represent a growing niche, propelled by fashion trends and rising popularity among younger consumers, especially in Asia-Pacific markets. However, they remain secondary to the strong performance of daily disposable lenses.

Market Overview

Rising Demand for Daily Disposable Lenses

The growing popularity of daily disposable contact lenses significantly drives the Contact Lenses Packaging market. Consumers increasingly prefer single-use lenses for their convenience, hygiene benefits, and reduced risk of infections. This shift is leading to higher consumption volumes, thereby boosting demand for cost-effective and sterile packaging solutions like blister packs. Manufacturers are responding with scalable, high-speed packaging lines to meet the rising demand, particularly in developed markets such as North America and Europe. The trend aligns with consumers’ busy lifestyles and enhances recurring sales, contributing to market expansion.

- For instance, Johnson & Johnson Vision Care’s Jacksonville, Florida facility houses over 30 high-speed packaging lines, each capable of producing more than 18,000 units per hour for daily disposable lenses.

Expanding Vision Care Awareness

Increased global awareness about eye health and the importance of vision correction is fueling the adoption of contact lenses, consequently driving packaging demand. Government-led healthcare initiatives, eye care campaigns, and improving access to optometry services in emerging markets are key contributors. As more consumers undergo vision screening and correction, the demand for safe, reliable, and user-friendly packaging formats rises. The growth is particularly strong in Asia Pacific and Latin America, where large populations and rising middle-class income levels are expanding the consumer base for both corrective and cosmetic contact lenses.

- For instance, SEED Co., Ltd. expanded its retail distribution in Indonesia and the Philippines in 2023, resulting in the shipment of over 75 million daily lenses annually—each requiring individual sterile blister packaging.

Advancements in Packaging Technology

Technological innovations in packaging materials and design are enhancing product safety, shelf life, and user convenience, thereby propelling market growth. The development of moisture-resistant, tamper-proof, and eco-friendly packaging formats has attracted the attention of both consumers and regulatory bodies. Smart packaging technologies, such as QR code-enabled blister packs for product traceability and usage guidance, are gaining traction. These advancements not only improve user experience but also align with sustainability goals and compliance requirements, positioning them as vital growth enablers in an increasingly competitive market landscape.

Key Trends & Opportunities

Sustainability and Eco-Friendly Packaging

Sustainable packaging has become a prominent trend in the Contact Lenses Packaging market, driven by increasing environmental awareness and regulatory pressure. Consumers are favoring recyclable, biodegradable, or reusable packaging materials over traditional plastic formats. Major brands are responding with initiatives to reduce plastic use, adopt post-consumer recycled (PCR) materials, and implement take-back programs. This shift offers an opportunity for innovation in green packaging solutions, allowing companies to differentiate their offerings while aligning with global sustainability standards and gaining favor with environmentally conscious consumers.

- For instance, Bausch + Lomb’s ONE by ONE recycling program in partnership with TerraCycle has collected over 63 million used blister packs and lens cases in the U.S. since its launch, marking a significant effort toward packaging circularity.

Customization and Aesthetic Appeal

As cosmetic and colored contact lenses gain popularity, especially among younger consumers, there is rising demand for visually attractive and customized packaging. Brands are leveraging premium packaging designs, personalized formats, and influencer collaborations to appeal to fashion-forward users. This trend presents opportunities for packaging providers to deliver unique, brand-enhancing designs that cater to niche customer segments. Customization also allows companies to position their products as lifestyle accessories, thereby increasing product value and improving customer engagement in a highly competitive marketplace.

- For instance, Menicon Co., Ltd. launched their Magic 1Day lenses with a patented flat-pack design measuring just 1 mm thick, which combines aesthetic appeal with ultra-compact form factor to differentiate in premium and travel-oriented markets.

Key Challenges

Environmental Concerns Around Plastic Use

Despite plastic’s dominance in contact lens packaging due to its affordability and functional advantages, its environmental impact presents a major challenge. The increasing volume of non-biodegradable waste generated from single-use blister packs and vials is drawing criticism from both consumers and regulators. As environmental regulations tighten, manufacturers face pressure to innovate sustainable alternatives without compromising product safety. Transitioning to eco-friendly materials while maintaining cost efficiency remains a complex issue that could hinder growth if not addressed effectively.

High Cost of Sustainable Alternatives

While eco-friendly packaging is gaining momentum, the higher production cost associated with biodegradable or recyclable materials poses a barrier for widespread adoption. Small and mid-sized manufacturers, in particular, may struggle to transition due to limited resources and production scalability. Additionally, price-sensitive markets in developing regions may resist cost increases associated with sustainable packaging. Bridging this gap between affordability and environmental responsibility requires significant investment and innovation, making it a key challenge for the market’s broader transformation.

Complex Regulatory Compliance

Contact lenses are classified as medical devices, requiring packaging to meet strict health and safety regulations. Compliance with regional standards, such as FDA (U.S.) or MDR (Europe), adds complexity and cost to packaging development. Variability in global regulatory frameworks also creates challenges for companies aiming to operate across multiple regions. Navigating these evolving standards demands continuous R&D investment, rigorous testing, and certification processes, which can delay product launches and increase operational burdens for manufacturers and packaging providers

Regional Analysis

North America

North America held a substantial share of the Contact Lenses Packaging market in 2024, accounting for over 30% of the global revenue. The region’s dominance stems from a well-established eye care industry, high consumer awareness, and widespread adoption of daily disposable lenses. The United States leads regional demand, supported by strong distribution networks, rising disposable incomes, and a growing preference for advanced packaging formats like blister packs. Additionally, the presence of key market players and investment in sustainable packaging solutions contribute to the market’s maturity and continued growth in this region.

Europe

Europe captured approximately 25% of the global Contact Lenses Packaging market in 2024, driven by increased demand for daily and cosmetic lenses in countries like Germany, the UK, and France. The region benefits from stringent regulatory frameworks that prioritize safe and eco-friendly packaging, encouraging innovation in recyclable materials. Additionally, the high penetration of premium and reusable lenses in Western Europe fosters demand for vials and customized packaging. A rising aging population and growing prevalence of vision-related issues are further driving the consumption of contact lenses, indirectly boosting the packaging market across the continent.

Asia Pacific

Asia Pacific emerged as the fastest-growing region and held around 28% of the global Contact Lenses Packaging market share in 2024. Rapid urbanization, increasing disposable incomes, and rising awareness of eye health in countries such as China, Japan, South Korea, and India are key growth drivers. The region also experiences high demand for cosmetic and colored lenses, particularly among younger consumers, which propels the need for visually appealing and customized packaging. Local manufacturers are expanding production capacity and adopting cost-efficient packaging solutions, contributing to robust market expansion across both developed and emerging markets in the region.

Latin America

Latin America accounted for a modest share of approximately 10% in the global Contact Lenses Packaging market in 2024. Growth in this region is supported by rising demand for daily disposable lenses and expanding optical retail chains, particularly in Brazil and Mexico. While price sensitivity among consumers affects premium packaging adoption, the increasing availability of affordable eye care solutions and awareness campaigns are gradually boosting market participation. Efforts by regional players to localize production and improve distribution networks are expected to enhance packaging demand and support steady market growth in the coming years.

Middle East & Africa

The Middle East & Africa region held a relatively small yet growing share of about 7% in the Contact Lenses Packaging market in 2024. Market growth is primarily driven by expanding urban populations, increasing healthcare investments, and gradual adoption of vision correction products. Gulf Cooperation Council (GCC) countries lead regional consumption due to higher disposable incomes and access to premium eye care services. Although the market is still in its nascent stage compared to other regions, ongoing improvements in healthcare infrastructure and a growing awareness of contact lens hygiene are expected to create new opportunities for packaging providers.

Market Segmentations:

By Material

- Plastic

- Glass

- Aluminum Foil

- Others

By Packaging Type

- Blister Packs

- Vials

- Customized Packaging

By End-Use

- Daily Disposable Lenses

- Reusable Lenses

- Cosmetic and Colored Lenses

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Contact Lenses Packaging market is characterized by the presence of several well-established players and emerging regional manufacturers striving to capture market share through innovation, sustainability, and strategic partnerships. Key players such as Johnson & Johnson Vision Care, CooperVision, Bausch + Lomb, and Alcon Inc. dominate the global market, leveraging their strong brand portfolios and wide distribution networks. These companies focus on enhancing packaging efficiency, improving user convenience, and integrating eco-friendly materials to meet evolving consumer preferences and regulatory demands. Additionally, packaging firms are collaborating with lens manufacturers to develop customized, high-performance solutions tailored for daily disposables, cosmetic lenses, and reusable formats. The market also sees increasing competition from specialized packaging companies offering cost-effective and recyclable alternatives, particularly in Asia Pacific and Latin America. As demand for sustainable and smart packaging grows, players are investing in R&D and automation technologies to gain a competitive edge in this evolving landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SEED Co., Ltd.

- Bausch + Lomb

- Euclid Vision Group

- Menicon Co., Ltd.

- ALCON INC.

- HOYA CORPORATION (HOYA Corporation Contact Lens Division)

- Contamac

- Johnson & Johnson Services, Inc. (Johnson & Johnson Vision Care, Inc.)

- CooperCompanies (CooperVision)

- EssilorLuxottica

Recent Developments

- In October 2023, XPANCEO, a deep tech startup, raised $40 million in a seed funding round to develop the first contact lenses featuring augmented reality (AR) capabilities. Opportunity Ventures (Asia), based in Hong Kong, led this funding round. The capital will be utilized to advance the next prototype, which aims to integrate multiple features into a single device.

- In July 2023, the introduction of Hydro by Hubble contact lenses was announced by Hubble Contacts. These daily lenses come in clean, environmentally friendly flat packs and provide clear vision, maximum comfort, and all-day hydration. The world’s thinnest contact lens case, made of recyclable materials, is included with the Hydro by Hubble contact lenses. When compared to traditional packaging, this dedication to sustainability results in 80% less waste due to the reduction in raw material and plastic consumption.

- In January 2023, Carter Ledyard’s client CooperVision, Inc. finalized its acquisition of SynergEyes, Inc., which offers a diverse array of specialty contact lenses, including unique hybrid lenses. These products enhance CooperVision’s portfolio, particularly its Onefit scleral lenses.

Market Concentration & Characteristics

The Contact Lenses Packaging market exhibits a moderately concentrated structure, dominated by a few global players such as Johnson & Johnson Vision Care, CooperVision, Alcon Inc., and Bausch + Lomb. These companies leverage strong R&D capabilities, wide product portfolios, and global distribution networks to maintain competitive advantage. It features high entry barriers due to stringent regulatory requirements and the need for medical-grade, sterilized packaging. The market favors suppliers that can offer scalable, compliant, and cost-efficient solutions. Demand remains heavily skewed toward plastic-based blister packs, which are preferred for daily disposable lenses due to their affordability and user convenience. Companies that introduce sustainable alternatives or customizable formats for cosmetic lenses gain market visibility. The market demonstrates a growing preference for eco-friendly materials and smart packaging designs. It remains innovation-driven, with increasing focus on material recyclability, reduced carbon footprint, and enhanced product safety. Regional competition intensifies in Asia Pacific and Latin America due to cost sensitivity and expanding consumer base.

Report Coverage

The research report offers an in-depth analysis based on Material, Packaging Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to increasing global demand for daily disposable contact lenses.

- Manufacturers will focus more on sustainable packaging materials to align with environmental regulations.

- Smart packaging solutions with traceability and user engagement features will gain popularity.

- Growth in cosmetic and colored lens usage will drive demand for customized and visually appealing packaging.

- Asia Pacific will emerge as a major growth hub due to rising disposable incomes and expanding vision care access.

- Companies will invest in automation and high-speed packaging technologies to improve production efficiency.

- Regulatory compliance will continue to influence packaging material selection and design innovations.

- Mergers and partnerships between lens manufacturers and packaging firms will shape market competitiveness.

- Increasing online sales of contact lenses will push the need for tamper-proof and secure packaging solutions.

- Recyclable and lightweight packaging formats will become essential to meet evolving consumer preferences.