Market Overview:

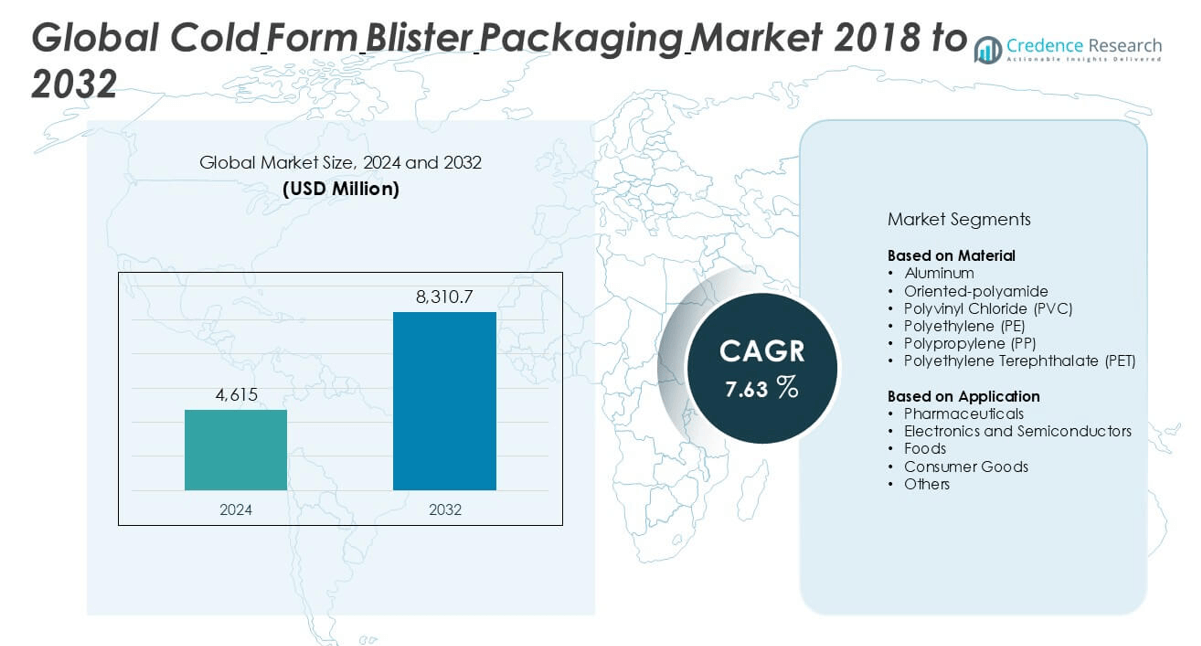

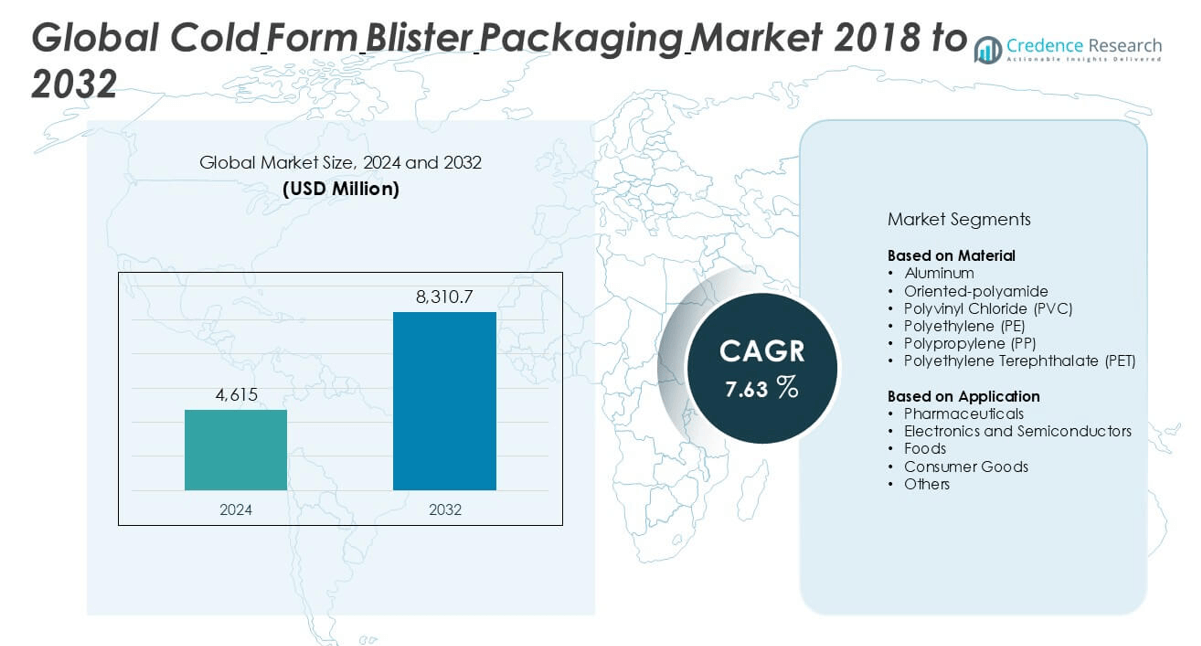

The Cold Form Blister Packaging market size was valued at USD 4,615 million in 2024 and is anticipated to reach USD 8,310.7 million by 2032, at a CAGR of 7.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cold Form Blister Packaging Market Size 2024 |

USD 4,615 million |

| Cold Form Blister Packaging Market, CAGR |

7.63% |

| Cold Form Blister Packaging Market Size 2032 |

USD 8,310.7 million |

The Cold Form Blister Packaging market is led by prominent players such as Constantia Flexibles, Amcor, Bilcare Limited, Honeywell International Inc., and TekniPlex, who collectively command a significant share of the global market through advanced packaging technologies and strong client networks in the pharmaceutical sector. These companies focus on high-barrier materials, product safety, and compliance with stringent regulatory standards. Regionally, North America emerged as the leading market in 2024, holding approximately 32% of the global market share, driven by robust pharmaceutical production, stringent packaging regulations, and high consumer demand for secure medication delivery. Europe follows closely with a 28% share, supported by a well-established healthcare system and emphasis on sustainability. The competitive dynamics are further shaped by regional players like UFlex Limited and Liveo Research AG, who are expanding through innovation and strategic partnerships to address evolving packaging needs.

Market Insights

- The Cold Form Blister Packaging market was valued at USD 4,615 million in 2024 and is projected to reach USD 8,310.7 million by 2032, growing at a CAGR of 7.63% during the forecast period.

- Growing demand from the pharmaceutical industry, especially for moisture- and light-resistant packaging of tablets and capsules, is a key market driver supporting global growth.

- Market trends include rising adoption of sustainable and recyclable materials, along with innovations in barrier film technology to improve shelf life and reduce material usage.

- The market is moderately fragmented, with key players like Constantia Flexibles, Amcor, Bilcare Limited, and TekniPlex focusing on product development, while regional players expand through strategic partnerships and capacity enhancements.

- North America held the largest regional share at 32% in 2024, followed by Europe at 28% and Asia Pacific at 25%; aluminum remained the dominant material segment with over 45% share, and pharmaceuticals accounted for more than 60% of application-based revenue.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The aluminum segment held the largest market share in the Cold Form Blister Packaging market in 2024, accounting for over 45% of the total revenue. Aluminum’s dominance is primarily attributed to its superior barrier properties against moisture, oxygen, and light, which are critical for ensuring product integrity, especially in the pharmaceutical sector. Its non-permeable and tamper-evident characteristics make it the material of choice for sensitive drugs. Additionally, increasing regulatory focus on product safety and extended shelf life in global healthcare packaging continues to drive the demand for aluminum-based cold form blister solutions.

- For instance, Amcor has implemented ultra-high barrier cold form foil solutions like Formpack® Ultra, achieving a moisture transmission rate of less than 0.001 g/m²/day and an oxygen transmission rate below 0.005 cc/m²/day, enabling extended stability for humidity-sensitive drugs.

By Application:

Pharmaceuticals emerged as the dominant application segment in 2024, contributing more than 60% of the overall market share. This dominance is driven by the growing demand for unit-dose packaging for tablets and capsules, along with stringent drug safety regulations across North America, Europe, and Asia. Cold form blister packaging ensures complete protection against environmental factors, making it ideal for preserving the efficacy of pharmaceutical products. The rising prevalence of chronic diseases, expanding geriatric population, and increasing production of generic medications further reinforce the segment’s leading position in the global market.

- For instance, Bilcare Limited supplies cold form blister packaging to over 140 pharmaceutical clients globally, with its Bilcare Ultra® foil offering a shelf-life extension of up to 36 months for sensitive formulations, significantly exceeding conventional standards.

Market Overview

Rising Demand from the Pharmaceutical Industry

The pharmaceutical sector is the primary growth engine for the cold form blister packaging market, driven by its need for secure, tamper-proof, and contamination-resistant packaging. Increasing production of prescription drugs, over-the-counter (OTC) medications, and generics—particularly in developing countries—has fueled the adoption of cold form blister packs. This packaging format offers excellent protection against moisture, oxygen, and light, making it ideal for sensitive formulations. Moreover, growing regulatory compliance requirements and the trend toward patient-centric packaging are further accelerating demand across global pharmaceutical supply chains.

- For instance, Honeywell’s APTARPHARMA™ ColdForm™ solution is used by pharmaceutical manufacturers in over 80 countries, with zero reported breaches in product integrity during shipment over a 24-month tracking period.

Regulatory Push for Enhanced Packaging Integrity

lobal regulatory agencies such as the FDA and EMA are imposing stricter standards for pharmaceutical packaging, which has prompted manufacturers to adopt cold form blister packaging for improved product protection and traceability. These regulations emphasize the need for barrier-resistant packaging to maintain drug stability and shelf life, especially under variable storage conditions. Cold form blister packaging meets these requirements effectively, supporting the integrity and safety of high-value medicines. This regulatory shift is particularly impactful in emerging markets where compliance with international standards is becoming a priority.

- For instance, Constantia Flexibles developed Flexible Blister High Barrier (FBHB) films, which are compliant with EU 2017/745 and US 21 CFR 174-186, and currently used in over 1,200 approved drug formulations across 50+ markets.

Expansion in Healthcare Infrastructure in Emerging Markets

Rapid improvements in healthcare infrastructure across Asia-Pacific, Latin America, and parts of Africa are opening new avenues for cold form blister packaging. As pharmaceutical companies expand production and distribution networks in these regions, the demand for secure and high-barrier packaging solutions has surged. Governments in developing economies are also investing in local pharmaceutical manufacturing to reduce import dependency, further boosting the need for cold form blister packs. These infrastructural advancements, coupled with rising health awareness and access to medications, are expected to sustain long-term market growth.

Key Trends & Opportunities

Adoption of Sustainable and Recyclable Materials

The industry is witnessing a growing trend toward sustainability, prompting packaging companies to explore eco-friendly alternatives to traditional cold form materials. While aluminum-based structures dominate, manufacturers are investing in recyclable and bio-based polymers to meet environmental goals. This shift is driven by increasing consumer awareness and corporate ESG commitments. As sustainability becomes a key differentiator, companies that innovate in material science—without compromising barrier protection—stand to gain competitive advantage and unlock new market segments, especially in environmentally-conscious regions like Europe and North America.

- For instance, Liveo Research and Bayer launched a PET-based blister for Aleve that reduces carbon emissions by 38 units per package, consumes 78 units less water, and requires 53 units less land, delivering significant resource savings per blister.

Technological Advancements in Material Engineering

Innovations in polymer and laminate technologies are enabling the development of cold form blister packs that offer thinner profiles, improved flexibility, and enhanced barrier performance. Advanced multilayer films combining aluminum with high-barrier polymers such as oriented polyamide and polypropylene are gaining traction, improving both product safety and production efficiency. These technological breakthroughs also enable customization for specific drug formulations, supporting the pharmaceutical industry’s growing demand for precision packaging. Continuous R&D in this area is opening up opportunities for high-margin offerings and expanding use cases beyond traditional medicine packaging.

- For instance, Constantia Flexibles’ Blister Eco lidding foil uses 48 g/m² material, compared to the conventional 62 g/m² foil, and contains 40 units of aluminum per sheet, resulting in fivefold improved moisture resistance over PVC/PVdC lidding.

Key Challenges

High Production Costs and Limited Material Recyclability

Despite its functional benefits, cold form blister packaging is associated with high material and production costs due to the use of aluminum and multilayer laminates. The complex structures involved make recycling difficult, posing sustainability concerns. As regulatory bodies and consumers push for greener alternatives, manufacturers face the dual challenge of maintaining barrier properties while reducing environmental impact. This increases the cost and complexity of R&D efforts, potentially limiting adoption among smaller pharmaceutical firms and budget-conscious sectors.

Slower Packaging Speeds and Process Limitations

Cold form blister packaging requires more intricate forming and sealing processes compared to thermoform alternatives, resulting in slower production speeds. This limitation affects operational efficiency, especially in high-volume manufacturing environments. Additionally, the cold forming process is less adaptable to complex or irregular product shapes, limiting its versatility in non-pharmaceutical applications. These process inefficiencies can lead to higher capital expenditures for specialized equipment and may deter manufacturers seeking rapid scalability.

Supply Chain Disruptions and Raw Material Availability

The market is vulnerable to disruptions in the supply chain for key raw materials, especially aluminum and specialty films, which are sourced globally. Geopolitical tensions, trade restrictions, and rising energy costs can cause volatility in material prices and lead to delays in production. This poses a significant challenge for manufacturers relying on just-in-time inventory models. Such disruptions not only impact cost structures but also hinder timely delivery to pharmaceutical companies operating under strict timelines and regulatory mandates.

Regional Analysis

North America

North America accounted for a significant share of the global Cold Form Blister Packaging market in 2024, holding approximately 32% of the total market. The region’s dominance is driven by its well-established pharmaceutical sector, stringent regulatory standards, and growing demand for tamper-proof and high-barrier packaging solutions. The U.S. remains the primary contributor, with continued investments in drug development and specialty medications requiring cold form blister packaging. Additionally, the presence of major packaging firms and strong healthcare infrastructure supports sustained market growth. Increasing consumer awareness regarding safe medication packaging further boosts regional demand.

Europe

Europe held around 28% of the global Cold Form Blister Packaging market in 2024, making it the second-largest regional market. The region benefits from a highly regulated pharmaceutical industry that emphasizes product safety, traceability, and extended shelf life. Germany, France, and the UK are key contributors, driven by robust drug production and exports. Additionally, rising adoption of eco-friendly and recyclable packaging materials in response to stringent environmental regulations is shaping the market. Technological innovation in packaging formats and the presence of leading global packaging firms further support Europe’s strong position in this sector.

Asia Pacific

Asia Pacific captured nearly 25% of the Cold Form Blister Packaging market share in 2024 and is projected to be the fastest-growing region during the forecast period. Countries like China, India, and Japan are leading demand due to expanding pharmaceutical manufacturing, rising healthcare expenditures, and increasing demand for secure medication packaging. Government initiatives supporting local drug production and export, particularly in India and Southeast Asia, are further driving growth. The region’s cost-effective manufacturing capabilities, growing population, and increasing access to healthcare services are expected to sustain the upward market trajectory in the coming years.

Latin America

Latin America held approximately 8% of the Cold Form Blister Packaging market share in 2024, with Brazil and Mexico being the major revenue-generating countries. The market in this region is fueled by growing investment in pharmaceutical infrastructure and rising demand for affordable packaging solutions. While the industry is still developing, international companies are expanding their footprint through partnerships and manufacturing facilities. Government support for healthcare reforms and generic drug production is also contributing to market growth. However, slower regulatory approval processes and economic instability in some countries could moderate expansion in the short term.

Middle East & Africa

The Middle East & Africa region accounted for around 7% of the global Cold Form Blister Packaging market in 2024. Market growth is supported by increasing healthcare investments, particularly in Gulf Cooperation Council (GCC) countries, and efforts to enhance pharmaceutical self-sufficiency. Countries such as Saudi Arabia, UAE, and South Africa are witnessing rising demand for quality packaging in line with growing local drug production. Although infrastructure and regulatory frameworks are still evolving, partnerships with international pharmaceutical firms and government initiatives to boost healthcare access are expected to drive gradual market development across the region.

Market Segmentations:

By Material:

- Aluminum

- Oriented-polyamide

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

By Application:

- Pharmaceuticals

- Electronics and Semiconductors

- Foods

- Consumer Goods

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cold Form Blister Packaging market is characterized by the presence of both global and regional players striving to strengthen their market position through product innovation, strategic partnerships, and geographic expansion. Leading companies such as Constantia Flexibles, Amcor, Bilcare Limited, and Honeywell International Inc. dominate the market with their extensive product portfolios, advanced barrier technologies, and strong customer bases in the pharmaceutical and healthcare sectors. These players focus on developing high-performance, multi-layered structures to meet the growing demand for product protection and regulatory compliance. Meanwhile, regional firms like UFlex Limited, Svam Toyal Packaging, and Pack Time Innovations are enhancing their capabilities through investment in manufacturing infrastructure and technology upgrades. Collaboration with pharmaceutical manufacturers and contract packaging organizations (CPOs) remains a key growth strategy. As sustainability becomes a priority, companies are also investing in recyclable and eco-friendly material innovations to gain competitive advantage and address evolving consumer and regulatory demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Constantia Flexibles (Austria)

- Amcor (Switzerland)

- Bilcare Limited (India)

- Honeywell International Inc. (U.S.)

- TekniPlex (U.S.)

- UFlex Limited (India)

- Liveo Research AG (Switzerland)

- Aphena Pharma Solutions (U.S.)

- R-Pharm Germany GmbH (Germany)

- Wasdell Group (U.K.)

- Pack Time Innovations Pvt. Ltd. (India)

- HySum Europe GmbH (Germany)

- Perlen Packaging AG (Switzerland)

- Ecobliss Pharmaceutical Packaging (Netherlands)

- Svam Toyal Packaging Industries Pvt. Ltd. (India)

Recent Developments

- In July 2023, Constantia Flexibles launched its latest pharmaceutical packaging solution, the cold form foil REGULA CIRC. The packaging replaces traditional PVC with a polyethylene (PE) sealing layer, reducing plastic content while increasing the proportion of aluminum. REGULA CIRC embraces the principles of the circular economy through increased aluminum percentage.

- In June 2023, TekniPlex Healthcare has extended its North American footprint and global capacity with a new 200,000-square-foot manufacturing plant in Madison, Wisconsin, U.S. This facility is estimated to boost the company’s lamination capacity for a broad range of materials, including PET, nylon, paper, foil, PE, EAA, and ionomer, in both peelable and non-peelable structures.

- In April 2023, Amcor plc announced a collaboration with Tyson Foods, Inc., a global food company, to develop and design cost-effective cold-form blister packaging solutions for food products

Market Concentration & Characteristics

The Cold Form Blister Packaging market shows moderate concentration, with a mix of established global leaders and several strong regional manufacturers. Companies such as Constantia Flexibles, Amcor, and Honeywell International hold significant market shares due to their advanced material technologies, global distribution networks, and strong client relationships within the pharmaceutical industry. It remains competitive with continuous innovation in high-barrier laminates, compliance-driven product design, and expansion into developing regions. The market is defined by high entry barriers, including capital-intensive manufacturing processes, regulatory certifications, and technical expertise in multilayer material formulation. Product quality, moisture resistance, and shelf life protection are critical success factors. Demand is heavily influenced by pharmaceutical packaging needs, particularly for moisture-sensitive drugs. The shift toward patient-compliant packaging formats and regulatory pressure to ensure product safety drive further adoption. Emerging players in Asia are gaining ground by offering cost-effective solutions and expanding manufacturing capacity. Sustainability trends are reshaping material selection and driving R&D investments.

Report Coverage

The research report offers an in-depth analysis based on Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising demand for high-barrier packaging in the pharmaceutical industry.

- Increasing adoption of cold form blister packs in emerging economies will expand the global market footprint.

- Sustainability concerns will push manufacturers to develop recyclable and eco-friendly cold form materials.

- Technological advancements will improve film strength, reduce pack thickness, and enhance shelf life protection.

- Growth in generic drug production will significantly boost the demand for cost-effective blister packaging solutions.

- Regulatory requirements for safe and tamper-evident packaging will continue to favor cold form blister formats.

- Investments in localized manufacturing facilities will help reduce dependency on imports and ensure supply continuity.

- The market will see greater collaboration between pharmaceutical companies and packaging providers to improve customization.

- Automation and smart packaging technologies will gain traction to increase production efficiency and traceability.

- Rising healthcare awareness and increased access to medication will support long-term market expansion globally.